Last weekend was ye olde county fair here in Vermont and, of course, we were on the scene to cuddle cows (if you’re Kidwoods) and look askance at cows (if you’re Littlewoods). The county fair also provides a panorama of consumerism. So much to buy, so little time! Annoying, but a fantastic opportunity to practice money management with our children, currently clocking in at ages 5 and 7. Lucky for us, the county fair isn’t the only venue where we’ve been able to broach the thrilling topic of money with our kids lately.

Annoying Instances of Kid-Directed Consumerism We’ve Come Across Recently:

- Museum gift shops: WHY DO THESE EXIST???

- The Scholastic Book Fair: again, WHY?!?

- The County Fair: I’m less outraged at this one, but still mildly annoyed

Our Solution? Bust Out The Family Money Philosophy

In each of these kid-directed-marketing experiences, we fall back on our “family money philosophy,” which sounds a lot more formal and impressive than it is.

It’s actually quite straightforward and brief:

Mom and dad pay for everything you need, including: clothing, shelter, toys, books, games, healthcare, and admission to places like museums and county fairs. We even provide food!

You, child, are then welcome to spend your own money on discretionary items, including, but not limited to:

1. Special snacks/foods/treats outside of what said parent has provided.

A great example here is dessert at a restaurant. Mom and dad pay for the meal but you need to pay for your own dessert if you want one.

2. Trinkets and toys at such places as the county fair and museum gift shop.

Mom and dad pay for admission to the museum and fair, but if you want a souvenir, you have to buy it with your own money.

3. Books from the Scholastic Book Fair.

Mom and dad provide you with a house FULL of books from the library and used book sales. If you want to order something from the book fair, you have to use your own money.

These are the three main consumer options for our girls since we don’t really shop anywhere except the grocery store. But these three provide plenty of avenues for money lessons.

How Does A Kid Pay for These Extras?

We offer our kids the opportunity to do chores on a regular basis with compensation at fair market value. Parents are open to negotiation on a chore price/chore bundle if child feels the proffered amount is insufficient. For example: Kidwoods recently cut a deal with me that if she organized all of the kitchen cabinets and drawers in one day, I would pay her a lump sum of $10. Deal, kid.

Here’s our current list of chore options (which rotate seasonally and with child ability levels):

- Sorting all of the clean laundry into baskets for each family member

- Folding all of the clean towels, rags, etc

- Putting away mom and dad’s laundry (Kidwoods is very good at this and I’m willing to overlook the occasionally mis-filed shirt for the convenience. We did lose a person’s ski sock for several weeks before discovering it was in the cleaning rag box, so this isn’t a perfect system, but it’s good enough. )

- Collecting all of the trash in the house

- Sorting the recycling

- Organizing drawers, cabinets, the pantry, the tupperware, etc (Kidwoods is a natural organizer and excels at this, although the downside is that she then scolds family members who don’t keep it organized. I’ve pointed out to her that this is actually job security)

- Cleaning that I don’t normally bother to do (washing the exterior of kitchen cabinets, washing windows, etc)

- Dishes: washing, putting away, loading of dishwasher, etc

- Miscellaneous chores that crop up

Chores are only paid if the job is done to completion and with minimal adult assistance. For example: you cannot empty the house trash cans but spill 40% of the contents on the stairs and declare mission accomplished. You have to return to the scene of the incident and pick up each individual trashlette you dropped. Just for example.

Our girls go through phases with chores–some Saturdays end up being a chore sprint and the girls clean out my wallet. Other days, no one wants to do any chores for any price at any time whatsoever. This is fine, but the girls are aware that not doing chores = no spending money for them.

Daily Unpaid Work

Our kids also have daily unpaid chores, which are just part of life in a family. These include things like: putting away your own laundry (I only pay them if they put away MY laundry), collecting eggs from the chickens, taking out the compost buckets, cleaning their rooms, making their beds, cleaning up their toys and ephemera, clearing the table, etc. The differentiation is between chores they do to help themselves (such as putting away their own laundry) and chores that help the family (such as organizing the kitchen cabinets). They get paid for the latter but not the former. I always wonder if I’m using latter and former correctly… Here’s hoping I did.

Money Education: Start Super Simple & Super Basic

I view our kids’ financial education as a scaffold–I’m not teaching them about investing for retirement yet because that’s too abstract for a 5 and a 7 year old. Instead, I am teaching them how to count different denominations of money, how to read prices on items, how to comparison shop and how to work for money. My husband and I go out of our way to explain the rudimentary concept of how money works in our society. We often reiterate the following:

Mama works and is paid money for her work. She then uses that money to buy the things that we need and want for our family, such as groceries, clothes and toys.

This is so simple as to seem ridiculous, but I tell you, it’s revelatory for a kindergartener. Kids don’t go around thinking about the fact that adults are paid to do their jobs. Nor do they consider that a car full of groceries represents a certain number of hours worked. By breaking down this equation for them, we’re working to demystify and simplify this weird adult world of money. These super basic explanations also remove judgement, bias, stress and anxiety around money. We’re just laying out the facts so that our kids understand how the world operates.

A lot of parents fear that talking about money is inappropriate for kids or that it’ll cause kids to be anxious about the family’s wellbeing, but it’s all in how and what you share. There’s no need for my husband and I to bring the girls into our investing strategies at this stage just as there’s no need to put the burden of building a household budget on them (yet).

