Rebecca and Robert are newlyweds living with their two cats in Washington, DC. Rebecca works in environmental sustainability and Robert is in donor relations at a non-profit. Their ultimate goal is to buy a home in a rural area with lots of natural beauty and the opportunity to grow their own food. They also have dreams of traveling full-time in the future–perhaps with their future young children. Right now, they’re living in a one-bedroom apartment in the city and want our help mapping out their next move.

What’s a Reader Case Study?

Case Studies address financial and life dilemmas that readers of Frugalwoods send in requesting advice. Then, we (that’d be me and YOU, dear reader) read through their situation and provide advice, encouragement, insight and feedback in the comments section.

For an example, check out the last case study. Case Studies are updated by participants (at the end of the post) several months after the Case is featured. Visit this page for links to all updated Case Studies.

Can I Be A Reader Case Study?

There are three options for folks interested in receiving a holistic Frugalwoods financial consultation:

- Apply to be an on-the-blog Case Study subject here.

- Hire me for a private financial consultation here.

- Schedule an hourlong call with me here.

To learn more about one-on-one consultations with me, check this out.

Please note that space is limited for all of the above and most especially for on-the-blog Case Studies. I do my best to accommodate everyone who applies, but there are a limited number of slots available each month.

The Goal Of Reader Case Studies

Reader Case Studies highlight a diverse range of financial situations, ages, ethnicities, locations, goals, careers, incomes, family compositions and more!

The Case Study series began in 2016 and, to date, there’ve been 91 Case Studies. I’ve featured folks with annual incomes ranging from $17k to $200k+ and net worths ranging from -$300k to $2.9M+.

I’ve featured single, married, partnered, divorced, child-filled and child-free households. I’ve featured gay, straight, queer, bisexual and polyamorous people. I’ve featured women, non-binary folks and men. I’ve featured transgender and cisgender people. I’ve had cat people and dog people. I’ve featured folks from the US, Australia, Canada, England, South Africa, Spain, Finland, the Netherlands, Germany and France. I’ve featured people with PhDs and people with high school diplomas. I’ve featured people in their early 20’s and people in their late 60’s. I’ve featured folks who live on farms and folks who live in New York City.

Reader Case Study Guidelines

I probably don’t need to say the following because you all are the kindest, most polite commenters on the internet, but please note that Frugalwoods is a judgement-free zone where we endeavor to help one another, not condemn.

There’s no room for rudeness here. The goal is to create a supportive environment where we all acknowledge we’re human, we’re flawed, but we choose to be here together, workshopping our money and our lives with positive, proactive suggestions and ideas.

And a disclaimer that I am not a trained financial professional and I encourage people not to make serious financial decisions based solely on what one person on the internet advises.

I encourage everyone to do their own research to determine the best course of action for their finances. I am not a financial advisor and I am not your financial advisor.

With that I’ll let Rebecca, today’s Case Study subject, take it from here!

Rebecca’s Story

Hi, Frugalwoods! My name is Rebecca, and my husband Robert and I are both 29 and live in Washington, DC with our two cats. We both currently work full-time – I work in environmental sustainability and Robert works in donor relations for a non-profit. We met on day one of college over 10 years ago (even though we grew up living close to each other, we didn’t meet until we both moved to DC!) and have been together ever since. We were married earlier this year in a beautiful setting in New England and embarked on a two-week road trip through the Pacific Northwest for our honeymoon.

Hobbies

The main hobby we do together is hiking. We love spending our weekend days in the woods either in DC or in nearby Maryland, Virginia, or West Virginia. Robert is an avid homebrewer and volunteers as a little league baseball coach, and I can never have too many books in my ‘to be read’ pile. I also adore swing dancing (although this has been on hiatus with the pandemic), and volunteer as a tutor during the school year. We enjoy cooking together and both come up with ideas and love to eat, although Robert does most of the cooking and I do most of the cleaning. With the extra time spent at home during COVID, we ventured into making sourdough, kombucha, pickling, and homemade sodas and jam. We also love traveling – we’ve been to 3 countries and 24 states together and have a very long travel bucket list. The main thing that prevents us from traveling more often is our lack of paid time-off.

Our Dreams

We’re starting to think about growing our family from the two of us and our two cat children, to ideally add a few human children. Our dream is to leave the professional workforce when our future children are still young and to travel with them around the world together.

A few years ago, I was traveling with a friend in South America and we met a family with three young boys (I think they were 10, 7, and 4) who were almost done with a year-long trip around the world. Hearing about their experience and seeing their boys so happy, nearly fluent in several languages, and so well adapted to their lifestyle was incredible. Since then, we’ve been fascinated by the idea and have been following other traveling families for continued inspiration.

We’re not sure what would come after that adventure, but maybe moving to a small house in the woods and homesteading. We dream of a large vegetable garden, a small orchard, and acres of woods we can preserve. I studied abroad in Europe in college and my host family had a huge apple tree in front of their house. Once a year, they invited the entire community to join them as they pressed the apples into fresh cider. It was such a fun community experience and nothing beats homemade cider all year long. Both of us also grew up with vegetable gardens at home and I’ve recently had the opportunity to manage the community garden at work. What could be better than to eat (and drink) fresh produce every day that we’ve grown ourselves?

Another dream is buying an RV and traveling around the country to visit all the national parks. Robert also dreams of seeing a game at every Major League Baseball stadium. We started camping during the pandemic and have loved the low-cost opportunity to explore the national and state parks throughout the mid-Atlantic.

What feels most pressing right now? What brings you to submit a Case Study?

Now that we are married, we’re trying to work through what is next for us.

Because of all of our big dreams, we’d like to make sure we’re setting ourselves up for success on whichever paths we choose to pursue. We definitely want to retire early, and I think the most realistic goal for us is coastFIRE, which we understand as saving enough in our retirement accounts within the next few years to allow us to stop contributing and leave the professional workforce. We’d also like enough saved in cash to be able to take off completely and travel for a few years. When we return, we would both start working part-time jobs in fields we love – ideally at a brewery for my husband and at a science center for me. We’re both gaining experience in these chosen paths now and the goal would be to make enough money working part-time to cover our annual living expenses while being able to spend a lot of time with our children during normal day-to-day life as well as traveling.

We’re leaning towards coastFIRE because we want the flexibility of not working full-time, but we aren’t sure our dream is to stop working completely. From what we can see, a lot of the FIRE bloggers we follow continue to work in some capacity after achieving FIRE, so if coastFIRE can get us to a similar place significantly faster than full FIRE, then that is an important consideration for us!

What we’re really struggling with is our next steps–especially as it related to housing–before we achieve coastFIRE.

The way we see it, we have three options for housing:

1) Continue renting in DC:

- We’re happy in our current rent controlled, one-bedroom, month-to-month lease apartment and if nothing changed, we could see ourselves continuing to live here for the foreseeable future.

- Pros: We like our apartment and our neighborhood, know the staff in the building and haven’t had issues with management, and have enough space for the two of us and our cats to live comfortably. Renting also provides us with significant flexibility over a house.

- Cons: Lack of outdoor space, a tiny kitchen (less than 20 square feet), no dishwasher, and no space for family to stay when they visit. Plus, if we grow our family, we would consider moving into a two-bedroom apartment, which could significantly increase our rent. Although we think we might be able to manage to stay in our one-bedroom plus den apartment with one child.

2) Buy a house in the DC metro area (probably the DC suburbs as we’re likely priced out of DC itself):

- Last year we were convinced this was the right move – to the point where we put in an offer on a house in June – but we’ve been reconsidering this.

- Pros: More space to grow our family, a larger kitchen, a yard, and space for our parents and siblings to stay when they visit. This would be especially important if we have a child. We also would not need to leave our current jobs.

- Cons: Real estate costs in the area would likely mean maxing out our budget on a house that needs work or doesn’t meet all of our needs, moving away from the conveniences we enjoy in the city without the benefits of living in a rural area (lower costs, access to outdoors spaces), and knowing that we dream of traveling and living in the woods, not living in the suburbs.

3) Buy a house in the woods:

- One of our dreams is to buy a house where we can create a small homestead.

- Pros: Living closer to places we can hike and enjoy time outdoors, spending ‘home time’ outside, and growing some of our own food.

- Cons: Moving out of the DC metro area would require significant life and job changes and we have a bit of decision paralysis about the exact location we want to move. Also, if we’re considering starting a family, making two large lifestyle changes at once – and potentially moving further away from my parents – could be overwhelming.

