Lily and her husband Robert are in their late 60s, have been married for 40 years, and planned to retire to a life of travel in 2022. Lily and Robert paid off nearly half a million dollars of debt in their late 50s and since then, have put themselves in a fabulous financial position. However, the pandemic has them questioning their readiness for this move. They’d like our help today determining what to do if Lily is laid off from her job during this recession.

What’s a Reader Case Study?

Case Studies address financial and life dilemmas that readers of Frugalwoods send to me requesting advice. Then, we (that’d be me and YOU, dear reader) read through their situation and provide advice, encouragement, insight, and feedback in the comments section. For an example, check out last month’s case study. Case Studies are updated by participants (at the end of the post) several months after the Case is featured. Visit this page for links to all updated Case Studies.

NEW INFO: Based on popular demand from you all, and a TON of submissions, I’m going to start featuring TWO Reader Case Studies per month!

I probably don’t need to say the following because you folks are the kindest, most polite commenters on the internet, but please note that Frugalwoods is a judgement-free zone where we endeavor to help one another, not condemn.

And a disclaimer that I am not a trained financial professional and I encourage people not to make serious financial decisions based solely on what one person on the internet advises. I encourage everyone to do their own research to determine the best course of action for their finances. I am not a financial advisor and I am not your financial advisor.

With that I’ll let Lily, this month’s Case Study subject, take it from here!

Lily’s Story

Hi, Frugalwoods! I’m Lily, I’m 68, and my husband Robert is 69. We live with our cat Elliott in Texas, where Robert is an artist and I’m a marketing executive. We’ve been married for 40 years and have two grown children, both of whom are married with no children.

I work from home, and normally go on business trips several times per month, though currently I’m grounded due to the pandemic. Robert has a small studio and sells his paintings online and through a local gallery. I love to read, cook, and garden (my favorite part of gardening is harvesting!), and I’m trying to learn French.

We love exploring our area, especially the excellent Texas wineries, and we enjoy hosting dinner parties.

Lily & Robert’s Financial Background

For many years, we did the opposite of managing our finances, running up credit card debt, dining out constantly, and generally ignoring fiscal responsibility. We woke up in 2010 and realized we had $100k in credit card debt, plus two car loans, a mortgage, and significant student loan debt. We started working on it, subsequently discovered Frugalwoods, and have been scrambling to make up for lost time. Fortunately I have a good income, so we’ve been able to pay off all our debt and save a substantial amount. We also paid off our mortgage (we purchased our house for $339k in 2017). We’re currently saving well over $100k per year.

Lily & Robert’s Lifestyle

Our lives have a happy rhythm. We usually have coffee together in the morning before one or both of us takes a walk (Robert walks with a neighbor and I listen to books on my solo walks). Then Robert goes to his studio and I go to my home office for the day. We meet up after work for cocktails while I prepare dinner.

We love to watch movies and usually have “dinner theater” when we’re home alone. On weekends we like to have friends over for dinner, take a day trip (Texas wineries!), or run errands, but of course now we mostly stay home. We are foodies and occasionally splurge on a special restaurant experience; recently we enjoyed a nine-course tasting menu inspired by a region in Mexico.

I mostly enjoy my business travel, although sometimes it’s exhausting. I’ve flown over 2 million miles in my career and have visited India and the Philippines, but most of my travel is domestic. The frequent flier miles I’ve earned have enabled us to take some memorable trips, and we’ve fallen in love with France and Italy in particular.

Life In The Pandemic

We’re grateful to be relatively unscathed by the pandemic: we’re healthy, I still have my job, and our family and friends are safe so far. However, being stuck at home is weighing on us (literally; I’ve gained ten COVID pounds!) and, like everyone else, we’re anxious about the surge in Texas and across the US. We never get tired of each other, but we miss seeing friends and family, and I have been rather bored since my workload has declined. I need more hobbies!

We’re looking forward to traveling full-time when I retire. Having made that decision, it’s getting harder to wait—we want to go NOW! Also, we’re rethinking our plan of trying to make a financial profit from Robert’s art, which has never been profitable but provides helpful tax write-offs. When we begin traveling, he’ll probably switch from oils to watercolor (as they’re more portable), but he’s considering taking down his website.

Where Lily & Robert Want To Be In Ten Years:

- Finances: Independent, with some growth in assets.

- Lifestyle: Either traveling full-time or settled down (maybe in Europe?) in an owned or rented home (not our current home in Texas).

- Career: Retired!!

Lily and Robert’s Finances

Monthly Income

| Item | Amount | Notes |

| Lily’s net income | $12,443 | Lily’s net salary, minus the following deductions: vision and dental insurance, 401k contributions, and taxes. This includes a prorated variable annual bonus that’s paid out in late March. |

| Robert’s Social Security | $1,716 | Net after Medicare deduction (no taxes withheld) |

| Lily’s spousal Social Security | $751 | Net after Medicare deduction (no taxes withheld). I will switch to my own when I turn 70 and will receive around $3,300 per month. |

| Loan repayments from kids | $750 | Interest-free loans to our kids. These will be repaid in a couple of years. |

| Robert’s income from a family investment | $375 | Gross; no taxes withheld. |

| Robert’s art income | $25 | This was about $700 per month last year, but Robert has only sold one painting so far this year. |

| Monthly subtotal: | $16,060 | |

| Annual total: | $192,720 |

Assets

| Item | Amount | Notes | Interest/type of securities held | Name of bank/brokerage |

| Home value | $375,000 | Fully paid off; planning to sell by 2022 | ||

| Lily’s IRA | $347,506 | Primarily Blackrock mutual funds | Edward Jones | |

| Post-tax investment account | $378,771 | After funding 401(k) and Roth, all extra goes here | 52% in stock index funds and 38% in bond index funds | Fidelity |

| Lily’s 401(k) | $152,105 | I contribute 90% so that it’s fully fund in Q1 each year. | 100% in Fidelity 500 Index fund | Fidelity |

| Savings account | $39,126 | This is our emergency fund. We’ll probably increase it to about 12 months of expenses when we retire. | Earns 0.8% interest (it was 1.6% when we opened it several months ago) | American Express Bank |

| Robert’s Roth IRA | $31,176 | We add $7k per year | We pay about $35/month in fees | Edward Jones |

| Health Savings Account | $29,479 | We’re saving this for old age | Vanguard Total Stock Market Index Fund | Benefit Wallet |

| Robert’s life insurance | $6,539 | Cash value on a burial policy Robert’s parents bought | Prudential Life Insurance | |

| Health Savings Account | $3,738 | We’re saving this for old age | Choice Strategies | |

| Checking account | $1,500 | We keep as little as possible in this account | Bank of America | |

| Money market account | $1,413 | We moved most of this into the AmEx account but kept a little in. | Bank of America | |

| Total: | $1,335,087 |

Cars

| Vehicle make, model, year | Valued at | Mileage | Paid off? |

| 2014 Lexus 350 SL | $15,000 | 112,000 | Yes |

| 2016 Toyota Venza | $9,000 | 63,000 | Yes |

| Total: | $24,000 |

Debts: $0

Expenses

| Item | Amount | Notes |

| Taxes | $1,086 | Property tax, vehicle registrations, tax on Robert’s family business income, and tax prep fee. |

| Healthcare and medical | $863 | Includes Medicare, supplemental insurance and Part D premiums, plus prescriptions and out-of-pocket expenses. |

| Groceries | $826 | We eat almost all meals at home and buy high quality/organic foods. |

| Utilities | $382 | Water and electric |

| Home maintenance | $372 | Includes every-other-week housecleaning, supplies, exterminator service, heat & air service contract, garden supplies, etc. |

| Travel | $347 | This has declined since the pandemic began. |

| Robert’s art business expense | $265 | Equipment, supplies, client meetings, etc. |

