Welcome to this month’s Reader Case Study in which we’ll help Bridget figure out how to tackle her student loan debt. Case studies are financial dilemmas that a reader of Frugalwoods sends to me requesting that Frugalwoods nation weigh in. Then, Frugalwoods nation (that’d be you), reads through their situation and provides advice, encouragement, insight, and feedback in the comments section (for an example, check out a previous Case Study).

P.S. Another way to support each other on our financial journeys is by participating in my Uber Frugal Month Challenge! You can sign-up at any time to join the over 10,000 fellow frugal sojourners who have taken the Challenge.

I probably don’t even need to say the following because you all are the kindest, most polite commenters on the internet, but, please note that Frugalwoods is a judgement-free zone where we all endeavor to help one another, not to condemn.

With that I’ll let Bridget, this month’s case study subject, take it from here!

Bridget’s Story

Hi, I’m Bridget! I’ll be 28 in March and I live with my boyfriend Jack, also 28, in Portland, Oregon. We’ve been dating for five years and live a simple life with no pets or kids. We don’t have concrete plans to get married yet, but we hope to do so in the next few years.

We’ll likely march down to the court house and have a big reception afterwards in someone’s backyard with catered Chipotle. No big dress, no frills, just a lot of fun with people we love.

Bridget’s House

In May, I used every penny I had to buy a 750 square foot home in Portland for $280,000 with a 30 year mortgage and a 4.25% interest rate. I put 5% down, which was $14K. This was my dream, but I’ve been living on a shoestring ever since the purchase in order to fund aesthetic renovations to the house (the house doesn’t require any improvements from a safety perspective).

Bridget and Jack

Jack and I love cooking together and renovating our tiny home. I’m the frugal planner out of the two of us and I make a sport out of minimalism and thrifting. Spending time with family and friends is very important to both of us. We keep our entertainment costs low and don’t have cable or Netflix and we also don’t go out to concerts or the movies. About four times a year, we take a camping or ski trip, which usually totals $100 per trip.

I graduated with an M.S. in Public Relations from NYU in 2013 and a B.S. in Corporate Communications from Duquesne in 2011. Jack graduated with a B.S. in Economics in 2011 from Tampa.

I currently work as a Social Media Manager for a healthcare start-up in the urgent care and health insurance field. It’s an extremely fast-paced job and I’m on-call 24/7. I’d really like to move into a more conventional, steady 9-5 in communications strategy/planning over the next year. My current employer offers a 401K plan with a 6% match.

Jack has worked primarily in software sales since graduation. He recently landed a new job and expects to make around $50,000/year (pre-taxes) after commission. He’d ideally like to move into the fitness apparel industry, but is fine staying in tech sales at present.

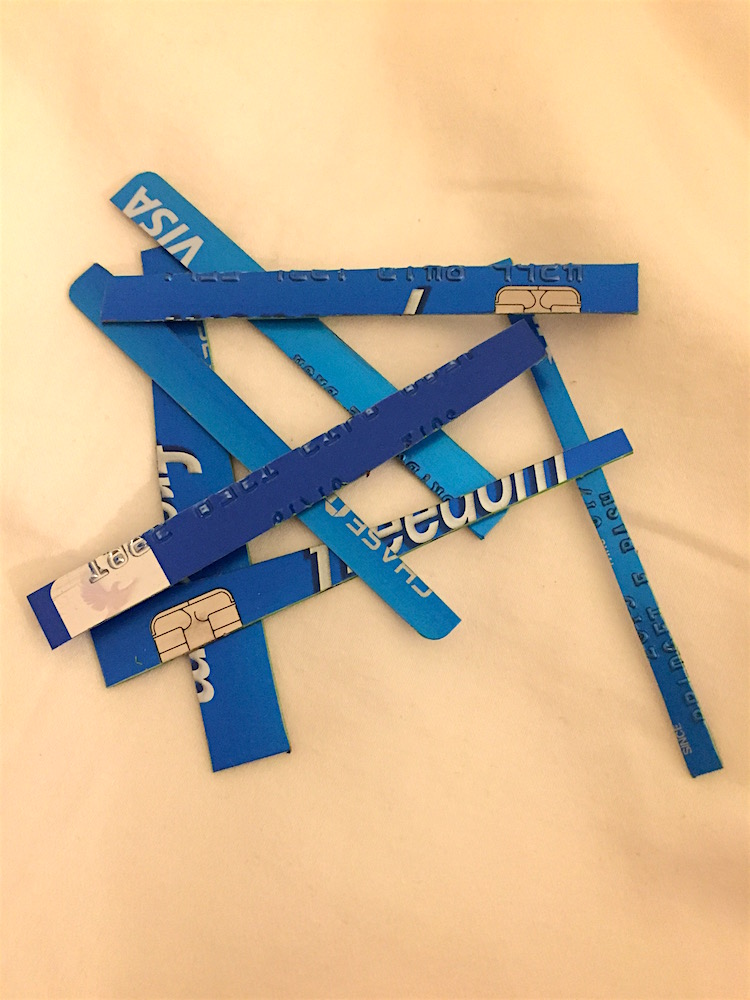

I recently cut up my credit cards and would like to move towards living entirely debt-free. I watched my parents go through a bankruptcy, lose their home and get divorced and it has scarred me for life. Jack has two credit cards that he pays on time every month.

Bridget’s Long-term Goals:

In 10 years Jack and I would like to be married, living debt-free in our fully paid for house in Portland. Maybe with a kid or two. Possibly with Jack staying home to raise them. We’d also like to have the financial freedom to frequently travel for pleasure.

The Challenge

I currently have $185K in federal student loan debt at a 7.25% interest rate. I had no idea what I was getting into at the time and took bad advice from broke people. The student loans and the house are my only debt. Jack is (mercifully) debt-free. I’ve researched working for non-profits where my federal student loans would be forgiven after 10 years (through the Public Service Loan Forgiveness program).

At this stage, I’m unsure if I should:

- Buckle down and start paying off my student loans more quickly while actively seeking out the highest paying job I can find.

- Pursue a career in the non-profit space (possibly making less money) and ride out the minimum student loan payments for 10 years, after which time the loans would be forgiven through the Public Service Loan Forgiveness program. If I did this, I think I could pay off my mortgage in 6 years (according to my estimates on how much extra I could throw at my mortgage payments each month).

I’ve gamed out these two scenarios a bit:

If I decided to pay off the loans myself and threw an extra $2,300 per month towards them, I estimate they’d be paid off in 6.7 years. This would be faster than the 10 year forgiveness program. On the other hand, if I used the income based repayment plan and utilized the 10 year Public Service Loan Forgiveness program, I believe I would save more money over time.

Option #1: Pay off the loans in a shorter timeframe on my own:

- I’d pay $2,300/month for 6.7 years, which would be a total of $184,920 paid off and without the potential savings of option #2.

Option #2: Utilize the PSLF program:

- I’d pay $151 to $300/month for 10 years, which would be a total of $18,120 to $36,000 (plus the tax I will have to pay on the forgiven portion, which I’ve unofficially heard is taxed at around 25%, so perhaps $30K in taxes?)

- Total = $60K-ish of the loan paid off and the rest forgiven

- I estimate I’d be able to save $276K while doing this ($2,300 saved/month for 10 years)

Bridget’s Questions For You:

- How should I pay off my student loans? (see options 1 and 2 above)

- Should Jack and I wait to get married until the student loans are paid off?

- Should we pay off the house first or the student loans first?

I think I make too much money to be this broke – help!

