Tara and Squash live on the West Coast and are about five years away from reaching financial independence. They would like our help crafting a contingency plan in case one (or both) of them loses their job in light of the pandemic and recession.

What’s a Reader Case Study?

Case Studies address financial and life dilemmas that readers of Frugalwoods send to me requesting advice. Then, we (that’d be me and YOU, dear reader) read through their situation and provide advice, encouragement, insight, and feedback in the comments section. For an example, check out last month’s case study. Case Studies are updated by participants (at the end of the post) several months after the Case is featured. Visit this page for links to all updated Case Studies.

I probably don’t need to say the following because you folks are the kindest, most polite commenters on the internet, but please note that Frugalwoods is a judgement-free zone where we endeavor to help one another, not condemn.

And a disclaimer that I am not a trained financial professional and I encourage people not to make serious financial decisions based solely on what one person on the internet advises. I encourage everyone to do their own research to determine the best course of action for their finances. I am not a financial advisor and I am not your financial advisor.

With that I’ll let Tara, this month’s Case Study subject, take it from here!

Tara’s Story

Greetings Frugalwoods! I’m Tara, age 39 and my husband, Squash, is 35. We live on the outermost periphery of a major metropolitan area on the West Coast. I’m a second generation American while Squash traces at least three generations back to Kentucky. Our wedding brought together friends and family from five continents, and I credit our community’s multiculturalism for the life we forge together.

Right now, our primary goal is to reach financial independence and early retirement in order to pursue a nomadic lifestyle of long-term, slow travel. Our target date is December 31, 2025.

Tara’s Education and Work

My parents generously funded all of my undergraduate education and, after college, I started my career in New York City in September 2001. On the second day of reporting to my internship, I emerged from the subway station to witness a plane fly into the second World Trade Center tower. It took me 6 hours to walk from Battery Park City to my apartment in Morningside Heights.

A month prior, I’d taken on nearly $46k in student loans to pursue my master’s degree (I paid this debt down over five years). My third alma mater awarded me a fellowship that fully funded my doctoral studies and I received my PhD. For the past 8 years, I’ve worked in higher education administration. Prior to that I worked with, or on behalf of, domestic violence survivors.

Squash’s Education and Work

Squash earned his first wages at age 11, cutting blooming onions at a race track on weekends while his dad raced stock cars. His manager paid him in cash once he realized he was breaking employment law!

Squash paid his own way through the last half of college and completed an MBA through a combination of employer tuition reimbursement and personal savings. He has worked jobs in landscaping, retail, fast food, IT support, manufacturing supply chain management, and software development. He currently works as a programmer analyst at a research institute.

Interests and Hobbies

I credit our first vacation together (to Akumal, Mexico) as our motivation for pursuing financial independence and early retirement. On the Monday after our return, my commute blessed me with a dreary view of a correctional facility. Automatic thought: “This is what every Monday will look like for the rest of my life until I die …” I googled “early retirement” as soon as I got to my desk. After an induction period facilitated by generous FIRE bloggers, Squash and I hatched a plan for: OperFLI (Operation Financial/Location Independence).

Since launching our OperFLI goal, personal finance has been my primary interest. Other hobbies pale and have shrunk due to neglect. I am a voracious reader and The Atlantic Monthly is my favorite subscription; their columnists feed me a steady supply of subjects for further reading, informing weekly requests for loans from the county library. On uncharacteristically ambitious days, I imagine building a virtual coaching business that helps people build healthy relationships and financial capability — their ability and opportunity to pursue happiness however it morphs over time.

Generally, I read like Squash hobbies.

Squash is a tinkerer at heart. He loves understanding how things work. He bounces between the desktop in his office, the garage, and his laptop at the kitchen table throughout the day, most days, even with a pre-pandemic 3-hour commute. His hobbies and interests compound upon one another. Here’s a recent sampling: electronics, motorcycles, cars, DIY, upcycling, 3d printing, gardening, and their intersections. Squash enjoys finding objects inexpensively (or for free), repairing or improving them, and then using or selling them. He strives to develop self-sustainable capabilities that enable him to fix things in a way that’s cheaper than paying someone to fix it.

How We Money

Prior to our wedding, we decided to preserve our individual accounts and open a single joint account by depositing all of our wedding gifts. Before our first anniversary, as tribute to our future financial independence, Squash sold his house, I sold my car, and both of us swept the proceeds into our respective brokerage accounts. I had hoped we could function as a one-car family, but Squash’s hobbies consistently procure a spare.

On the first of every month, each of us deposits the same amount, a sum amounting to roughly half of our shared household expenses, including mortgage and escrow, utilities, insurance, and groceries into the joint account. On the same date since October 2016, we jointly update an Excel worksheet that tracks our incomes, accounts, expenses, and savings and calculates our time to OperFLI based on a 6.61% real rate of return and 3.25% withdrawal rate. On the 11th of every month, we celebrate the anniversary of our relationship by sweeping post-tax savings into VTSAX. Credit to the Mad Fientist for providing the Excel file as a template, Big ERN for the baseline assumptions, and JL Collins for his book, “The Simple Path to Wealth.” (side note from Mrs. Frugalwoods: Tara has done her homework and I also recommend these three resources!)

The Best

The best part of our current post-pandemic life is spending all day, every day together! We enjoy how working from home brings more space and flexibility to our daily routines. We also eat, sleep, and socialize more intentionally. Since my parents live nearby, they share our bubble. We’ve talked about reducing our dependence on restaurant meals for years, and the stay at home order has facilitated taking greater responsibility for feeding ourselves. Practice hasn’t made perfect, but we are more willing to risk a bad meal.

The Worst

The worst part of our current lifestyle for me is my professional discontent/boredom. I value my job for the compensation and benefits. Ten years ago, if a fortune teller had told me I would hold this job title, I would have laughed and dismissed it as overreach. Now that I’m here, I expect the gig marks the end of my career trajectory. Emotionally, I feel ready to opt out.

Most of my personal discretionary spending lands in the travel and restaurant categories. Travel offers an escape from routine and a peek into post-OperFLI life, or so I fantasize. On a much smaller level, restaurant meals serve a similar purpose. While I rarely impulse shop, I readily purchase food as diversion. Pre-pandemic, going out to eat was entertainment and also one of my main avenues to see friends. Now, I’ve transferred that emotional energy to grocery shopping, meal planning, and reconsidering what’s for dinner.

Squash also has reservations about his current employment. However, he views OperFLI as a means to even more free time for tinkering and traveling, which makes him happy. He also likes to eat well, although more of his discretionary spending supports his hobbies.

Where Tara Wants To Be In 10 Years:

1) Finances: Financially independent/retire(d) early, preferably in 5 years. Net worth sufficient to support a 3.25 to 3.5% safe withdrawal rate.

2) Lifestyle: Nomadic lifestyle of long-term, slow travel with the option to live near family for longer periods as desired or needed. This may entail bringing elderly parents to live where we are.

3) Career: Financially independent/retire(d) early. I am not interested in working part-time to hedge my bets. Squash is more pragmatic. He is willing to work part time as long as it aligns with his interests. He envisions potentially earning a very small amount of income from projects using skills he has sharpened during the path to financial independence. Should we realize our goal of long-term slow travel, I would like to blog about OperFLI

Tara’s Finances

Income

| Item | Amount | Notes |

| Tara’s Net Income | $9,411 | Deductions include health, dental, and supplemental disability insurance, FSA, and taxes; excludes 401(a) and 403(b) contributions. |

| Squash’s Net Income | $5,836 | Deductions include health, dental, and supplemental disability insurance, FSA, and taxes; excludes 401(a) and 403(b) contributions. |

| Monthly subtotal: | $15,246 | |

| Annual total: | $182,952 |

Mortgage Details

| Item | Outstanding loan balance | Interest Rate and Terms | Equity (amount you’ve paid off) | Purchase price and year |

| Mortgage on primary residence | $289,006 | 3.625%; 30-year fixed-rate mortgage | $245,955 | $424k; purchased in 2013 |

