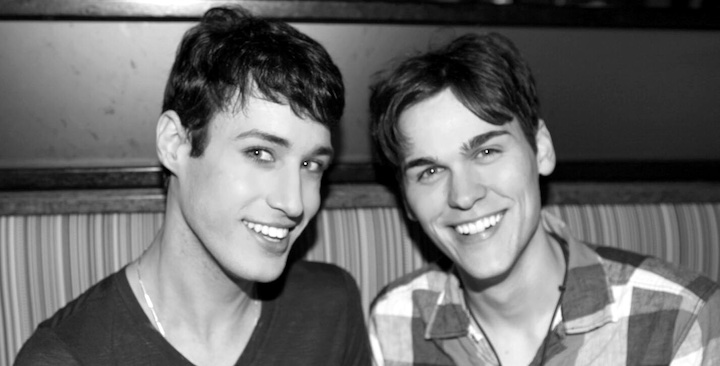

Sam and Riley are a married couple living in Winnipeg, Manitoba in Canada along with their dog Bisky and two cats, Theodore and Greta. Sam works as a plasterer and Riley is a social worker at a local college. The couple, both age 36, hope to have a child soon and are wondering how to balance that new financial responsibility alongside their current goals of finishing up a Masters of Social Work (Riley) and changing careers to become a sprinkler fitter (Sam).

Additionally, they bought their first home in June 2022 and are still settling into the realities–and expenses–of home ownership. Sam wrote that they feel like a lot of things are up in the air at the moment and said, “We have so many ideas for ourselves but need help creating plans to execute them. We want to do all these things as soon as possible to increase our incomes, pensions, and employment options, while also having a child soon as we are both already 36 and feeling the pressure on that front too.” Join me in my 100th Case Study today as we help Riley and Sam plan for their future!

A note on pronouns: Sam uses he/him pronouns and Riley uses they/them.

What’s a Reader Case Study?

Case Studies address financial and life dilemmas that readers of Frugalwoods send in requesting advice. Then, we (that’d be me and YOU, dear reader) read through their situation and provide advice, encouragement, insight and feedback in the comments section.

For an example, check out the last case study. Case Studies are updated by participants (at the end of the post) several months after the Case is featured. Visit this page for links to all updated Case Studies.

Can I Be A Reader Case Study?

There are four options for folks interested in receiving a holistic Frugalwoods financial consultation:

- Apply to be an on-the-blog Case Study subject here.

- Hire me for a private financial consultation here.

- Schedule an hourlong call with me here.

- Schedule a 30 minute call with me here.

→Not sure which option is right for you? Schedule a free 15-minute chat with me to learn more. Refer a friend to me here.

Please note that space is limited for all of the above and most especially for on-the-blog Case Studies. I do my best to accommodate everyone who applies, but there are a limited number of slots available each month.

The Goal Of Reader Case Studies

Reader Case Studies highlight a diverse range of financial situations, ages, ethnicities, locations, goals, careers, incomes, family compositions and more!

The Case Study series began in 2016 and, to date, there’ve been 99 Case Studies. I’ve featured folks with annual incomes ranging from $17k to $200k+ and net worths ranging from -$300k to $2.9M+.

I’ve featured single, married, partnered, divorced, child-filled and child-free households. I’ve featured gay, straight, queer, bisexual and polyamorous people. I’ve featured women, non-binary folks and men. I’ve featured transgender and cisgender people. I’ve had cat people and dog people. I’ve featured folks from the US, Australia, Canada, England, South Africa, Spain, Finland, the Netherlands, Germany and France. I’ve featured people with PhDs and people with high school diplomas. I’ve featured people in their early 20’s and people in their late 60’s. I’ve featured folks who live on farms and folks who live in New York City.

Reader Case Study Guidelines

I probably don’t need to say the following because you all are the kindest, most polite commenters on the internet, but please note that Frugalwoods is a judgement-free zone where we endeavor to help one another, not condemn.

There’s no room for rudeness here. The goal is to create a supportive environment where we all acknowledge we’re human, we’re flawed, but we choose to be here together, workshopping our money and our lives with positive, proactive suggestions and ideas.

And a disclaimer that I am not a trained financial professional and I encourage people not to make serious financial decisions based solely on what one person on the internet advises.

I encourage everyone to do their own research to determine the best course of action for their finances. I am not a financial advisor and I am not your financial advisor.

With that I’ll let Sam and Riley, today’s Case Study subject, take it from here!

Sam and Riley’s Story

Hello, I’m Sam, I’m 36 and I live with my spouse Riley (also 36) in Winnipeg, Manitoba in Canada. I was a chef and restaurant owner until 2019 when I came to the hard realization that I could not continue in that industry any longer and made the change to become a plasterer. Plastering was meant to be an in-between job until I found something more permanent, but I enjoy what I’m doing for the time being. My long-term goal is to switch to sprinkler fitting, since it’s a good union job with a pension and a higher rate of pay.

Riley is a social worker at a local college and they are weighing the feasibility of finishing a Masters of Social Work degree that they completed most of between 2015-2019, before dropping out due to the onset and diagnosis of systemic lupus. Riley’s had a couple of significant health leaves from work since then, also due to lupus, and has been fortunate to be covered by short and long-term disability insurance through their employer. This has resulted in only small decreases to overall income (although pension contributions were paused or reduced since they were based on employment income and not insurance benefits income). Overall Riley’s health is relatively stable now, but there are some challenges; recently they had to take a few weeks off due to Covid, which hit them harder due to their immunosuppressed status, but they seem to be making a gradual, full recovery.

Riley’s employer approved an education plan in which they will reimburse a portion of the tuition on completion of their MSW degree. They are awaiting final approval to transfer vacation time to have enough to use instead of taking unpaid leave during school, so Riley’s income should stay at the same level.

Sam and Riley’s Hobbies

Riley enjoys cross-country skiing and we both love riding our bikes and gardening. We try to get out camping when we can in the summer and enjoy seeing live music once in a while. We take care of our nephew, who just turned 5, every weekend. We have a dog named Bisky, who is a Shepherd/Husky rescue dog from up North. He’s a handful but keeps things lively around the house. He’ll be 3 this summer. We also have two cats, Theodore and Greta. They are great singers and love to cuddle. They are getting older, at ages 14 and 12.

The Wedding and The House

Riley and I married in September 2021, in a somewhat spur-of-the-moment decision to go through with a small ceremony, as we had a window of lifted pandemic restrictions and less transmission. We gathered a few of our closest friends and family in a park near a river and had a gorgeous (and affordable) wedding.

We bought our house in June 2022 and are head over heels for it. It has great character, lots of original wood, and a huge backyard with a lot of garden beds. We can’t wait to raise a child together in our home and hope to have a baby soon. We like having friends over for casual get-togethers on the weekend– brunch, bbq, bonfires, etc.–and it means a lot to us that our home is so conducive to hosting.

What feels most pressing right now? What brings you to submit a Case Study?

Right now there are so many things up in the air that we feel a bit tangled up and don’t know exactly the right order in which to do things.

Riley writes: In 2022 we made a larger combined income than ever before, and expect to make more in 2023. We are coming from periods of going in and out of debt as we struggled to manage expenses on lower incomes. Fortunately, the debt never became unmanageable and we were able to take advantage of low-interest balance transfers to pay it off quickly. We managed to start saving beginning in 2020-2021 when Sam shifted to plastering work and I increased from 4 to 5 days a week of work.

That helped us with the down payment and costs to buy our home, but we still basically wiped out our savings buying the house and went briefly into debt from moving expenses. Not the smartest move, but fortunately we have quickly paid off those debts and are slowly rebuilding our savings again. Our car was totaled this fall, and it turned out to be a financial opportunity for us as we were able to take the insurance money from the car, pay off our car loan, and buy a lower cost car we could afford outright, while still having some money leftover.

I think that was a significant shift in our thinking as we made the difficult choice to downgrade our car for the sake of not having a car payment any more.

It’s saving us several hundred dollars a month. We would like to look ahead now that we’ve reached the big milestone of buying a house, and set some bigger saving, investment, and retirement goals for the first time in our lives. Clarifying our goals will help motivate us to keep making frugal and smart financial decisions.