Bridget’s Finances

Yearly Take Home (Net) Income

| Net Income | Amount | Notes |

| Bridget’s monthly take-home | $3,554.00 | This is after taxes and other deductions |

| Bridget’s annual take-home: | $42,648.00 | This is after taxes and other deductions |

Monthly Expenses

A note on cars and cellphones: I don’t own a car and use the bus to get to work most days and sometimes Jack drives me. My office is 10 miles from my home. I’m currently on my Mom’s cell phone plan and she pays the bill (embarrassing), but I’d like to get on my own plan ASAP.

| Item | Amount | Notes |

| Mortgage, taxes and insurance | $769.00 | $1,536.65 monthly payment (boyfriend pays half at $769.00/month); $263,378.08 remaining; $2,621.92 in equity; 4.25% interest rate. |

| Groceries, household supplies, eating out | $300.00 | This is just for me. We keep grocery budgets separate because I don’t eat meat. |

| Student loan payment | $151.00 | $186K remaining; 7.25% interest rate. On an IBR plan based on my 50k income from last year. This payment will go up in November 2017, likely to around $300. |

| Bus pass | $100.00 | I don’t have a car and ride the bus to work. |

| Home renovations | $100.00 | We’re slowly fixing up the home I bought including finishing up a kitchen remodel and painting. |

| Internet | $41.00 | $82 paid monthly, split 50/50 with boyfriend |

| Utilities: electric | $35.00 | Averaging around $70 a month, split 50/50 with boyfriend |

| Vacations | $33.33 | About 4 times a year we take a camping or ski trip totaling $100 per trip (or $400 per year) |

| Utilities: water and sewer | $28.50 | $57 monthly, split 50/50 with boyfriend |

| Healthcare | $25.00 | I work for a healthcare company so my payments are low and I have no known medical issues. |

| Clothing | $20.00 | I hardly ever buy clothes but I’ll buy one big ticket needed item about once a year for around $240 |

| Garbage/recycling | $16.00 | $95 paid quarterly, split 50/50 with boyfriend |

| TOTAL each month: | $1,618.83 | |

| TOTAL annually: | $19,425.96 |

Assets

$100,000 life insurance policy through employer

| Asset | Total | Notes |

| IRA Traditional | $14,784.00 | |

| Cash | $3,390.17 | In a Betterment account earning 0.2% with a time-weighted return at 0.7% |

| TOTAL: | $18,284.00 |

Mrs. Frugalwoods’ Recommendations

First of all, can I just say how THRILLED I am to hear from a young reader who is taking charge of her finances now! Hooray! While there are things you can do to improve your financial prospects at any age, time is certainly in Bridget’s favor here, which will be key to ironing our her debt situation–and to building her long-term wealth.

Bridget’s question #1: Student loan repayment

The elephant we want to address is her student loan debt and I commend Bridget greatly for tackling this debt head on. Plenty of folks would simply ignore debt like this, pay the minimum, and hope it’d disappear in a magic puff of unicorn dust (newsflash: it won’t). And so, before we get into the weeds, I want to encourage any other readers facing a debt load like Bridget’s to take heart that you CAN pay debt back and you CAN right your financial ship.

Kudos to Bridget for researching the Public Service Loan Forgiveness (PSLF) program–it’s wonderful that she’s explored these two options for payback. Unfortunately, there’s no one right answer here. The right answer is to pay it back. The strategy, however, is really up to Bridget.

It’s true that she could likely save more money by going the PSLF route. However, it’s also impossible to know what earnings she’d be sacrificing by leaving the for-profit sector. If Bridget is a hustler (and I highly suspect she is), she could climb the ladder and catapult herself into a mid-six-figure salary in a few years in the for-profit sector, which would mean she could throw mega dough at her debt and then quickly get to the business of building her net worth.

On the other hand, I hear from Bridget that she’s looking for a less fast-paced job with a better work/life balance. And so, aggressively climbing the ladder might not appeal to her. From that perspective, perhaps finding a slower-paced non-profit position would be a better fit. A word of caution here: don’t automatically assume that a non-profit position will be slower paced or will deliver that desired 9-5.

My entire career (prior to doing what I do now) was spent in non-profits and I’ve been at both 9-5 institutions and 8am-9pm institutions. From my experience, larger, more established non-profits are likely to: 1) offer higher salaries, and 2) provide better work/life balance. That being said, they’re also more competitive in their hiring.

I encourage Bridget to continue her research and start looking around at the non-profits that are hiring in her town and in her field. Try to suss out the salaries of these positions and also the general atmosphere of the non-profit. Is it well-established and well-funded (likely to be 9-5 with better salaries)? Or is it more of a bootstrapping start-up (likely to demand longer hours for lower pay)? And, more importantly, is it a cause you’re passionate about?

Similarly, I suggest Bridget start looking around at other for-profit positions. Could she command both a higher salary and a better work/life balance at a company that’s not a start-up?

Another consideration with the PSLF program is that 10 years is a long time. It’s a long time to stay at the same organization (Bridget–research whether or not you can change organizations but still accrue years in the program). It’s also a long time for a federal program to go unchanged. In our current political climate, I’m a tad concerned for the longevity of this program.

I wish I could give you a final answer on this one, but I think there are too many factors that you’ll need to determine on your own. From a mathematical and financial perspective, the right answer is to pay it off. How you get there is largely up to you.

Bridget’s question #2: Should Jack and I wait to get married until the student loans are paid off?

Debt itself is not a reason to delay getting married. If Jack is ‘the one’ and you’re certain you want to spend the rest of your lives together, then there’s no financial reason not to get married tomorrow. I’m delighted to hear that you’re planning on a frugal wedding and it sounds like a marvelous plan!

Aside from marriage, since you’re already living together, I’d advise looking for greater efficiencies in your budget. I imagine there could be savings to reap by combining the grocery/household/eating out line item. You two are a household, so I’d start spending jointly in that arena as I bet you can save more by doing so.

If you’d prefer to pay your loans off with your own money, that’s totally fine. If you’d prefer to pay them off as a couple, that’s also fine. Sit down and have a frank conversation with Jack (you probably already have, but just in case not… ) about the size of your debt and your plans for repayment.

Ask his opinion on how the debt should be paid off. Again, there’s not a right answer here, but there is a wrong answer: not discussing it. An absence of communication is the only danger I foresee. So, iron out how you want to handle the debt–singly or jointly–and then go get yourselves married.

As a sidenote, I think it’s wonderful you two have already discussed the possibility of Jack being a stay-at-home dad. That takes a lot of forethought and it demonstrates that you two have a good, open line of communication. Plus, you’ll save untold amounts of money on daycare!

Bridget’s question #3: Should we pay off the house first or the student loans first?

I have a definite answer for this one: THE STUDENT LOANS. The interest rate on the student loans is 7.25% whereas the mortgage is at a meagre 4.25%. This alone makes the student loans the priority. But there are several other reasons to pay the student loans off first: 1) unlike the house, the loans will not appreciate; 2) unlike the house, the payments on the loans aren’t stable–they fluctuate with your income.

Paying Off The Mortgage?

I hear from Bridget that she wants to pay off her mortgage; I actually advise against this. From a mathematical and financial perspective, the wisest course of action is to instead invest her extra money. Many people enjoy the psychological boost of paying off a mortgage, but it’s not a boost financially.

Bridget is suffering from what I call ‘mega debt aversion.’ I completely understand the desire to be debt-free, but the fact is that some debt can actually be a good thing. I also completely understand that she is scarred by the example of her parents and I commend her for wanting to chart a wiser financial path for herself. However, there’s a happy medium between having $185K in student loan debt and having absolutely no debt.

I discussed the folly of paying mortgages off early the other day and I’ve excerpted my notes below:

I view holding a mortgage–and having money properly invested in diversified assets (aka low-fee index funds)–to be a much less risky financial decision. Why? Say you funnel all of your extra money into paying off your mortgage early. Then, two months later, you lose your job and have a health crisis and your car breaks down and you need a new roof. And all of your money is now tied up in a potentially very illiquid asset–your home. While you might be able to get a HELOC (home equity line of credit), you also might not.

Furthermore, a mortgage is an excellent hedge against inflation. Inflation is when money becomes less valuable and the neat thing about a mortgage is that it’s denominated in the dollars you originally paid for the house and so, over time, as inflation increases (which generally happens), the money you’re using to pay off your mortgage is “cheaper.”

Essentially, it’s not bad to hold a mortgage and it’s actually a fine component of a diversified portfolio of assets. In sum: paying off your mortgage is a lot like putting all of your eggs in one basket.

