Laura and her husband Ethan are from Philadelphia, PA, but have been living in Hanoi, Vietnam for the past two years. Ethan teaches English literature at an international school and Laura is earning her Master’s degree in public health. They’ve loved their time in Vietnam and plan to be there for at least another year, but are less certain of their plans after that.

Ultimately, they know they want to return to the US in order to be closer to their families, have children and buy a home. Laura is concerned they’re falling behind on retirement and won’t be able to afford a house once they move back stateside. Join me today as we help these ex-pats chart a stable future!

What’s a Reader Case Study?

Case Studies address financial and life dilemmas that readers of Frugalwoods send in requesting advice. Then, we (that’d be me and YOU, dear reader) read through their situation and provide advice, encouragement, insight and feedback in the comments section.

For an example, check out the last case study. Case Studies are updated by participants (at the end of the post) several months after the Case is featured. Visit this page for links to all updated Case Studies.

Can I Be A Reader Case Study?

There are four options for folks interested in receiving a holistic Frugalwoods financial consultation:

- Apply to be an on-the-blog Case Study subject here.

- Hire me for a private financial consultation here.

- Schedule an hourlong call with me here.

→Not sure which option is right for you? Schedule a free 15-minute chat with me to learn more. Refer a friend to me here.

Please note that space is limited for all of the above and most especially for on-the-blog Case Studies. I do my best to accommodate everyone who applies, but there are a limited number of slots available each month.

The Goal Of Reader Case Studies

Reader Case Studies highlight a diverse range of financial situations, ages, ethnicities, locations, goals, careers, incomes, family compositions and more!

The Case Study series began in 2016 and, to date, there’ve been 101 Case Studies. I’ve featured folks with annual incomes ranging from $17k to $200k+ and net worths ranging from -$300k to $2.9M+.

I’ve featured single, married, partnered, divorced, child-filled and child-free households. I’ve featured gay, straight, queer, bisexual and polyamorous people. I’ve featured women, non-binary folks and men. I’ve featured transgender and cisgender people. I’ve had cat people and dog people. I’ve featured folks from the US, Australia, Canada, England, South Africa, Spain, Finland, the Netherlands, Germany and France. I’ve featured people with PhDs and people with high school diplomas. I’ve featured people in their early 20’s and people in their late 60’s. I’ve featured folks who live on farms and folks who live in New York City.

Reader Case Study Guidelines

I probably don’t need to say the following because you all are the kindest, most polite commenters on the internet, but please note that Frugalwoods is a judgement-free zone where we endeavor to help one another, not condemn.

There’s no room for rudeness here. The goal is to create a supportive environment where we all acknowledge we’re human, we’re flawed, but we choose to be here together, workshopping our money and our lives with positive, proactive suggestions and ideas.

And a disclaimer that I am not a trained financial professional and I encourage people not to make serious financial decisions based solely on what one person on the internet advises.

I encourage everyone to do their own research to determine the best course of action for their finances. I am not a financial advisor and I am not your financial advisor.

With that I’ll let Laura, today’s Case Study subject, take it from here!

Laura’s Story

Hi Frugalwoods! My name is Laura and I’m 32 years old. My husband Ethan (38) and I are both from Philadelphia, PA but we have lived in Hanoi, Vietnam for just about 2 years now. We don’t currently have any kids or pets but would like a few of both in the near future :).

We moved to Hanoi for Ethan’s job as an English literature teacher at an international school. Before moving here I worked at a non-profit in Philadelphia for 7 years where I worked my way up from answering phones in the call center to software engineer, after my company paid for me to go to coding bootcamp. Learning to code was an awesome opportunity and I liked it in the context of the organization’s mission but it ultimately is not what I want to do with my life. I am currently in graduate school full-time pursuing a Masters in Public Health in Maternal and Child Health and a Certificate in Global Health. I have a Bachelors in Public Health and it feels great to get back into something I’ve always been passionate about. School is great, but I am eager to get back into the workforce in a role I love!

Laura and Ethan’s Hobbies

Ethan and I have a number of hobbies we enjoy independently and together. I learned to knit during the pandemic and got a bit obsessed. I love spending an afternoon watching knitting “podcasts” on Youtube and knitting sweaters and hats for myself and family. I’m an avid reader and I love to go for long walks, do yoga and dance. Ethan is also a big reader, a runner, and a newly obsessed rock climber. Before we moved to Hanoi, Ethan was section hiking the Appalachian Trail every summer break from teaching and we would regularly go camping. We love to travel, which was a big draw for moving to Southeast Asia. In the last year we’ve: spent a month in Indonesia, met my mom and aunt in South Korea, rock climbed at the beach in Thailand, feasted on sushi in Japan, and traveled Vietnam from top to bottom.

While I feel like we are doing pretty well financially, we’ve had an intense 5 years since we starting dating. Within the first four months of meeting Ethan, he made his final student loan payment on $80k of debt. I have always been frugal, but I was more of a squirrel hoarding away savings, avoiding my debt. He inspired me to attack my student loans and, within 11 months, I paid off nearly $60k of debt. Last year Ethan got an accelerated Masters in Education, which was necessary for him to maintain his teaching certification. Between choosing a cost effective option and some professional development funding through work, he only paid $4k out of pocket. I am paying out of pocket for my MPH, which after scholarships will run me about $17k over two years. I’m proud of these accomplishments but it’s felt like a lot of money going out for a long stretch.

We are EXTREMELY debt averse as a result of paying off tens of thousands of dollars in student loans. We aren’t sure exactly when we want to move back to the States but we do know that we’d like to buy a house when that day comes. We are terrified of taking out a mortgage, especially with the high current interest rates.

What feels most pressing right now? What brings you to submit a Case Study?

We haven’t had a good stretch of us both working good jobs while not either paying off debt or paying for graduate school. While Ethan feels good about our finances, I have a lot of anxiety about money, which I think is due to:

- Not currently working

- The money stress I’ve inherited from my parents

I think once I’m done with grad school and we are both working and can maximize saving I’ll start to feel better.

I’m also worried about the transition to moving back home in a few years. We currently have extremely low expenses and the thought of having to pay a mortgage, buy a car or two, everything being more expensive, etc etc is really stressful. I want to think about ways to soften that blow and make the transition less jarring.

I’m concerned that we haven’t contributed to retirement in nearly two years. I’m confused about if we are actually allowed to contribute to the Roth IRAs we already have. Right now we have a good amount of cash saved that is earmarked for a house. I would love to explore with you, Mrs. Frugalwoods, if it ever would make sense to keep piling up cash to pay for a house outright or if we are being foolish here.

What’s the best part of your current lifestyle/routine?

Life in Vietnam is easy! Ethan is well-compensated given the cost of living here and his expat package includes rent and flights home for both of us every summer. Teachers are well-respected in Vietnam and the job is generally less stressful than it was back in Philly. He gets lots of long breaks from school which we have used to travel internationally and explore all over Vietnam.

We have both been able to invest in our hobbies in ways that we never would have previously. I have a gym membership so I can go to dance and yoga classes 4-5 times weekly; I have a basket of lovely yarn to knit sweaters and hats and socks. Ethan has an unlimited rock climbing gym membership and climbs with friends 3 nights a week. We can enjoy exploring our city and feasting on the insane Vietnamese cuisine — a bowl of pho is 75 cents, our favorite vegetarian stall is $2 for a giant plate of food, bowl of soup and green tea. We rarely went out to eat at home so this feels like such a treat.

I had a job in Hanoi from October 2021-January 2023, but quit to focus on school full-time. It feels like we have an incredible amount of freedom to make decisions like that, which was never an option before. While I still have a lot of anxiety about the future, I really do feel less stressed about money than I ever have.

What’s the worst part of your current lifestyle/routine?

It is hard to be so far away from home. This year we will visit the states for the first time in two years. I missed my niece’s birth in January as well as four good friends becoming first-time parents in the past year. My parents are getting older and I have a lot of guilt about not being close by. Hanoi can also be really challenging — the air pollution in the winter gets really bad, traffic is insane, and the temperature is too hot to go outside for months at a time.

I feel like we are generally responsible with money, but we don’t have a plan mapped out for the future. As a planner, this makes me nervous/feel out of control! I really hate not having an income of my own, but I’m so grateful to be able to focus solely on school right now.

It’s hard to make a plan when there are so many unknown variables:

- Where are we going to live after the 2023-2024 school year? Will we stay in Hanoi? Will we move to a new country?