Sam writes: I want to make a career change but that will mean less money for a few years as I start out as an apprentice again. It will take about 2-3 years to make the same income I have now, and about 4-5 years to reach journeyperson status and max out the income for the trade. It will be worth it in the long run, especially to switch to a union job with an employer-matched pension.

Riley wants to complete their MSW which may mean more student debt. However, their work will reimburse a portion of the tuition upon completion of the MSW.

Starting a Family

We want to have a child, which means parental leaves from work and reduced incomes (we want to take close to a year off). The Canadian government Employment Insurance (EI) provides 15 weeks of leave for the parent giving birth, and up to 40 weeks of standard parental benefits that can be split between both parents (55% of income to a max of $650/week).

We are looking at starting IVF by the end of the summer if we’re not pregnant by then; the medication costs of $5,000-$6,000 would be covered at 80% by Sam’s health insurance; the other costs would be around $14k. There is a provincial fertility tax credit that would return 40% of the cost to us; we can also claim medical expenses on our federal taxes but it would reimburse a smaller amount (the lesser of 3% of net income, or $2,479). We have an unused line of credit with $10,000 available to help with the upfront costs.

Riley’s employer also tops up their income to 90% (including the EI benefit) for 17 weeks. If Riley becomes pregnant soon, they would be in school when they have the baby. The implications of that are: the employer top-up would be reduced because it would be 90% of the 80% income during school. The EI may be less depending on the timing; EI takes your best paid 22 weeks from the last year to determine the income the benefit is based on. And we would need some extra help to allow Riley to finish the program with a newborn, and it’s really hard to predict how the postpartum period will go. But we do have friends who live nearby and family who would be able to help a lot. If Riley goes back to school, tuition will take some of our savings that would otherwise go toward supplementing our income during parental leaves, and their income will be a bit less during school so we will be saving less during that time.

The rush to complete the MSW is because previously completed credits are starting to stale-date, and have to be assessed for currency.

If Riley can complete the degree in 2023-24, only a few courses will have to be re-assessed (and repeated if not found to be current). If more time goes on, more courses will have to be assessed. So, it feels like the last chance to complete this degree. If not, they could go back to school to re-do it or do a different master’s program sometime in the future. The motivation is to have more confidence in trying new roles in their current job and to have more job options if they want to make a job change in the future.

Retirement Plans

We want to retire as soon as we can. Although realistically, we expect that won’t be super early based on where we’re starting from, but even age 55 or 60 would be nice to aim for. We do our best to keep our expenses low and live a frugal lifestyle.

I suppose this is where you come in. We have so many ideas for ourselves but need help creating plans to execute them. We want to do all these things as soon as possible to increase our incomes, pensions, and employment options, while also having a child soon as we are both already 36 and feeling the pressure on that front too.

Other short-medium term expenses are that our aging cats could start to have additional costs, a car replacement (hopefully the Mazda can hang in there another 3-5 years) and dental surgery for Riley (not urgent but in the next 1-2 yrs, about $2,000-$3,000).

We recently bought a new bike for Riley and a second-hand trail-along bike for our nephew for a total of $900. Riley’s been biking to work and we’ve been taking our nephew on bike rides every weekend.

What’s the best part of your current lifestyle/routine?

We aren’t under any major pressures and we live a pretty relaxed lifestyle. We’ve fine-tuned our routines around cooking, chores, and getting to bed on time. We love enjoying summertime outdoors in our yard gardening, chilling on the front porch, camping, and biking around the city visiting with friends and family. Lots of friends live in our neighborhood and it’s nice and central in the city, easy to walk, bike, and bus to many places. Plus, several car co-op (short-term rental) cars are located within a 10 minute walk, which allows us to remain a one-car household.

Although we don’t have much savings or a clear plan for the future yet, it feels great to not have too much debt hanging over us and the ability to have some of our spending align with our values, such as purchasing our meat, eggs, some of our veggies, and much of our grains/beans from local CSAs. Although interest rates went up more than expected after we bought our home, we were able to switch our variable rate mortgage to a fixed rate for peace of mind, and it still feels affordable for us. We can see ourselves living here for a long time and that feels really good.

What’s the worst part of your current lifestyle/routine?

We feel some anxiety when we want or need to make bigger purchases because we don’t have the saving buffer we know we need. We’d like to be able to travel a bit more and visit friends and family in other parts of the country. We’d like to feel less financial pressure about purchases that improve our quality of life, such as Riley getting acupuncture and taking some supplements that support their health, or sending Bisky to doggie daycare once a week so we can have a slightly less hectic Saturday with our nephew.

Riley’s bus commute is not ideal on the coldest winter days but since it is only twice a week it is tolerable. Riley’s job can be unpredictable and stressful at times. Sam doesn’t have vacation time but gets vacation pay added to each pay cheque, but it ends up getting treated as regular income and so he rarely takes “vacation” time. It would be nice to take a week or two off together a couple times a year.

Where Sam and Riley Want to be in Ten Years:

1) Finances:

- We’d like to have sizable, comfortable savings available for house repairs/upgrades, emergencies, car repairs/replacement, pet emergencies, etc.

- We’d like to upgrade our kitchen and maybe upgrade our outdoor gear, such as our cross-country skis and bikes.

- We don’t want to be stressed about expected or unexpected costs.

- We’d like to have a clearer idea of our target age for retirement and be setting aside extra money to allow us to retire potentially ahead of receiving our CPP, OAS, and employer pensions at age 65.

2) Lifestyle:

- In general, not too different from now.

- Hopefully, we will have a child who we will be taking to festivals and camping in the summer, and doing outdoor activities like skating and cross-country skiing in the winter.

- We’d like to travel outside our province every 1-2 years to visit friends and family.

3) Career:

- Sam should be well-established in a unionized trade job as a journeyperson. This would mean having vacation time and fairly regular hours, as well as increasing his income by $30k or more annually vs. his current income.

- Riley may be content to stay in their current position as they enjoy the work/workplace overall, the pay is decent, and there is still about $14k left of advancement on their salary band. However, they may wish to move into more policy/administrative work or other types of leadership work in their field.

Sam and Riley’s Finances

Income

| Item | # of paychecks per year | Gross Income Per Pay Period | Deductions Per Pay Period | Net Income Per Pay Period | Notes | Annual Net Amount |

| Riley’s work pay | 26 | $2,732 | govt pension (CPP): $155, income tax: $518, employer pension: $216, life and accident insurance: $7, federal employment insurance: $45, charity: $2, health & dental insurance: $69. TOTAL deductions: $1,012 | $1,720 | This is assuming full time hours; on a health leave the income is partially supplemented by disability insurance. | $44,720 |

| Sam’s work pay | 25 | $2,123 (includes vacation pay paid out) | govt pension (CPP): $118, income tax: $438, federal employment, insurance: $35, group life/disability: $27, group medical: $19. TOTAL deductions: $637 | $1,486 | $37,150 | |

| Tax return | 1 | $4,500 | $4,500 | What we expect this year. The previous year we owed a bit; there are some tax credits related to buying our home that helped this year | $4,500 | |

| Sam’s side jobs | Variable | $2500 | $2,500 | Started picking up cash side jobs last year, made $1,000 in 2022. So far have earned $500 this year, expects to be busier this year than last, but amount is an estimate. | $2,500 | |

| Sam’s Bonus (2022 amount – could vary) | 1 | $700 | Income tax: $140 | $560 | $560 | |

| Sam’s EI for 2 week lay-off | 1 | $583 | Income tax: $117 | $466 | $466 | |

| TOTAL GROSS: | $131,690 | TOTAL NET: | $88,870 |

Mortgage Details

| Item | Outstanding loan balance | Interest Rate | Loan Period and Terms | Equity | Purchase price and year |

| Mortgage | $257,160 | 5.19% | 25-year mortgage, 5 year term (4 years 9 months remaining) | $4,508 | $282K; purchased in 2022 |

