But it only costs $20! Or $10. Or even just 5 measly bucks. So what’s the big deal? It’s remarkably easy to lull myself into thinking that a couple dollars spent here or there won’t amount to a hill of beans (oh but there are so many things one can cook with a hill of beans… ).

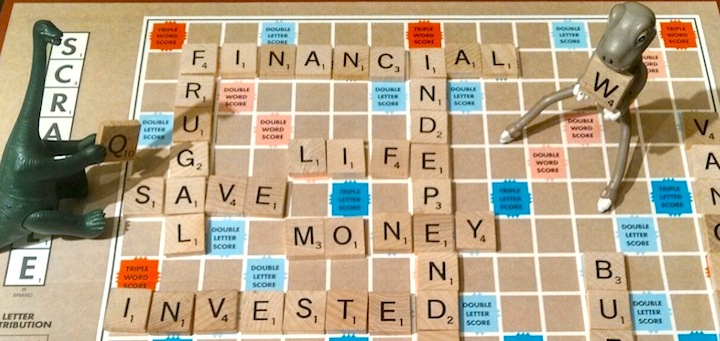

When I start to think this way, I remind myself that frugality is a compounding game. Or more accurately, money is a compounding game: either it compounds in your favor if you’re saving and investing (gold star!), or it compounds to your detriment in the case of debt (sad face, boo).

Rarely do our financial decisions exist in a vacuum. Rather, our spending habits are ingrained grooves that we repeatedly grind along. Whether it’s as catastrophic as continually maxing out credit cards we have no ability to pay off or as pedestrian as shopping every week at an expensive grocery store (cough Whole Foods cough); we are what we repeatedly buy. And our ultimate financial destiny is enshrined in the spending decisions we make on a daily basis.

But I’m no a devotee of onerous, multi-part budgets or time-intensive coupon cutting ordeals. No indeed. My easy trick is to simply embrace frugal habits, which provide a lifetime of savings with very little effort. I’m all about efficiency and repeated, autopilot frugality is by far the most efficient means of not parting ways with your money.

Don’t Sweat The Small Cents

In the vast ocean of money-saving tips and tricks, how does an emerging frugal acolyte decide where to start thrifting? Easy, my friends. Focus your frugal energies on reducing–or ideally eliminating–your continual, repeated expenses.

After you comb through every dollar you spend in a given month (I recommend using Personal Capital for this task), isolate the things that crop up on a regular basis. For most folks, these repeat offenders are things along the lines of: groceries, household supplies, insurance, haircuts, custom-made guinea pig outfits, restaurant meals, clothes, chainsaws… you know, the everyday stuff of life.

By reducing (or banishing) your spending in these “repeat offender” categories, you’ll permanently lower your overall spending each and every month. As you’re performing this expense review, don’t get caught up in the “necessities” mindset and simply gloss over something like an astronomical grocery bill thinking it’s a sacred cow. Yes, food is a necessity, but expensive food is most certainly not.

This might require changing your mindset or your approach–for example, if you have a haircut that’s entirely too complex to cut at home, then your might consider transitioning to, well, a more manageable haircut. This is the lifestyle shift element of frugality. It’s not only about spending less, it’s also about creating a simpler life where your require less money in order to achieve happiness.

Banishing Repeat Expenses: The Haircut Edition

One of my fave examples of a repeated expense are haircuts. Why? Because most people get haircuts and most people pay for them. And given the fact that hair continually grows, most people find themselves paying for thousands of haircuts over the course of their lifetime. What if I told you that I’ll let you in on the one secret trick to snaring free haircuts for the rest of your life? Ok, it’s not actually that much of a secret–all you have to do is cut your own hair at home (or have a friend/partner/spouse cut it for you).

When I first started cutting Mr. Frugalwoods’ hair at home four years ago, I couldn’t predict just how much money this would save us over the course of a month, a year, or a lifetime. In retrospect, that’s exactly what I should’ve calculated, if only for my own affirmation. Now in hindsight, I can perform this favorite exercise of mine: calculate how much we’ve saved over the years.

For his very first buzz cut (the style my main man rocks), Mr. FW trotted off to the barber and slapped down $23 for his ‘do. As anyone with a buzz cut will tell you, this is an absurdly high price for two reasons:

- Buzz cuts are not a difficult style

- S/he who has a buzz cut must get said hair buzzed approximately twice a month in order to not appear shag-a-riffic*

*technical term

Hence, we can bust out our frugal calculator (which, by the way, is the same calculator I’ve used since high school) and do a bit of figurin’:($23 per haircut x 2 haircuts per month) x 12 months in a year = $552. Not bad! Oh but wait, we’ve been DIY buzzing for four years now, which gives us a grand total of $2,208 saved, which is more money than we typically spend in two months’ time. Dang, people.

Now we did have to purchase these Wahl clippers for our buzzing escapades, but this one-time expense of $18.99 has paid for itself many times over.

Change Your Mindset: Save $$$!!! Yay.

Hold onto your garage sale-sourced seats because we don’t just DIY Mr. FW’s haircuts, we DIY mine too. Being a lady, who previously wasted waaaaaaayyyyyy too much money/time/effort on my appearance, I used to indulge in $120 (that’s with tip included) haircuts four times a year. For those of you following along with your frugal calculators (or your epic math brains) I spent an embarrassingly high $480/year on my hair. Yikes.

I was a slower convert than Mr. FW to the DIY cut. I basically delayed getting my hair cut for close to a year because we’d commenced our extreme frugality regime and thus, I didn’t want to get my absurdly expensive salon cut. Nor did I see the point in spending $20 at a cheaper joint when I knew we could cut it at home for $0. But I had to first change my perspective. I’d previously dropped so much dough on my grooming because I was under the mistaken impression that I needed to. I went through an entire process of disavowing perfectionism–especially as it pertains to my appearance–which ultimately liberated me from a whole slew of beauty-related expenses (not to mention the amount of time these rituals consume). I’d fallen for our culture’s clarion call for women to look a certain way, and I was paying for it dearly.