- What job will I get and how much will I make?

- How much money do we need for a house? Does it make sense to keep saving cash to buy a house outright?

- How can expats contribute to retirement? How far behind are we?

Where Laura and Ethan Want to be in Ten Years:

Finances:

- I’d like to have a paid off house in the states, preferably near mountains/hiking

- I’d like to have a combined $500k in savings (between cash and retirement)

- I want to feel financially comfortable and not beholden to 9-5 jobs

Lifestyle:

- I’d like to have 2 kids plus dogs and cats running around

- I’d like to be able to spend lots of time with my family outdoors hiking, camping, gardening, rock climbing

- I’d like to still be investing time and money in my hobbies and creative pursuits

Career:

- I want to have worked in a global health role abroad for a few years and then find a hybrid role in the states that allows me to live where I want and visit the office occasionally — a dream is to move to Staunton, VA and find a job in DC that only requires 1-2 visits to the office monthly. I have no idea if this is realistic.

- Ethan would like to still be teaching at a school that gives him the same autonomy in his classroom he has enjoyed in Hanoi.

- He also has dreams of owning a bike shop one day, but I think that’s more like 15 years away.

Laura and Ethan’s Finances

Income

| Item | Number of paychecks per year | Gross Income Per Pay Period | Deductions Per Pay Period | Net Income Per Pay Period |

| Ethan’s salary from teaching job | 12 | $5,514 | Taxes: 2133 (ouch!) Health insurance: 391 | $2,990 |

| Laura’s contract work* | 2 | $4,137 | Untaxed | $4,137 |

| Annual gross total: | $74,442 | Annual net total: | $44,154 |

*This is what I earned this year for this job but I am no longer receiving this income. This was a contract that was paid incrementally, so this was not the figure I received monthly, just FYI

Debts: $0

Assets

| Item | Amount | Notes | Interest/type of securities held/Stock ticker | Name of bank/brokerage | Expense Ratio (applies to investment accounts) | Account Type |

| Ethan High Interest Savings | $76,500 | We view this as house savings. | 3.90% | Marcus – Goldman Sachs | Cash | |

| Laura 401k | $51,867 | 401k through previous employer. | Vanguard Target Retirement 2055 | Voya | Retirement | |

| Ethan PSERS | $20,692 | PA Teachers pension | We couldn’t figure this one out | Retirement | ||

| Laura Brokerage | $18,783 | This is my taxable investment account, which I opened (prematurely) several years ago. I consider this house savings. | It says I have 13 different securities: FDIC, MUB, SUB, VB, VBR, VEA, VNQ, VNQI, VO, VOE, VTI, VTV, VWO but I have no idea what this means!! | Ellevest | Investments | |

| Ethan 403b | $17,362 | Retirement through previous | Vanguard Target Retirement 2050 | PenServ | Retirement | |

| Ethan 403b | $14,764 | Retirement through previous | We couldn’t figure this one out | Alerus | Retirement | |

| Laura High Interest Savings | $10,165 | Back up money for grad school tuition and house savings. | 3.90% | Marcus – Goldman Sachs | Cash | |

| Ethan and Laura Vietnamese Checking | $9,477 | We plan to run this empty, as spending the VND earned here is the cheapest way to spend money here | 0% | Standard Chartered | Cash | |

| Ethan IRA | $5,544 | Vanguard | Retirement | |||

| Laura Checking | $5,228 | 0% | TD | Cash | ||

| Ethan Checking | $3,000 | 0% | TD | Cash | ||

| Laura Roth IRA | $2,326 | Same as brokerage acct. | Ellevest | Retirement | ||

| Total: | $235,708 |

Vehicles

Expenses

| Item | Amount | Notes |

| Tuition | $700 | I got a department scholarship and hoping to get more! |

| Groceries | $250 | Includes all food, alcohol/beer, household and personal supplies (such as toilet paper, shampoo, etc) |

| Travel (flights, hotels, taxis, meals out) | $250 | We travel a lot, it is part of the joy and opportunity of living here. International flights are cheap and comfortable accommodation is usually $25-40/night. We are reimbursed for the cost of two round trip tickets to the States every summer (whether we buy the tickets or not). |

| Restaurants, cafes, bars | $150 | We regularly go out to eat but prioritize eating local food (like pho and vegetarian buffet which cost as little as 75 cents) rather than expensive Western restaurants. We love to spend a weekend afternoon at a coffee shop which is a huge part of Vietnamese culture. |

| Transportation | $60 | Motorbike rental, gas for motorbike, occasional taxi |

| Electric | $50 | On average. We don’t ever run the heat even though it DOES get cold in the north and we minimize AC usage as much as possible |

| Gym | $50 | We paid for our gym memberships upfront. Laura paid $400 for 2 years and goes to classes nearly daily. Ethan paid $400 for a year at a bouldering gym |

| Clothes, shoes | $45 | We buy good running shoes once a year and don’t cheap out on these. We don’t often buy new clothes but things pop up a few times a year. |

| Drinking water | $30 | Tap water is unsafe here so we currently buy 20 liter jugs a few times a week |

| Gifts | $30 | We aren’t big gift givers – we view our frequent trips as gifts for birthdays, anniversaries, etc – but have had close 5(!) friends and family have children this past year and send small gifts for immediate family birthdays |

| Netflix | $22 | I’d like to cancel this because we don’t really use it but I pay for my family’s account |

| Charitable donations | $20 | I use the Libby app with my Kindle. It feels good to make a donation to my library back in Philly every month. Would love to do more. |

| Knitting supplies | $15 | This is an estimate. I got really into knitting during the pandemic and spent $187 on needles, yarn, patterns last year. I have enough yarn and unfinished projects to last me the whole year and then some so it’s likely this will be much less. |

| Spotify | $14 | |

| Cell phones | $10 | $60/year each gets us unlimited data but no minutes or SMS which is fine because we just use WhatsApp and never make calls |

| Massages, haircuts | $10 | Massages are ~$12/hr and we go a couple times a year. Ethan gets a $15 haircut 2x/year. I have been giving myself little trims at home since we’ve lived in VN. |

| Misc (books, etc) | $10 | We use the Libby app with our Kindles but occasionally order through Thriftbooks for things unavailable at the library. |

| Dentist | $8 | We each get teeth cleanings 2x/year (very inexpensive but high quality here – $15 each out of pocket without any insurance!). I had two fillings in January ($40) and hoping to not need any additional work done in the near future |

| Shrole | $6 | Site for international school job postings |

| Air and shower purifier filters | $5 | Air pollution gets really bad here during winter months so air purifiers are essential. The water is heavily chlorinated and getting a filter has been immensely helpful for skin and hair issues! We change both every 6 months or so. |

| The Atlantic | $3 | |

| VPN | $2 | $56/26 months. Finally bit the bullet this year because we couldn’t access some banking sites from abroad |

| The New York Times | $1 | Got a deal on a new subscription for this year, will go up next year or we may cancel |

| Rent | $0 | Ethan’s school pays our rent directly to the landlord |

| Monthly subtotal: | $1,741 | |

| Annual total: | $20,892 |

Credit Card Strategy

| Card Name | Rewards Type? | Bank/card company |

| Ethan – Blue Cash Everyday | 3% cash back | American Express |

| Laura – Citi Double Cash card | 2% cash back | Citi |

| Joint – Venture One Rewards* | 1.25 miles per dollar spent | Capital One |

| Laura – Chase Freedom Unlimited | 1.5% cash back; 5% on travel | Chase |

*I got this one when we moved here because it doesn’t charge foreign transaction fees. I don’t like having this many credit cards. We barely use them since we pay for most things with cash from our Vietnamese checking account.

Laura’s Questions for You:

-

Eating our way around Seoul Can you help us think through saving for a house?

- We aren’t even sure when exactly we would do this, but it feels like the next big thing to save for.

- Given how much cash we have currently and that we wouldn’t buy a house valued at more than ~$300k, should we continue saving? Is the idea of paying for a house in cash terrible?!

- Are expats allowed to contribute to retirement?

- How far behind are we on retirement?

- Our income and expenses are likely to change after next summer when I no longer have to pay for grad school and start making an income again.

- What should we do with this extra money? Retirement? Cash savings?

- Should we start a separate savings earmarked for ‘moving home’?

- How can I feel less anxious about the future?