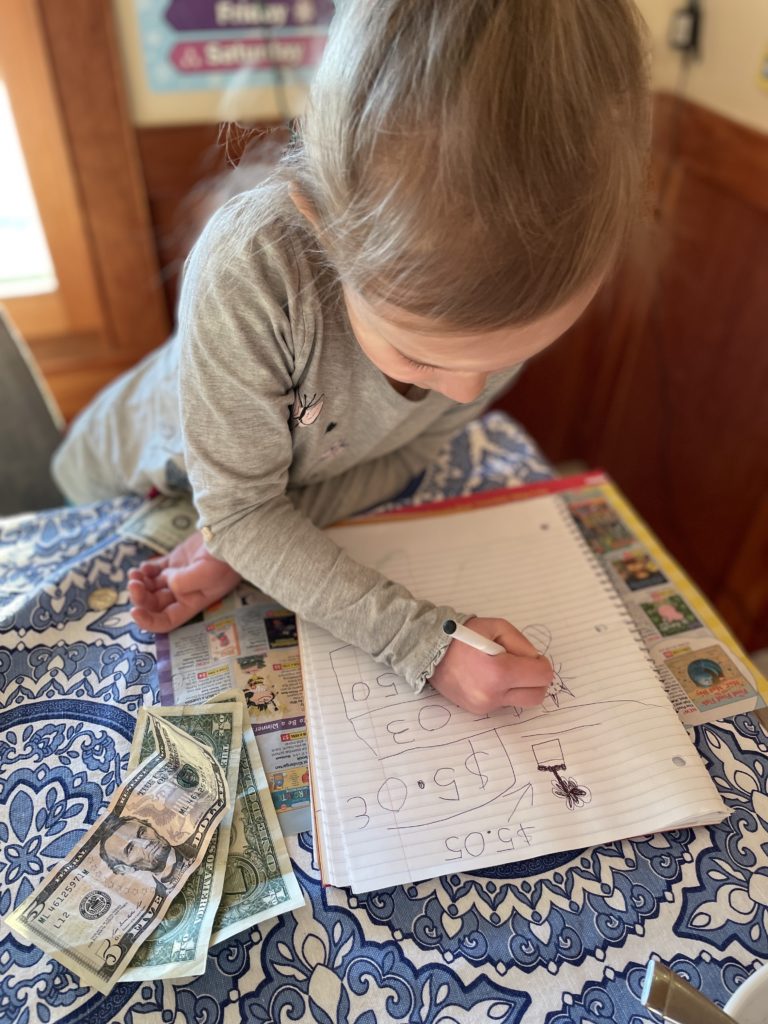

I know this is sinking in on some level because Kidwoods recently presented me with a “book” she’d written about my job. I sometimes let her read a book in my office while I work so that she has some sense of what I do when I’m in here typing away at my keyboard. The salient parts of her book read as follows:

“…her job is to help other people with their money. She does a lot of meetings. The meetings are very boring. But they are really important. They drink coffee and tea. They are serious but kind.”

She nailed it. Although I would disagree with the assessment that my meetings are “boring”…

In general, I am trying to demystify money for the kids and help them view it as what it is: a tool. Money is not status, self-worth, emotional wellness, happiness or contentment. Money can certainly be used to buy those things–to an extent–but it’s just a tool like any other. Exercise, good food, sleep, water, safety–these are also tools that can help you achieve those desired ends.

You Are Responsible For Your Own Money

Another pillar of these early money lessons is the fact that our kids are responsible for keeping track of their own money. The girls each have their own wallet and purse, in which they (are supposed to) store the proceeds from their chores. Kidwoods (at 7) is better at this than Littlewoods, but both are getting the hang of the idea that money should not be stuffed into the bottom of your stuffy basket. Or in the memorable instance of my friend’s son: crumpled up and thrown into the trash.

If You Want to Spend Your Money, You Have To Remember to Bring Your Money

Mom and dad do not keep your money for you, nor do they preemptively bring your money places for you (unless you specifically ask us to do so). This is something we’re still working on and there’ve been quite a few tears over forgotten wallets. I want the girls to take full ownership over their money and remember that if we’re going somewhere like the county fair, they might want to bring their money.

You also can’t lose your wallet. We had a near crisis-level incident at the science museum gift shop earlier this summer when Kidwoods misplaced her wallet. She’d gotten herself this far: earned the money, put it in her wallet, remembered to bring her wallet with her and then, right at the moment of purchase, misplaced it. I had her go up to the cashier to ask if anyone had turned in a sparkly wallet with hearts on it and, lo and behold, they had. Tears of relief flooded her tiny face and she gulped them back in order to purchase the butterfly ring she’d spent roughly 3 hours selecting. This near total loss freaked her out but again, provided us with a perfect real-life example of the importance of keeping track of your stuff. She asked how you get your money back if you lose it and I had to explain to her that, often, you don’t.

Why I Let Kidwoods Go Into Debt: You Can Only Spend What You Have

This is perhaps the toughest lesson of all and a lesson that a lot of adults still struggle to internalize. At last year’s county fair, there were inflatable unicorns for sale. Kidwoods fell deeply in love with a turquoise one and was adamant that she wanted to spend her money on this plastic horse with a horn. As it turned out, the unicorn was $13 and she only had $9. I told her I was willing to pay the extra $4, but that she’d have to work off her debt. She agreed and clutched her unicorn with glee. Once home, the reality of “work off your debt” began to sink in. I explained that, since she was in debt, chores-for-payment were not optional until she’d re-paid the $4 I’d lent her. Chores were now required. After a solid hour of work, she remarked:

“It is not fun to do chores to earn money for something I’ve already bought. This is a lot of work and I’m not getting anything!”

This was, again, a very basic lesson: don’t spend more money than you have. But it’s something kids have to experience for themselves. I allowed Kidwoods to go into debt because I wanted her to know the feeling she articulated above–that it stinks to work to pay for something you’ve already bought. Me explaining debt to her in the abstract would do nothing to help cement this visceral understanding for her.

This happened over a year ago and neither girl has gone into debt since. I’m not saying they won’t ever go into debt in the future and I’m certain this lesson will need to be repeated over the years. And that’s fine because I think allowing kids to go into debt exemplifies the crucial elements of:

- Start with very basic money concepts

- Let kids experience all steps of the process–positive and negative–themselves

- Enfranchise kids to earn and spend their own money on whatever they want:

- They will not have as much buy-in if it’s your money

- Parents seem to have an endless font of money and unless kids have to use their own money, it’s a meaningless exercise for them

Plan Your Spending

Based on this unicorn-induced debt experience, Kidwoods is now much more aware of how much money she has and how much she’s likely to need for any particular spending sojourn. Over the summer, we periodically went to pizza night at a nearby farm where we–the parents–purchased pizza for everyone to eat. The farm also sells desserts, but the parents weren’t going to purchase any. Kidwoods decided she’d start buying her own desserts. She knew the price of the dessert (mercifully it never changed and was always $7) and she knew she’d share it with her sister.

Initially, Kidwoods paid for the dessert herself and shared it with Littlewoods. After a few weeks, however, Kidwoods pointed out that she was earning and spending all of her money on a dessert that was also benefiting Littlewoods. Not having a leg to stand on in this argument since she had indeed been eating half of these desserts, Littlewoods agreed they could split the price. A secondary crisis ensued when Kidwoods noted that $7 can’t be divided evenly. A great opportunity to re-visit counting coin denominations! We also had the girls go up to the counter to order their own desserts, pay for them and bring them back to the table by themselves.

