All other events in February were truly dwarfed by the fact that our second daughter, Littlewoods, was born this month! I’m sure other things happened, but it feels like that was about it. Our spending certainly reflects her imminent arrival, most notably in the area of…

Restaurants!

Whoa, Mrs. Frugalwoods, you’re probably thinking, what is with that line item for restaurants?!? All for a good cause, I assure you. My fabulous mother-in-law came to help us out for Littlewoods’ birth and before Littlewoods made her arrival, my mother-in-law offered to babysit Babywoods for us while we went out on dates! And so go out on dates we did! Mr. Frugalwoods and I went to a pre-natal appointment together, went to the grocery store, took care of errands and… went out to lunch multiple times! And to dinner once too!

Normally, we eat out one night a month, but seeing as we had a loving, free, in-home babysitter in the form of grandma, we decided to take advantage of the opportunity to cram in a bunch of dates all in one week. A true hedonistic jaunt of dining out. And it was glorious. We’re not exactly sure when we’ll be able to go out sans children again, so I’m very grateful to my mother-in-law for watching Babywoods while we lived it up.

This also caused us to reflect on the fact that, while we had fun eating out a ton in one week, our preference is to mete these treats out over a longer period of time. As I’ve written before, the rarity of a luxury’s occurrence truly does make it all the more special. If we do something all the time, it loses the luster of novelty and becomes a rote chore. Constantly treating ourselves numbs us to the luxury of something like dining out. Conversely, when we save treats for special occasions, they’re more amplified in our minds and we get a higher return of happiness on our investment.

Driveway Of Ice

We also paid for a load of sand and gravel to be dumped on our quarter-mile long driveway, which had helpfully molded itself into a solid sheet of ice. Usually we just wait for the driveway to thaw or for it to snow again or Mr. FW will use the chains on the tractor to rough up the ice. However, given the impending birth of Littlewoods, we wanted to be really sure we’d be able to get out of our driveway in a hurry. Hence, we ordered a delivery of sand from our neighbor!

Other than these two aberrations, it was a fairly standard month despite the arrival of the fourth member of the Frugalwoods fam! If you’re interested in learning more about how we parent frugally, check out my Kids section.