Debts

| Item | Outstanding loan balance | Interest Rate | Loan Payoff Year | Monthly required payment |

| Riley’s Federal Student Loan | $7,282.06 | 0% | 2031 | $72 (both student loan payments were set when my income was much lower; gov’t recently announced 0% interest set during covid will now be permanent) |

| Loan from Sam’s RRSP (retirement account) | $7,210.56 | 2038 | We used this toward our house down payment; we have to repay the balance of $7,210.56 over 15 years ($481/year; $40.08/month), beginning in 2023 | |

| Energy Loan for Central Air | $3,828.05 | 7.70% | 2027 | We pay the $83 minimum payment; additional payments can be made any time without penalty or fee |

| Riley’s Provincial Student Loan | $1,484.00 | 0% | 2028 | $25 per month |

| Total: | $19,804.67 |

Assets

| Item | Amount | Notes | Interest/type of securities held/Stock ticker | Name of bank/brokerage | Expense Ratio | Account Type |

| Riley’s Employer Pension Plan | $25,000 | Currently 8% income is deducted and employer matched. I just learned I can elect to contribute an additional 2% (not employer-matched). Contributions reduce my taxable income, and reduce my RRSP contribution limit for the following tax year. At retirement I can elect to transfer my balance to 1. a life insurance company to purchase a lifetime annuity; 2. a Life Income Fund (LIF) or 3. a combination of these. Earliest retirement 2037. | Pension Plan Details | Retirement | ||

| Savings Account 1 | $9,634 | Emergency fund – currently increasing this as much as we can each month | 1%; 5.25% on new deposits to this Account until July 31, 2023. | Tangerine | N/A | Cash |

| Chequing Account | $4,017 | This fluctuates from about $2000 – $5000 as pay comes in and bills get paid/money transferred to savings | 0.01% | Tangerine | N/A | Cash |

| Sam’s RRSP 1 | $3,778 | GIC | Assiniboine Credit Union | Retirement | ||

| Savings Account 2 | $2,901 | Annual expenses – we try to put about $350 here monthly and take out as needed for annual/quarterly expenses | 1%; 5.25% on new deposits to this Account until July 31, 2023. | Tangerine | N/A | Cash |

| Total: | $45,330 |

Vehicles

| Vehicle make, model, year | Valued at | Mileage | Paid off? |

| Mazda 5, 2010 | $4,500-$5,000 | 174,000km | Yes |

Expenses

| Item | Amount | Notes |

| Mortgage | $1,544 | |

| Groceries | $926 | Includes consumable household supplies (such as toilet paper, toiletries) as well as pet food and supplies. |

| Medical (health co-pays, prescriptions) | $365 | this includes Riley’s supplements, co-pays for acupuncture, massage, dental, etc. |

| Spending money | $363 | includes restaurants/fast food, personal purchases such as books, and spending on our nephew for eating out, toys, activities |

| Dog sitter and daycare | $252 | |

| Property Tax | $213 | |

| Home items (decor, non-consumable supplies, tech items) | $200 | |

| House Insurance | $198 | |

| Gas (car) | $177 | |

| Home repair/maintenance | $160 | this is a very rough estimate since we only have 10 months of home ownership experience; we like to do what we can ourselves so that helps keep costs down |

| Hydro | $153 | |

| Eggs and Meat CSA | $117 | |

| Car Insurance | $116 | |

| Car maintenance and repairs | $100 | |

| Christmas gifts & decor | $96 | |

| Vet visits/pet medical expenses | $92 | |

| Clothing | $88 | |

| Energy loan repayment | $83 | |

| Cellphones | $81 | PC Mobile and Koodo |

| Water and Waste | $75 | |

| Bus fare | $73 | |

| Federal student loan repayment | $72 | |

| Spiritual Companioning | $70 | |

| Summer camping and festivals | $68 | |

| Donations | $65 | |

| Car coop | $45 | |

| Gifts (birthdays, other holidays) | $45 | |

| Alcohol/Kombucha | $45 | |

| Internet | $42 | Can com |

| RRSP loan repayment | $40 | |

| Subscriptions | $34 | |

| Veggie CSA | $33 | |

| Gardening | $33 | this doesn’t account for any savings by eating our produce. decorative flowers are the biggest expense of this category |

| Grain CSA | $26 | |

| Provincial student loan repayment | $25 | |

| Haircut | $20 | Sam cuts his own; this is for one haircut every couple months for Riley |

| Parking | $7 | |

| online yoga annual membership | $6 | |

| Costco membership | $5 | |

| Credit card fee | $3 | |

| Monthly subtotal: | $6,156 | |

| Annual total: | $73,872 |

Credit Cards

| Card Name | Rewards Type? | Bank/card company |

| PC Financial Mastercard | Earn points for buying gas and groceries; use points to reduce grocery costs | PC Financial |

| MBNA Mastercard | We have only used this for balance transfers to pay off debt quickly | MBNA |

| RBC Visa | We keep this for the insurance coverage that applies to our car-coop membership, and because it’s the one Riley’s had the longest. The amount we spend on it doesn’t equate to much in terms of rewards. Only card with a fee – $39/yr | RBC |

Anticipated Social Security & Pensions

| Item | Annual Amount | Year and age you’ll begin taking SS |

| Riley’s CPP | $13,666 | 2052, age 65 (amount is estimate if working till age 65) |

| Sam’s CPP | $13,666 | We haven’t looked into Sam’s CPP and OAS amounts yet but will likely be similar to Riley’s |

| Riley’s OAS | $8,250 | 2052, age 65 (amount is estimate if working till age 65) |

| Sam’s OAS | $8,250 | CPP and OAS would be less if we stop working before 65 |

| Riley’s CAF Pension | $2,441 | 2047, age 60 |

| Annual total (starting in 2052): | $46,273 |

Sam and Riley’s Questions for You:

-

Apple pie filling – preserves from our apple harvest Is it financially possible and prudent for Riley to go back to complete their MSW this fall, even while we are trying for a baby?

- When is the best time for Sam to pull the trigger on switching careers?

- Should we wait until after having a kid/finishing parental leaves to keep his income stable until then? What if we aren’t able to have a baby or it takes a while to conceive?

- We’re eager for Sam to switch so he can get to the increased pay that will be just a few years away, and to be paying into a pension sooner. But, we’re also nervous about the temporary income decrease.

- Where do we start to get on track with getting a clearer picture of our retirement possibilities and starting to work toward them?

- We haven’t made intentional efforts in this area yet since we’ve been focused on saving for the house and paying off debt.

- Should we pay off the energy loan (our only debt with interest right now) or keep making minimum payments to keep more cash available until we figure out school/baby/Sam’s career change?

- Should we keep saving to our emergency savings account until we have a 3-6 month expense amount? Then what? Should Riley start making the optional additional 2% contribution to their employer pension – or should that also wait until after baby/school/Sam’s job?

- We know we can pull in our spending a bit more, where would you suggest we try to focus our efforts on that front?

Liz Frugalwoods’ Recommendations

I commend Sam and Riley for pulling all of this information together and taking a pause to iron out their next steps. I think it’s noteworthy they’re doing this type of in-depth financial–and life–analysis on the precipice of so many potential life changes. Very well done! Alrighty, let’s jump right in.

Sam’s Question #1: Is it financially possible and prudent for Riley to go back to complete their MSW this fall, even while we are trying for a baby?

I’m of several minds about this, but what keeps popping to the forefront for me is that if they really want to have a baby, they should just start trying. Fertility doesn’t exactly improve with age–nor does one’s energy for parenthood–and I’m always hesitant to suggest that someone in their late 30’s delay starting to try. Plus, I don’t think there’s ever a ‘perfect’ time to have a baby. There are certainly less optimal moments, but Sam and Riley are in a stable financial position, have a loving marriage and, most importantly, a strong desire to become parents. What more could an infant want?

→My real questions here center around Riley completing their MSW:

1) Is there a direct, measurable, known salary increase/advanced job position/new career option that’ll become available once Riley has an MSW?

It wasn’t clear to me if this is the case. If it’s not the case, why do the MSW? I am the proud owner of a master’s degree that I’ve never once used or needed and I wish I’d done this meticulous calculation before the blood, sweat and tears (LOTS of tears) of going to grad school while working full-time. If you don’t have to do this, why do this to yourself? If you’re not going to see an immediate and directly correlated salary increase, why do it?

