Nici lives on the West Coast with her cat and works as a journalist. She loves her job–and her 20-year-old Mustang–but doesn’t make a lot of money. She prefers renting an apartment over owning a house, but is concerned about future rent increases and what they might do to her retirement plans. She’d like our help today assessing her financial position as well as our advice on whether or not it’s time to put her old Mustang out to pasture.

What’s a Reader Case Study?

Case Studies address financial and life dilemmas that readers of Frugalwoods send to me requesting advice. Then, we (that’d be me and YOU, dear reader) read through their situation and provide advice, encouragement, insight, and feedback in the comments section. For an example, check out the last case study. Case Studies are updated by participants (at the end of the post) several months after the Case is featured. Visit this page for links to all updated Case Studies.

The Goal Of Reader Case Studies

Reader Case Studies are intended to highlight a diverse range of financial situations, ages, ethnicities, geography, goals, careers, incomes, family composition, and more!

The Case Study series started in 2016 and, to date, there’ve been 53 Case Studies. I’ve featured folks with annual incomes ranging from $17,160 to $192,720 and net worths ranging from -$317,596 to $1.5M. I’ve featured single, married, partnered, divorced, child-filled, and child-free households. I’ve featured gay, straight, and trans people. I’ve featured cat people and dog people. I’ve featured folks from the US, Australia, Canada, England, South Africa, and France. I’ve featured folks with PhDs and folks with high school diplomas. I’ve featured people in their early 20’s and people in their late 60’s. I’ve featured folks who live on farms and folks who live in New York City.

The goal is diversity and only YOU can help me achieve that by emailing me your story! If you haven’t seen your circumstances reflected in a Case Study, please feel free to apply to be a Case Study participant by emailing mrs@frugalwoods.com.

Reader Case Study Guidelines

I probably don’t need to say the following because you folks are the kindest, most polite commenters on the internet, but please note that Frugalwoods is a judgement-free zone where we endeavor to help one another, not condemn. There’s no room for rudeness here–the goal is to create a supportive environment where we all acknowledge that we’re human, we’re flawed, but we choose to be here together, workshopping our money and our lives with positive, proactive suggestions and ideas.

A disclaimer that I am not a trained financial professional and I encourage people not to make serious financial decisions based solely on what one person on the internet advises. I encourage everyone to do their own research to determine the best course of action for their finances. I am not a financial advisor and I am not your financial advisor.

With that I’ll let Nici, today’s Case Study subject, take it from here!

Nici’s Story

Hello! I’m Nici, a 37-year-old journalist with a master’s degree. I’ve always lived in the western part of the US, but a few years ago I traded pine trees for palm trees. Budgeting was always part of my life, but moving to a city with a higher cost of living got me to really track my spending. I live in an apartment with my cat and have no desire to own a house. I love that I can give the maintenance crew permission to enter my apartment and then whatever issue is “magically” fixed. My career has sent me to different states, so renting also allows me the freedom to move at any time.

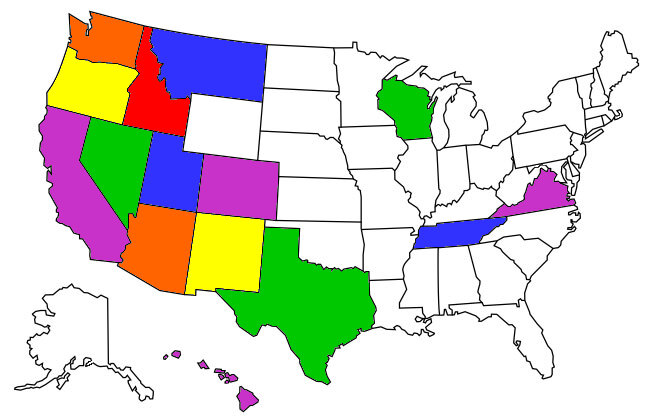

When I’m not working, I like to travel (my goal is to visit all 50 states) and go to concerts. Unfortunately I don’t have enough vacation time or money to do those things as often as I’d like. If I’m still with my current employer in 2022, I’ll gain an extra week of vacation, but my salary will be about the same (salaries were frozen for 2020 and raises are typically 2-3%).

My life is pretty easy breezy. I love what I do and living in my new city has been a fun adventure. A lot of times I don’t really feel like I’m an adult compared to others my age since I don’t have their responsibilities of kids and a mortgage. But honestly, I love it! I can pick up and go anywhere! My cat even travels well.

The Downside

While I can’t imagine having any other job, I have to admit it doesn’t pay very well. Media jobs are also being cut with semi-regularity so there is a bit of worry that I won’t be able to continue on this path for my entire career. I don’t plan to retire early, but I’d like to be in a position where I could take early retirement (or a forced layoff) in my late 50s and not have to look for a new job.

Additionally, my employer has a very strict “code of ethics” that makes it difficult for me to take a second job (or even volunteer somewhere) because of potential conflicts of interest.

If I was married, I’d even have to disclose my partner’s job. As an example, here’s a link to another media organization’s conflict of interest policies (note: this is not my employer, but the rules are similar).

Where Nici Wants To Be in 10 Years:

Finances:

- No debt! Once the student loan is paid off, I will increase my 401(k) contribution.

- In 20 years, I want enough saved to be able to retire if forced to.

Lifestyle:

- A bit related to finances, I’d love to have a two-bedroom apartment so guests have a place to stay instead of having someone sleep on the pull-out couch or get a hotel room.

- Hopefully I’ll have visited all 50 states by then!

Career:

- I do contemplate a move into management, but I truly love what I do now.

- So far, the company I’m working for has been great. We haven’t had nearly the cuts of other media companies during this pandemic. Fingers crossed!

Nici’s Finances

Income

| Item | Amount | Notes |

| Nici’s base net income | $2,834 | Deductions: 7% 401(k), medical insurance and HSA, taxes |

| Nici’s average extra net income | $355 | *I take as much OT and holiday pay as I can, but this amount could vary in the future |

| Monthly subtotal: | $3,189 | |

| Annual total: | $38,268 |

Debts

| Item | Outstanding loan balance | Interest Rate | Loan Period/Payoff Terms/ monthly required payment |

| SoFi student loan | $17,862 | 4.60% | 7 years remaining; Minimum payment is $221/month; I pay an extra $50 |

Assets

| Item | Amount | Notes | Interest/type of securities held | Name of bank/brokerage |

| 401(k) | $37,076 | I contribute 7% for the full employer match | VFFVX | |

| Checking Account | $4,832 | no fees | Chase | |

| Brokerage Account | $4,551 | no fees | VTI, IVV, SPLG | TD Ameritrade |

| EE Bonds | $3,500 | Gifts from grandparents maturing over the next 15 years; value listed is the current approximate | varies based on purchase date | |

| Health Savings Account | $1,584 | Can invest starting at $2,000 | Optum | |

| Roth IRA | $1,431 | no fees | SCHB | Schwab |

| Savings Account | $878 | no fees | .65% (ouch, that went down a lot) | Capital One |

| Total: | $53,852 |

Vehicles

| Vehicle make, model, year | Valued at | Mileage | Paid off? |

| 2000 Ford Mustang | $1,400 | 168,500 | Yes! |

Expenses

| Item | Amount | Notes |

| Rent | $1,390 | |

| Car Maintenance, Repairs, Registration | $395 | |

| Student Loan repayment | $271 | $221 is the minimum; I can’t wait to not have this debt |

| Groceries | $122 | Includes household supplies and non-food cat supplies. See note below on how this is so low. |

| Electricity | $93 | |

| Entertainment | $92 | Primarily concerts (I used 2019 average) |

| Dining out | $62 | |

| Internet | $57 | I call every year to get a rate reduction; I think this is really $87 |

| Gas | $53 | |

| Car Insurance | $48 | Through GEICO |

| Travel | $47 | Family lives in another state and I have a goal to visit all 50 states (2019 average) |

| Cat | $42 | Food and vet visits (she has ear issues) |

| Clothing/Makeup | $41 | |

| Personal Care (Hair/Facials) | $39 | My skin started having issues when I moved |

| Cell Phone | $35 | Cricket used to have a great rewards program that got my bill down to $10. For work I need either AT&T or Verizon networks. |

| Gifts | $18 | |

| Renter’s Insurance | $12 | Required by apartment complex; through GEICO |

| Healthcare | $12 | Reimbursable from HSA |

| Patreon | $10 | Gets me an extra episode per month from my favorite podcast |

| Hulu | $6 | |

| Monthly subtotal: | $2,845 | |

| Annual total: | $34,140 |

A note on how my grocery bill is only $122:

Since I can’t have an actual part-time job, I make use of the time that would go into a second job to scour ads for deals. Here’s an example of a great deal on toothpaste for this week.

