Aurelia is a high school teacher at a public school in Boston who recently bought her first condo and is thrilled to be a homeowner at the age of 27! Tempering that enthusiasm, however, are her new competing financial demands of house maintenance costs, retirement, saving for Invisalign braces and paying off her student loans. Aurelia has a zest for life and a love for her students, but her salary doesn’t quite match that enthusiasm. She’d like our help determining how to prioritize her financial goals while still living a robust life filled with friends, travel and hobbies. Let’s head to Boston to dive into Aurelia’s questions!

What’s a Reader Case Study?

Case Studies address financial and life dilemmas that readers of Frugalwoods send in requesting advice. Then, we (that’d be me and YOU, dear reader) read through their situation and provide advice, encouragement, insight and feedback in the comments section.

For an example, check out the last case study. Case Studies are updated by participants (at the end of the post) several months after the Case is featured. Visit this page for links to all updated Case Studies.

Can I Be A Reader Case Study?

There are four options for folks interested in receiving a holistic Frugalwoods financial consultation:

- Apply to be an on-the-blog Case Study subject here.

- Hire me for a private financial consultation here.

- Schedule an hourlong call with me here.

- Schedule a 30 minute call with me here.

→Not sure which option is right for you? Schedule a free 15-minute chat with me to learn more. Refer a friend to me here.

Please note that space is limited for all of the above and most especially for on-the-blog Case Studies. I do my best to accommodate everyone who applies, but there are a limited number of slots available each month.

The Goal Of Reader Case Studies

Reader Case Studies highlight a diverse range of financial situations, ages, ethnicities, locations, goals, careers, incomes, family compositions and more!

The Case Study series began in 2016 and, to date, there’ve been 95 Case Studies. I’ve featured folks with annual incomes ranging from $17k to $200k+ and net worths ranging from -$300k to $2.9M+.

I’ve featured single, married, partnered, divorced, child-filled and child-free households. I’ve featured gay, straight, queer, bisexual and polyamorous people. I’ve featured women, non-binary folks and men. I’ve featured transgender and cisgender people. I’ve had cat people and dog people. I’ve featured folks from the US, Australia, Canada, England, South Africa, Spain, Finland, the Netherlands, Germany and France. I’ve featured people with PhDs and people with high school diplomas. I’ve featured people in their early 20’s and people in their late 60’s. I’ve featured folks who live on farms and folks who live in New York City.

Reader Case Study Guidelines

I probably don’t need to say the following because you all are the kindest, most polite commenters on the internet, but please note that Frugalwoods is a judgement-free zone where we endeavor to help one another, not condemn.

There’s no room for rudeness here. The goal is to create a supportive environment where we all acknowledge we’re human, we’re flawed, but we choose to be here together, workshopping our money and our lives with positive, proactive suggestions and ideas.

And a disclaimer that I am not a trained financial professional and I encourage people not to make serious financial decisions based solely on what one person on the internet advises.

I encourage everyone to do their own research to determine the best course of action for their finances. I am not a financial advisor and I am not your financial advisor.

With that I’ll let Aurelia, today’s Case Study subject, take it from here!

Aurelia’s Story

Hi Frugalwoods! I’m Aurelia and I’m 27 (where does the time go?), born and now living (forever!) in Boston, MA. My parents dragged me to suburbia when I was young but I’m a city girl at heart and have been back in the city since college. I’m happily single and have a wonderful job teaching history to newcomer immigrants in an urban high school while co-running an outdoors club for the kids. When I’m not at work I’m usually at the ballet, reading, playing video games, hiking and camping, bouncing, or going out (especially eating out) with friends. My parents live less than 30 minutes away and I spend as much time with them as I can, since my sibling lives in Florida. I just became a home (condo) owner this past June – something I thought would never happen, especially at a young age – and I’m absolutely loving it!

What feels most pressing right now? What brings you to submit a Case Study?

I was NOT imagining I would become a homeowner and certainly not at 27! To make a long story as brief as possible: I was idly perusing real estate listings in my neighborhood (don’t all millennials do this?) and an income-restricted unit in a large building I’ve always liked came up. After reading over the requirements, I realized this would be the only time I would be eligible to buy in this income bracket AND in my neighborhood, which I would have been priced out of otherwise, as the rent is too damn high. After talking it over with my parents to check if I was crazy to even consider it, I pulled the trigger and ended up being the only offer. And here I stand before you, a homeowner… who now must figure out her next steps (again)! I am now ahead of all of my friends and feel like I’ve skipped a few steps in how I understood life’s progression to be.

Even before buying my condo, I had a few different goals I was juggling – retirement, travel, saving for a 2nd masters to increase my income (which I have since shelved, as I think there are better options), paying off my student loans, and saving for Invisalign – and not particularly well. Now enter a house and…you can see how I’m a bit stressed trying to figure out what to do first and what needs to wait! I’ve landed on getting rid of my student loan debt as quickly as possible, but there are some questions I want input on with regards to work and retirement.

What’s the best part of your current lifestyle/routine?

Even though I spent a lot of my childhood in rural/suburban areas, it’s fair to say that I’m a city girl at heart. The ease of being able to go anywhere and do anything, try different cuisines, and enjoy fun and interesting places (inside and outside) makes me very happy. I also have an intense need to be outside, and Boston/New England is perfect for that! I have a nice palette of hobbies and activities to choose from and friends who live nearby that I can do them with (or by myself, if I want). Professionally, work can be “messy” sometimes (if you know, you know) but I am at the point in my teaching career where I’m only working 40 hours a week and can happily leave work at work. I won’t deny that teaching, especially this specific population, can be emotionally draining sometimes, so I’m happy that I live alone now and have some mellower hobbies I can recharge with. I also love the community spirit of my building and my neighborhood.

What’s the worst part of your current lifestyle/routine?

Work can be draining sometimes and the pandemic years were rough in my school, not just because of the pandemic. As a result, I don’t get as much face time with my 9-5 friends during the school year as I want (being this tired might also just be…getting older?). Teaching is also not terribly lucrative, and while we won a massive salary increase in our contract, things are tight financially.

I have always tried to live as frugally as possible while having a full and happy life, but adding the expenses of homeownership is making things even tighter.

At the same time, there aren’t a lot of opportunities to earn more money at work and the few available are: a) too much time/responsibility relative to the compensation offered; or b) threaten my work-life balance or work happiness.

I find that the more people I must work with, the unhappier I am. I am so not interested in work politics. I also have to be careful managing my health and energy levels because I have some chronic illnesses that can spiral into serious sickness if I overextend myself. Still, my position exists in very few places and the team I work with is wonderful.

Where Aurelia Wants to be in 10 Years:

Finances:

- Free (or close to free) of non-mortgage debt

- Paid for Invisalign

- Paid for one of my big “projects” (finishing the loft in my condo or going on a large trip)

- More money saved for emergencies and retirement

Lifestyle:

-

What’s better than board games while camping? More of what I’m doing now, although with more traveling (currently nothing, previously 1-2 long weekend-style domestic trips).

- I would really love to visit Central and South America where all my students are from.

- I’m currently single but I imagine in the next 10 years I may meet a partner and incur expenses related to that.

- Due to health issues, I would have a difficult time having biological children. I have not ruled out adopting or fostering, but my condo is not big enough and I would not do it by myself. I can see myself as the aunt who spoils her nieces/nephews rotten with fun trips/events in the city with nice meals afterwards…

Career:

- Still teaching because the work is intellectually stimulating and the kids are great, but looking to maximize earnings without compromising my values.

- I don’t want to be an administrator having seen how much mine works (plus I would need to go back to school for that).

- Next year I will apply to be a new teacher mentor for a salary bump (I applied for a vacation position and didn’t get it, which was discouraging).

- I thought about a second MA, which I found online for a reasonable price, but I can’t justify that upfront expense right now and honestly… I don’t want to go back to being a student, as much as I loved it.

- Side note: I already have my Master of Arts in Teaching English as a Second Language and a BA in History with a minor in dance!

- I don’t think there is much else out there that suits my skillset and my lifestyle goals/dreams at the same salary point.