Debts

| Item | Outstanding loan balance | Interest Rate | Loan Period/Payoff Terms/Your monthly required payment |

| Car Loan | $16,912.93 | 2% | $454 required minimum payment every month |

Assets

| Item | Amount | Notes | Interest/type of securities held | Name of bank/brokerage |

| Tara’s Individual Brokerage Account | $514,046 | Deposit on the 11th of every month. | VTSAX, various ETFs | Vanguard |

| Squash’s Individual Brokerage Account | $376,860 | Deposit on the 11th of every month. | VTSAX, various ETFs | Vanguard |

| Tara’s Current 403(b) | $115,775 | $19,500 (max allowed) deposited pre-tax annually. | VITLX | Vanguard |

| Tara’s Current 401(a) | $100,881 | Employer contributes 5% salary and matches up to another 5% for 10% total. Contributions suspended for 2021. | VITLX | Vanguard |

| Squash’s Current 403(b) | $86,228 | $19,500 deposited pre-tax annually. | VTRLX | Vanguard |

| Tara’s Rollover IRA | $69,683 | 403(b) accounts rolled over from previous employers | VBTLX, VTSAX | Vanguard |

| Tara’s Previous 401(a) | $65,937 | First 401(a) opened with current employer | VITLX | Fidelity |

| Squash’s Current 401(a) | $37,120 | Employer contributes 5% salary and matches up to another 5% for 10% total. Contributions suspended for 2021. | VTRLX | Vanguard |

| Tara’s Previous 403(b) | $35,089 | First 403(b) opened with current employer | VITLX | Fidelity |

| Squash’s Previous 401(k) | $21,916 | 401(k) from a previous employer. | VTRLX | Vanguard |

| Tara’s Money Market Account | $10,190 | This account along with the joint checking account functions as our joint emergency fund. | 0.40% | n/a |

| Joint Checking Account | $7,539 | All joint household expenses are paid from this account. | Checking | n/a |

| Tara’s Roth IRA Account | $7,369 | VBTLX | Vanguard | |

| Squash’s Roth IRA | $6,811 | VTSAX | Vanguard | |

| Tara’s Individual Checking Account | $5,996 | Employment paychecks are deposited here. Tara’s credit card balances are paid from here. | 0.05% | n/a |

| Squash’s Individual Checking Account | $1,909 | Employment paychecks are deposited here. Squash’s credit card balances are paid from here. | Checking | n/a |

| Total: | $1,463,350 | (Total Reflects Account Balances on July 1, 2020) |

Vehicles

| Vehicle make, model, year | Valued at | Mileage | Paid off? |

| BMW i3 2015 | $15,902 | 35,000 | No, the amount we owe is listed under debts |

| Harley Davidson Road King Classic 2011 | $11,000 | 14,000 | Yes |

| Mercedes-Benz 300D 1987 | $5,000 | 114,000 | Yes |

| Suzuki GS750 1981 | $2,500 | 11,000 | Yes |

| Total: | $34,402 |

Monthly Expenses

| Item | Amount | Notes |

| Mortgage | $1,545 | Joint household expense. |

| Federal & state income tax payment | $992 | One time annual expense = $5,951 in April 2020. Joint household expense. |

| Automotive | $605 | Joint household expense. Includes monthly car loan payment of $460 plus registration and maintenance |

| Property Tax | $542 | Paid via escrow. Joint household expense. |

| Groceries and household supplies | $493 | Joint household expense. Organic products whenever possible from Costco, Sprouts, Trader Joes. Includes household supplies. |

| Tara’s Restaurant Purchases | $185 | Perhaps the most intractable of Tara’s categories. |

| Charitable giving | $167 | Individual expense. |

| Tara’s Medical Expenses | $129 | Includes co-pays, supplements, supplies. We sought care from a functional medicine doctor at the year’s start so this number is considerably higher than usual. Usually = $0 |

| Tara’s Gift Purchases | $128 | |

| Squash’s Vehicle Maintenance | $128 | Oil changes, repairs, accessories, etc… |

| Squash’s Restaurant Purchases | $121 | |

| Squash’s Hobby Purchases | $119 | |

| HOA Fees | $116 | Joint household expense. |

| Travel | $112 | Significantly lower than usual because we paid for 2020 Q1 travel in 2019 and have cancelled all other travel since March 2020. That said, we don’t expect to travel abroad again this year and are willing to titrate based on circumstances. |

| Water, trash | $110 | Joint household expense. |

| Squash’s MobilePhone + Data Plan | $99 | We cancelled our home Internet service and rely on Squash’s mobile wireless subscription to work from home. |

| Auto Insurance | $89 | Joint household expense. |

| Tara’s Miscellaneous | $89 | Includes credit card annual fee, subscriptions. |

| Squash’s Tools | $84 | New tools acquired for Squash’s projects |

| Electricity | $74 | Joint household expense. Powers our electric vehicle. Closer to $100, pre-pandemic. |

| Squash’s Home Maintenance | $74 | Service, parts, or supplies needed for home repairs. Also includes household supplies like new cookware or coffee maker. |

| Squash’s Personal Care | $74 | Preferred personal care products, mostly. |

| Housekeeping Service | $67 | In-sourced effective March 2020. Now = $0 |

| Home Security Service | $66 | Joint household expense. |

| Squash’s Clothes | $64 | |

| Tara’s Entertainment Purchases | $55 | Includes Netflix, tickets, parking. |

| Homeowner’s Insurance | $52 | Paid via escrow. Joint household expense. |

| Home Gas | $43 | Joint household expense. |

| Squash’s Automobile/Motorcycle Fuel | $41 | Gas/diesel pump or charging an electric vehicle. |

| Landscaping Service | $40 | In-sourced effective June 2020. Now = $0 |

| Tara’s Work Lunch | $29 | Currently = $0 |

| Squash’s Gift Purchases | $29 | Includes treating family and friends or birthday presents. |

| Squash’s Work Lunch | $23 | Currently = $0 |

| Squash’s Motorcycle Membership | $19 | Membership cancelled due to reduced use. Currently = $0 |

| Squash’s Gym Membership | $19 | |

| Tara’s Personal Care | $14 | |

| Squash’s Parking | $10 | When we have to pay to park somewhere. |

| Squash’s Netflix | $9 | |

| Tara’s Shopping | $5 | Includes clothes and tangible items. |

| Squash’s Entertainment | $0 | Usually greater than $0 pre-pandemic. |

| Monthly subtotal: | $6,663 | Reflects expenses between January and June 2020. |

| Annual total: | $79,956.00 |

Credit Card Strategy

We both use the Chase Sapphire Preferred travel rewards card (affiliate link).

Tara’s Questions For You:

1) Our goal is to pursue a nomadic lifestyle of slow travel abroad once we reach our OperFLI target at the end of 2025, nearly 11 years after setting the intention. We’re about half-way there, but the pandemic and corresponding recession has us nervous. Both of us are concerned about the risk of being laid off from our jobs and being unable to get new jobs at equivalent levels of compensation. If one or both of us becomes unemployed, should we pull the plug and leverage geo-arbitrage, e.g. Southeast Asia, Latin America, Eastern Europe, other places?

- If yes, how would you recommend we reduce expenses (including relocation) in order to maximize quality of life?

- If I am unemployed, should I take a job that pays me 50% less or retire now while Squash keeps working? (If I go back to work at a nonprofit, I can expect a significant reduction in pay).

- Should we stay in our house, sell it, or propose my parents move in and take over the mortgage while we travel?

- I bought this house reluctantly as a singleton, and my parents encouraged me to buy it assuring me they would take it when they were ready to downsize. As a second-generation immigrant family, the option to live as an intergenerational household stands so this may be an intermediate arrangement.

2) We are open to having a child, but haven’t conceived over the past two years of trying/not trying. While Squash is happy with our life as is, I am ambivalent. Part of me wonders if my desire for a child is a combination of life stage and FOMO.

- As I am nearing 40, should we foreclose this option?

- We also recognize that having a child now could mean caretaking until we reach a more traditional retirement age, especially if world schooling isn’t a feasible option due to the child’s specific needs.

Mrs. Frugalwoods’ Recommendations

This Case Study is a superb example of what you can accomplish when you: 1) have high salaries; 2) pay off your debt early and fast; 3) create a focused, intentional goal; 4) spend and save your money carefully and with intention. I commend Tara and Squash for their judicious management of their finances!