In all of these instances, I’m trying to enfranchise our kids to manage each step of the process on their own:

Earning money, saving money, planning purchases in advance, and then executing the purchase in real life (as independently as possible).

Up Next: A Savings Account!

What we have yet to convey to them in a meaningful way is the concept of long-term savings. My next money lesson plan is to open up a Bank of Parental Units that will pay interest on their savings. So far, the girls spend almost all of the money they earn, which is fine. They needed to first learn these very basic elements of earning, counting money and spending. Now, I think Kidwoods is ready to learn about interest rates and the advantages of saving. I’ll let you know how it goes!

I commend teaching the Your Money Or Your Life precept of $=hours of one way life energy spent earning money. They’ll be grateful to you when they are older.

I raise my kids about the same w money. They started years ago around preschool age collecting, rinsing and taking to the neighbors a dozen chicken eggs each week and getting paid by the neighbors. From the beginning, I’ve asked them to put half back into savings/investment/their business (chicken food!), 10% into giving, and they can spend the rest however they’d like. 50% may be steep savings for us as adults but hopefully is instilling in them savings as a habit when grown.

Do you have a chores chart or list that is posted along with rates? I used to give an allowance, but that didn’t work because my son always had too much money and not enough opportunities to spend it. Now, I require chores, but I often struggle with how much to pay and he is constantly trying to barter!

I keep meaning to make one, but haven’t yet. I have this idea of doing something like post-its that they could pull off of a board for each chore, but that seems laborious for me ;). I could print out a list with prices, although my kindergartener can’t read yet, so this would surely enrage her, but I could do pictures. So far, I just announce chores that are available or one of them will ask me what they can do. I honestly need to brainstorm some new chores because Kidwoods has gotten really fast at all of hers.

My husband of 40 years has no clue about or interest in money. None. Luckily he also doesn’t usually spend money BUT occasionally complains that I am to frugal…I’m going to rework some points of this post to this try apply it to him about how the real world works. He paid very little attention to his wage for his work career and frankly trying to manage life with someone who is content with being clueless about finances has been a ….Challenge…Thank goodness his tastes are simple.

Love this! I have an ongoing discussion with my son (5) on money. Why do parents have to work, what is the cost of a really horrible toy at goodwill that will only be played with once, why cannot one buy games everyday in Google Play Store.

He would not take to a system as yours but he really likes the logic and explanation of money. I think every kid could benefit from this, but one has to find the angle that fits the kid (not always the angle that fits you as a parent).

Excellent lessons in economics and finance! A friend who homeschools her children has been using their family household expenses and budget to explain these things. Taxes are a big point of her lessons, and the children are always shocked to learn how much things like appliance and car repair cost. A new roof about send the kids into shock. They go over the grocery receipts with great care and decided that cookies from the store are more expensive than homemade cookies, so they only want homemade now. Same with bread (fortunately mom loves to bake). They are currently looking at where to vacation next summer, and the kids are considering all aspects of the trip, including gas and airline costs.

Brilliant! All of it!!

Okay, have to admit that I raised an eyebrow at the title but I love this post! Especially the distinction responsibilities (work for yourself) and chores (work for the household). What age did you start?

We started last year when Kidwoods was 6 (1st grade) and Littlewoods was 4 (preK). I’d tried to initiate money conversations prior to that, but it didn’t really click for Kidwoods until 1st grade.

We started when our kids were around the same ages. Do you have the issue of your kids wanting to get on Amazon all the time to buy things? I’m struggling to know how to manage this because it’s essentially available 24/7 😬

To be honest, my kids don’t know much about Amazon (or online shopping in general). When we need to buy something online that they need to provide input on, I select a limited number of items and open them in different tabs in my browser and then Let them choose. Recent examples: birthday gifts for their friends and a swimsuit for Kidwoods. In both instances, I curate first and then give them a limited selection. In general, my kids don’t have much access to technology (they don’t have tablets or computers), but I know that’ll change when they’re older and I’ll have to come up with a strategy! Advice welcome :)!

My son is 4 and wants to look at toys a lot. I taught him about making a list. Whenever he’s interested in something, we add it to his own Amazon list. He’ll ask to review the list every so often, so we’ll talk about how if there’s something he no longer wants we can remove it from the list. He also knows that the list is shared with his grandparents and that’s what we will use for gift-giving occasions. I’ve been able to find things free or at yard sales that were on his list!

When each of our 3 kids turned 12 we gave them a check for $50 and a trip to the neighborhood bank to open a savings account. For the first year we matched anything they put in savings dollar for dollar. There were no withdrawals allowed the first year. This helped to establish the concept of saving and planning.

That’s a great idea!

Wonderful lessons and learning! So great to hear!

Here’s an exercise I used when my kids were much older than yours. My daughter was in college and anticipating looking for her first job. She could supply examples for up to $100; I offered the rest. It was eye-opening for her!

What can you buy with $1: a pack of gum (maybe) or…

What can you buy with $5: a cup of coffee or 2 candy bars or…

What can you buy with $20: lunch out or a new paperback or new flip flops or…

What can you buy with $50: tank of gas or phone bill for the month (on our plan) or…

What can you buy with $100: electric bill for the month or groceries for the week (for 1-2 people) or a new outfit or …

What can you buy with $500: monthly loan payment for a car or long weekend away (not too far) or…

What can you buy with $1000: one month’s deposit or rent for an apartment (especially if you share with roommates) or car insurance for 6 months or domestic airplane ticket or…

What can you buy with $5,000: real estate taxes for a year or healthcare deductible for a year or…

What can you buy with $10,000: mortgage for a year or a semester of tuition (excluding room and board, etc.) or (very) used car or…

What can you buy with $50,000: down payment on a modest house or fancy wedding or new car or…

What can you buy with $100,000: add an addition to your home or buy an RV or buy a franchise or…

The point of these examples is that things like car and health insurance, down payment on a home and mortgage and real estate taxes, etc. were familiar ideas but unfamiliar amounts. Feel free to substitute your own examples!

What a great exercise! Thank you for sharing! I can totally see doing something like this with Kidwoods with smaller dollar amounts.

This is so cute and fun!

I don’t remember at what age my sisters and I started handling money, but we joined the family resale business pretty young: buy underpriced antique stuff at garage sales, sell it at flea markets and such for a profit. I didn’t always have cash (such as when Grandma sent me a birthday check) so I kept a neat written record of my accounts in “the bank of Mom and Dad”. I got $5 for that birthday gift, $15 for that item I sold, then I spent $10 at Toys R Us, so my remaining balance is $10, etc.