On the other hand, if there is a measurable difference, go for it! It sounds like Riley’s completed credits will expire if they don’t finish the degree soon, so it seems like it would make the most sense to finish it now. I will say that going to grad school while parenting an infant AND working doesn’t sound tenable (at least, not to me), so I caution against assuming that’ll work. If, however, Riley can complete their MSW before a baby is born, that would definitely be a mark in favor of getting started ASAP.

2) How much is the financial burden?

Sam wrote that Riley’s employer would reimburse a portion of tuition after the MSW is done and that Riley’s income would remain the same during school. In light of that, I’m curious what the actual total cost for the remainder of the degree will be? They have the financial flexibility to pay for this degree–depending on how much it’ll cost.

Sam’s Question #2: When is the best time for Sam to pull the trigger on switching careers?

Since there’s a direct pathway to an increased income and more stable career path, it seems like Sam should get started on this transition right away. While it’s not ideal to make a bunch of changes at once, it’s also true that there’s no time like the present. Since this is a years-long process, delaying it for an “easier” time doesn’t seem possible. It’s not going to be easier when you have an infant. It’s not going to be easier when you have a toddler. It’s not going to get easier at any near-term future point, so might as well dive in now.

To the question on the potential for reduced income, the good news is that Sam and Riley can manage this by reducing their expenses. Let’s explore how they might make that happen!

Sam’s Question #4: We know we can pull in our spending a bit more, where would you suggest we try to focus our efforts on that front?

Anytime a person wants to spend less, I encourage them to define all of their expenses as Fixed, Reduceable or Discretionary:

- Fixed expenses are things you cannot change. Examples: your mortgage and debt payments.

- Reduceable expenses are necessary for human survival, but you control how much you spend on them. Examples: groceries and gas for the cars.

- Discretionary expenses are things that can be eliminated entirely. Examples: travel, haircuts, eating out.

Sam & Riley’s current annual take-home pay: $88,870

– Their current annual expenses: $73,872

= $14,998

This is a great savings rate and it’s allowed them to build their emergency fund back up after buying a house. However, if Sam’s income reduced by more than that difference, they’ll need to reduce their expenses. The good news is that they have a lot of discretionary line items, which means they have a lot of flexibility in where/how they make up the difference.

| Item | Amount | Notes | Category | Proposed New Amount | Notes |

| Mortgage | $1,544 | Fixed | $1,544 | ||

| Groceries | $926 | Includes consumable household supplies (such as toilet paper, toiletries) as well as pet food and supplies. | Reduceable | $826 | Hard to know how much can be reduced here since household supplies and pet food are lumped in.

Between their groceries, three CSAs and the Alcohol/Kombucha line item, they’re spending $1,147 a month on food. |

| Medical (health co-pays, prescriptions) | $365 | this includes Riley’s supplements, co-pays for accupuncture, massage, dental, etc. | Reduceable | $365 | While technically a “reduceable,” I’m leaving this amount the same |

| Spending money | $363 | includes restaurants/fast food, personal purchases such as books, and spending on our nephew for eating out, toys, activities | Discretionary | $0 | An area ripe for reduction if they need to. |

| Dog sitter and daycare | $252 | Reduceable | $152 | Are there opportunities to reduce this? | |

| Property Tax | $213 | Fixed | $213 | ||

| Home items (decor, non-consumable supplies, tech items) | $200 | Discretionary | $0 | Another line item that could be reduced if needed. | |

| House Insurance | $198 | Fixed | $198 | ||

| Gas (car) | $177 | Reduceable | $100 | ||

| Home repair/maintenance | $160 | this is a very rough estimate since we only have 10 months of home ownership experience; we like to do what we can ourselves so that helps keep costs down | Reduceable | $100 | |

| Hydro | $153 | Fixed | $153 | ||

| Eggs and Meat CSA | $117 | Reduceable | $0 | Between their groceries, three CSAs and the Alcohol/Kombucha line item, they’re spending $1,147 a month on food. | |

| Car Insurance | $116 | Reduceable | $116 | I’d shop this around if they haven’t done so recently. | |

| Car maintenance and repairs | $100 | Reduceable | $100 | ||

| Christmas gifts & decor | $96 | Discretionary | $0 | Another line item that could be reduced if needed. | |

| Vet visits/pet medical expenses | $92 | Fixed | $92 | ||

| Clothing | $88 | Discretionary | $0 | Another line item that could be reduced if needed. | |

| Energy loan repayment | $83 | Fixed | $83 | ||

| Cellphones | $81 | PC Mobile and Koodo | Reduceable | $25 | Canadian readers: are there any cheaper MVNOs available? |

| Water and Waste | $75 | Fixed | $75 | ||

| Bus fare | $73 | Reduceable | $73 | ||

| Federal student loan repayment | $72 | Fixed | $72 | ||

| Spiritual Companioning | $70 | Discretionary | $0 | ||

| Summer camping and festivals | $68 | Discretionary | $0 | ||

| Donations | $65 | Discretionary | $0 | ||

| Car coop | $45 | Discretionary | $0 | ||

| Gifts (birthdays, other holidays) | $45 | Discretionary | $0 | ||

| Alcohol/Kombucha | $45 | Discretionary | $0 | ||

| Internet | $42 | Can com | Fixed | $42 | |

| RRSP loan repayment | $40 | Fixed | $40 | ||

| Subscriptions | $34 | Discretionary | $0 | ||

| Veggie CSA | $33 | Reduceable | $0 | ||

| Gardening | $33 | this doesn’t account for any savings by eating our produce. decorative flowers are the biggest expense of this category | Discretionary | $0 | |

| Grain CSA | $26 | Reduceable | $0 | ||

| Provincial student loan repayment | $25 | Fixed | $25 | ||

| Haircut | $20 | Sam cuts his own; this is for one haircut every couple months for Riley | Discretionary | $0 | |

| Parking | $7 | Reduceable | $0 | ||

| online yoga annual membership | $6 | Discretionary | $0 | ||

| Costco membership | $5 | Discretionary | $0 | ||

| Credit card fee | $3 | Discretionary | $0 | ||

| Monthly subtotal: | $6,156 | New Monthly subtotal: | $4,394 | ||

| Annual total: | $73,872 | New Annual total: | $52,728 |

To be clear, I’m not advocating for this budget or implying that they SHOULD make all of these reductions. Rather, it’s an illumination of the room they have to reduce their spending if they must in order to enable Sam to change careers, to take parental leave and/or to pay for Riley’s MSW. The point of this exercise is to illustrate how much flexibility they have in their monthly spending, which is a good thing! Where and what they decide to reduce/eliminate is entirely up to them. This spreadsheet gets them started on identifying where they can cut.

When they have Sam’s new salary in hand as well as Riley’s MSW costs and any potential IVF fees, they can comb through their expenses and decide what they’d like to eliminate or reduce.

Don’t Take On More Debt

One thing I caution Sam and Riley against is taking on debt to cover any of these upcoming costs. It seems this may have been a habit in the past and it’s an easy one to fall back into. But it’s not sustainable, safe or wise. Riley mentioned using a line of credit for their IVF costs and, while I don’t know the parameters or interest rate associated with that, I instead encourage them to reduce their spending in order to pay cash for what they need. This brings me to my next suggestion to:

Pay Off The Energy Loan for Central Air

This loan is only $3,828.05, but it has an interest rate of 7.7%!!! If Riley and Sam reduced their spending per the above for just 2.5 months, they’d save up enough cash to pay this off in full! Just do it.

Since Riley’s student loans as well as Sam’s RRSP loan are at fixed, permanent 0% interest rates, there’s no reason to pay those off ahead of schedule. But, it absolutely makes sense to dispense with the energy loan as soon as possible.

Sam’s Question #3: Where do we start to get on track with getting a clearer picture of our retirement possibilities and starting to work toward them?

1) Fill the Emergency Fund First: $16,552

Sam is spot on that they should first fill up their emergency fund to a full three to six months worth of their spending. Between their three cash/checking accounts, they already have $16,552 saved up, which is wonderful! At their current spending rate of $6,156 per month, they should target an emergency fund of $18,468 to $36,936. However, if they decide to reduce their spending, they can commensurately reduce their emergency fund total.