Tara and Squash have mapped out their life goals and tailored their finances to enable them to meet those goals. I very much like this approach: set the goal for the type of life you want, then figure out how to manage your money to make it happen. Money is a tool you can deploy, not an end goal in and of itself. Much of what they’ve done is a straightforward, well-researched path to financial independence and the sources Tara cited are the ones I recommend to anyone serious about pursuing FIRE. Congrats to Tara and Squash!

The really basic, oversimplified methodology for reaching financial independence is as follows:

- Set a specific, achievable goal and make sure your partner (if applicable) is 100% on board. Research safe withdrawal rates and determine your FI number. Don’t forget about heath care costs! Be realistic about the amount of time it’ll take you to get there. In Tara and Squash’s case, it’s 11 years. Sounds long at the outset, but ends up being a pretty small fraction of a lifetime.

- Resources that are helpful: Early Retirement Now’s Safe Withdrawal Rate Series

- Pay off all high-interest debt and don’t take on any new debt (with the possible exception of fixed low-interest rate mortgages, either for a primary residence or rentals).

- Focus on your earning potential: advance in your career(s) in order to increase your income(s). The more you earn, the more you can save.

- Create a lifestyle that enables you to live well below your means (and like it!). Choose housing, transportation, entertainment, food, etc that enables you to spend far less than you earn. It’s not about deprivation, it’s about values-based spending. Allocate your resources of money, time and energy to the highest and best purposes, as defined by you.

- Resources: I’m going to recommend myself here and my free Uber Frugal Month Challenge

- More about how we manage our money here: How We Manage Our Money: Behind The Scenes of The Frugalwoods Family Accounts

- Invest, invest, then invest some more. Also, invest. In order to grow your wealth, research indicates you need to invest–and remain invested–in the stock market for decades. This includes both tax-advantaged retirement investments (401ks, IRAs, etc) as well as taxable investments (for example: low-fee, total market index funds).

-

- Resources: my favorite source for investment strategies and advice is JL Collins’ book, “The Simple Path to Wealth” (affiliate link) and also the stock series on his blog.

-

- Understand and utilize tax-advantaged strategies.

- Resources: the MadFientist does a great job outlining tax-advantaged approaches in his blog

- Consider adding passive/semi-passive additional income streams, such as: rental properties, side hustles, consulting, freelance work, etc.

- Rinse and repeat items 1-7 for as long as it takes to reach your FI number (which, by the way, is likely to change and shift over the years).

Yes it takes research, time, money, and sacrifice, but I’d argue that most goals worth pursuing do. Ok, let’s turn to Tara’s specific questions!

Question #1: If one or both of us becomes unemployed, should we pull the plug and leverage geo-arbitrage?

There’s a lot to unpack in this question and I’ll start with the obvious: what is the FI number Tara and Squash are targeting? I’m curious about this because I’m wondering how much they anticipate needing to live on. It appears they’re targeting a pretty high number and it seems they might be able to do it sooner. I join them in being pretty conservative in my estimates, but at first glance, they’re a lot closer to FI than they’re calculating. There are, however, a few major wild cards to consider:

1) Their House:

They have a lot of equity in their home and, if they’re serious about traveling full-time, it seems to me that the most straightforward thing to do would be to sell the house. Sell the house, the cars, all their possessions, take the proceeds and funnel them into their investments. Selling all of this would significantly beef up their bottom line and permanently eliminate a lot of their fixed costs. However, what I can’t answer for Tara is the question of her parents living in her house.

From an outsider’s perspective, that could create a hairy interconnection between her and her parents–who is paying the mortgage, who gets the equity, who is responsible for replacing the water heater? But I’m not in Tara’s position and I don’t know the understanding she has with her parents. If the expectation is that Tara will provide her parents with a place to live, it might actually be less fraught for her to just give them the house, rather than trying to charge them rent.

The other lingering question I have is whether or not Tara’s parents expect to live with Tara and Squash as they age. If so, how does the world travel plan synchronize with that expectation?

I don’t think I can answer this adequately for Tara and it’s something she’ll need to discuss with her parents. From a PURELY financial perspective–ignoring all familial love and filial expectations–it would probably make the most sense for Tara and Squash to sell the house and invest the proceeds.

2) Tara also asked, “how would you recommend we reduce expenses (including relocation) in order to maximize quality of life?”

I think their expenses would naturally reduce if they no longer owned anything. They’d have no HOA fees, no mortgage, no car insurance, no utilities. If they’re traveling full-time, their fixed expenses would be low, particularly depending on their mode of travel and how interested they are in credit card utilization. If they haven’t already, I recommend they take the free Travel Miles 101 course on how to leverage credit cards for maximum travel point advantage.

If Tara and Squash delete all of their fixed-in-place costs (everything from property taxes to gym memberships), their monthly spending free falls from $6,663 to $2,765 a month (see spreadsheet below). In other words, they’d save $3,898 a month just by virtue of not owning their house and cars.

| Item | Amount | Notes |

| Federal & state income tax payment | $992 | One time annual expense = $5,951 in April 2020. Joint household expense. |

| Groceries and household supplies | $493 | Joint household expense. Organic products whenever possible from Costco, Sprouts, Trader Joes. Includes household supplies. |

| Tara’s Restaurant Purchases | $185 | Perhaps the most intractable of Tara’s categories. |

| Charitable giving | $167 | Individual expense. |

| Tara’s Medical Expenses | $129 | Includes co-pays, supplements, supplies. We sought care from a functional medicine doctor at the year’s start so this number is considerably higher than usual. Usually = $0 |

| Tara’s Gift Purchases | $128 | |

| Squash’s Restaurant Purchases | $121 | |

| Travel | $112 | Significantly lower than usual because we paid for 2020 Q1 travel in 2019 and have cancelled all other travel since March 2020. That said, we don’t expect to travel abroad again this year and are willing to titrate based on circumstances. |

| Squash’s MobilePhone + Data Plan | $99 | We cancelled our home Internet service and rely on Squash’s mobile wireless subscription to work from home. |

| Tara’s Miscellaneous | $89 | Includes credit card annual fee, subscriptions. |

| Squash’s Personal Care | $74 | Preferred personal care products, mostly. |

| Squash’s Clothes | $64 | |

| Tara’s Entertainment Purchases | $55 | Includes Netflix, tickets, parking. |

| Squash’s Gift Purchases | $29 | Includes treating family and friends or birthday presents. |

| Tara’s Personal Care | $14 | |

| Squash’s Netflix | $9 | |

| Tara’s Shopping | $5 | Includes clothes and tangible items. |

| Monthly subtotal: | $2,765 | |

| Annual total: | $33,180 |

This doesn’t account for:

- Where they’re going to live. They’ve got to live somewhere once they sell their house, but I imagine they can live much more cheaply than $3,898 a month.

- Health care (depending on their health and what type of plan they choose, this could easily double their monthly spending).

- Travel expenses.

- The potential absence of income tax (I left it in above).

This is an illustration–imperfect though it is–of just how many of their expenses are tied to their location and their ownership of a house and cars. These lowered expenses, combined with the infusion of their previously illiquid assets (house and cars) into their investment accounts could dramatically tip the balance of their FI number (in my opinion). Tara’s smart and can do the math here, but the salient point is how many of their costs are tied up in their house.

3) Tara asked, “If I am unemployed, should I take a job that pays me 50% less or retire now while Squash keeps working?”

This is fairly contingent upon what they decide regarding their house and the rough calculation I did above on their fixed-in-place costs. The other obvious factor at play right now is the global pandemic. In light of the pandemic, it doesn’t seem feasible (or wise) for Tara and Squash to being traveling now. For starters, I’m not even sure which countries are allowing Americans in. Given that, I think the commencement of travel is necessarily a post-pandemic consideration.

Due to the pandemic, I think it probably makes the most sense for both Tara and Squash to continue working. If she’s laid off, I think she can easily find another job. I sense there’s some imposter syndrome at play here and I want Tara to be more confident in her abilities and expertise. Tara stated, “Ten years ago, if a fortune teller had told me I would hold this job title, I would have laughed and dismissed it as overreach.” But clearly it’s NOT overreach. She has this job for a reason and she’s probably very good at it!

