Today is all about getting your financial affairs in order. Doing proactive stuff with your money necessitates knowing everything about it: how much you have, how much you earn and spend, what your debts are, and where your assets are held.

All this and more in Day 6 of the Uber Frugal Week series! I know you’re trembling with excitement. Who doesn’t love a good missive on organizing exciting things like NUMBERS!!!!! Spoiler alert: there will be spreadsheets. Oh will there be spreadsheets. Also check lists!!!!!

We discussed tracking expenses on Day 1 because that’s the thing you can immediately impact; however, there are other elements of your finances that are equally important. So today, we’ll talk about all the numbers in your life that are not your expenses (because you’re already tracking those, right?).

Uber Frugal Week: Day 6

Welcome to Day 6 of my pandemic-inspired, what-do-I-do-with-my-money Uber Frugal Week series. For more about the series, including an overview of what I’ll cover each day, check this out. I recommend you read the series in order; start with Day 1 here. Read disclaimers about me and the series here.

So far in the series I’ve covered:

- Day 1: Categorizing and compiling your expenses

- Day 2: The relief and forbearance programs available in response to the coronavirus

- Day 3: How to save money in almost every category of your budget

- Day 4: Making your money work for you: emergency funds, high-interest savings accounts, and using credit cards to your advantage

- Day 5: How to get on the same financial page as your partner ASAP

- And a special Reader Suggestions on how to make extra money working from home during the pandemic

While the Uber Frugal Month is an email program, the Uber Frugal Week appears right here on the blog in a series of posts. I’ll publish Uber Frugal Week posts as quickly as I can but, in all honesty, I haven’t written all of them yet because pandemic means both of my kids are home all the time and my husband and I are both working from home. I’m writing as fast as I can, I promise!

Day 6: It’s organization time!

Fellow spreadsheet fanatics, our time is now. Open up excel and don’t look back! If you are in Camp Anti-Spreadsheet, don’t worry, you’re welcome to use whatever format you like: graph paper, Word document, robot-themed stationary. We’re going to get our affairs in order and we’re going to do it together.

On Day 1 we discussed how to track our spending; today, we’ll address how to track all other money-related things. The goal is to come away with a clear picture of your finances. This is important because it’ll help you discern where you stand and what areas need your attention.

Why are we doing this now? Because the economy is not looking so great. Due to the pandemic, we’re in an uncertain state and it’s hard to predict when the economy will rebound and return to a state of normalcy. When things get weird, it’s a great idea to have all of your affairs in order. It’s also a lot easier to do this stuff before you’re in a state of true crisis.

If things get worse with either the coronavirus or the economy, you’ll be glad you put in the time to have everything in order. And if things get better, you’ll also be glad you put in the time to organize everything. See? There’s no way this isn’t a win!

For each of the below, I’ve included a sample spreadsheet format that you’re welcome to copy and paste. If you’d like to see examples of these spreadsheets with real live people’s finances, check out the Reader Case Studies.

Step 1: Track Your Spending

If you’re not tracking your spending, loop back to Day 1 of this series to get yourself set up with an expense tracking system. I use and recommend the free service from Personal Capital (here’s more on how Personal Capital works and why I like it).

Step 2: Know Your Income

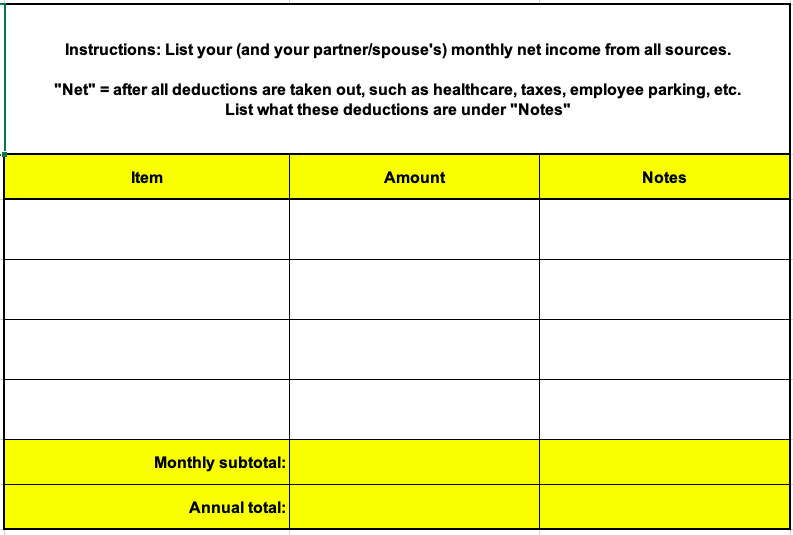

Don’t laugh, you guys, this is actually more complicated than a lot of folks realize because we’re not talking about your gross income–we’re talking about your net income. And we’re not just talking about your income from your primary job, we’re talking about all your income and all your partner’s income. The goal is to determine exactly how much money you (and your partner, if applicable) bring home every month.