When I finally let go of caring what other people think, I was free to do what I wish with my hair–which, as it turns out, is have my husband cut it in our bathroom for free. And you know what? Not a single person noticed this change in my hair regime. I didn’t lose my job. No friends deserted me. I wasn’t suddenly less of a woman. A salient lesson for me in the universal truth that no one cares how we live our lives as much as we do ourselves.

After getting myself right in the head, I began my campaign of imbuing Mr. FW with the confidence that he could manage my haircut and that I wouldn’t divorce him if it turned out badly (actual conversation). I’ll admit, we were both fairly tense as the scissors neared my locks, but then, Mr. FW’s heretofore hidden talent as Vidal Sassoon sprung forth and my hair turned out great–with layers and angles around the face and everything!

JK guys, it wasn’t a hidden talent–we just watched a bunch of YouTube videos on how to cut hair. Life really is easy thanks to the internet. I then wrote this step-by-step how to so that you too can cut your hair at home! Hesitant about a home haircut? Chew on this: hair will grow back; your money won’t.

The Compounding Nature of Frugality

Continuing on with the haircut example… since Mr. FW and I have permanently converted to our free, DIY, at-home haircuts, we’re now set up to reap the benefits of these cost savings for the rest of our lives. We’ve saved a combined $2,688 thus far, and will continue to save $1,032 every single year (probably more since I imagine the cost of haircuts will increase with inflation).

Of course these savings on their own are not all that earth-shattering, but when we couple our haircut savings with our thriftiness is all other aspects of our lives, that’s when the magical unicorn of compound interest takes flight. Essentially, the more you save, the less you spend, the less you spend, the more you save, the more you save, the more you invest, and…. the richer you grow (and then financial independence, pursuing your passions, blah, blah, blah).

Ok so you get that this saves us money. But did you know that there’s a trove of other beneficial elements related to the DIY route? Read on, fair frugalite!

1) We learned a new skill.

When we were paying for our haircuts, we weren’t accruing any benefits beyond merely getting our fur trimmed. Conversely, with our DIY approach, we advance our self-reliance and our own personal reservoir of knowledge. Let’s be honest here, no one ever yells into a crowd “Help! Does anyone know how to perform a DIY HAIRCUT???!!!” but it’s a skill that’s socked away in our pantheon of abilities nevertheless.

Realizing that we’re capable of doing things ourselves opened a door for Mr. FW and me to start performing tons of tasks on our own–baking our own bread, felling our own firewood, grooming our own dog, re-plumbing our own pipes… the list is endless. Because with each new thing/problem that crops up in our lives, we first try to figure it out ourselves. If that fails, then we call in the experts. But far more often than not? We’re able to insource it.

2) It’s a relationship-builder.

Would you like to spend more time with your friends and/or loved ones? What better way than by giving them a haircut! Laugh all you want, but we usually have great conversations while clipping each other’s locks. It’s dedicated, quiet time together. Same goes for all the other projects we perform.

There’s also an element of learning to problem-solve together. Mr. FW and I don’t agree 100% of the time, nor are we nice to each other every moment of every day. But what we’ve recognized is that having a strong framework for working through challenges–be it how to unfreeze a pipe or how not to bicker when we’re stressed–is vital.

Every time we collaborate on a project together–such as planting our vegetable garden the other week–we hone and refine our partnership and communication skills. Much like a garden, a marriage is a living, breathing entity that requires tending (awww, homestead metaphor). Continual collaborative work is an excellent way to strengthen and expand the framework of a relationship. And if you just thought “but we fight every time we try to do something difficult together!” then I challenge you to tackle a project as a team and figure out the pressure points that cause arguing to erupt.

3) Saves time.

Rather than trek all the way to the barbershop, wait in line, drive all the way home, etc, we simply trot into the bathroom and, 15 minutes later, emerge with a fresh ‘do! There’s a fallacy that outsourcing always saves times, and while that is sometimes the case, it’s also true that the embodied time of outsourcing sometimes far outstrips the time it would take to DIY. I’ve literally spent more time writing about our haircuts than actually giving/receiving them. But then I love to write (and am longwinded!!!) so, the balance of my time is good here :).

4) Made an expense obsolete.

Also salient to realize is that Mr. FW and I didn’t just find a way to save on haircuts, we made that expense obsolete. Rather than trying to stretch out the time between haircuts or use coupons or hunt down discounts, we simply removed this expense wholesale. This approach, in case you’re wondering, is massively easier than trying to perform haircut-savings jiu jitsu every month.

Parting Thoughts (get it?)

Our consumer culture never misses an opportunity to remind us that we’re incapable of doing things ourselves and so had better pay a professional. But you know what? We’re all a great deal more capable of self-reliance than we give ourselves credit for. Our insourcing started small–with painting a room by ourselves. And yours can start small too. Once you unlock the liberation of doing things for yourself, it’s honestly hard to stop. And, oh yeah, you’ll save a ton of money in the process.

But why cut at the hair at all ? Don’t cut it at all.

Great idea! Once you have an 8 inch length you want to cut, you can donate it to Pantene Beautiful Lengths and they’ll make wigs for cancer patients.

I only cut my hair once a year to donate it, so I am impressed about how much I save without noticing. But I pay for it because I become from really long hair to a “bob” so I let specialists do it for me.

Split ends — definitely a problem that can damage long hair.

