I Hate to Fail

I am a type A overachiever, and I have been since the early days of kindergarten when my mom said that I would get dressed and wait on the stairs for the bus to come two hours before its scheduled arrival time. I’m not sure where this drive came from; however, I know that it has motivated me and continues to motivate me to accomplish my goals and excel along the way.

As a type A overachiever, I don’t handle failure well, and I typically consider failure what other people would call average. However, even though I don’t handle failure well, I understand the importance of its role in our lives.

Failure is truly the greatest teacher we can have, she’s tough, she’s unforgiving, and she teaches the same lesson until we master it.

While Mr. Frugalwoods and I enjoy/attempt to survive our very first month as parents to our daughter, Babywoods, I have a delightful slate of guest posts from my friends lined up for your reading pleasure. Today, please welcome the fabulous Shannon McLay from Financially Blonde!

I Hate to Watch Failure

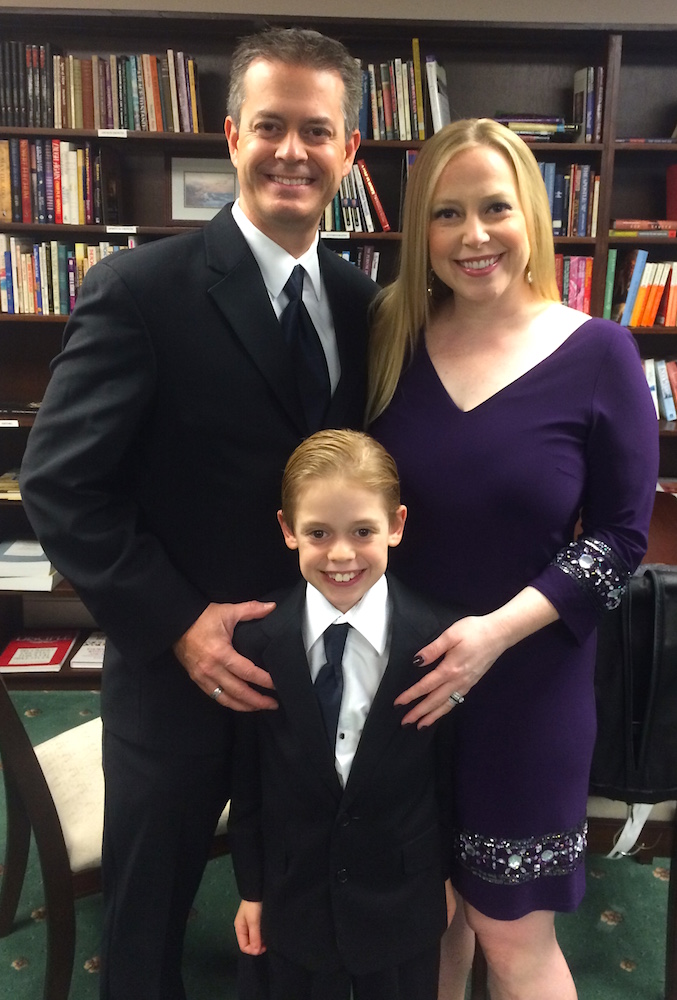

As a parent, I want nothing but the best for my son, and I want him to achieve everything he wants from life, but I want him to experience failure as well. Witnessing the failures of my son are more painful than my own because I want to prevent him from feeling any pain, but at the same time, I see the results of failure on him and I have to say I love it.

When my son was six years old, he saved close to $200 from the holidays and his birthday and at the time he was obsessed with LEGO. My husband and I allowed him to purchased LEGO sets with his own money literally down to the last dollar. Right before he spent his last dollar, we reminded him that he would have nothing left yet he still moved forward with the purchase.

But I Love the Results

Almost four years have passed since that unfortunate day for my son and he has never dropped his savings account balance below a few hundred dollars. He even started investing at the beginning of this year. Frequently when we talk about his spending, he brings up the time when he had no money. He even brought it up on the podcast I recorded with him earlier this year.

It was a painful lesson for him to learn and it was a painful lesson for me as a parent to sit back and watch as it unfolded; however, he needed the failure in order to learn the success. As parents, we need to stop trying to protect our kids from all that could harm them, especially as it relates to money. The time for them to fail and learn is early and often. They need to experience failure on a small scale (even though it won’t feel small to them) so that the lesson is firmly ingrained by the time they’re making larger money decisions.

This holiday season, I urge you not to think about what tangible gifts you can give your children but what lessons you can gift them; and my number one choice is the gift of failure. Allow your children to make money choices that will lead to failure, and then embrace the opportunity to give them the knowledge to make better choices in the future when the stakes are much higher.

Shannon is a financial planner who left a “traditional” financial services firm to start her own company, The Financial Gym, because she felt traditional financial services firms did not have the tools or resources to help people in their 20s and 30s who are starting out and trying to build assets while also managing debt. She realized that the key to long-term personal financial success is a commitment to financial fitness and making smart financial choices.