- The pandemic taught me the hard way that remote work is not satisfying for me (hybrid, maybe).

Aurelia’s Finances

Income

| Item | Gross Income | Deductions & Amount | Net Income |

| Income, paid in 24 checks September – June (so it’s biweekly, but kind of not) | $5,872 | medicare: $85, PPO: $326, 457: $100, vision: $6, dental: $43, pension: $646, state taxes: $296, federal taxes: $508.05, union dues: $87 | $3,805 |

| note: December is a little bit higher because we have a premium holiday, and I get roughly $100/month from my club (but I try not to count it since it’s unpredictable!) | |||

| Monthly subtotal: | $3,805 + $100-$150 club | ||

| Annual total: | $45,660 (just salary) |

Mortgage Details

| Item | Outstanding loan balance | Interest Rate | Loan Period and Terms | Equity | Purchase price and year |

| Primary mortgage on my condo | $317,000 | 2.75% | 30-year fixed-rate mortgage | ~$20k (not including secondary mortgage) | $362k, purchased June 2022 |

| Secondary mortgage on my condo | $23,500 | 0.00% | 30 years…sort of | n/a | $0, this was the downpayment assistance from my city when I bought my condo. The secondary mortgage is paid off in full, interest-free, upon refinance or fully paying off the mortgage. I would be a fool to refinance 2.75%, so… |

| Total: | $339,500 |

Debts

| Item | Outstanding loan balance | Interest Rate | Loan Period/Payoff Terms/Your monthly required payment |

| Federal student loans | $73,000 | 5.20% | I’m on an income-based repayment plan for Public Service Loan Forgiveness (PSLF). I am almost halfway through my 10-year requirement and will see forgiveness (with no tax bomb) in late 2028. I am eligible for $10k in loan forgiveness if it passes, but it would not change my monthly payments right now. |

| Private student loans | $45,000 | 4.98% | Paid biweekly to sneak extra payments in. Payoff is 2041, but I want to be free ASAP! |

| Total: | $118,000 |

Assets

| Item | Amount | Notes | Interest/type of securities held/Stock ticker | Name of bank/brokerage | Expense Ratio |

| Pension | $25,100 (what I have put in) | This is the total of what I’ve put in so far to my MTRS contributions.

How do I factor pension value into retirement? If I max out my pension (at 58, eligible to retire at 60) I get 80% of my last few years’ income in retirement. |

Mandatory 11% contribution from every paycheck | MTRS (the MA state teachers’ retirement system) | n/a |

| Roth IRA | $15,700 | I started this when I was 19! | Target 2060 retirement fund (although I will realistically retire in 2055) | Vanguard | 0.08% |

| Checking Account | $7,500 | Checking account | Charles Schwab | n/a | |

| Savings Account | $3,000 | 4.25% | LendingClub | n/a | |

| 457 (employer plan) | $1,400 | This is my non-pension employer plan. I didn’t enroll in it until I earned PTS (tenure) out of a silly fear that I’d be fired.

For now I put $50/month in since my tax bracket is on the bubble re: if Roth or non-Roth contributions make sense. I don’t have a good sense of what my taxes will look like now that I’m a homeowner (!!) It’s also really annoying to request changes in contributions so I want to make sure I have more money on hand. I can also contribute to this post-tax. |

Target 2060 retirement fund | Empower | 0.07% |

| Total: | $52,700 |

Vehicles: none!

Expenses

| Item | Amount | Notes |

| Mortgage | $1,346 | Principal, interest, taxes. My property taxes are $30/month. Thank you city owner occupancy deduction! |

| Private Student Loan | $413 | Typically 2 biweekly payments of 155, sometimes 3 if it’s a 3 paycheck month. I’m sending an extra $50/payment to get out of debt faster! |

| Savings: No August Salary | $400 | I get 3 paychecks in late June that are meant to cover July, August, and early September…clearly not enough money. I’ve decided to eliminate uncertainty by saving money in advance just for salary replacement. |

| Groceries | $250 | This includes household/cleaning supplies and alcohol (I live next to a certain fine craft cider taproom/brewery). I exclusively shop at Market Basket (rarely sneaking into Trader Joe’s for snacks), but sometimes I use Amazon Fresh as I live in a food desert. |

| HOA Fee | $167 | Hot water, common spaces, landscaping, typical HOA things |

| Savings: Homeowner Fund | $150 | In my Homebuyer 101 class we were told to save 1% of our home’s value each year to go towards improvement and maintenance costs. Money is very irregular for me in the summer so I don’t know how much a month this looks like this year, but by this 1% calculation it should be $300/month. I am a little ahead so it’s about 200/month. I have an unfinished loft that I want to build sooner rather than later and my appliances are wonderful but older, so I want to be ready when those times come.

goal is 3600 each year, current balance 2k |

| Boston Ballet | $100 | Paid in May, averaged monthly. 2 orchestra seats to every show + $20 volunteer dues (I give tours, among other things!). I basically live at the Opera House when the ballet is in season and see most shows 4-5 times (and get to hang out with the dancers!). I also receive perks like additional free tickets, attending company class and special performances for free. I get to treat a variety of special people in my life (they pay for meals in return). I’ve been a subscriber for 8 years now and I’ve received multiple seat upgrades – if I pause my subscription I would lose my seats. |

| Friend Dates | $100 | Averaged to account for the academic calendar (more free time during breaks), but a slush fund for things I do with my friends. I count meals out with friends toward this amount. This summer I used library passes to go with friends to many museums for free, but some were only discounted. |

| LinkPass | $90 | Unlimited bus, train and ferry. No employer transit benefits but can be deducted from taxes. 🙁 |

| Savings: Invisalign | $87 | I need to start saving for this as my teeth are crowded and getting worse. I have shopped around and the lowest quote (dental school) have quoted the work at $5.5k over a year (monthly payments). All consults agree that the work needs to be done within the next 5 years (by 2026). Dental insurance covers 0%. Unfortunately no discount for paying everything up front, but I would like to save at least 1/2 of the amount before beginning the treatment.

Goal is $2,250 by May 2024 |

| Trampoline / Dance Classes | $85 | Unlimited bounce + cheer classes that more than pays for itself. Very important to my physical and mental health and can’t do it at home! Plus I get passes to bring friends so we can do something fun at a low cost. |

| Homeowner Insurance | $70 | |

| Electric | $50 | Despite the brutal heat wave this past summer, my electric costs are pretty consistent. |

| Doctor Visits | $50 | copays and urgent care averaged – higher than usual due to a recent MRI |

| Family Vacation | $50 | My parents expect me to pay 1/3 of the family vacation. |

| Christmas | $50 | Averaged over the past 2 years. Includes a tree, presents for friends/family, holiday expenses (baking for coworkers), any travel and donations to community orgs who help folks in need of a meal. I go frugal for people’s birthdays so Christmas is my once a year thing. |

| Savings: Laptop Fund | $50 | Saving for a new laptop. 100/600 |

| Internet | $40 | |

| Medicine | $35 | sometimes higher depending on the illness of the month |

| Gas | $30 | Averaged. Still haven’t turned my heat on because big windows = big sun! |

| Contact Lenses | $30 | Curse astigmatism! |

| Dining Out | $30 | When I eat out by myself, either full meals or getting treats at a coffee shop. Pre-pandemic this was higher but I try to cook more. Usually dip into this when I’m too sick to cook and want a meal. This is an easy place to cut down (sometimes you just need Dunks) |

| Furniture / Home Goods | $20 | This is hard to quantify since I made some big ticket purchases that I will not be making again (as YNAB reminds me, my average is high!): this includes a couch I got for FREE minus the cost of moving it, a TV, a washer machine, and a new drying rack (sadly not free). I think I’m done for now… |

| Outdoorsy Things | $20 | Averaged; if I hike with friends, covers gas expenses or any meals/snacks we need to get. This could be higher if I get new gear, but I’m all set for now. |

| Haircut | $20 | 2x/year for a curly cut, can’t go any longer between |

| HBO MAX | $16 | Don’t tell anybody that my mom has my HBO password…! |

| Final Fantasy XIV Subscription | $13 | I play regularly with my friends. |

| NYT Academic Subscription | $12 | |

| Amazon Prime | $12 | I’d rather not, but I a) live in a food and store desert and b) keep my mother happy with Prime Video. I order enough things that the monthly cost is lower than what I would pay in shipping. |

| YNAB | $6 | Sharing a family plan with a friend! |

| Donations | $5 | Averaged, annual donation to work scholarship. |

| Clothing | $5 | The last time I bought clothes was last February? I bought myself a very nice ski bib… |

| Federal Student Loan | $0 | Currently paused. When payments resume I need to request a recalculated monthly payment, but only after I file my taxes to see if this is a benefit or a burden.