If Bridget were to pay off her student loans and pay off her mortgage, in ten years she’d have $0 in savings. Conversely, if Bridget were to pay off her student loans and invest the rest of her savings, in ten years she’ll have diversified and robust assets: real estate AND low-fee index funds. Additionally, if Bridget and Jack decide to have kids, as she mentioned they might, having $0 in the bank is a risky way to start a family.

Savings Accounts Side Note

One of the easiest ways to optimize your money is to keep it in a high-interest savings account. With these accounts, interest works in YOUR favor (as opposed to the interest rates on debt, which work against you). Having money in a no (or low) interest savings account is a waste of resources because your money is sitting there doing nothing. Don’t let your money be lazy! Make it work for you! And now, enjoy some explanatory math:

- Let’s say you have $5,000 in a savings account that earns 0% interest. In a year’s time, your $5,000 will still be… $5,000.

- Let’s say you instead put that $5,000 into an American Express Personal Savings account that–as of this writing–earns 1.70% in interest. In one year, your $5,000 will have increased to $5,085.67. That means you earned $85.67 just by having your money in a high-interest account.

And you didn’t have to do anything! I’m a big fan of earning money while doing nothing. I mean, is anybody not a fan of that? Apparently so, because anyone who uses a low (or no) interest savings account is NOT making money while doing nothing. Don’t be that person. Be the person who earns money while sleeping. Rack up the interest and prosper. More about high-interest savings accounts, as well as the ones I recommend, here: The Best High Interest Rate Online Savings Accounts.

401K

Bridget’s employer offers a matching 401K and I highly recommend she take advantage of it by contributing up to the max that her employer will match. By not doing so, she’s leaving free money on the table. Rather than put money into her IRA, she should be taking advantage of this matching 401K. For more on why you should almost ALWAYS utilize a matching 401K, check out this post.

Build An Emergency Fund

Another reason to table the mortgage payoff idea is the fact that Bridget doesn’t have an emergency fund. I’m delighted she’s saving now that her credit cards are paid off, and that $3,390 is a fantastic start! In addition to paying off her student loans, her other financial priority right now needs to be building an emergency fund. If she were to lose her job, or have a health crisis, or a major repair was needed on her home–she’d tunnel back into credit card debt in a hurry.

Before throwing her extra savings toward her student loans, Bridget should pay the minimum on the loans while building a robust emergency fund.

A good rule of thumb is to have six months’ worth of living expenses in an emergency fund, which would be $9.712.98 for Bridget. Save up this amount and THEN (and only then) start putting extra towards the student loans.

Expenses

Bridget and Jack are some frugal folks! Their expenses are quite reasonable and they’ve clearly embraced the frugal ethos quite well. And if we weren’t dealing with the debt situation and the lack of emergency fund? I wouldn’t advise any tweaks to their spending. However, since we are, there are a few things Bridget could do in order to save more every month:

- Groceries, household supplies, and eating out: $300 isn’t terribly high, but if Jack is also spending $300? That’s a whopping $600 for just two people. I’d suggest eliminating eating out and carefully combing through the grocery and household lists to identify possible savings. As previously mentioned, since you and Jack are a household, I’d advise the approach of combine-and-save.

- Bus pass: HUGE kudos to Bridget for not taking on a car loan! Gold star here! However, $1,200/year on a bus pass is kind of a lot of money. I wonder if there’s any way that Bridget could bike to work? Or carpool with Jack every day?

- Home renovations: these need to stop. I completely understand the desire to fix up one’s home–especially one you’ve just moved into. But given her debt load and lack of emergency fund, these need to be put on hold for the moment. Since these renovations aren’t necessary for the safety of the home and are purely aesthetic, Bridget should instead be saving this money. There’ll be plenty of time in the future to spruce up the ol’ abode.

I’m pretty sure my girl Bridget took the Uber Frugal Month Challenge, but if not, take a moment to read through Uber Frugal Month: The Ultimate Guide To Saving More Money Than You Ever Thought Possible for tips on how to save even more.

Conclusion

Bridget is super smart to proactively tackle her finances now rather than waiting until she’s older. To summarize my advice, I think Bridget should:

- Build an emergency fund while continuing the minimum payments on her student loans

- Research employment options for: 1) a higher-paying for-profit position; 2) non-profit positions that qualify for the PSLF program. Decide which route she prefers and go for it sooner rather than later.

- Start contributing to her employer’s matching 401K program.

- Reduce monthly expenses.

- Get married :).

- Pay off her student loans.

- Invest any extra savings in low-fee index funds.

- Remember that eliminating debt is only one aspect of a healthy financial portfolio.

- Enjoy an awesome life that’s financially secure.

Ok Frugalwoods nation, what advice would you give to Bridget? She and I will both reply to comments, so please feel free to ask any clarifying questions!

Would you like your own case study to appear here on Frugalwoods? Email me (mrs@frugalwoods.com) and we’ll talk.

Updated June 20, 2017 with Bridget’s decision:

We’ve decided to stockpile every extra penny possible while I continue to look for non-profit work. That way if the system changes, we’ll be able to write a check and pay off the loans in just a few years. We’re also now considering selling our house as we’d profit over $100k and could throw that at the loans immediately. Thanks so much for featuring me!

-Bridget

As someone who helped his spouse pay off $107k in student loans, I wish you luck. Yes, you can continue to accrue public service credit at multiple institutions, but be sure to file the employment forms quarterly to keep a paper trail and be sure to not consolidate after you start the forgiveness program or you risk resetting the clock. We cut out eating out and gave up a lot of.little things to crush our debt. While there is a small risk the PSLF may not exist in 10 years, I think the bigger risk is having children and wanting to not work. Staying home won’t be an option for mom. It’s a tough call. Another benefit to getting married is the tax savings, you might find a few thousand extra in your refund check. Good Luck!

Thanks, John! I was terrified to air my laundry out in such a public way but everyone is being so kind and supportive. The first step to getting out of debt is to talk about getting out of debt! 🙂

She also might not. Getting married isn’t always a tax savings. Two professionals working can mean a BIGGER tax bill. If this is a consideration I’d suggest running the taxes both ways before getting blind sided.

Two pieces of advice from my side.

1) continue to contribute to the 401k as stated. One of my biggest regrets from earl adulthood was ignoring my match to pay off my loans as quickly as possible. After the match and emergency fund needs I’d focus only on the debt. 2) have you looked into consolidated or refinancing that debt. I would think in today’s environment there is a way to make at least some of that 7 percent become 5, even if it’s using a home equity line of credit. The risk is of course monthly payments would no longer tie to income per government plan but if you don’t go the PLSF route this might be very helpful.

One very important note: you do NOT have to pay taxes on debt forgiven under PSLF! Under the standard 25 year forgiveness, yes, but not PSLF. Also, you can switch jobs.

We are currently working on paying back a large law school debt in this way, but like you the current political climate had me worried.

Me too! Will debt forgiveness be around long?

Nonprofits also go through downsizing, reorganization, funding cuts, and staff layoffs. I worked at nonprofits both large and small for 20 years and found this to be the case. I’d be wary of putting my eggs in this basket for that reason.

@Winifred, yes, I’d be a bit cautious about non-profits too, particularly smaller/newer ones for the exact reasons that you mention. But PSLF also covers federal, state, & higher education jobs too which tend to be a lot more stable.

Thanks so the info! I definitely need to look into it a bit more but am excited to hear this!

I agree. I took the leap of faith to go from practicing a law as a solo practitioner to becoming a social worker and working at non-profits because of PSLF. I racked up two years in higher ed, so I only need eight years after this (I work for a non-profit now but you need to be paying on the loans to qualify.) I’m very frightened that it may go away. But I had no idea two years ago when I applied for my MSW that things would turn out this way. I chose a state school, only borrowed federal money, and work to make up the difference.

It may help the writer to note that there are state based repayment programs as well she may be able to tap into if she is going to go into non-profit work. I’d do some Googling and see what other information she can come up with. Finally, working at a college can have benefits beyond that of salary and work-life balance. I worked in higher education for two years and I qualified for tuition remission from one of the two institutions at day one. The other I needed to put in a set number of years. Either way this is excellent information to file away for if or when you have kids.

Best of luck. I feel your pain.

