I have a kid old enough to start learning about money! Of all the parenting milestones we’ve marked over the years, I think I’m the most excited about this one.

You all have been asking me for advice on teaching kids about money for eight years and I’ve demurred because I didn’t know how I was going to teach my own kids about money. Until today!

Our oldest child, six-year-old Kidwoods, started asking about money this fall and her curiosity reached an inflection point earlier this week thanks to a school book sale flier advertising a $7 unicorn book. So here’s my non-expert, imperfect tale of how we’re teaching money management to our children. Well, really just to Kidwoods since Littlewoods (age almost four) remains unimpressed and uninterested.

Wait Until They Indicate Readiness

This is the approach we’ve followed with pretty much every aspect of our parenting. Potty training? Wait until the child wants to and is ready. Sports? Wait until the child expresses interest and is ready.

I’m in no rush for my kids to grow up and I’m not interested in forcing them to do something they’re not cognitively/emotionally ready for. Every single time I’ve tried to force one of our kids into something they’re not ready for, it ends in tears. Theirs and mine. So I now try to sit back and let them lead.

Here’s a story:

I despaired when we couldn’t get 20-month-old Kidwoods to potty train in three days like the book promised. We did, eventually, get her fully trained at around two years old, but it was a struggle with a lot of bleach wipes involved. Our couch may never be the same.

With our younger kid, Littlewoods, we waited. We let her test out the potty, make mistakes and lead at her own pace. She potty trained herself in essentially a day at just shy of three years old because she was ready and enthusiastic. She has had far fewer potty accidents than her older sister, despite the fact that her older sister was technically potty trained at a younger age.

So there’s my sample size of two and my weird comparison of potty training to money training; but, I think the analogy holds up. Think about us adults: do we thrive when someone forces us to do something we’re not ready to do? NOPE. Same for kids.

Bottom line: I see no value in forcing a kid to do something they’re not ready to do, whether that’s potty training or money management. My reference point for this approach is Kim John Payne’s work in the Simplicity Parenting series (affiliate link).

Ok back to money… the same principle applies: we waited until Kidwoods demonstrated curiosity about money and was ready to handle money with care, which brings me to my next point:

Use Actual Dollar Bills

Despite the fact that I do all my banking online, we’re starting Kidwoods off with paper money because it’s easier for her to comprehend a tangible object as opposed to ephemeral numbers on a screen. Conveniently our currency has large numbers on it, which Kidwoods can read and understand to be $1, $5, etc.

For Christmas, we gave her a wallet and purse (sourced from a garage sale for $0.50) to grant her full responsibility over her money. There was a minor panic last week when she couldn’t find her wallet and I had to say, “yeah, sometimes people lose their wallets and their money.” She did eventually find it, but the point is that the responsibility lies with her, not with her parents. It’s her money, she needs to keep track of it.

We’re starting with physical money and the concept of safeguarding money in a very real sense, which I imagine/hope will later translate into lessons on safeguarding your money in other less tangible ways, such as: avoiding debt, shopping second-hand, etc.

Start Basic and Small

We’re starting Kidwoods off with basic concepts and small amounts of money. Very basic. Very small.