The biggest money message I remember from my childhood is my mom saying “save your money!” when I wanted to buy some toy or other.

I love this! This has been my money focus lately. I recently read The Art of Allowance and am going to start an allowance and chores for extra cash situation here too. I have had very little luck searching for great kids’ savings accounts so if you find a great one, please tell us! All the kid friendly options seem to have low interest rates, so I’m tempted to just open them a HYSA but then I won’t have some of the perks like a kid friendly app, etc.

I think I’m going to start my kids off with a fake bank account run by the bank of me so that I can tailor-make the lessons and set the interest rate as I see fit. But, I do eventually want them to open real bank accounts once they’re ready for things like writing checks and using a debit card. Also if their account balances do actually grow larger than the ~$10 they currently have, I will get tired of paying them interest 🙂

This strategy looks so useful! I have a toddler now and we do some chores around the house together but nothing about money yet. What age have people started their kids on this chore-for-money system?

I didn’t start the payment thing until last year when my girls were 4 and 6. And I’d say the 4-year-old did not get it and really didn’t care. But my 6-year-old totally got it and was into it. We’d been having them do simple chores since they could walk, but didn’t introduce the concept of payment until much later.

I really like the book The Entitlement Trap: How to Rescue Your Child with a New Family System of Choosing, Earning, and Ownership

Book by Linda Eyre and Richard M. Eyre. We have been using the Family Economy system they talk about (which has similarities with what you are doing) but tweaking it for our family since our oldest was 6 and our youngest was 4. They have an opportunity to earn their age in wages for the chores they do each week and those chores change as they get older and by the season (school vs summer). 20% goes into savings @ 1% interest per month, 10% to charity, and the rest is for their spending money. Eventually we will move the funds from the Bank of Mom and Dad and start talking about investing and how much college costs. They have already hit the point where their interest deposits more than what they deposit each week and are excited to see it grow. They also understand how far a dollar goes and are ahead of peers in school with their knowledge of how money works. They have made poor choices on buying the expensive poorly made toy that breaks which leads to making wiser decisions the next time and hopefully will save them from larger future poor choices. And they don’t beg at the store anymore because the answer is simple, if you have the money you are free to buy it but Mom is not buying it.

Love this! When thinking of former and latter, think of former as “first” and latter as “last”. Or you can also think of it alphabetically; former is before latter =] That’s what helps me differentiate the two!

I love every word of this! These lessons might be the very best things your kids ever learn, as so, so many do not. So far, I see all the comments are positive. I sincerely hope they stay that way, because this is Very Important. Don’t let a single naysayer tell you otherwise.

The first time I took my 2 grandkids to Disney, it was “Nana, will you buy me this?” and Nana, will you buy me that?” with no concept with how much this or that costs (and quite frankly Nana was horrified at what this and that cost!) On the last trip, Nana got smart and presented them each with a $100 Disney gift card so they could buy what they wanted, but they were told that once it was gone, there was no more. You never saw 2 kids so tight with money! Toys were inspected, debated and very often put back because “they cost too much of MY money.” Once they had responsibility for their own purchases, they soon realized that they couldn’t have everything they wanted because they didn’t have enough money to buy it all, and more than once Nana heard, “Well, I guess I really don’t need this.” It really made the trip much more enjoyable because they were taking responsibility for their decisions, and not just expecting their every wish to be granted (even if it was Disney World!)

What a great idea!

Same with us at Disney! I’ll never forget my daughters agreeing to split a snack bag of Lays chips with literally the last $ they had left! What a hoot. My youngest spent all her money on a doll the first day and learned a big lesson about “all the money is gone” for the next four days.

For perspective: the Scholastic book fair was originally pushed in schools to enable access to books, especially in rural communities with limited access to libraries and bookstores. In return, a portion of your spending (I think 25%, but that may have changed since I last looked it up) gets tagged as credit for your child’s class or the school library, which is what gives a lot of schools the budget to get new books for their students. It’s spending, sure, but … it’s also enabling access to books in schools and in homes (though that purpose got SLIGHTLY diluted when the book fairs started carrying toys and widgets, but anyway). For most of your examples, I’m on board. For the book fair, I do send money, because I personally get GREAT joy from browsing books and picking something new that I’m personally excited to read, and I want to share that with my kids.

… And, because I’m That Parent and remember my friends who had to look at the books and whose parents never had the money: I do send extra to the teacher, to get some books for other kids. Because books bring me joy, and because we can, and because I’d like kids to get to experience joy about personally chosen books.

I appreciate your comment and totally agree about books! I generally follow a similar money method as Liz with my teen daughter, with one big exception – I will pretty much always buy her a book if she asks for it. We don’t go to bookstores much so it’s not like this is happening all the time, just once every few months or so. And we were always huge fans of the Scholastic Book Fair when my daughter was young. I love books and want her to appreciate the excitement and joy of getting a new book to keep every once in a while.

One of my treasured family treats (which, yes, involves some spending) is to pack everyone up in the car and drive the hour to the nearest small town with an english-language bookstore, where each kid is allowed to pick ONE book (within budget limits – last time, the 3-year-old tried VERY HARD to convince me that he wanted the 60$ encyclopedia of tractors…) and then we go to the coffee shop up the hill and get a hot chocolate and a cookie, and we read our books together.

We don’t go out to restaurants… ever, basically, so the kids think it’s a HUGE treat. And of all things I’m willing to spend money on? Books and reading time to share with my kids is pretty much top of the list! Zero regrets about doing this a few times a year – as far as spending goes, let’s just say it’s not out of control!

(But also, full honesty: we have bookcases covering two walls, and one wall is double-stacked. Meanwhile, we have a 15-year-old tv under 30 inches, mounted in the corner out of the way. We all have our priorities!)

That’s really wonderful. I grew up in a family where books were rewards for almost any special occasion or job well done – acing a test, getting straight As, completing a piano recital – and it fostered a lifelong love for reading. I share a Kindle account with my parents and grandma these days, and to this day my dad refuses to accept reimbursement on any book I buy there. The value of parents supporting kids reading can’t be overstated.

(I will note that my parents shared Liz’s disdain for the book fair – I didn’t typically get to buy anything there, which remains a small tragedy in my memory.)