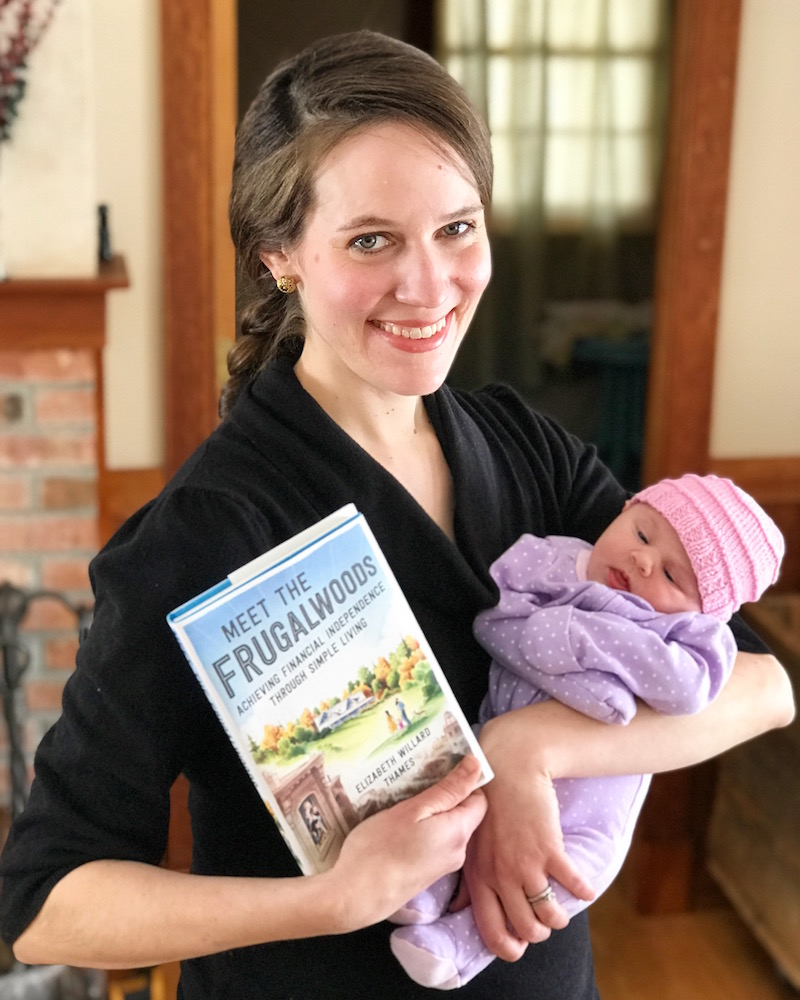

I Wrote A Book!

I really did! And I’m so excited! My book, Meet The Frugalwoods: Achieving Financial Independence Through Simple Living, was published on March 6th by HarperCollins.

Huge thanks to everyone who has already read the book and written a review and shared their thoughts with me! If you’re so inclined, I’d love it if you’d consider writing a review of the book on Amazon. Many thanks!

Credits Cards: How We Buy Everything

Mr. Frugalwoods and I purchase everything we possibly can with credit cards for several reasons:

- It’s easier to track expenses. No guesswork over where that random $20 bill went; it all shows up in our monthly expense report from Personal Capital. This prompts me to spend less money because I KNOW I’m going to see every expense in detail at the end of each month.

- We get rewards. Who doesn’t like rewards? Credit card rewards are a simple way to get something for nothing. Through the cards we use, Mr. FW and I get cash back as well as hotel and airline points just for buying things we were going to buy anyway.

- We build our credit. Since Mr. FW and I don’t carry any debt other than our mortgages, having several credit cards open for many years (which are fully paid off every month) has greatly helped our credit scores. By the way, it’s a dirty, dirty myth that carrying a balance on your credit card helps your credit score–IT DOES NOT. Paying your cards off IN FULL every month and keeping them open for many years, however, does help your score.

If you’re interested in opening a credit card, I highly recommend using this site to search for a card that’ll best fit your needs. And if you’re interested in travel rewards cards specifically, check out this list curated by my friend Brad from Travel Miles 101. I respect Brad’s work in the travel rewards space and I trust his advice on which cards will reap the best benefits.

Huge caveat to credit card usage: you MUST pay your credit card bills in full every single month, with no exceptions. If you’re concerned about your ability to do this, or think that using credit cards might prompt you to spend more money, then credit cards are not for you–stick with using a debit card and/or cash. But if you have no problem paying that bill in full every month? I recommend you credit card away, my friend!

Personal Capital: How We Organize Our Expen$e$

Mr. Frugalwoods and I use Personal Capital to aggregate and consolidate our transactions from across all of our accounts. We then drop them into a spreadsheet to provide the below analysis for you fine people.

Tracking expenses is, in my opinion, the best way to get a handle on your finances. You absolutely, positively cannot make informed decisions about your money if you don’t know how you’re spending it. Sounds harsh, but without a holistic picture of how much you spend every month, there’s no way to set savings, debt repayment, or investment goals. It’s a frugal must, folks. No excuses.

Personal Capital (which is free to use) is a great way for us to systematize our financial overviews since it links all of our accounts together and provides a comprehensive picture of our net worth. If you’re not tracking your expenses in an organized fashion, give Personal Capital a try. Here’s a more detailed explanation of how I use Personal Capital for my expense tracking.

Where’s Your Money?

One of the easiest ways to optimize your money is to use a high-interest savings account. A high-interest savings account gives you money for nothing. With these accounts, interest works in YOUR favor (as opposed to the interest rates on debt, which work against you). Having money in a no (or low) interest savings account is a waste of resources–your money is just sitting there doing nothing. Don’t let your money be lazy! Make it work for you! And now, enjoy some explanatory math:

Let’s say you have $5,000 in a savings account that earns 0% interest. In a year’s time, your $5,000 will still be… $5,000.

Let’s say you instead put that $5,000 into an American Express Personal Savings account that–as of this writing–earns 1.70% in interest. In one year, your $5,000 will have increased to $5,085.67. That means you earned $85.67 just by having your money in a high-interest account.