I have researched PSLF extensively (because my wife is on this plan) and there are a few important points that I think Bridget should factor in. The PSLF benefit is NOT taxable, so that $30k tax expense should not be there. Also, if you go the PSLF route, you really should think about delaying marriage. PSLF will increase your payments if you file as married. It has really dramatic tax implications. You can always file “married filing separately” (like us) but that comes with a whole host of complications. As for the longevity of the program, that’s anybody’s guess, but my assumption is that once you’re in, any change that they make will grandfather you in (but my assumptions have been wrong before 😉). Let me know if you’d like to discuss further. I’d be happy to share what I’ve learned about PSLF.

As someone else who has extensively researched the PSLF, my understanding is that the danger re: counting on this is that you are only eligible to apply AFTER you have made your 10 years/120 on-time payments while working for a non-profit, which means that someone who’s currently doing it is SOL if the program gets cut tomorrow, even if they’re on payment 119. I would think that once you apply you’d be grandfathered in (though again, maybe not!), but it’s more that you have to wait the 10 years to even apply that worries me.

I agree with Sophie. I am currently about halfway through the payments for PSLF, and my husband and I have been discussing the same concerns. Our understanding is that you are not grandfathered in to the program even if you have been making qualifying payments for several years. The paperwork that we have about PSLF states “Se cannot make any guarantees about the future availability of PSLF. The PSLF Program was created by Congress, and Congress could change or end the PSLF Program.”, and you cannot apply until you have 120 qualifying payments. So if the program were to get cut, we are worried that we would be SOL at this point. Se have been married and filing our taxes separately for the last several years, and paying smaller income based repayments that aren’t actually dropping the debt amount. We are currently trying to decide if we want to stick with the PSLF plan given the concerns we have about it, or take my loans on head on and demolish them asap… This article is very relevant timing for us! 🙂

Hi Sophie, so that’s not quite true. You can certify as you go along. The program website actually recommends certifying regularly–generally yearly–so you have an accurate record of your service.

You can definitely certify as you go to minimize paperwork on the back end, but all that is doing is demonstrating your eligibility as you go – you’re not actually applying for the program yet. According to the PSLF website, you can’t actually apply until you’ve made your 120th payment (there is no existing application, even, since it was only started in Oct 2007) so no one is yet technically eligible.

“Will I automatically receive PSLF after I’ve made 120 qualifying monthly payments?

No. After you make your 120th qualifying monthly payment, you will need to submit the PSLF application to receive loan forgiveness. The application is under development and will be available prior to October 2017, the date when the first borrowers will become eligible for PSLF. “

Hi Sophie, while yes, you cannot technically apply until you have all 120 payments, the PSLF program is not as iffy as many people make it seem. First off, yes, Congress could in theory eliminate the program and make the elimination retroactive but (1) that would require an act of Congress (which is not a low hurdle) and one that is deliberately retroactive (which is virtually unheard of) and (2) Congress’s actions would have to survive legal challenges in court. Those are both HUGE ifs.

Let me discuss the second one in particular. When you took out your loans you signed a Master Promissory Note (MPN) for each loan. The MPNs actually contain PSLF as a provision. That means the program is part of a binding contract between you and your creditor (the U.S.). Thus you now have a contractual right to PLSF. That’s not the end of it of course because it’s not a huge deal of Congress breaks a contract if there is no actual harm. But many of us can show harm by saying that we spent X number of years working in public interest (the proof is in the yearly certifications) making less money because we were pursuing a contractual right granted to us in the MPN (a legal concept known as detrimental reliance).

So my point is that it will be very very very hard if not impossible for PSLF to be retroactively eliminated. It’s just not accurate the way it is currently described as something that can just disappear without warning, because it’s highly unlikely.

The PSLF is what caught my attention most while reading through. I don’t think anyone knows for certain if it’ll be there in the future and if it’s not if they’ll allow those currently repaying to be grandfathered in if it’s done away with.

I can tell you there hasn’t been any specific mentioning of doing away with PSLF but the anticipated threat to it isn’t without merit. With the report coming last month that it cost the government much more than anticipated I could see it becoming a political issue as the new administration looks to form it’s own education policy along while creating budgets.

Plus, as mentioned, getting married and filing jointly will count both incomes in the calculation where filing separately will not.

If you file married filing separately you can’t claim the Student Loan Interest deduction either.

Hey Ross,

It depends on the type of eligible payment plan you are in. For instance if you are in Income Based Repayment only your income counts if you are married and file separately. If you end up in the Pay As You Earn program your spouse’s income will be included in the income calculation no matter how you file. One resource to check out is the Repayment Estimator (https://studentloans.gov/myDirectLoan/mobile/repayment/repaymentEstimator.action) which allows you to plug in your loan information directly to see what you qualify for payment plan wise and you can see how a spouse’s income could potentially impact your plans.

As for your monthly bus pass, I wonder if you could talk your employer into paying for that. It’s worth a try! I think employers may be able to get them at a discount.

I second this! My employer pays for any employee’s public transit, up to $100/month. It’s definitely worth asking about getting them to pay it, or at least get a discount.

Or get a 1 year pass. https://trimet.org/fares/1yearpass.htm

It only saves $100/year, but that’s a whole $100!

I buy monthly TriMet passes off Craigslist for $70/month. A lot of people get them free from their employers and sell them. It sounds annoying but I only had to find someone to sell them once off Craigslist and they now sell me theirs each month. I’ve seen them posted for $60.

It might also be worth it to look and see whether she’s saving much or even anything by buying a monthly pass instead of pay-as-you-go. When I lived in Chicago, my employer allowed us to deduct monthly transit passes pre-tax, but when I added up the number of times I took the train per week (instead of riding my bike, using a free shuttle, walking, or driving with my now-husband), I would have only saved a few dollars. There were other months when I would have paid more just for the monthly pass! It’s possible Bridget has already looked into this, but if she hasn’t, it’s definitely something to consider.

Unfortunately this math doesn’t add up: “I’d pay $2,300/month for 6.7 years, which would be a total of $184,920 paid off and without the potential savings of option #2.”

That assumes no interest accrues that whole time. By plugging the numbers into Unbury.us, the loan would be paid off in April 2026 by paying $2300 per month. So 9 years and 2 months.

Thanks for the feedback, Kyle! I’ll definitely check out that site. I was just doing quick estimates and didn’t account for interest so I definitely need to keep digging!

Egad! I read about debt like this often ($180k is average for graduating medical students), but usually paired with the potential for an eventual high paying career. The same concepts apply, though. Either work for a non-profit and enroll in PSLF — and do it fast before the program is altered — or find a job that pays enough to make up for the loss of potential loan forgiveness.

It’s also important to share these stories for others to learn. An ounce of prevention is worth a pound of cure. That quip won’t help Bridget much, but that’s a huge loan burden that could stay with her for decades if she doesn’t make addressing it a priority.

Cheers!

-PoF

I tell every high school kid I come across as a cautionary tale. I took advice from people who meant well and didn’t know any better. If other’s can learn from my mistakes I’m happy to help!

I definitely don’t remember anyone talking to me about the effects that student debt can have on your future life. I’m counting myself lucky, getting out with only $40,000 owed but I’ve also pigeon-holed myself into a non-profit line of work that is not very lucrative. There’s no market for private work either where I live. I do enjoy my work, which was the only advice I received on selecting a path of study, but It will still take me years to dig myself out and in the mean time my dreams of home ownership are on hold. I’m 28 as well and it feels like I’ll be lucky to be able to move on from renting by the time I’m 40… I’m hoping to do better than that though.

Good for you, Bridget! I wish you the best in tackling that massive debt.

I totally agree with the need to warn people about student loan debt! It’s easy to be flattered by impressive-sounding scholarships, and I think a lot of tuition prices are so high they don’t feel real to people. It’s important to remember that there are VERY few careers out there that genuinely require an ultra-pricey college degree. State schools are good enough for the vast majority of us.