What a kind and caring tradition you have in sending money for other, less fortunate children to purchase at Scholastic Book Fairs, while encouraging your own to choose books that are exciting for themselves! Great ideas! (I do agree that there are too many toys & junk anymore, but I am always glad to see a kid reading. (When I was a child in the fifties, I ‘d read the cereal box on the table if there was nothing else to read . . .)

Roswell, I replied in another comment but it ended up further down . . .

The worth of Scholastic Book Fairs is amazing! I taught school for 38 years and it gave children such a wonderful opportunity to have access to great literature. The parents of some children were beyond generous to provide books for children who could not afford them, the school library and even my classroom. I so appreciated the families that supported this wonderful opportunity!

Yes! This!

I’m a school librarian (high school, though, so I don’t usually do book fairs), and I like a lot of the ideas presented here, but I have to admit that the “why?” about the book fair bummed me out. Of course Scholastic is a publisher that makes money off of the fair, but a cut goes to your school and students in your school who might not otherwise get any books– and it’s just plain awesome to see kids get so excited about reading! 🙂

I guess I see books as being a bit different from trinkets. Growing up, my parents were really frugal about pretty much everything except books (and extracurriculars we were into, within reason). My mom would surprise me with a special trip to the local bookstore every now and then, and my parents always gave me money for the book fair. They would give me a budget that probably wasn’t a lot of money, but I remember being able to get a few books at the fair.

My parents explained often that a lot of consumer items were waste of money (or at least should be carefully considered before purchasing), but that books and learning opportunities we were excited about were worth spending money on when it fit in their budget. I have so many great memories of the book fair at school (and Book-It at Pizza Hut… anybody else?). I love library books (I mean… I’m a librarian!) and cool secondhand finds, but there’s something special about owning certain books that you really want.

So I agree (mostly) with the teaching kids about money concept.

My youngest is now 17 (I know a lot older than your kids) but I didn’t pay kids to do chores, which for my step son (teen at time) was revolting. Let me explain. I believe the kids helping out as family chores, which expand as they get older. I wanted to teach my kids that there are LOTS of things we have to do in OUR LIFE (for ourself) that we do not get paid for.

Examples— teen capable of mowing grass. As adult no one pays me to mow my grass. Can you earn money from mowing grass, absolutely! Teen mows elderly neighbor grass for money, in addition to mowing our grass. Same with snow removal, moving items, etc. By this age there are also flexible chores—we all do (combined) laundry & someone folds then puts (others) piles of laundry in their room. One day might be me, next might be teen, and so on. Granted there are some times where reminders are necessary for those flexible chores but it depends on personal ability of being available. If teen home & only on phone playing games & not doing any chores, there is reminder but other times schedules make it necessary for chores to be postponed.

So how do lids earn money if not paid for chores? When we out grow, don’t use or want items then they are bought (flat rate when younger) & that money is theirs to keep. I did not gave ability for hand me downs, so this may not work for some others but did for me. We had yard sales in warmer weather & few inside mom to mom/vendor sales in cooler months which we sold unwanted items. As kids got older the flat rate changed to I get percentage of what item sells for & child (if present) can accept lesser offer from customer if agrees. But child had to help set up or take down process of sale to see/experience what it takes to make (more) money. There were times if great joy selling old items, other times of despair when later deciding still wanted item already sold.

I also taught about donations & sometimes having to take loss. But those are older lessons.

Today teen (select few that parents did not purchase) want to have own vehicle which has been working & saving to be able to buy. We do have deal as to insurance & repairs once able to purchase, but after much thought & conversation.

I do want to add that I did have slightly different changes involving teaching money to older kid versus youngest kid. My step son (completely different story because different situations all together) though had roughest time adjusting did learn that my lessons were most realistic & benefited from thos lessons as adult. My daughter (year younger) had to pay for some items that my now youngest does not as times have changed & some things not relevant anymore. Though most lessons stayed consistently the same for all kids (15 years difference between youngest & next oldest).

I also do not pay for chores as I would like to teach my child that not everything can or should be monetized. I am not American, so this could be a part of a different cultural/value outlook but I fully expect my child to do chores which benefit everyone with the understanding that you will pitch in because you care about your loved ones (and that they do the same for you), and not because you get any sort of monetary reward for it. He does get a small allowance which he manages, has a lemonade stand during the summer, and has even started dog walking and working as a “mother’s helper” on occasion, and so far is very excited about work. When we do discuss his allowance its always in line of “what is it that you need and want” and does it make sense for our family budget as we are one economic unit. Obviously when you teach about money you are also teaching about your values and mine tend to be more socialist and community based (do what you can for the common good, get what you need) rather than focusing solely on individual actions.

Yes, this is one thing I struggle with. My daughter is about the same age as Kidwoods. We have not been paying for chores exactly because of this – we feel like helping out is just part of being in the family. I did recently agree to a sticker chart working her way up to a new iPad after her very old one broke, though to be honest I would have replaced it anyway. I worry I am missing an opportunity for her to experience budgeting, but her grandparents tend to send her small amount of money to buy vacation souvenirs etc so she is not totally without practice.

I don’t have more suggestions but I want to commend you on this. I was raised without allowance or payment for doing the chores, nor was I taught money management. How I wish I had been! At least I managed to do better with my own kids, although I stumbled here and there.

Why do Museum Gift Shops exist…to make money for the museum..Why Scholastic Book Fairs…in some school districts ,here in Texas anyway…whatever money the Scholastic Book Fair makes is the only money the librarian has to buy new books for the school library. Also for many children it is the only chance they have to browse and buy a book. When I was a school librarian (at a charter school with a generous budget for books) I put most of what I call “junk” away and just put books out for the children to purchase. The money I made was just extra for my library, but I have known librarians for whom that is the only money they will get for the entire school year.

In short, if good things like museums and schools and libraries were funded properly, we wouldn’t need gift shops. Sadly the gift shops and the museum stores become an excuse to undercut funding even more because they make money from the gift shop…and on it goes.

Well done with your girls!

I would think as someone who used to work at a non-profit, you would understand why the gift stores exist 😉 All jokes aside, it’s cool to see the ways you are teaching your kids about money. My mom used to work at a bank, so she opened saving and checking accounts for me in the 5th grade (although she oversaw them at that time). Once I entered high school, she took me into the bank to get my first debit card and checkbook associated with those accounts. I remember being the first of my friends to actively manage my own money, and it definitely paid off when it came time for college loans and all that. Proudly debt-free (including car and student loans) for over 5 years now!