| Adult beverages and wine | $252 | We love wine and have several winery memberships |

| Restaurants | $218 | We don’t eat out often, but when we do it’s usually a special place. |

| Insurance | $194 | Includes home and auto insurance |

| Gifts | $185 | Birthday and holiday gifts for our adult kids and their spouses. This will decrease as some of them no longer want “stuff.” |

| Personal care | $162 | This has dropped to almost zero since February–no haircuts/color! |

| Charitable giving | $100 | Various organizations |

| Entertainment | $79 | Includes local theatre season tickets (now donated due to the pandemic), Hulu, Netflix, and movie theaters prior to pandemic. |

| Credit card fees | $75 | Amex $550, Delta $250, Marriott $95. High, but we get benefits that more than offset these fees. |

| Gas for cars | $66 | |

| Cell phones | $60 | This averages $135/month (includes phone device payments), but Lily’s company reimburses $75. Lily needs a large data plan due to business use. |

| Automotive | $59 | Repairs, maintence |

| Cat care | $49 | Elliot’s food, litter, treats, and annual exam |

| Clothing | $48 | This is even less since the pandemic. |

| Subscriptions | $31 | International Living and Amazon Prime |

| Service charges and fees | $22 | Includes 401(k) record-keeping fees plus check order, also a $95 annual Citibank credit card fee. We don’t use that card but I’ve had it for many years and the credit limit is $66k.

Should I close the account, or will that hurt my credit score? |

| Hobbies | $19 | Amazon Kindle and Audible |

| Home improvement | $13 | Home Depot (can’t remember what we bought!) |

| Monthly subtotal: | $5,773 | Since March our spending has been well below $5k. |

| Annual total: | $69,276 |

Credit Card Strategy

| Card Name | Rewards Type? | Bank/card company |

| Amex Platinum | Travel | American Express |

| Delta Skymiles Platinum | Travel | American Express |

| Marriott Bonvoy Boundless | Travel | Chase |

| Citibank Advantage Gold | Travel (I got this card years ago when I traveled on American, but now that I use Delta should I cancel this one?) | Citibank |

Lily’s Questions For You:

Originally I planned to retire in April 2022 at which time we would sell our house, cars, and almost everything else, and travel full-time, mostly in Europe, staying 1-6 months in each location (using AirBnB or similar). However, my company, like so many others during this crisis, has reduced its staff by about 30% YTD, and I could easily be on the chopping block if further reductions are taken.

Given that, my questions are:

- Assuming a post-retirement budget of about $90k/year, does our plan seem reasonable financially?

- If I lose my job in the near term, does it make sense to go ahead and retire (I’d get severance, probably 3-4 months)? I’d still want to wait until age 70 to take my own Social Security, so we’d initially rely on passive income (about $3,050/month post tax, assuming a 15% tax rate) + some withdrawal from savings to cover living expenses.

- Should we hire a fee-based financial advisor to handle our money? We wonder whether we’d get an ROI with an advisor that charges 1%.

Mrs. Frugalwoods’ Recommendations

Lily and Robert are in great shape and have made some excellent financial moves in the last ten years! I want to congratulate them for turning things around in 2010 and making real changes to their longterm trajectory. Lily and Robert are a SUPERB example of what’s possible when you come to terms with your money and the changes you have to make. Let’s review their story:

- At ages 58 and 59, they had $100k in credit card debt, two car loans, a mortgage, and significant student loan debt.

- That’s a lot of debt–even for someone with a salary as high as Lily’s–but she and Robert weren’t daunted.

- They paid off all of it, including their $339k mortgage, and have managed to save enough to make themselves not just solvent, but ready to retire to a wonderful lifestyle!

I want to highlight this for anyone who feels like they’re too deep in debt to climb out or too far along in life to make a dent. Lily and Robert are living proof that it’s possible to change your entire financial outlook as you round the corner to traditional retirement.

I think many folks in their late 50s/early 60s assume the die is cast and are resigned to their situation, but it doesn’t have to be so. The primary reason they were able to do this was Lily’s excellent salary and career–kudos to Lily–coupled with their determination to make it happen.

Ok, on to Lily’s questions!

Lily’s Question #1: Assuming a post-retirement budget of about $90k/year, does our plan seem reasonable financially?

The short answer is yes, as long as the $90k estimate includes lodging.

Let’s dig deeper:

Lily and Robert already know their expected monthly Social Security payments, which helps our planning tremendously. Side note: you can find this information by following these instructions on how to retrieve their earnings tables from ssa.gov (the government’s Social Security website). Robert is already collecting $1,716/month and Lily noted she’ll receive around $3,300/month.

Monthly social security: $5,016 (annual: $60,192)

That amount alone would cover their living expenses. Further, since they plan to sell their house and cars, many of their expenses will evaporate. There are so many embodied costs to ownership and once they’re free, they’ll be spending a whole lot less every month.

Here’s a list of all the expenses they WON’T have after they sell their house and cars:

| Item | Amount | Notes |

| Taxes | $1,086 | Property tax, vehicle registrations, tax on Robert’s family business income, and tax prep fee |

| Utilities | $382 | water, electric |

| Home maintenance | $372 | Includes every-other-week housecleaning, supplies, exterminator service, heat & air service contract, garden supplies, etc. |

| Insurance | $194 | Includes home and auto insurance |

| Gas for cars | $66 | |

| Automotive | $59 | Repairs, maintence |

| Home improvement | $13 | Home Depot (can’t remember what we bought!) |

| Monthly subtotal: | $2,172 | |

| Annual total: | $26,064 |

They’ll obviously be spending much more on travel and lodging, but it’s important to note the hefty chunk they’ll save by no longer owning big expensive things like a house and two cars (I’ll admit, I’m a tad jealous thinking about their carefree post-retirement life… ahhh).

Required Minimum Distributions

The rest of their post-retirement income will come from distributions from their various retirement and investment accounts, some of which will be required, due to something called Required Minimum Distributions (RMDs).

You’re not allowed to keep money in retirement plans forever–at some point, the IRS requires you to start withdrawing money from them. In general, you have to start making withdrawals when you turn 72 (it used to be 70.5, but a new law in 2019 bumped it up to 72). The exception here are Roth IRAs, which you don’t have to take from until after the owner of the account is deceased.

Let’s take a look at Lily and Robert’s retirement accounts:

| Item | Amount | Notes | Interest/type of securities held | Name of bank/brokerage |

| Lily’s IRA | $347,506 | Primarily Blackrock mutual funds | Edward Jones | |

| Lily’s 401(k) | $152,105 | I contribute 90% so that it’s fully fund in Q1 each year. | 100% in Fidelity 500 Index fund | Fidelity |

| Robert’s Roth IRA | $31,176 | We add $7k per year | We pay about $35/month program fee. | Edward Jones |

| Total: | $530,787 |

Since Robert’s Roth IRA is exempt from RMD rules, we’re really just looking at Lily’s IRA and 401k. According to the IRS:

The required minimum distribution for any year is the account balance as of the end of the immediately preceding calendar year divided by a distribution period from the IRS’s “Uniform Lifetime Table.” source: IRS

What is the “Uniform Lifetime Table”? I was waiting for someone to ask that! Thankfully, the IRS provides it for us in this IRA publication. Per this table, the Distribution Period for age 72 is 25.6.

If Lily begins RMDs when they’re legally required–when she’s 72, which’ll be in four years–the math she’ll do is the account balance of her 401k and the account balance of her IRA at the end of the 2023 calendar year (assuming she turns 72 in 2024), divided by the Distribution Period as listed in the above table. Since we can’t know what those account balances will be at the end of 2023, let’s do the exercise using the current balance totals:

- Lily’s IRA: $347,506 / 25.6 (the Distribution Period for age 72) = $13,574.45

She also has a 401k, which is subject to RMD rules, so she’ll also do this math:

- Lily’s 401k: $152,105 / 25.6 (the Distribution Period for age 72) = $5,941.60

The total amount she’d be required to withdraw (using this year’s account balances) is $19,516.05. The required amount increases each year, so she’ll be withdrawing more with each passing year.