What’s the best part of your current lifestyle/routine?

We enjoy living in DC – we love our apartment, we have good friends here, and we both enjoy our jobs. We are able to walk to a farmer’s market, we have an enormous diversity of restaurants at our fingertips, and we’re able to get to concerts, theaters, and ball games all via public transit or walking. Apart from the COVID years, we have been able to travel every year. When we’re close to home, we spend a lot of time hiking and exploring the natural spaces around us.

What’s the worst part of your current lifestyle/routine?

The uncertainty about what’s next. We’re quickly moving into a phase of life where our friends and siblings are getting married, buying houses in the suburbs, having children, and settling down. While we’ve gotten married and are considering children, the thought of settling down in DC is daunting.

Real estate is so expensive that it could mean doubling (or more) our monthly housing and commute costs. We’ve looked at a lot of houses, run the numbers with a mortgage lender, talked with a realtor and friends that own homes about their additional costs, etc. We’ve also considered significantly compromising on the areas where we want to live, but we’re not sure we’re willing to do that.

Also, in considering where we want to end up long term, we know we want to move to a rural area eventually. While we both grew up in the suburbs, we consider the suburbs to be the worst of both worlds – away from the conveniences of the city and without the benefit of being surrounded by natural spaces (no offense to those living in the suburbs 😉).

The issue is, neither of our jobs would be willing to have us be full-time remote, which means we would need to find remote jobs or jobs near wherever we choose to live. We are both fairly new in our jobs due to both of us being laid off from our previous jobs last year (thanks, pandemic budget cuts). I’ve been at my current job for just over a year and Robert at his for just under a year – and we don’t want to start over again quite yet after the stress of our unexpected job hunts last year.

That said, neither of us are in our ‘dream’ jobs. I really enjoy my job and most of the people I work with, but I do not like–and have some ideological differences with–the organization where I work. Despite the organization, though, I think the work I’m doing here is important and making a small but positive impact on the world. Robert on the other hand, works for a non-profit doing incredible work with some wonderful co-workers. However, while his role in donor relations is essential for the organization, it’s not his preferred type of work.

We also haven’t decided exactly where we want to settle down. In considering proximity to family, weather, cost of living, proximity to mountains and the ocean but also cities for conveniences like airports, etc., we have a few ideas, but none are a clear winner.

Plus, knowing that we want to travel full time at some point and that our families live elsewhere – my parents are in the mid-Atlantic and Robert’s family (and the rest of mine) are in New England – makes us extremely hesitant to put down that significant of an investment at the moment.

Where Rebecca and Robert Want To Be in Ten Years:

Finances:

- We want to be happily semi-retired.

- We want to be able to work where we want, when we want, while knowing that we’ve already saved enough for retirement and only need enough money to cover our daily living expenses.

Lifestyle:

- I’d love to be either actively traveling full-time or recently returned from doing so.

- Other dreams include living on a small homestead or in an RV traveling the country.

Career:

- If we’re working, I’d love to be working part-time somewhere I can teach kids about nature and the outdoors.

- Robert would love to work part-time at a brewery.

Rebecca and Robert’s Finances

Income

| Item | Gross Income | Deductions & Amount | Net Income |

| Rebecca’s income | $7,725 | 403b contributions: $1,716.25 Pre-tax transit: $50.00 Taxes: $1,639.36 |

$4,319 |

| Robert’s income | $5,333 | 401k contributions: $1,653.34 Healthcare: $593.17 Taxes: $582.90 Pre-tax transit: $10.00 |

$2,504 |

| Monthly subtotal: | $6,823 | ||

| Annual total: | $81,875 |

Debts

| Item | Outstanding loan balance | Interest Rate | Monthly required payment |

| Car Loan | $10,572 | 2.99% | $325 |

Assets

| Item | Amount | Notes | Interest/type of securities held/Stock ticker | Name of bank/brokerage | Expense Ratio |

| Rebecca IRA (includes rolled over 401k and TSP from previous jobs) | $81,109 | I do not touch this account | 90% stock, 10% bond including VTI (83%), VXUS (7%), BND (7%), BNDX (3%) | Vanguard | VTI 0.03%, VXUS 0.07%, BND 0.03%, BNDX 0.07% |

| Rebecca Taxable Investment Account | $41,201 | I add $1,000 monthly | 90% stock, 10% bond including VTI (83%), VXUS (7%), BND (7%), BNDX (3%) | Vanguard | VTI 0.03%, VXUS 0.07%, BND 0.03%, BNDX 0.07% |

| Robert IRA (includes rolled over 401k from previous job) | $39,868 | Robert does not touch this account | 90% stock, 10% bond including VTI (83%), VXUS (7%), BND (7%), BNDX (3%) | Vanguard | VTI 0.03%, VXUS 0.07%, BND 0.03%, BNDX 0.07% |

| Robert Taxable Investment Account | $39,438 | Robert adds $1,000 monthly | 90% stock, 10% bond including VTI (64%), VXUS (8%), BND (5%), BNDX (3%), VOO (18%), VYM (3%) | Vanguard | VTI 0.03%, VXUS 0.07%, BND 0.03%, BNDX 0.07%, VOO 0.03%, VYM 0.06% |

| Rebecca Savings Account | $39,000 | This is emergency fund and additional cash | Earns 2.25% interest right now | Capital One | NA |

| Robert Savings Account | $36,023 | This is emergency fund and additional cash | Earns 2.25% interest right now | Capital One | NA |

| Rebecca Current 403b | $24,896 | I max out my contributions to this account and receive a 10% match from my employer; the offerings are very limited. If/when I leave this job, I’ll move this into my IRA for the better expense ratios. | QCBMPX and QCSTPX | TIAA | QCBMPX 0.28%, QCSTPX 0.29% |

| Robert Current 401k | $10,160 | Robert maxes out his contributions and receives 0% match for his first year of service, then 8% per year (starting Feb. 2023 for him), and will be vested after three years of service. | FXAIX (80.8%), FXNAX (9.75%), FTIHX (9.44%) | Fidelity | FXAIX 0.015%, FXNAX 0.025% , FTIHX 0.06% |

| Robert Taxable Investment Account 2 | $3,857 | Robert’s parents started this account when he was in high school and just transferred ownership to him – we need to move it to Vanguard. The balance is at a low point given the market right now – does it make sense to switch it to Vanguard now or wait until it recovers? | Pioneer Select Mid Cap Growth Fund A | Amundi | 0.99% |

| Rebecca Checking Account | $1,500 | This is where paychecks are deposited and bills are paid from | Earns 0.10% interest | Capital One | NA |

| Robert Checking Account | $1,140 | This is where paychecks are deposited and bills are paid from | Earns 0.10% interest | Capital One | NA |

| Total: | $318,191 |

Vehicles

| Vehicle make, model, year | Valued at | Mileage | Paid off? |

| Subaru Impreza 2017 | $18,300 | 41,000 | No, the amount I owe is listed under section 3. Valued at number is based on KBB valuation of a standard model at $16,500-18,300, but we have a limited model so I assume it’s at the higher end. |

| Total: | $18,300 |

Expenses

| Item | Amount | Notes |

| Rent | $2,181 | Includes annual renter’s insurance |

| Travel | $775 | This is significantly higher than most years (esp. considering pandemic years) because of our wedding/honeymoon travel, traveling for other weddings (this is our busiest wedding year), and the first time we’ve ever done a significant group trip with friends (meaning we didn’t have full control over costs) |

| Groceries | $483 | Includes some cleaning supplies |

| Car Payment | $325 | |

| Restaurants | $188 | |

| Gifts | $120 | Higher than a normal year due to multiple bridal showers, bachelorette parties, and weddings this year, plus the normal small birthday and holiday gifts for family |

| Cable and internet | $119 | Includes cable and internet; we need to find a way to get this down, but our building only provides access to two companies and they raise prices every year |

| Household supplies | $110 | Includes toiletries, toilet paper, hardware supplies, some cleaning supplies, the occasional upgrade or organizational tool, and supplies for the occasional DIY project |

| Car Gas | $81 | |

| Activities and entertainment | $80 | Includes tickets (ball games, theatre, etc.) and occasional camping supplies |

| Pet | $75 | Includes food, litter, and vet visits |

| Clothes | $66 | |

| Car Insurance | $60 | Paid biannually, averaged monthly |

| Taxes and other life admin | $58 | |

| Car expenses | $39 | Includes annual registration and parking permit, servicing, other parking, etc. |

| Laundry | $33 | Our building charges $4 per load (we hang dry about half our clothes to help lower costs) |

| Cell phone service | $27 | Rebecca recently switched to Ting (5 gigabyte plan based on observed usage). Robert is still on his family plan, but we plan to switch him to Ting too, meaning this will double. |

| Personal Items | $20 | Occasional visit to a bookstore, hair cuts, etc. |

| Subscriptions | $14 | New York Times and Disney+ (Rebecca’s family shares Disney+, Netflix, and Hulu, with the others paying for those plans) |

| Monthly subtotal: | $4,854 | |

| Annual total: | $58,248 |

Credit Card Strategy

| Card Name | Rewards Type? | Bank/card company |

| Rebecca:Capital One SavorOne Cash Rewards (affiliate link) | Cash Back | Capital One/ Mastercard |

| Robert: Discover | Cash Back | Discover |

Rebecca’s Questions For You:

-

Homemade Pizza with Spent Beer Grain Should we buy a house or keep renting?