- I’d love to get to a place where I’m comfortable with what’s coming in and knowing that we are automated to meet our goals for the future.

Liz Frugalwoods’ Recommendations

I’m thrilled to have Laura and Ethan as our Case Study subjects today! They bring an interesting twist with their work abroad and desire to one day move back to their home country. I love that they’re taking the time now to map out their financial moves for the next few years. Even if things don’t go perfectly to plan, it’s usually best to start with a plan! Let’s dive into Laura’s questions:

Laura’s Question #1: Can you help us think through saving for a house?

Laura and Ethan already have a hefty amount–$76,500–saved up for a house, which is fabulous! My concern here is their stated desire to pay cash for a house. Laura asked:

Is the idea of paying for a house in cash terrible?!

The answer is that it depends. If you are ridiculously wealthy–as in, a billionaire or multi-multi-multi-millionaire–then it doesn’t really matter. Pay cash, don’t pay cash–either way, you still have a ton of money. On the other hand, if you are in the category of most of us–as in, you have some money, but it’s not endless–it very rarely makes sense to pay cash for a house. There are a number of reasons for this, so let’s explore them all!

Why You Probably Shouldn’t Pay Cash For a House (or pay off your mortgage early)

1) It’s a massive opportunity cost.

When you buy a house in cash (or pay off a mortgage early), you’re missing out on the potential investment returns you’d enjoy if your money was instead invested in the stock market or a rental property.

The deal with this is that a paid-off house returns the rate of your mortgage interest rate (or the interest rate you would’ve gotten on a mortgage).

For example: if your mortgage interest rate is fixed at 3.75% and you pay if off, you’re getting a 3.75% rate of return, which is pretty low. By comparison, historical stock market trends demonstrate that–over many decades of investing–the market delivers somewhere in the range of 7% annually. That does not mean 7% every year, but rather, a 7% average over the lifetime of an investor. Since 7% is a higher return than 3.75%, you’d be better off–in this hypothetical–with carrying a mortgage and instead investing your extra cash in the stock market.

→Where this logic doesn’t hold up as well is when mortgage interest rates are high.

However, even in the case of higher mortgage interest rates, it still usually makes sense to carry a mortgage because of the opportunity cost of that cash sitting around earning nothing for all the years it took you to save it up. Most of us don’t wake up one day with $300k in our bank account. Instead, we’d have to spend many years–potentially decades–saving up that much cash. During that time, we’d be consistently exposing ourselves to the opportunity cost of not having that cash invested.

The reason to not save enough cash to buy a house outright mirrors the reasons why we don’t save only cash for retirement:

- Cash does not keep up with inflation (every day, your cash is worth less than the day before)

- When you spend your cash, it is gone (versus drawing down a sustainable percentage of an overall investment portfolio)

- Cash does not have the potential to appreciate (beyond the interest rate you earn on your savings account)

2) Saving this much cash might limit your retirement contributions.

Since you’re only permitted to put a certain dollar amount into tax-advantaged retirement accounts every year, if you’re instead putting that money towards cash savings, you’re shooting yourself in the foot twice:

- You’re missing out on the tax advantages conferred by retirement accounts

- You’re missing out on the potential growth of those retirement accounts (opportunity cost)

If you have the financial ability to do so, you want to max out all of your tax-advantaged retirement accounts annually. Again, there’s an annual cap on how much you can funnel into tax-advantaged retirement accounts, which is why it’s important to do so every year.

3) A paid-off house is an illiquid asset.

This is another salient concern because you can’t use a paid-off house to buy groceries or fix your car or pay for health insurance if you lose your a job. Yes, you might be able to get a Home Equity Line Of Credit (HELOC), but that’s not a guarantee and certainly not very likely if you’ve lost your job.

Tying up ALL of your excess cash in a paid-off house is a dangerous proposition. Sure, you could sell the house, but then you’ll need to pay for somewhere else to live.

4) Before buying a house in cash (or paying off a mortgage early), you need to have all of the following:

- A robust emergency fund of, at minimum, three to six months’ worth of your living expenses, held in an easily accessible checking or savings account.

- No high interest rate debt.

- Retirement investments (i.e. a 401k, 403b, IRA, Roth IRA, etc) that are fully funded as appropriate for your age, goals and anticipated retirement date.

I would further argue that you should also have at least one other form of investment (in addition to your retirement), such as:

- A taxable investment account of diversified total market, low-fee index funds, both domestic and international (aka stocks)

- 529 College Savings accounts for your kids

- Optional: an income-generating rental property

You certainly don’t need to have this entire second list of items lined up, but you should absolutely have the first three on lockdown.

5) A mortgage is a nice hedge against inflation.

Inflation is when money becomes less valuable. The good thing about a mortgage is that it’s denominated in the dollars you originally paid for the house. Thus over time as inflation increases, which generally happens, the money you’re using to pay off your mortgage becomes “cheaper.” This is another way in which a mortgage can really work to your financial advantage.

Summary:

Unless you have unlimited funds (in which case you’re likely not reading this… ), paying cash for a house (or paying off a mortgage early) is typically an emotional decision, not a financial one.

Laura’s Question #2: Are expats allowed to contribute to retirement?

This answer depends entirely upon Laura and Ethan’s tax situation. According to H&R Block:

In order to contribute to an IRA while living abroad, you need to have income leftover after deductions and exclusions. If you exclude all of your income with the FEIE and have no other sources of earned income, you are not eligible to contribute to an IRA. However, if you only exclude part of your income or claim the foreign tax credit (FTC) instead, you may still be able to contribute to an IRA.

To put this more simply, Laura and Ethan need to have enough earned income leftover after claiming the foreign earned income exclusion (and any other exemptions, such as the foreign housing exclusion). Since we don’t have Laura & Ethan’s tax returns, we can’t precisely answer this question, but I hope this helps point them in the right direction. If they’re using an accountant to prepare their taxes, this is a great question to ask them.

→The other thing to note is that Laura needs to have earned income in order to be eligible to contribute to an IRA. Since she doesn’t have earned income right now, she can look into opening a spousal IRA.

Here’s the IRS documentation on this (control F for “Contributions to Individual Retirement Arrangements”).

Laura’s Question #3: How far behind are we on retirement?

Let’s take a look at what they currently have in their retirement investments:

| Item | Amount | Notes |

| Laura 401k | $51,867 | Retirement account through previous employer. |

| Ethan PSERS | $20,692 | PA Teachers pension |

| Ethan 403b | $17,362 | Retirement account through previous employer. |

| Ethan 403b | $14,764 | Retirement account through previous employer. |

| Ethan IRA | $5,544 | |

| Laura Roth IRA | $2,326 | |

| Total: | $112,555 |

While this total technically puts them behind on retirement given their ages, it also doesn’t accurately account for the three mega wildcards here:

- Ethan’s pension

- Their anticipated Social Security

- Their future jobs and potential future employer-sponsored retirement plans

As we’ve discussed in previous Case Studies, pensions are a wild card. In some cases, a pension means you’re set for life once you retire. In other cases… not so much. Laura noted that they weren’t able to figure out Ethan’s pension, but they need to. There is someone whose job it is to explain the PA pension system to teachers and they need to call that person. I can’t answer this for them since I don’t know the dates of Ethan’s service or his job title, but, this is a worthy rabbit hole for them to go down. I’d start with the PSERS website and/or the teacher’s union rep.

→Another a major factor is whether or not Ethan plans to go back into public school teaching once they’re stateside.

If so, he’ll likely be eligible for another pension system and he’ll want to ensure he understands the ramifications of fully qualifying for that pension. Note that in some cases, receiving a public employee pension disqualifies you from receiving Social Security. Furthermore, if Ethan teaches in a public school under the same PSERS pension plan, he’ll want to spend some quality time with HR and/or his union rep to ensure he’s able to apply his previous years of service.

From their above list of retirement accounts, it looks like Laura and Ethan did a terrific job of contributing to retirement through their previous employers. In light of that, they should continue that habit once they’re stateside. They can also resume their IRA/Roth IRA contributions at that time.

Laura’s Question #4: Our income and expenses are likely to change after next summer when I no longer have to pay for grad school and start making an income again. What should we do with this extra money? Retirement? Cash savings? Should we start a separate savings earmarked for ‘moving home’?

I love that Laura’s planning so far ahead! However, I think this answer will depend on where they are in their process of moving back to the states.