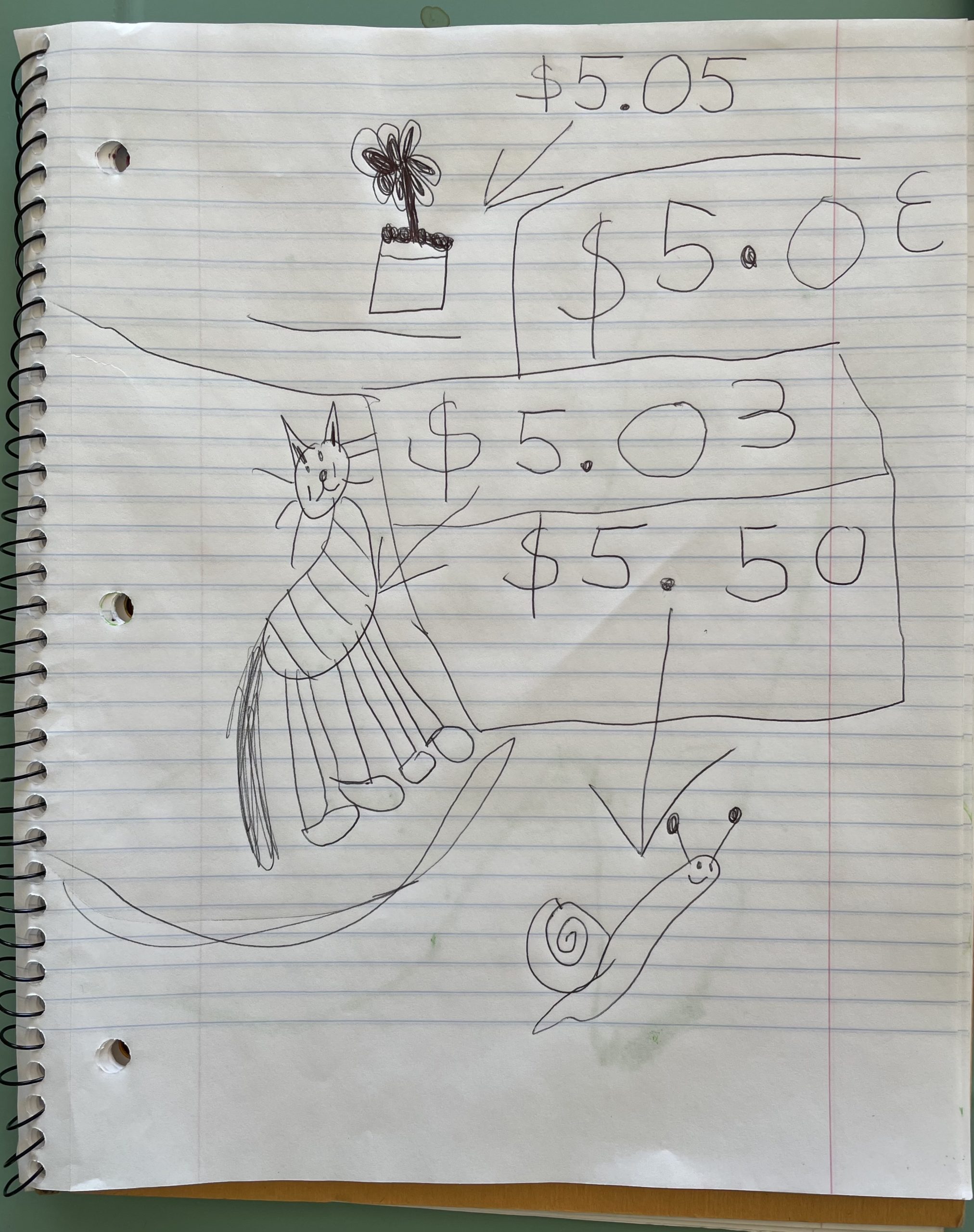

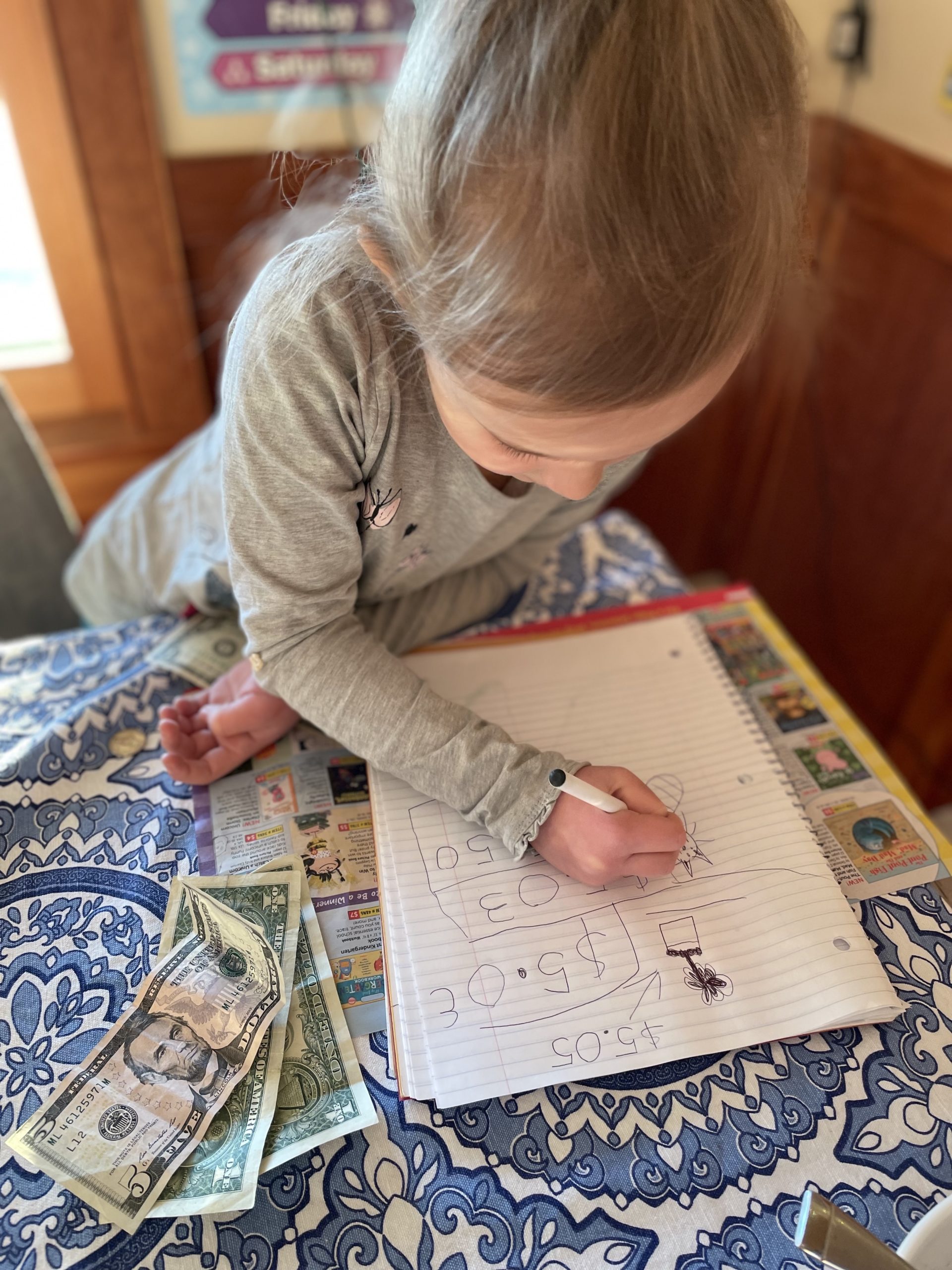

I taught her what a dollar sign is, how to write it, and how to indicate two decimal places for cents. Then, she wrote a list of prices and drew pictures of items next to each dollar amount. She informed me that each item was for sale at the price she’d written. Next, she “bought” the items from me, which introduced the concept of making change.

Once she realized that money is just math, her face brightened and she had no trouble calculating the change. I found it interesting that she initially thought the numbers in money operated under a different formula than the numbers in math. Made me realize that many adults think the same thing! My hope is that by initiating this very basic foundation, we’ll be able to build on it over the years.

Point being: no need to overcomplicate things. And if anyone knows where I can purchase a smiling snail for $5.50, please let me know.

Have Them Earn Their Own Money

The question of earning money arose organically, driven entirely by Kidwoods. That’s my preference for these lessons, because WOW was she ready, motivated and enthusiastic.

My parents sent Kidwoods $6 for her 6th birthday back in November and she later found a nickel on the ground somewhere.

She harbored that $6.05 for three months and periodically brought it out to count. A fine and simple introduction because yes, sometimes you do receive money as a gift. Then along came the…

School Book Sale Flier

Earlier this week, Kidwoods came home waving a flier advertising books for sale through the school. On principle I don’t like this because I think it encourages unnecessary consumerism, BUT, I recognize that’s a money lesson for another time. For now, my kindergartener is getting the fundamentals down and this book flier provided the perfect entry point for more money education. I mean truly, I could not have scripted this situation better if I’d tried.

Here’s the scene:

We sat down to tea-time as a family–our daily after-school tradition–and Kidwoods was OBSESSED with this book flier. She was reading the dollar amount of each book and picking out a few words from the titles. Predictably, she asked:

Can you buy some of these books for me?

And my parent antennae shot through the roof: THIS is the money opening I didn’t even realize I’d been waiting for! She was ready, enthusiastic and fully understanding that these books cost money, that she wants one of these books and that her parents have money that could be traded for these books.

In my ideal dream parenting world, I prefer to plan ahead for a scenario like this; however, it was clear to Nate and I that the moment was now, so we figured it out on the spot. My husband replied:

No, but you have your own money you can use.

Kidwoods bolted upstairs to grab her wallet and proceeded to count out her money (still $6.05). She leafed through the book flier, circling everything she could afford. A perfect self-taught lesson in comparison shopping and not exceeding your means.

But wait! Another crises ensues:

Advertised in the book flier is a book about unicorns that comes with a UNICORN CHARM BRACELET. Kidwoods’ eyes grew wide, then crinkled in bereavement as she noted the price: $7.

She again turned to me and asked:

Do you have one more dollar I could have?

The money lessons just keep on giving! It was time to introduce the concept of doing a job to earn money. I told her that I did have a dollar but wasn’t going to just give it to her. Instead, she could do chores around the house to earn money.

She brightened and enumerated all the chores she already does: cleaning her room, making her bed, folding her own laundry, clearing the table, cleaning up her toys. I explained that those are not the type of chores I’m talking about. Those are things she does as a member of the family, not things I’m going to pay her for.

If she wants to earn money, she’ll need to do something for the household, separate from her own maintenance (which is what I consider all of those tasks to be–I’m not going to pay my kids to clean their own rooms, for example, because that’s something I expect them to do as members of the household). She then leapt off her chair yelling:

I am ready to do a chore for money!

Yikes, I had to think of some chores real quick! This would’ve been easier if I’d thought about it in advance, but again, the moment was right, so we seized it.

My husband and I came up with the following:

- Empty all the trash cans in the house: $0.50

- Sort and fold other family member’s laundry: $1

- Organize the tupperware cabinet in the kitchen: $1

- Peel sweet potatoes: $1

- Organize the kitchen junk drawer: $0.50

- Organize the kitchen cabinets containing the drinking glasses and coffee mugs: $1

She perused the list and ran into the kitchen to start organizing the tupperware. I must say, she did an impressive job. After earning her dollar, she ran upstairs to sort and fold the family’s laundry. She wanted to do more, but it was dinner time (thank goodness because I was running out of chore ideas… ).

My goal with these tasks is to create a menu of options for her to choose from, all at slightly different price points. I want her to begin assessing the difficulty of the task–and the resulting payment–in making her chore selections. These will all be jobs above and beyond her regular slew of chores, which again, I expect my kids to do as part of being people in the house.

I need to brainstorm more chores-for-money since we’ve decided they need to be:

- Tasks she can do on her own. It kind of defeats the purpose for her if a parent is standing there showing her what to do. It was empowering for her to organize the kitchen cabinet all on her own and she clearly took a lot of pride in how well she did. She even presented me with two orphaned lids lacking their containers.

- Things that actually need to be done. At six, she can sense a faux task from a mile away, so it needs to be stuff that’s legitimately helpful.

Once I come up with this list of chores, I’ll make a chart outlining the jobs and their prices so that she can elect to do a chore-for-money anytime she wants. If you have any good chore ideas for a kindergartener, please let me know!!! Also I need to go to the bank to get more $1 bills…

Give Them Purchasing Power

Thanks to doing chores for the past three days, Kidwoods is up to $11.05 and the kitchen is looking VERY organized. She perused the book flier afresh, calculating which things she could afford and which things she wanted. I’m almost certain she’ll end up with that $7 unicorn book, but I think it’s a valuable exercise for her to deliberate between the different options and prices.

She noted she’d be able to buy three books priced at $3, but that she isn’t actually interested in those books. Thank you, annoying book flier, for this perfect money lesson!

For kids, there’s something deeply appealing about doing an adult thing for real.

It’s clear to me she’s engaged and fascinated by this world of money because she’s an active participant in it. She sees that she has control over how much money she earns and how much money she spends. Without me even mentioning the concept of saving, she said she didn’t want to buy something for $11 because then she’d have no money left and she wanted to have some money leftover. I tried not to look too pleased at that revelation.

Establish Your Family’s Money Philosophy

Your family’s money philosophy needs to undergird lessons about the mechanics of money because the mechanics of money are very simple–it’s just math. It’s the mindset, trauma, emotions, experiences and fears we entangle with money that make financial management such a fraught issue.

Remember that we adults don’t have to pass our money fears or anxieties down to our kids.

We can establish a positive, proactive way of talking about money with our children. It’s kind of like how I’m afraid of spiders but I’ve never told my children because it’s my fear and it doesn’t need to be their fear. Maybe it will be, maybe it won’t, but they don’t need to look at every spider through the lens of “mama is afraid of this, so I should be too.”

Over the years I’ve received hundreds of pleas from parents for advice on how to teach their kids about money and the only advice I can really offer is that it’s up to you.

It’s up to YOU, the parent, to set the money standards in your home.