- If we continue to live in DC but don’t buy, will we regret not doing so if we end up staying in the area for another 5+ years?

- Other considerations: if we don’t buy now and wait until after we travel, our understanding is that it will be very difficult/impossible to get a mortgage if we don’t have a steady source of W2 income. On the other hand, if we own a house and then decide to travel for an extended time, we’ll need to consider what to do with the house when we’re gone and consider the possibility that traveling could change our priorities and we may not want to return to the house we own.

- What is the best way to save for a goal – such as traveling full-time – that might be 5-10 years away?

- We have our money in high-yield savings accounts, but should we invest that money since we expect it to be some time before we need it?

- Considering we have a lot in cash right now, should we pay off our car even though the interest rate is low?

- If the decision is to not buy a house and continue renting, another option could be to invest anything above our emergency fund in our Vanguard taxable investment accounts.

- How do we determine how much we should save when the future is uncertain?

- We’re planning significant life changes – children, buying a house/RV, traveling full-time, etc. How will we know when what we’ve saved is enough? How soon might that be (the sooner the better 😊)?

- With us being so young, how can we possibly estimate how much money we will need in retirement in order to feel comfortable leaving our full-time jobs in the professional workforce?

- Is there anyone in this community that has transitioned (with children or not) to full-time travel?

- Any guidance on how much to save and how to know when you’re ready to take the leap would be much appreciated!

- What are peoples’ experiences with coastFIRE?

- What might be some unexpected challenges we should be aware of? And is it worth putting off coastFIRE for a few more years in order to achieve full FIRE?

Liz Frugalwoods’ Recommendations

Rebecca and Robert are on the precipice of a new life and I can feel their exuberance coming through the screen. They want to embrace the whole world and do it all. I love their enthusiasm and their desire to plan. However, many of their questions don’t have a right or wrong answer as many of them are questions of discernment. I can’t tell them what to do with their lives, which path to choose or whether that path will make them happy. I can outline different financial scenarios in light of their different goals, but only they can determine what to do with their time and money. And I have every confidence they will do so beautifully! With that in mind, let’s dive in.

Rebecca’s Question #1: Should we buy a house or keep renting?

It depends.

Something that jumps out at me are Rebecca’s repeated mentions that they don’t want to live in the suburbs. Yet, they’re considering buying a home in the suburbs. I wonder if this interest in home-buying stems from a sense that they should buy a house? That buying a house is the route to wealth building and proper adulthood? I encourage them to interrogate their interest in buying a home since they’ve articulated that the suburbs are not where they want to live.

Rebecca makes a salient point that it can be harder to get a mortgage if you don’t have a W2 job since banks do not seem to like or understand FIRE (and often don’t take assets into consideration–only incomes, which is ludicrous, but a fact). However, again, we’re back to the root issue: why buy a home in place you don’t want to live?

Could this be a rental property?

Of course one reason to buy a home you don’t want to live in is to turn it into a rental. I’m not super familiar with the rental landscape in the DC suburbs, but I imagine it’s probably pretty good given the proximity to the city. If Rebecca and Robert are interested in purchasing this home with the intention of turning it into a rental, that could make a ton of sense.

They’ll need to explore the viability of this idea:

- How common are rentals in the areas they’re looking at buying a home? How many units are rented versus owned?

- Would they be in a Home Owner’s Association (HOA) with rules/restrictions regarding renting out your home?

- What is the tenant population? In other words, who would be interested in renting their home?

- What is market rate rent for the area? Does this include utilities, lawn care, snow removal, etc?

- Would they manage the rental themselves or hire a property manager? If so, how much can they expect to spend?

And also evaluate these financial considerations:

-

Hiking in Shenandoah Will rents keep pace with the mortgage, taxes, insurance, property manager fees, repairs and maintenance?

- What will your net return be each month?

- Do you have enough cash for a robust maintenance reserve (for when the roof needs to be replaced, the boiler dies and the stove breaks all in the same month)?

- Do you have enough cash to cover vacancies and tenant transitions?

I encourage Robert and Rebecca to dig into this research and see what they come up with. It might be that the areas they’re targeting are fabulous rental propositions and that this could be an excellent cash-flowing venture for them.

If It’s Not A Rental…

If the numbers don’t pan out for this home to be turned into a rental, the impetus to buy seems much less attractive. It’s tough to break even (let alone make money) if you sell a home soon after purchasing it, so I can’t say I’d ever recommend someone buy a home in a place they know they don’t want to live.

This Is Too Many Changes at Once (IMHO)

Stepping back a bit and looking at the holistic overview Rebecca provided us with, I think she hit the nail on the head when she said, “…if we’re considering starting a family, making two large lifestyle changes at once – and potentially moving further away from my parents – could be overwhelming.” I 100% agree.

Rebecca and Robert are considering making four different seismic changes:

- Having children

- Buying a home in the DC suburbs

- Traveling full-time

- Buying a home in a rural area

As Rebecca noted, #2-4 are in conflict with each other and #1 makes everything more complicated. Wonderful, but vastly more complicated. I know that I personally wildly underestimated how transformational having children would be to my life, my time, my money and my priorities.

Regarding Children and Travel

If it were me, I would have the children first and then see how I felt about traveling with them full-time. There are families who do it with infants, but most of them have already been full-time travelers–in other words, they didn’t start traveling when they had a baby, they were already traveling and had a baby along the way. There are so many unknowns in this recipe that I encourage Rebecca and Robert to eliminate/pare down as many variables as possible ahead of time.

Theoretical children are compliant, happy, colic-free and sleep through the night from birth! Actual children have, uh, very different ideas about what comprises a good time… “3am screaming party in my criiiiiibbbbbb! Everybody’s invited because I woke up all the neighbors after pooping myself awake! WOOHOOO!! Also I need to eat again. Please ignore the fact that we just had this party at 1am and will have it again at 5am.”

Then there’s the question of school once the kids are kindergarten age. There are plenty of road-schooling/homeschooling options, but that is yet another variable you can’t know until you have the kids. Another thing to bear in mind is that, when the kids are older (say age 5+), they’ll be able to actually appreciate the travels and won’t just nap through the entire Grand Canyon. Plus, they’ll have three months off every summer along with a number of week-long vacations throughout the school year (my kids have a full week off every December, February and April).

Buying A Rural Home

This is another area ripe for research for Robert and Rebecca! She noted that they “…have a bit of decision paralysis about the exact location we want to move to.” Rural does not mean the same thing to everyone and it certainly does not look the same in every state/region. I encourage Rebecca and Robert to dig in on what rural means to them and what type of property they’d love to have. Your region matters a lot when you go rural because, unlike the largely homogeneous American suburbs, rural areas vary WILDLY. This will also be a chance to do lots of fun AirBnB weekend explorations! My husband and I had so much fun traipsing around Vermont for several years investigating different areas and visiting tons of available properties/homes. You can read my series documenting our search here: The Frugal Homestead Series.

I’ll also add that renting out a rural property is often a tough proposition. It’s unlikely you’ll be able to cash flow it, although if you’re ok with losing some money, you can likely find a caretaker-type person who will look after the place for you in exchange for nominal rent. Again, this is region dependent, but often there isn’t as much infrastructure–or tenant diversity–for managing a rental in rural areas.