I am on a 6-month no-hair-cut season and enjoying it. The thing to note is, the rate of growth slows down drastically over a period of time. I have to admit that sometimes food gets stuck on the moustache and beard, but as long as you don’t care about it, that’ll also soon pass 🙂 Sometimes you wakeup thinking that something has fallen on the face and you find that its your own hair 🙂 And you will observe that people are so obsessed with fitting in(you have to cut or trim, you look odd, you are disrespecting others etc.) and no wonder they don’t get frugality or early retirement. The other key learning is that don’t do things that are unnecessary. If you design a concrete box, you will have to fit an air conditioner whatever be the climate outside. I also heard that your health improves if you have a beard(not a superstition some study). So let me see how long I can hold on 🙂

hair grows from inside the scalp and apart from specific periods in life (pregnancy for example), growth is very consistent. It is less noticeable the longer the hair gets, but the growth rate is consistent for each person.

Like the Frugalwoods, we also DIY our own haircuts. With 4 family members (3 males), that saves us a ton on our regular haircuts. It’s such an easy expense to kill too!

And, like the old saying goes – The difference between a good haircut and a bad haircut is….about a week!

I love your posts, and I have to say Baby Frugalwoods is *adorable*! Wonderful picture. Without a spouse, I have yet to make the haircuts obsolete, but I love the concept. I have ordered the Collins book on investing, btw. Many thanks for that tip, as I am a wannabe Boglehead! You and your family inspire me! 🙂

Yay! Glad to hear you’re on your way to Boglehead-dom :)!!

Check out some YouTube tutorials on cutting your own hair (it involves a weird ponytail). I do my own and I actually get tons of compliments!

Thanks for your message! The problem is I have short hair, nearly a pixie. I have thought about going to discount very hip barber shop as it can’t be all that different from a boy’s haircut but I just haven’t taken the plunge. I might have an adventurous guy friend who would cut it for me. LOL. Frugality is an adventure!

I have a pixie cut and go to the barber. It costs me $16. I’m extremely aware of how expensive it can be and try to only go every 8-10 weeks. I make sure it’s on the shorter side when it gets cut so the grow out can go a bit longer. Not quite ready to insource my cuts ????

Wow, $16! Thanks for letting me know. 🙂

“Focus your frugal energies on reducing–or ideally eliminating–your continual, repeated expenses.” Yes!

Here are some monthly expenses I’ve eliminated: cable, home warranty (such a rip-off), any type of monthly subscription, gym membership, etc. I’ve also increased my deductibles for health insurance, car insurance, and homeowner’s insurance. I’ve dropped down to a cheaper cell phone plan. These changes have added up to hundreds of dollars in savings every month.

I was paying $45 (not US) for imported sea salt up until recently when my husband said, “we must be rich to buy salt for that much”. Regular salt (with anti-caking agent) is $3 by comparison. So, I took up the challenge and we collected some sea water yesterday and boiled it away and presto, we made our our fine grained (couldn’t afford that before) sea salt. Also wrecked my mom’s pot but it’s still usable just no longer pretty…

Now that’s some awesome insourcing!!

I cut my own hair, and everyone is amazed when I tell them. I tried cutting my now ex-husband’s hair, but he was so fussy that is was a horrible experience.

My hubby is hesitant to cut my hair, but I just ordered the Creaclip (at least the generic version on Amazon) and he promised to give it a try. Progress!!!

I’ve heard people have good success with the CreaClip so I hope it works well for you :)!

I quickly realised how unwilling I was to pay for haircuts when I moved from a small village to Edinburgh and they tripled in price. I managed to convince my mother to do them a couple of times per year instead. No one notices apart from me and my bank account.

This is something I’ve been working on building up the courage to try for over a year now! I’ve watched Youtube videos to see how it’s done, but they always make everything look so easy!

The funny part is, I’m more nervous to cut Mr. Frugal Turtle’s hair than I am to cut my own. I have long hair and probably wouldn’t notice mistakes unless they’re really bad. However, Mr. Frugal Turtle’s hair is short and one can easily see any mistakes that were made. It doesn’t help that he almost always criticizes his hair cut when he gets home! Although I don’t think he’d criticize haircuts from me. He’d probably tell me he loves it, and I’m cutting his hair forever. He’s nice like that. 🙂

Unfortunately, my hair is complex enough to even give barbers the heeby-jeebies . My wife and I spoke about it, but we agreed to continue to just pay for our haircuts. She definitely does not spend that much on hers (Maybe $25-30 a cut) and for me its only $20 (including tip) at a specialty barber shop. I have tried cutting my own hair, that was a nightmare. But we do sometimes cut the kids hair at home. Well, the benefits of being able to write off haircuts since we are self employed and work in the entertainment space!

Hmm… I’ve been buzzcutting my own hair for years but I’ve never done my wife’s hair. She isn’t nearly as much of a frugal weirdo as you though so I don’t think she would ask for it. However we do have 2 daughters that are young enough not to care yet so I could practice on them first 🙂

I, too, did the math several years ago regarding our recurring expenses. I cut out all magazine subscriptions (I can read them at the library for free), premium channels on the television (I would do away with television altogether but I’m sure my husband would divorce me), pedicures (I invested in three colors, and some special tools for feet), and grocery shopping more than once a week (this has been the biggest saver who knew). This was after my husband got downsized for the second time in less than a year.

Now I write down everything I spend, so I can look for outliers. And although I didn’t completely stop going to the gym there is a gym near the hospital that i work at that has a partnership with the hospital and I am saving $70.00 per month on membership. And, although I dearly love racing, I have cut down my yearly road races to four, and I am embracing the virtual runs, which are $20-50 cheaper than road races. With the same swag.

You should check out fitnessblender.com on YouTube or their website. They have over 500 free video for exercises you can do at home with no equipment.

Second the fitness blender videos! Been doing them 5x a week since February!

The DIY haircuts at our house started with my son, but it probably had more to do with not trusting anyone getting scissors near my baby boy’s face than frugality.

As we started adopting a more frugal lifestyle, I talked Mr. Smith into giving me a chance to cut his hair. It didn’t look that awesome the first time. However, I’m getting better with practice.