When a deal requires the purchase of too much for me to use alone, I either split with a friend or donate to a shelter. I stack as many discounts as possible and go to multiple stores (a perk of the big city is that I have six major chains within three miles of my apartment).

I don’t eat much meat, but I always look for mark downs (when meat is going to expire soon) that go along with a store sale.

There’s also a store here that allows “buy one get one free” coupons to make both items free when the store also has the B1G1 sale.

I’m also able to keep costs low by drinking tap water or tea most of the time.

Credit Cards*

| Card Name | Rewards Type? | Bank/card company |

| Chase Freedom | Cash Back | Chase |

| Citi DoubleCash | Cash Back | Citi |

| Hilton Honors | Travel | American Express |

| Expedia Voyager | Travel | Citi – Fee is $95, but has $100 annual airline credit |

*All cards are paid in full every month. These are affiliate links.

Nici’s Questions For You:

1) When does it start becoming unrealistic to keep repairing a car?

I drive a 20-year-old Mustang (purchased used, of course) that I absolutely love, but the maintenance and repairs add up to a car payment. I found a 2013 Mustang (the year may change, but the model never will!) for $14,500 and insurance at about $70 a month. Registration would also increase since it’s based on the value of the vehicle.

Knowing that even a newer used car would have maintenance and at least the occasional repair keeps me thinking that it’s worth hanging onto my car (which the coworker-recommended independent mechanic I go to assures me is in great condition), but I’m also pretty emotionally tied to the car as it’s what I bought shortly after getting my first job out of college.

2) How should I plan for rent increases in retirement?

I don’t want the responsibility of home ownership, but renting means I have no way of knowing what I’m going to pay the next time my lease renews. Of course, I could always move if the increase is too much, but that’s a hassle. I also might eventually need care and wouldn’t have home equity to pay for assisted living.

3) What should I be doing with the EE Bonds from my grandparents?

As each one has matured, I’ve used the money to pay down my student loan. Is this the best course of action? Should I reinvest the money somewhere? Or maybe put it toward buying a newer car? One consideration with that is my FICO is over 815, so I should get a great interest rate if I needed a vehicle loan.

Mrs. Frugalwoods’ Recommendations

Nici is doing a tremendous job of making it work on a small salary in a high cost of living location. She has truly done astonishingly well and should feel proud! The challenge is that I don’t think it’s going to be sustainable for the long term.

The Bottom Line is Income

Nici is doing everything right. Her expenses are low, she’s paying down her student loan debt, and she’s investing for retirement. She lives the lifestyle she wants and she loves her job. She’s clear-eyed about her preference for renting, her desire to travel, and her enjoyment of her cat and car. The only thing wrong with this entire picture is her income. I HATE it when this is the case because Nici has taken all the steps necessary to be financially secure and happy in her chosen profession.

The absolute bottom line is that she just doesn’t make enough money. She’s a highly skilled mid-career professional making peanuts. As a great respecter of journalism, I hate this. I want Nici to make ten times what she does. I want her investigating the crap out of things and reporting in a way that makes us a better-informed citizenry. Journalism is the Fourth Estate and I want it to pay more!

While she’s able to make it work month to month, my concerns for Nici are as follows:

- A major crisis or emergency could wipe out her liquid assets of $5,710. At her current monthly expense rate of $2,845, her emergency fund would cover just over two months.

- Future rent increases and the inability of her salary to keep pace with these increases. If her salary was increasing annually, I’d be less concerned, but her mention of salary freezes and nominal annual raises have me concerned.

There are a few different options for addressing this situation:

- Consider moving to a lower cost of living location.

- That being said, Nici’s expenses aren’t that high. Plus, she enjoys living in the city!

- The vast majority of people who make it work in higher cost of living locations on low(er) salaries often have one of three things:

- A live-in partner with whom they share expenses. That’s how Mr. FW and I scraped by in our early years in the city. I remember his salary alone BARELY covered the rent and how relieved we were when I moved into his one-bedroom basement apartment. A doubled salary would undoubtedly help here, but we can’t magic a salary-earning parter into existence, nor does Nici necessarily want one. One of the most poignant explorations of this situation is Elizabeth Warren’s book, The Two Income Trap.

- The other strategy is to live with a bunch of roommates in a sub-par apartment, which is what I did when I lived in NYC. Nici doesn’t want to do that, no one over the age of 25 wants to do that.

- Have a trust fund/financial help from family. I never had that, but I want folks to be cognizant it’s usually not “magic” that people are able to hack it in the city on a low salary.

- Consider a career change to something more lucrative.

- I hate to even say these words because Nici loves her job and her work is important to our democracy. But, if her current profession can’t pay her a living wage, she may need to look elsewhere. Depending on her specific skill-set, she might explore something like corporate PR.

- Or, she might be able to make more money as a full-time freelancer. She’d lose the security of her salary, her health insurance, and 401k match, but she’d be able to take as many jobs as she wants. I get the sense she feels constrained by not being able to freelance right now and I wonder if it’s something she’s considered?

- If she has any interest in full-time freelancing, I suggest she poll her network for what rates she could command per article and how abundant the work is right now. Depending on the types of outlets she’s had a byline in, she might be able to parlay her experience into a higher price per word. She’d need to calculate what her healthcare costs would be through the ACA and consider opening a solo 401k/SEP IRA, but working for yourself is feasible, if a bit more administratively frustrating than having a traditional employer.

The Mustang

Ok, let’s talk cars! I feel like the Grim Reaper today and I hate to rain on Nici’s beloved car, but unfortunately, her car is costing her a ton of money. She’s paying $496 every month ($395 in maintence, repairs, and registration + $53 in gas + $48 in car insurance), bringing her annual car expenses to $5,952, which is a sixth of her annual take-home pay. I hear Nici’s love of this car, and of Mustangs, but I don’t see a way for her to continue paying this much to maintain an old car or to drop $14,500 on a newer model. There’s just nowhere for that money to come from.

To be honest, if this is a financial question, she should sell the Mustang and look into buying something small and reliable with better gas mileage, such as a 2010 Toyota Corolla/Camry/Prius or Honda Civic/Fit/Accord. I understand that these cars are not sexy or particularly fun to drive, but, having owned both a Camry and a Prius I can say they’re reliable, inexpensive, have good gas mileage and good maintenance/repair records.

Rent Increases

This is another of Nici’s questions that I unfortunately don’t have a great answer for. Basically, where rent increases are concerned, you hope for your income to increase commensurately. The challenge of a high cost of living area is that rent increases are usually all but guaranteed and will eventually catch up with you.

Something for Nici to explore is the possibility of subsidized housing. Her income may be low enough to qualify her for subsidies or the eligibility to enter a lottery for a subsidized apartment. The other option could be a first-time-homebuyer program that either waives the downpayment or requires far less than the standard 20% down.

Bonds

As these bonds mature, Nici should consider keeping the money as an emergency fund. While paying off her student loan is important, she also needs to build up a larger cash reserve. I’m less concerned about the student loan than her small emergency fund. The priority should (almost) always be ensuring you don’t go deeper into debt, which is what could happen without a solid emergency fund.

Her student loan–while it is debt–has a pretty low interest rate of 4.6%. If she had to incur credit card debt to, for example, pay her rent and utilities in the event of a job loss, the interest rate would most likely be north of 15%. Ensuring she doesn’t ever need to take on credit card debt takes precedence over paying off the relatively modest 4.6% student loan.