However, if you buy in a desirable area–say, near a ski resort or hiking trails–you might be able to AirBnB a rural place, provided you can find someone local to manage your AirBnB. This seems to be the major sticking point for a lot of folks I know who want to AirBnB a rural place–there’s no one to clean it, turn it over and manage renter relations. That’s one of the major reasons why we decided not to pursue putting an AirBnB spot on our property–I do not want to spend my days cleaning another house!

Rebecca’s Question #2: What is the best way to save for a goal – such as traveling full-time – that might be 5-10 years away?

Early and often. I jest, but in reality, the best way to save money is to do just that: save it. The vehicle it’s in is always secondary to your ability to not spend it. And Rebecca and Robert are doing this splendidly! In general, if you anticipate needing money within a ~5 year timeframe, you want it to be in either a high-yield savings account or something short-term and guaranteed, such as a government bond. You likely don’t want to invest this money in the stock market because it’s entirely possible you could lose money in that short timeframe. Investing is a long-term proposition that does not favor pulling money in and out of the market.

Let’s take a look at Rebecca and Robert’s full asset rundown:

1) Cash: $77,662

Between their four different checking and savings accounts, they have $77,662. Since they only spend $4,854 per month (v. frugal!), this means they have almost 16 months of living expenses in cash. This makes them overbalanced on cash, which Rebecca noted. If they were targeting having only an emergency fund in cash, they’d want to reduce their cash position to somewhere between three months worth of their expenses ($14,562) to six months ($29,124).

The reason to not keep excessive cash lying around is the opportunity cost.

Cash loses value every day since it doesn’t keep up with inflation. Plus, when you’re overbalanced on cash, you’re missing out on the potential investment returns you’d enjoy if your money was invested in, for example, the stock market or a rental property. Hence, the crux of Rebecca’s question is whether or not they need to keep this much money in cash, which is something only they can answer.

Consider:

→If they want to buy a house in the near-term, they will absolutely need this much cash (and likely more).

→If they want to quit their jobs and begin traveling full-time in the near term, they will absolutely need this much cash (and likely more).

Conversely:

→If they want to continue renting for the next ~10 years and THEN retire (fully or partially) to a home in the woods and/or to full-time travel, then it’d probably be wisest to invest this money.

Where to Keep This Money

Definitely in a high-yield savings account. Robert and Rebecca have their cash spread out over four different accounts, which is three too many accounts in my opinion. Unless there’s a compelling reason–for example if they intend to keep their finances separate permanently–I strongly suggest consolidating to ONE high-yield account. They have a Capital One account earning 2.25%, but there are accounts earning even higher percentages right now, such as the American Express Personal Savings account, which–as of this writing–earns 3.30% (affiliate link). That means that in one year, their $77,662 would earn $2,563 in interest!! Woohoo!

2) Retirement: $156,033

Let’s see how they’re doing according to Fidelity’s Retirement Rule of Thumb:

Aim to save at least 1x your salary by 30, 3x by 40, 6x by 50, 8x by 60, and 10x by 67.

Since Robert and Rebecca are almost 30, they should have 1x their combined gross incomes, which is ($7,725 + $5,333 = 13 058) x 12 = $156,696. In light of that, they’re right on track for traditional retirement.

3) Taxable (non-retirement) Investments: $84,496

Very well done! Since Robert and Rebecca have completed the first three steps of financial management:

- No high-interest debt

- A fully-funded emergency fund

- Maxing out their retirement accounts every year (which in 2023 is $22,500/year per person)

They wisely opened taxable investment accounts! And as Rebecca herself pointed out, “If the decision is to not buy a house and continue renting, another option could be to invest anything above our emergency fund in our Vanguard taxable investment accounts.” I couldn’t have said it better myself.

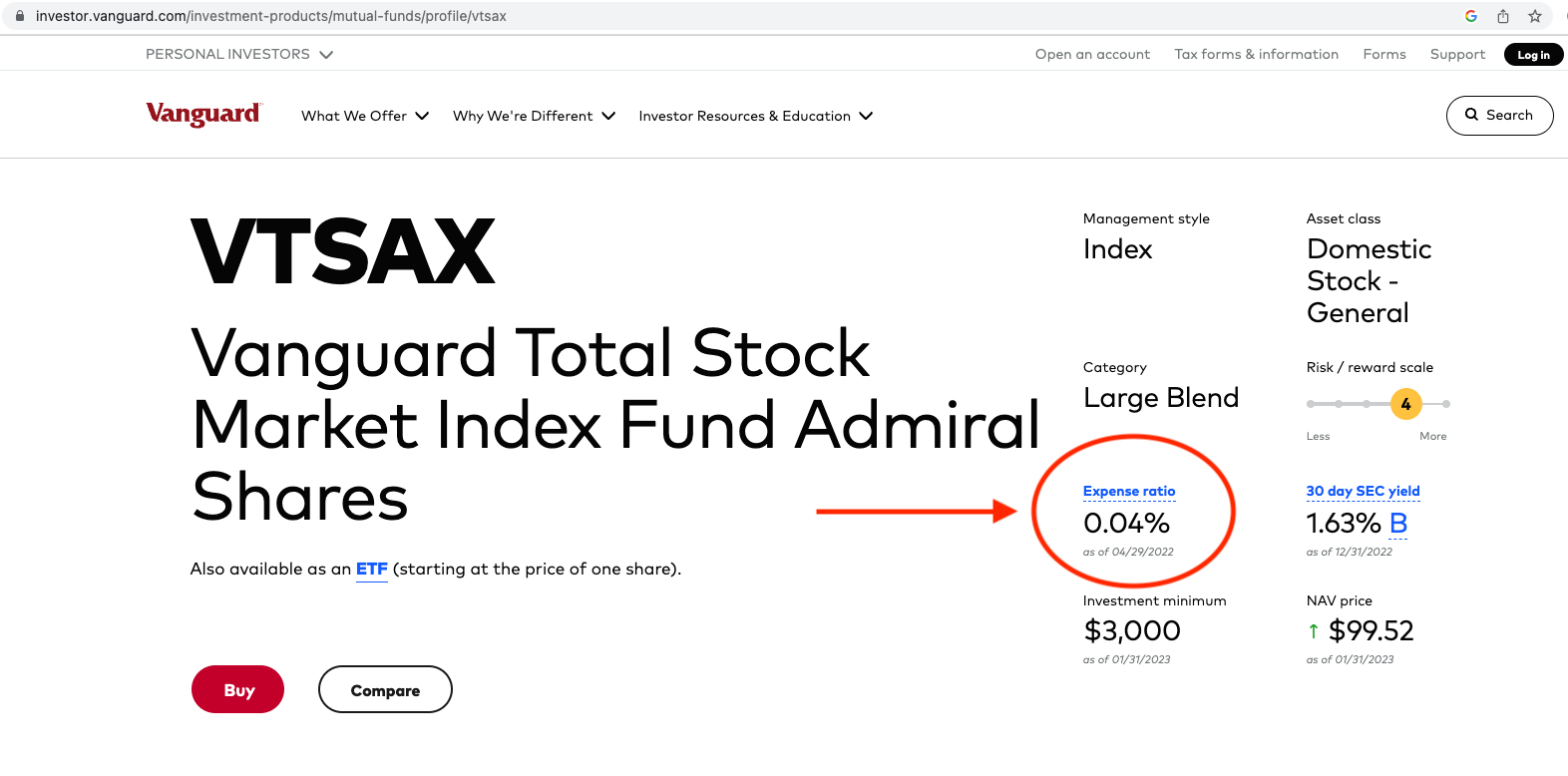

Expense Ratios

Rebecca and Robert get an A+ on selecting investment funds with low expense ratios. Expense ratios are the percentage you pay to a brokerage for investing your money and, as they’re fees, you want them to be as low as possible.

As Forbes explains:

“An expense ratio is an annual fee charged to investors who own mutual funds and exchange-traded funds (ETFs). High expense ratios can drastically reduce your potential returns over the long term, making it imperative for long-term investors to select mutual funds and ETFs with reasonable expense ratios.”

In light of their importance to one’s overall long-term financial health, I encourage everyone to locate the expense ratios for all of your retirement and taxable investments and ensure that they are low! Here’s how to find an expense ratio:

- Google the stock ticker (for example: “VTSAX”)

- Go to the fund overview page

- Look at the expense ratio.