Next up was my turn – I did it myself using this technique and am getting pretty comfortable with it

Compounding really is the name of the game. Our debt has been holding us back for so long, but thanks to our frugal lifestyle, we’re finally starting to feel a change in momentum 🙂

You mention that “we are what we repeatedly buy”, and I fully believe this to be true. One of the things that is most important to me in this world is, well, this world. That’s why I’m willing to buy more expensive produce, often organic, at a grocery store (your dreaded Whole Foods) that allows me to buy locally, in season, in bulk, and lets bring my own produce and grocery bags, thus cutting out unnecessary plastic waste. I save money in many other ways, but scrimping on what I put into my body and what I take from the earth is not one of them. It’s just too important.

I agree! We also buy primarily organic veggies and local whenever we can! It’s just that they can be procured for much, much less at grocery stores other than Whole Foods (at least that’s the case where we live). And I always bring my own bags (except for the times when I forget… 😉 ).

Aptly said! Same for us, too. We live in an inexpensive house, etc. to make up the difference. Thought I was the only one who felt this way.

Yes! We save time and money by cutting our 3 sons + my husbands hair at home. I love it when friends recommend a barber/hair stylist that charges “only $20/kids haircut”. If we went that route, we’d incur around $60 every six weeks. I also tackled my hair maintenance expenses last year by discontinuing my decades long highlighting habit (my hair is already blonde by nature for goodness sake) and switching to a much lower cost stylist. I now spend $30/haircut three times per year vs my previous expense of $175 per cut/color. I honestly thought that I *needed* to highlight my hair to look good all those years. It’s amazing what expenses are on autopilot due to what is socially normal.

I appreciate what you said about the habit of justifying small, repeated expenses. I am a profligate used book buyer. It’s just a penny (+ $3.99 shipping) on Amazon! I rationalize that $4 repeated expense more times than I care to admit. (Yes, I do use my library’s inter-library loan service a lot but often, they just can’t get the titles I am looking for.) But if I am to be honest with myself, I just don’t have the time or attention span to read as much as I did in past years. I’ve become aware of nickel- and diming-myself in this way over and over so that when a big expense comes up, I can’t manage it.

Anyway, thanks for all the food for thought. I appreciate your writing so much.

Sincerely,

Dana

Another DIY haircutting family here. It saves a lot of time compared to scheduling an appointment, driving to the hair salon/barber, waiting, getting a cut and driving back home.

Maybe that’s the secret to being able to FIRE? 🙂

Haha, YES.

I’m trying to convince the GF to cut my hair, but she’s too nervous. I think we’ll get there soon after some youtube videos.

I’ve been cutting my own hair for years. Amazing how much you can save by doing so! I live in Northern New Jersey where women’s haircuts can cost upwards of $50 which is INSANE for a trim! One thing I’ve been doing lately is using powdered milk instead of regular milk in sauces and recipes (never for cereal though, yuck). It’s really saved us money since milk is so expensive.

That’s a really good idea about the powdered milk! Never thought to try that before! I agree, it tastes absolutely awful to drink, but putting it in recipes is pure genius. Thanks for the tip!

Good idea on the powdered milk!

I began getting my haircut at home in the last year or so, and so has my two year old son. It took some convincing, but the Wahl clipper plus youtube videos put out by Wahl on how to use them were all we needed. I haven’t started cutting my wife’s hair at home yet, that takes a pretty big leap of faith on her part to trust me with that! I may send her over to read this post and see if it can help change her mind.

There’s great power in perpetuity, and I think this is hard for us to get our minds around since we’re stuck in one moment at a time. Whether it’s through cutting expenses or earning compound interest, the small stuff adds up over time because it’s not just about saving $1000 per year on haircuts, for example. As you said, that’s $1000 less you need to live on forever! Not to mention how that money can grow. Great topic!

Thanks to Frugalwoods, I too now use Personal Capital and am loving it. Question though. I have been receiving emails and voice mails asking me to have a Personal Capital advisor go over my portfolio to make suggestions. Have you also used this service through Personal Capital? Thanks.

Just ignore them, they go away after a while.

Guinea pig outfits. Lol. Love the pics! Once I started tracking, I realized I was spending waay too much on Victoria’s Secret because I had their catalog. My husband said that because the models we so young he felt like a creeper having it in the house. So, killed 2 birds with one stone by discontinuing the catalog.

It’s funny how your spending defaults can change one way and then back to the original, too! Your haircut example reminds me of how I was super-frugal on haircuts for most of my life, but then around age 25 decided to splurge on the expensive salon ‘do with highlights and all. I loved the feeling of getting pampered and feeling pretty, and soon got hooked. I changed my default of what was acceptable to spend and told myself it was fine. I only went twice a year or so because it was so expensive, but now I have reverted back to the cheap route. Not DIY, but a $13 cut at Great Clips or someplace like that is a great improvement over $120! Having more concrete goals like being a SAHM and retiring early helps so much in motivation to save everywhere we can!

There is always a middle ground, too. 🙂 I go to a salon for $35 + tip.

Count one more in the DIY side for haircuts here. I think however that my wife still like to outsource it. But the kid and myself are doing it at home 🙂

This is so true. It is so hard to see money this way, but once in a while, when you really do, it’s stunning. One of the rewards websites we use goes into our children’s college savings account. I always try to remember to shop through it when I shop online. The rebates are just 3% here, 5%there – small amounts. But I can always see the lifetime tally on my account – it is over $1000 after 8 years. When I am able to look at it that way, that’s a thousand bucks that I wouldn’t have have had in my child’s college accounts. NOT including compounding. Truth is, everything in life works this way – it is just hidden from daily view.

There are probably a lot of things I could spend money on that I don’t, but the one thing I’ve purposely insourced is trimming my cats’ claws. The first time I brought one to the groomer and they went snip, snip! and charged me $10 I said screw this, I’m learning how to do it myself. I trim both cats’ claws every other week or so, which would have gotten quite expensive quick. And I do need to keep their claws trimmed because they love to paw at my legs and climb up my shoulders with their claws out!