Retirement:

If they determine that their tax situation makes them eligible to contribute to their Roth IRA and IRA, they should absolutely go ahead and max those out. Note again that Laura would need to either have earned income or open a spousal IRA.

Additionally, if their future US jobs offer employer-sponsored retirement accounts, they can max those out.

Cash Savings:

Laura and Ethan are already overbalanced on cash, as we can see below:

| Item | Amount | Notes |

| Ethan High Interest Savings | $76,500 | We view this as house savings. |

| Laura High Interest Savings | $10,165 | Back up money for grad school tuition and house savings. |

| Ethan and Laura Vietnamese Checking | $9,477 | We plan to run this empty, as spending the VND earned here is the cheapest way to spend money here |

| Laura Checking | $5,228 | |

| Ethan Checking | $3,000 | |

| TOTAL: | $104,370 |

In light of that, I’m hesitant to recommend they stash even more money in cash, for all the reasons I outlined above related to opportunity costs.

I do, however, fully support their current cash stash since it represents:

- A house downpayment

- Buffer for grad school tuition payments

- Their emergency fund

- Vietnamese currency they intend to spend down

- Moving-back-home money

→Now I’m going to disagree with myself: despite the opportunity costs of cash, it’s also true that Laura and Ethan are in flux right now.

They’re not certain where they’ll be living in a few years, how much a house will cost, when they’ll have kids, how quickly they’ll find new jobs, what their moving costs will be and what their expenses will be back in America. That’s a lot of unknown variables! And the best thing to have when there are a bunch of unknowns is extra cash. I do want to caution them, though, that cash is not a longterm investment strategy. Nor is it the place to keep large chunks of money for long periods of time.

If it were me, I’d keep all of this current cash on hand and wait and see how plans shake out. Another option for them to consider are medium-term investment options, such as CDs, Money Market Accounts, etc. However, they’re already in a high-yield savings account, which is the most flexible way to leverage your cash.

If Laura and Ethan know they won’t be using their house downpayment for the next year or so, they could certainly see if there’s a 12-month CD offering a higher rate of return than their high-yield savings account. That would be one way to essentially keep their cash, but also have it earn more. A CD locks your money up for a specified period of time and then delivers you a specified return when you cash it out. It’s not a great long-term investment vehicle–since the returns typically lag behind the stock market–but it can be great for short-term goals.

Laura’s Question #5: How can I feel less anxious about the future? I’d love to get to a place where I’m comfortable with what’s coming in and knowing that we are automated to meet our goals for the future.

I personally don’t see anything in their financial situation to be particularly anxious about. Their expenses are low and they clearly have good financial habits ingrained. I get the sense that Laura’s anxiety might be more about the many unknown variables in their life right now. I also don’t know that she’ll be able to “automate” things until they’ve moved back to the states and ironed out where they’ll live and work. It’s really too many variables to control for at this point, but I want to emphasize again that they’re doing a great job! The key will be for them to retain their excellent money habits once they return to the US and experience a dramatically higher cost of living.

In many way, they are in a holding pattern while living in Vietnam. But that’s not necessarily a bad thing! Saving up more money is always a good choice. When and how to deploy that money will become clear as these other lifestyle factors fall into place. I realize that this is easy for me to say since I’m not living it, but, from an outsider’s perspective, Laura and Ethan are doing great!

Research Your Investment Accounts

One final piece of advice for Laura and Ethan is to look into their investment accounts. While it’s fantastic that they have retirement investments as well as a taxable investment account, they didn’t provide much detail on what those accounts are invested in. This is the “devil in the details” of investing. The first important step is to open these accounts and put money into them. The next most important step is to make sure you’re investing in a way that fits your priorities and limits the fees you pay.

Rollover the Old 401ks and 403bs

Since they have a number of accounts from previous employers, I encourage them to look into rolling over these accounts–the old 401ks and 403bs–into IRAs. The reason to do this is so that you can control what you’re invested in. When you have a retirement account through a current employer, you can only choose investments that are offered by your company’s plan. In some cases, that’s totally fine and you have great options to choose from. In other cases, you’re locked into funds with high fees and/or poor performance. Despite that, it still makes sense to max out employer-sponsored accounts. But, once you leave that employer, you’re free to roll that account over into an IRA that falls fully under your jurisdiction.

Roll into a Roth IRA or a Regular IRA? If your 401ks/403bs were set up as Roths, you can roll them into a Roth IRA. If they’re not set up as Roths, you can roll them into a traditional IRA. You typically do not ever want to roll from a regular to a Roth as you’d then have to pay allllll the taxes in that calendar year. Not good!

Here’s how to execute a rollover:

- Call the brokerage (or do it online) that currently holds your 401ks/403bs to ask about doing a “direct rollover” into a traditional IRA (either at that brokerage or a different one).

- You’re likely not going to want to roll them into Roth IRAs because you’d then have to pay taxes on the full amount all in this calendar year (assuming these accounts aren’t Roth). If they are Roths, they can only be rolled into a Roth.

- Your new brokerage will want to know what you want to invest your rolled over IRAs in.

Here’s an article explaining rollovers: Your Guide to 401(k) and IRA Rollovers.

What to Invest In?

Now that we know the vehicle Laura and Ethan will be utilizing–either a Roth or traditional IRA–what should they invest them in? I can’t tell them specifically what to invest in, but I can tell them the broad strokes that I follow with my investments.

If it were me, I would put everything into one total market, low-fee index fund that matched my asset allocation needs and risk tolerance. The reason for this is that, in general, investing in a total market index fund gives you the broadest possible exposure to the stock market (as well as the lowest fees).

In a total market index fund, you’re essentially invested in a teensy bit of every single company in the stock market, which gives you a ton of diversity. If one company–or even one sector–tanks, your entire portfolio isn’t toast. It’s the “not putting all of your eggs in one basket” version of investing.

Know Your Risk Tolerance

Another key factor in investing is understanding your personal risk tolerance. Investing in the stock market is inherently risky. In light of that, Laura and Ethan have to determine how risky they want to be with their investments. A good way to mitigate risk is through diversification, which is why many folks have both stocks and bonds in their investment portfolio.

Find Your Expense Ratios

Something missing from Laura and Ethan’s list of assets are the expense ratios on their investment accounts. This is a critical bit of data they should look into for the retirement accounts and their taxable investment account. Expense ratios are the percentage you pay to the brokerage for investing your money and, as they are fees, you want them to be as low as possible.

As Forbes explains:

An expense ratio is an annual fee charged to investors who own mutual funds and exchange-traded funds (ETFs). High expense ratios can drastically reduce your potential returns over the long term, making it imperative for long-term investors to select mutual funds and ETFs with reasonable expense ratios.