(will be around $250/month starting in June 2023) |

| Savings: Travel Fund | $0 | Saving to see a dear friend graduate in VA this spring, using a mix of points and cash. After this, saving for a trip to Canada to see another friend.

(fund gets topped up as spent, @ 350) |

| Savings: Video Game Fund | $0 | This has been much higher than usual since 2022 was a great year for game, and I had gone years without buying any. I either wait for deep sales, go to the library first, or I buy used at a local retro store (and get a 10% teacher discount)! 2023 looks quieter so I will probably buy 1-2 games and be done for a bit.

(fund is 65, replenished when spent, had been spending 40/mo last year) |

| Cell Phone | $0 | My mom complains about the phone bill but refuses to take my money? (Don’t worry, I’ve already suggested an MVNO.) |

| Gardening | $0 | On hold right now as I cross my fingers and wait for a community plot. Typically $5-10/month averaged otherwise for soil and local seedlings. |

| Monthly subtotal: | $3,802 | includes invisalign and homeowner savings, but not upcoming student loan restart in june 2023 |

| Annual total: | 45,624 | $3 under! |

Credit Card Strategy

| Card Name | Rewards Type? | Bank/card company |

| Chase Freedom Unlimited | Travel/Cash Back | Chase Bank |

| CapitalOne QuickSilver | Cash Back | CapitalOne |

| Citizens Bank MasterCard | nothing (I got it as an AU at 16 to build credit and learn good habits) | Citizens Bank |

Aurelia’s Questions For You:

-

This year’s Christmas tree! Pre-tax or Roth contributions?

- For lowering my taxable income (PSLF), it probably makes sense to go heavy on pre-tax retirement contributions, but I only have 5 more years of PSLF (Public Service Loan Forgiveness).

- Lowering taxable income is beneficial in general, but at my income I almost definitely can’t get into the 12% bracket (nor will I see a higher one, at least not for a while).

- What’s a gal to do?

- How should I think about my pension in the context of planning my other saving for retirement?

- I’m in MTRS (the Massachusetts state teachers’ retirement system)

- If I max out my pension (at age 58, eligible to retire at 60) I get 80% of my last few years’ income in retirement.

- Since I’m in this pension system, I won’t receive any Social Security

- How do I prioritize a myriad of savings/debt-purging goals? To recap, my goals are:

- Paying off student loans

- Saving for retirement

- Paying for Invisalign braces out-of-pocket

- Saving for homeowner projects/repairs

- Travel, much later

- Am I missing something I haven’t thought about? I’m also worried about my parents:

- My parents have little retirement savings and will probably have to work until the day they die. They are in their late 50s and both have multiple chronic health conditions that impair their quality of life.

- They have a mortgage on a single family home in metro Boston that they could easily sell for 3-4x the price they paid and, after paying off the mortgage, have some money to live on in addition to Social Security. They could move somewhere with a lower cost of living and be fine, but I’d like for my parents to be close.

- Is it worth putting off retirement contributions altogether to get out of debt faster?

- I’ve taken enough personal finance classes to know that the answer is probably a staunch NO (time value of money, baby!), but the complications of having a pension and the interest in opening up cash flow make me hesitate for a microsecond…

Thank you so much for any insight you can offer, Liz and the Frugalwoods Community!

Liz Frugalwoods’ Recommendations

I love Aurelia’s love of life! She has so many interests, hobbies and passions and her enthusiasm exudes from her writing. I had a smile on my face the whole time I read about everything she’s curated in her life. Her Case Study also raises the sad specter that we do not pay our teachers enough in this country. Nowhere near enough. If I were Queen of the World, I would pay all teachers an investment banker salary because they deserve it! Sadly, no one will elect me Queen of the World (much as I’ve tried… ). Given my inability to increase Aurelia’s salary, let’s do what’s within our control and dig into her questions!

Aurelia’s Questions #1 and #2: How should I think about my pension in the context of planning my other saving for retirement? And, should I make pre-tax or Roth contributions?

The answer here depends on whether or not Aurelia thinks she will remain working in MA public schools until she retires. If she does, she’s got a great deal here. 80% of her salary annually in perpetuity is fantastic! As her current salary, she couldn’t afford to live on 80% of it, but her salary will increase over the years and her expenses will decrease as she pays off her student loans and eventually her mortgage.

→The major caveat is the health of her pension system.

While I feel more confident about the viability of a state pension system, such as Aurelia’s, there remains an inherent risk of default in any pension system. Since the MA Teacher’s Retirement System Independent Auditor’s Report on Pension Plan Schedules is publicly available as a PDF, I read it (well, some of it). I honestly don’t think you guys realize how thrilling my job is…

In an audit, an outside auditor looks at the books of an organization or entity (in this case, Aurelia’s pension system) and provides their opinion on how that organization/entity is doing financially. The auditor in this case was charged with making assessments such as: Is this pension system likely to default? How likely? How healthy is this pension in light of the number of living pensioners? And more! Let’s see what they found!

The MA Teacher’s Retirement System Independent Auditor’s Report on Pension Plan Schedules For Fiscal Year 2021: a fun read-along with Liz!

We begin by looking at page 7 in order to better understand the parameters of this pension system:

These requirements provide for superannuation retirement allowance benefits up to a maximum of 80% of a member’s highest three-year average annual rate of regular compensation. For employees hired after April 1, 2012, retirement allowances are calculated on the basis of the last five years or any five consecutive years, whichever is greater in terms of compensation… Members become vested after ten years of creditable service. A superannuation retirement allowance may be received upon the completion of 20 years of creditable service or upon reaching the age of 55 with ten years of service. Normal retirement for most employees occurs at age 65. Most employees who joined the system after April 1, 2012 cannot retire prior to age 60.

This is super useful info! I assume Aurelia was hired after April 1, 2012, which means these new provisions apply to her. To recap (in plain-er English):

- She’ll get 80% of either her last 5 years of salary OR any consecutive 5 years throughout her career–whichever has the bigger salary. This is nice to know because it means she could potentially scale down her responsibilities as she nears retirement since she doesn’t have to have her highest earning years at the end of her career (as is the case with many pensions).

- She’ll be vested after 10 years, so she’ll definitely want to stay working in the system for a minimum of 10 years.

- She likely cannot retire prior to age 60 if she wants to receive the full 80%-of-salary benefit.

Next, let’s examine the health of the pension system by going to page 9:

Note that these numbers are written in thousands, which means the totals are actually billions. I agree, this is very confusing, but apparently it’s standard auditing procedure. No wonder people are confused! Here’s what the auditors report about Aurelia’s pension system:

The collective net pension liability on June 30, 2021 was as follows (amounts in thousands):

Total pension liability……………………………… $59,795,000

Less: Plan fiduciary net position…………………… $37,088,124

Net pension liability………………………………… $22,706,876

Plan fiduciary net position as a percentage of total pension liability………………………… 62.03%

What we’re looking at here is:

- How much money the auditors estimate will need to be paid out of the pension system in the future, called “Total pension liability” ($59.8 billion)

- How much the pension has in assets, called “Plan fiduciary net position” ($37 billion)

- The difference between how much the pension owes and how much the pension has, called “Net pension liability” ($22.7 billion)

The bottom line is that the pension is 62% funded. For context, 100% funded would be the best and 0% funded would be the worst. But, a 62% funded rate is not bad. Not awesome, but not terrible. So how do we know if Aurelia will get her full pension? We can’t know this. However…

→The real way to judge the likelihood of Aurelia’s pension being there for her is through the lens of the political landscape of the state/entity that controls her pension.