Oh, yes, this is a great saver for us! It is so easy to cut cat claws if you can get your cat to sit still. I worked up to it slowly.

You can trim their claws with a toenail clipper, but I’ve found it’s nice to have a special tool for it. My MIL gave me their old rabbit claw trimmers, and those work great.

Another DIY-haircutter here! I do my husband’s and 3 sons’. It takes a bit longer than it does at the hairdresser’s but they actually get a better cut (usually!) because I know exactly what they want and how their hair falls – plus, if I miss a bit it’s very simple to correct the next day unlike at the hairdresser’s where you’re stuck with what you’ve got unless you want to pay again. Next step is getting my husband to do mine

I’d been saving on haircuts by not getting them at all the past few years. I don’t think I could take the stress case that would become my husband if I asked him to hack it off even if I assure him a dozen times it won’t upset me. But I’d be totally willing to trade haircuts with other, hardier-souled, friends who wanted home cuts! We should set up a hair cutting club 😀

“Essentially, the more you save, the less you spend, the less you spend, the more you save, the more you save, the more you invest, and…. the richer you grow (and then financial independence, pursuing your passions, blah, blah, blah).”

This is all true, but I think you sell saving a bit short here. By cutting out a $480/yr expense, yes you save/invest $480 more every year. But the cooler part is…you need less saved to retire!

Assuming the 4% rule, that $480 reduction in annual expenses means you need $12k less to retire. It’s not just that you’re saving at a faster rate, it’s also that the amount you need to save to retire is lower too!

(To address the 4% naysayers: whether I use 4% or 2% as a safe withdrawal rate, the point remains that the amount of money you need to save to retire is some multiple of your intended annual retirement expenses).

I’ve been cutting my husband’s hair for over twenty years now with (Wahl clippers, some scissors and an old shower curtain as a cape) and none of our 8 children (6 girls, 2 boys) have ever had a paid hair cut as I have always cut/trimmed their’s too. Our children are now aged 8 to 24years and some of the older ones are learning how to cut each other’s hair. About 12 years ago I started to cut my own hair too and haven’t paid for a cut since. So much more convenient to be able to have a hair cut at home at short notice, within your routine and not having to make and attend appointments etc

‘But it only costs $5’ – as you say the small repeat expenses matter. Being a family of ten I mentally multiply many ‘only’ expenses by 10 to figure a more accurate real cost. Suddenly things seem less attractive or more appealing to find/make alternatives.

“What expenses have you permanently reduced or eliminated?” Cable TV is gone forever. We have had Amazon Prime for several years (actually we didn’t know it had movies for almost 2 years – we just wanted it for the shipping!). We did get a Roku just recently. We do like coffee and alcohol but, it’s all consumed at home or we take it with us if on a vacation or camping. Of course, all lunches are brought to work. I consider it a fail when I have to buy lunch because my planning got out of whack for some reason (dinner didn’t make any leftovers, nothing in the house to even make a salad or PBJ!). We live in Utah (going to hit upper 90sF this week) and we manage to not use A/C for maybe one total week out of the entire year (thank you dry heat). Fan management when we’re home and closing blinds keeps the cool night air inside. We outsource only a few things like car repairs/oil changes, knock on wood no big repairs needed yet like exploding ovens. We wash our own dog (she got a bath yesterday), we do our own yard work, clean our own house,blow out our own sprinklers, I’m debating on paying for a window washer though. Screens and sills are filthy not just the windows, but I really don’t want to do this. Meanwhile we just live with really dirty windows/screens. I haven’t let the beauty regime go though. I still get my hair cut and colored and I buy make up when I run out. However, I did pick a highlighting scheme that I only have to do 1 or 2 times a year enough to cover the grey and doesn’t look too noticeable when it’s growing out. Not sure how long I can get away with that!

Hmmmm…this is a difficult one for me. I don’t think I’ve given up anything completely. I’ve cut down certainly, but for me to cut out something forever and ever just doesn’t make sense. I really live simply already. That’s a given. However, there are times when I will get my hair done and spend a chunk. There are times I will get those new shoes that weren’t in any budget. I also am a sucker for ceramics. I know all that and so like the person who is on a diet all the time, I know if I binge once in awhile I won’t blow a gasket. So, once a year I go to the ceramics art festival and buy a non-functional piece of art. A couple times a year I will get my hair done so that I can be pampered – I take care of an elderly woman 24/7 so I think it’s healthy for me to do this. As for the shoes? Actually, not shoes – sandals are my addiction. Instead of crave them from a distance I do get a new pair as soon as the calendar turns to May. This is probably not for everyone but it keeps me sane and I don’t have to deal with numbers. I know what I can spend what I can’t. I don’t owe anything except a mortgage and a few more car payments…so, I guess I’m really doing okay.

Peony HARVEST!!??? Outrageous (in a totally wonderful way)!

We are $2500 from being debt free including the house and one tuition payment away from kicking college expenses to the curb forever ( our youngest son will be done with college in December) . I am 46 and hubby 57 years old. I’m so excited I can scream. I still feel that I will continue to dry our clothes on drying racks!

We have started the at home haircuts as well but Poopsie has only trimmed mine… he has not yet ventured into layers. We might have to jump on YouTube tonight and learn how!

I used to cut kids’ hair when they were little, but now that I have a few teens, I have a pro do it. Thankfully, she’s a good friend, she comes to our house, and since we have 9 heads (7 kids, 2 parents), we always get a great price AND no schlepping all those kids to the salon!!! Priceless.

Dear @MrsFrugalwoods, may I ask what is the book on investing someone mentioned on this thread? I have recently purchased “Finances for Dummies” and “Early Retirement Extreme” by Jacob Fisker, but I haven’t finished them yet.

I love that you got the garden going. I was wondering if you needed the link I left you in regards to the calendar. You guys are inspiring change in my life. It is slow, but I look forward to every single blog. Every single tip. Thank you for being there for me, and for all of your other readers.