At our house, we remind ourselves to be smart shoppers by saying “Remember the Soccer Ball”. When my son was 13, he needed a new soccer ball. We went to buy one and my son grabbed one off a prominent display of Adidas balls with “World Cup” branding on it. It was $20. I looked around and asked him if he cared about the World Cup decor and he said “No” but that he wanted an Adidas ball. I had him follow me over to the regular soccer section and we dug out another regular Adidas ball for $14. Same ball with different decoration.

Basically paying attention and looking around can save you lots of money.

My Daughter is 7 and I have a similar chores earn money philosophy. She is very goal oriented so it works out well. I did have an epic win this summer, my daughter wanted a new stuffy, was willing to spend her money but we have like a million stuffies. I got the bright idea to tell her that if the little girl wanted to do a trade with one of her stuffies then we could do that. It worked out and everyone was happy!

I love this! Especially explaining about your work. I’ve started to get ready to pay in cash more (where I can, the UK is card mostly only now except charity shops, petrol, food) with my daughter and found a purse for her to put money in.

Two money things we discussed recently:

– ‘The Barbie screaning on TV cost the same as your rock climbing today, it’s £20! Let’s look at other options (we already saw it at cinema for cheaper too). Her face was shocked!

– ‘I’ve made you up a purse, it has £2 in it, those toys you want when I’m paying for stuff at the counter, you can use your money now to buy those things’ her face lit up with happiness.

Thanks for inspiration I hope I can get her doing chores at some point.

I still remember how my brother and I ended up with shared custody of a stuffed duck. We fell in love with this duck at the mall kiosk and pooled our funds to purchase him. It was something like $3.75 each, very similar to your girls’ dessert budget. Clearly the duck was not included in our parents’ spending and we had to use our own finds. Then we switched off every night with who got to sleep with the duck. I definitely don’t remember this much about any stuffies bought by our parents! I bet the girls will have fond memories of their self purchased desserts!

Re: book fairs, I can tell you that the district where I am employed does not have an adequate book budget for the school library so the librarian hosts a book fair each year in order to afford the books that kids ask for on a regular basis. It’s not ideal but it does allow for the purchase of new books.

We are very similar in our approach- we’ll pay the boys to do chores I don’t want to do (or won’t really do, such as dusting baseboards or painting the bee hives) but they are responsible for things that are basic to the family (folding laundry, emptying dishwasher, etc.) That said, the best deal I ever made was to pay for some subscription for some game monthly in return for them cleaning the bathrooms 2 x a month! We also let them go into debt and work it off (and they also think it sucks, since they can’t refuse a “job” when they are in debt). But we feel like it’s sinking in because right now they are saving for some fancy computer thing and won’t spend a penny!

Just chiming in to say…it might not be too early to teach about investing!

We are currently in the middle of a year in South America, and we are living off investment income. We wanted our kids (ages 6, 7, and 9) to understand how it is that we are able to have this life, so we just had a chat this past weekend about investments.

We used kid-friendly language and lots of simple examples, of course, but we talked about we have paid money to become partial owners of someone else’s company, and how now, because their companies are making money, WE make money too—enough to live on. We made a big deal about how making careful investments enables you to do amazing things like go to foreign countries for a year, and they were enthralled. The 6yo didn’t really get it, but the 7yo and 9yo totally did.

On a small tangent – when kids are ready for a bank account, TD Bank has no fee accounts, and will add $10 to a child’s account if they participate in TD Bank’s summer reading program.

I absolutely loved Kidwood’s quote “ “It is not fun to do chores to earn money for something I’ve already bought. This is a lot of work and I’m not getting anything!”

She nailed the concept. A great teaching moment.

My mom used to tell the story when I was about 4. The newspaper boy came to the door to collect. She was short on change so asked me to borrow a nickel.( It was 40 years ago!)The next day she gave it back with an extra penny “for interest”. She says I spent the next week following her around and asking if she wanted to borrow any money.

Wonderful ideas!! I have a love/hate affair with Scholastic Book Fairs. I loved it as a child. Time spent picking out books was, and is, one of my favorite ways to spend time and money. It wasn’t until I was a parent myself, that I realized just how unfair the system was. No money, no books. For families that are stretched financially, as many in our district are, this just seems so unfair to the kids. Have and have nots are sorted out by first grade and man can they lord it over their classmates. Just my two cents.

Most of these book fairs are run by the PTO, which (in my experience as a member/volunteer) sets aside some books for kids who cannot bring money from home. Those kids don’t have the full run of the place for free, but no one goes home empty-handed.

It’s great to teach kids about money!

As someone with a history of disordered eating, I try to be careful with approaches to money and food. I have used the whole Oh I can’t afford that as an excuse to not eat.

Stuffed animals on the other hand….

That borrowed $4.00…

I would tach the concept of interest. You borrowed $4.00, but you have to pay back $4.25 or $4.50.

This can also be a lesson about the cost of financing stuff. My husband was briefly a manager (he hated it) for one of the “rent to own” store chains; the name rhymes with “Sharon’s”. People spent the last of their paychecks so they could make payments on overpriced furniture sets and huge TVs with speakers.

So wonderful you are teaching your children money management principles at a young age! I can remember going to the Scholastic Book Fair as a kid and coming out with an armful of books and a few posters for under $20. If I took $10 of allowance (if chores didn’t get done no allowance!) money my mom would match it.

Having teenagers now I see such awful trends with other teens such as constantly asking parents for money but balking at being asked to load the dishwasher or get a job. It’s even more disturbing when the parents make excuses for them like “they are too busy”…..and you as a parent balancing a job and a household are not?

This was great. Sounds like you guys are knocking it out of the park, especially with the debt-regret scenario. I love when natural consequences just pop up exactly when you want them to.

I believe Mr. Money Mustache did a post about “The Bank of Dad” or something along those lines many years ago. “Smart Money Smart Kids” by Dave Ramsey and Rachel Cruze (his daughter) is another good resource.