Time for a Mrs. Frugalwoods Q&A:

Q: What is net income and what is gross income?

A: I’m so glad you asked. “Net income” refers to the money you actually bring home every month. Net income is what you earn MINUS all deductions, such as: taxes, healthcare, employee parking, retirement contributions, etc. “Gross income” is what you earn before all of those deductions. So if your salary is $60,000 per year, that’s your gross income. Your net income is less than that because of taxes and other deductions that come out of every paycheck.

The easiest way to figure out your net income is to look at your paystub. Then, enter your net income, along with your partner’s, into a spreadsheet. Be sure to include all income sources from any side hustles.

Here’s a sample spreadsheet format:

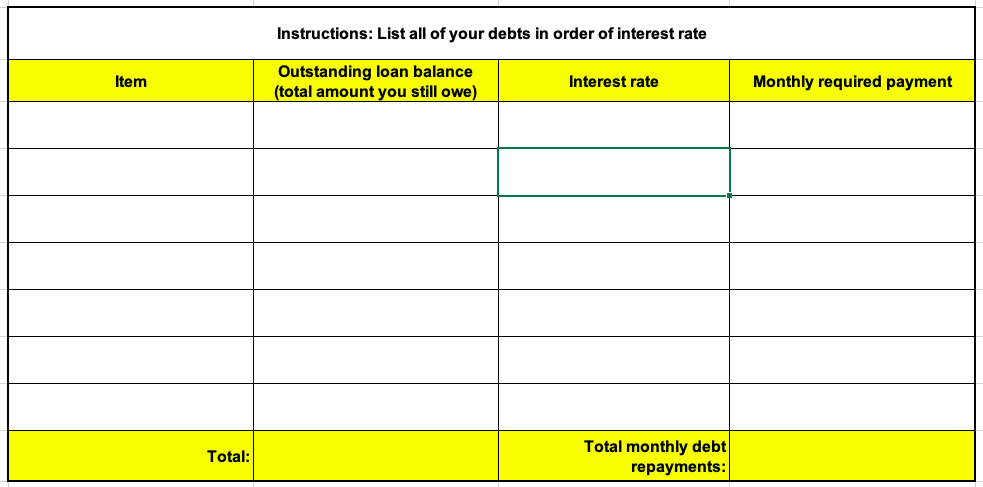

Step 3: Know Your Debts (and which to pay off first)

Make a list of everything you owe money on, the interest rate, and the terms of the debt. Examples of debts: student loans, credit cards, car loans, and mortgages. A debt is anything you don’t own outright. Organize your debts by interest rate with the highest interest rate first.

Pay Off Debts According To Interest Rate

In general, the most mathematically efficient way to pay off debt is to pay it according to interest rate. The higher the interest rate, the faster you want to pay it off. There are lots of different debt-payoff methods, but this is the one that makes the most sense from a math perspective. Interest rates are what make debt bad. Interest rates are what add more money onto your debts. The higher the interest rate? The worse the debt.

I’m a HUGE FAN of chipping away at debt according to interest rate and of staying focused on smaller, more manageable goals in debt repayment.

Here’s a sample spreadsheet format:

Why List All My Debts?

The goal of listing all your debts isn’t to depress or overwhelm you, it’s to bring you face to face with what you owe and how you can start paying it down. Ignoring debt does not make it disappear. Take a deep breath, write down your debts, sort them by interest rate, and make it a priority to pay them down when you’re able.

Before starting an aggressive debt repayment plan, please refer to Day 2 of this series, which has information on relief programs for people who’ve lost their jobs due to the coronavirus and can’t make payments. Even if you’re still employed, you might qualify for forbearance programs being offered right now, such as for federal student loans.

If you received a stimulus check, are still employed, and already have an emergency fund saved up (see Day 4 for details), you might consider putting that money towards paying off high-interest debt.