Thanks! Can you remind me what the link is? Most appreciated 🙂

Yes ma’am I use the almanac to tell me when I can plant what for my area. It was most helpful as I thought I was running out of time for some produce, only to learn I still had weeks left! Here is the link, the site has tons of info. 😀 http://www.almanac.com/content/online-garden-planner-old-farmers-almanac

Totally off topic, but you Peonies are AMAZING!!!! ????

I used to shell out $35 ever six weeks for a bikini wax. I tried doing it myself but found it too painful. I finally decided to get laser hair reduction and although it cost me $1000, I will never have to pay anyone else to wax me again! In around 3 years the treatment has paid for itself and over the course of a lifetime, that’s good savings.

I decided to cut my son’s hair at home – to get the courage, it took me almost a year. But by today, we already have a great routine – I turn on TV, my son is sitting on his high chair and while watching cartoons, I slowly cut his hair. And almost 40 € for a haircut in a fancy kids hairsalon stay at home 🙂

I’ve been buzzing my hair for 20 years, with the same $15 clippers. No telling how much I’ve saved.

A thought has just crossed my mind. Is it actually OUR CONSUMER CULTURE never misses an opportunity to remind us that we’re incapable of doing things ourselves and so had better pay a professional OR is it actually developed market? Because there are far more poor countries that don’t have such developed businesses and a professional solution for everything, so ppl have to insource lots of things at home.

My husband recently went back to the barber full-time, but I have 3 teen boys and girl, and I have cut their hair since they were born. I never figured out how much it has saved us, but I just like to think of it as a small fortune. 🙂

“Essentially, the more you save, the less you spend, the less you spend, the more you save, the more you save…”

A recent six-month car insurance bill in our household listed the price to renew for six months. Then came the payment options. We could save $62.50 off the listed price by paying in full, or we could pay monthly (not only paying the full price, but also adding a “processing fee” onto each sub-payment). An awesome justification for having a cash-cushion in our checking account: pay in full, save the $62.50, and have no worries about when next month’s payment is due!

ah, I suffered bad home haircuts from my mum when I was small. Embarrassingly bad 🙁

I swore I’d never do the same to my kids. But they are boys, it really should be so easy – I have a big confidence hurdle to get over to even attempt a buzz for them!

The first part of a new financially healthy life is admitting you have a problem; I decided last November that I “hated” my naturally wavy/curly hair so I brilliantly decided to go twice a week for blowouts at $35 + tip, I spent until literally last week (embraced the curls again three days ago), over $2,000. $2,000!! NEVER, ever again. Why did I care so much about fighting my natural hair that I blew through so much money? VERY eye opening. Thank you for your blog, I have hope! 🙂

Curly girls! (conditioner washing group for women) on facebook might be a helpful group for you right now.

Thank you!!

I read your blog for the great financial advice BUT your gorgeous, beautifully dressed baby is a welcome distraction !

Would love tips on computers? Eg. How often do u update? Do u choose the best model?

It’s funny how, when you start cutting just a few expenses, more follow! We’ve also started doing our haircuts at home to save money, as well as waaay more cooking at home. The result? We’re now able to save 50-60 percent of our income. That number was a big, fat ZERO just one year ago. Keep fighting the good fight, y’all!

I got rid of my mortgage and, boy, let me tell you, that has really made a difference!

I’m on year three of not paying for a haircut. I used to to go religiously for a $40 hair cut and then twice a year for highlighting and color treatments…what a waste. Now I just go to my aunt who I’ve entrusted my locks to and she gives me my trim and I save hundreds of dollars per year.

Also love your garden. I am a garden enthusiast and have had the pleasure of harvesting radishes, spinach, lettuce, snow peas, snap peas and green beans so far this year. My first cucumbers are coming up and I have a boatload of little tomatoes growing, (still waiting on my summer squash and peppers to take off). I just pulled out my peas last night (their time was up), and will be planting some winter squash and more green beans tonight. Eating food that you’ve grown yourself is so much more fulfilling and tasty than what you buy at the store. Added bonus…saving money on organic produce!!! I hope you have good luck on your garden endeavors. Really enjoy reading your blogs and am looking forward to the homestead updates!!

My husband is in the military so a haircut every three weeks is pretty much mandatory. I’ve been cutting his for 16 years. His favorite part is he can have a beer while getting his hair cut. He hasn’t tried mine yet. I usually trim my own but haven’t mastered layers. So this will sound weird but the reoccurring expense that I’ve learned to minimize is moving. We move about every 18 months. We’ve moved 11 times in 16 years. The military will only move so many pounds of your things. Most my friends just give away their stuff and buy new at each duty station. Drives me nuts to get rid of stuff just because of weight. The military has a program called Personally Procured Move. They will pay us 90% of what they figure a move will cost them to move it ourselves. So I became an expert in hiring trailers (ABF Upack) finding good free boxes craigslist, nextdoor. I have a supply of moving blankets slowly acquired through harbor freight coupons. I buy big rolls of bubble wrap on ebay and reuse it move after move. As a result I can move three times as much weight the military allows us, and make a little money for my labor and time. We have at least 4-5 more moves in the next 8 years so for me this is a significant expense to minimize.

Wow, that is great planning! My husband works on an air force base, so we know a lot of people in the military. The moving expenses can be crazy.

I am in complete agreement especially as it relates to hair and for Mr. FW the savings I’m sure is even larger with the beard and lack of the clean shaven look made popular by those with extra dollars to give to . Some might even perform the trick of using that same Wahl clippers to keep a semi shaven look for months and even years.

Well done, hope the great state of Vermont is treating you all well:)

Not a huge fan of this post as my husband makes his living cutting and coloring hair and doesn’t exactly make a king’s ransom doing so. 😛 However, I do, of course, understand the joy of a free haircut (and in my case, color). Of course, the only problem is that the cobbler’s son often has no shoes…ha!