Screenshot below for reference:

- Fidelity’s Total Market Index Fund (FSKAX) has an expense ratio of 0.015%

- Charles Schwab’s Total Market Index Fund (SWTSX) has an expense ratio of 0.03%

- Vanguard’s Total Market Index Fund (VTSAX) has an expense ratio of 0.04%

You can also use this calculator from Bank Rate to determine what you will pay in fees over the lifetime of your investments, based on their expense ratios. If you find that your investments have high expense ratios, it will be well worth your time to investigate whether or not you can move them to lower-fee funds. This is not always possible with employer-sponsored 401ks/403bs as you’re beholden to whatever funds your employer offers. But, it’s always worth looking through all available funds to select the ones with the lowest expense ratios.

This brings me to another tidbit Rebecca asked about:

“Robert’s parents started this [investment] account when he was in high school and just transferred ownership to him – we need to move it to Vanguard. The balance is at a low point given the market right now – does it make sense to switch it to Vanguard now or wait until it recovers?”

The key consideration here is the “cost basis” for this stock. That’s what you originally paid to buy the stock. If the stock is worth MORE than the cost basis, this is considered a capital gain and selling it will be a taxable event. Conversely, if the stock is worth LESS than the cost basis, it’s considered a loss. So, if Rebecca and Robert want to transfer these stocks over to another brokerage (through what’s called an ACATS), they’ll want to first determine the cost basis and whether they’ll be posting a capital gain or loss, which will determine the amount they’ll need to pay in taxes. For more on this, check out this article from Charles Schwab: Save on Taxes: Know Your Cost Basis.

Rebecca’s Question #3: Considering we have a lot in cash right now, should we pay off our car even though the interest rate is low?

I mean, the interest rate on the car loan is really low (2.99%), but the balance remaining ($10,572) is also really low in light of their cash position. This decision hinges on whether or not they’re going to buy a house in the near term. If Rebecca told me, “We are definitely buying a house in the next ~5 years,” then I’d say not to pay off the car loan because they need the cash for a downpayment. My advice would be exactly the opposite if they’re not buying a home in the near term. 2.99% is low, but it’s still money being lost every month to service this debt.

Rebecca’s Question #4: How do we determine how much we should save when the future is uncertain?

“We’re planning significant life changes – children, buying a house/RV, traveling full-time, etc. How will we know when what we’ve saved is enough? How soon might that be (the sooner the better 😊)?”

As I noted above, these are four discrete goals that contradict each other somewhat and have very different price tags. Again, I suggest Robert and Rebecca spend the next few years isolating the variables:

- Have kids (assuming you definitely want kids).

- You’ll know A LOT more about your family and your goals once the babies are born.

- Buy a house in the DC suburbs or don’t.

- Determine if it can be purchased now and transitioned into a cash-flowing rental later.

- Research locations for your rural homestead.

- Determine purchase prices and local or remote job opportunities.

- Travel or don’t.

- Determine if the house(s) can be rented while you travel.

- If they can’t be rented, this becomes a tough proposition of paying for a home you’re not living in. That math only works if you’re a multi-multi-multi-multi millionaire.

In terms of how much money is needed to fully FIRE, there’s debate about this, but the most commonly sited rule of thumb is the 4% rule. What this means is that you need to have enough in investments to be able to withdraw 4% of those investments annually to cover your living expenses. Here’s how that math would work for Robert and Rebecca:

Their expenses = $58,248 annually

It always comes back to what we spend, doesn’t it? That’s why I harp about the need to track your spending. It’s impossible to know how much money you need for retirement (or anything else) if you don’t know how much you spend. I use and recommend the free expense tracker from Personal Capital because I like to automate everything I possibly can (affiliate link).

If Robert and Rebecca want to continue spending $58,248 annually (assuming increases for inflation), they’d need an investment portfolio of ~$1,470,000 as 4% of $1,470,000 = $58,800. This is pretty basic, back-of-the-envelope math, but it provides a rough sense of their FIRE (financial independence, retire early) number.

Their current assets = $318,191

They’d need to save and invest another $1,151,809 to reach their FIRE number of $1.47M. Of course, the less you spend each year, the lower that number. However, I always caution against cutting it too close. Better to have more than you anticipate needing than less! Rebecca asked how long this will take to reach and the answer is based on how much they can save and invest each year. If they attack it from both sides of the equation–earn more and spend less–they’ll get there faster.

Another Option: CoastFIRE

Rebecca said they might be more interested in reaching CoastFIRE as opposed to full FIRE, which she correctly identified as earning enough each year to cover all of your expenses, but not enough to contribute anything more to your retirement and taxable investments. The idea being you can quit your full-time job and transition to something with way fewer hours (and lower pay). Then, you let your investments “coast” and continue to grow in the market until you want to fully retire at a more traditional retirement age.

Rebecca said that neither of their jobs allow for fully remote work and so, I wonder if they’ve considered finding jobs that do? Most white-collar jobs these days do allow for (or even require) primarily remote work, which would be wonderful for either full-time travel or living somewhere rural.

Summary:

-

Cat 1 and 2 Spend the next few years isolating your variables and refining your goals:

- Have kids (assuming you definitely want kids).

- You’ll know A LOT more about your family and your goals once the babies are born.

- Buy a house in the DC suburbs or don’t.

- Determine if it can be purchased now and transitioned into a cash-flowing rental later.

- Research locations for your rural homestead.

- Determine purchase prices and job opportunities.

- Travel or don’t.

- Determine if the house(s) can be rented while you travel.

- If they can’t be rented, this becomes a tough proposition of paying for a home you’re not living in. That math only works if you’re a multi-multi-multi-multi millionaire.

- Have kids (assuming you definitely want kids).

- A lot of your questions can’t be answered until you know the answers to these four questions.

- Don’t fret–you’re doing all the right things to enable your goals. Continue:

- Living below your means

- Maxing out your retirement accounts

- Investing in your taxable investment accounts

- Consider consolidating all of your cash into one high-yield savings account

- Commit to researching all of the avenues we discussed today and enjoy the process!

- You’re at an exciting juncture and I can’t wait to see what you decide to do next!

Ok Frugalwoods nation, what advice do you have for Rebecca? We’ll both reply to comments, so please feel free to ask questions!

Would you like your own Case Study to appear here on Frugalwoods? Apply to be an on-the-blog Case Study subject here. Hire me for a private financial consultation here. Schedule an hourlong call with me here, refer a friend to me here, or email me with questions (liz@frugalwoods.com).

The advice to have kids first is a good one. I would also not underestimate the importance of being near family & established community in the first few years. Also not knowing what the Fertility journey could look like- some get pregnant on the first try, others have a longer road, others spend thousands trying to conceive. So I wouldn’t assume that step 1 of their plan will be easy or complication free.

Not to be discouraging but just offering some realism.

If it were me, I would look into buying an RV or camper that can facilitate travel, sray in that STEAL of an apartment and start working on getting pregnant. You can enjoy the travel in the meantime, and then you can try some shorter excursions and work up to longer ones eventually.

But you have a lot of amazing things going on right now that many people would desire….I wouldn’t trade the good life you have, the opportunities you’ve created, for a dream of something that looks idyllic from the outside but is actually quite challenging to achieve.

Agree 100%!

Some goals don’t have as rigid a timeframe as getting pregnant can. As you put it you can manage in the apartment you have with a baby when you start to get your sea legs and come out of that first foggy year you will probably know better what you want to do next. And it’s wonderful to have family close by during that time.

Totally agree! As a mom with two young kids, being near family who can offer support with childcare and just general helpful, loving company is EXTREMELY valuable. From an emotional and a financial stand point.

Even without children, being near family is lovely. It makes spending time with them easy, and you don’t have to eat up vacation time from work in order to do it.

I agree with the having kids first. They have done lots of travel without kids already and seem ready to begin their family.

It occurs to me that it would actually be easier living with a baby in a 1-bed apartment than it would be backpacking around the world with a baby. So if you have a baby and can’t handle being in a one he’d apartment with baby, you probably won’t enjoy being stuck in a camper van or on planes trains and automobiles with baby either.

I wonder how the whole “world traveling with kids” works regarding sleeping arrangements. When my dh and i look for hotels now we don’t feel confident letting our kids sleep in a hotel room on their own so we have to look specifically for large hotel rooms which can be hard to find.

Our parents started taking my brother and me on international vacations when we were 9 and 5. They would always book apartment rentals and we’d have a “home base” from which to take day trips. I’m not sure how they set this up back in the 90s, but nowadays there’s Airbnb and VRBO which are perfect for families. I agree that it would be challenging with very young children, though.