And this is minor, but it might be helpful to parents of high school students (I do a lot of editing and tutoring work with college-bound kids). There are loads of scholarship opportunities out there that ask kids the same question: “When have you shown leadership in your community, *independent* of your school or church?” Trust me, this question comes up ALL THE TIME, and I strongly encourage the parents of middle school/early high school students to talk about it with their kids as soon as possible. These volunteer opportunities can be surprisingly tough to find, so you might need to get creative. (For example, my kid organizes a monthly cookie drive that provides the desserts for our local no-barrier shelter, and that combination of outreach + leadership has proven to be worth scholarship gold.)

#1, like others said, Bridget should start contributing to her 401k at least enough to get the employer match. It doesn’t seem like she is doing that now, which means that her monthly available income is actually $250 less than what is listed above. #2, at her current income level, she does not have enough surplus cash to pay her student loans off on the aggressive plan described above. She is at least $500 short. Where is the extra money coming from?

I recomment the PSLF option. My SO and I 180k in student loans each and are going the PSLF route so I’m probably a little biased but I’m going to add my two cents anyway.

Based on my calculations, even if Bridget increases her income 20% a year for the next 5 years–taking her income from 50k to 124k–and even if she puts every single drop of that extra money into paying off her student loans, it would still take her 5-6 years to pay off her student loans. And it will take even longer if she has kids, has house repairs, etc. Meanwhile, she would have been putting only the bare minimum in her retirement account and so at 33 years old will have very little saved for retirement. Yes, she would be debt free but at what cost?

The great thing about PSLF is that it allows you to leverage your money to achieve multiple financial goals at once. Because we use PSLF, we have been able to buy a house, save $175,000 towards retirement, and are halfway to our student loans being “paid off.” There is no way we could have done all three–or even two out of three–if we weren’t using PSLF.

BUT, to maximize PSLF we decided not to get married. We both make over six figures (which is totally doable in public service jobs) and have found that we pay less taxes (and have lower student loan payments) filing single instead of married. So that’s what we are doing.

Well done on not recommending PSLF. It’s an incredible program that is likely going be dismantled under the current administration. So many people are shaping their entire future lives based around its existence, and are going to be destroyed when congress yanks it away. It would be a phenomenal deal for my husband (massive medical school debt), but we just can’t trust its longevity.

Is your husband currently in residency? My understanding is that as long as the residency is in an “under-served” area, those years still count toward the service requirement. And residency is at least 3 years anyway (more if he’s not doing FM).

If you do decide to pay your student loans, is it possible to lower the interest rate? The current rate seems a little high. Paying it off early might negate that somewhat but locking in a better rate seems prudent.

Reading this made me feel like I was reading my own story – thank you!! I have approximately $170k in student loan debt and have been working at a non-profit for almost 3 years, planning on taking advantage of PSLF. I am always fearful that it won’t exist or will change when my ten years are up and am so interested to see what happens come this October, when the first people who are eligible for it will reach their 10 years (I believe the program was started in October 2007). My husband and I do have to file our taxes as married but separate so that his income is not included in my monthly payment calculation. I agree about filing the forms often to leave a paper trail – it somehow makes me feel better about the program possibly being changed, if I can prove that I was participating before any potential change.

You’re not alone! As I mentioned on someone else’s comment above, the first step to getting out of debt is to talk about getting out of debt! 🙂

I recommend Google Fi for when Bridget gets her own cell phone plan. I pay around 30 bucks a month, using about 1 GB of data per month. You only pay for the data you use, so she could get it down to under 30 if she was very careful about data. The downside is that you have to pick from a small selection of phones. I have the Nexus 5x, which cost about $250.

Awesome, thanks so much for the tip! I’ll definitely look into it.

Or split the current bill with your mom. I calculated out Google Fi and the savings were going to be minimal (under $10/month) for questionable coverage (I spend lots of time in the woods).

Why is your internet so expensive? I live in Beaverton and I only pay $45 for internet with Frontier.

Seconding this. I’m in Portland, but Washington County, and we just switched to CenturyLink from Xfinity and now have a bill of ~$33/month (I think. We were offered credits of $90 so we technically have no Internet bill until May.). Even calling Xfinity–which is my guess on provider, because we paid $82/month recently–can make a huge difference. We did that in January 2016 and got our bill lowered from $82/month to $50/month for the same service, locked in for a year. (No Frontier service on my street, unfortunately. Ugh.)

Congrats on buying a house and being frugal! I would concur that paying the student loans would be the way to go. I would double my payments, if possible. I would not go work at a nonprofit. My reasoning is what happened to me. I worked at a much lower salary place which would qualify for loan forgiveness and four and a half years in, I lost my job due to economy (2011) and ended up having to cash in my retirement to eat. No kidding. I am a little scared of ten year plans for loan forgiveness because of this. I would maybe try to reduce my grocery budget. I commend you on not having cable ,and taking frugal camping trips (which sound awesome), and on buying a house!!! Always keep a six month reserve of housing costs, just in case the economy tanks. Do not touch it no matter what, until (and if) you lose a job.I also lost my house, my car, etc., when I lost my job because I had used up my six months cushion working at a much lower pay (my salary kept getting cut until my job was finally cut)… . Thankfully, I have recovered, moved a couple of hours away and got an awesome job, and have a little house and small car, but I am still a bit paranoid. I do not want that to happen to you. It has been tough to recover at my age. So, to be clear, work in private sector and make more money, while you can, sock away a healthy six month housing costs just in case, put any extra money towards student debt. You are doing fantastic! I am not giving any marriage advice because I do not know the laws in your state.

Cindy, I’m so sorry that happened to you. Private non-profits employment can be unpredictable, just like working in the public sector. That’s why I highly recommend either picking a larger, well-established non-profit or sticking with state or federal government jobs. Plus the added benefit of having a state/federal job is that you most likely also get a pension!

Would hesitate to recommend the PSLF program. Ten years is a long time, and unless she is driven to enter the public sector, it is a long time to devote to a career with less earning potential (so the greater money in eliminates the benefit of the less money out). Also, PSLF program requires at least a 40hr work week. Never know what the future holds – a child may come along, and she may choose to decrease her schedule temporarily while kids are young. (I myself am particularly driven and would not have expected I would ever choose to cut down to 4 days/wk, but I did. Expected to go into a job that would pay my loans off for me and didn’t put extra toward them when younger, as I was advised, and now regret it.) IMHO, better to get the student loan debt paid off as much on the front end as possible before more obligations arise so that you have the freedom to make broader quality of life decisions later down the road.

Hi Kerry. I was actually doing my PSLF verification paperwork recently and my understanding is you need to work 30hrs a week to qualify.

^^ That’s correct, 30 hours a week at one employer. I was screwed for years because I had three employers who kept me at 19 hours a week or less, even though all three jobs were in non profits.

Get real information about PSLF and then make your decision. I know with the death and disability discharge it was counted as income for tax purposes. Ouch. If you do nothing else, for the love of dog get disability insurance- I was healthy as a horse until I wasn’t.

This is my experience only, so I want to be clear that I’m in no way insinuating anything or passing judgement on anyone. My experience is just something to ponder. While I qualified for loan forgiveness, I didn’t take advantage of it for one simple reason…personal integrity. As I saw it, my loans were my responsibility. Burdening taxpayers because I wanted advanced degrees and restaurant meals and new paint on my walls was, as I saw it, irresponsible. Not everyone will feel this way and many people criticized my decision, but after paying off all my loans I had an overwhelming sense of pride that I took full responsibility for my decisions and didn’t pass the burden onto someone else. Had I taken advantage of the plan it would always be nagging at my conscience. It was initially created to help lower-income borrowers which, according to poverty charts, I was not. I would never have felt at ease with my decision had I gone that route, Only you can decide whats right for you, but loan forgiveness was not the path for me. Good luck!

I will disagree with you. I don’t think it’s irresponsible. I am a social worker, which requires a Masters degree. Many of my colleagues have student loan debt over $100K, and our starting salaries are around 35-45K. We devote our lives to helping others, and this is something that helps us.