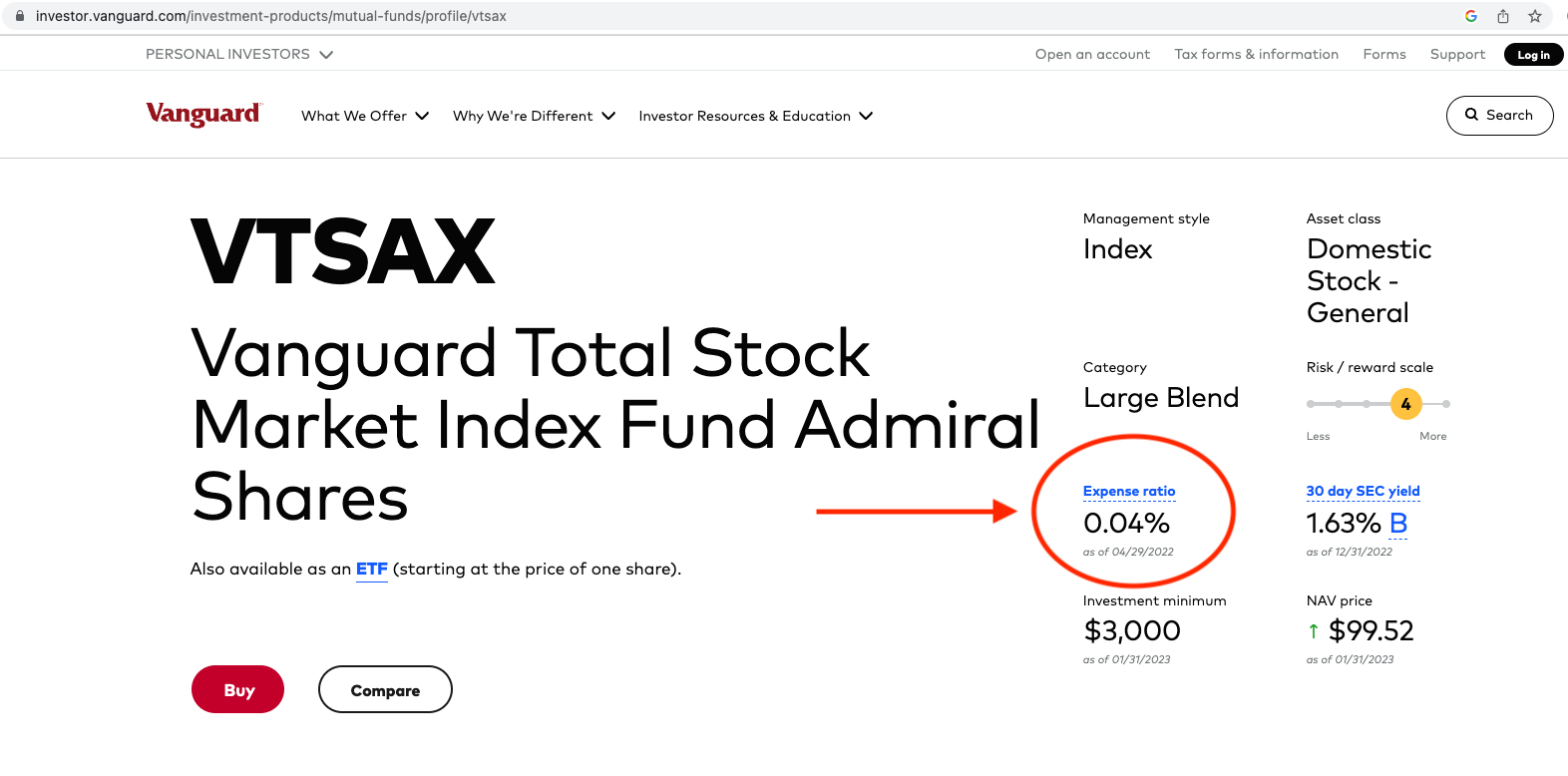

I’ll use Vanguard’s Total Market Index Fund (VTSAX) in a demonstration of how to find a fund’s expense ratio:

- Google the stock ticker (in this case I typed in “VTSAX”)

- Go to the fund overview page

- Look at the expense ratio

Screenshot below for reference:

To give Laura and Ethan a sense of whether or not their investments have reasonable expense ratios, the following three funds are considered to have low expense ratios:

- Fidelity’s Total Market Index Fund (FSKAX) has an expense ratio of 0.015%

- Charles Schwab’s Total Market Index Fund (SWTSX) has an expense ratio of 0.03%

- Vanguard’s Total Market Index Fund (VTSAX) has an expense ratio of 0.04%

They can also use this calculator from Bank Rate to determine what they will pay in fees over the lifetime of their investments, based on their expense ratios. If you find that your investments have high expense ratios, it is well worth your time to investigate moving them to lower-fee funds (or changing brokerages altogether).

Investing 101

I highly recommend the book, The Simple Path to Wealth: Your Road Map to Financial Independence And a Rich, Free Life, by: JL Collins, if you’d like to deepen your knowledge around investing. It’s well-written and easy to follow.

Summary:

- Familiarize yourselves with the drawbacks of paying cash for a house:

- Know that not all debt is bad. In some cases, leveraging debt is the most financially prudent move.

- Examine your tax situation to determine whether or not you have enough earned income to contribute to your IRA:

- Since Laura doesn’t have earned income right now, she can look into opening a spousal IRA

- Research Ethan’s pension:

- This could be a pivotal part of your retirement and it behooves you to know the parameters.

- Consider rolling over your old 401ks/403bs into IRAs:

- Research funds, read JL Collins’ book on investing and locate a brokerage that’ll offer you low-fee funds that match your desired asset allocation and risk tolerance

- Plan to max out your future US employer-sponsored retirement plans:

- If Ethan returns to public school teaching, ensure you understand the pension system

- Feel confident that you’ve made great financial decisions up to this point and that carrying those good habits forward will serve you well.

Ok Frugalwoods nation, what advice do you have for Laura? We’ll both reply to comments, so please feel free to ask questions!

Would you like your own Case Study to appear here on Frugalwoods? Apply to be an on-the-blog Case Study subject here. Hire me for a private financial consultation here. Schedule an hourlong or 30-minute call with me, refer a friend to me here, schedule a free 15-minute call to learn more or email me with questions (liz@frugalwoods.com).

Another thing to think about, re: kids, is the possibility of infertility and potential expenses involved with conceiving. I don’t want to add to any anxiety but it might be something to consider setting aside some cash for and if you don’t need it, then you can always invest it later. It seems to vary a lot from one insurance company to another what procedures are covered (anecdotal evidence only) and I know it can be expensive to undergo fertility treatment. This is something my husband and I have been dealing with for the past 3.5 years and while I personally have no interest in IVF I know a lot of people go that route, but that it can be pretty pricey. Laura and Ethan, I think you’re doing great overall and setting yourselves up well for the future!

Hi there! Thanks so much for reading and for the kind feedback. This is a great tip and I will definitely keep this in mind.

Agree. Infertility is 1 in 6 people now, and if you’re really set on 2 kids you may want to think about starting to conceive sooner than later! I regret not starting younger and all my worries about whether I was ‘ready’ or we were in the perfect place in our lives financially / house-wise / location-wise etc. proved to be so silly once I had one.

OMG – those baby sweaters are adorable :). So cute!

RE the budget for the new house. I think the $300k budget is great in theory, but, given the current housing market, it may be tough to find something less than that. I live in Orlando, which is not a particularly high cost-of-living area, and our local paper just reported that the median house price in the metro area was $378k!!! We bought our house for less than $300k in 2016, but now houses in our neighborhood are all going for more than $400k. It’s crazy!

Thanks so much! I’ve discovered baby knits are the most fun because 1) SO CUTE and 2) so quick!

Wow, that’s crazy re: housing prices in your area. I do think we will have to keep open minds and set expectations that literally everything is going to be more expensive than we think/hope it is.

Honestly, “everything is always more expensive and time-consuming than you think it’s going to be” is one of the life mottos that has proven very true/helpful in my life. Highly recommend everyone adopt this belief! 🙂

Laura and Ethan you guys are on the right track! Transitional times can be anxiety producing but they are also an opportunity to look deeply into next moves. What you can’t have is: guarantees. The unknowns are what everyone faces. You are both setting yourselves up for solid opportunities because you’ve gotten debt free and educated. You are both aware of how incredibly expensive it will be to live in the northeast of US–like quadruple what you are currently spending without necessarily earning that much more-though Laura it is clear you are really ready to get back into the working world in a career you love. While you’re still in Vietnam I would spend a lot more time digging into your understanding of investing (love the book Rec-Simple Path to Wealth) Being so Cash positive is not a bad thing given that you are near some big transitions. You’ve done some really important work here, getting out of debt, getting an education, focusing on what you love to do (you’re hobbies sound like so much fun!) Best of luck, keep learning and earning!

Another possible strategy to add on to the 401k to IRA conversion, is to maximize your low tax rate and transfer as much as you can at that rate. You have until April the following year to do the conversion, so once your taxes are figured out you can then go ahead and do the conversion. Guessing income and tax rate will only go up from.here, so it is nice to lock in the low one now.

This is a great point! We’ve been talking lately about getting going on rolling over our various accounts to IRAs and this is a smart strategy and good motivation.

That would only be for Roth conversions (sounds like you meant that?). Pretax transfer from 401K to pretax IRA would not be taxable. But moving funds into Roth when one’s tax rate is low is an excellent idea, but in the context of other priorities, of course.

Hi. You might consider what we did after our first two year period abroad but before the one after that- buy a “bolthole”, as we called it. It was a small ownhouse in a development with communal grounds (helped it look occupied), in one of the best school districts in our city suburbs. Almost outright, paid it off within two years. We wanted a place we owned that our family could return to quickly and easily if things went very wrong (death, job loss- didn’t think of a pandemic, but…). The US has a lot of protections for mortgagees that other countries don’t (such as not discrikinating on the basis of age, allowing a loan term to extend past retirement age).. But you still have to show a record of secure employment, etc, which can take some time to re-establish when repatriating. Also, you said you’d like to work overseas again in public health. Our bolthole wasn’t the rambling estate of our dreams, but it was an address, storage, a summer home, and an asset, if not a liquid one . And it reduced anxiety about a lifestyle with few other guarantees. Good luck.