And you didn’t have to do anything! I’m a big fan of earning money while doing nothing. I mean, is anybody not a fan of that? Apparently so, because anyone who uses a low (or no) interest savings account is NOT making money while doing nothing. Don’t be that person. Be the person who earns money while you sleep. Rack up the interest and prosper. More about high-interest savings accounts, as well as the ones I recommend, is here: The Best High Interest Rate Online Savings Accounts.

How To Read A Frugalwoods Expense Report

Want to know how we manage the rest of our money? Look no further than Our Low Cost, No Fuss, DIY Money Management System. We also own a rental property in MA, which I discuss here.

Why do we save so much and spend so little? It’s all in service of our goal to reach financial independence and move to a homestead in the woods (which happened in May 2016).

For us, embracing frugality is a joyful, longterm choice. We prefer a simple life to one filled with consumerism and we spend only on the things that matter most to us. Our approach isn’t one of miserly deprivation; to the contrary, we live a luxuriously frugal existence.

If you’re interested in the other things I love, check out Frugalwoods Recommends.

A Note On Rural Life

Since we live on 66 acres in rural Vermont, our utilities and expenses are slightly different from traditional urban and suburban dwellings. We don’t pay for water, sewer, trash, or heating/cooling because we have a well, a septic system, our town doesn’t provide trash pick-up, we heat our home with wood we harvest ourselves from our land, and we don’t have air conditioning. For more on our rural lifestyle, check out my series This Month On The Homestead as well as City vs. Country: Which Is Cheaper? The Ultimate Cost Of Living Showdown.

But Mrs. Frugalwoods, Don’t You Pay For X, Y, Or Even Z????

Wondering about common expenses that you don’t see listed below? Our August 2015 expense report has the answers you seek! Plus, as I explained here, we pay bills in full the month we receive them–that’s why you won’t see monthly payments for things like car insurance or property tax.

If you’re curious about how we handle charitable contributions, check out How We Donate To Charities Like Billionaires and also How We Make Meaningful And Tax Efficient Charitable Donations.

Alright you frugal money voyeurs, feast your eyes on every dollar we spent in February:

| Item | Amount | Frugalwoods Musings |

| Vermont mortgage | $1,392.86 | |

| Groceries | $557.41 | |

| Household & miscellaneous | $216.72 | All non-food household and miscellaneous purchases, such as laundry detergent, toilet paper, farm supplies and tools, etc. |

| Preschool | $180.00 | Babywoods goes to preschool two mornings a week and absolutely loves it! |

| Restaurants | $123.39 | WHOA! Highest ever on account of our many pre-Littlewoods dates :). Totally worth it. |

| Gasoline for cars | $119.62 | |

| Utilities: Electricity | $84.12 | |

| Internet | $74.00 | We LOVE our high-speed Fiber internet out here in the middle of nowhere. |

| Driveway sand and gravel load | $65.00 | |

| Doctor visit co-pays | $40.00 | |

| Diesel for tractor | $37.91 | |

| Fancy beer! | $30.06 | |

| Holiday gift for preschool teacher | $20.00 | |

| Cell phone through BOOM Mobile | $19.99 | |

| New spatula | $10.40 | Ahh yes, our replacement spatula, the tale of which I told in detail here. |

| Hand cream | $6.35 | My hands get ridiculously dry in the wintertime and this seems to be the only cream that does the trick. |

| Airport parking | $5.00 | Parking at the airport while picking up my in-laws |

| TOTAL SPENT: | $2,982.83 | |

| MINUS MORTGAGE: | $1,589.97 |

I was worried you forgot about the expense blog posts!!! The arrival of Littlewoods def would’ve warranted a pass on posting Febs haha. Glad to see it’s up!

That’s insane you guys spent so little, and still were able to enjoy so much this month! So inspiring.

My new goal in life will be to spend less than $10.40 on a spatula. No it’s not a competition….

Congrats again on the book and baby!

Congratulations again on Littlewoods! That was so kind of your MIL to baby-sit Babywoods, though I expect it was as much a treat for her as you all. 🙂

Question: did you not have a co-pay with the birth of your second child, or has it not billed yet? I saw doctor co-pays, but I didn’t see a hospital bill for your stay there!