I would also note that there there are very few 100% unique jobs in the world. I know she feels like this is the one and only for her, but if she got laid off, she might be able to find an even better position–who knows? She might not find something right away, but thankfully, her finances don’t necessitate she do so. With a PhD and lots of work experience, she could launch a nationwide/worldwide job search and investigate a lot of options. Plus, since most white-collar positions are exclusively work-from-home due to the pandemic, this might open up positions that weren’t perviously available due to geography. If I were Tara, I wouldn’t assume that her career is over if she loses this job. Ditto all of the above for Squash.

Slow Travel Trial Period?

Something I’m wondering is if Tara and Squash have ever done a trial period of long, slow travel? If not, I wonder if they’ve considered doing a trial period–lasting at least several months–before committing to the lifestyle? I know they’ve traveled extensively, but I’m specifically curious if they’ve spent months at a time on the road.

Once things are back to a semblance of normal (in terms of the pandemic), I recommend taking a sabbatical to travel for several months straight. That would provide Tara and Squash with data on the experience without committing them to a longer term of travel. Sometimes the reality of a situation doesn’t meet with the expectation or fantasy. Conversely, it might turn out even better than Tara and Squash anticipated and they might decide to depart sooner! Either way, I see no downside in doing a several months long exploratory trip (jobs and pandemic permitting, of course).

One aspect of their lives that appears potentially incompatible with travel are Squash’s hobbies. Tara noted that he enjoys tinkering, working on cars, gardening, and more. These are all hobbies that require a home base and lots of space. Just something for them to consider since a lifetime of travel might put these hobbies on hold.

Tara’s Question #2: We are open to having a child, but haven’t conceived over the past two years of trying/not trying. While Squash is happy with our life as is, I am ambivalent. Part of me wonders if my desire for a child is a combination of life stage and FOMO.

This is one of the most personal of personal questions and it’s something only Tara and Squash can answer. Since we can’t answer this for them, my suggestion is that they commit to a specific action item around this question (I’ve outlined possible action items in my summary at the end). Here are my thoughts–from an outsider’s perspective–in case they’re useful to Tara and Squash in their discernment process:

From a fertility perspective, if Tara and Squash want to pursue having a biological child, it’s probably advisable for them to meet ASAP with a fertility specialist (assuming they haven’t already) to discuss recommended/potential routes to conception (medication, IUI, etc).

If Tara and Squash aren’t wedded to the idea of a biological child, perhaps they turn off the ticking clock and pursue adoption when the time feels right for them. Perhaps they decide to travel the world for awhile and then settle down and adopt.

Medical considerations aside, I think the lifestyle question is one we can brainstorm about a bit more. Everyone experiences parenthood differently, but it’s undeniably a life-altering event. Tara’s spot on when she notes that having a child might mean they delay their travel plans–but it also might not. Plenty of families travel with their child(ren) full-time and, if she and Squash are up for home/world-schooling, then their plans might remain on track. The world contains unknown multitudes and who’s to say if having a kid would ruin their travel plans? A child certainly adds another dimension and is another variable that can present complications, but it’s not necessarily a variable that’ll prevent travel. For all we know, we’ll just have global pandemic after global pandemic and no one will ever travel again. KIDDING!! But my point is that no one knows the future and, if you really want kids? Go for it. If you really don’t want kids? Don’t go for it.

If I read into Tara’s phrasing, and appoint myself as an armchair psychologist, it doesn’t sound like she and Squash really want to have a child. There’s nothing wrong with wanting to have kids and there’s nothing wrong with not wanting to have kids. Tara noted they’re pretty happy with how their life is now and, if neither of them feels a strong pull to have a kid, why bother? Kids are expensive and a ton of work. I love my children and I wanted them desperately. I wanted children in a visceral, instinctual way. And if Tara and Squash aren’t feeling that? Then I think the best thing anyone can do is listen to what their gut is telling them.

Just because other people have kids, just because society portrays “ideal” families as having 2.5 kids, just because your parents want to be grandparents, just because you’re worried maybe no one will care for you in old age–none of those are good reasons to have a child. The only reason to have a child is because you want to have a child. If not? Let it go and be at peace with the fact that you’ve made the right choice for you.

Side note: If Tara and Squash want to have the experience of taking a kid to the zoo or out to get ice cream sometimes, I am CERTAIN they have friends/family who will HAPPILY lend them their child(ren) for an afternoon.

If Tara and Squash feel conflicted over this question, I encourage them to seek out a couples’ counselor to help guide them through the conversation–thankfully, there are tons of online options right now! The money and time spent on therapy will PALE in comparison to the anxiety and stress of not feeling in alignment with your spouse and not coming to a resolution on this question.

Finances

I have very little to say to Tara and Squash about their actual finances because they’re doing such a fabulous job! The one note I have is for them to consider consolidating some of their old retirement accounts.

That being said, if the fund options are fine for all of their old retirement accounts, then there’s no real reason to consolidate other than ease of administration. If they have all of their accounts through the same bank/brokerage and can see them all in one place, then there’s even less of a reason to pursue rolling over. I just felt I’d be remiss if I didn’t mention this!

Summary:

- Discuss the expectations around long-term care–and the house question–with Tara’s parents. Ensure there’s clarity and clear communication.

- Crunch the numbers on what they could expect to net if they sell the house, the cars, their stuff and move to full-time travel. Are they actually closer to this goal than five years?

- Once the pandemic allows, consider taking a lengthy sabbatical to do slow travel for at least several months. Before quitting their jobs and selling everything they own, I think it’d be great for Tara and Squash to have first-hand knowledge of what the experience is really like.

- Decide on an action item regarding the “having kids” question.

- Possible action items:

- 1) resolve that they’re happy to remain kid-free and be at peace with their decision;

- 2) resolve that having biological children isn’t imperative and table the decision until later in life, at which time adoption could be pursued;

- 3) resolve that they do want to have biological children and make an appointment with a fertility specialist ASAP;

- 4) resolve that they’re undecided and want professional guidance for the conversation. Book an appointment with a couples’ therapist ASAP.

- Possible action items:

-

- My hope is that by pursuing one of these four action items, Tara and Squash will feel confident that they’re moving in the right direction.

Ok Frugalwoods nation, what advice would you give to Tara? We’ll both reply to comments, so please feel free to ask any clarifying questions!

Would you like your own case study to appear here on Frugalwoods? Email me (mrs@frugalwoods.com) your brief story and we’ll talk.

This is totally a personal choice…but their fancy cars stick out to me. If they want them and they’re worth the extra months they need to work before becoming FI, then keep them. If they want time off more or to spend their money on traveling, sell them and replace them with more middle of the road options. It’s okay to want nice things. You just have to weigh them against all of the other things you can and want to do with your money.

I’d say get a replacement job, even if it pays less, if Tara is let go during the pandemic. Part time is even an option. I can’t speak for all and I’m not a psychologist, but no work or volunteering or established hobbies during a pandemic when you can’t go anywhere or do much of anything seems like it would be bad for most people mental health wise. People need purpose and when we’re socially cut off from finding purpose in our relationships, it seems like having productive goals seems like one of only a few safety nets available right now.

The cars are actually kind of old, for the most part. I think they maybe have too many of them, but that’s just me.

Yes, Marcia, they are old. One is very old (33 years!) and mainly a hobby car Squash uses to learn how to wrench. The newer (shared) one is also nearly 5 years old. We bought it used when it was 3 years old and significantly reduced in price because a better model had been released. Our original intention was to purchase a shared vehicle with cash but couldn’t agree on a make/model. Squash leaned toward older and bigger, and I leaned toward tiny or none at all.

Hello Allison! Thank you for your feedback. I agree that having productive goals are important. Since preparing this post for Mrs. Frugalwoods, I have been writing nearly every day. I’m hoping that I can accelerate my goal to blog and become more entrenched in the FIRE realm during OperFLI rather than waiting to start after reaching a magic number. I credit Squash for our fancy cars. Before I met him, I drove the same Toyota Corolla for 11 years — 11 seems to be my lucky number. 🙂 Thanks for taking the time to comment.

Well said. I had the same reaction.