I started cutting my own hair 7 years ago, and have never looked back! Mr. Mt has always shaved his head (there isn’t much hair left there anyways!) Now that we have 5 kiddos, we cut all their hair as well. It really adds up. =) Right now my hair is crazy long and I can trim it in about 90 seconds. But in the next few months I might try a shorter cut, which takes a bit more time. Although it’s still faster than going to a salon. And way more convenient! I images the savings are well into the 5 figures by now. =)

Ha, not 5 figures. 4. at best. All the action figure wars happening next to me right now had me distracted!

I started cutting all my men’s hair 25 years ago. My boys just had a buzz cut which was easy with the electric hair cutter I bought. My husband wanted layers and learning to cut his took a little longer but I’m so good now no one can tell when he gets a haircut. Also I’m fortunate that I have a beauty college not far from my home where I get a cut and color done for a fraction of what it cost in a hair salon. We have saved thousands and our hair cutter is still going strong.

I do pay $23 (including tip) for my fabulous haircut every 6-8 weeks. For me, it is worth it to look the way I desire. However, I make my own shampoo, conditioner, and pomade. I spend less than $2 on all the cleaning and products my hair requires in a year.

You make your own shampoo and conditioner? How cool! Recipes please :)!

There are so many out there, but the simplest is just baking soda + water for a shampoo, and apple cider vinegar + water for a conditioner! It can take a few weeks to get used to it, but once you do, it’s fantastic. Here’s one resource, but you can google “no poo” for many more.

https://www.nopoomethod.com/

This is what I do http://www.zjthorne.com/?p=471 and if you are interested in how my face is frugally taken care of, see http://www.zjthorne.com/?p=330

Been on the DIY home haircut routine since my then boyfriend, now husband gave me a haircut shortly after we started dating. I said go for it for three reasons; 1st I had gotten too many bad haircuts in the salon, last one left me in tears, 2nd I didn’t have the money in my budget, 3rd he had the scissors and I figured he could do no worse than the salon. He did a great job and my days of going to the salon were over. I got him to take over giving my children their haircuts and I calculated the savings over $900 a year. No frumpy haircuts, I get compliments on mine and a couple friends have come over to watch my husband do the children’s haircuts so they could do their own children’s haircuts. My best friend stopped by while I was getting my locks trimmed one afternoon, she watched him as he did my hair and when he finished she said, “I’m next”. I nodded my head in approval and he said have a seat. He did a great job as usual and she asked if it was a one time good deal. He said if she stopped by when he was doing mine or the children’s, it would not be an inconvenience.

We have a garden and are buying a new to us home with plenty of acreage for the fruit tree orchard, berry patches, and a large garden. I’ll be investing in a lot of canning jars, but saving money as we eat the produce from our garden, rather than spending money for it at the grocery store. Going to raise chickens for eggs and also rabbits as well.

No cable TV as we get 25 free channels by an antenna. My guy is handy, so he changes oil, does carpentry and plumbing repairs. He grew up in a home where everything was done themselves, so he acquired those life skills early. The haircutting skills he picked up from a girlfriend decades ago who was a hairdresser that dreaded the salon who taught him to cut hers.

I seriously have not paid for a hair cut in like 13 years. I cant even imagine how much money I have saved but its been a lot! Lucky for me I am bald so I just shave it myself. Wow never thought I would be saying that im lucky to be bald!!! haha

I have been cutting my husband’ s and two boys hair for 14 years. From time to time, I’ve given in and let them have a cut at supercuts. All 3 of them prefer to have their hair cut at home. I use the Wahl clippers. They were a great investment. One of the expenses I’m cutting back on this summer is dryer use. I’ve been faithfully hanging my clothes out on the lines in our warm weather.

I was inspired and cut my own hair for the first time tonight. Was going to be a year until I could go to my regular hairdresser, and it was getting majorly straggly. And…it turned out great! At least the front is awesome – back I can’t really check too well 🙂

Random question that occurred to me since this post is talking about hair. Do you have any recommendations on long lasting hair ties? I always find that they stretch out and/or break – i end up tying them back together and limping along until i finally give up and throw them away and buy new ones.

Love the blog!

I struggle with making deeper and deeper cuts. My home was bought at the court house steps. I paid cash for a car. I managed to put my life together after the economy and a job in construction nearly killed me. I am the first to admit it was the best thing that ever happened to me, losing everything gave me the opportunity to redo my life and live the frugal life my mother had taught me. I tossed the cell phones, ditched the cable and stopped eating out. I no longer have my hair cut but do it myself. I also buy cheap color and do that also. Most shopping is done second hand. I have very little debt and amazingly my credit score is fantastic. No worries there, I wont be using it. My weakness is stopping and getting cold drinks while running errands. I just bought a 60 cent cooler and plan on taking cold water with me. I just discovered Republic wireless for 10.00 and am delighted. Thank you for your posts. Each day I am inspired. I finally am becoming comfortable with the concept of being frugal. It sure is nice having money and not being stressed.

You’re so right about the way small things add up over time. It can be tough at first, but after a while it’s fun to find new places to cut recurring expenses and watch the savings build up!

I’ve been using the Wahl clippers to cut my son’s hair for a year, and my husband finally started letting me cut his too. I am completely poor in the fine motor skills department, but both look fine. My girls and I wear our hair long and hippie-esque, but if I was braver, I would buzz my own hair. A friend of mine does, and it’s easy, comfortable, and cheap. I don’t have her face or her cojones though- at least not yet.