To recap, Lily and Robert’s total annual Social Security amount is projected to be $60,192 and her RMDs from her IRA and 401k are projected to be circa $19,516.05, which gives them a total base annual income of $79,708.05. Of course, these are estimates and Lily will need to do the math at the actual time that RMDs kick in for her. Laws changes and the best way for Lily to stay on top of this is to read the IRS website. I prefer to use primary sources (such as the IRS and the Consumer Financial Protection Bureau) due to the changing nature of these laws. But, these estimates give Lily and Robert a rough sense of the income they’ll have in retirement.

Other sources of retirement income for Lily and Robert:

- Robert’s Roth IRA

- Lily’s taxable investments

They can plan to make sustainable withdrawals from both of these to supplement the above base income.

Will Our Money Last?

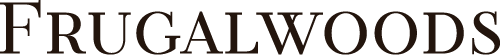

I input Lily and Robert’s numbers into Engaging Data’s Post-Retirement Calculator and, according to this calculator, they are supremely unlikely to run out of money in retirement:

Source: Engaging Data

Lily’s Question #2: If I lose my job in the near term, does it make sense to go ahead and retire (I’d get severance, probably 3-4 months)? I’d still want to wait until age 70 to take my own Social Security, so we’d initially rely on passive income (about $3,050/month post tax, assuming a 15% tax rate) + some withdrawal from savings to cover living expenses.

It probably does. Since Lily is so close to retirement, it seems like it wouldn’t be worth the hassle of a job search, starting a new job, etc only to turn around and retire a year or two later. In terms of cash flow, I think they could either reduce their expenses to fit into the $3,050 per month or, as Lily noted, withdraw from savings. Since it’s the difference of two years at most, it seems to me they’d be able to make it work until Lily started taking Social Security and their RMDs kicked in.

Lily’s Question #3: Should we hire a fee-based financial advisor to handle our money? We wonder whether we’d get an ROI with an advisor that charges 1%.

This is really a question of how much Lily and Robert want to dig in and do the research themselves. They’re imminently capable of doing this on their own and, since Lily noted she’s been bored due to work slowdown in the pandemic, this might be the perfect time for her to take her financial prowess to the next level.

An advisor is worthwhile if you’re willing to pay a lot of money to have someone do your research for you and if you have a tendency to panic in market downturns. An advisor is not going to give you hot stock tips or radically increase your net worth, but if you know yourself and know you’re panicky, paying someone to tell you not to sell at the bottom of the market is a worthwhile investment.

If Lily and Robert do hire an advisor, it’s important they keep in mind they’ll be losing 1% of their assets under management (AUM) every year. 1% might not sound like a whole lot until you do the math. At their current net worth of $1,335,087, they’d be paying an advisor $13,350.87 PER YEAR to tell them stuff they probably already know.

Lily and Robert have a pretty straightforward financial situation with no complicated pensions or debts. It’s entirely up to them and, if they’d feel more comfortable hiring an advisor, they should go for it. They can afford it and if it’ll give them peace of mind, it’ll be money well spent. On the other hand, if they’re up for doing some research, I think they can easily take care of it themselves.

I say this because Lily and Robert are already on the right track and, going forward, here’s what they should be doing:

- Ensuring their asset allocations are appropriate given their ages (this is something they can research and implement on their own)

- Ensuring they’re taking their RMDs (this is something they can research and implement on their own)

- Ensuring they understand the tax implications of the above (I suggest hiring a CPA for a one-time or once-annually consultation)

- Ensuring they’re not paying too much in fees for their investments (more on that in a moment)

- Then there are the major unknowns we’ll all face in older age, such as long-term health and nursing care, which they can research and implement on their own.

Given this, if it were me, I would probably do the financial research myself–which’ll save them $13k per year–and then hire a CPA to offer tax advice on tax-efficient withdrawal strategies for their retirement and taxable investment accounts. An advisor might be able to help with this, but a CPA is really who you need and you’d pay them for a one-time consult versus paying 1% annually in perpetuity. Further, if they haven’t already, I recommend hiring a lawyer to create a will and estate plan (Mr. FW and I did this a few years ago and I am VERY HAPPY we spent the money on a real lawyer–well worth it and way cheaper than a financial advisor).

There’s absolutely nothing wrong with Lily and Robert hiring a fee-only fiduciary as an advisor, but they could probably save a bunch of money by doing the research themselves.

Avoid Fees

One thing that jumps out at me are Lily and Robert’s Edward Jones accounts. It’s likely they’re getting ripped off with fees on those accounts. If it were me, I would transfer these accounts over to a reputable, low-fee brokerage. Since their Edward Jones accounts are retirement accounts (an IRA and a Roth IRA), they shouldn’t incur capital gains taxes in making this transfer.

The fees you pay for the investments you hold are usually listed as a percentage called an “expense ratio.” You want a low expense ratio, so that you’re not losing a ton of money to fees. Many a shady stock broker/brokerage has raked in millions by charging high fees. I always recommend folks look for low-fee, total market index funds.

Choose A Bank and Stick With It

If it were me, I would go ahead and consolidate all like accounts (i.e. put the savings, money market, and checking accounts together) and put them all under one banking roof. Since their taxable investments are already with Fidelity (and they would incur capital gains taxes if they moved those), it would probably be easiest to transfer everything to Fidelity.

Summary:

- Decide if they want to put in the time to do the research that’ll avoid hiring a financial advisor. If they decide to hire someone, make sure it’s a fee-only fiduciary.

- Work to consolidate accounts and banks. Consider switching from Edward Jones (high fees) to a brokerage with low fees.

- Have a game plan for keeping track of their upcoming financial moves (either by hiring an advisor or researching it themselves):

- Ensure their asset allocations are appropriate given their ages (general rule of thumb: decrease risk as you age)

- Ensure they’re taking their RMDs when and as required (see above IRS guidelines)

- Decide when and how much to withdraw for a sustainable draw-down of their Roth IRA and taxable investments

- Ensure they understand the tax implications of the above

- Consider hiring a CPA for a one-time consultation on tax-efficient strategies. Consider hiring a lawyer to prepare a will and estate plan (if they haven’t already done so).

- Feel confident in the knowledge that they’ve put themselves in a fantastic financial position and that whether or not Lily is laid off, they’re in good shape. Toast some Texas wine to that!

Ok Frugalwoods nation, what advice would you give to Lily? We’ll both reply to comments, so please feel free to ask any clarifying questions!

Would you like your own case study to appear here on Frugalwoods? Email me (mrs@frugalwoods.com) your brief story and we’ll talk.

Seconding the leave Edward Jones advice. My FIL discovered upon retirement that he could save *$10,000/year* by switching from Edward Jones to Vanguard. I don’t know how much they had in that exact account, but it is definitely more in the mid- to low-six figure range than the seven figure (since they didn’t have a million dollars saved– most of their retirement money is in the form of pension). $10K is THREE online classes per year that my MIL no longer had to teach. Just in fees! He was like, no wonder my EJs guy had no problem donating $300 to my pet charity each year. Now he makes that donation himself.

Nicoleandmaggie, I told Robert about this and we’re going to move everything from EJ to Fidelity ASAP! Thanks for sharing your FIL’s story.

@nicoleandmaggie, that is amazing! We felt the fees were high, and the performance of the EJ funds is far below those in Fidelity. We’ll be moving those accounts asap. Thank you!