Reason being? This pension is backed by the full faith and credit of the commonwealth of Massachusetts. So the question you have to grapple with is: how likely are MA state legislators to allow the state teachers’ pension to go into default? Are they likely to bail it out if need be? Or are they likely to allow teachers to not receive their pensions? In some states, that’s tantamount to political suicide. In other states… not so much. It’s also important to remember that, in the event of a budget crisis, it’s very unlikely Aurelia would receive NONE of her pension–it’s much more likely she’d receive a partial percentage.

Here’s what I mean by that:

A 62% funded rate in a conservative state is much more precarious than a 62% funded rate in a liberal, progressive state like Massachusetts.

So how will the pension get fully funded? If I had to guess, I’d say that at some point in the future, there’ll be a grand political bargain in the state wherein the state bails out the teacher’s pension because it would be politically disastrous not to (assuming the prevailing political winds haven’t drastically changed).

However, this is an unscientific assessment because there’s no way to know what the future holds. That being said, you have to do something to help yourself plan for the future. If I had to make a prediction right now, I’d say Aurelia’s pension is likely to be reasonably close to what’s currently promised

My Recommendation to Aurelia:

Since Aurelia’s financial future depends heavily on her pension, I suggest she read and understand the annual Audit report on her pension (just as we did above).

→If you don’t understand your pension, talk with your union rep as it’s their job to make sure you understand it.

This goes for everyone reading this who has a pension. There is someone (either in your union or your HR department) whose literal JOB is to ensure you understand your pension benefits. Do not take “I dunno” as an answer.

Bottom Line on the Pension:

If Aurelia thinks she will remain a MA public school teacher, then I think the only thing she can do is assume her pension will be there for her. That being said, Aurelia is very wise to invest in other retirement vehicles too since, as she noted, she’s not eligible for Social Security and the pension will only be 80% of her salary (in the best case scenario).

Aurelia’s Other Retirement Investing Vehicles

In addition to her pension, Aurelia has two other retirement vehicles available to her:

- A 457 (through her employer)

- A Roth IRA

The reason to invest for your retirement—as opposed to just saving cash for it—is threefold:

- There are tax advantages to utilizing retirement accounts

- There are grave disadvantages to cash (opportunity cost and it doesn’t keep up with inflation)

- There are advantages to investments (namely, their anticipated rate of return)

Wait, What’s a Roth IRA Again?

IRA stands for “Individual Retirement Account” and there are two different primary types of IRAs: Roth and Traditional. The difference between the two is in how they’re taxed.

- A Roth IRA is a retirement account that’s post-tax:

- That means you pay taxes on the money you put into a Roth IRA, but you don’t pay taxes when you withdraw the money in retirement.

- A Traditional IRA is a retirement account that’s pre-tax:

- That means you don’t pay taxes on money you put into an IRA, but you do pay taxes when you withdraw the money in retirement.

In 2023, the total amount a person can put each year into a traditional IRA and/or a Roth IRA can’t be more than $6,500 (or $7,500 if you’re age 50 or older).

- A person can have both a Roth and a traditional IRA, but their combined annual contribution to both can’t exceed this $6,500 ($7,500 for ages 50+) limit.

A Roth typically makes the most sense if your income is on the low end because in that case, your tax rate is low and so it doesn’t matter that you’re paying taxes on your contributions. To address her question, given Aurelia’s relatively low income, Roth contributions probably still makes the most sense for her.

What’s a 457b?

- 457bs are deferred compensation plans available to certain government (and specified non-government) employees

- You can put a maximum of $22,500 into a 457b each year (as of 2023)

- The money you put into a 457b plan is tax-deferred

- Any earnings on the money in your 457b are tax-deferred

One thing to note about a 457b is that it’s “deferred compensation,” which makes you a creditor of whoever runs the plan. In Aurelia’s case, that’s the commonwealth of MA. In light of that, there is an argument here for NOT using the 457b since her pension is also through the commonwealth of MA. What that means is that, if the state were to default, Aurelia would lose both her pension and her 457b. As I noted above, however, I find that very unlikely.

I’m not trying to scare her, but I do want her to be aware that–unlike with a 401k or an IRA (which is your money free and clear)–a 457b is technically an IOU from your employer stating, “I will give you this money in the future.” In practice, deferred compensation is usually quite secure, especially when it is publicly sponsored (as Aurelia’s is). But, it’s a nuance to be aware of.

→All that being said, if it were me, I would probably focus on increasing my contributions to the 457b because it’s more flexible than an IRA.

In 457b plans, you are allowed to withdraw money penalty-free before age 59.5, after you leave the employer who sponsors the plan. Hence, if a person planned to retire earlier than age 59.5, there’d be a real advantage to having a 457b versus an IRA. Note that you do pay taxes on your withdrawals, but this is usually fine because–presumably–by the time you’re withdrawing the money you’re retired and thus, your income is lower as is your tax rate.

→Question for Aurelia: Does your employer match 457b contributions?

If so, you will absolutely, 100% want to contribute enough to qualify for the full employer match.

Roth IRA vs. 457b: Final Smackdown

In a perfect world, Aurelia would have a high enough income to max out both her IRA and her 457b (which would be a total of $29k per year). In reality, she doesn’t. So which one should she focus on? To help us out I made a handy, and also dandy, Smackdown Chart:

Roth IRAs:

| Pros | Cons |

| You’re in control of where this is invested (which brokerage) and what it’s invested in (which funds). This enables you to select funds that are: diversified, have low fees, and appropriately matched to your risk tolerance. | That means you have to manage it and select your investments yourself. |

| It’s 100% your money. It’s not through an employer, so you control it fully. | There’s no opportunity for an employer match. |

| You don’t pay taxes when you withdraw the money in retirement. | You pay taxes on the money you put in. |

| The annual contribution limit is low (only $6,500 in 2023 if you’re under age 50) | |

| You can’t withdraw money without a penalty before you’re age 59.5 |

457bs:

| Pros | Cons |

| The annual contribution limit is high ($22,500 in 2023 if you’re under age 50) | |

| You can withdraw money penalty-free at any age after you leave the employer who sponsors the plan | |

| Taxes depend on whether or not the plan is a Roth | |

| Your employer might match your contributions. If they do, you should contribute at least enough to qualify for the match. | It’s technically an IOU from your employer and not “your” money until you withdraw it |

| You don’t have to manage the investments yourself. | You do not control where this is invested–your employer does. Hence, you might be stuck in higher-fee, lower-performing funds and there’s nothing you can do about it |

For more on the difference between her two options, I suggest Aurelia check out this Investopedia article: Roth IRA or 457 Retirement Plan?

Aurelia’s Question #3: How do I prioritize a myriad of savings/debt-purging goals? To recap, my goals are:

- Paying off student loans

- Saving for retirement

- Paying for Invisalign braces out-of-pocket

- Saving for homeowner projects/repairs

- Travel, much later

Federal Student Loans: do not pay these off early. Continue to make payments that count towards PSLF and look forward to having them forgiven in another five years.

Private Student Loans: these are a bit trickier since they don’t qualify for any forgiveness programs. However, it’s still going to make the most sense to pay these off according to the required schedule–and not any sooner.

Retirement: as outlined above, Aurelia has a pension to look forward to. However, since she won’t receive Social Security, she should plan to supplement her pension via her Roth IRA and her 457b. The earlier you start investing for retirement, the more you’ll have in the end. As her salary increases, she should increase her contributions to these plans.

Paying for Invisalign braces out-of-pocket: Aurelia already has a system for this whereby she’s saving $87/month. I commend her for her extremely organized and forward-thinking savings accounts and plans. Keep on keeping on!

Saving for homeowner projects/repairs: here again, Aurelia is very wise to have monthly savings set aside for home repairs. She’s not currently in a financial position to do optional home projects (such as finishing the loft she mentioned), but she does need to have money set aside in case of emergency repairs. A few thoughts:

- Since Aurelia is in a condo with an HOA, I encourage her to examine what her potential repair cost exposure actually is.