Good question! The bill for her birth didn’t show up in February, so it’ll be on the March expense report 🙂

Thanks as always for the update. Two questions: First, (i think you may have mentioned this but cant recall), I’m sure you have a very low trash footprint, but how do you dispose of trash (exclusive of recycling, and composting discarded food like peels, etc). Second, is property tax and insurance included in “Mortgage”?

Good questions! Our town doesn’t provide trash pick-up and we pay $2 per bag of trash that we take to the town transfer station once a week. We generate one bag of trash per week. We purchased a bunch of trash bags in bulk a few months ago, which are detailed here. Property tax and insurance are not included in our mortgage–we pay those separately and in full in the month they come due. Property tax bill for the year is in this expense report.

I love this! Makes you think twice about generating trash when you have to pay.

No Mrs FW pays for them once per year. Clearly not in Feb – they have there own line in the budget but aren’t part of THIS months budget

Woah, I guess it really is about perspectives. $123 is a lot for eating out?! Where did you guys go? I thought it would be in the thousands! I know mine would be! Buffets everyday!

Congrats on the big beautiful life you’ve bought over to this side 🙂

I was so glad to see you indulging in your pre-baby dates. As a mom of two boys, it’s smart. And I also feel like it is totally in line with your message of, spend thoughtfully but don’t be miserly.

I was so so excited when your book finally came in the mail! I pre-ordered it back in November and have been patiently awaiting its arrival. ( I didn’t receive the book plate though…) I have not been able to put it down, in my free time of course, and am about halfway through. I truly enjoy your writing style. Even if I have had to look up a few words 😉

I’m sorry you haven’t gotten your bookplate yet! I haven’t mailed out the latest batch yet (for orders from the past few weeks), but if you ordered yours in November, you should’ve gotten in by now. Did you email your receipt for the book to bookplate@frugalwoods.com?

Nope – I definitely didn’t. Apparently I don’t read or follow the rules! I will send it over today. Sorry!

$123.39/mo for restaurants is not too high at all. I think it’s pretty reasonable, given the fact that you can get free babysitting from grandma and that having an infant and a toddler would make it more difficult to find out. I’m glad you and Mrs. FW had lots of fun 😉

We’re also planning a babymoon for the summer. We want to go on a week long trip before I give birth to our second baby in last August. We will be running around like crazy when the baby is born, so we want to take this time to explore the world a bit (on the frugal side of course!)

That picture of you, Littlewoods, and your book is wonderful!

Hi-

I don’t see any kind of insurance premiums in the budget and I was wondering if you both have disability insurance? Is it possible to have disability insurance without traditional salaried 9 to 5 jobs? Thanks!

Well, for goodness sake, I could have slept a lot better had I known you had “gravel and sanded” that icy driveway! I don’t know why but I would lie awake at night hoping you didn’t get stuck with a home delivery. (Tee-hee) Congrats on your new daughter…………and the book. Being the frugal gal I am, I have not purchased one but have requested that our library buy one. (They love getting suggestions on books to add, so others might try that request as well.)

My husband and I were enjoying one of our rare date nights out (celebrating wedding anniversary) and discussing starting to leave restaurant tips in cash, because of the potential of new Department of Labor regulations “allowing tips to be shared more between tipped and nontipped staff”: https://www.dol.gov/newsroom/releases/whd/whd20171204 and https://newfoodeconomy.org/department-of-labor-tip-pooling-backlash/. So we may not be able to remember where every dollar goes, but we’re sure that the people for whom we intend the tip actually receives it. I worked as wait staff for years and sometimes it’s hard to get those credit card tips back.

Yay Littlewoods and gravel!

We always leave our tips in cash, and if possible, place them right into the server’s hand as we leave. I worked as a waitress years ago and know how easy it is for tips to be taken by other customers and the table cleaners if the restaurant has those. I also witnessed a boss put part of a tip into his pocket, putting the rest in the general box that got divided among workers every night.

What a lovely pic of you and Littlewoods and new book! Congrats again on all of it! And get some sleep whenever you can!!!