There is a YouTube channel called GoWithLess, they also have a Facebook group which is more active. It is all people who have FIRE’d and travel full time. They have some great information on spending and the cost of travel along with travel hacks.

Thanks for the suggestion! We’ll have to check that out!

Congrats on your choices so far. A few thoughts: 1) it seems really significant to me that you all have a rent controlled apartment; that seems to tip the balance to not buying given your future desire to move away 2) I totally agree on the wait and see approach post kids. I traveled throughout Latin America pre-kids and saw ex pat families with babies, assuming I’d want the same post-kids. My need for security and support post kids led me on a different path. So, just a note that things can change. 3) Lastly, I live in the close-in DC suburbs (right over the MD line). There are some not soul crushing suburbs that are less expensive than DC. My area is walkable, close to transit, lots of access to nature,etc. I wouldn’t say it’s “affordable” and I don’t know anything about rentals, but just a note that if you do decide to buy, “suburbs” aren’t a monilith. Good luck with all your decisions ahead!

The rent controlled apartment has been a huge help – before moving into it, we were in a non-rent controlled unit and they tried to increase our rent 12% that year. We quickly decided that any future apartments would be rent controlled. That said, rent still goes up every year based on the CPI (landlords are allowed to raise it CPI%+2% with a max of 10%), so over time, it can climb significantly.

Good point on the suburbs – not all are as soul crushing as the ones we’re most familiar with! Since the DC metro extends far into MD and VA, we could definitely take another look at some walkable communities that aren’t in DC proper. Thanks for your insight!

Just want to wish Rebecca and Robert well with their future plans. They seem to be in a great place financially and have a lot of interesting ideas. Twenty years ago, my wife and I didn’t want to put down roots in a car-centric suburb either so gave DC a try. We’ve managed to raise three kids in a relatively small house and have friends who have stayed in apartments with their families. I’ve really enjoyed living in a walkable neighborhood. If you do decide to buy, perhaps you could take a look at Baltimore. It’s much more affordable than DC these days and many commute by train into Washington a couple of days a week for their in-office days at work.

Agreed, there are some very lovely family-friendly neighborhoods in Baltimore (Locust Point, Riverside come to mind) that are a fraction of the cost of DC and situate you very close to BWI (and frankly, Dulles has become more accessible via metro now, along with DCA, PHL, and EWR, or heck, take the train up to NYC and fly out of JFK or Laguardia!)

Right now interest rates are at such a high that buying a house will cost a lot compared to few years ago. It will probably make more sense to wait until your family grows and you need the space – by then you may have a different idea of what you want to do and where you want to live.

What you want to do with your life is wonderful; however it’s worth noting that in order to get there you will have to make sacrifices now for at least the next 5-10 years as you can’t travel extensively (or full-time), and at the same time save enough money to have invested for the future and also travel extensively (in the future, with several kids!).

Something to keep in mind for the future, when you do travel, you can rent your home to a visiting professor/researcher, but you have to play the landlord. We did that in Boston when we traveled overseas with our teenage kids for 9 months a year.

But you can’t have it all now as you also have to save aggressively for your future lifestyle (check Mr. Frugalwoods’ book – very inspiring!). Good luck on your amazing journey!

I agree having kids first is a good idea. Then you can gauge how much you value being close to family, and how comfortable you are with the idea of travelling full-time with little kids. My husband and I had our first baby while living in a one bedroom (without a den) apartment in DC — which was not a good living situation for us post-baby. We moved to the VA “suburbs” when he was 6 months old. I think Rebecca and Robert are probably familiar with the DC area suburbs since it seems like they grew up there, but if they haven’t spent much time there recently I’d encourage them to go explore some neighborhoods. We rented half of a duplex (3 bedrooms, two baths) for $2250 (so not a lot more than they are paying in DC right now) in Alexandria, VA for three years. We had a cute little backyard, enough space for family to stay when they visited, and were able to walk to lots of places. We’ve recently relocated for work and to be closer to family, and are now in more of a traditional suburb that is nearly as walkable. I can’t tell you how much I miss being able to walk to a bunch of parks, the grocery store, a few restaurants, and being a short (free!) bus ride from Old Town Alexandria (which I would honestly not even call a suburb given how much is on offer there). It’s also much easier to get to know your neighbors with higher population density and when people are walking around more imo. I think the rental market in that area is quite good too, though current mortgage rates may make it a little difficult to turn a place you buy now into a profitable rental.

Totally agree, Kari! I’m from the DC suburbs (Virginia side) and there are definitely walkable communities that have a very “city” feel. Alexandria, Clarendon, Vienna, Falls Church/Tysons. These were all legit towns before they became suburbs, so it’s pretty different from the stereotype of McMansions on cul-de-sacs. (Though we have those too!)

If Rebecca and Robert are thinking of buying in the DC area, they should check out the PBS show “if you lived here.” Each episode takes on a different neighborhood in and around DC. And you get a good sense of the housing market too!

I just wanted to say that having a baby in a one bedroom apartment is totally doable. We lived in a one bedroom until our son was almost 2. He slept in a crib in the corner of our bedroom. Like Mrs. Frugalwoods said, having a baby is a huge transition. If you decide to have a baby sooner rather than later, it sounds like staying in your apartment for the time being would make your life easier.

I came to say the same thing. It wasn’t my personal experience, but my sister and her family had their first baby in a 1 BR. they turned the walk in closet into the baby’s “room” and just moved most of their clothes out of the closet and into their dressers. They moved to a 2 BR when they were expecting their second child and their first was about 2 years old. It’s doable for many families, even if you wish you had more room.

At least there’s no need to rush a move before the baby is even on the way.

Agree. We haven’t even used the nursery yet at 12 months. AAP recommends room sharing at least 6 months ideally a year, and since my baby still gets up at night we don’t plan to move her out yet. Totally doable in a one bedroom!!

I kind of wonder if they should consider a short term leave of absence from their current roles and try full time traveling for three months. There is job risk for doing such a thing, so they’ll need to weigh the pros/cons, but it would be a nice way to figure out that variable.

Agree with this 100% I found at 30 that four months was long enough to travel and after that I wanted home comforts.

I often dream of full time travel with my kids, but I think the reality would be very difficult. My 7 year old likes stability and I’d feel guilty taking him away from school and his home. We moved countries when he was 4 (England to Ireland) and it took him a year to get over the upheaval. Everytime he got tired and emotional, he said he wanted to go back home. I’d love to get an RV to travel in the holidays though.

I love hearing all of your lovely ideas for the life you want to live, it’s making me very nostalgic for that “precipice” time in my own life. 🙂 It also reminds me of what I think of as the Sylvia Plath FOMO Fig Tree quote: https://www.goodreads.com/quotes/7511-i-saw-my-life-branching-out-before-me-like-the

Not to induce disappointment at the impossibility of pursuing every wonderful idea you have, but hopefully to offer comfort that it’s part of the human condition to want to pursue every path and wonder what might happen differently if you make different choices.

Great quote. On one hand, it encourages a very practical approach to decision-making. On the other, it kind of squashes dreams and forces the reader to recognize that time, energy and resources are finite… and that ‘doing it all’ may very well be impossible or come at a cost. But doing nothing is worse!

I say: don’t stop dreaming (and trying new things), but definitely question your motives! Society likes to fool us into think we want something that we don’t actually want.

To the frugalwoods: this was the first case study that resonated with me because they want to do a lot of things I want to do and they are asking themselves the same questions I am asking myself. It was an interesting read! Thanks for posting.

What a perfect quote, Abby! It definitely resonates with our situation – I very much feel like we’re stuck trying to figure out what to do right now. It’s difficult to know where to start, but I’m hoping we might be able to grab a few of the figs/dreams, even if we adjust them as we go 🙂

I will come for the defense of the suburbs. Much like rural areas, there are many many suburbs. My small New England town is 1 hour to Boston and Providence (ideal for commuting and high paid work) but contains many types of neighborhoods. We have tiny 1/3 acre lots and cookie cutter colonial neighborhoods while I live on 2 acres with 1 visible neighbor and 3 sides abutting permanent conservation forests. I can drive 5 minutes to Target and 4 minutes to my parents but I can also hike for an hour or two out my front door. I can’t truly homestead (though I could have chickens and a large garden if I wanted) and we’re considering some fruit trees. There are a lot of kids activities and we escape to the woods camping/to our cabin when we want more space. Just something to consider that all suburbs aren’t equal!!