- What is she responsible for fixing versus the HOA?

- How high could her repair costs potentially be?

-

Baby Yoda gone wild on family vacation It’s a very different financial story if you own a home and might need to replace the roof versus owning a condo and needing to replace the oven.

- Additionally regarding the HOA, Aurelia should investigate its reserves. Just as we analyzed the health of her pension system, she should do the same for her HOA. The reason you want to know this is to understand whether or not you might potentially be on the hook for a major assessment in the future.

- Back to the roof example–if the building’s roof has to be replaced next year, does the HOA have a large enough reserve to fund it? Or would they levy a $40k assessment on each owner?

Travel, much later: as these other priorities become fully funded/paid off, Aurelia can divert savings into a travel fund. Jet off an enjoy! Since Aurelia is so organized and responsible, I suggest she get serious about travel rewards credit cards since careful management of those can = free flights and hotels.

Increasing Income

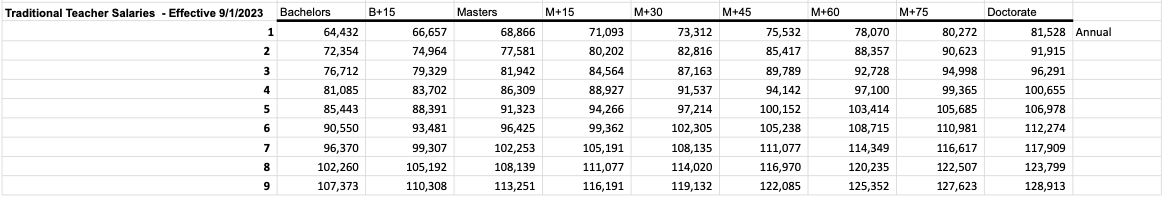

Aurelia didn’t ask about how to increase her income, but, she happens to be in a profession with a very straightforward and publicly available schedule for salary increases. As you can probably guess: YES, I READ IT! And you can too. Courtesy of the Boston Teacher’s Union, I found this great PDF on teacher salary schedules and am thrilled to report that Aurelia has a number of opportunities for increases!

From the Boston Teacher’s Union:

→What I don’t know from this document is how it differs by school and by position (if at all).

This is something for Aurelia to ask her union rep. I also don’t know if Aurelia is in a Boston public school or a surrounding town’s school, which would likely have a different salary schedule.

If I’m reading this correctly, Aurelia doesn’t have to actually get another Master’s (or a PhD), she just has to take credit hours. This is advantageous because that should be a lot cheaper and easier than enrolling in another Master’s program.

Another element for her to research: it often doesn’t matter where you obtain these credit hours. For example, Aurelia could go to Harvard for her continuing ed (and pay a ton of money) OR find a far less expensive online graduate school. Additionally, some districts will pay for a certain number of credit hours every year. Aurelia should ensure she’s utilizing all employer-provided opportunities since every credit hour counts towards a salary increase!

Of course, Aurelia needs to do her own research and confirm all of this with her district. But, it looks like it should be a great route to increasing her salary! And with an increased salary comes… an increased pension!

Expenses

Of course the other side of the equation are Aurelia’s expenses. However, even if she trimmed to the bone, her take-home pay would still be just $45k. She can certainly reduce discretionary categories if she chooses to, but I suggest she put more effort into the salary increase project since that’ll yield greater dividends.

Aurelia’s Question #5: Is it worth putting off retirement contributions altogether to get out of debt faster?

NOPE NOPE NOPE NOPE NOPE NOPE NOPE. The reason being: Aurelia needs to prioritize investing for retirement so that she’s able to take advantage of many decades of compounding interest. If she were to pay her student loans off tomorrow, she’d be locking in a return at the interest rate of her private loans (4.98%), which is lower than the historical average return from the stock market (~7%). Don’t do this!

Summary:

-

Dogsitting. How did you get in there? Review all pension plan materials and ensure you fully understand your pension and any changes to it in the coming years.

- Determine if your employer matches 457b contributions. If they do, contribute at least enough to qualify for the match.

- Continue to invest for retirement and try to put more into your 457b each year. If you’re able to reach the max contribution limit, put money into your Roth IRA as well. If you’re able to max out both each year, take yourself out to dinner to celebrate!

- Do not pay off your student loans ahead of time. Continue paying them off as required.

- Do not sacrifice retirement contributions in order to pay off the student loans faster.

- Investigate the credit-hours-for-salary-increase possibilities through your district. If the above schedule is correct, start taking credit hours as soon as possible. Find out if your employer or union will pay for any credit hours.

- Continue to save for the Invisalign braces as you have been.

- Asses your actual cost exposures in your condo. What are you responsible for repairing vs. the HOA?

- Analyze the reserves of the HOA to determine whether or not a costly assessment is likely.

- Continue living your wonderful life and keep us posted!

Ok Frugalwoods nation, what advice do you have for Aurelia? We’ll both reply to comments, so please feel free to ask questions!

Would you like your own Case Study to appear here on Frugalwoods? Apply to be an on-the-blog Case Study subject here. Hire me for a private financial consultation here. Schedule an hourlong or 30-minute call with me here, refer a friend to me here, or email me with questions (liz@frugalwoods.com).

Wondering about hiring me for a consultation? Grab 15 minutes on my calendar for free to discuss!

WOW! Thank you Mrs. Frugalwoods! I have some great reading material this vacation week with the MTRS report… 😉

I will definitely be back to answer any questions and comments during my break (it’s 7AM here before kids come), but a few points I wanted to answer and clarify for anyone reading:

— I am sadly not teaching in Boston Public Schools — trust me, I have thought about making the switch for salary (and nearly did this upcoming year), but after discussing with coworkers who have made the move it’s a “grass is greener” syndrome and I am probably better off sticking in my job with perpetual security (not only do I have tenure, I have seniority in a department of 2). One sticking point in our contract is we do not have as many lanes as BPS does. My next lane is MA+30, which would mean 30 credits or roughly an entire degree. The final lane after this is CAGS/PhD (yikes).

I did find an online program that priced out 30 credits at 7.5k total for the entire degree, but couldn’t justify setting aside money for it while juggling so many other savings goals. Work would reimburse up to 1k a year but only if it’s related to my job (this would be an MA in history). The new teacher mentor position next year would move me into this MA+30 lane without having to earn credits, but only as long as I do that job. My thought process is this immediate move is probably enough of a gain. I have also been feeling unmoored and a little jaded at work this year so I’m hoping that I can pay forward the great mentorship I received as a new teacher. I am open to reconsidering!

There is sadly no 457b match at work. Worse, my employer encourages people to choose 403bs with terrible expense ratios and does not advertise the 457b. I have saved some coworkers!

“Do not pay off your student loans ahead of time. Continue paying them off as required.” — How does Frugalwoods and co feel about the extra $50/biweekly payment to the private loan?

HOA reserves: Our reserve is very healthy (over 600k) and our board must read Frugalwoods because they do a lot of HOA work in-house if possible. The building is only 17 years old so the roof, etc. are in great shape and right now there are no major projects being considered. I’m responsible for things in my unit so big ticket items coming soon will likely be my water heater and fridge. (HVAC is also a big one, but I only run it in the summer). We are voting soon to possibly enter into a partnership with a utility company to generate thousands of dollars a month (!) for the HOA. Not sure if it will pass, but it would certainly help…

Something small but important to note is my HOA fees are also income-protected and set at a lower rate than a comparable market-rate unit. It would not protect me from special assessments but insulates me against any large fee increases (which have not happened in the history of the building).

Thank you everyone!!

-Bummer on the salary lanes–I was so excited for you! Ahh well, there are always other options!

-In my opinion, I’d go for the MA+30 credit hours once you’ve paid for Invasalign. Again, increasing your income in your current position is going to help you now and later with your pension since it’s calibrated on your highest earning years.

-Even without the employer match, I’d still up the 457b contributions (and thank you for saving co-workers from high expense ratios!!!)

-Wonderful news on your HOA–that sounds fantastic!!

