Leigh is a diabetes educator living in Denver, CO. Her children are on the cusp of adulthood and she’s looking around her soon-to-be empty nest, considering her options. She’d like to downsize to a smaller home in her same Denver neighborhood and is interested in exploring the possibility of buying a second home in The Dominican Republic. Leigh wants to continue her work, a passion she feels called to, but would enjoy reducing her hours. Let’s help Leigh figure out this next chapter of her life!

What’s a Reader Case Study?

Case Studies address financial and life dilemmas that readers of Frugalwoods send in requesting advice. Then, we (that’d be me and YOU, dear reader) read through their situation and provide advice, encouragement, insight and feedback in the comments section.

For an example, check out the last case study. Case Studies are updated by participants (at the end of the post) several months after the Case is featured. Visit this page for links to all updated Case Studies.

The Goal Of Reader Case Studies

Reader Case Studies intend to highlight a diverse range of financial situations, ages, ethnicities, locations, goals, careers, incomes, family compositions and more!

The Case Study series began in 2016 and, to date, there’ve been 78 Case Studies. I’ve featured folks with annual incomes ranging from $17k to $200k+ and net worths ranging from -$300k to $2.9M+.

I’ve featured single, married, partnered, divorced, child-filled and child-free households. I’ve featured gay, straight, queer, bisexual and polyamorous people. I’ve featured women, non-binary folks and men. I’ve featured transgender and cisgender people. I’ve had cat people and dog people. I’ve featured folks from the US, Australia, Canada, England, South Africa, Spain, Finland, Germany and France. I’ve featured people with PhDs and people with high school diplomas. I’ve featured people in their early 20’s and people in their late 60’s. I’ve featured folks who live on farms and folks who live in New York City.

The goal is diversity and only YOU can help me achieve that by emailing me your story! If you haven’t seen your circumstances reflected in a Case Study, I encourage you to apply to be a Case Study participant by emailing your brief story to me at mrs@frugalwoods.com.

Reader Case Study Guidelines

I probably don’t need to say the following because you folks are the kindest, most polite commenters on the internet, but please note that Frugalwoods is a judgement-free zone where we endeavor to help one another, not condemn.

There’s no room for rudeness here. The goal is to create a supportive environment where we all acknowledge we’re human, we’re flawed, but we choose to be here together, workshopping our money and our lives with positive, proactive suggestions and ideas.

A disclaimer that I am not a trained financial professional and I encourage people not to make serious financial decisions based solely on what one person on the internet advises.

I encourage everyone to do their own research to determine the best course of action for their finances. I am not a financial advisor and I am not your financial advisor.

With that I’ll let Leigh, today’s Case Study subject, take it from here!

Leigh’s Story

Hi Frugalwoods, I’m Leigh and I’m a 49-year-old diabetes educator living in Denver, CO. I’ve been amicably divorced since 2019, when my partner and I decided that our child-raising was mostly finished and we were coming to a natural end of our marriage. Our kids are 21 and 19, and are my biggest joy and priority in life. Getting them launched well in life with support, love, and as much guidance as possible, has been my number one priority for many years. When we divorced, I bought my partner out of his equity in our home so I could keep the family home. It’s the only home my kids have known since they were 6 and 4.

It’s been a great situation for the past few years, as my kids have been home more than I ever anticipated (due to COVID and remote learning being in effect for each of them at different times). I’ve also truly enjoyed having our home be a space for them to rest and relax during their college summers and breaks. My oldest graduated with their BA a few months ago, and is currently living at home and applying for grad school to start in the fall. They are delightful and I’m enjoying what may be the last time they live at home for an extended time! My baby is a sophomore in college studying engineering at a state school, and lives at school with their roommates. I have two senior cats, George and Lucy, who’ve been our family pets for many years, and give me so much enjoyment, especially with the periodic empty nest I’ve experienced over the past few years.

Leigh’s Community and Hobbies

In addition to my wonderful kids and a job I truly love, I feel lucky to live in a community of fabulous neighbors. We have book club, coffees, a neighborhood park, library, walking trails, and a community of caring people. Anyone in my circle who needs meals, pet-sitting, or just general care gets taken care of by a loving group of neighbors. My cat-sitter lives down the street, I bartered yard work in exchange for storing a neighbor’s trailer on my extra parking space, I read over 50 books per year for free courtesy of my library branch’s fabulous inter-library loan system, and I walk most days when the weather is nice and see neighbors out doing the same. I’m also very fortunate that two of my sisters live nearby and we see each other frequently and are a wonderful support system for one another.