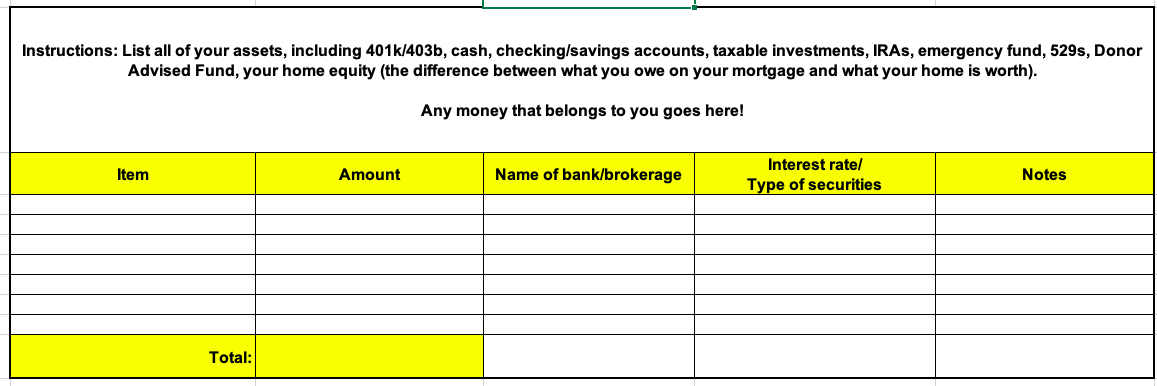

Step 4: List Your Assets

An asset is the opposite of a debt: it’s money that’s yours! All yours! Assets include stuff like your checking account, emergency fund, retirement investments, the equity you have in your home, and more. Assets do not include stuff like cars, your grandmother’s china, and an antique clock collection. If you were to sell those things, the cash would become an asset. But until you find a buyer for those things, they don’t have a monetary value you can utilize. In other words, you cannot buy groceries with them.

Here’s a sample spreadsheet format:

Step 5: Review Your Overall Net Worth and Pat Self On Back

There are several goals in compiling all of this information. Now that you’ve done the work, you:

- Have a clear picture of your overall financial position, including your: income, expenses, debts, and assets.

- Have all of your information in one place and can make informed decisions about your money.

- Can run through the below checklist:

- Do my monthly expenses exceed my monthly net income? If so, check out Day 3 for tips on reducing your spending.

- Do I have an adequate emergency fund? Refer to Day 4 for details.

- Are my savings/checking accounts earning a high interest rate?

- Am I on track with saving for retirement?

- Do I have a plan for paying off my high-interest debt?

- Have an easy way to review your holistic financial picture with your partner/spouse (if applicable). If you’re encountering challenges or barriers to discussing money with your partner, check out Day 5.

- Pursuant to #4, if you have a partner/spouse, make sure you both know how to access all of your accounts, which banks/brokerages they’re at, and where all account passwords and related documents are held.

With all of this information in one place, you can feel confident about creating a plan for your money. You now have a deeper understanding of what you need to work on and where you’re excelling. Most importantly, you’re not in denial about your financial health.

If you want to automatically track all the data we compiled today, consider signing-up for a service that’ll do this for you every month.

I use Personal Capital because it’s free and it links all of my accounts together automatically, giving me a comprehensive update on my overall net worth every month. Here’s more about why I use Personal Capital.

Day 6 Summary:

The goal of today is to get your financial affairs in order.

- Track your spending every single month (we covered that in Day 1)

- List your net income from all sources

- Create a list of all of your debts and sort them by interest rate with the highest interest rate first

- Write down all of your assets

- Review all of this with yourself or your partner (if applicable) and set actionable goals about your finances

What questions do you have about Day 6?

Day 7 is coming your way next week! If you’d like to get an email letting you know when it’s published, sign-up for my email list in the box below.

I started tracking my expenses just over 2 years ago and it’s been great! Seeing where I spent (and many times wasted) money helped me drastically reduce my spending, so that I could drastically increase my investing. This action alone sent my savings rate and net worth skyrocketing and shaved years off the number of years I need in the working world. Thanks for this great piece of advice!

I completely agree with Katie Camel! Tracking expenses rocks, and I like to do it manually–it’s sort of like writing down everything you put in your mouth when you are following Weight Watchers and trying to lose weight! I keep a piece of paper with 3 columns: “groceries,” “regular bills,” and “miscellaneous.” The miscellaneous column is for everything that does not fall under groceries or regular bills. If things get tight, we could spend zero on miscellaneous and still be fine (but I would be missing my wine!). Tracking not only helps to save money, pay off debts, and invest more dollars, but it is really helpful as you plan to retire. You know exactly what your spending needs and habits are, so you can plan your finances accordingly (and retire early, as I have done).

Why do you include equity in a home as an asset and not other valuables? Isn’t it basically the same thing? Wouldn’t you have to sell the home to access the equity? Or do HELOC options make a difference?