JoJo I agree 100% plus. I’m finishing my MSW and I already sacrifice for my clients and my agency. If you want people to stay in these low paid, high stress jobs, they need to at least see a light at the end of the tunnel. Believe me when I tell you, I pay my taxes, and I pay much more into society by doing this work than I get out by having my student loans forgiven. If you don’t believe me, ask any social worker, public defender, DA, cop, firefighter, or military member. Yes, this particular reader can take advantage as a person who’s career has public and private sector options, but the above careers really don’t. If you’re a passionate DA or firefighter or even social worker there are no other options THAN public service (or very very few). But masters degrees are required for many poorly paid public sector jobs. Many cops I know have masters degrees, many state troopers I know have law degrees. Social workers need an MSW. DA’s and PD’s need to go to law school. In state tuition here in MA for UMass Law is still about $30,000 per year.

I think there’s NO personal integrity problem with taking advantage of a program like this if you’re paying into the society in general with your work at a lower rate. And like I said, for many careers, without these programs there would be fewer public school teachers, cops, fire fighters, district attorneys, VA nurses and doctors, social workers,………

Melissa, I wholeheartedly agree! I’m a public librarian and most positions in my field require a master’s of library science.

But if one acquired student loans due to a lack of education and bad advice, that’s not one’s responsibility. Not knowing any better is not one’s fault.

Unfortunately, yes it is. You’re still stuck with whatever the consequences. I’m not saying it’s right or wrong, that’s just the way it is. If you have a mortgage and you lose your job and it’s not your own fault, you still have to make the mortgage payments.

The loans are one’s responsibility now, yes, but not everyone was responsible for acquiring their student loans.

Did they not put their signature on the loan paperwork?

So I think the important thing to remember with Case Studies is that we’re not here to litigate on, or judge, past decisions. The goal is to help the Case Study participant make decisions moving forward.

My advice parallels Jennifer’s. Regardless of bad financial decisions made early on our adult lives (sometimes due to bad advice, true….but still our decisions) the responsibility to repay them is a sign of personal integrity, in my view. I too have wrestled with this, and it was a decision made with my conscience in view. Everybody is on their own on this one, but it’s a factor to consider.

Also, ten years is a long time, both personally and financially….not to mention politically. Your personal wishes regarding children and their needs, for instance, might change a lot in that time, and you could find yourself locked into an untenable position. Politically….who knows?

Make sure you have yourself and potential family members covered for health insurance purposes, whichever path you choose. That can be life changing as well.

Otherwise, Mrs. Frugalwoods, as usual, is spot on!

I very much appreciate your point of view, but I’d like to say that, as a taxpayer, I appreciate it when people go into non-profit and government work with their fancy advanced degrees. I was fortunate that my masters program was paid for (thank you, Ivy League endowment…) but I am thrilled that friends of mine from other excellent schools have chosen to dedicate their careers to the non-profit and government sectors and will receive some loan forgiveness. I’m happy that some of my taxes can go to pay for those loans since I know that (in general) the quality of services provided goes up with highly educated (and in many cases, specialized) workers! Way to go on paying off all your loans!!

Thank you for this viewpoint and not shying away from posting this. Credit to you for your integrity and decision!

Jennifer – above comment was intended for your post.

@Jennifer, I see that personal accountability argument so often in the frugal/anti-debt circles. I find that argument to be so strange because all PSLF really is is a 10 year long employer loan repayment program. PSLF is the federal government’s way of incentivising public service work, thereby attracting a talented group of individuals who would otherwise pursue more lucrative careers in the private sector. How is it any different than an employer offering student loan repayment in return for working X number of years?

To give another example, my law school has a loan repayment assistance program. The program is income-based and pays up to 100% of my student loans over the course of 10 years. Would it be morally wrong to take advantage of that program? My answer is no because that incentive was offered to me to induce me to attend that school (and then to work in less lucrative public service work). So I’m not sure why PSLF is seen differently.

I can see the argument being made (perhaps) for the general loan forgiveness after 20-25 years because in theory the borrower did not give up other, more lucrative work in order to do public service work. But even then the argument can definitely be made that the person is merely adhering to the terms they agreed upon: X number of payments over X years, with the remaining principle to be forgiven at the end.

Well said. Good for you, Jennifer!

Jennifer – my comment was intended for your post, too.

I respect your choice, but I’ve heard this argument before and have never understood the reasoning. Many people who make much more money in the for-profit sector regularly take advantage of tax credits, tax-advantaged retirement accounts, and other things that ultimately help them save money at the expense of other tax payers. You don’t HAVE to take advantage of these, but everyone does it and no one bats an eyelash. So why is taking advantage of PSLF considered poor personal integrity?

Agreed.

I don’t disagree that it’s important to take responsibility for ones decisions, however, I’d like to present an alternative argument (and don’t get me wrong, you should be very proud for what you have done – I would be). Here goes: education, whether primary, secondary or post-secondary is something that helps your country. When the population doesn’t have access to it at an affordable price, it has negative impacts on the country socially and economically. Secondly, the public service needs qualified, educated and intelligent people. They can’t necessarily compete on salary but they can compete on benefits and it sound like loan forgiveness is one of those benefits. So in a sense, one could say that a highly educated and hard working person is serving their country by working in public service, rather than pursuing a higher paying job in the for profit sector. To take it further, this person is arguably helping the tax payer. Clearly I’m also biased. I don’t live in the US. I’m a northern neighbour that works in the public service. I paid for my own (highly subsidized) education (2 degrees with a third paid for through my work). And even this was too much in my opinion. If you look at Scandinavia (where I’m originally from) they provide post-secondary education free for anyone that qualifies (not anyone that can pay for it).

Jennifer,

I would love to be working a full time job and be paying back my student loans. Lung failure and the aftermath have made that impossible- I am incredibly grateful for my student loan discharge since it is highly unlikely I will ever work again beyond a few hours a week (if I am lucky).

A note about saving a boatload on childcare with a stay at home dad: Maybe. I was actually surprised how reasonable childcare was for us. Full time (7a to 6p) care, 5 days per week costs us about 1/3 of what my husband makes per month (take home, after fully funding his 401k and other deductions). He also gets very reasonable health insurance for our whole family. So if we had him stay at home to save money, we’d lose 2/3 of our income, plus what I’d have to pay for health insurance through my company. (I make twice what he makes, so leaving my job is definitely not an option, plus, I really love my job!)

Beyond just the immediate loss of income, there will come a point where my son will go to school and my husband won’t need to stay home during the day, but he’ll have a tough time getting back to his current earning potential and manager title after 5+ years out of the workforce.

I also was very surprised how much I like the daycare experience – I love that he interacts with tons of other little kids, I like that his little immune system is put to work early, I like that he gets comfortable around different people, and (this probably sounds terrible but it’s true) I like farming out some of the childcare work to people who really love it and are good at it! My kid knows sign language and is 13 months. Daycare taught him, I just reap the benefits.

Certainly some people value wanting to focus their lives on raising their children, and I think that’s excellent as well. It all depends on your priorities, of course, but I don’t necessarily think you should just “stay home with the kids to save money on childcare” without considerable thought, because it can hinder your earning potential in the long term.

Amen to this. I am SAHMing right now. Having me at home rather than in the workforce is absolutely the most expensive thing we do. We both love it and value it, but a stay at home parents is a luxury, not a way to save money. A SAHP can help lower household expenses, but it’s probably not possible for most people to do enough of this to make up for the loss in earnings, benefits, and career equity.

It depends on what area you’re in, too. In Portland (where I also live), daycare is typically at least $1,000/kid. Depending on the sector, working from home is always an option, too. I spent much of last year with daycare one to three days a week, and working during naptime the other days.

Only one piece of advice from me, ask parents/friends for gift cards from Lowes, Home Depot etc for birthdays & Christmas and use those to reno your home a little at a time. Same with if you decide to get married before your debt is paid off! “Register” for gift cards so you can complete your home without spending from your pocket 🙂

Great advice! We always get Home Depot and Lowes gift cards for birthdays and anniversaries and it’s made a huge difference in our home repair costs.

I think this was a very good suggestion.

Hi, Bridget! Thanks for sharing your story with us. I taught at a Title I, low-income school for 5 years, in part to qualify for loan forgiveness. Long story short, I ended up not qualifying because I had advanced into a position in which I was still teaching, but not full-time hours. I urge you to be careful and hyper-vigilant if you do go the PSLF route. Last year, I actually re-financed my loans through Earnest. My interest rate lowered two percentage points and by making bi-weekly payments I’ll save thousands over the life of the loan. I’m also on track to pay off my loans in the next three years. Check out Earnest or other companies like SoFi or Credible if you decide to go the for-profit route.