If they are planning on moving, my suggestion would be to start selling/donating household items now. eBay, Craigslist, FB marketplace, and/or local sales. It can take longer than one thinks to sell some things.

Excellent suggestion! Give yourself an outbound house deadline to sell or donate to get it done.

In my opinion, they should retire now regardless of her job status. She didn’t mention any health problems so I assume they are both healthy but they will be both be in their 70’s VERY soon. Even if healthy now, the window for their ability to travel domestically and internationally full-time AND enjoy it fully is closing within a few years….let’s say 6-8 years. After that, health issues will likely begin to creep in and one or both will not be able to/want to travel to the same extent. They are in great financial shape and know how they want to spend their retirement so I’d recommend they do it ASAP. She makes a huge salary which have probably turned into golden handcuffs that are difficult to break from. My thinking on this began to change after reading Bill Perkins Die with Zero and I’d suggest they read it.

I agree with this. My parents are retired and have been traveling until the pandemic hits. (They are in their early 70’s.) My mother always says that she is acutely aware that they are only one health crisis away from never being able to travel again. If it’s your dream to travel, see if you can retire now and go do it!

I agree with this except…. with travel being currently unsure during the coronavirus (if they are not comfortable or feel unable to travel now/in the next 18 months), why not keep the job and the income while selling off home items etc to prepare for the retirement transition?

Lori Beth, we’ve been discussing that recently. One option might be to go ahead and sell the house, so that when we’re permitted to travel again we’ll be ready to take off. And at this point my job isn’t super stressful, so it makes sense to keep working until we can start traveling. Thanks for your suggestion!

Another thing I like about this is that in many places, the real estate market is red hot right now. Who knows what will happen in a few years but you might get the best price you’ll be getting in a while right now.

And I just want to say, I’m super inspired by your story!

The US is huge with loads of great places to visit! New Orleans, Grand Canyon, Yosemite, Yellowstone, Smoky Mountains, Seattle, Portland, Hawaii, Alaska, Glacier, San Fran, Zion, Big Bend, etc….

KJ, you’re so right! We started traveling full-time last October and have spent a month each in various places, including Seattle, Portland, Hawaii, and more. We’re really enjoyed seeing Yosemite, Grand Canyon, Big Ben, etc.

Yes, also…there are currently still travel bans in place. An American cannot travel to EU for tourism purposes. Unfortunately, living as an American in EU right now, it’s not a fun situation as family is unable to visit for an unknown time.

Kudos to Lily and Robert for getting out of debt so quickly! Y’all are in great shape financially now. I second all of Mrs. FW’s advice, especially leaving Edward Jones due to the exorbitant fees. I use Vanguard and am very happy with their service. I get the sense that they might want to relocate entirely to somewhere in Europe (Italy?) and use that as a base for traveling. If that’s the case, their money will go even further as they age due to the decrease in health care costs, which are exorbitant here in the US but not in the EU. If Lily has the opportunity to retire (or is forced to do so), take that severance package and get started on your new life!

When considering health care overseas, keep in mind that (per Medicare.gov) “In most situations, Medicare won’t pay for health care or supplies you get outside the U.S.”

I agree with simplifying banks. It sounds like they have great plans for their initial retirement years. What would they like to do with their time in their 80s & 90s if travel becomes tedious or if they feel they would prefer to have a home base?

I think this is an important point.

Also, It’s clear they have enough savings to cover their existing expenses, but not knowing what kind of international travel they plan to do, where they plan to do it, and how much that costs seems like an important piece of the puzzle. We are sort of close to retiring at 60/62 and when playing with calculators, even changing our monthly expenses by 1-2k/month makes a big difference in how long the money lasts.

Yikes, Jess! We haven’t even thought about post-travel, aside from a vague sense that we’d like to be in France. Thanks for prompting more discussion!

For her question about the Citibank Advantage Gold, I would not close the account, but instead product change to the Citi Double Cash Card. I think that would be a better use for this card, and it would keep your credit limit the same and the length of account the same and not affect your credit score, plus give you a 2% cash back card that could be useful.

They’ve already got three credit cards, I don’t think they need another one. Just cancel it. A potential very slight dip in credit score really does not matter for a couple of millionaires who have a paid-off house and two paid-off new cars.

Agree with this! My husband had the $95 fee citi card and we got sick of paying and were able to convert it to a no-fee citi card. Then you keep your credit history! (at least I think so, best to confirm of course!)

Jessica, I’ve done it and it does keep your credit history.

Me too! If this is a long term card definitely worth product changing to a no-fee card.

I’ll second the advice on the financial planner. Hire a CPA or attorney for advice about how to structure withdrawals but those percent of assets under management people aren’t worth it at all unless you can’t keep your hands off the account. If you do decide to hire a financial advisor, sit down before the first appointment and make a list of questions you want answered and/or tasks you want performed. Make sure that the financial advisor actually can answer the questions or perform the tasks. We paid a couple of years of fees to one who gave us very general tax advice (fill your IRA and in your circumstances a Roth is better) and a diversified mutual fund portfolio. He had no answers to questions about how to deal financially with my disabled son. Basically everything he did/told us was info available on hundreds of websites. The mutual funds were medicore too.

I would say it depends on the financial planners. We have had Lord & Richards in Denver, CO looking after our investments (a little more than one-half million). They also charge 1%, but have been growing our money nicely, even in all the uncertainties this year. The key: total honesty. We can check our accounts daily, if we want to….and they have explained their strategy very well.

I can focus on other things, and not worry about investments. We can travel all we want, and not worry about them, either. So that’s why I’d say it depends on the company.

Agree that Edward Jones is a rip off in fees. We had them for about 2 yrs many years ago and he had us in several different accounts and when we closed out those accounts and moved them to our vanguard accts there was around a thousand dollars in fees to close them. Well worth it though because we have had well over a decade of low low fees with vanguard. At a certain amount invested at vanguard you get admiral shares which are even lower than the low fees offered to smaller accounts. I think it is 50000 but I don’t remember. All of our vanguard is admiral. You have done an amazing job with your finances. If you now feel you are ok to retire, I encourage it. Just realize at first it is a learning experience. I retired in March at 68. My husband retired at 53, he is now 78. I felt bored when I first retired but we were in the midst of Covid. I now feel great and never want to go back. We had to forego a Europe cruise in 2019 due to a colon cancer dx and subsequent major surgery. He was stage 1 and all is good now. Just saying go do the traveling while you can before you become too ill or too old to do it. We are still fit to go but with Covid, just not sure if we want to do that. What will be out there next? Some countries do not like Americans so I just encourage you at your ages to be careful where you choose to travel. There have been some bad experiences with airbnb. I don’t mean to sound discouraging. Just encourage you to be careful in other countries. Good luck to you both.

Jean, I have often wondered about how Americans might be treated in some countries. We want to travel extensively in Europe in retirement. Which countries are better and which ones are worse, in terms of their sentiment?

I would be interested to hear from other readers who have traveled extensively, but in 20 years of traveling and over 20 countries, I’ve yet to be treated badly because of my nationality. I’ve been witness to unpleasant events, but they have generally been a result of the traveler behaving inappropriately (loud, rude, expecting things to be “American” etc.) or the person in the host country just being less friendly than we are used to in the USA, or trying to scam anyone they can, regardless of nationality. I believe that if you observe how locals conduct themselves, and try to learn basic words like please and thank you in the language, you will be welcome in most places.

Me too! I’ve traveled to over 20 countries as well and the only place something bad has happened to me was in the US! (Was stolen from). I’ve never had anyone have a problem with me for being from the US.

A tip, I would recommend having phone service and data, that makes it very easy to get around and I use Google Fi which is the same price for data in most countries.

Agreed, I’ve always been treated very well overseas. The most fun interaction was in Korea, my husband and I were asked by multiple people if we were Canadian! Not sure what made people suggest that as we are very much from the southern USA.