Yes, very much that too. We have a house in one of our original country that we rented out, but it is also a from of financial stability, go back too if shit happens thing.

Hey there, thanks so much for reading and for your comment. I really like this idea — it feels like a more manageable way to start putting down some roots in the US without fully transitioning our lives here. I especially like the idea of having our own place to go in the summers so we don’t have to rely on staying with family for such a long stretch.

I think this is an outstanding suggestion. My wife and I have a similar property…a house near the best elementary school in a low cost of living city. It’s been a great long-term rental, and our tenants have reduced the mortgage to the point where we could use our savings to pay it off anytime. If we suddenly lost our jobs, we’d just pay it off, move there, and live very cheaply for as long as necessary. I call this Escape Plan FIRE.

I agree with Liz that paying cash for a primary residence is a very inefficient use of your long-term wealth. If you think of your bolthole as a business instead of your family home, the fact that it’s earning you a combination of income and/or equity might help you feel better about using a loan to buy it. Doing that for a while might help you feel better about taking out a loan for you primary home later.

A rental property is NOT passive income, but it is a way to build wealth with tax advantages and risk that are different than cash savings or stock investing. It might be a good addition to your family’s overall nest egg.

You mentioned wanting to live near mountains. Could you find something reasonable in a less expensive mountain location to give yourselves an excuse to visit and try out a potential future home area? (SD, ID NV, UT…all outside the major metro areas.)

Perhaps they should rent upon returning to the US. When in transition, I think it’s helpful to try out an area first before you commit to it with planting roots into a home. (up-size when your family expands). That allows them some flex in savings for retirement. No one says that retirement funds need to be in Retirement accounts. They could build up their retirement in taxable brokerage accounts. The key is they they are savers and attacked the debts they have.

They should simply their accounts in cash. Just toss it into one joint account in the Marcus account. No point in having so many divisions in cash. Money markets are paying more than 3.9% so look into those. Some have 5% +payout.

All new saving should be into brokerage account for now. And when it’s time to buy a home with cash, they could just exchange the stocks for a home. Let the money do the heavy lifting for you.

*townhouse

Maybe Freudian slip there.

As someone who has move continents and countries on a regular base. Don’t assume moving back into the states is going to go smoothly, the country changed and you have changed a lot more by living abroad. You may very well want to continue on living in different countries, or move back to the states but wish for a more international lifestyle than before. I would wait at least 2 years after living again in the states before buying a house. Pregnancy and child raising is going to be cheaper in Vietnam than the states. We live 9000km from where we where born( 2 different country in Europe) , one kid, 25, is doing

His second master in yet an other country and is going to live a very international life. We visit each other about twice a year and by spending 2 week at the time living together or traveling together, we have remained closer then most of our friends and their kids. This is not a financial advice in anyway, but more be ready for a bit of a harder adaptation into life in the states.

“we wouldn’t buy a house valued at more than ~$300k…”

Um, may I ask why? Sticking to this rule would really limit you! I’m not sure which part of the U.S. you want to live in, but a 300k house is not feasible in a lot of popular urban areas. Especially with your plans to have a lot of kids and pets.

In your place, after you move back to the U.S. I’d probably start with a cheaper apartment. Have one kid. Then assess whether you really want another kid & the pets & the big house.

Hi! Thanks for reading and for your comment 🙂 This figure is mostly rooted in our serious debt aversion. It scares me to imagine paying off a loan bigger than that. We also don’t want to live in a popular urban area once we move back. We have our hearts set on the western part of Virginia, a bit rural, but close to Staunton and Waynesboro. I’m hoping that means that housing prices will be a bit more management. However, we also don’t really want to buy a house that we don’t love and just want to move out of after a short time, so perhaps upping our budget is a good idea to make sure we end up somewhere for a good long while.

You can do a quick search on Zillow to see if that is realistic. Don’t set your heart on anything but you can see what $300K will buy you. In my area, it’s quite rural but $300K is a teardown or a small condo. 🙁 Housing prices are rough!

Also remember that you’d have a downpayment – so a $300k house isn’t $300k in debt!

Yeah 300k honestly seems low in my low cost-of-living area too 😬 prices are wild right now, everywhere.

Yes, you should be able to contribute to a RothIRA when you are overseas. It appears that your Vietnamese income taxes are higher than your US taxes would be, which means you can file for a foreign tax credit instead of FEIE (foreign earned income exclusion). Foreign tax credit filers can use a Roth IRA, and you can also carry forward any excess foreign taxes you have paid for up to 10 years, so if you later work overseas in a low tax jurisdiction you can offset. You should use an accountant to file this, as it is a bit complicated.

If you want to work in global health I would suggest looking at USAID positions. You may need to wait until you have a couple of years of experience before applying. Salaries are very good, housing and children’s education is still free, and in many posts it would be easy for the spouse to find international school teaching positions.

I would caution moving back stateside primarily because of family guilt, if that is what is happening. You have your own life and journey to forge, and that decision should ultimately be your own.

Hi Anne – thanks for reading and for your super helpful comment!! I think going forward we will use an accountant to file our taxes as this year felt complicated and stressful trying to make sure we were doing things correctly.

Great idea about USAID. We have friends who work for the World Bank with the same benefits you outlined and also tax free. If I can get a foot in the door, it absolutely seems like a no-brainer and a great financial move.

Great point about family guilt. I think we do need to do some more soul searching about why we want to come home and when.

Hi Laura!

I enjoyed reading your story and found a lot of parallels to my own which I submitted to Mrs. Frugalwoods a couple years ago. My husband and I are moving from Germany to the US at the end of this year in order to be closer to family.

I came to the comment section to suggest what Anne did. As an expat, I’ve been using foreign tax credits to invest in a Roth IRA for several years now. It means tax returns that are a bit more complicated than when using FEIE, but there are some guides online about how to do this if you choose to file your return on your own.

Rooting for you both!

Thanks for reading! I will definitely look into using foreign tax credits.

I think worrying about whether you should pay cash for a house is premature- a big chunk of that close to $100k savings could get eaten up with renting a place, furnishing it (assuming you haven’t stored furnishings, but even so you’ll need some new stuff), getting a car, and potentially having kids, when you get back to the US. $20k easily for closing costs on a house. At best you have a cushion for returning to the US and a down payment on a house.

Echoing what others have said here. $300k wouldn’t buy you a house on the north side of Chicago. Maybe a townhouse but maybe not. Prices are through the roof.

I love Staunton! Vicariously celebrating this choice 🙂

Hi- I’m also an international school teacher and am wondering if you’ve read Andrew Hallam’s books? They are specifically written with expat teachers in mind and give advice on brokerages and suitable ETFs to invest in, tailored to nationality. If you haven’t already, I’d definitely suggest having a look. I (and many others) in the same position have found them very accessible and practical.

Family of teachers here. Teaching is now an onerous profession in most positions in the US now. Be prepared to look for a more palatable career. Best wishes.

Thanks for the recommendation! I have not heard of Andrew Hallam but sounds like these are really aligned with our current life situation. I’ll look into them for sure.

Am impressed with this couples finances.

I’d think very carefully about moving back to the USA at this point in time. The country is very much in flux and unaffordable for most who are not wealthy. It’s going to be while before we have a truly stable government again. So explore the political upheaval closely to determine if you can weather the years of instability, (loss of social security, limited voting options, a billionaire owned & operated economy, unaffordable healthcare, even with insurance, etc.)

I’m an older adult and given the times are living in I wouldn’t want my adult children to return to the USA. I’d feel they’re more secure & have better options in other countries. VN sounds wonderful!

Thanks so much! I’m overwhelmed by the number of comments encouraging us to think again about moving back to the states. Definitely time to reflect on what we really want at this point. There are a lot of pros and cons and a lot of unknowns! I really appreciate your comment.