Additionally, since it sounds like she’ll need to buy another car at some point in the near future, this money might go towards that. I personally wouldn’t tie it up in accelerating student loan repayments.

Nici’s Expenses

Are admirable!!!! She’s done a fabulous job of spending very little and is a frugal model to us all. Her grocery hacks alone are worthy of front-page news! If she wants to, there are a few areas where she could save a teensy bit more. The reason to save more would be to build up a more robust emergency fund and save for a new-to-her used car.

I have no beef with Nici’s current spending. She spends WAY less than me, she’s crystal clear on her priorities, and she’s a certified frugal maven. However. It all circles back to her income and the margin between her income and expenses. If her income remains the same, she may need to make deeper cuts to her already impressive budget.

Here are some ideas for how she could save more every month:

| Item | Current Amount | Mrs. FW’s Notes | Possible New Amount |

| Rent | $1,390 | Fixed; no change | $1,390 |

| Car Maintenance, Repairs, Registration | $395 | Discussed above; I’ll leave as is for now, but I recommend reduction | $395 |

| Student Loan repayment | $271 | I would actually stop accelerating re-payment and would just pay the minimum. | $221 |

| Groceries | $122 | AMAZING | $122 |

| Electricity | $93 | Any opportunities to reduce this? | $93 |

| Entertainment | $92 | Discretionary; could be eliminated | $0 |

| Dining out | $62 | Discretionary; could be eliminated | $0 |

| Internet | $57 | Nicely done on calling to get a rate reduction!!! | $57 |

| Gas | $53 | Discussed above | $53 |

| Car Insurance | $48 | Discussed above | $48 |

| Travel | $47 | Discretionary; could be eliminated | $0 |

| Cat | $42 | Fixed; no change | $42 |

| Clothing/Makeup | $41 | Discretionary; could be eliminated | $0 |

| Personal Care (Hair/Facials) | $39 | Discretionary; could be eliminated | $0 |

| Cell Phone | $35 | I suggest investigating other MVNO options. There are plenty that re-sell AT&T and Verizon. I personally use Ting, which re-sells Verizon, and I pay circa $14.79/month (affiliate link).

Also, if she’s using her phone for work, would they reimburse her? Worth asking if she hasn’t already. |

$14.79 |

| Gifts | $18 | Discretionary; could be eliminated | $0 |

| Renter’s Insurance | $12 | Fixed; no change | $12 |

| Healthcare | $12 | Fixed; no change | $12 |

| Patreon | $10 | Discretionary; could be eliminated | $0 |

| Hulu | $6 | Discretionary; could be eliminated | $0 |

| Current Monthly subtotal: | $2,845 | Possible New Monthly subtotal: | $2,460 |

| Current Annual total: | $34,140 | Possible New Annual total: | $29,520 |

With the above, she’d be on track to save an additional $385 per month ($4,620 per year); plus any savings she’d accrue from driving a different car. She might consider these savings for the short term while she builds up her emergency fund and saves up to buy a car.

I hate that I had to strip out all the fun stuff from her budget and I’m not an advocate for miserable deprivation. However, I really really really don’t want Nici to find herself in a precarious or untenable financial situation down the road.

Summary:

I want to emphasize again how well Nici is doing. She created a life she loves on a small(ish) salary in a high cost of living city. Everything we discuss today is in the shadow of her excellent financial decisions up to this point. Kudos to Nici!

- The ceiling Nici will continually bump against is her salary. She is doing all the things right in terms of keeping her expenses low, investing for retirement, and paying off her student loan. But, she will never make tremendous headway on her current salary. This is fine, but it is a trade-off. If she wants, Nici should consider exploring other jobs/careers that might afford her a bit more financial breathing room.

- The major concern here are possible future rent increases that’ll outstrip her salary.

- If it were me, I would sell the Mustang and buy a reliable, boring, fuel-efficient small car, such as a 2010 Toyota or Honda. Of course, this is easy for me to say because I don’t have the emotional connection to Nici’s car. This won’t be an easy decision, but from a financial perspective, it’s a slam dunk.

- As the bonds mature, I suggest Nici keep that money in cash for her emergency fund and her buying-a-used-car fund.

- Consider reducing her expenses–as outlined above–for at least the short term to allow her to build up her emergency fund and the cash to buy a used car.

Ok Frugalwoods nation, what advice would you give to Nici? We’ll both reply to comments, so please feel free to ask any clarifying questions!

Would you like your own case study to appear here on Frugalwoods? Email me (mrs@frugalwoods.com) your brief story and we’ll talk.

The wait to get subsidized housing in Southern California is 5-7 YEARS. Not a reasonable option, unfortunately.

Getting rid of the money-pit Mustang is a given. I understand the hesitation as I used to love having a Jeep Wrangler, but I wised up last year and traded it in for a boring, fuel-efficient, preowned Hyundai Tucson. Driving the crossover isn’t quite as fun as driving a Jeep, but saving hundreds a month in fuel, insurance and maintenance makes it worthwhile. That decision alone has me several years closer to financial independence.

Thanks for sharing and safe travels!

Seems soooo unfair that her employer basically prohibits her from having another job but doesn’t pay her enough to achieve her (relatively humble) financial goals.

That’s what I came down here to the comments to say!! Either pay her or let her make money outside of the 9-5…

true. maybe she can ask her manager how strict this policy is, or if there are exceptions. Then get it in writing of course, an email would probably do. She could also look for a new job, when she gets a new offer, go to her current manager and ask for a raise. Or as she said, consider moving into management. She’d still be making an impact in her chosen profession, but would likely get paid more.

Ultimately, it really does all come down to her salary. There’s another great website, esimony dot com that has great advice about this.

At last, a case I can really relate to!

Nici, I have worked as a newspaper journalist for my entire career (starting in 1984) and now only make about $68,000 a year!

I’ve never left because it’s the most interesting job in the world. But likely the reason I still have it is that I’m in a guild and now have enough seniority that they basically can’t lay me off (our newsroom has lost probably 2/3rds of its staff in the last 10 years).

I looked at the code of ethics you linked to and it’s similar to ours. There are part-time jobs you can probably get. For 10 years I’ve taught as an adjunct at a local university. Night school communications class. During the semesters I’ve taught the money is very helpful. If you are a good editor, you may also get freelance editing projects in unrelated fields. I’ve edited an economics professor’s journal submissions because English is his second language. A friend at a prestigious NY paper does freelance editing, too, for academics.

You also could probably get an unrelated gig, such as dog walking (very random suggestion, I know). I’m just saying that a second job is not out of the question.

If you love your job, as I have, that may be worth more to you than financial compensation. But whether you’ll be able to still have that job in 20 years is the point I would worry about.

Also, I bought a used Prius a few years ago and am so intrigued by people who actually travel and even live out of their Priuses. Do you drive when traveling? Lots of people save money by sleeping in their Priuses on mattresses, etc., cooking using an inverter linked to the car. Just a thought.

Good luck!

P.S.

Also, if you are a writer, think about rewriting and selling stories you’ve produced for current employer (with their permission of course). They might allow that if they had it first (it would have to be rewritten from a different angle, probably). Or they may approve letting you sell stories that are about topics they don’t usually cover.

Thanks Leslie! Like you, I love the job. But yeah, with retirement 30 years away, I do wonder if the job will even exist.

Some of my coworkers do have permission to do things like teach. I need to find out just how hard it was for them to get the approval.

I generally fly to my travel destinations. Home is over 1000 miles from my current location and my focus is (or will be when travel is a thing again) to visit states I haven’t been to yet.

Sigh. These are the things I suspected. So many of my coworkers have left for PR or to teach journalism to college students. I just can’t bring myself to do that…at least not yet. And unfortunately, my phone bill won’t be reimbursed by my employer—just another one of the many cuts media companies have made over the years. We don’t even have free coffee in the newsroom anymore.

But in the list of things needed for a lower income person to make it, I do thankfully partly have number 3. No trust fund, but my parents both retired from union jobs with pensions. I don’t take money from them, but I could count on them helping in an emergency.