2) Then Save More Cash

While Sam is correct that they should begin to save and invest more for retirement, they’re at a true juncture right now with many potential changes on the horizon. And one thing that makes changes easier? Having a cash cushion. Sam and Riley are potentially facing:

- Costs for conceiving a child

- Costs associated with pregnancy/birth/an infant (they’re notoriously unreliable and expensive)

- Costs for Riley’s MSW

- Reduced income for Sam while he changes careers

That’s a lot of balls–financial and otherwise–to have in the air at once! If it were me, I would start spending a lot less every month and stash that money in a high-yield savings account. That way, I’d be able to deal with any and all of the above expenses.

3) Next, Save for Retirement

Once these four variables settle out and Sam and Riley have a solid grasp on their new expenses and life with their baby, they can turn their attention to increasing their retirement investments.

I encourage them not to wait too long for this since they’ll want to reap the benefits of remaining invested in the market for many decades before they need to withdraw the money to live on in retirement.

Summary of Recommendations:

- Determine the financial basis for Riley completing their MSW:

- If it is indeed going to lead to new career opportunities–and a higher salary–go for it and don’t delay so that you don’t lose any of your existing credit hours.

- If Riley’s career and salary will remain the same, consider very carefully if it’s worth the time, stress and expense.

-

Tomatoes from our garden If you want to be parents, get started right away:

- Fertility is not one of those things that improves with age.

- Have Sam look into starting his career transition training now:

- No time like the present, especially if you are willing to…

- Reduce Expenses and Save The Cash:

- You have a lot of discretionary and reduceable spending categories, which means you have a lot of options for reducing your monthly expenses.

- Trimming here and there will enable you to easily live on a reduced income, fill up your emergency fund and have the cash to pay for other major expenses, such as IVF.

- And remember: you don’t have to eliminate/reduce these expenses forever. Just for now as you navigate this transition period.

- Pay off the Energy Loan:

- You could have this paid off in under 3 months if you reduce your spending per the above recommendations.

- Don’t Take on More Debt:

- You are SO CLOSE to being debt-free (other than the 0% student & RRSP loans and your mortgage). Don’t let yourself slip back into a debt/payoff/debt cycle again. Save up the money to pay cash for IVF and whatever else you might need.

- Invest More For Retirement:

- Once things have settled down in terms of becoming parents, Riley’s MSW and Sam’s career change, start saving and investing more for retirement.

- Keep your extra money in cash for now as you navigate all of these changes.

- Keep us Posted!

- Among other things, we demand baby pictures.

Ok Frugalwoods nation, what advice do you have for Sam and Riley? We’ll all reply to comments, so please feel free to ask questions!

Would you like your own Case Study to appear here on Frugalwoods? Apply to be an on-the-blog Case Study subject here. Hire me for a private financial consultation here. Schedule an hourlong or 30-minute call with me, refer a friend to me here, schedule a free 15-minute call to learn more or email me with questions (liz@frugalwoods.com).

What a lovely couple with such beautiful photos!

I think it’s really important to check that Sam meets any eligibility criteria for parental leave in the apprenticeship before trying to conceive. I don’t know how it is in Canada, but each country I have experience living and working in has bizarre windows of employment length/status etc before being eligible.

I also would caution against working, studying for the MSW and doing IVF at the same time, especially when you have periods of chronic ill health.

You never know how your pregnancy health, birth and how challenging the early weeks,/months or years with a young child can be. Even with friend and family support it is totally life changing.

I’m with Mrs Frugalwoods – unless there’s an outsize and immediate benefit to doing the MSW then I would avoid it. But if you feel like you’d really enjoy and benefit from it, and have good support then it may be worth it to you!

Many find that the process of IVF is gruelling – loads of appointments that are closely timed by where you are in your cycle and the physical and emotional toil it takes is not easily compared to fertile hetero couples.

For parental leave in Canada, there is a minimum amount of hours required to be worked in the past year, and the pay will be based on your best 22 weeks of pay (approximately, I think there is some variation by geographic region) and from those 22 weeks, it’s 55% of income to a max of $650/week. So it doesn’t matter where you worked/how long with any employer as this is a Federal benefit for all Canadians. The only issue with transitioning to the trades is whether he would have continuous employment through out his apprenticeship stages. He could probably always go back to plastering if he was having a hard time finding work for a period because there is always demand and he is skilled in that.

Part of the motivation on the MSW is that I am so close to done and it saves me having to do a graduate degree in the future. MSW is gradually becoming more of a requirement for clinical work or leadership positions, though this is not exclusively true, but thinking to the forward, I know an MSW or another graduate degree or other specialized certificate would probably feel necessary eventually, so I’d like to get it over with now since I have done 3/4 of the program already and can save a lot of time and money vs starting something from scratch.

I’m am not looking forward to IVF – we are trying to conceive naturally and have been for a year and a half; there have been 2 early miscarriages in that time. We are recommended to start IVF now/soon because of our ages; if we continue to have miscarriages/difficulty getting pregnant we would be better off at least having frozen embryos now at age 36 vs later at age 38, 39, etc. We have friends who are queer who conceived through IFV, as well as a family member, so we do fortunately have people with local experience to share with us about what the process looks and feels like.

Fellow IVF’er here. I am truly sorry for your loss. I recommend doing coagulation blood tests to make sure it wasn’t the cause of your miscarriages.

Thank you. We have done extensive blood testing, with my lupus it was considered before I even started trying. I have no indicators of anything causing the miscarriages.

I’m also curious if it feels like an option to freeze embryos ASAP then finish the process in a few years when finances are more settled?

Yes we are considering that option to freeze the embryos for later use. This could also be for if we want to keep trying naturally a while longer.

Hello from a neighbouring province 🙂 the thing that stuck out most to me was food costs. We spend significantly less than you do, eating well, and we have 2 adults and 6 children (and we do not grow any of our own food or eat out at all). And with the PC points system, you are likely getting free groceries as well on top of that! I would definitely brainstorm ways to save on food.

Hello! 🙂

Yes, this is coming across as a theme for us. I will have to look into it more. I know that some of this is the cost of pet treats, which is high because we have a reactive dog who needs a lot of food re-enforcement to help him on walks or throughout the day with training. Since we do so much training with him we have used higher quality treats, but I can look into cheaper alternatives, even to supplement part of the treats.

Another factor is that we try to eat very healthy, “Mediterranean-style” partly on the recommendation of our fertility doctor, as well as my care team for lupus. So we eat a lot of fruit and vegetables, some fish/seafood, etc.

I do think there is some room for cost comparing, and looking at making more of our meals grain/bean/legume-focused, and perhaps switching more of our vegetables to frozen (although sometimes that is not a cost savings).

I am open to other brainstorms!

My reactive dog gets dehydrated beef lung, bought in 5 lb bags off Amazon

We tried dehydrated beef lung for a while but it doesn’t happen to be a high enough level of reward. Right now we buy no-name cheddar cheese in the club packs, as well as dehydrated chicken (https://www.realcanadiansuperstore.ca/dog-food-chicken-strips-dog-treats-for-dogs-of-any/p/21198521_EA)

I will try price comparing on Amazon and some local pet stores though.

I’m not sure if you can get these dog treats in Canada but Charlee Bear treats are pretty inexpensive for the number of treats and not bad on ingredients. They work well as jackpot treats for my more reactive dog. Ingredients for the cheese and egg: wheat flour, cheese, dried egg product, wheat gluten, salt, garlic powder, Brewer’s yeast and mixed tocopherols. There are a bunch of flavors and my dog likes them all.

This actually makes me wonder if we should experiment with making our own treats, since those ingredients sound pretty simple. If we found something he liked we could make it in bulk and freeze it… hmmm…

(I am concerned about the garlic powder in the treats, as I’ve read that we should keep garlic away from dogs, though I have seen it as an ingredient on other dog treats too so that’s a bit confusing).

Oh I meant to add – we are currently saving up our PC points as an extra fund to draw from when the baby hopefully comes. But maybe this only makes sense psychologically and not financially!? Logically we should increase our savings/pay down debt as much as possible now, and accumulating PC points don’t earn any interest, or reduce our debts… hmm. I think we just like the idea of being able to make some bigger purchases with our “free” money but maybe it is not the best strategy.