Good luck on these decisions! FWIW, I’ve lived in Philly (Queens Village and further S Philly) as well as the Shenandoah Valley (not Staunton itself) and live outside of DC now. Although I’m not in public health, it seems plausible to get a job in DC that would require limited in person presence (remember if you join the govt, decisions re telework can change with administration). I’d also definitely talk to a wide variety of folks living in Staunton to make sure it’s a good fit; the Valley is changing, but in my experience, quite conservative compared to the northeast. That may be fine for you, but just a consideration. I’d also note that public school teachers’ salaries are quite low in VA (outside of NOVA). Good luck as you figure out these exciting next steps.

Hi Eliza, thanks for reading 🙂 You make a really good point about making sure that Staunton will be a good fit. It’s always different visiting a place vs actually living there. We should definitely try to get a bit more info before diving in and especially before purchasing property.

I had the same thought about Staunton as a dream location. I grew up outside of DC, went to college at UVa (Charlottesville is still where my heart feels at home), and lived in Philly for several years. Staunton is cute but SMALL. The population is < 1% that of Hanoi or Philadelphia. And the amenities are correspondingly slim. It's about a 3 hour drive to DC; even if you only go once or twice a month, that's a long round-trip or an overnight stay. It's also about 2 hours to the nearest decent-sized airport (Richmond), which could put a cramp in your travel plans or visiting ageing parents, depending on where they live. I also second what Eliza said about the conservatism; I am not white and vividly remember walking into a restaurant there with my (white) college boyfriend; heads swiveled/it went quiet, like a Hollywood movie. Most uncomfortable meal ever.

Don't get me wrong, I love love love the Shenandoah Valley and am never happier than when I am in the mountains; it's the towns that leave something to be desired. If you do want that easy access to nature while still being relatively close to city living, think about Chantilly or Centreville in western Fairfax County (which pays teachers well and has a phenom school system, though housing prices will be correspondingly high).

I agree on the other comments about not moving back to the US so soon. I understand the couple’s concern for aging parents. But another 5 years working abroad could make a huge difference. If Hanoi isnt ideal for them, they can explore other countries that offer high pay for teachers such as Taiwan and Hong Kong. Also having young children as expats in Asia can be more ideal. Its very affordable to have a full-time nanny / helper which would allow the couple to really focus on their careers and life in general. Thats not to say the nanny is raising their kids but its such a game changer to have help at home and free up your time My husband and I both live in Asia with our 2 young children and I cant imagine moving back to North America any time soon!

Hi Adeline – it’s great to hear from someone living abroad with young children. My sister just had a baby in January and following her journey trying to figure out how to 1) get into a decent childcare center and 2) how to pay for it has been eye opening. You’re totally right that another 5 years, especially with two incomes, could make a huge difference to our finances and set us up really well for the future. But the guilt (and air pollution – eek!) is also really real. How often does your family visit back home?

Love this case study! As someone who is actively working towards becoming an expat, it is super inspiring. It seems like you have a great life over in Vietnam. Things are a bit hairy over here, in my opinion at least. I challenge you to look deeply into why you are wanting to come back to the US, esp given your stated desire to work abroad. Maybe switch to a different country? Also- regarding the money anxiety–I have a book recommendation for you- “Die With Zero.” I am partly through it and it is really shifting my perspective on money. Good luck to you!

Thanks Laura for sharing your story.

I am also an ex-pat albeit an Irish ex-pat who spent 10 years in Australia and am now in Houston, TX for 5 years now. I completely understand any anxiety you have about the future. I am also going through the same thing. My husband (who is South African) and I have spent so long moving around that we haven’t put down any roots anywhere and now have anxiety about what retirement might hold for us (we are in our mid 40s) given that if we had stayed in the same place and jobs we would be much further ahead. What I keep coming back to, is that even though it has cost us financially to live this way, we have more than made up for it in the experiences and memories that we have shared. As long as you are not completely irresponsible (which you are not), I believe that things will work out. No-one has ever said on their deathbed that they wished they had paid off their mortgage sooner.

I will also add to this, as a somewhat objective observer, that I agree with a number of the comments here regarding the US.

Things are very uncertain at the moment, and once you are back and settled, you may not be so inclined to leave especially where kids and grandparents are involved. Property can feel like an anchor that ties you to a place you may not want to be tied to. Do your travelling now while you are young, and then settle down. Things become more difficult as you get older.

Also, as I woman in her mid-40s who would like to soon settle down, I am very conscious of how difficult the job search becomes the older you get, which is likely to get even worse with AI. My advice therefore would be, come back when you are ready to settle down in both place and job. Until then, do what you can and enjoy your freedom.

Wow what a great life you’ve made for yourselves including being on a good financial path. Public health person here working for a DMV area employer! (I actually found frugalwoods through my best friend from my MPH program.) you can absolutely find a remote job in the area (and one that would allow you to travel internationally if you want that, though maybe not once kids are in the picture). Another poster recommended USAID which is great but there are also many health focused nonprofits and academic institutions doing global health research that would likely have more flexibility and better pay — PATH, Johns Hopkins, the big NGOs that get a lot of govt contracts, etc.

I want to second Liz’s recommendations to consolidate your retirement accounts and get them away from your old employer. I see you’re invested in many vanguard funds and most certainly are paying more to have them invested with a different brokerage company than you would if you just had an account with vanguard directly.

Keep up the great work and enjoy some vegetarian Vietnamese food and more massages for me!!

Hi Shayna! Thanks for your comment 🙂 Great tips re: potential orgs to look at when it comes time to find a job.

I’m definitely going to get moving on rolling over the retirement accounts. I hadn’t even considered that we are likely paying a lot of more for vanguard funds in a non-vanguard account when my husband already has an IRA through vanguard! Thanks for calling this out!!

You’re doing great!

Just a word of extra encouragement to get your accounts out of the 403b plans and rolled into IRAs.

Many many of those plans have horribly high fees and poor investment options.

There is a website dedicated to seeing how yours compares

https://403bwise.org

Overall, it’s really crucial to do the rollover asap.

I am going to say something that goes against the grain, but as someone who had financial anxiety. We bought our modest house cash and although I knew all the arguments against doing that, I felt an immediate peace when I knew I had something completely paid for and then I started working on a more robust savings plan for other areas. Sometimes financial decisions need to consider your own emotional needs, by which I don’t mean the “need” for fancy but the need to reduce emotional drag on your life. As I said, our house is modest which also makes it cheaper for upkeep and taxes and such…And I know housing prices have gone up in the U.S., but we travel through the states a lot and there are places with more modest housing prices if you are patient and especially if you are willing to take a fixer-upper and do some of the work yourselves.

I appreciated the way you put this, Lindsey. We are Canadian, and we do not receive any tax deductions on interest for a principal residence mortgage where we are (I think this is different in the states?). However, we chose to pay off our mortgage… Knowing that we don’t have that monthly mortgage payment as an expense is freeing and in our opinion, worth it.

I just reread my comment and it doesn’t make sense the way I wrote it. The “however” should not be there. What I meant to say was, there were no tax benefits for us in holding a mortgage, and we felt that paying off our mortgage was the right thing to do in our situation.

I’m in my mid- 40s, live abroad in NZ and own a ‘bolthole’ as someone referred to it, or ‘our cupboard’ as I refer to it. I rent ours out though and rarely go home to the UK, it is there for when I need it and I really appreciate the fact it is there and that my long-term tenants are looking after the place. I have travelled alot and only recently started setting myself up for retirement, but that’s okay, we can’t all live the same secure financial life in the same place and I wouldn’t swop the experiences I’ve had for anything. I would echo people’s comments about delving into why you want to go back to the US so soon? I am lucky that my parents never discouraged my travelling, quite the opposite and never encourage me to return to the UK, so there’s no guilt there, but if you have built a life that you love and can afford, why would you turn your back on it? You can raise kids in VN? Why not?