So wonderful you could spend time together with just your husband. I love going to the grocery and multiple errands with mine. We are much older and retired and still enjoy being each other’s best friend. Glad you could have several meals out too. Congratulations on your new baby addition

Good call on taking advantage of the opportunity for dates, you have to strike while the iron is hot! My favorite line item is “Diesel for tractor” it might be a guy thing… or maybe I just listen to too much country music. 🙂

I’m glad to see you are awake and able to post. Sleep is not easy to get at this point with most new babies.

I’m steadily reading your book, a little at a time in the evenings. If I just didn’t have to do stupid things like work, sleep and eat, I could read it straight through! I’m really enjoying it, and plan to give a nice review on it. (Do I get brownie points for that? :))

I was kind of down that we spend more than the Frugalwoods for just two people, till I realized my budget includes savings and building up funds to save up for big bills, like homeowner’s insurance and property taxes. So I need to look at what we actually spend, not what we save, to get a true picture of our spending., right?

Mud season is almost upon you, I assume, so getting that driveway done was probably a good idea even without the new baby concern. I’m looking forward to pictures of lovely Vermont in Spring bloom.

After reading your book and giving it a five-star rating, I discovered your blog. Fascinating. As a 91-year old Canadian, I’m lucky enough to have our free comprehensive health system and drug prescription programme, so that’s one line item I don’t have to worry about. For years, I thought I was an oddball, as my late wife and I kept a strict budget long before computer spreadsheets were invented. Our friends thought it strange that we discussed every major purchase, and the joke was that we made these decisions jointly, except my wife got to decide which was the major or minor purchase! I still keep a monthly budget spreadsheet and find comfort in knowing exactly where each dollar is spent. A small request, please? I find your grey type hard to read. Maybe a little more contrast. Happy and frugal March everyone.

John

I’m younger than John, but would also welcome more contrast in the color of the text. Thanks!

I’m 50, and would also welcome easier to read text! Thanks for bringing it up, Mr. Fisher!

Congrats again on the new addition! We ate out a lot last week as well; I was recovering from surgery and poor hubby isn’t much of a chef. 😉 But I like to say that we’re frugal during the normal parts of life so we can splurge a little every now and then, like y’all getting a rare date. 🙂

We were able to cut our food costs in February, but we’re shooting to meet out $400 budget in March. Every extra ounce of money left over goes to debt, which means we reach freedom more quickly. 🙂

Just a suggestion for your hubby. Get him an instant pot. Go online and get recipes and neither you nor he will ever regret the purchase. The flavors of the food are soooo much better in the instant pot plus mostly one pot cleanup for him😀

I just went to check out the Amazon page for your book and was SUPER pleasantly surprised that there is an audio version of the book available!!!!! I hardly have time to sit down with a book these days, but I listen to booookoooos of audio books while doing houseworks. I’m going to find a way to get your book in the audio version.

Beautiful sunrise photo! As someone who has only recently passed the 10-month mark of success (read: everyone’s still alive) regarding our own recent addition to the family, I’m glad to hear you mustered some reinforcements to help in the early stages.

Mrs. FFP and I found that a newborn seriously lowers the bar on date nights. Going out, looking good, and discussing the topics of the day in an eloquent fashion went out the window for us in favor of a rather disheveled collapse on the couch and an exchange of wan smiles with the baby fast asleep in the other room.

That was the first few months, at any rate. Now we manage somewhat better, thanks in no small part to the wonders of The Moby Wrap (yes, it is deserving of capitalization).

Did you use Bradley or Logan to pick up the in laws? I love the cell phone lot at Logan and never park when I’m picking people up anymore- just text me when you get your bag and I’ll be right over! 😊

I haven’t used Bradley in years so not sure their situation!

Congratulations on another month of super low spending. I’m always amazed at you guys! I just listened to the podcast with Paula from Afford Anything and it was awesome! 🙂 Hope your March is filled with.. sleep! Or as much as you can get these days!

I live in Canada and looked to buy the same spatula and it was $24.61 on the Canadian Amazon site. And people wonder why people cross border shop.

Whats the deal with spatulas? I think I’ve had the same two for 15 years (I suspect they were a buck at Dollar Tree). I’m clearly not a gourmet cook – ha ha!