You, as the parent, have control over what you buy–or don’t buy–for your kids. It’s not up to the kids to dictate how money is used, the onus is on you to establish guardrails for them to follow. I think the overarching key in doing so is to be clear, firm and straightforward. It’s the same as explaining to your children why your family chooses to eat vegetarian, or play soccer, or attend religious services or not… explaining how you use money can take the same format.

How We’re Instilling Our Family’s Money Philosophy

Every family is different and every family will choose to broach money in a different way. With that said, here are a few concrete examples of how we instill our family’s money philosophy in our children, which might–or might not–be helpful to you.

1) I am transparent with my children about buying their clothes, books, shoes, puzzles and toys used from garage sales and thrift stores.

I am matter-of-fact and honest.

I might say something like, “I found these dresses for you at a garage sale today and I think you might enjoy them! They were inexpensive because they used to belong to someone else!”

Kids respond, “YAY dresses!”

The overarching ideas of “used” of “inexpensive” are lost on them at this point; I’m just establishing the expectation and understanding that we value buying second-hand whenever we can.

2) I am firm, clear and brief when explaining why I’m not going to buy something for my kids.

This mostly comes up when we’re in a store together. Recently at the grocery store, Kidwoods spotted a plastic toy and wanted to buy it. She pointed out that it was “only $1” and I could afford it. I agreed with her that yes, it was cheap and yes, I could afford it, but said I wasn’t going to buy it because we don’t need it.

I went on to explain that we already have a lot of toys and don’t need more at this point. She was disappointed, but I remained firm in my explanation. It’s the same approach most of us use in all other aspects of parenting: firm, clear and brief. She didn’t need an entire lecture on environmentalism and why I buy used and the waste stream and clutter and minimalism. That will come later. For now, I’m setting standards around how we make purchasing decisions as a family.

3) “Different families do things differently. This is what our family does.”

This is my favorite phrase for the stage of parenting we’re in because our kids ask so many questions that can be answered by this statement.

The most relevant to money is the classic question of parity with peers:

This other kid got a new bike for Christmas, why didn’t I?

I can respond that “different families do different things.” I can also explain to Kidwoods that she already has a bike (which I got at a yard sale for $15), that she doesn’t need another bike, that she didn’t even ask for a bike for Christmas, that she received lots of other great things for Christmas…. and I might bring those points up if she presses the question.

But the reason I like “different families do things differently” is that it establishes a shared language for our family and it closes the door to begging for a bike. I’m not saying, “well, maybe you can get a new bike next year,” which would prompt a round of desperate whining in my house. I’m firmly sticking to our family’s money philosophy by using words my kids can understand.

I also love this phrase because it doesn’t imply judgement or that our family’s way is “better.”

It merely points out that our family’s way is “different.” It’s important to me that my kids grow up kind, non-judgmental and not deluded into thinking there is “one right way.” Because there’s not. There are so many different reasons why people manage their money the way they do and it is not my job (or my kids’ job) to judge anyone else’s money choices. When I use this phrase, I’m not saying that our approach is better or that another family’s approach is wrong, merely that they are different. This is an important distinction for me.

There will be COUNTLESS things over the years that we do differently from their peers and I want my girls to understand that different is ok. Because it is. And because we will never all be the same. And there will always be another new bike to buy… but, “this is what our family does.”

4) Introduce frugal substitutions as early as possible.

Anyone who just took my free Uber Frugal Month group challenge (which you can sign-up for anytime) knows what I’m talking about!

Frugal substitutions are when you arrive at the same end result for WAY cheaper.

For example: you use an MVNO for your cell phone service because it costs a fraction of the amount but is the exact same service.

For my kids, this comes up most often in terms of food. Because we all love food. And my kids–JUST LIKE ME–love themselves a restaurant meal. The pandemic put a damper on that for several years and still does to a large extent. But Kidwoods is onto the concept of take-out. Onto it like a greyhound on the scent of a rabbit. And sometimes? I buy her food when we’re out. And she thinks it’s divine. I make a point of saying how special it is and she agrees and we munch our food happily. But most of the time? I pack our food.

Our most topical example these days: the ski lodge food court.

Kidwoods skis twice a week at our local mountain and the first time we skied, I didn’t know about the food court or the need to bring A LOT of food for a skiing child. So we bought a hot chocolate, a blueberry muffin and a yogurt. Fine, no problem. But, it was $11 of food that I can make at home for much less.

For all subsequent ski days, I’ve brought hot cocoa in a thermos along with a lunchbox of food (now double food because the kid ate her sandwich AND my sandwich the first time… ).

Kidwoods periodically asks if we can buy food at the food court and I remind her that I brought food from home and that we can still sit with her friends in the lodge to eat.

She noted that some of her friends bring their own food and some buy food, which was a perfect moment to bust out, “different families do things differently and… at different times! Sometimes we buy food and sometimes we don’t.” This enshrines a level of flexibility and acceptance. I’m not saying it is “bad” to buy food or “good” to bring food, just that these are different approaches to choose from.

The point of this ski lodge exercise isn’t to make Kidwoods feel like she’s missing out; rather, it’s to highlight that there’s often a cheaper way to get the thing you want. She is still drinking hot cocoa and eating a baked good with her buddies after skiing, she’s just doing it for less. I will likely buy her food at the food court at least once more this season because it’s fun and it’s a treat and yes, we have treats sometimes! But treats are the exception, not the rule.

The deeper message of these substitutions isn’t just about saving money, it’s also about:

- Avoiding hedonic adaptation: this is the idea that if you treat yourself all the time you’ll require more and bigger treats in order to achieve the same level of enjoyment.

- Recognizing that we have enough: we don’t need more toys and further, buying another toy isn’t going to increase our happiness over the long term.

- Environmentalism: instead of a disposable hot cocoa cup, we have a reusable thermos. Instead of buying new, we reuse something old.

- The joy that comes when less is enough: one of my favorite things I’ve ever written, this is a deep dive into how rarity heightens enjoyment.

These are all higher-order concepts I’m unlikely to introduce with Kidwoods until she’s older or unless she asks. But once she asks–once she’s curious beyond my immediate response–I will have those concepts ready to discuss with her. This goes back to establishing your family money philosophy. You need to know what YOU believe about money before you can pass it along to your kids.

Remove the Taboo

My husband and I have been talking about money in front of/with our kids as part of normal family conversations since they were born. It’s not a taboo topic in our household, so it’s always been a thing we discuss in a kid-friendly way.

That being said, we don’t scare our kids or expose them to concepts that are too advanced. Our kids have no idea what FIRE is or what the stock market is or how compounding interest works. That stuff’s irrelevant to them at this stage. What is relevant is the price of bananas. They look at the bananas, they look at the price, they ask me if I have enough money. They’re getting the basic idea that things cost money and that you have to earn money in order to buy things. The complex topics will come later.

If money is a taboo topic in your house, your kids will pick up on that. They’ll internalize that money is a secret, shameful thing that no one talks about. But if you’re open about money–in age-appropriate ways–your kids will think of money just like everything else you teach them. It’s no different than teaching a child how to fold laundry.

Here’s how that analogy plays out in my mind:

Parent: This is how we fold pants.

Kid: My friend doesn’t have to fold her pants.

Parent: Yeah, different families do things differently. In our family, everyone folds their pants.

Kid: Could I ever not fold my pants?

Parent: When you’re an adult, you can choose to fold or not fold your pants. What do you think would happen if you never folded your pants?

Kid: I wouldn’t be able to find them when I’m getting dressed. Wow, parent, you sure are the best!

Parent (silently, to self): That went unrealistically well! I should try parenting as a cartoon more often…

…you get the idea. My point is that there’s no cultural taboo embedded in folding pants. The parent is not embarrassed or flustered to discuss pants-folding. See if you can bring that same clear, firm, calm, direct approach to discussing money. Pretend you’re saying “fold pants” instead of “spend money” if that helps.

In Conclusion

I’m not a money expert or a parenting expert. I just happen to have children and enjoy writing about personal finance. I also don’t think there’s “one right way” to teach kids about money. My hope is that this might help guide or initiate your approach to discussing money with your kids.

As my children get older, I’ll have more lessons to learn and share. Next up, I think we’ll have Kidwoods create a ledger book of the money she’s made and spent. Later, we’ll introduce the Parent Bank, at which one can make a deposit and earn interest. Plus, we may do a base rate allowance…. then there’s the concept of donating to charity and buying things for other people… I am SO EXCITED about this, can you tell?!? Potty training was not my thing. Money training? Yes please! I’ll let you know how all of this goes once we do it!

How do you broach money with your kids? What feels tough about it? What feels natural and easy? Got any chore ideas for Kidwoods?