Ok so here goes. I am retired and will turn 70 this year. I originally received a degree teaching Spanish and German at middle school or high school level. Unfortunately I decided to stay in a not so progressive Midwestern state and jobs earning any substantial income were few and far between. I eventually obtained my L.P.N. while working. I took on a variety of roommates too. I have had a variety of jobs as time went on. Finally at 67 I was able to retire. I have never been particularly close to family even though I am a great aunt several times over. In this state education levels are not that great. And jobs for the elderly are not plentiful or paying much. I am quite frugal and get by mostly on social security and savings I put back every month. My best friend bought my small house I live in in cash. We are old enough things happen and I did not want her to get hung up with having a mortgage payment. I am so happy I suggested that!! My best friend had a flare up of some mental issues. I also suggested that I mow the lawn and landscape instead of paying a higher rent. I do other small repairs as well. At any rate there are so many issues in the education system I hardly know where to start. Consider too that a very controversial election is coming up as well. Despite family pressure I am getting ready to move out of the US to Portugal. I will be able to purchase a small home. I could never do that here in the US. Furthermore their health care system is ranked much better than the United States by WHO. I will be self sufficient again. Whoever said things have changed since you moved away is not joking. My best friend now lives in independent living and can afford to travel. So she will come and spend a month or 2 with me. And back to housing costs. We bought the house I live in for a 100k and it’s now valued at just over 200 in a little less than 10years. It’s in a downtown area of a suburb and it’s.a fixer upper. We grow gardens and make do. I mow with a push reel mower and walk 4 miles a day. There are young families here and we have a 98 year old lady who lives down the way. The schools are good. Rents in the area are sky high and in general are absolutely ridiculous. I wish you the best but please think clearly before moving back

Becky

Reading about life in Vietnam was fascinating!

Can confirm: Life in the U.S. with young children is very difficult right now. We are living under minority rule, people who want to keep life as it was many decades ago. However, many other countries are going through tumultuous times and seeing the rise of right-wing policies (which tend not to favor working families). It’s not just the U.S.!

If you know this, you can be strategic in how you design your life so that it’s still fun, comfortable and rewarding.

I’ll share a bit about my experience, since what else is the internet good for other than hearing about strangers’ life experiences? DH and I are 38, and our kids are 7 and 4. We’ve both worked since we graduated from college, but soon DH will stop working because we are completely burned out. Daycare costs more than our mortgage. We’ve used all our sick days. We don’t want our kids in childcare for more than 8 hours a day, so we take advantage of having flexible jobs to pick them up early… but then we lose work and personal time.

The entrenched minority rule has set up a society in which they’ve told families KMAG YOYO, which is old military slang for “kiss my a**, guys; you’re on your own.” So what does this mean for you?

It means that a) life in America is easier if you don’t have children; b) if you do have children, it’s easier for only one parent to work; and c) if you both must work, remote/flexible work for at least one parent is a must.

All this is to say that you have to figure out what you want. And if you want to move back to the U.S., you can look at these facts and be strategic in how you make it work. And if you look at it and say, forget it, we’re staying overseas, that’s great too.

Related to this, would you qualify for maternity leave benefits in Vietnam? I would research that, because (and I’m sure you know this), maternity leave benefits in America are dependent on your employer, unless you live in a small handful of states that offer benefits. Not sure if you’d want to have a baby while outside the country, but man, it is enticing to take advantage of somewhere that gives mothers actual maternity leave.

Additionally, it sounds to me like renting is ideal for you guys. You mention being terrified of debt, not wanting a mortgage, etc. You have a lot of fear around owning a house. And rightfully so! As Ramit Sethi says, rent is the maximum you’ll pay per month, while a mortgage is the minimum you’ll pay. If and when you come back to the U.S., run some serious numbers on buying vs. renting, especially if one of those options allows you to have one parent either not work or work very flexibly. And mathematically, it is not very prudent to pay cash for a house. If a mortgage + associated costs versus rent were roughly equal, I’d rather rent and hold onto my big wad of cash.

And finally, kudos on getting your MPH! I work for a large public health NGO. I’m in a skilled support position; I could work in any industry. I love working in public health and supporting the work we do. Many of the NGOs are using remote/hybrid models these days, including mine, so your Staunton dream could become a reality!

I agree with so much of this. I lived abroad for 13 years; 12 of them in Asia. I’m now raising a kid in the US (Ann Arbor, Michigan) and I desperately wish I had not returned to the US. Childcare for the years until he went to K would have paid for a BA + MA at a public university. Now in-school aftercare is almost $5k/year. Life is a rat race. I work full-time, run around to pick up my kid from the childcare (hours were shortened and many places closed during the pandemic) and then work 2 freelance jobs…all to make ends meet (and I have a paid-off townhouse, an Ivy master’s, and a “good” FT job for a university). The cost of therapy, medication, and just basic health insurance (which doesn’t pay for much of the necessary therapy and meds) for my neurodivergent (ASD/ADHD) child is staggering–avg $400/week, and he’s not even in a residential program or a private school. I understand that you want to be able to see your family more, but in my experience, I had more quality time to spend with my family when I lived in Asia, because then I was able to return to the US for extended periods of time. Now that I live here, time off is rare and things are so rushed that I maybe see them one weekend a year. I also very much miss travel, the amazing food, and having time for hobbies… Many states are NOT a good place to be a teacher right now, either. Teachers are being being blamed for society’s shortcomings, while simultaneously being asked to not only teach, but also be social workers, therapists, and in some states, armed guards.

I know this is a finance question and so my comment may not even be appropriate. But it sounds like you’ve got a lot of anxiety and guilt, especially where money and family are concerned. I have struggled with these issues myself! It’s taken me a lot of therapy (and supportive husband and friends) to understand that life isn’t as scary as I thought it was. I’m 58 now, so I see things from a different angle. You and your partner have a lot going for you…you’re frugal, you’ve got money in the bank, you’re on a mega-adventure, you are getting a Master’s Degree in a very cool and useful subject. I hope you’re able to enjoy the fun of it all and to trust that your future will unfold without worrying about it so much. Your plans probably won’t work out the way you’ve planned them, but you’ll be ok anyway! As John Lennon wrote in his song “Beautiful Boy”, “Life is what happens when you are busy making other plans.” Take good care of you! You’re doing great.

My husband and I moved to Staunton, VA last year and are really enjoying it. We’re 30-somethings originally from the northeast. I’m happy to answer any questions about living here!

I was in a similar position 10 years ago. I’d travelled and worked overseas, came home to study and met my partner. We travelled for a while longer and at 30, I was so anxious about the future . I was unsure where we’d live and wanted to buy a house and start a family in a few years. I rushed into everything and whilst it has all turned out ok and I have a lovely home, live in a lovely area, work is ok and I have 2 amazing kids, I wish I had relaxed and enjoyed the ride a bit more.

As several friends have done, I wish I had travelled more and worked with my kids overseas. Now we have a house and the kids are at school, everyone is too settled to move. I’m desperate for more adventure and ‘normal’ life can be monotonous, don’t rush back to it. Everything will be waiting for you, when you are ready to come back. House prices may have gone up, but so will your savings. Enjoy living in the now and go with the flow. I’m a firm believer in everything happens for a reason and you’ll end up where you’re meant to be, but who knows what path will take you there.

Looking at your finances it looks like you are saving a lot each year and once you start working, you will be able to save more each year. If you enjoy life in Vietnam, why not put that extra money towards a low fee investment account for your retirement.

I would recommend starting to try for children soon, as you don’t know if it will happen right away or take longer to get pregnant. Are your parents retired? Maybe they could come visit you for a long visit and help out with the baby.

From what I’ve heard it sounds like it will be much cheaper to take care of children in Vietnam than it would be in the US.

Of course, if you are missing home or want to try to live somewhere new it would be easier to move before having children. There’s never a perfect time though and best not to leave it too late as it can be more challenging to get pregnant when you get older.

Good luck and enjoy your hobbies now while you have the time. Once you have children it’s very difficult to maintain so many hobbies.

It seems like you guys have an amazing life in Vietnam. If you are hell-bent to be back with family then I’m sure moving back will satisfy that. I’m 36 now and unfortunately we are struggling to get pregnant… That is already becoming the financial endeavor ( you can get free IVF with a PT Starbucks or Tractor Supply Jobs!) but if you are already a parent and work FT- the states blow. My best friend and her husband have two small kids, five and two. They both work white collar jobs and it is insane how they have to shuffle around just to make being parents feasible. They are torching their candles at both ends and their childcare is just under 5k a month in Philly.

During the pandemic it was insane for everyone, but especially with little ones in daycare. Both her kids have to be in daycare and because of the ages they are in separate daycares. They are always sick, ALWAYS. And both their jobs are sick of their kids being sick and them having to be parents to their sick children. I feel bad that you’re getting this resounding ” don’t come back!!” but politics aside, I don’t envy anyone with children in the US that has a 2 parent income. I think we are all on the same $ responsibility bandwagon but there is a live to be lived in all of this. Don’t lose sight of the seemingly phenomenal life you guys share in VN.