The rent controlled apartment in DC leapt off the page when I read it. You love it, the location etc. It sounds like your life would be pretty great especially with room enough for a new baby. Love the RV idea as a practical way of satisfying your travel goals. You’re a young couple with the world at your feet and time to decide as your lives change. Change is the one thing you cant count on. Congratulations!

If I were you (I’m a mom of young kids), I would 1) STAY in that rental. Kids do NOT need a lot of space, especially babies. You don’t need all the gadgets. Minimize your stuff if you have to. Especially if you want to travel, I would not buy right now. 2) Pay of the car. Just do it. That’s a monthly payment you can reallocate back to savings. 3) As Liz said, have the dang kids! They may or may not change everything. We started camping after kids and it’s a sloooow adjustment. You need to figure out what you need when traveling/camping with kids, and it’s certainly a journey. 4) Once you start traveling (or not), THEN consider buying a house. You’ll know where you want to be because the kids will have a big impact on how you feel about that decision. Best of luck! I wish we would have been into the “frugal” lifestyle before kids.

I second the suggestion to pay off the car immediately!

I’d definitely try to stay where you are. Why buy in the suburbs if you don’t like them? If there really isn’t any scope to buy even a small place where you want to be, then just continue renting!

Even if you got pregant tomorrow, you’d have minimum 18 months before a child was walking so you don’t need a garden yet. Cross the bridge when you come to it!

There hasn’t been any mention of possible daycare costs, which is high in this area. When my kids were little, the childcare cost was as much or more than our mortgage. Another item to consider is commuting times if you move to the suburbs and where that childcare will be – near your house or your work.. I live in the DC suburbs in Virginia and honestly, I love it. Within a 15 minute drive I can get to any type of restaurant you can imagine, there is a farmers market on the weekend, and we have parks galore. I can walk to the library and elementary school. I even have a small garden in my townhouse backyard. But before I worked remotely, my commute was awful and I didn’t have great work/life balance. Getting to the city on the weekend is a breeze, but not during rush hour. If you did choose to buy them rent later, it probably won’t be hard to rent out a home. In my neighborhood several people rent their townhouses. We have a lot of government/military folks that want to rent for 2 or 3 years and then move. I think in reading your case study it may be best to stay put (avoiding a commute) and keep saving until you do have a child. Priorities and finances can shift a lot after children!

We had our first two kids inside the Beltway and I still tell everyone that it is the BEST place to have Littles. Free Museums? Check. Public Transportation? Check. More playgrounds and splash pads than you can ever visit? Check, check. Did one of our kids sleep in a closet for a bit? Yes. Did my husband and I give up the bedroom and sleep in the dining room at one point? Also, yes. But when they are little, it’s totally doable and I think, worth it. (For the longest time, our oldest thought the Hirshhorn was a craft store because of their storytime crafts. I loved that!)

That said, we did eventually move out of the area because they don’t fit in closets forever and there’s no way we could purchase a house and we had no interest in moving out and having a 2+ hour round trip commute. So I feel ya on that one. (Also, sign up for daycare and preschool about a year out. Ask me how I know! Ugh!)

There are so many fun decisions to make here and I wish Robert and Rebecca all the best. It is an exciting season in life and there is no rush. Since they sound close to their families, one (very future) idea I want to throw out there is considering some sort of co-living arrangement with family members or grandparents. I’ve found that retirees (at least the ones in my family! 🙂 desire similar kinds of freedom and flexibility and this might be mutually beneficially down the road. We are considering it with some of our family members now and I’m a little sad I didn’t think of it sooner! Good luck!

I traveled full time for 2 years before I was married. I got married and had a kid who is now 10. I always kept thinking it would great to travel as a family, but to be honest, it wouldn’t have been best for my daughter. We do take regular trip and “post pandemic” have begun traveling more with her, but her need for good friends and a consistent education and a hometown really outweighed the desire to travel. It is on deck for non school weeks though! Child care is a HUGE expense. Huge. It’s not that you can’t afford it, but it will change some of your financial calculations for the future depending on when in your journey you have babies. Lastly, I have a condo in a rural ski town in NH (which we also unexpectedly moved to from the suburbs in 2020 and aren’t leaving!) and although we do rent it out on Airbnb sometimes, we do as many seasonal and monthly rentals as we can. It’s very common to have a 6 month rental in ski towns that are easily accessible to larger cities. And I have 2 1 month rentals lined up for other parts of the year. You don’t HAVE to have turnover every few days. Also note – you could live in that rural condo and upgrade later to something else, keeping it for rental or selling it when you upgrade. Also, kudos for planning ahead!! As a nearly 50 year old, the only regret most of my friends have is not doing more and taking chances when they were younger. That will NOT be you!! The biggest regret you can have is never making a decision – you are both so thoughtful in your planning that even if you look back and think you COULD have done something slightly differently, you will not have regrets about your decisions. Enjoy and pat your self on the back!!

My experience lines up almost exactly with Alison. We have one daughter, and she also has a “need for good friends and a consistent education and a hometown”. So much so that we bought an RV with dreams of spending Summer 2023 on the road traveling America and then realized that our 12 year old might actually die if she can’t see her tween friends 😉 So we’ve compromised with a 2 week trip at the beginning of summer vacation, a month back for summer camp and hanging out with friends, the last month of summer vacation is one long trip.

Rebecca, you and your husband are terrific savers and you will do well. If you do choose to travel with children I recommend at younger ages. Before the school years you’re not beholden to the school calendar. But they can’t walk as far, so there are always pros and cons. Best Wishes!

I agree! As someone who is just a few years older than Rebecca and Robert and who has had/still has similar life goals, I wouldn’t make any of them without first having children (if that is the #1 priority in all the scenarios – sounds like it is). It will radically reshape any of the other priorities, even if you still hold them as life goals. I’m from Portland, OR (nice pic of multnomah falls! did you check out oneonta?), and currently live in Richmond, VA with my husband and kindergartener. While many of my goals in life have stayed even after baby (although many of them have disappeared as I’m sure any parent will tell you), the way to get there couldn’t be foreseen pre-baby AND the ways I thought I might get there and timelines it would take pre-baby, radically shifted post-baby anyways. Moral of the story: ALL OF IT WILL CHANGE!!!! And I (personally) wouldn’t recommend making any major decisions until after this one (assuming it will happen in the next couple years – if not, maybe feel free to make another big decision in it’s place?)

Another thing to mention: having a baby is expensive, even if it is done the cheapest way possible (pregnant on the first try, zero complications, etc). Depending on your insurance, I would have at least 10k in reserves per child (even more if your insurance isn’t great) if you plan on having a baby or two in the next couple of years. I had my son with great insurance, mild complications and got pregnant after my husband looked at me, and it was ~$7k almost 6 years ago. I have a friend who just gave birth a couple months ago and it was ~$13k for them to have their 2nd (with decent insurance). Maybe ask around to different people you know who might be comfortable sharing how much it cost them to have a child? Could be a good data point to include in your calculations.

Best of luck and I would be happy to share more in person, or over the phone if you’re interested. We’re frequently up in DC (check out King Spa speaking of suburbs) and sounds like we have similar goals, hobbies, etc : ). Best of luck and look forward to reading the update in a year +

Thanks for input and for mentioning the costs of actually having kids! We know its a cost to expect (and have seen the example estimates that insurance companies provide with their plan options), but it’s always helpful to have actual numbers.

Multnomah was beautiful! We hiked the loop behind Multnomah and over to Wahkeena, but only spent that one day in the gorge before heading to Mt. Hood. We’d love to go back and spend much more time in that area – and all of Oregon – if we can!

As far as D.C. suburbs, check out Riverdale Park, specifically the neighborhood between LaFayette and 51st on the north side of East-West highway. Economic development is BOOMING and you can walk and ride a bike everywhere: Hyattsville Arts District, playgrounds, parks, brew pubs … the purple line is coming through, the green line is walkable, the MARC train is right there, lots of tech jobs, the university is nearby so you could easily rent out when you are done. There are so many trails nearby, for walking and biking … We lived there for several years and loved it. You still get all of the urban vibes without the small-apartment city life. Riverdale Park has its own police department and they do have some rules around renting, which is honestly great because it keeps the neighborhood nice.

Thanks for the tip! We’re not too familiar with that area, so we’ll have to check it out!

I’m sensing a great deal of exuberance about “getting on with life” and making some foundational changes, but not really any specific passion for one destination vs. another. I can definitely sympathize with feeling So Ready for change! However, until there’s a clear winner for what changes to make, I’m voting for a mental deep dive while standing still in the sunny spot you currently occupy.