P.S. does this font look any better? Many of you have requested a darker font, so I tried out something new today. Let me know what you think!

Great advice. Wish I had this knowledge when my kids were little. One is naturally a saver and the other has learned from our mistakes!!

Empty dishwasher? for Kindergartner? Depending on height of counter, sharpness, etc. 🙂

We definitely considered empty dishwasher, but, she can’t reach most of the cabinets! Maybe we should redesign our kitchen with only under-counter storage 😉

A two or three step ladder can solve that nicely.

Our 8 year old has been emptying the dishwasher since he was 6. This is his regular, part of the family chore, not for extra money. He just stacks all the dishes on the counter and we put them away. He puts away the silverware only. We do run into the issue that he likes to make towers so he will stack a bunch of breakable dishes and glasses as high as possible – eek! By some miracle, no dishes have yet been broken and we are gradually training him to stack responsibly. Next step is to start getting him to get on a stepstool and put the dishes away.

My friend has her children “unpack” the dishwasher. They stack the dishes on the counter. Then, she did move plates and glasses to lower cabinets for the younger children to put away.

My 30 yo daughter has developed great financial habits. We started her with the “jar” concept (donate-10%, spend-45%, save-45%). When she gave us her savings we matched it. By the time she turned 17, she had enough in savings and investments to buy a hybrid car, and pay the tag and insurance for 5 years. She recently sold the 13 year old car. She discovered international travel in high school and that opened another opportunity for budgeting for travel (research, travel and eat like a local, etc…). Thank you for another great post.

I read your book several years ago, gifted from a friend who read it, enjoyed it, and wanted to pass it along and have been reading your posts ever since. I just wanted to say how much I appreciate the thoughtfulness and intentionality you put into your writing. We are not parents but the joy I felt reading about Kidswoods’ experience was equivalent to a freshly baked brownie on a chilly day.

Thank you so much, Kayla! You’re making me tear up!

WOW ! This is fantastic. I wish I had learned this as a child (or even as a teen)

I enjoyed reading your post. My kids are long past this stage but I do remember trying to different approaches to teaching them about money. My daughters loved American Girl dolls and back then you could get a paper puzzle from the company where you decided what doll you wanted and then assigned a dollar value to each piece and as they saved they added another piece to the puzzle. When the puzzle was filled they had enough money saved to purchase the doll. With my son who was always changing his mind, for a large purchase I had him write what he wanted on an envelope with the money inside. Then he needed to wait two weeks and if he really still wanted it, we would buy it. Invariably, he would lose interest and want something different after a few days and we would start the process over. Hopefully it helped him learn a little about delayed gratification. Anyways, I wanted to let you know that I do have a smiling snail bank that I would be glad to send to you for $5.50. If you’re interested, I can send you pics.

Best regards

Janet

This is great! I’m not a parent and don’t intend to be but your pedagogical approach really appeals to me. I’ll try to keep this stuff in mind if such conversation ever comes up with my niblings.

Very much like the font!

I love this topic, it’s actually incredibly relevant for us in our family right at this moment in time, though our children are older. This is because we have just emigrated from South Africa to the UK, and even for us adults, adults who met over here many years ago, and who own property here / lived here for several years, the change in money is definitely A Thing, much more so for our kids. It’s been so interesting to see what is much less expensive here than in SA, and what’s extortionately expensive by comparison, just because of exchange rates, import duties, size of market and so on. Anyway, as we kicked off the pocket money regime, watching the cogs start to turn in their respective minds as to what £20 actually is versus R150, what it actually gets you, how much something you want costs as a percentage of your allowance is fascinating. I’m cutting them a bit of slack at this point, because, you know, of having moved continents, left all their friends, the hemisphere etcetera, but still, the principles are there. You have X amount, and this is based on your continued participation in household chores in an age-appropriate manner (totally agree that keeping your own room clean and tidy is NOT an allowance factor!). The difference is that, with 3 of them, it’s easier for us as somewhat lazy people to give each of them a fixed amount but not tied to certain specific jobs. Anything that goes above the normal remit of taking turns washing up, vacuuming the stairs, emptying the bins might get you a bit extra, but it would be agreed beforehand. That’s another lesson around money: don’t assume. Agree terms upfront in a courteous, neutral way, and then stick to the agreement completely. No reneging, no messing around or taking advantage.

Great topic, and yes, even till they’re fairly old, physical cash is a much more realistic, tangible way to show them the ropes.

My parents handled money for me in a very similar manner. I had regular chores that were part of being a member of the household, for which I was not paid, and my mom had a steno pad with other chores that I could pick from to earn spending and saving money. Next to each chore was the price she would pay. The list was longer in summer, when I had more free time, and every now and then she’d rewrite the list when the oddball chores needed to be redone. I loved that, because it gave me a choice of what I could do versus being told.

We received gifts on our birthday and at Christmas, and my parents did go overboard at Christmas. But the rest of the year it was known not to beg or whine for anything because it wasn’t your birthday and it wasn’t Christmas. So if I wanted a comic book, back when they were affordable, I either had to sell some of mine to friends, or earn money. I grew up for many years in Europe, and when I wanted to buy postals or silly things, say a pen that you tilted and the tower of Pisa slid up and down (yes, I still have that decades later), I’d use my own money. The bank of mom and dad did an even exchange rate for me 🙂 But that prevented me asking for this and that at every souvenir stall across Italy. I look back and I’m very thankful that my parents instilled that bit of self-sufficiency in me.

I do recognize that I was fortunate to grow up in a family that could afford to pay me rates of $0.25 to $2 for various chores Like weeding the garden, washing all the windows I could reach, both inside and out. And thankfully, my mom would inspect the jobs but not demand perfection.

And, as always, love the photos! Also love Kidwoods’ drawing skills. Remember to save some of their art on heavier paper to last for years. Early art just fills my soul.

One of my personal favorites from years back regarding impulse purchasing desires of small children in the grocery line: “Oh goodness! Did you remember to bring your money? No? Well, darn it—next time,” and we’d move on through the checkout. It afforded my children to really think about if they wanted whatever treasure was there at checkout, avoided any kind of tantrum, and offered them a means to an end if they so desired. Incidentally, no one ever brought their money the next time.

One other note—we always shared about money awareness but never burdened our children about money concerns.

Oh – you’ve reminded me – I gave my children a small amount of pocket money when they were young, so if something caught their eye, I’d say ‘You can save up for it’.’ And then 99 times out 100, they’d forget about whatever it was.Needs and wants! (We live on the edge of a pretty affluent area, so their expectations needed to be managed.)

What a great job organizing the Tupperware! I’m a bit envious.

And I love the statement different families do different things. That will fit in so many circumstances and for many years.

I know, right?! She is REALLY good at organizing!

This is totally our philosophy, especially ‘different families do different things’, something we have said as soon as they were old enough to understand and articulate difference. I have also found it easier to wait for them to be ready and eager for a developmental stage instead of hurrying them along. We have found when our children have to spend their own money, they become so much more focused and stingy-suddenly the €5 item isn’t as appealing as when mum or dad gets it for them! We have also come to an arrangement with grandparents whereby they gift book tokens or giftcards for birthdays and Christmas, and this allows them to choose things they will enjoy, rather than getting ‘stuff’ that won’t be used.

This completely re suddenly becoming much more careful when it’s their money… for a long time, my eldest son, now 15 and I regularly drove past a place that sold really nice biscuits (cookies for my North Americans), and he’d always ask if we could stop off and get some. The place was easy walking distance from our house, so one day I suggested that if he wanted to, he could very easily walk down there – a less than 10 min – walk, and easily get biscuits with his money.

Let’s just say there was a lot of sulking and never did I see those biscuits purchased. They were a ”really good deal” as long as the money to buy them wasn’t his!

When my daughter was 4 or 5 years old, we went to a toy shop where she could choose what she would like for the money she got as a birthday present from her grandparents. She explained to me how she decided if something she liked was worth the price: “I look at it and think how much I would pay for it, then I check the price. If it is higher than what I think Iwould like to pay, it is no longer interesting for me”.

This approach at her age really impressed me, and so far she has always made reasonable decisions regarding money.

For chore options, just be aware of what you do throughout the day, viewed through the lens of “could my kid do this safely?”

In addition to emptying the trash, our little kid chores included putting away the silverware (and adding in plasticware when that was reachable–or after I rearranged some cabinets to make it reachable!), stripping bed linens, folding towels and doing as much other laundry folding/putting away as possible. We added in wiping down bathroom counters, dusting, etc., for things at their height or safely reachable. Bring your laundry to washer and put it in (laundry was on same level, not down scary stairs!), move laundry from washer to dryer (with help of grabber hand to extend reach). Added Vacuuming around 6 or 7, I think. Outdoor chores seem to be a limitless possibility at your place. Have fun with it!