One thing to consider with regard to Robert’s art and the tax breaks is whether he might run afoul of the IRS hobby/business distinction if it continues to be unprofitable for too many years. Hobby expenses are not deductible.

Good point. Sadly, he spends more money on supplies, then he earns in sales.

On the “might move to Europe or stay there 6 months at a time” situation…US citizens can only stay in Schengen countries (EU) for 90 days per 6-month period. And you can’t just go to a non-EU country for a week (UK) and then come back. And the only way you’d be able to permanently move here is if either of you can get an EU passport via grandparents/parents who emigrated. And you’ll have to see what your healthcare provider says about covering you overseas. For a 3-month trip I assume it’s extra. Do you speak French or Italian? Lots to think about.

You can obtain an EU passport and residency status most easily in Malta or Portugal by a significant investment in a property or business.

There are a lot of expat Americans near Lisbon, the algarve and in the Azores. Speaking Portuguese is kind of optional but you will get a lot more out of the experience if you can! My in-laws are Azorean-British and have a ton of retiree friends from the US.

Also beware of currency fluctuations- it can play absolutely havoc with overseas retirement plans

Malta recently terminated its program for citizenship (passport) via investment and now offers residency only.

https://best-citizenships.com/2020/07/05/malta-iip-to-be-terminated/

Debbie, these are great points! At this juncture we’re looking at applying for a one-year renewable visa for France, and using that as our point of departure for exploring other countries. Of course, Americans can’t get into most EU countries right now due to COVID–but we’re hoping that by the time I’m ready to retire (assuming no layoff) that will be possible. The other alternative we’ve considered is alternating between Schengen countries and the UK or Ireland to stay in compliance.

Lily, it sounds like you realize this, but just in case (and for others out there who may not realize it) – a one-year renewable visa for France does not override the Schengen restrictions of only being allowed visits of 90 days maximum per180 day period in the Schengen Zone. You mentioned using France as a home base and exploring other countries the other 180 days of the year when not allowed in a Schengen country. The UK and Ireland are good options (albeit a little pricey and too gray in the winter months for me), but the rest of the non-Schengen European countries are mostly in the “old” Yugoslavia and Soviet Union. There are 26 Schengen countries right now – Austria, Belgium, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, and Switzerland – that’s pretty much all of Europe. Plus, Bulgaria, Croatia, Cyprus, and Romania are expected to be added to the Schengen Zone in the next year or so. The days of spending a year running around Europe like we used to do in our backpacking days in the 1970s are no longer possible without spending half the year in a “secondary” European country that I suspect will not offer what attracts you to France and Italy. Maybe I’m being a little judgmental here, but I’m in the same position you are – recently retired and hoping to spend the majority of the year somewhere other than my home in Colorado post-covid. I don’t think I want to spend weeks (especially in the winter) in any of the European non-Schengen countries. Of course, there are alternatives in Northern Africa (like Morocco) and Central and South America, and Asia. But in my Schengen research it seems the best way around the regulations if you want to focus on Europe is to buy a teeny tiny place in France (probably not a pied d’terre in the 5th arrondissement in Paris!) but somewhere nearby a large city with good transportation options). My understanding is once you are a property owner, the Schengen restrictions do not apply. Besides giving you a home base, it might be possible to rent it out as an AirBnB when you’re not there. Just a thought, it’s something I’m looking into.

Was wondering about this plan too. I first came to Ireland (many years ago) on a visa relating to my spouse’s employment. It needed to be renewed annually. This is much more convenient than the digital nomad type of travel permission in Europe, but there is still NO guarantee a country will renew your visa, however long its duration and renewal dates. Your type of visa could also be discontinued or altered. (Happened to me about seven years in.) It adds extra uncertainty to any plans. Also, as we’re talking about the future, maybe keep in mind that visas aren’t just about security- they’re about economies, and can be politically weaponized, since the arrangements are usually reciprocal. Europe has been slow to react to some antagonism from the US about the movement of goods and people recently, but if it keeps up, relocating Americans may find these matters becoming more difficult. A bolthole in the States might be a good backup.

I would say to hire a good immigration / relocation person for the first country you’ll live and they can help a ton. From my experience relocating to EU, they like $$$, so if you’re able to show bank statements and financial support with health valid insurance , you might not have too much of an issue. They’re mainly considered about people who will draw from the social system.

One issue they may want to factor in is the cost of health insurance, if travelling outside of the US for prolonged periods – which can be extremely high for European destinations after the age of 70.

Also the window of the good health needed to travel maybe quite short. My mom was a very active traveler well into her late sixties (Rwanda, Bangladesh, Tunisia etc) but unexpected minor health issues (hypertension leading to flight related nose-bleeds and a cataract) have really curtailed her ability and confidence to travel at just age 72.

So my advice would be retired now – relax and enjoy yourselves! Looks like you are all set.

From a UK reader.

And Medicare generally does not pay for care received outside the United States.

Effie, those are wise words. If we’ve learned nothing else from this pandemic, it’s that life is short and we need to embrace each moment. We’re considering moving forward with full-time travel in the US until we’re allowed into Europe.

I went on a road trip to US national parks recently while moving and it was lovely! It felt reasonably safe as a fully outdoors activity that does not require flying (especially in states that took the pandemic more seriously, like on the west coast where there are many beautiful parks). If you are looking into full-time travel in the near future in the US, I would highly recommend that! And I went with a recent leg injury but most parks were still quite doable even with somewhat limited mobility! Extra bonus, you can get a cheap senior annual pass or lifetime pass to all national parks and other parks/monuments.

Totally agree. My MIL retired early at 62 to “Finally” tour the castles in Europe with my FIL who finally agreed to retire at 67. One year later she died while putting her make up on one morning. My FIL, now 86 regrets not retiring even one year earlier to have those times and memories. I would retire and travel as soon as a vaccine come available or you both are comfortable enough to feel its safe to travel again. Best wishes – LOVE reading one of these case studies about readers a bit older than the usual studies! It’s good to showcase because we will all be in that situation sooner than we think so its a good resource for planning ahead.

Lilly and Robert, Thank you for sharing your story, and congratulations on paying off so much debt so quickly at a later point in your careers. I’d like to echo the suggestion to move your investments to lower-fee funds at Vanguard or Fidelity, etc. However, as you embark on this next chapter of your life, you might consider buying some time with a certified financial planner just to make sure you have all your ducks in a row. CFP’s are fiduciaries, so they are obligated to provide sound financial advice rather than selling you products you may not need. My wife and consulted with a CFP before I retired and it was really helpful. Even though I’m a confirmed homebody, I enjoy following the GoWithLess couple on youtube. They’ve sold everything and are now enjoying their retirement of full-time travel. I’d encourage you to check them out.

I didn’t see any discussion about long term health costs, nor was there discussion about their estate plans, what was the return assumptions on the how long your money will last projection, will the kids be back for more loans? How about inflation, what’s their thoughts, just saying there are a lot of unanswered questions here.

Hi, Thanks for being a case study. Really impressive that you turned things around financially as you did. Kudos!

I agree about leaving Edward Jones. Remember, they are salespeople first and may have surprisingly little financial background. We are DIYers and I have found it really interesting to learn, especially when you have skin in the game. There is SO much good information about investing and financial planning on the web, along with helpful online communities like this one to answer your questions. I recommend starting with Jim Collins’ stock series and then as you get more advanced, the Bogleheads website. It’s free and people are truly eager to help at all levels. Keep it simple and remember that fees really matter over time.

One other note: The Frugalwoods retirement simulation at the top assumes keeping your money in 80% stocks. Just be aware that that is considered a risky asset allocation for retirees.