With creativity and effort, you can have nearly anything you want! But you probably can’t have everything, at least not all at once. Kids are a total game changer. I’m not sure I’d advocate for kids first unless you’re 100% sure parenthood is your path and you’d be willing to adjust (or possibly curtail or give up) your other desires to fit around it.

This – 100%.

You’re on point there – now that we’re married and nearing the 10-year mark in our careers, we are ready for what’s next, but stuck figuring out what that is! I’m not always the most patient person, lol, but from reading all these comments, it’s clear that a pause and a deep dive is what’s needed. Thank you for weighing in!

One thing not yet mentioned that jumped out at me is that in your response to the question of where you want to be in ten years, you did not mention children. There is certainly nothing wrong with opting not to have them (that’s the path I took, myself). But it is a massive life decision to make, and I’m wondering whether you are ambivalent. I’d suggest making that decision first, and then map out the next few years once you’ve decided whether or not children are part of the equation. Best of luck to you — I love your positivity and the great life you’ve created for yourselves so far!

I wouldn’t buy if I were you. It sounds like you don’t actually want to buy, you are just considering it because of fear that you might not be able to buy in the future. Fear is not a good basis for decisions.

That travel dream would be closer if you moved to a cheaper apartment. A little further out and that $2100/month rent could be 1500 (or less if you stick with one bedroom). I know you think you don’t like the suburbs, but there’s more nature out in Maryland and Virginia than you might think.

Keep in mind that when you each work part-time, you may not be able to get insurance as a benefit, and it is expensive !

My advice is to do nothing major in the next 3 years. Keep working, lower your cost and save, a lot. Put those monies in a short term easy access. While doing that, build on skills you need to improve your options. Learn how to brew, get the skills you needs for whatever the future bring. You are now full of hope and wishes, don’t act on impulse. Wait a bit , try some stuff until you feel more certain of the road you want to travel.

In considering proximity to family, weather, cost of living, proximity to mountains and the ocean but also cities for conveniences like airports, etc., we have a few ideas, but none are a clear winner.

This sentence sounds almost identical what my partner and I have been considering when looking at places to live long term and in retirement – three other factors that are high on our list but not mentioned here are access to medical care, a strong local food/agriculture scene and some cultural offerings. We currently live in Western MA which ticks many of this boxes, but are thinking our long term locale will be south western NH. It ticks almost every box except weather, but as lifelong New Englanders we’re willing to suck that part up. Southwest NH gives us easy access to I-91, lots of local outdoor activities to enjoy in the immediate area as well as the mountains and beach within day trip distance, low COL via no state income taxes (including on pensions and social security), it is close to our family who are primarily in Massachusetts. Keene and Brattleboro both provide some nearby cultural amenities and we particularly enjoy Keene for its bookstore, cute shops, local restaurants and international market, for airports we’d be easily accessible to Bradley/Hartford via 91 or to Boston (or even NY if really needed) for larger flights, and there are decent regional hospitals as well as all the facilities in Boston should anyone have a major health issue. We do like that there are lots of college towns, as we find they often bring cultural amenities to an otherwise “small town area” and get you that hybrid of some city amenites and small town living without feeling like an overpopulated suburb.

Y’all are in such an awesome position, way to go! We are on a very similar trajectory but maybe a couple of years ahead. We are mid-thirties with a three year old planning to get to coast FIRE when she’s 6 and then rent out our home in Austin for extended RV travel. Our travel style has changed a lot since becoming parents and we made the decision to travel less internationally while she is young and plan for full time round the world trips closer to age 8-10. Right now we’re testing and scaling (just bought a tiny fiberglass rv), investing a lot and enjoying the stability and help of having grandparents nearby. I don’t think you can underestimate the benefits of a walkable neighborhood with a baby, hello stroller walks! really think y’all can have it all and you’re poised for a fabulous decade (and more) ahead. I recommend moneyflamingo.com for coast fire with kids perspective.

Congrats on being so close to coast FIRE! It does sound like you’re on a very similar trajectory so it’s reassuring to hear that you’re finding a way to make several dreams become a reality! A walkable neighborhood is definitely a priority – we started going on several walks a day during the pandemic to make sure we were getting out of the house and some fresh air, and now its a very ingrained part of our routine. I can only imagine it’d be important to continue with a baby!

Thanks for sharing and for the recommendation, we’ll have to check moneyflamingo out.

I can’t relate exactly to your specific goals, Rebecca (except the distaste for the suburbs lol) but I do feel like I’m in a similar time of life. For context, I’m 30 with a toddler, I also live in an apartment in very high COL area.

My thoughts:

1. There is a hidden cultural message that when you have a child, you should have a house, and the only people who raise children in apartments are people who have no other choice. This is ridiculous. Many millions of happy children are raised in apartments. You do not need a house to have a child. Don’t live somewhere that you don’t want to be unless you have a VERY good reason and an exit plan. I would 1000% rather be close to my support system than be far away in a house. Living in a small apartment in a dense urban environment does have downsides but being isolated with a baby is worse. Practically speaking, you can easily have one child in a 1+1 apartment but two children in that space is tight unless your den (or primary bedroom) is really big.

2. You have a lot of dreams. That’s great! Many of your dreams cannot happen simultaneously (and I know that you know that.) It might be helpful to reflect on what dreams you want to accomplish first. Maybe in your 30s the goal is to have a child and accomplish coastFIRE. Maybe in your early 40s you’ll take a year to travel the world when your child is about 8 or 9, then buy a rural property and an RV. Not everything has to be done now, and most of your dreams (owning property, traveling, owning an RV, seeing baseball games) can be accomplished by spending money, so as long as you HAVE money when you’re that age, you pretty well can do what you want. You don’t have to do everything when you’re young.

Reading this blog as a European, the cultural difference when it comes to housing definitely stands out. Many functional and happy kids are raised in apartments here 🙂 my bf even shared a room with his sister and they turned out just fine

We were in a similar (half the investments as we were new immigrants but just purchased an apartment in downtown area with a plan to eventually turn it into a rental) situation before we had our daughter when I was 29 (4.5 years ago). Honestly, if I could go back, I would delay having kids. It adds a layer with childcare costs, less time, money and energy. We’ve been able to keep up with saving but not at the same rate. Also, as we were at the beginning of our careers, we have not been able to advance as quickly as we would have when we didn’t have a kid. We stayed in our apartment (2 BR) for 3 years with our daughter but ended up buying a house as we just needed extra space (COVID definitely played a role in this), backyard and all the appealing amenities in downtown weren’t as important anymore.

I think if you are able to delay it even for 5 years you would be in a more comfortable place and have more options available for your family. Then you can also do more research into homesteading, travelling full time, etc as with kids it’s harder to find the time and brainspace to do this.

Just something to consider with all the good advice Mrs. Frugalwoods has already given you!

My suggestion would be to make sure to travel together as a couple before any baby comes to get that out of your system. As many others have stated, you don’t know how parenthood is going to change you nor do you know the baby you get. So travel and try out some of that before. Maybe take a sabbatical and do the RV thing? Then, have the baby and check in with yourselves what you feel is the next step. 🙂

I would like to respectfully disagree with Liz and say travel FIRST then have kids! You are both still so young, sounds like you really want to keep exploring–I’d say take a mega-trip and then re-evaluate and see if you still want to have kids! Seems to me it is way too early for you to have kids. That being said it is just my opinion from interpreting your tone, do what feels best to you obviously. It appears travel is pulling strongly on ya though. 🙂 As a fellow travel bug I encourage you to go do that!

Second this. Prioritize whatever is most important, but consider that could be traveling for right now.

What’s the parental leave like with your jobs? If you can both get paid parental leave while you’re in your current jobs, what a great thing before you go part-time somewhere.

I love the exuberance and the sense of possibility, and I also read some romanticizing in your descriptions–you’re visualizing the apple orchard and the community gathering and traveling with happy kids, but maybe not the labor involved in those lifestyles.

As someone who was in your position a few years back and now has the baby and the house in the suburbs, I hope you can savor this sweet and temporary inflection point in life. Enjoy your urban lifestyle and affordable rental! Travel and cook and hike as much as you can! Continue saving, and don’t introduce unnecessary complexity in your life (e.g., by buying a house in a place you don’t want to live) until you have to. The path will reveal itself, especially after you have kids.

Good luck! You have an exciting future ahead of you.