Income is ~2.3 times expenses, excellent efforts to get there. Develop passive income streams, if only to avoid the inevitable draw down stage of SWR. The emotional uplift from income still coming in offsets a withdrawal only rut. Even with a 3.25% SWR, a passive income stream allows for frugal spending above and beyond essentials. Slow travel has a way of allowing spending creep (expansion).

Plan out probable increase in the family expenses with a child to develop a course of action impacting the planned SWR.

Potential passive income ideas include interest income as an accredited investor (>$1million net) in real estate syndication and a dividend portfolio that reinvests until a withdrawal stage is reached.

A strong base to grow is shown, this couple has options! Choice is a powerful position to be in.

Thanks for your encouragement, Ginzu! Financial capability is about cultivating both the ability and opportunity to pursue happiness however it morphs over time. Thank you for emphasizing the power of options.

I think Alison is spot on about the replacement job.

I also think the advice to figure out whether they really want to be parents or not is excellent.

Hi Carol! One consequence of staying at home has been a lot of extra time to think! Part of the challenge with figuring out if we want to be parents is deciding when to stop. For me, knowing when to stop has been harder than deciding to start. Thank you for taking the time to comment.

After retiring, I found I missed having a purpose. After three years of retirement, I’m back at work albeit part-time, but not with a job I’m truly passionate about. Is this something that you Tara, may perhaps feel with few outside hobbies? Perhaps a planned year of travel, where you can go back to your job (if desired) might be a good option. Question: Tara, what would you do with your new-found freedom in retirement?

I really feel this! I was getting overly focused on having the maximum amount of time off from work so that I could enjoy my life, then got a new job and realized that I’d just been a little bored with my old job. I’m really loving work right now and the idea of not having a job is … fine, but not as fun. Weird! I also think being financially stable (to a certain degree) and not necessarily having to have a job makes having a job much easier. Psycholgically and all.

Georgia, I’m glad your new job feels more challenging and enjoyable! Often, my pursuit of FIRE seems motivated by a desire to alleviate worry about what will happen if I lose my job. If I didn’t worry about the financial implications, I imagine it would feel like a different game.

What great questions! No joke — since preparing the reader portion of this case study for Mrs. Frugalwoods, I have been contemplating developing a virtual business either pre- or post-FIRE to offer online coaching for people dealing with problems at the intersection of healthy relationship and financial capability. I appreciate the suggestion to take a year to focus on travel and then plan avenues for contribution. Thank you for raising these questions, DLB.

Just a random personal story about fertility–my husband and I did the ‘trying not trying’ thing for two years with no buns appearing in any ovens, and then just when we decided to go ahead and live without kids and spend all our time traveling and eating pizza, we found out we were having a baby. So you never know, and sometimes it takes a while!

Best of luck to you, looks like you’re super well set-up to achieve your goals. Enjoy the travel for me!

Georgia! Thanks for stopping by! You aren’t the first to suggest that something could happen after we give up on the idea. The same thing happened to me before I met Squash. I could not go on one more date and had resolved to be single indefinitely. Since then, my friends have joked that I should have given up sooner! 😉 Thank you for your encouragement…

Just to add the other side…… We were both in our early 30s and tried for 9 months. 3 failed IUI and one round of IVF and no kids. No fertility issues either….2nd (and likely last) round of IVF in a few months. IVF is brutal, both emotionally and physically. It has worn me and my husband out. Adoption is not an easy route either, there is a reason those kids are up for adoption. This is not the child’s fault at all but it will have affected them. Sorry I don’t mean to put you off I just feel people throw out these options of fertility treatment and adoption like it’s an easy fix. None of it is remotely easy.

Your comment about adoption is horribly offensive. There are tons of reasons for children to be up for adoption. And to say that it has “affected them” is ignorant and simpleminded.

Hello K, I read Aphra’s comment differently than you did. I agree with you that there are multiple reasons why parents adopt and children may be adopted. At the same time, children, birth/foster/adoptive parents, siblings, and whole families (usually two if not more) are impacted by choices and decisions that lead to and follow adoption. This is how I interpreted her words.

You can interpret her words however you want, but the phrase “theres a reason these kids are up for adoption” is objectively ignorant and hurtful.

It sounds like they were not the kind of people who could do adoption. That’s fine! But leave the kids out of it.

I didn’t read it that way, and I work with adoption teams. It is not the child’s fault, but the many reasons why they end up needing adoption have impacted their development. They have emotional, mental and physical needs from that experience.

Any adoption or fostering agency if they are any good will be clear up front that these routes are not for the faint hearted, and they require more from an adoptive or foster parent than the average biological child would. The child is, through no fault of its own, higher need.

I know, for example, that my medical issues rule out adoption or fostering for me as I wouldn’t meet agency criteria.

You’re more courageous than I am, Aphra. I’m sorry that your experience with fertility treatments has been so painful. I have watched friends and relatives become overwhelmed by these procedures. In some families, they gave birth to healthy babies. In others, they were surprised when they later learned their infants and toddlers had special needs. In yet others, they remained childless after multiple cycles. I also notice that many of my well-wishers will speak of adoption immediately after recommending fertility treatments to increase the likelihood of a biological pregnancy. I try to be sensitive to this when speaking to my own friends. While all paths to parenthood are equivalent, they are different, especially when there might be a great deal of emotion invested in a particular path. Thank you for your comment.

Fertility treatments do not increase the chance you will have a special needs child. That’s just bad information you were given.

I have an IVF baby and while it wasn’t easy, I wouldn’t trade if for the world. I knew for me (and only for me) it would be a less grueling path than adoption. Obviously there are no guarantees.

Aphra, I am truly sorry that you’ve had such a difficult time. I don’t think, however, – whatever your specific experience with adoption may have been – that it warrants your offensive and sweeping comments about children placed for adoption. Perhaps it would not be a good idea for you, but adopting a child has been a wonderful experience for many parents.

I, too, didn’t take it in a bad way that kids who are up for adoption may have extra needs even if the poster was fairly blunt about her perspective. From experiences in my own family (a cousin who adopted, and then had to relinquish her children, plus another family member whose adopted children had serious emotional issues and are not a regular part of her life now that they are grown), plus reading about adopting older children, one of the biggest misconceptions is that love will fix all things. I’ve read that one out of twenty adoptions ends with the adoptive parents having to give up the child for a multitude of reasons. Is this an accurate percentage? I don’t know, but as I said it happened inside my extended family. That is something that saddens me a great deal – imagine a child not being able to stay with the biological parents and then losing an adoptive family as well! Anyone who is thinking of adopting should be honest with themselves that their adopted child is likely (although not quarantined) to have a variety of issues that will require time, counseling, patience, and in the end the child may never develop a strong emotional bond with the adoptive parents depending on what has happened to that child prior to being adopted. Anyone who is thinking about adopting needs to be clear-eyed about the negatives as well as the positives. Depending on the situation adoption can be difficult in many ways beyond the financial and time costs of the initial adoption process. I feel for the loving people who get in over their heads and end up suffering a great deal while getting little parental joy. I think it is a good thing to acknowledge up front that many kids available for adoption need parents who are realistic that it is not the same as bringing their own baby home from the hospital. Does it make me or anyone else unloving to be truthful about this? I think it’s best for the children involved that people who are thinking about adoption consider their decision with as much information as possible including the potential problems.

Well said

Hi, adoptive mom here. I actually agree with Aphra’s comment. There are serious social/emotional impacts to my adopted child. White parents should prepare to talk about race with their transracially adopted child every day, identify ways to honor and integrate their birth culture, and spend a chunk of change in therapy. Meeting your child’s unique needs is just good parenting for any child but you are much more likely to struggle with and be challenged by parenting adoptive parenting. Do not take the option lightly.

Sarah, I believe one reason I am not yet a parent is because I do not take any option to parent lightly! My personal and professional experiences align with your comment about the experiences of adoptive families. I’ve heard, “Oh, but you can always adopt” and “Why don’t you think about adopting a child?” uttered too flippantly, too often. Thank you for sharing your feedback.

Since you are doing so well financially, I wonder if you’d consider still paying your former housekeeper, who you noted that you laid off In March. Not everyone has had your level of privilege, and cutting off someone else’s income in a pandemic when you could easily afford not to seems a bit harsh!