I was also going to ask about that. The rule of thumb is to allocate investments into bonds equal to your age, i.e. if you are 68, then 68% of your investments should be in bonds. I really like that retirement calculator. You can change the various factors and see how it changes the graph. I don’t like seeing the chance of death on there, so I uncheck the Death box.

I might have missed this but where will Robert and Lily live when they aren’t traveling? What if they can’t travel from place to place due to situations like the pandemic we are currently experiencing or one of them becomes ill? It would be costly to replace everything.

Greeting from the UK. My husband Barrie and I are 65, recently retired, and divide our time between the UK and the French Alps- both small apartments as we have no children, and downsized our house ten years ago. Much of what we have done since fits in with the Frugalwoods philosophy, but that’s another story.

There are two things missing from this case story, from the perspective of Europe. Schengen, and a budget. Schengen first. As Brits we will soon be in the same position as visitors from the US- only allowed 90 days in any 180 in the Schengen area, which includes France and Italy. Lily and Robert need to research this, as it could affect their plans.

Next, a budget for Europe. How has the figure of $90,000 been reached? Will it be enough? It may be. I’ve just had a look at rental in the Dordogne, and €700-€1,200 a month depending on the season looks typical for anything reasonable. AirBnB adds up long-term for side-trips, food is more expensive here than in the States, both groceries and eating out, as is fuel for any vehicle. Car hire or purchase? Car insurance? Health Insurance? (Usually a big jump after 70). Internal flights? (But wine is cheap!)

They may also want the security of a small bolt hole back in the States knowing they can come home to it at short notice without needing to stay in hotels or with their children. We have seen sailing couples set off on their retirement adventure in excellent health, and have unexpected serious health issues a few years down the line.

You don’t need a financial advisor, in my opinion! I look after the finances in our household. We have a UK current account and credit card account with the same bank, a French current account, cash savings in a Building Society which we will draw down on over the next five years to supplement state and private pensions, Private Pensions both with the same provider, and Investments in a Vanguard Life Strategy Fund which we don’t plan to touch for at least five years. I moved a mix of investments into that recently because of their low charges, and it’s so straightforward to understand with a great website. We also have two rental properties. Like Mrs. Frugalwoods, a spreadsheet is my happy place, but now everything is set up I don’t sweat the income on a weekly or even monthly basis. I do still keep the accountant that we used when we had the business to prepare our annual personal tax accounts though, and his advise more than pays his fee.

Finally don’t wait! Go as soon as you can! The Pandemic is a great opportunity to make plans. I might even see Robert on an Italian quayside selling his watercolours one day.

I am also 68 and have been fully retired for nine years, with two years before that downshifting from a very intense well compensated law practice. I heartily second Alicia’s comment above – you can’t replace healthy years, and you never know how long they will last, so do not hesitate to retire and enjoy your dreams of travel. After 10 years of undertaking the trips we had dreamed of, with the time and money to do so, my zest for a lot of destinations is somewhat faded. A couple of other things are worth considering, in looking at the peripatetic life game plan. Lily says they have grown children- no grandkids yet, or never? The arrival of a new generation was a game changer for us. Also, since Lily loves to garden and cook, ( as do I) those pastimes will be challenging in an Airbnb type setting. If you two like your Texas home, it might be a good idea to hang on to it and rent it out at first, so you have a home base available to you. If you don’t particularly like the house or the area, think about acquiring a pied a terre somewhere that you do like so you have a home base. Finally, Lily probably already knows this, but Medicare does not pay for care outside the US. Her Platinum card will sell her a medical care policy for treatment outside the country. I don’t know if it will go for a period of six months or more, but she should look into it. Also, a few years back, the Wall Street Journal had an excellent article about retirees traveling full time in the fashion Lily contemplates – worth trying to find. Good luck?

Oops, that was Good Luck!

If Lily stops working I think they should look into a Roth Conversion for part of her retirement funds and do this before she starts social security payments. They would have to look into this, but basically you take pretax money out of retirement fund, pay the tax, then put it into a Roth. Best to do when have low income year (hence do it before social security payments) because this reduces the amount of tax you have to pay on the money taken out of traditional retirement fund. But you get Roth interest free growth after that and if I am not mistaken, Roths can be passed to children.

oops – that last sentence should read “tax free growth” not “interest free growth”!! 🙂

My biggest concern is also future health. Is there a long-term care plan in place? Some people never need it, but many do, and long-term health insurance is expensive, and gets worse the longer one waits. Assisted living can be brutally expensive, costing thousands a month per person. A person on SS and Medicare has to spend down their assets (retirement fund) to a little over $100,000 to be eligible to get state assistance for any kind of long-term care.

My suggestion would be to consult with a lawyer who specializes in elder affairs. It can be eye-opening. There is an option for one spouse to refuse to spend down his or her retirement for the other spouse who needs long term care (it’s a “spousal impoverishment” rule) assuming the other spouse qualifies for assistance due to not having his or her own big personal retirement fund, but that spouse that refuses to spend all her/his money therefore gives up all access to the other spouse’s income and personal assets.

And as someone else mentioned, a business that fails to profit for three years becomes a hobby with no tax breaks.

I’m really impressed with the way they have pulled out of debt and set money aside while doing it. With that kind of go-get-’em attitude, I’m sure they can dig out the right information and make a good, informed choice on their future. Congrats!

There are different models for paying financial planners, and this couple could get solid advice for $3-5k/year (not $13k) by paying for planning only (not asset management). This can include instructions for how to rebalance or move money to a new institution with lower costs. Other commenters have raised good issues about health insurance and LTC planning. Garrett Planning network is a great place to look. Also XYPN; it skews toward younger clients but also a good place to look for a fee-only fiduciary who will bill not on AUM.

How do they have a net income after taxes with these figures to support a spending budget of $90,000 a year? There is no way people at this age and depending on assets should be 80% invested in stocks. RMDs are required, but there is nothing saying you need to spend the entire RMD. That’s a poor measure. Better IMO to go with the 4% rule. And where is the emergency budget to avoid excess tapping of funds used for steady income? Given Medicare is no good outside the US. With their travel plans I hope they have factored in that hefty cost. Sorry, I think the plan is risky. What’s the backup plan if one or the other becomes ill, especially since they are selling their house? Although it’s not clear, is there adequate life insurance?

I agree. Travel in the age of Covid and its uncertain end with a vaccine is risky. Too risky IMO. Especially international travel. Health care? Where will you land if one or both develop health issues? Plus the whole Medicare scenario, not being able to use it outside the U.S. it is a personal decision but I would not travel during this pandemic, or very definitely not outside the U.S. They are in fabulous shape financially. Just too risky to travel now.

They are not able to travel to EU right now (travel bans still in place), but they seem aware of it already

I don’t have any advice for Lily but I just wanted to say I love reading these and am so excited to see 2 a month!

Would you ever consider posting the updates as their own posts, maybe with a link back to the original case study? I love to read them but it is a lot of scrolling to find them in the current format.

Ditto on the updates!

First of all, way to go on your financial progress! You did an outstanding job!

There are some really great responses in the comments above, particularly with managing long-term housing and health care. One of my thoughts is that Lily’s job outlook is questionable. If she is laid-off, the likelihood of her securing another equally high paying job at her age is not good (no offense, but I witnessed age discrimination during my corporate days and developed a deep fear of it). Since they plan to sell their home once she retires and the home already costs them a substantial amount in maintenance, etc., would selling it now be an option? Could they downsize into a condo that they could rent while traveling? Or could they find a rental? Is it worth it?

Also, and I could be wrong, but nearly $1000 on food per month for two people seems excessive to me. I live in an expensive area and understand pricey restaurants here and there, but $800 per month to feed two people with quality and/organic food sounds high to me – and I say that as someone who shops quite a bit at Whole Foods. I’m wondering if they can trim this expense a bit. If Lily does lose her job, any reduction in monthly expenses will decrease how much they need to dip into savings now, ensuring more $$ for the future.