I found this post very interesting and, in some ways troubling. As a child of very frugal (loving and generous, just extremely careful with their money) parents, I was constantly told “no” when I asked for something, and had to buy the “extras” by myself. Even with the financial education that my parents provided, I often felt guilty over even wanting anything non-essential, and if I were to be completely honest, I still occasionally feel guilty to this day when I spend money on something that is a little frivolous or not entirely necessary. Which when you think about it, is not a way to live! I also find your disdain for scholastic book fairs to be ridiculous, quite frankly. I am fortunate to live in an extremely well funded school district, and yet still our elementary and secondary book fairs are the only way that our schools can afford new materials. Not to mention that book fairs are exciting to kids, and make reading fun. And that is a wonderful thing, in my opinion, and well worth spending a few dollars on. And as a former museum professional, I can assure you that there would be no new exhibits, acquisitions, and even more abysmal pay for museum workers if there were no gift shops in museums. Museum shops are actually treasure troves of unique and educational toys, books, and art. Many museum shops also support local artists and authors. I urge everyone to support our cultural and educational institutions. They enrich our lives so much, provide employment opportunities for professionals and non-professionals in all kinds of communities and they are sadly dying from lack of funding.

I think the key is the parents’ attitude. “I won’t buy it for you, but you can buy it with your own money” can be delivered with the attitude of “It’s totally up to you! It’s your money, spend it if you want to” or it can be delivered with the attitude of “I think it’s a waste of money and will judge you if you buy it”– obviously the latter is going to teach the kid to feel guilty while the former (along with some help thinking it through if the kid is undecided) is going to help the kid learn what non-essentials are worth it to them.

This feels like it sets kids up for anxiety around money.

I’m with you, Julie. Way to suck the fun out of childhood …

It sounds like fun to me! She stated:

Mom and dad pay for everything you need, including: clothing, shelter, toys, books, games, healthcare, and admission to places like museums and county fairs. We even provide food!

The kids are getting toys, books, games, entry to museums… Just not all the overpriced extras when kids are out, that often are not great values.

Yep, scholastic donates to schools but it really organizes community to support the school…it made $1.62 BILLION last year and expects 10% more for 2023.

Of course we’re living similar lives 🙂 When our scholastic booklet came home the first week of school I was shocked! And now I’ve learned it gets sent home every month! Gah! We looked up all the books she circled and found all of them available at our local library.

Anywho… our 5yo is very in tune with her money. She has a piggy bank and her souvenir from our trip to Portugal was a change purse. She knows if we’re going to a store for kids toys (our fav is our local second hand shop), she can pick one small thing from us but anything else she’s on her own.

Our kids currently earn money by returning our refundable bottles to the bottle depot. She’s also done a lemonade stand where we introduced the parent tax (had to pay us back for supplies). They can also earn a quarter by taking out all 3 garbage/recycle/compost bins each week and bringing them back but they’ve lost interest. She got a loonie for using her scissors to cut the 100+ blades of grass that were too tall and thick for our lawn mower.

We do talk about investing a lot and she knows we no longer have to work because we saved and invested the majority of our earnings. We explain it as if you save you money it sits still waiting for you to use it in the future. If you invest your money, you’re buying a little piece of every store we drive past, every store we go in and shop at. And when they make money, so we do. I whisper her login and password to her accounts for her to type in while sitting on my lap and we buy ETFs together.

Money lessons like these are so important, and so often overlooked until children are much older. For some, they seem to naturally understand how it works quite quickly, but for many – me, for example, money remained very opaque until well into my adulthood, long past time. The main area of problem was ”credit” My parents were not very wealthy, but we were comfortable because they were sensible and frugal, with sensible, non-lavish notions of things such as holidays and other such luxuries. Where I grew up, credit cards were not quite so widely known / used – they obviously did exist, but not generally for young people – and it meant that when I moved somewhere out on my own, on a different continent where snazzy credit offers were literally raining through my postbox, I… was thrilled. And then, quite soon, in debt. Looking back, the amounts were tragically small in the overall scheme of things, but I just made minimum payments and thought I was ”paying them off” (while still using them – seriously, interest is not that complicated, but somehow… there we were). My husband – then boyfriend – was kind enough to sit me down and explain what was happening and how to arrange things to solve the problem. We did a 0% balance transfer that gave me 6 months to really aggressively pay off as much as possible AND NOT USE THE CARD, and then transfer again… till it was paid off.

Parents, even genuinely wonderful ones who are sensible and frugal, need to really teach these principles as early as is appropriate. I have very few complaints about my parents – I miss them so much – but that is one area that could have been improved.

We matched any money that our kids put in the bank.

My son’s god mother started a bank account for him and for Christmas and birthdays put money in. not sure he appreciated it as a wee one but he sure did as a teen when she turned it over to him.

For older children…if my teens were old enough to work and were not busy with a high school activity they had to get a job to pay for items they wanted but were not necessary such as going out with friends and the high school trip to Europe. We paid for things I wanted them to do certain sports etc. In college they bought their own books and it was amazing to see how creative they were keeping the cost down by buying used, reselling etc

I did the “this is how much you have” on school clothes. There was always the back and forth about what’s worth $25 and what’s not worth $25 Belt/pants for example. They would have to do the math to figure out how much would be left if they bought certain items as well. This saved me tons of money and a lot of arguing!!

I really enjoyed this post! Definitely got a chuckle out of the kids’ comments – thank you for sharing!

Scholastic book fairs exist because not all homes have books. Surely you know this. The book fairs also support the sadly under-funded public schools and (if they even have them) school libraries. Books are a dwindling resource, and yet just simply being around books raises kids’ intelligence and options in measurable (and proven) ways. As much as we want to teach our kids about careful use of money, we also want to teach them the value of books and the culture of reading.

I am a librarian and I have a really big love hate relationship with book fair because yes I desperately need that money to supplement my very meager budget and I know there are lots of librarians where the book fair IS their budget. Breaks my heart when kids don’t have money to shop.

I know that people have a lot of different opinions about kids buying junk but I do think there’s a certain important Canon event that happens when you buy something that’s junk and then realize it’s junk. I can tell my daughter till she’s blue in the face that a spy pen is a waste of money but she had to find out for herself.

My big question for you or anybody else in the comment section is how do you decide which chores are “freebies” ones are fee for services. My daughter is an absolute mercenary and is always trying to negotiate every single chore into a fee for service.

Also I wanted to say that another great chore for anyone who hates packing lunches is pay your kid to do it. My kid has to do it under my supervision to make sure that there is something nominally nutritious.

As always, you are nailing it in the money column! Teaching simple money concepts early will benefit your children for their lifetimes. It also proves that “money lessons” should be fun, instructive, and real. I see so many kids that have zero concept of money-in any form. It makes me sad because they will have a difficult life. Kidwoods gave the statement of the month; “It is not fun to do chores to earn money for something I’ve already bought. This is a lot of work and I’m not getting anything!” From the mouth of babes………..