Thanks Mrs. Frugalwoods!

A quick note to not count/rely on parents helping in an emergency…it could happen … or they could have emergencies first (health, dementia, accident, etc.) … and then that mental security buffer is gone. Many things can happen and often do.

Keep at it! A former journalist myself…the potential conflicts of interest are understandable, but as you say, working through supervisor and HR might be the route.

I read the conflict of interests document and it appears that you could have a second job as long as it cleared through the employer. I would discuss the types of second jobs that would be approved of with my employer then seek those out. Also I am suspicious of a mechanic that finds so many things that need to be repaired every month. I would seek a second opinion on that but do agree with getting a more reliable boring car. My husband repaired cars as a favor to our friends and I did see women being taken advantage of by professional mechanics. The worse case was a male friend who owned an older model vintage truck. He had no mechanical knowledge and was taken in very badly by an auto repair shop. Fortunately, my husband was able to correct their shoddy work. Finding an honest mechanic is difficult.

You are fantastically frugal and doing an awesome job!

Thanks Ellen.

It’s not impossible to get a second job, just very difficult. I’m definitely going to ask HR what the approval steps are.

The car repair expenses are not every month (I just broke it down monthly for the purpose of a budget) and I believe the shop is fair. I do know quite a bit about Mustangs and the shop was recommended by coworkers (and the employees there know where I work). It’s just that a 20 year old car needs some things. This year I replaced the radiator and starter among other things.

Usually the monthly rate is what the car cost total last year, divided by 12 to make it readable in Frugalwoods format.

So could have been just two bigger issues divided into monthly pieces for this article.

Nici is doing great, and this is all good advice. I have a 2010 Civic and I just want to put in a plug for how great of a car it is! Civics and Corollas both have “sportier” models available, and they have more horsepower than a Fit (thought I’m sure less than a Mustang). Despite not being “fun” cars, they get great gas mileage, and are known for their longevity.

You are doing great! Since you are living in the city would it be an option to give up the car for a while and use Public transport and ride share? Even a few months to save up for another car. I understand that’s not a great option if you are chasing stories. And agree about the second job teaching is a great suggestion, maybe an online side gig totally different like – writing resumes, helping kids with college apps, online tutoring, SAT prep.

This is one of those situations where I think you have two “big picture” paths you can go down:

1. Adjust your career: Find something that pays more or find a reliable and ethical way to make some side money.

2. Adjust your lifestyle: Get rid of the expensive car, do what you can to drive rent expenses down, stop travelling and going to concerts, and cut out non-necessities from your budget until you can shore up your savings. I hear you that you want to travel, own a Mustang, live alone in a decent apartment in a nice city, etc. But those cost too much money for your current lifestyle, if you also want to be financially secure in the future.

The thing is, I don’t think you have to do BOTH of the above, but I do think you need to do one or the other for long-term stability. Of course you can also do a little bit of both based on your priorities: like find a management position in your field, so you are paid a bit more but can stay in the field you love, and then adjust your lifestyle to that budget.

But sometimes I find it useful to do a little thought exercise where I think “If I had to make hard changes to either earn more or to spend less, which would I prefer?” Like my husband and I could both make more money in the private sector, but we love working in our current jobs, so we’ve adjusted our lifestyles accordingly. For us, we’d rather make the changes needed to spend less vs. the ones needed to make more. But you might have a totally different answer.

I totally agree that Nici needs to make more money to get where she wants to be in her 50’s. Giving up luxuries will always be hard but she can set a time in the future to pick up one luxury as a reward for herself after accumulating more in her emergency fund. Too many people are lacking emergency funds in this pandemic and it is their own faults. Everyone should always have 6 to 12 months in an account to survive on. Nici is doing a great job with groceries which is a money hog for most people’s budgets. Changing jobs right now could be financial suicide due to the job market and lack thereof. I suggest for now that you keep your present job but use the next several months to look for a new position while you tighten up and save more money. I agree with getting rid of the 20 yr old car. At that age it is a money pit and you will get so little in trade in if any unless someone would purchase it from you for parts. I have always thought it a bit scary for a woman to be out driving at night in a clunker that could breakdown and leave you stranded and possibly in a dangerous situation. Please keep your beautiful cat, pets are such a comfort, so well worth their expense. I agree also with having a roommate. I am sure you do not want one but in you low income I think it is necessary and would really increase your ability to save. You may need to move into a 2 bedroom to do it though. Perhaps it would be worth investigating getting a roommate before you change into a 2 bedroom. Each of you could then sign the lease. I also recommend a clothes buying ban and minimal makeup purchases. If you can sacrifice eating out for a year it would be more money in your savings. I don’t know if you have an instant pot or not. They are wonderful for making great tasty meals. I have the insignia 6 quart that I purchased 2 christmases ago for 29 dollars at Best Buy and it is absolutely one thing I will never not have. The food you make tastes like it has been cooked for hours with the pressure infused flavors. I have seen the same pot this year for 29 on their thanksgiving sales. A crockpot works too but it is not as quick as the instant pot. Good luck to you.

Congratulations for being able to manage so well on a low salary; that takes real attention and dedication. I would have to echo Mrs. Frugalwoods concern about your low salary — and prospects for the future. I’m decades ahead of you and while I wasn’t in the high income group, I made a good salary and was able to save. And savings give you options and security. I’ve always advised my younger colleagues to save as much as they could when they were young (20s, 30s,,,) because it doesn’t get any easier when you get older — there’s always and unexpected “something” and the bills/needs/circumstances/emergencies change.

While living this way is OK when you’re young like you are now, you don’t want to be in this position when you’re older. I’m fortunate — I was able to save. So now, furloughed and then recently permanently laid off due to pandemic, I’m OK. It’s not what I planned (I’m 62 and planned to work full time for at least 3 more years and longer part time) but my savings are “retirement ready” . I’m looking for work and will work again as this forced job loss adds more expensive non-employer/Cobra healthcare to my expenses — but I don’t necessarily have to. And that is a blessing to not have the stress of “what do I do”? You truly want to have options and choices, especially when you’re older. I can’t imagine having to track down a lower cost place to live if I was in my 60s, 70s or 80s. I can’t imagine the added stress and worry.

So truly, please consider taking time to rethink your career path and options for higher earnings. During this pandemic may not be the time to make the change (hang on to the job you have) but please consider other options. I liked Mrs. Frugalwoods suggestion of considering PR work. Its has the writing you’re skilled at but the possibility of higher pay. You can align with a company that you believe in or are interested in. Use this time to explore other options.

Best of luck to you in your journey; you have the skills and fortitude for continued success!

I’m not judging, it’s great to love your job, I loved mine. But it’s not ok to work for peanuts. It will eat away at your job satisfaction and you will stop loving the work eventually when you find yourself unable to fund a decent lifestyle. Get a better job without ethical restrictions and blog or freelance as a side gig. Then someday get a Shelby GT500! But I’m not a journalist so consider this an uninformed opinion. Good luck, the fact you are considering options speaks well of you.

I agree on the car, but I’d suggest a used Leaf, particularly if her employer has charging stations, which many do in the cities.

Another employment avenue to consider is municipalities. Our city has a City Information Officer and the job is always filled by a former journalist. Better pay, better benefits, lots of flexibility. Nici’s writing skills are worth a lot more than journalism can pay. Then she can freelance on the sode.

I don’t know what the real estate situation is where you live but you may be able to buy a small apartment or townhome. Then you wouldn’t have to do outside maintenance and you would be paying your rent as a 30 year? mortgage and not have to worry about increases. It does sound like you may live in an area where this is not an option due to all housing being crazy expensive. If so, do you have to live there? Maybe you could move to a lower cost area?