Great ideas. I also offer up jobs I dislike, lol. Cobweb removal from the porch (with a long stick), dusting the baseboards, cleaning tile grout with a small brush, dusting bookshelves (and putting all the books back on), taking out the recycling or trash, weeding the plant beds…

Hey Liz,

It seems we face the same fun challenges these days 😉 ==> https://www.mustachianpost.com/2021/11/03/how-to-manage-childrens-pocket-money-in-switzerland/

I already hear Mrs. MP claiming “You see, even Mrs. Frugalwoods agrees with me to have real bills vs. everything online for kids!” 😂

Thanks for having shared your process so far, it can only help our PF community!

Excellent article. I couldn’t agree more with everything you’ve said as I did a large part of them with me daughter (who is now 24 years old) The next step (when your daughter is ready) is to teach her to save.

In my case, our daughter loved to go to the dollar store with her weekly allowance. One week when she was 6 or 7 years old I suggested she think about starting a savings account and anything she put in to it, I would match. Wow! Did that account grow! So much so, that she was able to pay cash for her first used car in college. It wasn’t easy giving up things she ‘wanted’ but it was wonderful watching that money grow and accumulate interest.

Well, since she is ” earning ” money by doing extra tasks, right here at the beginning do you need to institute the give, save, spend jars? Instead of dollar bills, you’ll have to get coins. Just wondering if you need to start as you plan to go on in the future? Hopefully, your girls avoid money heartache their whole lives with their loving parents’ wise guidance. Blessings!

Love this! Saving to the Parenting section of my Notion database (where all good things for future reference–our kiddo is only 3–go) and sending to my spouse.

Teaching philanthropy: I set aside €10 every month. My three nephews can give this money away. I will not judge their choice. It is an opportunity to learn how to give. ( They might have to deal with my inheritance one day)

So sometime I get a phonecall when there a cause they like to contribute to from ‘their fund’ .

We are open with my stepson about money. He has questions, we have answers. We’ve always been super intentional and frugal but it’s wildly different at his mom’s house so we use the same approach as you, “Different people do different things,” and leave it at that.

Setting expectations about spending before we go out to do something helps, too. He’s old enough now that he can make his own decisions, which is great.

He has a few chores around the house and can always earn more money as he needs it. The idea of having kids organize stuff for you is genius. I am going to start this pronto!

While I understand your thinking that the school book sale could be considered unnecessary consumerism, I was always happy to spend the money on books sales for my kids. They all grew up to be voracious readers, in part from my willingness to buy them books in addition to library trips and lots and lots of 2nd hand books bought for them as well. I am now buying 2nd hand books for my grandkids, who also love to read. Second, if the school needs to have a fund raiser (and unfortunately what school doesn’t?), I would much rather it be books than candy, cards, wrapping paper, etc. By using books as a fund raiser, the school is encouraging them to read, giving kids an opportunity to choose what they want to read, giving them a chance to build their own at home library, as well as reinforcing the importance of reading.

I get tons of books from the library. I can’t afford to buy all the books my kids want to read.

I feel no guilt about £ spent on books. I buy used from better world books or from our delightful local bookstore, money that supports a local business. When my son has outgrown them, we pass them along to friends, the school or to the local library for their book sales.

When I was 4, we moved into an absolutely delapiated house, as that was the only way my parents could afford a house big enough fot the 4 of us (I had a baby brother). From as soon as we were old enoughwe were expected to help with renovations at weekends. Communication between home & our school must have been great, because i remember when a classmate grumbled that I got 1s 5p a week pocket money, and she didn’t get any. The teacher pointed out I had to work each weekend for my pocket money (‘Different families do things different ways’ – but reinforced by a teacher!) I have really enjoyed this post.

And you’re never too old – my 2 are adult & have jobs, but still live at home and pay a decent rent (they know I’m saving it up for them for when they settle down, but we all pretend they don’t know – it’s still teaching them to budget) They do their share of chores, but, if it’s above and beyond, I pay daughter for office work from time to time, and son for heavy lifting.

I love “different families do different things” I’m going to start using that phrase more often.

As for kindergartener-friendly chores to earn money, my 5 year old likes to clean the toilet with the toilet brush, wipe down the bathroom sink with a sponge and clean the mirrors he can reach with a stepstool. Washing windows has been a hit with all my kids, even at younger ages. Spray bottles = fun. Trash/yard waste pick up is also an option when the weather permits. As a kid my grandfather paid me 10 cents per magnolia seed cone that I picked up from under his tree in the front yard.

Have you thought about letting Kidwoods use her money to buy food at the ski lodge? We plan to let the kids occasionally spend their own money to buy snacks at the pool this summer. There are lot of kids in line making their own purchases and the cashiers are very kid-friendly, helping to count out change, etc.

I’m hoping to set up our first lemonade stand this summer with the 7 & 5 year olds, (we get lots of foot traffic where we live). I’m hoping to convince them to donate all or most of the proceeds to their school as a fundraiser. They are also interested in having a yard sale. I’m skeptical b/c they always change their minds about getting rid of toys – we’ll see how it goes!

Genius!! Thank you so much for the ski lodge food idea!!! That hadn’t crossed my mind, but it’ll be perfect!!! And thank you for the window idea–I have a feeling we’re going to have some clean windows soon 😉

yes to ski lodge transactions! i grew up attending a rigorous, weekly ski program, and can honestly say that i honed a lot of my purchasing and small talk skills at the ski lodge cafe. Perfect exercise to learn the act of transacting AND, a rarity in this day and age, communicating with a live human. Great read overall, even for this single, childless urban-dweller. It seems like you’re taking a very thoughtful approach and teaching your girls a very healthy money mindset.

We told our son we would pay for the special treat once, it was up to him to decide when to use that option. It gave him control over the process and he was able to evaluate when it was a worthwhile spend and when it wasn’t.

Loved this article. Teaching kids about money is critical. I hope somewhere in the course of your conversation about what her money CAN buy was the comment that she doesn’t need to spend ALL of her money just be she has it. The importance of saving money seems to be lost on many young people today. Good job, mom!

Oops. That was supposed to read “because she has it” !

My mother used to leave us a list of chores in summer in high school with a price next to them (for the total list). I love money so I would do them all the first day. 🙂 I love the idea of doing it younger.

As a skiing family, we also value the BYOL in the lodge. So many “fancy” places are doing away with the main seating to eat in favor of restaurants and I don’t like it. My favorite ski area, pre-COVID, used to host weekend ski teams and I would love to see the families bringing in crock pots, rice cookers, etc, to make hot lunch for the kids. I like to support my local cafeteria from time to time but I prefer a beer or hot cocoa vs. a full meal.

Money education continues into adulthood. When our kids turned 12 we went to our neighborhood bank and opened a savings account in their name. For the first year we would match any amount they added to their account. Fast forward: My 39 year old single daughter purchased her own home a few years ago. We felt she never thought much about finances so we gave her a challenge. For one year we would match anything extra she payed on her mortgage. What an incentive for her. And what fun for us to gift while we can share her excitement. And what fun to help teach our grandchildren. I feel as if we are kindred spirits.

I remember those book orders! I used to help out in the school library every week and sometimes I got to bundle those flyers into class bundles. Meant I just happen to see the pages with the teacher deals. I would sometimes order from both the kids flyer and the teacher flyer for Christmas and birthdays. Got some nice deals out of the teacher pages.

Another thing I would do was let my kids, I have 3, look things over in the fall for Christmas gifts for their siblings with each kid. I would help pay for those out of the Christmas fund. It was worth it to see one kid stop unwrapping their gifts when they notice their gift was being unwrapped by a sibling!! A wee lesson in that it’s better to give than receive. Fun times!!

Thank you for raising your children to be good people. Our world needs all of those it can get!

Be ready for the “when I’m grown up, I am going to pay someone to do this for me”. To which you reply, “that’s fine but you better know how it is done so you don’t get ripped off”.

Whoa…inflation! 40 years ago (at ~10 years old) I dug about a dozen 2-foot deep post holes in rock-hard ground for my dad’s new garden fence at 50 cents a pop as an extra chore. Now just emptying the trash cans or organizing the junk drawer gets that much. LOL! 🙂 This is a great way to teach about money!

My kids have managed their own money from a very young age, with a combination of cash and the RoosterMoney app.

When we traveled, I would decide how much I was willing to spend on souvenirs, and give them that amount of money to spend or save, as they wished. Then we progressed to letting them manage their own restaurant money (they never order drinks and pay close attention to prices!) and fun money (mini golf, ice cream cones, etc.) while traveling.