We started our now ten year old with an allowance at the age of four. It is half his age (so currently five dollars) and I have always given it to him in quarters to make it easier for him to divvy up into his piggy bank with four sections: save, spend, invest, and donate. He is required to put at least 10% into save, invest, and donate and the remaining 70% can be put into any section. Some weeks he evenly divides it. Other weeks he puts all remaining into spend. His money, his choice.

Whenever he builds up enough in saving, it goes into his bank account at the local credit union which pays more in interest than the banks around here. We keep it local so that he learns about depositing and making withdrawals when we are about to go on vacation. (We treat this one as a save to spend account.) His donation amount can be used for any non-profit (church, state park, museum, etc.) because we are teaching him that some of the best things require help from us to remain available. When his invest reached $100 we put it into a CD at the credit union and once he reached 10 years old we talked about the stock market using Jillian Johnsrud’s Halloween candy example. He loves owning bits of all the companies!

So far his money management skills are about where we’d expect at his age. Yes, we let him go into debt in a similar example. Yes, he sometimes doesn’t want to do his chores for pay. Yes, we’ve let him buy the junk that breaks after one use and he is sad. But in every instance he is learning a lesson that is a lot cheaper to learn at home than it is to learn as an adult. And that is why we do it.

Thank you for sharing your methods. It always helps to read how other parents are doing it.

I am not a parent, but I think a lot of this is great. So many of us entered adulthood without much financial knowledge and advice.

Thank you for this. It’s given us a lot of great ideas to implement for our son, as we have been trying to reach him about money and that everything costs money. He realized yesterday we paid money for our house (and I explained we continue to pay every month) and he goes “oh, that’s why you and dad work” 🤣

Curious if you’ve given any thought to friend/classmate birthday parties? We’re about to hit that stage, and I’m thinking he can choose a toy from my little stash or if he wants to buy something else it’ll need to come from his money? Or we set a budget for him to choose even though we would pay for the gift?

For friend’s birthday parties, I do one of two things:

1) If I find toys/puzzles/books still in their packages/with tags on at yard sales or the thrift store, we gift those.

2) If not, I help my kids select a gift online that they think their friend will enjoy and that’s within budget. It’s been a great opportunity for them to learn about comparison shopping and reading descriptions of things online.

In either instance, I pay for the gifts.

We use a similar money system with our kids, ages 8 and 9, including having some required chores and additional chores they can do to earn money. They have Saturday morning unpaid chores that were taking forever so we started using a bonus system. If their chores were done well in X number of minutes, they get $1. So far, this has worked amazingly!

We had one of those Real Life Learning Opportunities with my son at school last year where he was messing around with the electric pencil sharpener at school and broke it. We talked with him about it and explained that he would have to cover the cost to replace it, and then he pulled the dollars out of his wallet and realized he’d have only $1 of his own money left after paying for the new pencil sharpener. You may have heard him wailing from wherever you were at that time. It was one of those tough parenting moments as we could have easily paid for the new pencil sharpener and let him keep his money, but knew the lesson wouldn’t land the same as if he paid for it himself. The lesson definitely landed.

Absolutely love this post and the way you’re moving through these financial lessons with them so young. As a huge lover of those scholastic book fairs when I was a kid, it was SO thrilling to me when I could use my own earned money to go in and feel like such an adult by purchasing the thing I chose and shopped for on my own. Great life long lesson and you’re also instilling independence, responsibility and work ethic at the same time.

I’m sorry – please ignore my message, it was harsh. This post just triggered some of my own memories of my (abusive – emotionally / financially) childhood that I projected. You know your kids best and each situation is different. Please accept my apology.

Great job teaching your children about the importance managing their own money.

I was raised in a large family where money was tight, and I learned how important it was to spend wisely. My sisters and my brother, all got part time jobs when we were old enough and we understood how important it was to do a good job and to save some money as well as spend it wisely. I remember how much I hated a couple of jobs that I had doing cleaning at a local resort, people can be really disgusting in terms of the messes they left in the rental units, but it taught me how important it was to get a good education and training so that I would not be doing that for the rest of my life, as well as being able to afford to retire when I got older. The good habits last a lifetime. My husband and I are both retired now, he is collecting multiple retirement payments each month, our house and vehicles are paid for, but we still manage our finances wisely. We do eat out when we choose to, but we eat 95% of our meals at home. We have a garden, we can fruits and vegetables to preserve them, we do our own yard work, snow removal and we share the cooking and household chores. I cut his hair and he cuts mine for me. I don’t think we are being cheap, by doing that, I actually enjoy cutting hair, and I regularly give my two grandsons their haircuts. I knit, sew and do other projects that I enjoy, plus we get regular exercise, as well as eating healthy. So I am definitely a firm believer that raising your children to become responsible adults is your most important job as a parent.

I’m a little late to comment but wanted to add some thoughts. I have been a strong supporter of Scholastic book fairs for years. As many said, it provides books for our teachers’ classrooms and at one book fair per year our teachers even list 4-5 books they would like gifted to them, if a parent is so inclined. Each month, each flyer has/had a $1 or $2 book that was featured for the month. I would often buy multiples of these books from multiple flyers (using the online ordering system which shows flyers across all grades) and give them to my kids’ teachers. The teachers were extremely thankful.

With four kids, I had such a large collection of books over time that as the kids outgrew the younger books I boxed them up and donated them to the school (younger grades) and to a non-profit that runs a headstart program.

The book fair sold Harry Potter illustrated books when they were first being released (one every year or so because the illustrations took so long). I couldn’t find them elsewhere at the time and was glad Scholastic had them. I gifted a set to the 5th grade classroom and the teacher told me her kids created a waiting list to read them. I encourage anyone who hasn’t seen them to check them out! They are large books with full color illustrations and probably the most beautiful children’s books I’ve seen. It’s an example where Scholastic was the link that encouraged me to provide them to the teacher, and now her entire class can enjoy them for years.

https://www.amazon.com/Harry-Potter-Illustrated-Collection-1-5/dp/B0BHXJJBKP

This post may sound like “I gave this” and “I gave that”, which isn’t my point. Scholastic is the mechanism that allowed me to gift hundreds of books to my kids’ classrooms over the years, and in one large donation. Could I have bought books off Amazon or a local store? Sure, but I wouldn’t have had the monthly themes, the recommendations of popular authors and new authors, the $1/$2 books each month that made it so easy to donate, the direct shipping to the teacher, etc.