Although there is the advantage of saving at least enough to wait for one of the “get $500 for $300 worth of points” events, as those make your dollars go REALLY far.

I totally forgot about that, that’s a great point. Those would be great for stocking up on baby supplies.

I spend my PC points as I earn them because a few years ago people were having them stolen all the time. I can’t remember what the issue was, or if it was fixed, but it left me with the feeling that it wasn’t a terribly secure system.

Laura, we are in Ontario, 2 adults, 2 kids and spend too much on food. Do you have any info you can share on how you save on costs, what you eat for meals etc? One of the things that complicates ours is that I am celiac and all 4 of us are dairy intolerant – oat milk and almond milk are so much more expensive than regular milk. I know there is calcium in other foods but not enough for them to get what they need without having some of the milk substitutes. Would love ideas for savings in other areas though.

Hi Carla, Several of my friends have started using the Almond Cow milk maker to make plant-based milks at home. They have all raved about the quality, as well as the cost savings. Something to consider!

Definitely get started on IVF asap. As Liz said this is not going to get easier or cheaper with age. And i totally agree that Sam should start the new career asap and i second the reasoning that it’s going to be easier to do that now than with a baby/toddler.

However i am going to disagree a little about Liz’s take on the masters. As i understand it the masters is likely to help in the future if Riley wants to move into more senior roles, and losing already completed credits by not doing it now would make it more time consuming (and hence more expensive) to do at a later date. So even if you don’t have a firm plan to use the masters, i think it’s still worth doing. Also It seems like with all the financial support available you can afford to start the masters while starting the IVF. Reduce spending as much as you can and cash flow as much as you can, but you may be eligible for more student loans for masters expenses, and possibly government assistance of some kind if you are both technically students.

I assume the masters will be a minimum of 2 more years part time?

IVF cycles take a certain number of weeks (i think it’s about 2 or 3 monthly period cycles from when you start taking the meds till embryo implantation but i could be wrong). And then pregnancy is ~ 36 weeks from implantation. And IVF typically takes more than one cycle to be successful (i think only ~30% are successful on first try). So realistically it is at least a year before you have baby.

I suspect once Riley is back in the masters programme and has completed another year, the university is unlikely to use going on maternity leave as a reason to expire old credits. So realistically Riley may be able to take a year off the masters programme when baby comes and then restart again. Obviously this is not guaranteed but i suspect this would be the case. So plan for it that way, and then if you feel up to it, you can choose to do some masters work during mat leave or not.

Good luck with the IVF, new apprenticeship and masters.

With short IVF protocols you only have 17-20 days from start to embryo transfer.

We are absolutely starting IVF asap. As I mentioned in another comment, we have been trying for a year and a half, and have had two early losses. We have gone through fertility testing and nothing can be found, but we are recommended to start IVF right away based on our age. The soonest we could see the Dr at the fertility clinic again is end of July.

I do see Liz’s point about the masters, but I think I am still leaning to ward doing it because I am so close to done, and it will open some doors for me if I want to move into a different area of work in the future. I will be able to complete it on a part-time basis in just 8 months, (Sept to april) as long as all of the old credits are accepted. I’d like to just get it over with at this point! As you say, we might not have a baby yet in that time so I’d rather have given it my best shot to get it done since the baby might take a while/might not even happen.

Thanks for your well wishes!

I’m curious what SW salaries look like in Manitoba- $37,000 sounds pretty low compared to US

I think you’re looking at Sam’s net pay. My gross salary is $71k. My net pay is $44,720 after deductions which includes my portion of my pension contribution, taxes, health insurance, etc.

I’m so sorry for your losses.

If it’s only going to take 8 months to finish the masters then i think doing it is a no brainer

Thank you.

And yes, as long as those three credits get approved (should know in Aug), it should be doable in 8 months, which is pretty exciting. I think it makes sense to go for it.

Off-topic!

List of the case studies mentions “polyamorous people”. I don’t remember that one! I’d be interested to know how people deal with money in a group relationship. Any chance of a link? I’m about to start scrolling through all 99 but in case i don’t find it!

The only one that comes to mind is the one with Puck, who didn’t live with any of ver partners but did live with roommates (link: https://www.frugalwoods.com/2021/12/21/reader-case-study-from-ukrainian-immigrant-to-published-author-to-librarian/). A case study like you mentioned would be great as financial resources tend to assume couples (and more frequently than before single people). While not necessarily unique to polyam people, there can be extra finagling with more people making decisions, contributing and spending money, etc!

Oh yeah i remember that one. Not much of a difference from a non-poly single person though since they weren’t sharing finances.

Cheers.

This is the one I remember. “After an Abusive Marriage, What’s the Path Forward?

https://www.frugalwoods.com/2020/03/11/reader-case-study-after-an-abusive-marriage-whats-the-path-forward/

I would suggest Riley have a serious talk with the doctor managing their Lupus about what to expect during TTC and pregnancy. Autoimmune diseases can make pregnancy much more difficult, so it would be good to go into it with their eyes open about if they may need to financially prepare for medical leave during the pregnancy.

Full time Work + part time masters + new baby does not work. Year long parental leave + new baby + part time masters can be quite nice if you have childcare available for class times. I have fond memories of finishing a term paper in bed with a laptop on my lap and my baby sleeping on my chest.

Yes, I was going to comment about this too. It can be unexpected how your body will handle pregnancy but also post-partum period with an autoimmune disease. I don’t say this to discourage at all, but just to be informed so you can prepare the best way possible! Your immune system is generally suppressed during pregnancy, so you might even feel better (cross fingers)! But post-partum your immune system swings back the other way.

I also have an auto-immune disease (ulcerative colitis) and was really unprepared during my first pregnancy. I was not on maintenance meds due to lack of symptoms and had a serious flare in post-partum that normally would have landed me in the hospital, but I suffered at home due to start of Covid. It was very stressful and not safe for me or baby (who was solely breasted). Finally found outpatient Dr still open during Covid to start treatment.

Second pregnancy, I worked with Drs to keep on safe meds and managed the condition even though symptoms kept showing up through pregnancy. Post-partum period kept on meds and was so much easier than first time!

I wish you both the best of luck with all of these exciting life changes!

I’ve started to explain a bit in other comments, but I prepared extensively for pregnancy. I waited until my disease was stable, got shingles vaccines (since I had shingles once and am more susceptible to it being immune suppressed, and didn’t want a repeat, and read that labour could be a trigger); had my rheumatologist clear me and I do regular bloodwork and follow ups.

So once I have the baby, I will go on parental leave, and continue part-time masters if the baby comes that soon, but as others mentioned, if we don’t get pregnant in the next couple months, it will take a while to go through the IVF process so I would most likely finish the program before having the baby. And I have a plan to use vacation time 1 day a week while I am doing my practicum hours (just waiting final approval at work), so that I would not have to reduce my work hours/work full time. I also plan to apply for a policy-based, remote practicum, so that I will be able to do most of the hours on my own time, from home. I spoke with an MSW student who just finished one such practicum and based on her experience I think it would be a good fit for me. So if there is a chance to have the baby while still finishing the program, I would have the flexibility to do that part of it from home. Beyond that I would have one class per week, plus one class every other week. I’m aware that it might not work out but I am willing to take the chance that it will. It’s nice to hear your experience of finishing papers in bed with the baby on your chest. I have heard from other parents who have done similar. My partner Sam can also take his parental leave concurrent with mine, so I will have his support for whatever amount of time we choose to have him off. Both of our moms would likely be able to provide some amount of support too. So, we have our “village”. Obvs things can be unpredictable and everything might not line up, but I feel like I have to give myself the chance for things to go right too, to take a calculated risk on this.

In the main body of this case study, and additionally here, I wanted to say how impressed I am with how Riley has carefully considered options. And I think you can pull off the job/IV/school thing since you may be able to complete the masters in less than a year. The odds seem to be in your favor, and you seem like the type of person who can come up with a new plan if necessary.