Great advice Mrs. FrugalWoods. I agree…10 years is a very long time. If I think back 10 years, almost nothing is the same as today…including federal programs.

One big question I had — Why does she have such big student loans? That’s a lot of debt for 4 years of college. I myself went to school with student loans, and it was nowhere near that bad.

She went to NYU and has a masters. That amount of loans is a lot, but it is not unheard of.

When and where did you go to school? I went to a state school in NH, where our “state schools” are not really funded by the state so the costs are higher (so are private colleges and so is attending an out-of-state state school). Also, if you went to school even 20 years ago costs were much cheaper than they are now. College costs have been rising exponentially for the last 20 years and depending on where you live in the country, there might not be any reasonably priced options.

Mrs Frugalwoods’ advice about working for nonprofits seems right on. Do check to see if you can switch organizations and what the program’s definition of a nonprofit is. Only do this if you really want to work in the nonprofit sector. If your heart is in corporate world, it’s gonna be a tough culture for you (possibly). Do stick to the larger nonprofits if you want higher pay. If I lived in Portland I’d try hard to get a job at Mercy Corps. https://www.mercycorps.org/careers But that’s just me!

A nonprofit hospital or university or community college might also be good, if it qualifies for PSLF.

I echo what others have said about 10 years being a long time. If you have kids, you might find yourself longing to stay home with them for a while. Jumping in and out of FT employment is easier in the corporate world than in nonprofit higher ed or any union environment, where if you get off the train you can’t get back on. See if PSLF allows for employment gaps.

I would look at refinancing the current student loans. My recommendation is SoFi as I have a few friends that have used this and it has dramatically lowered their interest rate. After that your choice for pursuing a higher paying for profit job or going the non-profit PSLF route is yours to choose. Both are good options in my opinion.

Private loans can’t be forgiven through PSLF. She should consider refinancing only if she decides against PSLF.

All of this serious financial advice from people who know what they are talking about requires a short break:

WE NEED NEW PHOTOS OF FRUGALHOUND. These photos are re-runs. Frugalhound’s adoring public wants more photos of that artistic and creative model.

Purdy please.

I agree with your recommendations, Frugalwoods.

The PSLF might not be the best option if she doesn’t work for a non-profit as it won’t apply there. I think that it’s also important to note is that government programs like PSLF can and will change at any time.

With this type of debt I would defer to the Dave Ramsey approach. His get out of debt methods work. Throw every single penny at the debt and work like a crazy person to get rid of it ASAP. It is gonna suck and its gonna be hard but it is one of the best ways to get out and never look back.

Good luck!

There is nothing special about “the Dave Ramsey approach” that makes it work better than any other method. In fact, mathematically, the snowball is worse than the avalanche.

Agreed…but with this amount of debt you can throw mathematics out the window. What will get her out of this mess will take hard work, grit, determination, delaying pleasure, patience, cooperation, and from boyfriend/fiance/husband.

Well said, Jason. It can be done.

A few notes on PSLF:

1) You don’t pay taxes on the amount forgiven. The term the program is now using is “canceled” to correct this interpretation. Normally, loans forgiven after income-based repayment require taxes on what’s forgiven, but the public service program does not require it.

2) You can work as many different jobs as you want under PSLF. You just have to have 10 years of payments while at public service jobs. Technically, they don’t even have to be consecutive.

But you have to work at least 30 hours/ week to qualify.

All I have to say is I LOVE the idea of Chipotle catering. I swore if we ever had a another big formal event I would go that route. It’s so delicious! Anyways, I think your wedding plan is awesome!

I can see from the previous 26 responses, that I am definitely late to this party 🙂 I’m sure I’m not going to say anything that hasn’t already been said before me today. Definitely pay the student loans off first. The interest rate is much higher than the mortgage. I wouldn’t worry about paying off the mortgage at all. You’re so young and it’s a reasonable rate – go ahead and let it ride. As far as getting a different job with a 10-year service loan forgiveness program, I’d say it’s a good option, but one I would hesitantly chase after. I would, instead, pay off the student loan by adding the extra couple thousand to the principle each month…especially since you’ll be able to eliminate it BEFORE the 10-year forgiveness would kick in.

And marriage – you go get married, girl! this should NOT stop you and your boyfriend from walking down to that courthouse and enjoying some Mexican food 🙂 This is just one of many obstacles you will face as a couple. Don’t let it hinder your personal life!

Mrs. Mad Money Monster

My only advice regarding PSLF is that it’s a long time to wait it out, and you don’t know what Congress will do to change the program in the next decade. So, you might be halfway through the PSLF time period and then the program goes away. I’ve also had friends start with PSLF only to find their timeline has changed due to job considerations. I think gradually working towards higher salaries and aggressively paying off your loans is probably the better way to go, rather than relying on the PSLF program to still be there in 10 years.

Thanks for sharing, Bridget.

1 – get the 401(k) match. It is literally the best investment you can make – 100% return for each dollar that is matched.

2 – Think really hard about the public sector. The comments above are good. This is really an emotional and life/ career decision that will have money ramifications.

3 – If you go with the public sector route – ignore all the points below 🙂

4 -Private Sector – Start looking for a promotion and/ or new job with higher earning potential. You’re working for a start-up. Is that because you need to be in the medical field? You have a master degree from a prestigious university – NYU. Hit up that alumni network. You can public relate in any industry, right? Switch to where the money is at. No shame. Make it rain, girlfriend.

5- Refinance your student loans. The negative is you lose some of the federal benefits like the PSLF. However, you can probably get a sub 5% rate from SOFI or Commonbond or one of those startup-student-loan refi companies. That 2% savings a year would be almost $4,000 your first year. That’s like an extra monthly payment towards principle instead of debt. I think this is a big one, that hasn’t been mentioned as much in comments.

6 – House Appreciation. Owning a home is great. Renovations are fun. Portland seems like the coolest place! And Portlandia! – put a bird on it! In a few years, your 280,000 house might be worth close to $400k. In that case, you could probably sell, and the profit would not be taxed. You could plow this into your debt. Remember it is okay to rent and renting isn’t throwing away your money. It’s controlling your costs.

7 – Get married earlier before later to save money on taxes. Again, this probably doesn’t apply if you go the public sector route.

Okay, what do you think!? Good luck.

I agree with Mrs. Frugalwoods’ advice and would second those who suggested refinancing your student loans. You’ll give up those income-based repayment options by going private, but you’ll pay much less in interest and get them paid off faster. I would go with a variable rate on the longest term offered, then make additional principal payments every month. The nice benefit here is that as your loan reamoritizes (mine is quarterly), you’ll reap the benefit of the additional principal payments with a lower monthly required payment, which means more money to put towards principal. It’s like another version of the debt avalanche payoff method. Also, if you ever needed to cut spending due to some emergency, you’ll have the flexibility to only pay the minimum during that time. Good luck to you!

PSLF may not exist for much longer under the current Congress and Administration and I encourage you to refinance for a lower interest rate if you can. I am a social worker and I ‘ve been struggling to pay my student loan debt which was $110k total when I came out of grad school. Six years later, I am down to 55k, in part thanks to a State Loan Assistance Repayment Program grant that I received for working in public service. As a mom now I think it’s a great idea for one of you to be a stay-at home parent, because we pay 13K in day care costs per year and when my 2nd arrives this summer, that cost is going to about double. Good luck to you and your boyfriend! I am so impressed that you are so proactive about your debt and financial goals.

I agree with Jennifer. She said it best. You just have to pay it off, you, yourself personally. Find the highest paying job you can, throw all the money you can at this debt, sacrifice, and just do it as quickly as possible. It appears that you received a wonderful education, so you now know what needs to be done, and you have the education to do it. I worked two jobs for ten years and paid mine off, just as many other people have done. As Mrs. FW stated, it CAN be done. Just make it a priority and do it. Trying to find forgiveness here and there for debt that you knowingly incurred will only drag it out and morally I just don’t agree with it for anyone. Just my two cents. Sounds harsh, I’m sure, but it is what it is.