I was wondering the same thing. This might be different depending on the country you live in (I’m not an American reader) as a HELOC does not exist the same way around the world.

My home is not an asset. It’s an expense. When I sell it I will just buy another. All money is tied up. This is not an asset to me. People think differently about this, but unless you sell and then rent, you don’t make money from your primary home. Maybe someday when all my kids move out and I downsize? Then I might have a little extra from a sale.

you can take a home equity line of credit in an emergency.

I’ve though about this a bit before commenting. I’ve owned three houses with three outcomes: profit, breaking even, and loss. Having had these experiences, I would hesitate to assign a number to home equity until I was walking away after signing the papers for the sale. Also, i would personally subtract the costs of ownership (significant repairs and upgrades, taxes, housing association fees) and real estate transactions (agent fees, attorney, taxes) from the equity. My experiences are largely related to local and national boom and bust economic and housing factors, but you might have other issues- do you live in a state or town where more people are moving away than moving in? Has your school district declined in quality? Have your local taxes increased faster than, say, the next county? Has the fuel used to heat your house gotten more expensive or less popular? Is a pipeline going in near you? Is the next generation of smaller families going to want your McMansion? Are they going to be able to rely on your private well? It’s really tempting to ignore the individual conditions that cannot be separated from the worth of your real estate, and think of it like a 401K (though those are invested in companies with their own fluctuations, at least there’s a spread). I also wouldn’t assume a bank will lend to you based on your home equity- they’re “functioning” in the same economy, haven’t really regained a strong position since the last recession and are still near capacity for assuming more risk. Sure, they’re backed by the government….somehow that doesn’t reassure me.

Since we are retired and do most everything together except golf, and right now my husband is not even doing that, we do not really track our expenses. I have a spreadsheet (hand written on a spiral notebook) of all of our expenses that we spend money on in a month. The amts are set except for food, gas, repairs. We sit and talk about purchases before purchasing. Just today, we discussed purchases of fragrance from fragrance.net. We never pay the store price. We discussed all of our items for pickup at Walmart. We are not spending on dinners out, minimal gas, no travel or hotels, so right now it is really easy. We have always discussed our expenses with each other. If something needs fixed, we get it fixed if we cannot do it. I think after years of marriage and having similar goals and being similarly frugal, it just becomes second nature not to waste money on clothes, jewelry, watches, etc. and a daily tally just isn’t necessary. We have always bought our cars new which I know is a no no but we get a GM discount and always have an immaculately clean lower mileage car to trade in that is usually 6 to 9 yrs old. We only need add 15 thousand and we are driving a new, safe car with the latest multiple airbags and technology like lane change alert and back up camera and never breakdown at midnight somewhere. I know this is not considered frugal but our peace of mind is worth the extra dollars. We are older and cannot hike down the road in extreme heat or cold or fight off someone who wants to mug us. We keep the ac or heat at tolerable levels on a frugal level. We are not huge eaters so groceries are always reasonable. We drink a glass or so of wine each every other evening. Rarely eat sweets. Rarely eat junk food, rarely eat after 5 pm or before 9:30 am which really helps to maintain weight. I am still wearing clothes that I have had for many years. When you are sitting around at home who cares that your tshirt is 40 yrs old. It is clean. We call those our junk clothes. We have no mortgage, auto or credit card debt. No debt has been our motto for decades. The only debt I never minded was the mortgage but feels so much better without it. Amazingly better! Could we cut the budget further? Absolutely. We have a little fluff in it that could be eliminated if needed.

Hi jean. Your life sounds exactly like my husband’s and mine. We have been married for 50 years and are living a comfortable retirement with no mortgage or debts. It’s a nice feeling in these troubled times. I call it genteel frugality

I like that – genteel frugality!

Really nice primer on getting one’s financial affairs in order. And, I agree with focusing on net income rather than gross—it’s the only way that makes sense. What you actually have available to you is what you can ultimately control.

Understanding your current state is the first step in the road to figuring out how to improve your future state.

Take care,

Ryan

Glamour shed is lurking in the background like a silent sentinel in almost every one of these photos.

We’ve been enjoy this series, thanks!

For step/day 1, when working through expenses, what do you think about offsetting expenses when “income” occurs that cancels out an “expense”? For example, let’s say you buy a new to you phone for $250 and sell your old one for $175. It doesn’t seem like it’d make sense to put “$250” into your mobile phone budget (and then plans or that moving forward) when the real cost is $75 ($250 minus the revenue from selling the old one for $175).

We just finished working through our big FIRE budget review from 2019 and were wondering what your thoughts were on this topic. Thanks!

Hi! I’m looking for UF week #7! Where can I find it?