Hi Riley, you have a great plan in place, and it sounds like you have several great backup plans in place as well! You can definitely do this! In the 2020-2021 school year, I completed my master’s degree and internship while teaching full time, while also parenting a 1 year old and navigating a high-risk pregnancy with my second baby, who was born less than a month after the school year finished. It was challenging, but having that goal of finishing the program before my second baby was born was really motivating, and it worked out! Having that “WHY” in mind, as well as the “HOW” is key–and you definitely have both of those in place. Good luck to you, in all of your endeavors!

This is off-topic, but fwiw, I’d recommend that Riley check out Dr. Brooke Goldner, who was diagnosed with lupus at a young age and managed to “cure” herself (or at the very least, be in remission with no symptoms) and have 2 kids “naturally” (ie without IVF or specific medical interventions).

Just one note on the fact money are with Tangerine. It used to be a great online bank. It still has these occasional hight rates. But 1% is not enough, especially given inflation. There are other banks around with higher interest rates, one example is Hubert Financial. People’s Trust might be another, just Google for Canadian-specific high interest saving accounts and pick the one that has the easiest platform, doesn’t require in-person presence, is covered by the CDIC etc.

Thanks for this advice, I did join Tangerine ages ago when it was known as one of the best, but I haven’t looked at options lately. I will look around.

Canadian here! Just a note that Canadian cell phone plans are ridiculously priced. If Sam and Riley are paying a combined $88/month then congrats to them on finding a great deal! This is as cheap a plan as they can hope to find.

Thank you! We did both look around a lot when we had to renew our plans about half a year ago. We also own our phones outright (Sam recently had to replace his and got an older refurished model), and chose plans with moderate data amounts, and this was really the best we could find on offer. I think some of the bigger Canadian cities might have more options than us? But this was the best we could do.

We Canadians are lucky to have the highest cell phone bills in the world! We pay $90 a month for our two and are thrilled with that. The hours to only pay that.

Working in human services myself, I believe a MSW would be a great investment. The demand appears to be there.

All the luck with IVF and a high energy dog. Our high energy one is 13.5 and it is the last 2 years and especially the last year she has settled!

Canadian here (BC). I use public mobile and pay $12/month. Low data, but I WFH so works great for me!

Maybe their offerings are/were different in your region; unfortunately the cheapest one I see now is $39/month which is pretty close to what I’m paying now, though it does have more data than my current plan.

As previous poster stated I would definitely find out about pregnancy-Lupus before making any big decisions. More options for jobs with a MSW but you can go back to school later than being pregnant.

Your grocery bills can come down quite a bit. Price matching saves us a lot of money & you don’t have to run around to get the deals. Use the Flip app to find the sales. I get most things on sale this way. Save on Foods has 1.49 Tuesdays. Instead of a CSA next year, grow some veggies in your yard or community garden plot. Still not too late to put in some this year. Usually easy to find people giving away tomatoes or zucchini. I throw tomatoes, onions, garlic & balsamic vinegar in a big pan on the BBQ and cook down to make a pureed sauce. Flat pack vacuum sealed bags freeze well. Look into the rates for your house insurance through a group rate because of where you work or went to school. Consider putting your emergency money in a TFSA-any interest you earn isnt taxed then & you can take it out if needed.

I’m really curious about the food costs – as these are separated from the various CSAs they seem quite high. Is this perhaps down to specialist pet food? I imagine there’s a lot of scope to reduce these costs (for the two humans anyway!). Personally I found anyway that in the early months of having a baby, the unpredictability of CSAs/veg boxes made them untenable. We needed food that was quick, easy, plannable and batchable – which isn’t to say it can’t be done, but I think it’s not unusual for there to be a pause or for it to become a lesser part of meals for a while. And friends who grew their own food similarly found they needed to cut back production for a time. With kids everything changes though, a situation is rarely forever.

I agree with others that FT work plus PT study plus IVF or baby would be really, really hard. Look for a program that supports PT students, they’ll have a good setup for taking parental leave and/or taking a slower path through the course.

I do think that when your kids are young is a good time to have a lower income – if you are planning to be home anyway there is less or no childcare, and the kids typically have fewer costs – they’re not clamoring for branded toys or clothes, you’re probably traveling and going out less anyway. So all these life changes can work really well together! Good luck!

I check in regularly with my rheumatologist and have also checked in with other specialists as needed, and I am supported in trying for a baby. Although I have had periods of health leave and health challenges, I have been relatively mild all things considered. I am automatically considered a “high risk” pregnancy due to lupus but my rheumatologist said I would be considered at the lowest risk within that category because other than simply having the autoimmune disease, I do not have additional risk factors. I will still be with a high-risk ob-gyn if I do get pregnant.

We normally do pick-ups for our grocery orders, I will have to find out if there is a way to do a price match with that. We really value the convenience of a once weekly pick up, vs going to different stores.

We are already signed up for the CSA this year but will think about skipping it next year. We are getting more into the garden this year so next year we should have an even better idea of how much we can grow. We are learning more options for canning/freezing etc what we grow.

Yes, I meant to look into the insurance before we renewed this year but I didn’t have time. Interestingly when we first got our house insurance, some companies would not take us on as a new client because we were in a weird year where there was an extraordinary amount of spring flooding affecting basements etc. so there was a pause on new clients. So we stayed with the company we had for our tenant’s insurance. I will make sure to shop around next year.

If I put the money in a TFSA, I have to invest it to earn money on it, right? So would that money be easily accessible if we need it in an emergency? That’s the only reason I haven’t started putting money in one so far is to have the cash readily available.

I think it makes sense to put at least some of the cash in TFSA> yes, you do invest it, but I believe that any gains you get while it is invested increases your overall TFSA room, so if you end up withdrawing the funds, you can put the $ back up to the total amount it grew to. (of course double check)

You can probably structure a couple different pots of funds within the TFSA, so you have rolling due dates for term deposits for example.

and prob worth putting some of the cash into higher risk investments, helpful to do some cash flow analysis, but I doubt that you would need all the emerg cash all at once and you could just bite the bullet on any penalties if it came down to it.

In the meantime, you will probably do well on the growth, waiting in the emerg scenario.

You don’t have to invest money within a TFSA in stocks, funds, etc. Money within your TFSA can be in a simple TFSA savings account or invested in guaranteed investments like GICs. I have some emergency funds in a TFSA savings account with EQ bank (the interest rate is currently 3.00%, which is a little bit better than their regular savings account rate) and I’ve also previously bought GICs within my TFSA at EQ.

If the funds in a TFSA are liquid (like in a TFSA savings account) you can just withdraw them from the account (and your TFSA) at any time (and if they’re in a GIC, you can choose to withdraw from the TFSA once the GIC matures). However, you should bear in mind the effect of a withdrawal from your TFSA on your TFSA contribution room and make sure you don’t then subsequently over-contribute when putting the money “back” into the TFSA, as over-contributions are penalized. Definitely do your own research on this, but my understanding is that any withdrawals from your TFSA will free up contribution room but only in the FOLLOWING calendar year. (So, for example, if you’ve maxed out your lifetime TFSA contribution, and then you take out $1000 from your TFSA in 2023, you’re still maxed out for contributions for the remainder of 2023, but will get an additional $1000 of contribution room in 2024: see “How to know your TFSA contribution room”, and the explanations on how to figure out your contribution room, on the government of Canada page about TFSAs, here: https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/rc4466/tax-free-savings-account-tfsa-guide-individuals.html).

A related thing to keep in mind is that if you want to move money that’s in your TFSA between different financial institutions while keeping it under the TFSA umbrella (e.g., if you want to move money between TFSA savings accounts at different institutions or take money that’s been sitting in a TFSA savings account and move it to a TFSA investment account at a different institution) you can’t just withdraw the money from one account and deposit it in your account at the other institution without it affecting your contribution room. (For example, if you’ve maxed out your TFSA contribution room, if you withdraw $1000 from one of your TFSA accounts, you’ll be over-contributing if you try to deposit it in another TFSA account at a different institution that same calendar year.) I’ve been able to move money between TFSA accounts at different institutions without effecting a withdrawal by making a request to the institution and having them do the transfer (which took them some time).