Now at 12 & 14, they also manage their own clothing and restaurant and entertainment budgets, too. I pay 25% interest (note: should have stuck with 10%) on their savings, using that app. Currently the 12yo has $500+ saved and the 14yo has $250+. The 14yo is a gadget lover, and he managed to buy himself an iPad, Apple Watch, and a secondhand video game system, all in the past year, just using his squirreled away dollars, doing extra chores, and starting a little side hustle business in the neighborhood. I was very impressed.

He also mentioned that he “ran the numbers” to see if he could afford a Tesla if he saved all his money and got 25% interest on it, between now and age 18, but “it wouldn’t quite be enough…” 😀

Note: I give them each $50/mo for clothing and $50/mo for dining out, plus about $3 per week as a base allowance. We live in an affluent area, and their peers’ parents easily spend $500 in a single clothing or shoe shopping trip, so I’m good with our approach. I do occasionally have to insist that they actually purchase some clothes, though. They’ll grumble but finally relent and hit the thrift shop or a sale at Kohl’s.

We did something similar with souvenir money when we would travel. It saved a lot of begging in he gift shops and let them choose something they would really treasure – or save the cash for something else later!

I’ve been following you for several years since reading your book, which I picked up brand new for free in paperback at a library fundraiser. (They paid for the book so I don’t feel too guilty).

I’m already retired and saved carefully for when that day came. I signed up for the UFB last month and was impressed with all the younger folks who are already doing such a great job with frugality. It will pay off!

This was one of my favorite columns of yours. The timing just happens to be perfect as I am going to take my granddaughter on a grand trip for her 10th birthday in April ’23. I’ve been brainstorming ways to help her earn money for the trip, and really liked your ideas.

I have a small mortgage with a smallish bank that requires one to open a checking account with them from which to pay the loan. They further require one to put at least $25 in a savings account every month. So I do that, and rarely even look at the balance. Just looked, and the savings account is over $1000 in nine years. Which will help to fund our upcoming trip. And I have never missed the $25 every month…think I need to bump up that amount.

Thank you for sharing all your wisdom. And your photos of the adorable kids. They make me smile every time I see them. And your stories about them are so funny!

You are wise beyond your years!

I enjoyed this post so much! What a wonderful example of introducing concepts when the kids are ready. My wife set up the 3 jar system with physical money when our three where toddlers. That seemed to work well. They graduated to bank accounts when they were a little older. At first they did not like/understand that their money was safer in a bank and interest made no sense to them. They did get it over time, especially after we introduced a parent matching program (i.e. once you save $100 you get a $20 match) Selling girl scout cookies, doing yard work for neighbors, shoveling snow, babysitting, petsitting have all been ways they’ve earned money on their own. Next year our oldest will turn 18 and get their first credit card! We’re pretty confident (fingers crossed) these early money lessons will help them use this new tool responsibly.

I think “Raising Your Money-Savvy Family For Next Generation Financial Independence” by Carol Pitner and Doug Nordman is a great book for teaching age-appropriate money concepts all through high school and young adulthood regardless of whether you are into FI or not. The hardest lesson in the book (for me) is that we parents need to step back and let our kids make mistakes with their own money. They must learn that their money is theirs, that they are responsible for it and that their parents aren’t necessarily going to intervene and come to the rescue if they mess up.

I look forward to future posts on this important subject and good luck!

My children are adults now, but it strikes me that your eldest is very bright. She is, I bet, doing very well in school.

Meanwhile, I remember so fondly my mother’s buying me cheap Scholastic books off those flyers when I was in grade school. It was a great treat because I loved books. I know used and even free books are pretty easily available now, but choosing my own and seeing that my mother valued reading I think was very important. I majored in English lit and journalism and did most of my master’s before I found a job in journalism.

I am currently in the “teaching kids about money” stage. This was the first year we implemented a monthly allowance. They help a lot. Shoveling snow, feeding/caring for the dog, helping get dinner ready, babysit their little brother, keeping all toys cleaned up, folding and putting away their clothes. Right now the money goes into their wallets, and once it reaches a certain point we take some out to deposit into their online bank accounts. I agree they need to “see” the money to learn to respect it. Even as an adult, I think using cash makes it more difficult to part ways with it vs a credit card. This money gets spent on things they want(most recently a trip to build a bear), and donations to charity. As for used clothing/shoes… my middle daughter used to complain about using her sister’s old clothes(which are usually in pristine condition). One day I gave her a pair of her sister’s outgrown rain boots. Again she complained, so I offered her $10, the very least I would pay for another pair. I explained to her that reusing something literally saves you the cost of that item, and the energy it takes to work for the money to cover the cost. It’s a win/win. She gladly wore the old rain boots and saved the money. Anyway, it’s definitely part of parenthood to raise money conscious kids!

I’m kind of surprised that at 6 years old she only had $6.05 to her name. In my family, grandparents gave alot of money to our kid – more than he could think to spend, and for example at 9 years old, he has over $600 in his savings account. It’s a bit trickier since he technically has the money to buy expensive things. We tell him that “mommy and daddy still have a say in what he buys for himself”.

My kids get money from grandparents and the odd relative. If grandma gives $5 in cash in a card, it’s for my kids to keep and spend as they wish. If she gives a $100 check, that goes in the 529 account. My kids know that money is for their education.

Yeah, we have a separate education savings account (in Canada it’s an RESP), and grandparents often gift to that one too! Anyway, so far, my 9-year-old hasn’t been super eager to access his bank account money (since it’s just “numbers online”). Maybe when he gets a large amount as a cash gift, we can insist most of it get deposited so that he sort of forgets about it 🙂

The $6.05 is her own money, not inclusive of the money we have saved for her future, such as her 529 account and other investments.

What do you guys do for investing for your kids other than the 529? I haven’t done so yet, but I’ve now heard of gifting stock being done by some families – super curious about the logistics and intent

The biggest question – which books did she buy?!

Unicorn with the charm bracelet!

I love this so much! She will also learn the regret of spending money when what they spend it on disappoints. We were always transparent about money as my kid was growing up. We just weren’t super smart about money sometimes. My ex was not money motivated, so it was often up to me to earn the money. And I wanted to enjoy the money I worked so hard to earn, so I would spend more than I should because I “deserved” it. Because of that, my now adult child has had to learn a bit the hard way about saving/spending, but is overall doing a great job! Much better than I did at that age (23).

When my son was about 6 years old, i put 10 dimes on the table and 1 dollar bill. I explained to him that 10 dimes equals 1 dollar. I went on to say 1 dime is 10% of a dollar, 2 dimes is 20% of a dollar and so on. I told him from now on when he receives gift money, we will put 20% of each dollar he receives away for savings. (He agreed. No complaints.) We did that. When he graduated high school, he had a few grand available to him from that savings strategy.

I had a very similar thought as Maryann that I wanted to add. When I was a bit older than Kidwoods, my Mom used coins to teach me about division and percentages. Learning that a quarter was 25% (and 25 cents) made it so approachable for me. By learning that a single dollar bill also equals 4 quarters is magical. Using nickels, dimes, quarters and half dollars (if you can find them) really brings it all to life for a child that is a hands on learner. Yes, you can do it with M&M’s or grapes but spare change always attracts small children (and usually doesn’t get eaten before the end of the lesson!). My grandfather would empty his pockets of change every time we saw him so I had a small jar of change to work with and regularly count, add up, multiply, subtract and divide.

My daughter is the same age as kidwoods and in addition to similar “cost of living here” chores, she also:

-scoops dog poop when we aren’t buried in snow (if you get another dog down the road)

– collects the eggs and washes if necessary

– scrubs handprints and various marks of unknown origin off walls, cabinets, etc

– vacuums the coat closet/boot trays and organizes the shoes

– sorts recycling

– sweeps goat poop of the deck (really need to build a fence lol)

– fills the wood box

– brushes all the indoor animals

She started earning money for chores last year and has made a couple of purchases but after watching how fast those hard-earned dollars disappear she generally saves.

Her school does “snack shack” where the big kids plan, budget for, and purchase treats for the other students to buy. My daughter will typically use her chore money to buy herself a treat. They do it a little too frequently for my preference but I do like that the older kids are learning finances and it trickles down to my daughter as a consumer.

Could she carry wood? My kids all did at that age. Our son at four years old would use his wagon to haul wood from the shed then carry it into the house. He loved doing this. We only had to carry wood if it was really cold or bad outside. He even wore little coveralls! He always wanted to work hard and be like his Dad.

Our kids were in charge of their own money from five years old on. They received money for gifts, doing chores for neighbors like cleaning, yard work, cleaning barns, etc.. and sometimes for big chores at home or if they helped my husband with a construction project. For example we once set up a pool for someone and it is hard to do with two people so we had all four kids there helping us hold up the sides. I think we did the job for $300 back then and we gave the kids each $10. They were happy with that.