I know it’s hard to hear but I absolutely agree with Mrs F about the car. I drive a 2007 Mitsubishi Outlander and despite it’s age it costs me very little in maintenance. Even including the insurance it costs me way less to drive than what Nicole currently pays to maintain her Mustang. It helps that my hubby is a mechanic and does the work himself, but even aside from that, it’s just not that often that something major happens to it. Our 2nd vehicle is a Toyota Tacoma that’s 11 years old, and before that an ancient Toyota Sienna. Toyotas last a long time AND are super cheap to maintain. Toyota is a great brand, as is Honda, but I just have more experience with Toyotas and I love how the ones I’ve owned feel to drive even though they’re built for practicality. I’ve also owned a 2003 Mitsubishi Lancer and it was a fun little car that was also quite reasonable to maintain. Old doesn’t necessarily mean more costly to maintain. She has a reliable mechanic so I think it’s fair for her to stay confident in owning older vehicles. I were Nici, I’d trade the Mustang for an economic little Toyota and consider finding a different job. She could save up a little extra while she looks into different options for work, and then after she has a more solid cushion and a higher income she could go back to driving the Mustangs she loves.

I’ve driven two Corollas over the past 20 years and I agree with you, they are such great cars.

Yes- my family and I are Toyota all the way! I currently drive a 2012 Rav 4, my son drives my old car which is a 2009 Camry, and my husband drives a 1996 T-100. They might cost a little more upfront (though maybe not if you can find a good deal), but they will save you big-time in the long-run!

Hi, Nici! Former journalist here. I love that you love where you are professionally, but like Mrs. Frugalwoods says, they’re not paying you! LA Times has some openings — and a new Guild contract! If you could get on there, it would give you more money and more job security. The bigger the media outlet, the more $$$ they pay. I do congratulate you on your extremely reasonable rent for Big City, CA!

I keep applying! Last time was right before the pandemic hit, so I wasn’t surprised when that resulted in nothing. 🙁

I do love Liz’s “dog” disclaimer. I need to read more carefully.

Great work Nici! A couple of things I see as possibilities for reduction in expenses (and thus less emergency fund needs): Co-housing with another professional- a 2 bedroom house/apartment with 2 “primary” bedrooms might make sense as a compromise to a higher salary- it’s also relatively easy to change if it’s a not working. Less rent, split expenses (for electricity, internet, etc) might make sense. I would also ask- how often does she use her car? Could she go for a time without one? Could she use car sharing programs or otherwise to get around and reduce car dependency for a period of time? These savings could help build her emergency fund. I might also put a bit extra towards my student loan as 4.6% isn’t nothing-but split the extra she is paying- 50% to student loans, 50% to emergency fund. I like working towards both goals at once- but that may be a personal thing

I also have a Sofi student loan. They recently started offering lower rates for refinancing, and I was just able to reduce my interest rate to 3.6% from 4.6%. There are no extra costs or fees to refinance an existing loan with Sofi, so this could be an option for saving even more and paying off the loan more quickly.

Good to know! I’ll check to see if I can refi again.

Nici, did you already take advantage of your deferments or the govt’s income-based repayment options? Back in the day (which I don’t advise just so we’re clear, lol) I had (and still do) awesome credit, so I had a handful of cards with zero % offers & I wrote checks for my student loans & merry go rounded ( 0% offer on one card, pay it off by the end of the year & midway move more to another one) them to avoid interest. I paid off 3/4 of my student loan debt that way & saved thousands in interest. That was in the early 2000s for my Master’s degree which was in psych. & I had over 60K for those 2 years of education from the mid-late ’90s. The interest rates now on cards are crazy high though & the offers for 0% are few & far between & your credit score doesn’t even matter. In fact, if you ever do want to buy a home I can say from house hunting with my now ex-husband, that income is way more important than credit scores, unfortunately. I say, if you like traveling a lot then freelancing or owning your own virtual business is the way to freedom on all levels. You clearly have the self-discipline to live frugally so you’d probably kick butt if you worked for yourself & with social media you can create a huge community of friends & followers & even meet up in person with folks once the craziness of the pandemic is over. Podcasts are huge & blogs such as this are still going strong, but video & audio is where it’s at as people are wanting things faster & shorter & us older folks that appreciate a good read are declining with younger generations. Whatever you decide I wish you the best & to always be true to you 🙂

Thanks for the well wishes!

My loan is private, so it doesn’t qualify for the Covid relief. But I do qualify for 0% credit card offers (FICO is 815+) and have taken advantage of them in the past. And not to worry everyone, I’m very meticulous by setting up automatic payments, tracking through Mint and Personal Capital, and creating calendar reminders about payments for good measure!

Funny you should mention podcasting. I actually got permission from all the powers that be to launch a podcast (which my employer would own and have all rights to). But then the pandemic hit and they didn’t want to start any new ventures.

Why would you want to do that if they would own and have all the rights to?

Update: Couldn’t get Vanessa’s 3.6% rate, but was able to get a slightly lower rate of 4.13%.

I am impressed by Nici’s frugal lifestyle and the many helpful suggestions of readers. I am adding another viewpoint. My big take home lesson from my economics course was the concept of opportunity cost and the limitation on our time. I believe that Nici’s time spent on scouring ads for grocery specials is a wasteful. I was like Nici, and used to spend a lot of time perusing ads for deals and driving to and from stores. To me, this was a game that I became tired of. Even though her stores are near bye, this is additional wear and tear on a car and time that could be spend better elsewhere, such as figuring out additional income opportunities. Unlike me, she is a single person that thrives on mobility. The buy one get one free deals are better suited for families and hoarders. Also, many of these offers are for overpriced brand name products and highly processed foods. I suggest that she consider shopping at a no-frills store like Aldi. Also, I am wondering if Nici’s skin issues could be resolved by avoiding grocery food promotions and consuming more high quality raw produce ingredients. No mention was made of Nici’s time spent in a kitchen setting preparing meals. I am concerned that her mobile lifestyle might be incompatible with cooking and consuming healthy meals. Sound nutrition has huge implications for our short and long-term health.

I very rarely eat processed food. Here’s a typical workday menu:

Breakfast- oatmeal and banana

Lunch- home-cooked chicken with zucchini, red peppers, and red onions

Snack- raspberries

Dinner- same as lunch

It seems really inappropriate to shame a woman you’ve never met about her diet when you don’t have anything to indicate what her diet is one way or another.

😀

It’s actually pretty easy to eat healthy on a budget if you’re willing to put in the work. Just recently I had a grocery coupon for $5 off a purchase of $5 and potatoes were on sale for $.25 for 10lbs. around Thanksgiving.

And while I didn’t write about it for my case study, I cook all the time. The number one thing I look for in an apartment is a good kitchen!

I didn’t read her comment as shaming, just something to consider that we hadn’t had full details about in the case study.

Nici, ex-newspaper reporter here. It was the BEST JOB I will ever have, and nearly every day I thought: “I cannot believe I’m being paid to meet new people, find great stories, and tell them…and that no two days are ever the same.” Oh man, even as I type this, the energy and joy of pursuing truth and hammering out solid prose (and, if we were lucky, lyrical prose) on scorching deadlines—it all comes back to me. I still feel so blessed to have lived that.

And yet.

I made it work financially by living radically below my means in low cost of living places AND because I was lucky enough to graduate college with no debt. I did a lot of side hustles along the way in remote editing/proofing/writing that weren’t conflicts of interest. I never cared about money.

However, after a couple of decades, I wanted a family and saner hours and to not live paycheck to paycheck. Where I use my skills today: corporate communications, making double what I used to.

We need great journalists so I would never suggest you do what I did. I wrote to commiserate and to say: maybe it’s a choice between profession and location. If you can stay in the field but live someplace cheaper, maybe that is your way to funding retirement and travel. Good luck. I wish you all the best and do what I can for “our” industry with multiple newspaper subscriptions and public radio membership.

Also: you’re my hero on the grocery budget!

Appreciate all your thoughts. I especially appreciate your subscriptions though! I had a family member ask me how to defeat the paywall. I wanted to say, “Would you ask me how to shoplift if I worked at Macy’s?”