All that being said, if you’re investing in higher yield/higher risk investments (outside your RRSP) it makes more sense to use your TFSA contribution room for that rather than a savings account. (Someone else mentioned Modern FImily, and they talk about this here: https://modernfimily.com/investing-101-part-4-accounts-you-can-invest-in-canada-edition/.) But if not, nothing wrong with having your emergency fund in a TFSA savings account.

I suggest not drinking alcohol if trying to conceive and husband as well to support, bonus money savings!

I am already not drinking, hence the “kombucha” part of that budget line. And my husband is not drinking much, averaging $20-25month to have a beer or two when getting together with friends or family. But we can definitely consider cutting back further. I would like to get back into making my own kombucha which is a fairly easy hobby and would save me a little cash each month.

Two things really stuck out to me- when my partner and I were thinking about kids, I remember talking to my dad about if we were “ready” to have kids and if it was really the “right time”, and he said immediately, “if you wait for the perfect time, there’s never a perfect time, so you’ll never do it, and when you actually have them, that will be the perfect time.” He was right. I agree about just going for it and seeing what happens as far as pregnancy/ if you need IVF, and I’m speaking as someone who was an older mom myself. The other thing is that I *didn’t* wait until after grad school (I just went for a kid, and a miscarriage later I was pregnant during grad school) and it was HARD. And I was mostly healthy aside from being older. Grad school plus working plus older pregnancy plus auto-immune disease might just be too much, unless this is a super-useful degree, and it sounds like it’s more of a “sunk cost fallacy”. (you can look it up if you’re not familiar with the term- it’s basically the idea that you’ve invested so much you should just keep going, whether it’s worth it or not) There’s nothing wrong with not finishing something that isn’t you or isn’t going to help you now. Investing more mental energy, money (debt), time, and health for something isn’t always the best strategy. I do think it’s a good strategy to get Sam into the new program sooner rather than later because that will up the earning power down the road. I also thought their food costs were high, even for high quality food. We eat mostly farm raised/ sustainably harvested CSAs, etc. for a family of 4 and we spend about $700-$800 a month.

I agree about the “right time”, and given our ages and how much we know we want a child, we are going forward full steam ahead!

I do recognize that it might be too much, and I am okay with having to pull the plug on it if it I have to. It is hard to know what will be too much for my lupus, though overall since my diagnosis 4 years ago, I have trended upwards in terms of my health and capacity, and have learned a lot about managing stress/lifestyle factors (sleep, exercise, diet, limiting other commitments, boundaries in relationships, etc.) within my control to manage it better.

I have been wrestling with the idea of whether this is a sunk cost situation, and I will agree that it is at least somewhat of an influence on my thinking. However there really are more job options with an MSW and I think it is psychologically important for me, given my work, to know that I have a relatively easy “out” with at least comparable pay or better. I have really lucked out with my job, most BSW jobs have extremely high case loads and stress and many have less pay than me. I am probably at the top of the pay scale for most BSW jobs (having partially completed my MSW was likely a factor in my being hired for this position). Right now I am very happy and supported at my workplace and look forward to working here for at least the next several years. But I know workplace culture/health can change if there are changes in leadership and that it is possible that it might not feel sustainable for me any more, but that other BSW jobs could be even worse for my health/mental health. My health is a big factor in wanting to get the MSW to ensure I could get a more policy, etc. -focused job in the future, just in case. A backup plan. I think just knowing I have the option will go a long way for me. Sort of like having an emergency fund is such a massive relief, I’m sure many people can relate to that feeling.

Also I don’t think I mentioned anything about the tuition and fees, but it’s about $3500 if I am allowed to be considered a part-time student, and if I finish it in the 8 months as planned. I have to double check with my work plan about the portion that would be reimbursed. But it feels like a relatively small cost to have finished graduate school. I will update when I check in with my work about the portion that would be reimbursed.

Where are you located? I do find grocery costs are higher in Canada than US. Is that just with food costs? We are including household supplies and pet food/supplies in that total. I have addressed this food question in other comments though and we will be trying to uncover where we can spend less in that category for sure.

Just wanted to add that we are a household of two in another major Canadian city, and our grocery+household goods costs are around $700 per month for the two of us, no pets. However, we do eat out more than you, around $500 a month. So while there is always (I’m sure) room for improvement, your costs don’t seem outrageously high.

Another note is that depending on the store/app there can be hidden costs, or you can miss out on in-store sales. CBC did a story about this. https://www.cbc.ca/news/canada/marketplace-instacart-pricing-1.6306306?cmp=newsletter_Marketplace%20Watchdog_5589_373959

What a lovely couple! My only addition to Mrs. Frugalwoods’ excellent advice would be for Sam to start his job transition slightly later. First, pay off that one debt and beef up the emergency fund. Make sure you are both on track with cutting expenses and saving up cash — possibly this could happen in just a few months? Then take the pay cut and change jobs.

For Riley, the challenge is that even with a plan, things aren’t likely to go perfectly to plan. Health, bodies, and babies are unruly and unpredictable. If it would feel good to be making progress on the Masters, as the one thing in this situation that you actually have some control over, then go for it! It’s not all or nothing: Give yourself permission to pause and restart your studies (even if that would mean losing some credits) as life happens.

I’m just a bit confused about how we could do all that at once – Sams pay cut from the job change, at the same time as paying off debt, and building emergency fund, while paying for school, and IFV? I will look closer at the math and try to see how it could work but if we are to pay for the IFV upfront… we need that money in just a couple months.

Yes, I recognize that everything may not go according to plan, and I am (mostly) at peace with that. I have done a lot of avoiding situations where something could possibly go wrong/get worse for me since I got sick, and I would like to give myself this chance for something to possibly go right. I think it’s part of the journey of living with the uncertainty of chronic illness. Thanks for the encouragement!

One thing you could do over the next few months is create a budget based on the lower pay you expect and see how workable it is on a trial basis. You could also do one that reflects your mat leave pay (borrowing from Gail Voz-Oxlade here). That way, you know exactly what the financial toll of either or both of those options would be. Maybe you’ll find it’s more workable than you realized, especially guided by Liz’s advice here!

Hi I just wanted to pop by with my experience of being an immune suppressed autoimmune mum (twice!). So it’s very possible to do but I am not going lie it’s hard and you need to be able to cope with the unexpected and have room in your life and budget for that. Baby number two was a premmie and caused a very bad relapse (& permanent worsening) of my autoimmune disease. She is totally worth it!

One thing I learned was that I could cope much better with my desk based job on an ill days than taking care of the kids during the baby and especially the toddler phases. As when I couldn’t walk/lift/leave the house etc I just couldn’t take care of my kids solo but I could totally work my day job as it was significantly less physically demanding. So I worked full time and my kids went to high quality daycare. Also if I was truly awful my work would let me have sick day and time off for my treatment; no sick days for mom’s in my experience.

Another issue has been me catching bugs off the kids, literally I have had Covid 5 times caught from my kids (I had all the vaccines; they just don’t work very well when you are suppressed). In my experience it’s practically impossible to be a mum to small children and not pickup all their illnesses. Again totally worth it!

My husband has had to be very hands on with the kids (especially on the occasions when I have had a relapse or am flatten by an infection) we see this as a bonus and are fortunate that he has been able to negotiate this with his employer. His employers flexibility has been critical to family life and financial security.

I am hugely grateful that I managed to get and stay pregnant and have had the opportunity to be a mom despite having a life long illness but I have had to make work and family my complete focus- as I just do not have the energy for anything else. (So no hobbies apart from the occasional post on frugal blogs/own social life)

I wish you all the best with your future

I commented above already about auto-immune disease during pregnancy and post-partum period, but just wanted to write here and agree it is so hard but so worth it! Good job for you to figure out what works best, it’s nice to read here about other people with these same issues and feeling support by this online community! 🙂

Similar to you, my husband has to do a lot more “lifting” with the kids and I focus on my career work (also work from home desk job as consultant). We actually started our own consulting firm to have the most flexibility possible.

It works out well for us too!

Wow, that’s so great to hear that you also have an arrangement in your marriage and with your career that is supportive of you. It is so important to have these success stories in mind to give me confidence to believe it’s possible and be assertive in trying to get my needs met.