I gave them a certain amount of money each year to buy their school clothes and they could buy whatever they wanted which made it a pretty stress free experience. They learned to wait for sales and be careful with what they bought. I did buy their socks & underwear to be sure they had some! They said they loved being in charge of their own money because it made them feel more grown up.

Carrying wood is a great idea–Kidwoods can definitely fill the woodbox on her own!

The food in the school was rather expensive to my way of thinking, and it was not to my daughter’s taste either. She began taking a packed lunch at the beginning. What I packed was a sandwich of some kind, carrot or celery sticks, sliced apple, and homemade cookies or cake. She soon learned the value of her homemade desserts and traded parts of them for things I considered of low value—one cookie was worth an entire bag of chips, etc.

I bought a lined plaid wool jacket at a neighborhood garage sale for $1. A girl who had refused to wear her brother’s jacket was envious when my daughter wore it and a variety of other garage sale clothes that she never wanted until she realized that a girl could wear clothes originally worn by a boy. My girl wore the jacket for 2 years and also wore a variety of T-shirts ad jerseys ($,25 each) from the same source. Color and comfort were her only criteria.

LOVE “different families do different things”! Yes!

My daughter is a junior in high school. They offer a personal finance/economics elective class. It is going to be a family requirement for her to take it next year. Hearing the money talk from several sources doesn’t hurt. (Hmmm, maybe my parents aren’t idiots after all!)

I don’t have children, so wasn’t sure I’d read this one, but I’m glad I did. It was lovely. I think the lessons you’re teaching them are so valuable! As for the skiing lessons, I’m not sure children really get how expensive and valuable the lessons themselves are, for any activity, and how much harder it is to budget for them yourself (both in time and money) when you’re an adult. I wish I’d had skiing lessons! 🙂

My parents taught me great lessons about managing and earning my own money, and didn’t give in to my every whim. However, I still got into trouble as an adult, partly because of what I saw around me when I moved to the city, and this perceived sense of deprivation from being brought up in a small town where there were no “cool things to buy.” I think what you’re modelling for your kids will be just as important as what you’re directly teaching them. Though I had those great lessons about money, I also saw a lot of hoarding and buying things that weren’t needed, and those habits rubbed off on me too. It took me much too long to really get that stuff does not equal happiness.

I hope your daughter loves her books, but if she ends up being disappointed with one, that’s another lesson: that we often think the things we buy are going to be wonderful and magical and make our lives better, but far too often, they’re not and don’t.

For Thought

( Re: capitalist-consumer ethic)

Religion – 2 meaning (there are more)

· a particular system of faith and worship.

plural noun: religions

“the world’s great religions”

· a pursuit or interest to which someone ascribes supreme importance.

Excerpt from the book, “Sapiens” by Yuval Noah Harari.

The capitalist-consumerist ethic is revolutionary in another respect. Most previous ethical systems presented people with a pretty tough deal. They were promised paradise, but only if they cultivated compassion and tolerance, overcame craving and anger, and restrained their selfish interests. This was too tough for most. The history of ethics is a sad tale of wonderful ideals that nobody can live up to. Most Christians did not imitate Christ, most Buddhists failed to follow Buddha, and most Confucians would have caused Confucius a temper tantrum.

In contrast, most people today successfully live up to the capitalist-consumerist ideal. The new ethic promises paradise on condition that the rich remain greedy and spend their time making more money, and that the masses give free rein to their cravings and passions – and buy more and more. This is the first religion in history whose followers actually do what they are asked to do. How, though, do we know that we’ll really get paradise in return? We’ve seen it on television.

Thank you for this blessed article! When I was a kid, money equalled a war between my parents. My mother was a saver and very disciplined about money; my dad was full bore spend it all. Money- talking about money, thinking about money, working with money made me very, very nervous. It took me years, literally, as and adult to come to grips with it. I also credit “Frugalwoods” because you are the first people that I have ever had discuss money in all it’s forms, rationally and calmly. I LOVE this blog and get so much out of it!! Bless you two for giving your kids a firm and functional bedrock of money and how it works!

By far the best blog in a while. I really enjoyed your perspective and how you are teaching Kidwoods about money.

If you do initiate an allowance, may I offer the idea to wait until she’s added a heavier chore to her household duties? For me it was ironing my mom’s work uniform. The job was for the household, but not for personal responsibility, and such negated a paycheck, and possibly steer away from the term allowance? In the U.S. we aren’t given something for nothing, or an allowance. So instead, I had paydays when mom had paydays, and submitted a sheet of tasks for payment. Another thing was when you make your chart of tasks, put expected completion dates, or availability on them. Organizing the Tupperware is awesome, but not 5 times in a week. So maybe marking it off when it is done, or giving a date when it can be done again?

Just ideas. You always have such a good focus and I enjoy reading your work.

Thanks

Great article, Liz. I wish I had used this philosophy when my girls were young. Come to think if it, I never did teach my kids about money. All they heard was ” we didn’t have any”. When I think back, I know how lucky we were to have what we did. It afforded private education, good colleges and a roof over their heads, food and clothes. It just didn’t provide the “wants”.

I am totally impressed with that Tupperware cabinet. Kidwood’s did an excellent job! It looks beautiful. Mine doesn’t look that good!

What did she decide on her book order? I’m sure she didn’t spend the whole stash. But, I do know after raising 2 girls, that Unicorn bracelet sure look appealing to a 6 year old! I never minded putting out money for books from Scholastic, it helped the school with books for the library and teachers as well. I now have 2 voracious readers.

Curious, how often are you able to get to garage sales during the warmer months? Do you ever shop FB marketplace or other on-line thrift or bartering sites?

She went with the unicorn book and bracelet, after much deliberation. But she was happy to have money leftover, so I think it was a successful first effort :). The Vermont garage sale season is limited to the summer/early fall months and one of my BFFs and I go early in the morning on every Saturday that there’s a good sale within a reasonable distance. I love going with her because it becomes a social occasion and a deal finding mission! In the wintertime, I go to the thrift store on occasion, but I really do stock up on everything during those summer yard sales.

I was raised by Sicilian parents who used key phrases to raise us ( much larger family of all girls, bless their hearts!). Easy to internalize… and to pass to the next generation. My technique for managing school and school activity fund raisers was to donate time AND money and told them to keep the stuff. The math worked to go to the cause and not to the third party vendors. Books were ( sometimes ) different. One possible job for your daughter when she gets a bit older is to market her writing. My oldest started a newsletter in second grade called “ The Daily ( Insert his name)” marketed to friends and family and a few neighbors. He’s an adult in the publishing field in NYC today. You are an excellent writer, perhaps she can learn that a person can make money doing what is enjoyable and rewarding in other ways. Here’s one for the teen years “ Nothing good happens after midnight “.

This is so so good! I am bookmarking for when our one year old’s interest in money blooms beyond trying to eat coins he finds in the couch cushions…

I got a little teary at “I’m ready to do chores for money!” So sweet. A very respectful parenting type approach to money education and I am here for it x100.

Absolutely brilliant approach, which would work even if the parents have lots of money. I think that must be when it is harder to say no. Calm, confident, sensible, and empowering. Plus I love your writing.

When my brother and I were about the ages of your kids, my mom had us “baby sit ourselves” while she was working at home. Basically, we got a sticker for each 30 minutes that neither of us interrupted her, and then at the end of the day she’d pay us based on the number of stickers. It was a joint responsibility system, so if either of us bugged her, neither got a sticker! My brother (who was 6) was very motivated by this and used his earnings from the summer toward a Nintendo. I think I spent mine on silly little toys (I was 4 and not really at the motivated by money point yet). We used the same system the next summer, and my mom recalls that it worked well enough for her to get a few hours of work done each day (and she saved a chunk by not having to hire a baby sitter).

This is amazing! I work from home and when the kids are not in school, this sounds like a life-saving strategy. Thanks for sharing!

I love that a cat is less valuable than a smiling snail 🙂

Haha yeah, the pricing was questionable…

I dunno… have you seen the restaurant prices of escargot?!?! Kidwoods is quite perceptive of current market conditions haha.

Thanks so much for the suggestion on how to deal with book orders! We struggle with that one. I also appreciate the idea of how you don’t pay for tasks that are really “self maintenance” that they should be doing anyway. Great thoughts. We also definitely talk a lot about how each family has their own expectations/philosophy. We could buy fancy cars, but choose not to.

At 10 my son was ready for more information and we switched him from a normal savings account to a custodial investment account where he buy shares of index funds. He is 12 now and loves to see the change in value each month and is realizing the magic of compounding. It has motivated him to save more than our required 30% of all earned chore or gifted money. It’s always his choice, but he will occasionally save all of the check/earnings just to see the number jump on the next months statement. So many good lessons at this point about stocks, indexing, market fluctuations, etc. I just noticed Fidelity has a youth account starting at age 13 where he will be able to learn to manage his account on his own.