GIRL. Do not get me started. My kids have heard this since they were little: taking other people’s work in an illegal download or cut and paste or sneaking around a paywall is the same as pocketing stuff at the grocery store or driving a car off the lot without paying for it. My husband (also ex-newspaper) and I have instilled in them a serious respect for both the First Amendment and copyright laws. 🙂

As a former journalist (straight out of college,1983-2000), I applaud you and will always support working journalists. Especially in today’s climate. Freedom of the press is a cornerstone of democracy and must, MUST be safeguarded. I agree with others, try to find a way to have a second part-time job and replace the Mustang with a more economical car. I hated the need for roommates when I was young and first out of college and working, and as soon as I could swing it financially, I rented alone and was much happier. But I worry about your housing future. How about considering buying a condo/townhouse? They are almost like renting (no yardwork, little maintenance, etc.) and would give you home equity and a place to retire. Best of luck to you!

I have thought about buying a condo. But then I think back to a few years ago when I thought I was settled in my job and then the ax started swinging. I wasn’t among the people who got laid off, but about half the staff lost their jobs. It just makes me nervous about big commitments like home ownership, especially since I now live in a state I have no ties to other than the job.

I think that since you like the fact that you can pick up and go, apartment living is the best choice for you. It looks like you are living in the LA area and the price of a condo out there (fellow Californian here… Bay Area) in a decent area will not be less than 500K most likely. Where I live it is more than that. The cost of the Condo would be much higher than her rent. with mortgage, insurance, homeowners dues etc (homeowners dues alone could be anywhere from $200 on up per month!). Nici, I also have the goal to visit all 50 states! A little less than 3/4 there. My parents did not travel, so I caught the travel bug a bit later in life. 🙂 Good luck to you!

Thanks Kelley!

When I do The NY Times rent vs buy calculator, it says renting is the better option. I think that’s especially true now with the pandemic seeming to have driven up the price of a home while rents in some areas are dropping. My lease is up in April, but it appears rent is staying flat from my last renewal. I’m hoping that stays true when I get my next renewal.

Please remember that IF you buy a condo or townhome most of those have a monthly HOA fee or maintenance fees which can rise every few years. You own your living space but nit the gist. or the common areas. I’ve had friends buy a condo or townhome to retire to and then ended up selling and buying a small home instead because the HOA fees went from $300 a month to $600 a month within years. I’ve also heard condo nightmare stories where if the association decides to get a new roof for all buildings or make improvements, if it passes the condo board vote, then “your share” could be in the thousands.

Maybe Nici could eventually look into getting a condo that also has onsite maintenance? I rented a friend’s condo and the condo association had a property management company that maintained the building and grounds.

I also work somewhere where freelance/2nd jobs are frowned upon but NOT prohibited. I just can’t get a second job doing what I do for my first job. There is a lengthy approval process which seems scary but it’s just some forms and a slightly awkward conversation with my boss. I refereed youth sports which was an extra $1-2K a year (and way more if I put my mind to it) so well worth it.

I’m going to look into getting approval for a second job. I didn’t want to rock the boat so to speak when I started and some people are pretty discouraging about it. One horror story is the person who wrote a book about a case he covered and had to get a lawyer when the company tried to claim copyright!

Nici, you have done a great job at living in an expensive location and having a low paying salary. Have you thought about living in a camper? This would reduce your expenses, give you the mobility if you want to travel or even relocate and you would own your housing outright. Sometimes people will let you pay a small amount to keep your camper on their property with water, electrical and sewage hookups. As for making extra money, maybe buy and sell clothes on Ebay, tutor writing or consider cat sitting. Best of luck to you.

I am not in the journalism business so take this with a grain of salt, but I also had a “you should be willing to make less because you love it” career and here are my lessons learned.

1. Did you dig really, really deeply to find comparable salary data to see if you are truly being paid fairly? Even to the point of calling your college career guidance department, since they may have data from a career fair/recruiting standpoint for specific employers? I accepted $22k a year with an ivy league masters degree (20 years ago) living in San Francisco because I “thought” that’s what my peers were making. It took ten years of really hard work, including five years of living with my parents, before I recovered from the mistake of accepting less than I was worth.

2. I believed that cost of living increases were all that were available too, but are you asking for additional raises every single year and demonstrating the outcomes of your work? Experience has taught me that there are always a handful of people who are rewarded beyond the status quo. And employers are not going to trip over themselves to compensate you more if you aren’t asking directly and specifically for more.

3. I suggest big-picture lifestyle changes (rather than saving a few bucks here and there) to turn the ship. Do hard things while you are young and unencumbered enough to still be able to. I vote for all of these: no or different car, side hustle, less expensive housing/roommate, and new job/career with bigger salary. You’ll be fine and the growth experience will give you lots to write about 😉

4. I think the easy breezy lifestyle and fun job and fun car life priorities are creating a risk for your future self. I think if one big misfortune comes your way you could be homeless. You could sacrifice now and then live more comfortably when you are older, and oh the magic of compounding interest! Love yourself enough to be boring/basic (temporarily), so you can take care of yourself in unforeseen circumstances and truly be free.

Well said.

She is doing a lot right and has pretty modest expenses given her situation. Aside from Ms fruglewood’s advice my only other thought is to ditch the car if walking is possible and save up to buy and convert a van or bus. Crazy but here me out!

She wants to visit the states and travel while simultaneously not wanting to own a house but should against rental increases. Her best option is to literally live in a bus/van by the river. She can buy a bus and convert it relatively cheaply. It would be more than big enough to house her and a cat. She can probably find friends to allow her to park in their yards/driveways. If she can telecommute she can do so while traveling which may even open some doors for her journalism as an adventure style journalist. Further she’s fulfilling each of her requirements of traveling, saving money. WAY cheaper to live in a conversion vs. Renting and those savings expound the longer she does it.

Hi Nici – can you share more detail on the Mustang’s $395/month in repairs/maintenance/registration? At almost $4800/yr I’m assuming that you’ve had some major issues or you’re putting your mechanics kids through college? One way to save money is to buy your own parts and bring them to your mechanic (some don’t allow this, but some do). For example, a starter and radiator for your Mustang on rockauto.com is less than $150 for both parts. Another way to save is DIY. Tools and a place to work may be a factor, but if you’re willing and able to DIY, there’s video’s on youtube to fix anything yourself.

It’s clear that no one else commenting on here is a car enthusiast lol. As someone that owns far too many old cars, I get great joy from them so I wouldn’t be so quick to sell the Mustang to buy an appliance. I bet you can get that monthly cost way down.

Finally someone who appreciates the old car! This was the year that basically everything hit. Last year’s costs were about half. In addition to the radiator and starter being replaced, I also dealt with an oil pan leak, a new battery, and a brake job. Plus all the regular fluid changes. I’m not sure if the mechanic allows people to bring in parts, but now I’m going to ask. I’d love to do repairs myself, but my complex prohibits anything like that. I’m guessing I’d also need to invest in some tools??

Yes, I love old cars! My addiction tends to be old German cars and they can be quite expensive to keep on the road, but it’s all about choices where we spend and where we save. Brakes are one of the easiest jobs to do on a 90’s mustang and the parts are very reasonable. Rotors and pads are about $75. Labor should be no more than 2 hours for both front and rear brakes. In SoCal, you don’t have to worry about rust, which is the only thing that can really kill old cars. Oil pan leak is a $20 gasket and labor to remove the oil pan, but not hard to do. See if you can find a local Mustang club – they tend to be really friendly folks who are passionate about helping others with the same car. They also tend to help with DIY repairs and many of them have nice garage set ups with all the tools and welcome newbies who want to learn, save $, and meet some new car enthusiasts.

👍👍Going to join the Mustang club! The one closest to me has on their website that meetings are at a restaurant, so I can’t meet up with them yet but hopefully soon.