As someone who’s traveled extensively overseas (5 continents), I know it’s possible to travel frugally, so I’m wondering if they can learn to live well on less than $90k per year? If they can do it overseas, those habits can likely work well here too. Or, is the plan to spend much of the time in LCOL areas around the world? I’m just curious because $90k per year is more than enough for certain areas of the world.

Interesting story! I wish you all the best and hope Lily keeps her job as long as that’s what she wants. Good luck to you and have a wonderful retirement!

While I’m sorry to hear it happened to you, Lily, I am extremely relived to know that I’m not the only person to gain 10 pounds due to the pandemic!

As you move into retirement and start drawing from your various accounts, I suggest paying particular attention to tax advantages (and potential consequences) of withdrawing from your accounts. You have to take RMDs from your traditional 401(k) and IRA, which will be taxed, and withdrawing from your non-tax advantaged account could raise or lower taxes. If you’re looking to expand your knowledge of finances as a new “hobby”, this might be a good place to start learning.

You may also want to start looking into potential travel costs to get a better idea of what you’ll need to spend. Granted, in many cases, you won’t know actual costs until you pull out your credit card, but you can probably come up with some ballpark figures that may change your budget estimates.

You’ll also most likely come to the point that you don’t want to travel and will look for your retirement home; will you rent? Buy? If so, will you cash flow this or use some savings to buy a small house/condo? This could have an impact on your “burn rate” and budget.

Mrs. Frugalwoods’ suggestions are good; the one about having one bank/brokerage is really good (and once I start a non-tax advantaged account I’ll need to choose carefully). She’s pretty smart for being such a youngster! 🙂

Tom Just Tom, thanks for the weight gain support. I’m hoping that increasing my daily walking will help. But I’m not giving up wine!

We have a good CPA who’s done our taxes for 40 years, so we’ll definitely consult him for advice on withdrawals. And your idea about making a new hobby of financial acumen is great. Regarding travel costs, I neglected to mention that we’ve been pretty successful at traveling modestly. I have a lot of frequent flier miles and hotel points, but I know those will run out fast once we start traveling.

I’m Canadian, so maybe we don’t have the same options here (or we don’t use the same definitions) but usually if you want a “fee-only financial planner” in Canada, you are looking for someone who is going to sell you financial advice at a fixed cost, not financial products for an ongoing management fee. So you would pay a fixed cost to an advisor to get a second opinion on your asset allocation, develop a plan for going forward, crunch the numbers for retirement, etc., but they’re not going to tell you “buy this mutual fund”. Is there an option like this available in the US? It sounds like Lily would like to have a sober second opinion about their investments.

My other investment thought is whether you have robo-advisors in the US like we now have here (like Wealthsimple). These are kind of a mid-point between the traditional financial advisor who is charging you a fixed percentage of your assets to “manage” your accounts, and you doing everything yourself. With a robo advisor, once you’ve set up your account and established your preferred asset allocation, the company takes care of the buying/selling/rebalancing for you, whether you need to rebalance because the market has moved or because of your own contributions.

My final thought is again Canadian-related ignorance: how safe is Social Security? Here in Canada we have two government programs: Old Age Security (OAS) and the Canada Pension Plan (CPP). CPP is based around someone’s contributions into the plan, is independently managed, and is fully funded and secure for years to come. OAS is essentially a means-tested government handout and is vulnerable to being reduced, cancelled, or changed (e.g., raising the age of eligibility) as the population greys. When we crunch our retirement numbers (we’re in our early 40s), we assume we will get the CPP that the system predicts for us; we also assume OAS will no longer exist. Is there any possibility that Social Security could be endangered in the US?

First off, a round of applause to Lily and Robert for making the necessary sacrifices to pay off their debts in a short amount of time. This definitely frees up monthly income to do what you’ve planned to do in your retirement years. With expenses, you can always adjust accordingly. As for moving to another country, you may want to consider living in EU for a year before selling your home in TX, since it’s paid off. For added income, you can rent the home to someone you can trust for the time being to watch over it. I would also recommend consolidating as much as possible to help streamline investments as well as looking into one credit card that can meet the needs of the travel points and keep the oldest card while closing the others since you are retired. Yes, I agree with Mrs. FW points, especially about not needing a broker. With additional SSI & RMD soon, look at worst case vs best case for tax purposes. This at least would give a gauge of what to expect. I’m not sure if you’ve considered leaving any part of your legacy for your heirs or have a will or trust. Something to consider as well. Good luck and enjoy retirement!

Fidelity never charged me a fee for a 401(k) or an IRA. They don’t charge me fees for my mutual funds either. Paying off all that debt in a short time is great! You guys really went to work to pay it off!! You have great savings/IRA so enjoy retirement! You seem to be doing well enough on your own so I agree a financial planner would be a waste of money. There are so many free resources online.

Mrs FW, I love your case studies and website. Thank you for what you do to help educate and bring a different perspective to your audience!

Thank you! My goal with the Reader Case Studies is to highlight diverse financial situations, ages, geography, goals, careers, incomes, etc as I hope each Case Study can offer new insights or ideas to all readers. Plus, I learn A TON from the comments!!! As always, folks should feel encouraged to apply to be Case Study participants–I can only feature you if you apply :)!

The level of income indicates that retirement could happen now. One thing that helped me retire at 62 was figuring out probable lower income during retirement and just living on that for a couple of years. It was much less than what you are planning on. It built my confidence and in actual retirement I’m doing better than I thought I would. At the age both of you are, I would recommend just trying it for a few months and see how easy that was? Then retire and enjoy yourselves.

As some are suggesting, you may want a homebase. Perhaps sell house and buy in an area where the housing costs are less and there is more rainfall and freshwater. A shortage of fresh water has been predicted. Since you want to travel maybe buying just a small condo somewhere nice or into a small home in a retirement community. That way you have close neighbors to keep an eye on your property. Or if rent is low enough, then managers who live on property have a reason to keep an eye out for you. Which makes me think that maybe just travel for a few years and when real estate values plunge as they do periodically, snap up something at a great price.

JackeRose, that’s a great suggestion and it’s exactly what we’re doing this year! For 2020 we decided to live on less than we expect to have in retirement. It’s been much easier than I expected. Assuming I keep my job for a while, we’ll continue doing this in 2021 as well.

Regarding a homebase, we’re not sure where we want to be (maybe France?) long term. So selling the house will give us, we think, the flexiblity to explore various areas before settling down. And at that point we’ll have to evaluate renting vs buying. All these comments are so helpful! I’ve already called Fidelity today to start the ball rolling on getting rid of Edward Jones. 🙂

If Lily were laid off, wouldn’t she also be eligible for unemployment, as well as any severance package? That would be an additional 26 weeks. The amount is low, $521, but it would cover taxes and insurance, for an additional 6 months, and help reach 2022 without having to touch any retirement savings.

I also noticed that you are spending $1296 per month for 2 people on groceries, restaurants & wine! We eat REALLY well for a fraction of that. If there is concern about financial stability, that would be one area to save some money (I would save it as I thought of all of the amazing food to be eaten in France.)

You’re right! I really don’t know why our grocery bill is so high. That’s something to work on for sure. The adult beverage cost will decline because we’ve cancelled our wine club memberships.

First of all congratulations on your accomplishments of drawing down your debts in a short amount of time! This is definitely to be commended. I agree with a lot of comments. My suggestions are to look into a well/trust, consolidate investments into one company with low fees, don’t see a need for a broker, possibly rent your TX home out while you try living in EU for a year to test all seasons, try to consolidate credit cards, look for one to meet all your needs keeping the one that has been opened the longest. As far as taxes, run a worst-case vs best case for RMD, and SSI increases. Good luck and happy travels & retirement!