Good call on taking the date nights when the opportunity arises! It’s fun to get out and about with the kiddos, but it sure is special when you get a chance to have a real date 🙂

Ugh! I’ve been hanging on to an extra spatula “just in case”… too bad I couldn’t have given it to you for free. This is the first time I heard about Boom mobile and it’s making my non-contract, BYO-phone plan look downright spendy. I’ll be checking that out soon!

A sign that you are a great writer: you can make a post involving driveway gravel sound interesting. 🙂 (not sarcasm – I think you’re a great writer!)

I can’t decide if reading these posts is aspirational, inspirational, or just plain old disheartening…we try so hard to cut back where we can, but there are always things that come up in our lives that require money being spent. I keep track of our spending to the penny, and it is always so high. Sigh…

Maybe submit your financial situation on Frugalwoods monthly blog that examines a person’s situation. I know that I find the emergency fund very difficult. It seems that every time I get “ahead” enough to put extra cash aside, something happens. Debt is getting paid off, but savings is tough. I can’t remember what these monthly reviews are called, but the last one with the couple in Queensland, Austrailia was good. And a bit more like my own situation.

It also might help to remember that there are seasons to life and you might just be in a high expenditures season. Try to take heart, it will get better.

Regarding credit card balances and credit scores:

Recently Credit Karma here in Canada launched their newest version of the TransUnion scoring model. The biggest change is that utilization, essentially, now has a history. They look back 24 months to see whether you’re making minimum payments, paying your cards in full, or paying your cards down. Behaviour like “pays cards off in full monthly” results in a HIGHER score than if you leave a balance behind!

Despite my initial surprise that they’re now actually rewarding good behaviour (who saw that coming) I gotta say I’m very happy that the old myth of “leaving a balance behind” being good for your score can now be well and truly put to rest.

Sorry if this has been answered before, or if it’s a dumb question (LOL), but is Personal Capital available for Canadians? Sometimes the availability is different or there is a charge in Canada.

Good question! Unfortunately, Personal Capital is only available in the US, but I’ve heard from readers in other countries that they like using Mint (another free expense tracker). Good luck :)!

ANy chance you’d ever dig deeper into those “household” expenses? I’m always kind of curious and I don’t really remember a pacific post about them (but I’ve been reading for years so I may have forgotten).

I’m curious, when you guys were still in the wealth building phase, working your 9-5s, and living in Cambridge, did you factor childcare costs into how much you needed to save to reach FI? I am mostly curious since you guys don’t require daycare, since you have flexible work you can do at home. Now that babywoods is in preschool though it is at least a little bit of a cost adder.

Hello! Frugal Vermonter here (who now lives an urban life in RI). I love your blog and congrats on your wee one!

I have conflicting feelings out using credit cards. Yes, it is easy to track but I really struggle with the influence these huge credit card companies have on our lives. This year my family and I decided to stop using credit cards for most purchases. Yes, we loved the rewards and paid it off monthly but I started to feel like if I wanted my community to thrive and the small businesses within it where I shop to succeed, I needed to pay cash. Every credit card transaction for the merchant costs a percentage and while I don’t care if Target or the gas station pays this fee, it makes a difference for the local nursery, co-op, hardware store, and book seller in my neighborhood. I feel like the 1-3% I “lose” in rewards is worth it because it is a contribution to the vibrancy of my community. I’m curious if this is something you’ve ever thought about? I grew up on a homestead in VT and I think part of the reason the state has really resisted the pull of big box stores is because of this interdependence on each other and community focus.

Love reading your new book. Love your blog, congratulations on the new baby ! I love the new pictures.

I also like to use a credit card because it’s easier for me to connect all the spheres on which it seems. These banking applications are so intuitive that they count all costs themselves and segregate them accordingly. BTW. Cool ! A very nice book

Mr. FF and I can easily drop $123 on one meal (although we don’t do that too often), so that is seriously impressive for multiple lunches AND a dinner. I am just finishing up your book and absolutely love it. Even though I’ve been reading your blog for a while, I think the book really puts your story together nicely and answers some questions that I had. Congratulations on all your success! This looks like another great month.

My husband and I, 64 and 61, also have trouble reading this light type.

I am sorry about that, Lori! We are working on getting a darker font. I don’t like it either, but turns out, it’s harder to change these things than I expected!