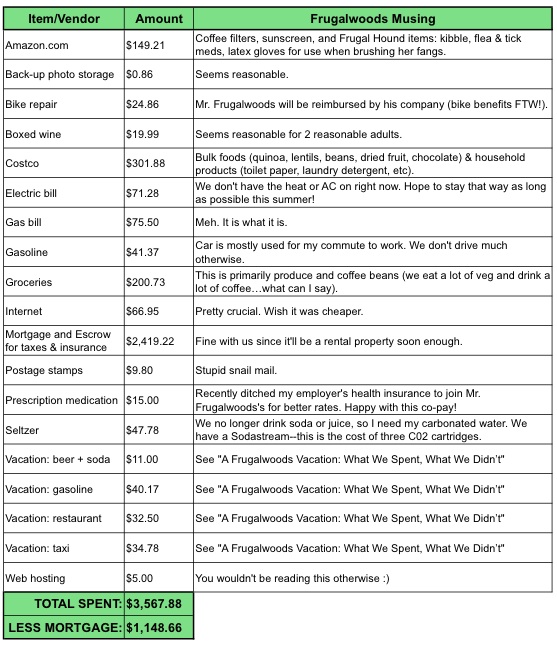

As my first foray into busting out our monthly breakdown for public consumption, I thought I’d ease into it by only enumerating our expenses. We did pretty well in May, especially considering we went on vacation (though we purchased our plane tickets several months prior). Not surprised to see that the bulk of our expenses other than our mortgage are groceries.

Fellow frugal folks–how does this compare to your monthly sheet? Where are we spending more/less? Tips, frugal hacks, and advice always welcome and appreciated!

I was paying around the same amount for internet until today. Go search Freedompop over in the MMM forum. A recent post there got me to switch over to a $15/month plan. I had no idea it existed until a few days ago.

Love the blog, keep up the good work.

Thanks for the heads up! I’ve looked at freedompop before and at least in our area their transfer caps are way lower than what we use. The largest offer for our zip code is 15GB / month. We’ve used 28GB so far in July! We’re power users though. I do videoconferencing and other bandwidth intensive operations for work from home on some days. We also stream TV content from Amazon Prime and a friend’s HBO Go account.

If they had a higher limit plan I’d be all ears though! Would be nice to get out from under the yoke of comcast! Do they have a higher bandwidth allowance where you live? Or are you managing to stay under their limits?

WOW that’s quite a lot of data.

Nope. 12GB is the most I’ve found but we’re not power users. I get most of my internet usage at the office. Biggest user is our son with Netflix. We just started this experiment so we’ll see how it goes. Hopefully an overhaul in this industry will happen soon and create a nice medium price point.

Hah, yeah, it really is!

As for netflix, definitely keep a good eye on your usage. According to the netflix help site, standard def video is 1GB/hr and HD is 3GB/hr. Could add up fast if your son is an avid watcher. Let us know how it turns out!

Do you use telephones or cell phones? I don’t see the line item in your budget. Also, when it comes to yearly payments on items, do you average out annual payments over the year or do you itemize it for the month it is paid?

Great questions! We don’t have a landline phone and our employers pay for our cell phones, which we feel very lucky for. We don’t average out big expenses over the year–the full amount just hits the expenditures for the month in which we pay it (we don’t carry any debt other than our mortgage, so we just pay for everything in full upfront). Thanks for reading!

I’ve just recently discovered your website and love it! Curious, do you pay down any extra on your mortgage each month or just the bare minimum? Any plans to accelerate those payments and eliminate that debt as part of your plan to retire at 33?

Great question! We don’t plan to accelerate payments on our mortgage as we have a really low % and so can realize more value by investing our extra money.

What do you use for photo storage? I’m currently paying for Dropbox ($99/year) but it’s mostly for automatic photo backup and storage. Any advice?