-Re. the $100/month extra to the loans–mathematically, the answer is still no. The answer is to put that into retirement because it’ll yield such tremendous dividends for you later on. That being said, if it brings you JOY to put it towards your loans, go for it :).

Hahaha, fair enough. Knocking out a short-term goal (invisalign) definitely makes sense before a longer term goal of a possible degree!

I’m a member of the BTU and there used to be a $3000 credit for braces for teachers, contact the BTU or your union rep. Also as a union rep you receive a stipend of $1000 per year.

Not in BPS so not a BTU member. 🙁

I have been asked to be a union rep at work but it conflicts with Outdoors Club, which pays more and is more fun, heh.

Hi Aurelia, Kudos to you on becoming a homeowner at such a young age, particularly in such a HCL area! For reaching M+30, I HIGHLY recommend taking courses through Dominican University of California Online. Through their EDUX 9928 course (“Maximize Your Professional Practice”), you essentially earn credits for Summer planning you’d probably already be doing. It’s only $715 for 6 credits! They have dozens of other relevant courses that help you advance on the salary schedule, and they are *much* more affordable than an additional degree would be. (This is how I earned most of my 75 credits on top of my Master’s degree…I teach in BPS, so that’s a separate lane for us.) One other thing to note is BPS is often looking for Summer school teachers and Acceleration Academy teachers for Feb and April breaks, and the pay is really good for those gigs. Good luck!!

We also host Acceleration Academy, but I was not chosen this year and was really disappointed. I was told I did absolutely nothing wrong and gave a great interview, but they chose a candidate who is currently enrolled in a educational leadership program and there were other politics involved in that decision.

Thanks for the tip on Dominican University, that is a LOT more affordable than any option I have found so far!

“Work would reimburse up to 1k a year…”

As a provision of the CARES act, you should be able to use professional development funds to reimburse you for student loan payments through the end of 2025. You can ask your benefits department about that – an additional $1000 a year for the next three years is nothing to sneeze at!

Really?! Could you send me this language? Our tuition reimbursement provision is written in a very specific way, but now I want to know more about this…

I would also love to know more about this. Is that specifically for teachers or does that apply to other industries? I work for a credit union. Thanks!!

Interesting that this is the first case study I’ve seen that doesn’t have the table of expenses and what could be cut. If the credit hours thing works out that would be a great option for increasing income. My other questions for summer income would be if you could do something to increase income that wouldn’t be stressful- for example, pet or house sitting for wealthy folks on vacation, dog walking, or using your history expertise to give historical tours. I definitely get the need to relax after working so hard all year, but it could help save more quickly for the fun stuff.

A note about your parents financial situation: like Liz says with kids college savings, you have to put your own oxygen mask first. So getting your financial house in order now when you’re young and relatively healthy is important so you’re self sufficient and could eventually help your parents with bills, selling their house, downsizing, as their older years unfold.

I came here to say the same thing about Aurelia picking up some part-time seasonal employment. There’s a constant need for servers in Boston and in the surrounding summer vacation hot spots (perhaps harder to manage without a car, but maybe the commuter rail could provide some options). Heck, she could even check out the craft cider place in her neighborhood (i’ve guessed it and i second that it’s amazing) for an easy gig that makes great tips and doesn’t have a commute!

If she has serving experience and wants to make MORE in tips, she can take on a more traditional serving role. The way the market is now, I imagine that employers are much, much more flexible than they used to be.

I had a thought that maybe she can commit to working part time one summer with the objective of saving for travel for NEXT summer. Have an alternating schedule of working and saving one summer, travelling for an extended period the next. Just throwing it out there!

Anyway, Aurelia, you are doing great financially at such a young age! Hope you get to make the most of what Boston in your late-20’s has to offer! (I’m still here but mid-30’s)

Thanks all for your kind words! I think I will look into a summer gig at our favorite cider house. 🙂

congrats on so many aspects of your life. home ownership with those terms in an ultra-premium market at 27!!! roth at age 19!!. loving car free life in amazing city with access to life you love crafted by you for you. you are so far ahead of the game it is unreal. yes you could prune your budget a pinch but i would focus on trusting your amazing plan, taking care of yourself and enjoying the hell out of it. stressing over being 3% better is a waste of energy. you are killing it.

one item that i was curious about is line “I’m currently single but I imagine in the next 10 years I may meet a partner and incur expenses related to that.”

this may just be about costs of dating and not cost of partnering so i don’t want to overstate it. but i apparently wanted a moment on my soapbox.

one thing i have seen in my 51 years with friends and certainly in my own failed relationships and now gloriously amazing marriage with kids is how INSANELY important choosing a financially competent partner is. someone you can collaborate and partner with to make your best life. not gold digging or any immature version of it. allowing for the profound self care of honoring the amazing work you have done in your own financial life and holding a high standard for your potential partner. it can be/is as important as other criteria we use when choosing a life partner.

The joke I have with my friends is future partner needs to keep up with me intellectually, mentally, and financially — at least one of these is definitely less of a joke than the other 😉

thank you for your kind words!!

I cannot second your comment about a financially competent partner. With my husband’s enthusiastic participation, we were able to retire by 50 and then take on working for small non-profits that could never pay us enough to survive, let alone thrive, if we were not financially secure. I have friends who have nothing due to spend thrift partners. Also, never believe what you don’t see—if you do let your partner run the finances (as I do in our home), always read the bank and investment statements. I have a friend whose wife developed a gambling problem and not only drove them into debt but managed to forge his name to take out a mortgage on their debt-free home. He is 76 and still working; she left him and remarried a wealthy man.

Since you mentioned you get dog fever… Possibly consider signing up on Rover to do pet sitting or boarding, even just over the summer. Would your condo allow for that? I’ve been doing Rover for close to a year now and it has been a good side hustle for me. Not lucrative, but you get paid to have a temporary pet, without any of the costs involved! You have control over many settings such as size of dog, and can block off dates on your calendar in the app.

Yes, our condo does allow pets! Someone already runs a dog walking service in the building but I will investigate Rover. Am also thinking of checking out our local cider house for summer work.

I came here to say the same thing! I wonder if Aurelia has ever considered a Rover side hustle? We own a dog and when we go away really only need someone to help with our dog for: walk/breakfast in the morning, walk/dinner in the evening, and out to pee at night. As you already pointed out she could have control over her calendar too and limit it to the summer months.

No deep dive comments but I’m so angry that we pay teachers so little. As a parent, I want the best educators and I want them to be happy so that they can support my kid. It’s ridiculous that public good pays so little!!

Yup. It’s such a shame and I’m even more angry about it as a new parent. Same with daycare providers. It’s some of the most important work in our country and the salary does not reflect that. 💔

Re: Rover and dog sitting. School teachers are our most reliable dog sitters! Our main one is as busy as she wants to be in summers and school vacations with her side dog sitting/walking hustles.

Just wanted to add that I don’t live in the same part of the country as you but in our midsize metro area dog sitting in the sitter’s home runs us about $50 a day per dog. That sitter usually has four or five compatible dogs at her house on the weekend. That many probably wouldn’t work in your space I’m sure, but just to give you an idea… It’s a nice side hustle.

As someone who lives in the Boston area and is married to a public school teacher I am super impressed by your progress in such an expensive place to live! Also really appreciate Liz’s breakdown/assessment of the MA pension system. This is so helpful, especially as a spouse who doesn’t have direct access to a union rep.

Oh I’m so glad it’s helpful! I was really excited to see how much information was available online, including that full audit report.

Congratulations on your financial successes and plans! You are a very mature young woman, and I applaud your savvy! As far as side gigs, any chance you could house-sit in July and August, while offering your condo as an AirBnB/VRBO? Boston is such a prime vacation and medical destination.

Hi Maura, I’m not allowed to rent out my condo per the restrictions of it being an affordable unit. But it’s a great thought!