I am in the same position in terms of kids, so I very much feel you on that one! It’s such an intense, personal decision. Good luck with all the decisions you have ahead of you!

Hi, C! Thank you for your concern about our former housekeeper. In early March, she contacted me to share that she didn’t feel comfortable continuing her business and intended to suspend it until she felt safe. I’m glad that she felt capable to make the choice that was best for her and her family.

Also glad to hear from someone in a similar boat re kids! Most of my friends are partnered with children or single and unwilling to parent solo. Squash and I are the in-between case. Thank you for your well wishes.

Although they are both healthy now, it’s best to plan for all contingencies . I imagine that being fully covered for a nomad existence would be expensive. My husband and I chose coverage (Medicare, supplement and drug plan) which would almost fully cover us anywhere and we pay $9,500.00/year. Most insurance rates are based on where you live.

Good point, Cindy; however, Medicare, even with a supplemental and Part D policy, will not provide coverage outside the U.S. So for global travel, even if you’re traditional retirement age, a travel or global policy would be necessary.

Hi, Cindy! I have been keeping my eyes peeled for news about insurance options for those seeking a nomadic lifestyle. Both Kristy and Bryce at Millennial Revolution and Purple (anonymous blogger) at A Purple Life have shared how they seek to meet this need. Like your comment suggests, rates explode if travelers intend to live in the US for longer than a couple of months. This will be a priority as we continue to plan for the future. Thank you for taking the time to comment.

They are doing excellent! Congrats! I only have 1 comment. If they both work at a university, do they have access to a 457b? If so, I suggest they start to contribute to that as much as possible since the only requirement to withdraw from it before retirement is leaving the employer. So there is no early 10% penalty! For those that want to retire early, this is an excellent pre-tax account (if the fees are reasonable)!

Great suggestion, G! Unfortunately, my employer restricts access to a 457b to those who earn considerably more than either Squash or I do. Otherwise, I would have been all over it! Thank you for thinking of it. Maybe others who have access to one could investigate it as an option.

Please continue to pay your house cleaner. You have the means.

Disagree. If you want to give to charity, give to an effective charity that targets the most needy. Don’t throw money at a random person just because of your past business relationship–for all you know, that housekeeper may be on unemployment making a lot more than before COVID.

Anyone who finds that $600 a week is more than they were making while working full time, was underpaid.

And that bonus is already over. Plus, “random person”? Way to diminish the service people who work for you.

Wow. What a crass and dismissive comment. As a business owner ( the house keeper) is not likely able to access unemployment funds. Regardless, service based industries have been hit very hard in this time.

I agree with you, Julie. We have continued to pay our house cleaner, who is not cleaning our house. We have also continued to pay our gym membership (the YMCA), which is not open but still provides a lot of services to our town.

If people like us, who have high incomes and decent net worth don’t care enough to continue to pay people a salary when we can afford to do so (during a national pandemic!) what does that say about us? Our cleaning service has been with us for 13 years. They want to work for a living. It’s not their fault.

Hi, I wholeheartedly agree with Marcia–her sentiments about kindness and the willingness to open your heart and help in whatever way you’re able, and also the fact that this pandemic nightmare is why people are “making the decision” to stay safe. For the most part, it’s not because they’re taking a sabbatical to find themselves, or taking a fun vacation, or going back to college to plan a lucrative new career. And even if a lot of people were uncomfortably unwilling to give up their livelihoods because they desperately need the income, the decision was taken out of their hands when customers stopped paying for the services and businesses were forced to shut down for who knows how long.

I’m sure the housecleaner would be very appreciative and touched if a former client surprised her with a pretty card containing a bonus or a gift card for groceries or a favorite treat. A gesture like that would put a smile on her face, make her feel like she was appreciated, and it would mean a lot to her to know she’s not forgotten, that somebody cares. I’ve discovered it really doesn’t take much to make us happy, to feel loved. Recently, I sent a card to my friends in the office mailroom with some money and a note to treat themselves to coffee and donuts, and that we’ll swap stories when we’re together again. I’m also working on some cards for the workers at the coffee shop (for when they re-open) and for the sweet gentleman who runs the newstand/candy shop I frequented.

I’ve even been happily surprised myself! I’m a secretary, and it really made my day when I received a package of books from my dear friend/co-worker. It felt great to know I was valued and loved. I’m always going to treasure those books and remember my dear friend’s kindness and generous spirit.

We’re in this together. We have to be strong and stand for each other and with each other. Frugalwoods is a great place for us to do that. 🙂 Thank you, Liz and friends! As Jerry Springer used to say,. “Take care of yourselves, and each other.”

Hi Julie, thanks for your concern about her. The housekeeping business she operates is a professional service. Likewise, my relationship with her is professional. In early March, she contacted me to share that she didn’t feel comfortable continuing her business and intended to suspend it until she felt safe. I’m glad that she felt capable to make the choice that was best for her and her family.

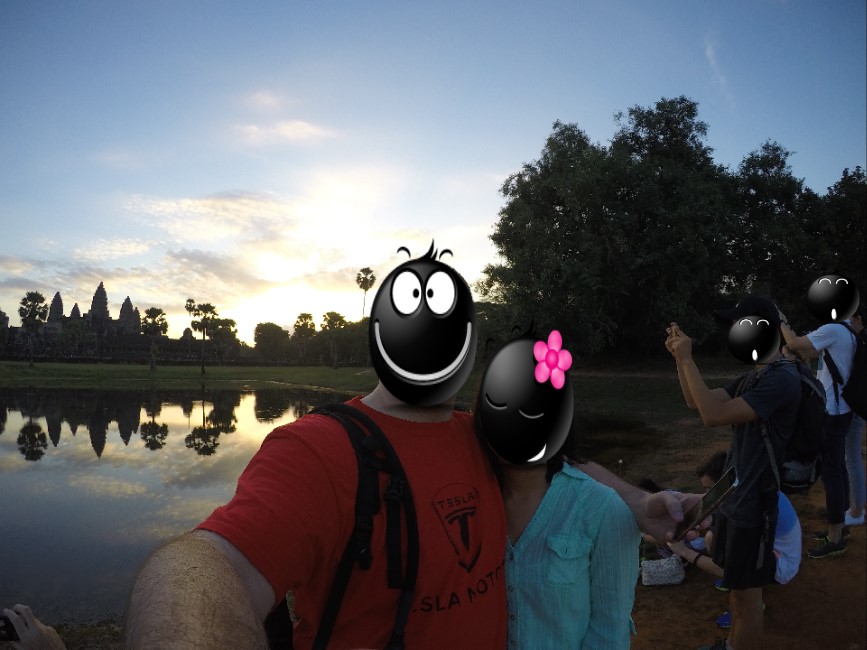

Can’t get past the scary, dopey face masks. What gives? Creepy.

Aw, sorry to hear they put you off, Marilyn. I preferred an alternative to the usual yellow happy faces folks use to conceal their identities in an anonymous post. The pink flower sold me.

When I saw the first picture in the post, the wedding picture, I thought you wore masks at your wedding. I thought it was very odd!😂

Joan, I would have been disappointed by the photos had that been the case! A close friend of mine married last month. Ironically, she, her groom, and their 8 guests all wore masks! Not the type anyone expected, but a joyous wedding nonetheless.

They want to remain anonymous. I don’t blame them. Nothing wrong with that.

Hello Tara and Squash,

Just some food for thought on whether or not to have a kid….I will tell you the same thing I told my 40ish newly married friend when she was feeling ambivalent about building a family and worried she would regret not having one…“Unless you have a burning, absolute desire to have a family, I don’t think you’ll regret not having a child”. This was based partially on my own experience of being newly married and 40ish. My partner and I were committed to building a family, no matter what that meant-IVF/adoption, etc. I am also an educator and have many years of experience working with children. They are awesome but also a literal life changer. Your control of your life will be drastically altered, forever. We have a son that we love to bits and would never change that, but don’t let anyone tell you that you need a child to be happy.

And an echo of the “try it out” advice from Mrs. Frugalwoods about travel. We LOVE to travel and thought we would enjoy extended slow travel in our vintage camper. Turns out, after a few trial runs, it was not what we had expected and we sold the camper and chose a new travel method. 😉

Finally, big props! You are doing an incredible job with your FI journey. Best to you both!