I’m going to second Rick’s opinion with the car (and thanks for asking about what drove the costs since that was my first question). I say this as someone who drives a 1999 Mustang with over 220k miles on it, and has not ever spent the amount in 1 year that you spent. Ironically, I’ve had fewer problems than some of my colleagues with newer “old cars.” I replaced the radiator many years ago, and it will likely not be an issue again. I have a slow transmission leak, so I do spend more on refilling the transmission fluids (<$30/yr). However, outside of that all problems have been minor. If the transmission leak rate increases I will likely spend the $1400-1600 I was quoted a while back to rebuild the transmission (I have money set aside for this). This is assuming that the engine/motor are still viable for a longer term. I've also replaced the mufflers as they had rusted out, and that is a job that I will probably never have to do again in this part of the country. Other than that, most other things have been really minor (battery replacements, oil changes, spark plugs replaced). Radiator and starter replacements are pretty common in the "newer year models" that you are likely to replace this car with, as are new batteries and brakes. I'd go so far as to say that new batteries, tires, oil changes, and brake pads are regular maintenance items that will occur on any internal combustion car that you ever own, and it almost makes sense to remove those line items for any cost comparison that you preform. The exception to this would be if you started looking at European luxury cars, and even then I'd likely only add any cost differential. You could make up for the lower monthly car expenses (I.e. – not having a car payment/increased insurance costs/increased state property taxes) by budgeting each paycheck for a "Car Fund." I use my car fund to pay for these kinds of things. You could also build it up over time as you find more income sources (bonus/tax refund/side gig/gift/etc) in order to one day have a deposit for another car if you do reach a point where this one starts to have more critical failures. For example, if your engine throws a connection rod like it did on my mother's (many years newer than my car 😛 ) Camry it's a safe bet that it might be time to move on. The best advice I can give to you is to be really good about oil changes, and ask your mechanic for what they think might be coming in the short-term and longer-term as far as repairs. If a particular rubber hose tends to crack around the 200k mile range, you can plan for it or at least not be so surprised. There will come a time when it might make sense to part with this car, but 1 year of elevated expenses for mostly minor items isn't the smoking gun I'd be looking for. My husband and I are beginning to have more of that discussion with his 1991 Toyota MR2. The motor was rebuilt by a master mechanic right before he bought the car. My husband can do most car repairs himself (including things like engine swaps), but …… In his case, the 2nd gen MR2 was/is his dream car, so it is also emotional for him (and me, since I have no desire to buy him a Lotus!)

Hey Nici, you might perhaps be already aware of this resource, but Glassdoor is great when researching companies and the salaries they offer. As per Glassdoor, the national average for a journalist is 44K per year. I would put a lot of effort in trying to change news outlets. Maybe you can set up some job alerts on several job search sites. Also try and take the time to update your LinkedIn profile and network for 30min every day.

Also, if you love the job you are doing, how about starting a blog or YouTube channel? It could eventually become an additional source of income and would also add to your resume and internet presence.

https://www.glassdoor.co.in/Salaries/us-journalist-salary-SRCH_IL.0,2_IN1_KO3,13.htm

Also, like many suggested, you should definitely push your outlet to allow you to work a second job as they are not paying you enough. Teaching evening journalism classes is a great option, as would be taking editing or proofreading freelance gigs. There are a lot of projects that demand English linguistic skills. I am currently freelancing full time with Upwork and am amazed at the amount of work that is available.

An additional source of income could be Airbnb. You could get a 2-bedroom apartment and rent out the second room on Airbnb. When you have guests, you can just block those dates on the calendar and the income from Airbnb would cover more than the rent of the extra room. Not sure if renting a room out on Airbnb would create an issue with your employer.

Otherwise, finding a flatmate does not a bad option at all as long you find a person who is aligned with your values in terms of cleanliness and noise. Sharing an apartment for several years would allow you to be able to save a good chunk on money. There are many people in Berlin, who are sharing apartments with other people, either in a single occupancy basis or as a couple. Some are musicians, photographers, actors who travel a lot and for whom the privacy of one room is enough. Perhaps this is something you could consider.

I wish you all the best for your journey!

I’m guessing the Glassdoor salary is gross, not net. Given Nici’s net, I assume her gross is higher than that.

Correct. My gross salary is about $50k.

Your low food expenses are phenomenal but I agree that that’s pennies compared to your fixed expenses: rent + utilities at 50% of your income is unsustainable if you also want to stay in this job + have a car/pet/travel/concerts etc. I’m also in a high cost area and you just can’t have it all if you also want the financial security. You’ll either end up scraping by and never be able to retire or you make a tough choice now about finding a different job, downgrading/eliminating your car, moving in with a housemate and/or eliminating all discretionary expenses as Mrs FW suggested.

Alternatively, look for a similar job in a lower cost area where your housing costs wouldn’t drag you down so much. That way you could keep driving an awesome car and do fun stuff 🙂

I left a job that required a masters degree and paid peanuts when I was almost your age. I went into an “accelerated” Registered Nurse program at a university that gave me extensive credit for my previous BA degree. I graduated in two years with a BS in nursing and have never, ever regretted the career change. I doubled my salary in my first job out of university and it has gone up steadily ever since.

Your preferred lifestyle would be in keeping traveling nursing and travel nurses are always in demand and very well paid. Your apartment is usually paid for too in your assignment city. It is a perfect for career for someone who isn’t tied down and who likes change. Nursing isn’t for everyone but it might be worth considering! Good luck!

Hi, lifelong renter here. Renting is fine, so long as you’re aggressively saving and investing. Owning is expensive… I am a lifelong renter, and I have so many conversations with friends who are trying to convince me to own, all while they’re complaining nonstop about the cost of owning (repairs, renovations, maintenance, property tax, it all adds up so fast). I just nod and smile while tucking all MY extra money into savings, heh, and call the maintenance people anytime something needs to be done. So I think more people should own that they prefer renting. One isn’t necessarily better than the other, depends on your goals. Sure, you could build equity in a home, but you can also have plenty of money stashed away in brokerage accounts, etc.

I also wanted to add, regarding wanting a 2 bedroom place so that people can sleep over and not stay in a hotel. If you math that out, it’s way cheaper to pay for a hotel for a guest (or to chip in, or just make them pay for their own hotel) than to pay extra every single month to maintain an entire room just in case you happen to have a guest. This is what we do. We live across the street from a very nice hotel, and if it’s someone we like a lot and want to see, we book them a room there for a few nights. No big deal. I always say, don’t pay to have something you’ll rarely use.

Others have commented on the challenges associated with your salary, and I do hope you’re able to figure that out. I think it’s wonderful to have a job that you love, and if you’re willing to really make sacrifices to keep it, you might be able to optimize your expenses to be able to save a bit more. Or you might be able to re-think your job as others have suggested. Or just brave that corporate policy and figure out what sort of second job you CAN have.

The mustang, I’d seriously ditch it. We drive a Honda HR-V, and yeah, it’s not exciting, but it’s going to run forever with low maintenance costs. Right now, you can’t afford exciting, later maybe you can. I’d be thankful for the time you had with your Mustang and move along to something more practical and less costly as soon as you can afford to do so. You mentioned you recently put a lot of money into the Mustang, so maybe drive it and save as much as you can until the next sign of issues? And I’d encourage you strongly to not take out a car loan. Think of how much you hate the student loan payment. A car loan payment will be no different.

Hope everything works out for you!

After reading the comments and the advice from Mrs. Frugalwoods, I do think I should replace the car the next time I’m faced with a major repair. I just love driving it though! It’ll be hard to pony (haha) up the money for repairs on a car I don’t love. I think I’ll be more likely to say, “Oh, new spark plugs? Time to trade it.”

But it’s good to know I’m not alone in doing the smile and nod whenever someone tries to convince me renting is throwing away money. Homeowner complaints about waiting for the plumber make me so glad not to be in that situation.

Please don’t dump the mustang over spark plugs. It’s not that expensive to replace them, you will absolutely need to do the same on the next car (unless you buy new cars and dump them after 5yrs) because they should be replaced at a certain mileage. To be honest, with a few You Tube videos or the advice of a friend that can work on cars you can actually do that job yourself. How do I know? I’ve replaced my spark plugs on the mustang. And I’m not the mechanically inclined member of the family. I’m the office worker (CPA) who likes to stay clean. 🙂

J, my spark plug reference was to having to make repairs on a car that isn’t my Mustang. I might love this Mustang too much as I’m basically completely rebuilding it with new parts each year. I read your other comment too (hey, fellow owner!) and yeah, knowing that a newer car wouldn’t be without at least basic maintenance makes it easier to justify hanging on to my beloved vehicle.