That’s awesome!!

Love this! It’s a great advice. My son is 2.5 yrs and I am.always open about money and being honest about it. Sure others stare but he knows that sometimes things are expensive and then we cannot buy them 🤷🏻♀️ Sure at the moment it’s more “This costs many many money” level but it won’t stay that way 😂

This is very timely for me! My 5 year old was gifted a large amount of cash this Christmas and couldn’t wait to go out and spend it, so we knew that it was finally time to get a game plan for how to teach our kids (5 and 3) about money. I have hangups about money from how I grew up and am still only slowing learning about good money management so I knew I wanted help and advice for how to do this. After some researching I found some kids books to help introduce some of the concepts we want our kids to learn and a book for us parents to help us figure out our approach

The parent book is “Make Your Kid a Money Genius (Even If Your’re Not)” by Beth Kobliner. I just got it from the library. For the kids I bought a used copy of “The Four Money Bears” by Mac Gardner, it teaches about basic functions of money with Spender Bear, Saver Bear, Investor Bear, and Giver Bear. Then through our local library I was able to check out the Money Bunny series of picture books by Cinders McLeod: Earn It!, Spend It!, Save It!, Give It! which gives another take on money basics for young kids through different bunnies using “carrots” which are money in Bunnyland. We’ll see how things go from here!

I’ll have to check out that book that another commenter recommended, “Raising Your Money-Savvy Family For Next Generation Financial Independence” by Carol Pitner and Doug Nordman. And I look forward to continuing to benefit from the Frugalwoods’ experience and comments being shared here 🙂

Great article and approach to teach our kids about money. I’m gonna start doing this as well with my 6 year old!

Thank you!

This is great, my parents had a similar philosophy and now at 26 I am one of few of my friends who holds a full time job and is not still on their parents cell phone plan (or any other mooching behaviors). From about 8 years old on my parents compensated me generously (compared to my peers) for chores, but stopped buying any non-necessities. I had a job by 15, and still vacuumed, did yard work, cooked 2 dinners per week, packed lunches for myself and my parents daily and did the bulk of spring cleaning. When I wanted contact lenses but already had free glasses through insurance, I paid, same with just about all clothing I bought after I stopped growing etc. I even cut and highlighted my mother’s hair every 8 weeks in return for my cell phone bill. In hindsight, I spent too much on makeup in high school, and my mother mentioned this every once in a while, but it was my money and she trusted that I would learn that lesson on my own and I never resented her for trying to stop me from buying something that I wanted. My materialistic high school self has evolved to prefer splurging in the “experience economy” and I am still very close with my parents, financially literate and aware of the sacrifices they made for me.

I love this topic! Both of my kids (10.5 and 5.5) have a weekly allowance of $4 (usually handed out in its entirety at the start of the month at their request). Of that $4, $2 goes into their ‘spend’ jar, $1 goes into their ‘invest’ jar, and $1 goes into their donate jar. We started this when our eldest was 6, but the younger one got in sooner because she wants what her big brother wants. When they are given money for birthdays, Christmas, etc., they get to put half in their spend jar, and the other half goes into their bank account (which they have no access to) for long-term savings. If they want to earn extra money, they have to contribute above and beyond their usual chores.

It was important to me that they had some money available to them consistently to allow them to make financial mistakes when the stakes were low, so I didn’t want to tie all of their spending power to chores.

If they see something they want when we’re out, I write it down for them on my phone and they can decide to buy it themselves with their own money at a later time.

Not much data from the little yet, but this system has worked amazingly well for my oldest:

– when he was 7 (I think) he really wanted a particular LEGO set and did many many extra chores around the house to get the money he needed

– in late 2020 he decided he wanted to save up his money for a Nintendo Switch and repeatedly refused to buy other things while he was saving (even a book that he really really wanted – he waited for the library hold to come in instead)

– once he had enough money to buy the Switch (he had a helping hand in getting started since he’d been collecting an allowance through the entire pandemic with nowhere to spend it, but I would estimate he still spent at least eight months diligently saving and earning money), he has gone through a phase of burning his fun money on non-tangible online items (mods in Minecraft, Robux in Roblox, etc.)

– he once did not have enough money for something he really wanted and found it incredibly difficult to have to wait to build up his allowance again. He regretted some (but not all) of his non-tangible online purchases

– he and his buddies like to go to the corner store to get treats after school. He can see that buying treats diminishes his future purchasing power.

– he asked for gift certificates for his Nintendo Switch for Christmas. Even though he got more than enough money to buy a game, he’s kept the balance because BOTW 2 is coming out this year at some point and he wants ‘to make sure I have enough money so I can buy it on the day it’s released!’

– when he asks for something and I say I’m not going to buy it but he can use his own money I can see him take a moment to really think through the costs/benefits

I will note that by age 10, the line ‘we don’t do that in our family’ often leads to shrieks of ‘I hate being in this family! This is the worst family in the world! All of my friends’ families don’t do this!’. But I hold firm.

My son has used the donate jar for his school’s Terry Fox run, or to donate to his favourite YouTuber’s good causes (Mark Rober’s Team Trees and Team Seas). He has loved having the ownership of deciding where it goes.

I need the pandemic to end before we can fully incorporate the invest jar, but I believe it is possible to set it up so that he can invest in index funds (I think he will get full control of the money at age 18, but I need to do more research on this). Anyway, my plan is to set them both up from the start with the idea that ‘saving’ is not enough and that they need to make their money work for them by investing in low-cost index funds.

The jar system I got from Ron Lieber’s The Opposite of Spoiled (I think he has a ‘save’ rather than ‘invest’ jar label). It’s worked really well in our family!

I can’t believe I forgot to mention that our oldest also wrote a novel during the pandemic and then sold copies to family, friends and neighbours, with a small royalty ($1.50 per book) built into the selling cost. That helped a lot with the Switch purchase!

Those book orders make me crazy with the consumerism. I do the same thing and tell my kids they can get something if they use their own money. I also note that I can check the library to see if the book is there and they can read it for free. I don’t think they have ever actually ordered a book.

Along the same lines, I despise the school book fair. Nothing caused tantrums with my kids more than that dang book fair. I would give them $10 to spend with the stipulation it be spent on books only, not the little toys and trinkets they sell alongside the books. They always wanted the trinkets or they wanted books that cost $15, and I would stick to the $10 on books rule, and by the time we got home, everyone was unhappy. Luckily we haven’t had a book fair in a couple years due to covid!

Looking at your suggestions, my kids are used to secondhand stuff and are fine with that for the most part. I also us the “different families do things differently” line a lot. I fall apart on the “firm clear and brief” idea. I am prone to lecturing my kids about the evils of waste and how lucky and privileged they are. Their eyes tend to glaze over, so I need to rein this in and be more clear and brief. I am also raising small lawyers who can make a good argument why they DO need me to spend my money on x, y or z and I sometimes let myself get drawn into arguments and debates.

I enjoyed this article. Love the new font. Beware once you start on the savings concept 😏……I can see a horse in the future appearing….

Hahah yep… Kidwoods would totally angle for that!

This made me laugh – “I found it interesting that she initially thought the numbers in money operated under a different formula than the numbers in math. Made me realize that many adults think the same thing!” – I’m a civil engineer, and it always surprises me how freaked out engineers get with numbers that happen to relate to money, regardless of the fact that we use complex maths every day in other contexts… If you give them a costing spreadsheet they lose their minds. I ended up being the go-to costing person in one job, and people thought I was magical and amazing, just because I treat money maths the same as normal maths!!!

YES!!!

Re: your daughter being able to read the numerals on dollar bills…for my niece’s 6th birthday she received a $20, a$10,a $5 and five $1s from grandparents. Niece sorted the money and placed the ones in a pile and the other bills in a different pile. She announced that she was not allowed to have “big” money and had to go give it to mommy. She came back and recounted the ones. She then announced that ” maybe ” she could keep all five but would have to ask mommy. (Mommy spent the $35 on new sneakers and sandals for niece- which was grandparents intent.) Grandparents had a college fund for her. She had enough scholarships for college costs so at high school graduation she and grandpa went to buy her a new car with that money! Yes, we are all proud of her and she is a mathematician and great with money!

From someone who wasn’t taught about money as a child, this is so, so important. My parents didn’t talk about money in front of me so I guess I didn’t realize how important it was in life. I didn’t learn about budgeting, saving, or really the value of a dollar, until much later in my life. I’m now trying to catch-up with both my learning and my personal finances. While early retirement isn’t in my cards, being able to retire at 65yo is a feasible goal for me now. I found your blog about a year ago and have tried to absorb as much of that brilliant frugal energy as I can!! Thank you!!