Thanks for your encouragement, Susan! I wondered what to make of the absence of a burning, absolute desire to procreate. For example, after being single during my early 30s, many of my friends, including me, have grappled with the idea that it might not happen for us, especially if we are unwilling to pursue single motherhood by choice. Sometimes I wonder if delaying marriage (by choice or circumstance) dissipates that burning, absolute desire others experience when they are happily coupled during their early adulthood. Of course, there are always exceptions. At the point we are now (nearing 40), some of these friends are seriously contemplating solo parenting via IUI/IVF or adoption when they hadn’t before.

In my late 20’s I experienced the burning desire… to get a dog. I volunteered with a rescue, moved to a dog friendly neighborhood and apartment and did all sorts of things to get ready before I actually got the dog. I’ve never felt that way about having a child, so I figure motherhood is not for me.

Hi Tina! A burning desire is much more straightforward than a tepid or absent one. I admire your clarity.

Just to comment on the other side of this, my daughter was a bit of surprise, as I never thought I would have children and was happy with my life as is. I never experienced a burning desire to have a child, but it happened, and it is now impossible to imagine my life without my child, even though it is absolutely more complicated than before. I will be thinking about and worried about this little person for the rest of my life. This just to say that not everyone knows with absolute certainty what they want, and sometimes things happen that change your life if ways you don’t expect. I believe we would also have been happy childless, but having a kid does open up a different realm.

Another thing to think about is that all kids are different. While some kids might be just fine traveling around, other kids need more stability and have a very hard time with change and stimulation. If you did decide to pursue children, that’s something to think about, because you may need to upend your plans depending on your child’s temperament and needs.

I absolutely agree with you, Jisel! Humans usually aren’t the best at predicting what will or won’t make us happy. Also a child will have unpredictable needs that will demand a high degree of adaptability. Thank you for your feedback!

I was fairly ambivalent about having a kid – was happy without kids but could also imagine having one (not two). But it was really important to my boyfriend to be a dad so I decided I was willing to try and see what happened and our son is just one of the most wonderful (and challenging) parts of my life. No regrets at all.

I’d also note that it has changed my relationship With my partner quite a bit and the last three years have been a roller coaster for both of us. We’ve learned a lot but it’s been rough. Still no regrets though and not all couples have such a rocky entry into parenthood, we’d also had a rough time at a previous major transition.

There is very little thought here about what to do if one or both of you develops a serious illness.. It’s great that your usual medical expense is $0, but relying on that is not sustainable. Even with really good health insurance (that you’d better make sure is portable) (Cigna and Bupa, I think have international options), there are lifestyle consequences to consider- like having to stay in one place, for years, for treatment. For example, a quick look for reputable statistics on the internet tells me that a man’s lifetime cancer risk is 1 in 2, a woman’s is 1 in 3, and that just about half of all first cancers occur before age 65 (20% of all between 35 and 55.). The good news is that, increasingly, cancer is something you can live with. Have a plan.

I want to add to this possibility: what happens if one of your parents becomes ill and the other parent needs your help and support? What happens if you have a child who has special needs? As you develop your plans, consider a few scenarios that would redirect your energy and focus–and make you grateful for the flexibility you have to adjust your goals.

Hello Alexa! Thanks for giving voice to at least two fears which play on my mind… Squash and I have discussed our willingness to support our parents should they become ill. Imagining a future of parenting a child with special needs feels more overwhelming than considering a parent’s illness. We are very grateful for the flexibility our FIRE strategy has cultivated for us. Ironically, our options also feed our ambivalence about pursuing more aggressive measures to grow our family.

Hello Cara! Thank you for the reminder about our lifetime cancer risk. I tend to worry more about chronic illnesses like diabetes and depression. As Mrs. Frugalwoods has observed, Squash and I imagine that some of the expenses we log by living in one place would be reallocated to expenses we currently don’t see as visibly now, e.g. health insurance or other health-related costs. When engaging in worst-case scenario planning, I imagine that if one of us became seriously ill, we’d park in a country with high quality of care and relatively low cost, e.g. Thailand, until our condition stabilized. I think more immediately about what we’d do if one of our parents became seriously ill. Would they be willing to join us abroad, or would we need to return to the US to provide in-home care they otherwise wouldn’t be able to afford/navigate? Thank you for the fair warning.

Would you please define financial independence. I define it as not needing to work and having adequate passive income to sustain one for the rest of their life, and that of a partner, if applicable

Richard, the definition you offer here is our goal. We’d like to have enough invested to forego the need to earn wages indefinitely. Btw, I thought I recognized your name. Thank you for your contributions to the Humble Dollar! I enjoy your posts.

Re: Tara and Squash’s parenting decision: I highly recommend the self-guided program outlined in “Motherhood: Is It For Me?” by Ann Davidman and Denise Carlini. (I believe there’s also a version for men.) It really helps understand and work through ambivalence about whether to have a child or not, and presents either outcome as totally valid. (And the program can serve as a precursor to professional counseling if that’s needed.) Gaining some clarity on the topic and working through any issues that might be lying under the surface is so freeing! And having a better handle on the decision one way or the other will free up mental energy so Tara and Squash can keep going after those FI goals!

Thanks for the recommendation, CVC! I l appreciate that most resources are targeted to women, but it would be helpful if there were more that addressed a couple’s decision-making process.

If you decide to stay in the house, definitely look into refinancing! Rates are super low right now and I’m guessing you could save a good amount of money in interest.

Thanks for the suggestion, betta! Again, ambivalence! Since we can’t figure out if we want to keep the house, hand it off, or sell it, I have been postponing investigating further. Squash and I attended a refinancing workshop (online) made available through our credit union, and the speaker implied rates could reduce further in 2021. Maybe my procrastination will register a win? 😉

Deciding to have a child is such a big decision. As such, I agree with Mrs. Frugalwoods, and I’d encourage Tara and Squash to seek out an online therapist together to figure out their answer to this question to come to a conclusion that brings them both peace and certainty. As someone who has battled infertility for years and pursued IVF to have a child, I have a lot of thoughts on this topic. I agree with Mrs. F- decide if you want a child and go for it ASAP or decide you don’t and close the door. Either option is completely okay, but follow your heart.

Erin, thanks for the clarity of your recommendation. Squash and I previously decided that we will not pursue aggressive fertility treatment. Rather, we are “open” to whatever happens. However, this openness has become wearisome for me over the past two years, as it feels like I am waiting for something to happen that never does. Honestly, it’s starting to remind me of how it felt when I was waiting to meet Mr. Right. Does it count as giving up if we give up and then hope for a surprise? (Kidding. My vote would say no.)

I truly feel for you about the weariness from waiting for something to happen and then it doesn’t. Every month. That in-between-waiting time is so grueling and emotionally exhausting. I understand that personally. I think that’s why it’s important to really decide if you want to pursue having a child or not and maybe stop waiting for a surprise. There are a lot of non-aggressive fertility options that don’t include IVF. You may consider meeting with a reproductive endocrinologist (fertility dr) just to have some labs run and get their opinion. Sometimes a small adjustment, a medication, or monitoring by a physician is what’s needed to become pregnant. Also, if you decide you don’t want to have a child, bravo to you for working through the emotions and coming to a clear decision together. All the best to you and Squash!

Tara- we came to a similar decision about having a 2nd child. My spouse and I both wanted a 2nd, but we did not want to go through the process of adoption, IVF, or anything like that. I did get pregnant and we have a lovely 2nd kid. I would not say that deciding to see what happens or doing “whatever it takes”, for lack of a better term, is giving up or is somehow a latent indication that we didn’t really want a kid.

Anyway, deciding to have a kid or kids is a personal choice. That being said, for us, having kids has been much much more fun than I ever could have expected and my only regret was waiting until I was older (I had my first at 35 and I’m the one who was pregnant) to start having them.

On the children question – I found the book Motherhood: Is it for Me by Denise Carlini and Ann Davidman so helpful. It might be worth a try. It helps you figure out what your desire is, and separates that from what parents expect / your partner wants / your peers are doing etc. I’ve been so confused by this question for a long time and this helped me gain clarity. My husband is also working through it and once he’s clearer we plan to talk about it and decide from there.

on your question about whether you should take a 50% pay cut… it’s difficult to answer because given you are in such a strong financial position I think it’s down to what you want, and what matters to you – high pay, more free time, a different kind of job? I would say it’s best decided based on what feels right once you’ve actually lost your job, which hasnt happened yet. But I agree with the commenter above that fully retiring during a pandemic might be hard.