I read the line, “sometimes you just need Dunks” while…. drinking my Dunks. I feel ya! I am also New England born and raised. I always love reading Case Studies of people around my age. I am 29! Congrats on being a homeowner 🙂

One thing I was unclear on was Mrs. Frugalwoods’ characterization of Roth IRA withdrawals: “You can’t withdraw money without a penalty before you’re age 59.5.” I was under the impression that you can withdraw money, but only your contributions. Vanguard says, “Withdrawals of Roth IRA contributions are always both tax-free and penalty-free. But if you’re under age 59½ and your withdrawal dips into your earnings—in other words, if you withdraw more than you’ve contributed in total—you could be subject to both taxes and penalties on the earnings portion of the withdrawal.” By this explanation, couldn’t Aurelia withdraw some money from her Roth if needed?

Yes, Katie, you’re correct. You can withdraw the principal, penalty fee, at any age. This is why Roths are such a great tool for those who qualify! I max-out a traditional 401(k) for current tax benefit and max out a Roth for future tax savings and, if absolutely necessary, a fund for extreme emergencies.

Yes! came here to say this — you can withdraw your Roth IRA contributions (not gains/interest) penalty-free after 5 years (google the “five year rule”). I would opt for Roth IRA over 457 to have more flexibility and because you’re not in a particularly high income bracket.

Re the Invisalign, is there a reason it has to be that brand? There are now a lot of more cost-effective alternatives. I haven’t tried any of the systems but friends have recommended Quip and SmileDirect; they are less than half the cost of Invisalign.

Invisalign: I have a lot of dental anxiety (even a regular cleaning is really horrible for me) so I’m really wary of things like SmileDirect. (Some other people mentioned dental work done in another country — I hear good things but I’m still wary.) Their closest in-person location is also not very accessible by public transit and has bad reviews. :l

I know friend who have done Invisalign and are satisfied so I’m kind of inclined to go with what I know.

Definitely understand the dental anxiety – I’m right there with you. Maintain the regular cleanings and don’t let a cancellation spread the time between. Whatever you find is most comfortable mentally to pursue regarding the dental work is the right answer, I say. I’d be inclined to go with what you know as well vs. kicking yourself later or starting/stopping another path and having to re-save. GOOD LUCK.

I came here to say the same about the Roth as well — you can withdraw contributions at any time, tax and penalty free, and can also make certain other withdrawals even of earnings (e.g for first time home ownership) without penalties as well. https://www.schwab.com/ira/roth-ira/withdrawal-rules#:~:text=You%20can%20withdraw%20contributions%20you,had%20less%20than%20five%20years.

Perhaps Mrs Frugalwoods can update the chart so it doesn’t confuse others who don’t read the comment

Why does the warm weather make me *need* an afternoon iced coffee when I have pledged to bring coffee every day?

I said the same thing to a coworker yesterday seeing kids walking home with Dunks…except I went home and cracked open a nice cold hard cider instead. Whoops 🙃

I’m wondering if you could bring in extra income doing tutoring. My son’s high school math tutor charges $70/hr and this could be a nice side hustle to boost your income. Maybe not math, but even English stuff (like helping kids with college essays or similar)😁

It’s not a bad idea — I’m dual-licensed in history and ESL so there could be demand!

You might also consider teaching English online to students who live in China. There is a high demand for this service and the pay can be quite good.

Regarding another degree, there is usually no rule that it needs to be completed in a certain number of years. Look for a degree that will allow you to take 1 class at a time, and do them as your time and $1k/year reimbursement allow. I have friends who got MA degrees over a few years because their employer reimbursed 3 classes per year, so they took exactly 3 classes per year.

Your finances are quite tight and you will be in the red once federal student loan payments start again. I would look at either firming up employment for this summer or temporarily reducing some of your discretionary spending. Your finances will be ok in 1-2 years once you get annual increases while your major expenses of mortgage and student loans stay steady. In the meantime though you don’t have enough savings to run in the red when federal student loans restart.

Ideas for summer or side-employment: summer school teaching, summer camp counselor, tutor for high school or middle school students, tutor for immigrants preparing for citizenship test (since it is civics and history), tutor or paper editor for college ESL students. Although I understand that your health means you can’t do a ton of side hustles right now, your finances don’t allow you to comfortably take off the summers yet and not have additional income coming in. You will be in a stronger financial position in a few years, just not quite yet.

These are great points, Anne! To your comment on summer jobs: I wonder if doing a combination of Rover/petsitting and tutoring might provide a nice balance since she’d be able to control her own schedule? Might feel less burdensome than something more full-time like teaching summer school?

Yes, this is what I’m thinking about — I definitely need to NOT work with kids in the summer after having done a few years of outdoor summer camp. 🙂 I also tend to have a really irregular schedule. Something like the local cider store would be good or petsitting.

Just a point of clarification that teachers do not have the summer off. I am a teacher and this summer I am doing a week of work/professional development in both June and August, writing recommendations for students, taking a class for my license, and prepping for the next school year. A veteran teacher once told me that we work full time jobs (2000 hours) but fit it into 10 months. Most teachers I know do the same….

Hi Aurelia! You are doing an awesome job! Thanks for what you do, and for sharing your story. A few ideas…

Can you work over the summer? You could do something fun, that also allows you to travel. Maybe work for a hiking/camping company as a guide? You seem like you’d be great at it. There are also wilderness therapy programs that always need guides. You could airbnb your condo while you are gone doing that.

Could you get your braces/invisalign in a different country? We always do dental work when we go to my husband’s home country of Argentina, and it is a LOT cheaper. You could get some travel out of it as well as dental! I hear Mexico can be really affordable.

Not much more advice, it seems like you have an awesome life and are rocking it!

I can’t rent my condo since it’s income restricted but I’m thinking a summer job would help me out a lot. Something relaxing and outside if possible. 🙂

Braces/invisalign — I’m feeling wary about going out of country since the retainers/aligners need to be swapped out every 2 weeks or so. Need to investigate further but I already have anxiety around going to the dentist 😬

My daughter has invisalign right now and she got the first 30 “trays/retainers” all at once. She has an app on her phone that she takes pictures with using this device that pulls her mouth back so the orthodontist sees all the teeth. Since she started in August she’s been in to the orthodontist 3 times maybe for check ups. But they don’t really do anything at those appointments. I swear they have the appointments just to justify the cost.

Also, even though you can’t do an airbnb/vrbo are you prevented from doing a home exchange? If you only offer reciprocal exchanges for no money you might be able to do it without running afoul of the restrictions.

I don’t have anything major to add. Aurelia, you are doing so well! You’ve crafted a beautiful, diverse life for yourself. Congratulations on your financial accomplishments, and continue enjoying Wingspan on your camping trips. (It’s one of my favorites, too!)

A 3 in one option could be teaching a summer class of English in Colombia or Mexico. You get paid a bit, get to travel and have access to very cheap dental care. There is a brace that you can take in or out and need to be in 12 hours a day. Dentist in the USA are the most expensive in the world.

Bella, how would one get a job like this? Asking for myself too — retired English teacher.

While saving early and often in retirement savings is generally the right call I don’t see the need in this case. You will get a very good pension that should cover all of your expenses with money left over since you will be mortgage free and student loan free by that time. I see no need at all to up the 457 contribution at this time. Maybe after the student loans are paid off and after you get a couple raises but not now. For now hold off on the loft work and focus on the dental work. I would also stop paying extra on the student loan until you cover the full cost of the dental work. Things may be a bit tight the next few years until the federal loan is forgiven and the dental work is paid for so no reason to try to add money to 457 right now. With the exception of the mentor job I see no reason to add another job to get more income. You need to keep your physical and mental health in check and adding another job would have the opposite effect. Best of luck to you.

Thanks for your kind words…I definitely worry about burnout because I have a few chronic illnesses that wear me down physically which then has an impact mentally. But I do think maybe something like petsitting or serving at the cider place would be possible! I can see the light at the end of the tunnel but just need to get there!

I know you don’t want to leave Boston, but something to consider with your 457. I used to work with a teacher who would stash as much money as possible in his 457, then leave that district for another, withdraw all the money he put in and use that to live off of for 1-3 years while he put all of his new income into other tax/retirement/savings accounts.

It’s a bit crazy, but him and his wife were both teachers, frugal by nature, and enjoy sabbaticals to Mexico every time they need an extended break from teaching. He has a blog- the millionaire educator- if you are interested.