When my boyfriend moved in last year we decided to try finding ways of saving money where we could. The two biggest areas were dining out (which we hardly ever do) and entertainment costs. Instead of paying piles of money to entertain ourselves we researched cheaper (read free) options to do instead. Our local library offers “leave a puzzle, take a puzzle” so we don’t have to buy jigsaw puzzles anymore (which can be ridiculously expensive!); I use the local library and my own personal stack of unread books for reading material; we go for walks down the street (we live in the city); drive a little ways out of the city to go hiking or kayaking; watch bunnies play on the grassy knoll beside our apartment; and sit on our balcony (or anywhere really) and just talk to each other. We do pay for Netflix which is only $10 a month, and then occasionally we pay for something like tickets to a theme park, zoo or for the local (shut down) pennitentiary.

Hi

I love that you are frugal. I sometimes feel bad about my frugality. My husband is so wasteful – he has little sense of cautionary spending.

I am envious how you have rooted out waste so diligently. I went from spending 98% of everything I made to saving in between 50%-55% of my income. That by itself is awesome but it kinda feels like learning a new language. At first, everything is coming so fast and the gains are awesome. Now I am trying to refine my skill sets and get every little grammatical structure correct. Wait… am I talking about my German now or saving money? I am tracking every dollar which means I can see where my other areas of waste are. I just need to do something about it. Thanks for the motivation!

I did the math, and my husband and I spend a combined $400 a year on haircuts. To me, that is not enough of a savings to offset the stress I would put on myself, and the time I would invest to do it ourselves. I do cut my dog’s hair though! I thought it was ridiculous that grooming expenses were as much as my own hair cuts, and there was always a month long wait list just to get her in. $30 clippers have paid for themselves 10 times over so far. Now what I really need help with is cutting our food bill…

You pick and choose the luxuries you want. Tried home hair cutting and our hair just looks terrible unless we get a skilled hair dresser, barber. We’ve had issues even going professional. We find other things that we can cut, both literally and figuratively.

As you truly age, you will see that paying for a bit of polish can reap great dividends. Went to 40th reunions for high school and college, and it was pretty clear who were the ones taking care of selves. Might be some exceptions but the money put into grooming can make huge differences.

Loved your ideas 🙂

I tried the home trim route to save money (£60 a visit to the hairdresser previously so about £700 a year !) but it didnt work out for me

My daughter suggested the local college , a final year 3 student gives a good cut and colour for about £10, plus it gives the students a model, so win win all round. I save over £600 a year but still have good hair plus its nice to have a little pamper every few weeks

I made the self haircut leap about a year ago – not only to save money but because I largely hate the whole hair cutting experience and I rarely liked the cut I would get anyway. The first time I cut it myself I got “hey great haircut!” compliments and so I haven’t looked back. Mine’s not even a buzz – I use a Wahl clippers on the side and barber scissors using my fingers as a guide for the top (stick fingers in hair, cut the tufts that stick out over fingers) and cut the corners a little shorter than the top and presto! People are often surprised to learn I cut my hair – they just assume I had it cut. It can be done!

Nicely done!

I’ve been cutting my own hair for a decade, and you’re right — no one ever notices and I often get compliments. (And I always disliked the way others cut it anyway.) Don’t be afraid, do it! You’ll never go back to the old way.

At the moment, DH buzz cuts his own hair but I normally go to the barber ($10 or $15, depending on who cuts it and how fast they are / how much I get done) about every 6 to 8 weeks. So that works out to about $90 to $140 p.a. I don’t get my hair coloured, nor do I colour it at home. I’ve had natural streaking since I was 23 (it just gets streakier as I age) and I’ve actually had compliments on it. People don’t believe I’m in my 40s so I ask them if they’ve noticed all my silver hairs. 🙂

This one is a little less obvious, but this afternoon I’m inviting a bunch of friends over for a jam session. We all play an instrument with varying degrees of skill level. As a latecomer to learning guitar I’m very unskilled but that doesn’t stop me from enjoying the process and learning from my friends. This to me is even more satisfying than paying 20-50 bucks to go see live music. Many people are intimidated by playing an instrument and I think that also is a result of our culture telling us we need to outsource everything, including creativity. Free yourself to strum! Ukuleles are a good starter instrument 🙂 Look up Amanda Palmer’s Ukulele Anthem for the full manifesto.

Love all the ideas in this article. My wife and I recently made a goal to save 3000 dollars in one month by selling old things, doing side hustles, or by saving money from our monthly expenses. We were only 400 dollars short. We are gonna start having her give me haircuts. Thanks again

I just can’t even fathom doing my own hair. I know it’s terrible. I have insanely thick and heavy hair that is naturally very dark. I spent the entire summer of 2017 having the color stripped from my hair, so my bleached head could then be colored a bright vibrant purple! I love love love it. After all that work, I don’t want to go back to my natural color. 🙁 And the idea of doing my own is really not in the cards. I used to do home color to cover the gray and that was a disaster of uneven color applied to all the wrong places. I do understand that the cost is a problem though. Especially now that I am a full time homemaker with no money coming in… I am now going to the salon every 8 weeks instead of 4. We budget for it. Baby steps.

Thank you so much for this. At high school, me and my mates used to cut each others’ hair. Then I just forgot about it and paid NZ$17 a pop at the barber. This is very cheap for New Zealand, it often costs more. This weekend I’m off to get some clippers and I’ll teach my wife how to cut my hair. This will cost NZ$30… Too easy.

To answer your last question, my best investment was an espresso coffee machine with bean grinder. Bought it 2 years ago on sale for about NZ$700, including a 5-year warranty which was $50 extra (I usually hate warranties but in NZ we only get 2-years covered by law). Anyway, I don’t go to cafes. When we meet for a coffee, it’s at my place where I wizz up a cuppa. We either have it here or we put it in takeaway cups and wander to the local park. I also enjoy a morning coffee every day. All added up, I think I have come out on top after the initial cost. I also do the same for meeting up for a beer. Always at home or at their place. No way will I ever pay $8-$10 for a beer at a bar.

Now, why the warranty? Probably because I’m too weak but I figured that it’s a guaranteed investment for 5 years and if it craps out I get a new one! I think this has saved us a killing. And I have learnt to make a pretty sweet flat white. 🙂