Rebecca, your endorsement of Carlini and Davidman’s book is the second today! Unfortunately, my county library doesn’t have it. My next step is to message the librarian as sometimes the book exists but doesn’t show up in the catalog. I’m glad that both you and your husband have decided to engage with it.

Thanks for your encouragement regarding next steps should unemployment occur. If Squash continues working, I imagine that I will take a break to explore developing a virtual coaching business before initiating a local job search. My fear is that if I become unemployed, it may be difficult to find comparable (or any) work in the short- or long-term. However, this may be another example of a catastrophic thought. I have lots of practice with those. 😉

As every couple figures out what is right for them , the individual vs.joint accounts issues is a very personal decision. I understand separate accounts and having your own money to spend as you wish. They have chosen to both contribute the same amount to the household expenses.

However, of the monthly net income Tara makes 62% and Squash makes 38%. We have a similar % gap in in our household and we go by percentage rather than 50/50 to avoid having the higher income person with a higher percentage of disposal income and financial power.

Hello J! Thanks for raising this point. Ironically, Squash and I arrived at the opposite conclusion after what might have been a similar consideration! Our lifestyle could be supported (with considerably less savings per month) with either person’s full-time earnings. Beyond our shared household expenses, our (pre-pandemic) discretionary spending also is about equal per month. Our understanding is that any surplus becomes invested in a brokerage account. Because of this pattern, greater earnings don’t feed greater discretionary spending or power in decision-making. That said, I agree with you — every couple must figure out what’s right for them.

Jalama! I live in Santa Barbara. I only have a few comments, take them for what they are worth – from someone a decade older than you (or a bit more).

1. What should I do if I get laid off? First, cross that bridge when you come to it. Lots of brain power used with what ifs. It’s good to have a PLAN, but I wouldn’t stress over it. Your plan could be as simple as “take a month off, spend 3 months looking for an equivalent job. If no equivalent job after 3 months, look for a lower paying job.” If you are unemployed for 6 months looking and you like it…then maybe retire.

2. Kids/ no kids. I love my kids. They change your world. They are not for everyone. I was very much ambivalent about kids. I got talked into the first one, and then the second one came when I was 42. (Kind of an oops, after we’d given up.) Yeah, I’m not retiring anytime soon, but that’s more because I like my life right now. Our NW was probably equivalent to yours 10 years ago and it’s double that now. We could retire right now if we moved somewhere cheaper. I have many friends and family members who are blissfully happy without children. They are aged 40 to 70. They love being aunties and uncles. This is a choice that only you two can make.

3. The house. Again, cross that bridge when you come to it. If you had any intention of moving back into it, then consider keeping it. Otherwise, sell it. Where we live (SB), it’s hard to get into the market. If I left town I’d want to make REALLY sure that I don’t want to come back.

Agree totally on housing! It’s so hard (or impossible) to get back into the market in CA, and much of the west Coast…we’d rent ours out for a couple of years to make absolutely sure we weren’t planning to return.

You busted me, Marcia. I spend a lot of brain power on what-ifs and justify it as scenario planning. Your suggestion for any future lay-off sounds about right. Pause, then look for a job. If no one hires me, prolonged unemployment = retirement!

As for kids, this might be the rub. No one who has kids claims they regret them. Rather, the opposite abounds, which leaves me listening to others who regret childlessness. It’s reassuring though to read about your friends who are blissfully happy without them.

Not too long ago, a close friend also confronted me about the house. She pointed out that my idea to give my house to my parents might be a way to have my cake and eat it too. In other words, keep a home base without having to bear the cost of a mortgage or become landlords. Overall, your advice is very well received. I would benefit from more of a deal-with-it-when-it-comes attitude. Thank you for taking the time to offer feedback!

I have a different perspective on the kid debate. I never had a burning desire to start a family. I was, like Tara, ambivalent. Did I really need to have kids, or was that just what was expected of me? My husband was all in on kids though. I went through a few years of fertility issues and I always considered the option of just quitting and being child-free. Eventually we had a kid. It completely flipped a switch in me. I went from ambivalence about kids to wanting 4 children. (We have 3). Having a kid was the greatest decision I ever made. The only regret I have is that I did not do it sooner.

Coming from that perspective, I would ask myself these questions: What will you regret more? Not having kids or having them? Fast forward 20 years and imagine your dinner table after a holiday meal when you are 60. What/who do you want to see there?

There is no right or wrong answer to these questions of course. Good luck with your decision!

Hi AJ! Thanks for sharing your experience. I imagine that the same thing would happen for me, in terms of the ambivalence switching off. With no personal experience to back up this hunch, I believe pregnancy and/or motherhood changes women from the inside out, and who you are pre-kid isn’t the same person afterward. (Some of my friends who are mothers vehemently disagree with his conceptualization, so I accept this is my imagination) I also accept that I am very bad at predicting the future or what makes future me happy. I can imagine the holiday meal, but I also can imagine a young adult barely departing adolescence and all the challenges that entails. Thank you for this suggestion. I’ll keep imagining. 🙂

Here’s yet another perspective: My husband and I were both ambivalent and let nature take its course. We have a 6 month old who had a series of medical needs right away and has lifelong special needs. His life will never be easy, and he won’t live independently. I like him most of the time but I regret having a kid, and I wish that I had listened to the small voice that told me it was ok to be child free instead of the louder outside voices saying I’d be sorry if I didn’t.

I understand this is an unpopular opinion and I understand why. My kid will never know that I feel this way, and I’ll probably find my feelings fade with time, but you and Squash should discuss broadly if you would be okay with the way a special needs kid shifts your future trajectory.

Sarah, I hope that you have a community of support around you and your family always, a village.

Sarah, thank you for honoring us with your story. I shared your comment with Squash immediately upon reading it. We will follow through on your advice to discuss this possible future very intentionally.

As the mother of an 8 year old special needs child, I want to provide encouragement that it will get easier. It is devastating to learn that your child will never lead a normal life and definitely changes your life overnight. The first year was really rough, but you will adjust and find a new rhythm.

Although my 8 year old can’t walk or talk and needs assistance with routine activities, he has a smile that lights up the room which makes it all worthwhile. I’d encourage you to accept help whenever it is offered and don’t forget to make time for yourself as well.

Sarah that was very brave of you to share, especially as the comments are not the normal FW standard this time round!

AJ, I respect your decision. I don’t feel that the choice to have children is one that can just be done on what a person might regret more though because the stakes are much higher with the child who may enter a family that is not ready/suited.

Tara, I’m a similar age to you and going on family history would still be fertile (my mum was older than I am now when she had me). I’ve been ambivalent, especially when a divorce closely followed a miscarriage a few years ago. It’s a very hard and personal decision, and I feel like you in that keeping the door open to ‘maybe’ can leave you in limbo emotionally and practically. I am 95% happy with the recent decision to finally put aside motherhood as an option in my mind.

You may feel differently but there a lot of comments on this post and the world in general about how motherhood embraces you once it happens, so I wanted you to know a different opinion.

I’m also really impressed with how gracious you are being with some of the comments, which aren’t meeting the usual Frugalwoods supportive standards in my opinion. I think this has much more to do with how mixed up people are feeling with the global situation and not totally about your decisions and thoughts.

Victoria, I’m glad to read about your contentment with the recent decision to foreclose the option. I agree that our current global situation has made optimistic people doubtful and those who identify as pragmatic (me) potentially cynical if they don’t guard against its encroachment. A couple of friends recently called me to share news of their pregnancies and it was hard to hear them express uncertainty about their choice to bring a child into a world so punishing. I imagine that when the limbo becomes more uncomfortable than an alternative, I will make a choice to take action or let go. Thank you for your compassionate reply not only to me but also Sarah and AJ.

Sarah, your comment broke my heart. Thank you so much for sharing your story – I hope that it inspires others to listen to themselves about what’s best for their family, and I hope your situation gets easier and you find joy.