Even if you don’t want his wanderlust lifestyle, he still shares lots of great financial advice geared specifically towards teachers.

Ok that is a pretty genius idea! I agree you’d have to be very careful managing your career and actual retirement accounts, but I love that idea for financially responsible people like Aurelia…

I. Hello fellow Bostonian! I love the shout-out to Market Basket!

My parents were both teachers and they both had summer jobs – you could definitely pick up a waitressing job during the summer for 1-2 days a week, which you could put toward your travel fund (and therefore short-term AND for a FUN goal). I worked at BU full-time as an admin before becoming a professor and I waitressed on weekends to pay for all of my extra-curricular activities. PLUS you get free meals and (for me, anyway) it became a social activity since I really enjoyed my coworkers there.

I think I would enjoy waitressing! I have food allergies to some common allergens so I’ve worried about it in the past. I might meet in the middle by hostessing at the local cider house this summer because they would also get me a bartending certification!

Does your employer offer a FSA (pretax health care expense savings account for medical expenses)? I was able to use mine to pay for Invisalign and it was effectively a 20% discount. 🙂

No FSA or HSA. We have incredibly bare bones benefits, it’s kind of wild. My employer is the only one I’ve ever worked for or known that offers NO transit benefit, which is depressing.

One possible idea might be some limited one on one tutoring– not your current students; some from a different population. You can often do it at a library and you can charge quite a bit. I made $50. an hour 10 years ago and that was not high.

Hi Aurelia, I teach high school in Utah. After I earned my Master’s degree, my goal was to get to the M+20 and then M+40 and then stop because the last lane was a doctorate degree. I was able to get all 40 hours in about 15 months by taking 1 to 3 credit courses that cost om average $20 a credit. These courses were through my district or State Universities with partnerships with the districts. I earned two endorsements that were very affordable – EDL and Educational Technology. Moving from a Masters degree to M+40 doesn’t look like a lot on paper, but it has definitely helped me with an additional few hundred each month. I would highly suggest looking into subsidized endorsements!

Gosh, I wish! Our state universities are price gouging — roughly $500 a credit for grad study — and our district has no agreements with any universities at a discount. I’ve got an online option for $250/credit and it’s the best I’ve found. :\ WGU has similar pricing too. That’s why the idea of just being a new teacher mentor to move over to MA+30 is looking way more appealing in the short term while I save money for another program.

yikes!!! This is all making Boston Public Schools look very attractive (although I also completely understand your reasons for wanting to stay where you are)!

Just after I sent you the case study I seriously started writing an application for a BPS school near me. Then I heard from multiple people I know there that my new supervisor would not be great which — !! — I have a great supervisor and would be loathe to give them up. I was also struggling to think of any other motivation besides “more money good” which leads me to believe that right now is not the moment. When this supervisor in BPS moves on? Maybe it’s worth another look.

The world of education (especially in my subniche) is frighteningly small.

BPS is also notorious for moving people around or cutting them loose early on (yes, in the middle of a teaching shortage, you read that correct). I am super risk-averse and starting over with no tenure would not be fun.

You may still have options! I know Umass Dartmouth has tuition discounts for teachers from certain districts, and I am sure the other state schools may also. And there is a Collaborative Teachers program where you can mentor a new teacher and receive a tuition waiver for a graduate class at any of the state universities for each teacher you mentor.

https://www.mass.gov/info-details/collaborative-teachers-tuition-waiver

My last idea would be to combine your side hustle and grad school a bit….. if you were interested in teaching an adjunct course it could help you earn more income but also (perhaps more importantly!) would likely get you a significant discount for your own courses.

One additional advantage to house/pet sitting during the summer is that you could leave your thermostat set very high while you’re away to reduce the summer HVAC use.

Aurelia, as you consider future partnering, some couples avoid most costs of a wedding. One of my sons married at the courthouse and called me that evening to let me know (they live several states away). I was so happy! He and his wife are quite frugal and well-positioned financially.

And yes, make sure your future partner is financially capable, literate, and willing to be a true partner in your joint finances. Mistakes here can be very costly. It’s important to know your state laws … what you’re signing up for financially when you marry. You may also wish to consider a prenup to protect your retirement/pension and other assets in the event of a divorce.

Since you don’t teach in the summer, love dogs, and don’t have a dog of your own at home, have you thought of looking into dog sitting when you are off work (weekends/summers)? I would imagine it pays well in Boston and you could still keep your same lifestyle, you just wouldn’t be staying in your own house all of the time. I’d also imagine that would help with your personal utility bills but yours are so low to being with that that selling point probably doesn’t matter as much.

Re: Invisalign, I am currently finishing up my round, and have multiple friends both where I live in NYC and in Boston who have gone through/are going through it right now. Mine cost $6k and my friends have all paid between $5500-6000 – seems to be the going rate? In my case, I put down $2000 when I decided to go for it and pay a monthly fee. It has absolutely been worth it and I would suggest shopping around orthodontists and finding one that you feel comfortable with. I have gone to a dental school for work before and while it was worth it at the time, I would advise going to a more experienced orthodontist, even if it’s a little more expensive.

I also had this concern so I asked the dental school what the different levels of experience are. It turns out they do run a clinic with students who are recently graduated, so that did make me feel better. They quoted me at $5.5k and 3 other orthos (including my own dentist) at roughly $7k which is high but probably accurate. I would need at least a full year.

Hopping on to say brava to Aurelia for managing elements of her life so well! I am also adding a plus to the Rover idea. I know someone who made significant side hustle income while in law school doing dog walking, and then clients trusted her enough to stay over and house sit when they traveled, and it could be a substantial amount of income for doing something fun – walking dogs and sometimes staying in fancier homes and being paid for it.

Thanks, too, for the retirement breakdown. I always learn more every time I read a new explanation

Is the MTRS pension a flat payout or will there be an annual COLA?

RE invisalign, I also had to have braces as an adult and did invisalign. You mentioned it not being covered by insurance. What I’m wondering is if you have the ability to choose from a number of dental plans at work or even privately? I read the fine print of the plans available to me and found one that would cover a really good portion of the cost. I had to participate in the plan for a year before they would cover the braces expense, but I found it to still significantly decrease my out of pocket expense, even taking into account the total amount I ended up paying in monthly premiums for multiple years.

We only have one dental plan and it is definitely 0% adult ortho. I would pay into another plan if I had options! Is private dental insurance an option if my employer offers a plan? My open enrollment just passed but since I’m hoping to start next year it might be possible. 🤔

Teacher here! Move up on the pay scale as quickly as possible with FREE teacher trainings and reading books!!! Spend as much time as you can taking those free trainings. If you get to MA +45 and then MA +90 you will increase your income a ton. Also look into getting National board certification. Many districts will help pay for it and then you SHOULD get a district bonus every year. Low income districts have higher bonuses. Where I am now it’s 10k August bonus each year but the boojie district near us is 5k bonus in August.

Also, consider moving (not ideal for many people) to a district/state that values teachers more. I taught in CO with my MA and made 32K/year plus benefits. I moved to WA and make 90K plus benefits with an MA +45 credits. I’m working towards MA +90 credits and then I’ll be making almost 100k/year. The earning potential is there!

Good luck!

Just wanted to chime in about your parents! Have them talk to a financial advisor- but their best path forward might be to sell their house and get into subsidized housing (where their housing payment will be limited by income). Honestly helping them plan for a sustainable future would be worth way more than any financial help you could give them.

You do such a great job with everything. Is your condo one or 2 bedrooms? You mentioned a loft renovation. I know you like living alone, however I wonder if you can find a (quiet!) roommate ….that could give you a lot of money each month and help you pay down your student loan payments far more quickly. If that means finishing the loft conversion that may even be worth while. In a city like Boston, there are probably some people who need a place monday – friday so they wouldn’t even be there at the weekend. Just a thought! Other thing you could do is rent your place for a few weekends on air bnb and stay at your parents for a little extra cash. Not sure if these are allowed by the condo association but wanted to throw those thoughts out there. Good luck with everything!