Through her blog, Financially Blonde, her book, Train Your Way To Financial Fitness, her podcast, Martinis and Your Money and The Financial Gym, Shannon is committed to making financial fitness fun, easy and accessible for everyone.

I had a similar situation about two weeks ago. My 6-year old daughter was “dying” to buy an iPad app for $4.99. After much discussion, I allowed her to purchase it with her money. She quickly handed over $5 from her piggy bank and was on her way. A few hours later I noticed her playing one the free games she already had on the iPad. When I questioned this, she just shrugged and didn’t really give me answer. Then two nights ago we went to Hersheypark Candylane for Christmas. She watched me pull out her $5 bill and purchase hot chocolate for our family. She was upset and wanted her money back. I felt terrible on the inside, but on the outside I gleefully handed over MY $5 to purchase those drinks. It was a valuable lesson. Sometimes I think the lack of adversity in my child’s life will be detrimental. I grew up in a very different situation. That situation forced me to work very hard to reach this point in my life. Hopefully, through discipline and life lessons, I can teach her that life isn’t always sunshine and kittens.

Mrs. Mad Money Monster

I totally know how you feel – a little bit sinister and a little bit joyful. I had a lot of adversity growing up and while I don’t want my son to have the same experience as me, I can’t help but see the value of it in my life.

Really great article, I wish you could send this back in time to my parents! 🙂

Even though you’ve been using this to teach your son lessons, I’ve also been using it for my own “kid” – my husband! Half a year ago we started budgeting and we each agreed to a set amount for fun money. We had regular meetings and towards the end of the month when he wanted to buy video games, I had to inform him he had no money left to buy them with because he spent it all on cigarettes…

Now, he’s been working hard to reduce his spending AND to quit smoking! Woohoo!

Ha! I know how you feel! I tell people all the time that I have two kids, my son and my hubby. 🙂

What a great story! I couldn’t agree with the sentiment more. I think parents can be too afraid for their kids to let them fail. I think many people, myself included, must experience failure or struggle to truly appreciate what we have and do better. A cousin of mine is 35 with a 10-year-old son who lives with her mom and still to this day doesn’t pay for any expenses for herself or son. My aunt actually lost her house due to her own financial illiteracy, partially due to the fact that she was financially supporting her adult daughter and grandson. And even after losing the house, the aunt is still getting a 3-bedroom apartment she can barely afford because she can’t just let her daughter take care of herself and hit rock bottom in the process. On the contrary, my sophomore year of college, financial support from my parents was cut outside of my car and health insurance (very grateful for!) As such, I learned to keep my living expenses such as rent and groceries cheap and those are traits I have kept in life, long after I had to start paying for my own car and health insurance! 😉 We all have to learn that struggle, and failure is often part of the equation. What a wonderful lesson you have taught your son.

I can’t tell you how many clients I have seen Tara with a similar story to your aunt. It’s so frustrating to watch from the sidelines and realize that things could have been different. Struggle sucks for all of us, but it really does give us the gift of growth as well.

I know I am going to struggle with allowing our kids to fail, especially with money, because I have a similar over-achieving personality. However, I am so thankful for the failures I’ve experienced. There is no other way to learn that you will survive failure and stop fearing it, as well as learning lessons specific to that situation. What a great example about your son. Thanks for sharing it!

I am not going to lie Kalie it is SO hard to sit back and watch failure unfold but as much as I hate it for myself, I can’t deny the results!

Love the article! Going to link to it in Suzewannabe.com today!

Thanks for sharing Suze!!

” I gifted him the failure instead.” I love that. Believe me, I saw the opposite of what can happen with my brother. My parents were caving at his failures WELL into adulthood, and it because the classic enabling situation. You don’t do your kids any favors by protecting them from everything, saving them from everything, or buying them everything in the name of love.

I saw the same thing happen with my sisters. My parents had more money when they were growing up and gave them more than me and as generous and thoughtful as that was, it also handicapped them for most of their lives.

This is such a great article. As a parent, I want to prepare my children for real life. For me, that includes failures as well as triumphs. I want my kids to know that things don’t always work out as planned, and to use that as fuel to do better next time. Failure is part of life, and it’s my job as a parent to let my kids experience it.

So true Holly! It’s our job as parents to prepare our kids for life and life is not perfect for everyone.

As a teacher, I constantly remind my students to not look at their failures on tests or other assignments as the end of the world. They are the best learning experiences. When they ask me how many points they will lose for a mistake, I tell them that, “points are irrelevant, only your knowledge matters.” I go on to ask that if I tell them that they lost 2 points for this part of this question on this test, what have they learned. Upon reflection they realize they have learned nothing from that. Then I show them a quote from Abraham Lincoln that is on my email signature, “My great concern is not whether you have failed, but whether you are content with your failure.” As teachers and parents, we need to let our kids fail. We also need to be there when they pick themselves up. One can’t know success without failure. Great post!!