I’ll be honest I did not read the entire post or all of the comments. But at your age and income/savings I don’t think you have much to worry about other than how to plan sensibly around COVID19.

I will also add that you should read the occasional nomads blog. Laura and Brett are great! They are currently grounded in Hawaii after pausing their travels duel to Covid.

Good luck!

*due

Hi Lily,

Your last 10 years are very inspiring and would be well worth a book. I have three observations ( as a 48 year old in New Zealand):

1 You may need to let go of one of your dreams: I believe that we are entering a new phases where international travel will not be as easy as it has been. Living in France with your children and possibly grandchildren in the US is going to be difficult. Equally difficult will be the ability to get visas and residency. The EU is not keen on retirees who are not contributing to the economy ( ie: owning and running profitable businesses, employing people). Also, the US is going to be on a black list for visas, travel insurance or medical insurance due to your rampant Covid spread. The problem for you, is that you don’t necessarily have time to wait for 5-7 years before this starts to settle down. And then we have to ask if we are prepared to continue burning the planet for all of this international travel with no thought of the consequences. Luckily for you you live in massive country where you can travel for the rest of your life and experience a vast melting pot of cultures and cuisines.

2. You may need to beef up other parts of your retirement vision: My advice is to make an exit plan ( whatever time length you want) and stop working on your terms. Be deliberate. Develop some meaningful hobbies ( which aren’t international travel), which are social and which stimulate you. There is an excellent ( American) book called the 100 year life, with great advice on how to do this and why it is important. Currently work fulfils you, so you enjoy solitary hobbies, but that will change. With your skill set , I imagine you would be sought after for non profits and volunteer boards etc. Or even local business associations. The book advises active hobbies as well as intellectual. In my experience Artists don’t need a lot of human interaction, but marketing people do. They thrive on it!

3 I think selling your house without buying another one is unwise. It makes you vulnerable. You need a safe place to lay your head. We have years ahead of us of boarder closures, quarantines and lockdowns. At your age you will not want to be house hunting if you or your family have a crisis or major life change.

(I also envy your housing prices. In NZ my 3 bed, 1 bath weather board house with no garage costs $1.3 million NZD. (currently 70cents to your dollar)

Best of luck.

It always amazes me how easy it is to get out of debt when you have a high income. Kudos

Having a home base will be very important, if one of you falls ill and wants/needs to be back in the US. Maybe even a small condo- something minimal but that you could come home to if needed (or between travels). Maybe even rent it out, if you have to. My mom (age 62) had to have 2 surgeries back to back, unexpectedly a couple years ago. You just never know, I think best to have a backup.

Hello. I don’t have many suggestions but just wanted to say that I’ve loved this reader case study as I can see myself in it!

COVID brought so many changes and uncertainty, I would agree with others who suggest downsizing to a smaller home base, whether a small condo or apartment. I do an annual summer vacation trip with my now 89 year-old mother who traveled frequently when younger; the heart and mind are willing but the body has slowed. So if you’re able to travel sooner, take advantage. I would imagine that it could provide peace-of-mind to know you have a small home waiting in-between trips, or if circumstances change quickly and unexpectedly.

Like Lily, I’m in marketing — or rather, WAS in marketing. I’ll be 62 on Monday — and was part of a company COVID layoff in June. So the fear of layoff is real, and as others have noted, finding a new position in these trying times is difficult. I’ve reset my sights on a lower level job (specialist or even coordinator) as a primary motivation is not salary, but to have healthcare coverage until 65. I elected COBRA at least through year-end; while it’s expensive ($733/month) it’s at least a sure thing until there’s more certainty in the market. And fortunately, I had my financial wake-up call in 2006, which helped focus me on saving with a purpose. But as I have questions as to my next steps, reading this study made me wonder if there’s room for a single person’s version of the imminent retirement story!!

I wish the best of luck and fun to both Lily and Robert; they’ve done an amazing job the past 10 years to be well-positioned for retirement.

Stay well.

Linda, thanks so much for this. Your journey does indeed seem similar. Our current thinking is that if something unforeseen occurred regarding our health, if we’re in France with a one-year renewable visa, we’ll be eligible for the French health system and could buy supplemental private insurance. Since healthcare in France is both more affordable and better than in the US, we’d get our care there (and we’re working on our language skills, which have a long way to go!). And if we decided to return to the US, we’d likely rent or buy a place. The notion of being “home free” really appeals to us.

Good luck with your own planning! I’ve found to my surprise that I still regularly get inquiries from recruiters and from my national professional network. I hope you’re able to land something great very soon. COBRA is so expensive, but you’re wise to do it until you can get employer-sponsored health insurance again.

Some advice from an American living in EU:

There have been a lot of comments related to accessing healthcare overseas. One quick and easy way to find out about this is call the most popular public health insurance provider in France and ask them! You will also find out quickly about your ability to get help in English or if your French skills are good enough.

Unfortunately, I have a feeling that you may not be able to access the public system in EU if you are not employed. In Germany, it’s difficult to do this even if you are a freelancer and working/making money in the country. But the only way to know for sure is checking with the providers directly.

Good luck, it’s such an amazing experience to live in another culture for a time (but also extremely difficult)!

Great job on all that you have accomplished! I want to echo what another reader said about unemployment insurance – if you lose your job and still based in the US, you would be eligible as Long as you periodically throw out some job applications. I wouldn’t work again at your financial status and age, but no harm in collecting unemployment in the case of a job loss, so that you can preserve your assets a little longer while delaying social security.

As you move out of EJ, it would likely be helpful to speak to a fee-only fiduciary who could provide advice on tweaks to your salary for a one-time flat rate. Then you can adjust asset allocations etc and plan more holistically for retirement. I completely agree with Mrs FW on hiring a good estate lawyer to make a will, power of attorney etc. A power of attorney will be especially important if you will be living outside of the US.

Regarding your travel plans, I would be hesitant at your age to start major travel during Covid. It seems risky to travel around the US right now, and if you lose your job and decide to, think seriously about how to reduce Covid risk in your plans. It may be more worthwhile while you still have your job to work on internet exploration of places you might like to live or visit overseas and to start selling off your stuff. It seems like you have a lot more planning to do in terms of where you would like to be, what exactly you imagine your life in France looking like, and what a new monthly Budget might look like.

Look into overseas health insurance NOW. Prudential and BUPA are both good providers, but may require you to initially sign up before age 70 (and then allow to renew much later as Long as you signed up in time). Both are U.K. Companies and offer comprehensive international plans. Look for something that excludes US coverage (where you would be covered by Medicaid) and has a relatively substantial deductible (BUPA has $450 to $5k I think) to get a lower cost plan that will cover you for anything disastrous that happens overseas. Outpatient care is often better to pay out of pocket because costs are lower than in the US.

When planning for your retirement it may be helpful to think in terms of 10-year increments or time of life increments. What you imagine retirement looking like from 70-80 vs 80-90 vs 90-100 or while you are healthy vs medical issues vs when there are grandkids etc. Life is of course never so clearly defined, but it could be helpful to seeing this as a journey, just as our careers are not “what you do when you grow up”, but are instead journeys that shift and change over our years and decades.

Personally, I would still sell the house and cars and plan to do a travel retirement as you want to initially (once Covid is more under control), but have a plan in place for 10-20 years down the line or when health and descendants make it more desirable to get a smaller place with less maintenance close to family.

Anne, I love your advice to think in terms of increments; brilliant! Thank you.

Mrs FW, would you consider doing an update post on how case study participants (those who want to write about it) are doing during COVID? I think a lot of us readers are invested in their success after discussing their lives and finances over the years, and it also gives a broader perspective of how people are ding in these uncertain times.

That’s a great idea, Anne! Ok, calling all past Case Study participants—please send me your stories!!!!