With more people now making encouraging comments about keeping my car, I’m leaning toward doing just that. When in-person learning starts up again, I might sign up for an auto repair class at a community college.

Perhaps get a 2-bedroom with a roommate to reduce the biggest expense, rent? Even just temporarily?

My husband and I are both introverted neat freaks and we happily had a roommate for our 2-bedroom 1-bathroom home for about 18 months.

Our first roommate posted to Craigslist needing a furnished place to crash Monday night-Friday morning while transitioning to a new job in our city. With his permission and an extra set of sheets, we still used the room for our occasional weekend guests.

Next we rented to medical school students on away rotation. They work all the time, barely cook or lounge around the house, clean the room themselves, sleep most of their off hours, and leave after a month. We still had tons of time to ourselves and felt more like landlords than roommates or hosts.

Sure, there were some slight inconveniences like timing showers, and more crumbs on the counter than we would have preferred, but we saved $8,315 in rent, which helped us pay off my student loan and build up an emergency fund in those 18 months. Minor sacrifice, major gain.

Nici you’ve done such a great job! First, know what what you’ve accomplished so far is impressive. If you do decide to change careers to make more money, remember that it doesn’t have to be permanent. You can work in the corporate world for a few years while you pay off debt and buildup massive savings. Your frugal habits will serve you well here. Then after you’ve reached your financial goals, you can go back to journalism and the work that you love, and then it will be ok if you just make enough money to pay the bills.

A few years ago I had a career I loved working in the arts. But it was barely paying the bills. So I started applying for office jobs, got one, and after a couple years was making almost 3X what I had in my pre-corporate life. The work is not as fulfilling or interesting, but 5 years in I’m debt free and almost at “coast FI”, with a year’s worth of emergency savings.

You can do it too! It’s ok if different phases in your life take you towards your different goals. Good luck!

I didn’t read all the comments, but didn’t see this mentioned in the first 10 or so… probably not what Nici wants, but what about getting a two-bedroom apartment with a roommate? More than likely, the additional cost of the extra room, divided by two, is going to be significantly less than she’s paying as a single person in a one-bedroom. This could be a strategy for the foreseeable future until she pays off more of the loan, gets a different car, etc. Over the next few years, she could be figuring out if she wants to jump ship, or stick it out and what that’ll look like. Just a thought…

Hi Nici! Thank you for sharing your story with us. First in response to your questions, do you think you could swing living car-free if you had to? I wonder if one compromise might be to reduce your reliance on the Mustang so it becomes a hobby/pleasure car instead of your daily driver while you go about your business by foot, bike, or public transport. I wasn’t emotionally attached to my car as much as I was to not having a car payment. Mixing it up with public transport allowed me to stretch its life out a bit longer. In your experience to date, how much has your rent increased per year? For long-term planning purposes, I’d pick annual percentage increase between 1 and 3% to build out a hypothetical retirement budget between now and your estimated retirement age. Keep in mind that any retirement calculator should also account for inflation.

As for where you’d like to be 10 years from now, how likely is it that you will have the same job (or one like it) for the next 20 years? If the choice isn’t entirely yours, what else have you thought about doing for income? What are the aspects of your job that you value most, that you’d like to see show up in anything else you might pursue? My suggestion would be to develop a back-up plan that privileges what you most value about your current profession. Over time, plan B might start to look shinier than your current path. Even if it never does, it’ll help alleviate anxiety about the risks involved with staying the course. Best of luck to you!

On second thought, maybe 1-3% is too optimistic. My rental history ranged from a landlord who didn’t increase my rent at all over the time I was there to another who increased it by $400 from one year to the next. (He argued the move-in special had expired) Maybe your market is more or less predictable?

Good thoughts here, so thank you. I’ll have to do the math on historic rent increases. Last year it was $110/month because they “upgraded” the complex, but the year before it was a much more reasonable $20/month.

I don’t think being without a car is too feasible. I don’t work the day shift, so public transit can get sketchy and surge pricing can hit Uber/Lyft. If I move within biking distance of work, rent doubles.

Nici, you really need to increase your income. You are earning about half of what you actually need. Your budgeting for current needs is outstanding,really. I have no issues with driving an older car, until it breaks too much or needs such a major repair that it’s unrealistic to repair. I drive my cars until they reach 250,000 miles or so. However, it is impossible to plan for the future unless you can earn more and save/invest more. I was part of the FIRE movement before it had a name and became a thing. I started my own IRA at age 25, 401k did not exist yet. Maxed out contributions every year. Started 401k contributions as soon as available, 8% with 2% match. Whenever I received a wage increase, I increased my 401k contribution, while continuing my IRA contribution, then Roth IRA contribution, then added taxable investments because tax deferred was maxed out. At the midpoint of my career, I was saving & investing about half of my income. The reason I mention this, is because it is impossible for you to do unless you double your income. There is no fat in your budget to save more unless your life is no fun except work, and even then you simply cannot save enough. I could have retired at age 50, at what was my crossover point. I could have stopped saving for the future at age 60, because the annual growth from compounding made my annual contributions fairly insignificant in the big picture. I kept working because I enjoyed my work. I eventually decided to retire at age 64, because there was somewhat of a culture shift at work and it became less fun; and financially it made no sense at all to keep working. I totally get that you love your work. However, I have learned that there is no such thing as a job that is worthy of love. It is good to enjoy and be satisfied with work. But love your job? At some point you may become brokenhearted.

Kudos on a job you love and creatively living frugally. Others mentioned job upgrades. One friend of mine does cat sitting and augments her income with minimal effort. She visits cats in their homes, feeds them, plays with them, changes the litter boxes etc. This can be an easy side job with no conflicts of interest.

Also, local libraries have amazing resources for online movies, books and entertainment that are a boon to anyone on a budget.

Can’t let my Mustang enthusiastic husband find out I’m saying this since I veto every suggestion to buy one (He’s owned several.), but here goes. Keep the car. You’ve just repaired so many things that you should be good for a while to come. A well loved Mustang holds its value so your eventual resale value should be decent. I would cut your other discretionary spending and split it to your emergency savings and a new to you car fund. Shop your car insurance around at quality insurers. During the current shut downs the Mustang may be your transportation and entertainment too. If you can find another source of income that your employer approves that would be wonderful. Best of luck getting on with the Times.

I don’t really have anything to add. Nici – you’re amazing.

Just one thought. I paid a serious amount of cash to have my doctoral dissertation professionally edited – like over $1,000 (worth every penny as far as I was concerned BTW). Perhaps that a side hustle you could do?

I found it interesting that the ethical requirements of your job essentially prohibit you from making a living wage, which is blatantly unethical.

I think it’s sad that people today think journalists aren’t ethical and that ethics guidelines are “unethical.” This is not true at all. There are many things they can do, they just can’t compete with their employer.

Also, again, Nici: Would you rather enjoy the best years of your life or earn more so you can feel comfortable at 65? I totally think you are doing well, now, and I understand some of these comments on building safety net, etc.

But how would you value the opportunities journalists have, like interviewing former presidents, seeing inside mansions, sometimes travel etc., versus becoming, say, a nurse (something you probably have no interest in) so you can feel secure at 60. Obviously the career you’re actually in has value beyond nickels and dimes.

Wondering if your company would allow you to do freelance travel stories (when travel again available). I’ve written travel pieces for my employer and boy is it nice to get paid for a free trip!

Yes, Rory! The things I’ve been able to do and people I’ve met through this job cannot be measured in dollars. We don’t cover travel, so I’ll ask HR about restrictions on that. I don’t think I’d be allowed to take FAM trips (where Hilton hotels, for example, pays) because of possible conflicts, but being paid by a publication would possibly be approved.

And for everyone lamenting my lack of emergency funds and thinking I’ll rack up credit card debt (or be on the streets) if I lose my job, I have no reason to stay in my current city if I lose my job so I’d immediately break my lease and move in with my parents (who have pensions and a paid off house).

Hi Nici,