Your kids are really lucky to have you as a teacher! And Abraham Lincoln was not only a great leader but a very wise man. Must have something to do with his birthday! 🙂

Letting kids fail financially is not only good parenting, but very cost effective in the long run. Everyone has to learn the financial lesson that your son learned – you don’t have an endless supply of money. They can learn it when they’re children and the dollar amounts are relatively small and the repercussions are relatively small.

My brother never learned this lesson – mostly because our mother would swoop in and rescue his bad childhood decisions. She didn’t want to see him frustrated. Fast forward to today and the financial failures involve a high 5 figure salary and a six figure inheritance. And he has 3 kids who don’t have the basics in life because money is constantly “burning a hole in his pocket.”

Back in our day it was $50 Atari games instead of $200 Lego sets. $50 or $200 sounds like a bargain price for learning this lesson!

I completely agree!! I would rather watch him lose $200 now than $2,000 in 10 years. And for me, it was $50 Nintendo games. Those things were always expensive!

I don’t know if my parents let me fail with money per say, but I knew if I wanted a toy and it wasn’t Christmas or my birthday, I had to pay for it myself. Because of this I started working quite young and would help out my Grandparents’ on their farm for a few bucks here or there, until I was old enough to babysit, and then old enough to start earning a real paycheck at 15. This taught me early on that if I wanted something I would have to work for it.

I had the same situation. I started working at 14 years old and purchased my “wants” from that point on and I love the lesson in hard work I learned from it.

Failure is a valuable lesson so long as there is no permanent damage.

So are limits, in general. You grow in capability & maturity when you struggle within and against limits, whether financial or the size of the canvas, whether imposed by others or imposed by yourself or your choices.

I remember when I was young that when I wanted something and my mom didn’t buy it for me, that was that. It was hard for me, but because of that, in the end, I was never spoiled. I don’t remember any money failures being taught to me in my childhood days. When I got birthday/Xmas money, I always spent it on a handheld gaming system and games that I wanted to go along with that system. I remember my money was spent so fast because of my spending habits, lol! Fast forward to my adult life now, my money failures occur when I buy something and it didn’t work out the way I wanted it to. Especially if the item was expensive (like, over $10.00). Or an even more inexpensive $1.00 item that didn’t work out for me. That is one dollar I will never see again and could have spent on something else! I guess I’m stingy, lol. ^^; I also budget my money tightly, so I will not overspend when I do not have to. But when I go to Costco, it is always hard, lol! I always want to buy myself something there. ^^;

That’s a great lesson to teach your son though! From his failure with his money, he grew from it and now takes pride in managing the money he gets from others! I wish my parents would have taught me how to budget, manage, and save my money when I was a child. But I discovered it all by myself recently last year, so all is not lost, right? xD

Speaking of managing money, in the next week, I am planning on making a big purchase. I decided that I would buy myself a real designer bag. I’m looking for one under $100.00 though and if I don’t find one that I like in my town, I’m going to order this $30.00-$40.00 not-so designer bag on Amazon! Besides a few small details on it, I really like it a lot! So I hope everything works out for me! I will also be purchasing a designer wallet as well seeing as the wallet I have currently have is fake. : ( Can’t have that! D:<

Wish me well and I hope everybody has a good holiday and a Happy New Year! C:

Failure aside from experience is one of the greatest things we could have because it teaches so many valuable lessons. I just hope that parents are there to back children up and to turn failure into positive thing. Merry Christmas Frugalwoods.

My kids are 3 1/2 and almost 5 and I am thinking about getting them started on allowances soon as they are starting to be interested in math (adding the fingers of two hands together, for instance).

I don’t remember any financial failures as a child, probably because I was born naturally tight-fisted. I do remember once I wanted an advance on my allowance to buy a doll at the toy store, and my mother said no. I had to wait a whole week! I worried all week long that someone would buy it before me. This was perhaps 28 years ago and I remember it vividly–great exercise in delayed gratification.

I struggle with this with my daughter. She’s six, and she’s a born spender! As soon as she has money, she wants to spend it. She doesn’t even have something specific in mind most times; she just wants to buy something. I have let her spend down her money on whatever toy she wants, but she knows there will always be more $5 bills coming from Grandma and Grandpa (Valentine’s Day, Easter, Halloween, etc.) This has tested my faith in letting her fail and learn her own lessons, a bit. I’m considering requiring her to deposit some portion – probably 1/3 or 1/2 – into her savings account, so all is not lost on whatever catches her eye at Target…

Fantastic post. You couldn’t be more accurate about this post. From a more theoretical perspective, this is idea is also commonly referred to as “natural consequences” teaching. But of course it only works if you let kids experience the consequence! Cheers to you for doing so, and for continuing to use it as a reference point in your future discussions. Those experiences will last a lifetime—and probably even play a role when your son has his own kids!