I do think that is a wee bit harsh. I found this on the internet about the PSLF program. It “was created to encourage individuals to enter lower-paying but vitally important public sector jobs such as military service, law enforcement, public education, and public health professions.”

I say this as a person who paid back a boatload of student loan debt through working relatively high paying corporate jobs. Even though I did it myself, I don’t begrudge people loan forgiveness if they put in their 10 years in a non-profit or the public sector. I actually feel a little guilty that I although I’ve paid back loans and done a reasonably good job of saving money, I haven’t made a meaningful contribution to the world. Often the “highest paying job you can get” is one that will compromise your morals far more than taking advantage of a government program meant to give people financial incentives to work in non profits.

A lot of other commenters have noted cons of the PSLF program such as the uncertainty of the future of the program and losing the flexibility to take time off work to care for a child or to switch into the private sector before 10 years is up. I think those are very valid things to think about. But I think to say she morally shouldn’t take advantage of this program is not true.

Priorities:

1. Build up emergency fund.

2. Pay off student loan.

3. Begin investing for retirement / pay off mortgage.

in this order. $185k of student loan is a whopper. That would be my focus for the next decade, and I’d look for the high-paying jobs, even if they were high-stress, in order to get the student loan paid off as quick as possible. High-stress jobs might not be what she wants, but it’s do-able if she can see the financial benefits. And when she has the student loan paid off, she can quit and get a job with a better life balance.

I love Mrs. Frugalwoods’ suggestions!

Mr. Picky Pincher and I lived together while we were engaged but waited to fully combine finances until we were married. To pay joint things like rent, groceries, and utilities in the meantime, we opened a joint checking account. We deposited half the rent, etc. into the account and kept everything else separate.

And once you get married you can likely save on a few bills by combining them. Mr. Picky Pincher and I got a better rate on our cell phones once we combined.

My only other suggestion would be to consider moving to a cheaper area. $280k for a small house is pretty pricey to me (I’m in Texas) on such small salaries. Mr. Picky Pincher and I make roughly what Bridget and Jack bring in, but our mortgage is $145k, so we’re able to save significantly more money because the cost of living here is much lower. Consider remote work and live in a cheaper area with a higher salary. Just a thought!

I was thinking the same thing. $280k might be cheap in Portland but where I live it’s a HUGE house and they could easily match their salaries or even be ok with a little less with a much smaller mortgage. It’s one of the reasons I hesitate to move anywhere. We have 5acres, an 1800 sq ft house and a 10 minute commute to work and pay $1000 per month on our mortgage/escrow on a 20 year loan. For something the size of what you are living in, you’d pay maybe $60,000! In our “downtown” you could have something even bigger for that price and still be on the bus line.

So, yes pay off student loans after getting a healthy emergency fund in place, but seriously consider a move to a cheaper area, especially if you are considering kids. In my experience, kids do best when they have room to roam, especially outdoors.

Option #1 ALL THE WAY – I would NOT go the nonprofit/PSLF route. It locks you down into having to stay in that job or a similar job. You will be limited in terms of income and career growth. Plus if you lose your job and can’t find another one that qualifies for PSLF, you have added YEARS to your student loan repayment process, and you still have to pay it off yourself. Not to mention they could change PSLF rules at any time and there is no guarantee that you would be grandfathered in. Not to sound paranoid, but I really don’t trust it.

If you can find a job in the for-profit sector that pays significantly more (which should be doable), you will more than make up the benefit you would have received from PSLF and you maintain your freedom to grow and change your career however you wish. With that higher income level and paying off the loans YEARS faster than under PSLF, you will make up for at least some of the lost savings that might be possible under PSLF. Depending on how high your salary goes, you might be able to pay it off even faster than the 6.7 years you are estimating here.

No matter what you choose, you must tap into “gazelle-like intensity” (to borrow from Dave Ramsey) to get this done. It is admirable that you are ready to tackle this debt, and if you focus on paying it down like crazy it will be doable.

As someone who has worked back and forth in the non-profit/profit sector (I am in education and healthcare as a speech-language pathologist) I can tell you that the loan forgiveness program begins to limit your thinking. You become anchored and afraid to take jobs that might be more fulfilling, higher paying. or have the potential for advancement–sort of like golden handcuffs. Ten years is an incredible long time in today’s job market where large income boosts are often attainable only by changing employers. What if you want to stay home with the kids or your SO gets a great job opportunity somewhere else where you can’t find a non-profit job? I have heard Dave Ramsey say to people in your situation that you could stockpile the money you would put towards your loans in a separate account (that is really hard to get at) and then if you don’t end up staying with your non-profit (or the program gets yanked) you can dump that savings at the loan and be no worse off (except for some interest). I would also check out SoFi who should be able to get that interest rate down.

Sara — I am so glad you said about PSLF beings to “limit your thinking.” I have been at my current position for 4.5 years and actually didn’t realize until about 1.5 years in that my job qualified for PSLF. Now that I have logged so much time, I don’t feel like I can leave. Or if I did leave, I would have to find another job that qualifies for PSLF — which makes me feel rather trapped. I would not recommend going and looking for a job that qualifies — especially here in Portland, since you could end up in a career path you really don’t enjoy, which defeats the purpose of getting an education in the first place!

Like others have said, I do worry every day that the PSLF program will simply go away, so I continue to pay my minimum payment + interest to ensure my loans don’t increase over the time period over the length of the program. What so many don’t understand is that ICR/IBR/PAYE all sound great on paper, but the amount “forgiven” after the designated time period is TAXABLE. Depending on the size of your loan, and how much interest accrues over the time period, this could put the borrower into a financial disaster. (Yes, I did the math on this myself and it left me in tears and figuring how I would pay off a $55k+ tax bill).

I would encourage anyone considering consolidating their debt to make sure they don’t qualify for any other government funded loan repayment program first. For example, my husband is a nurse practitioner and works in public health, which qualifies him to apply for loan reimbursement through the National Health Service Core (NHSC). If he had consolidated his loans through a private company, he would NOT be eligible to receive repayment — most programs like NHSC, PSLF, etc. all require you to be in a federal loan program. Based on his ability to get direct reimbursement we have prioritized paying off his loans while I continue to pay my interest only. (And thanks to our frugal methods and YNAB — best OCD budgeting software ever, have paid more than half his loans off in 5 yrs). If PSLF goes away (I agree with what others said that there is so much uncertainty around the future of student loans we are seriously discussing backup plans) we will have minimized his debt so we can then prioritize mine.

I will echo what others said as well about filing jointly as a married couple — this WILL impact your loan repayment if you are on an income based plan. Depending on how much debt/income you and your partner have this could increase or decrease your monthly payment. Also remember that if you file jointly and pay off your debt, his monthly payment will increase. If you file separately my understanding is only one of you can claim the house, which has a variety of tax implications.

I want to address some of the misunderstandings regarding PSLF, a couple of which have been addressed already above. If you choose to go this route, please do more research to really understanding what you’re signing up for. Student Loan Hero has some good posts about it, including this one: https://studentloanhero.com/featured/public-service-loan-forgiveness-do-you-qualify/

1) Forgiveness under PSLF is NOT taxable

2) You can switch jobs, but only payments made while working for a non-profit will count. I’m pretty sure these payments do not have to be consecutive.

3) Federal Perkins Loans and Federal Family Education Loans (FFEL) are not eligible for forgiveness

4) There is a lot of doubt around whether or not the program will stick around, especially considering that no one’s actually been forgiven under it yet since it didn’t start until 2007.

5) At one point a cap at only $57,000 was proposed. Although it did not pass, I would not be surprised if another one was proposed again.

Always go directly to the source to research the rules of any program.

https://studentaid.ed.gov/sa/repay-loans/forgiveness-cancellation/public-service

Another option for the PSLF is working for the government instead of a non-profit. I just made the switch from a non-profit to a government role, better pay, benefits, and retirement match (11.35%!!) with the benefit of still receiving the pay-off.