My hobbies are reading, hiking, meditation and yoga, watching great series on Netflix, and drinking coffee and/or wine with friends. I’m grateful to have a healthy body and a healthy community. Colorado has so many hikes and I’m having fun exploring different ones! I also love thrifting and am more committed than ever to buying most things ethically or second-hand.

One of my biggest passions is travel to the Dominican Republic. I’ve been going to the same area for many years and have developed a love for my friends there and the people and culture. I hope to live there part-time when I retire, and one of my goals for the next five years is to buy either land and build a home, or buy a home, and spend a couple of weeks per year there with my friends who are now like family.

What feels most pressing right now? What brings you to submit a Case Study?

1) Career:

My career is fulfilling and I love what I do. I have no plans to retire early at this point. I’m at a wonderful diabetes center with a great community and, as a natural helper and educator, I feel a strong sense of mission and purpose in my work. I’ve always been a bilingual (Spanish) educator so I feel particularly called to working with our Spanish-speaking clients.

Prior to my divorce, I worked three days per week, for a total of 30 hours. I’ve been fortunate to move to full-time work within my current position; however, I miss the flexibility and extra time off I enjoyed when I was working 3 ten-hour shifts a week. I moved to full-time to be able to afford all my expenses, particularly my mortgage, and feel lucky to have done so over the past couple of years. However, with the recent changes in my mortgage, as well as potential future downsizing, I wonder if I might return to my lighter work schedule.

If I decreased to 30 hours per week, my salary would be $3,300/month.

2) Downsizing:

My other question, in general, has to do with eventually downsizing. My goal, since the divorce, has been to keep the house until both of my kids are in their own places and graduated from college. My parents always allowed me to move home during college and I so appreciated this stability during a time in my life that was filled with change and I hope to continue to provide this for my young adult kids. Also, I am very attached to my house and my neighborhood. And there aren’t many smaller places nearby. Denver’s housing market is insane right now, the prices are high across the board and there’s a very small inventory of homes for sale. People are often telling stories of sellers having multiple cash offers for well above asking price. While this would be amazing for me on the selling end, it would be difficult on the buying end. Additionally, I’d prefer to stay in my house for at least another 2 years, until my baby has their BS degree completed. Plus I’m picky about staying adjacent to my current neighborhood, as this is where much of my close community is.

My home is estimated to be worth $630k-650k. Denver home prices are bananas right now! I bought this home in 2007 for $290k. The townhomes I’m interested in are in the $550k-$600k range. Also bananas. I’m pretty ambivalent about downsizing right now given the high price of a townhome.

3) The Dominican Republic:

Related to this question is my desire to potentially buy or build a small place in the DR. I think it might be possible sooner than I think, although I’m a pretty risk-averse person. But many of my friends who live there are in construction, so I think I could hire some of them. I also wonder about hiring some of my friends to be caretakers of the home and possibly using the space as an AirBnb. I know nothing about any of this and haven’t done much research–I’m in the “dreaming” stage at this point.

A dear relative passed away during COVID and left me a significant inheritance. I am so appreciative of this incredible generosity, and used the gift to pay off my mortgage. I now have the peace of mind of owning my home and not having to worry about paying my mortgage payments! I acknowledge the immense privilege of this situation and am grateful for my family.

What’s the best part of your current lifestyle/routine?

- Working four days per week at a job I love and feel called to

- Health and physical abilities: hiking, yoga, walks, and maintaining my home and yard (with some help from Task Rabbit contractors)

- Kids who are doing well and thriving in school and life

- Friends nearby for hangouts planned and spontaneous

- Being in charge of my own personal budget and space. I love a tidy home space and am a homebody at heart

- Connection with my sisters

- Yearly trip to the DR (paid for last time with credit card points)

- A couple of yearly smaller trips to see friends in CA and NM

- Time to read

What’s the worst part of your current lifestyle/routine?

-

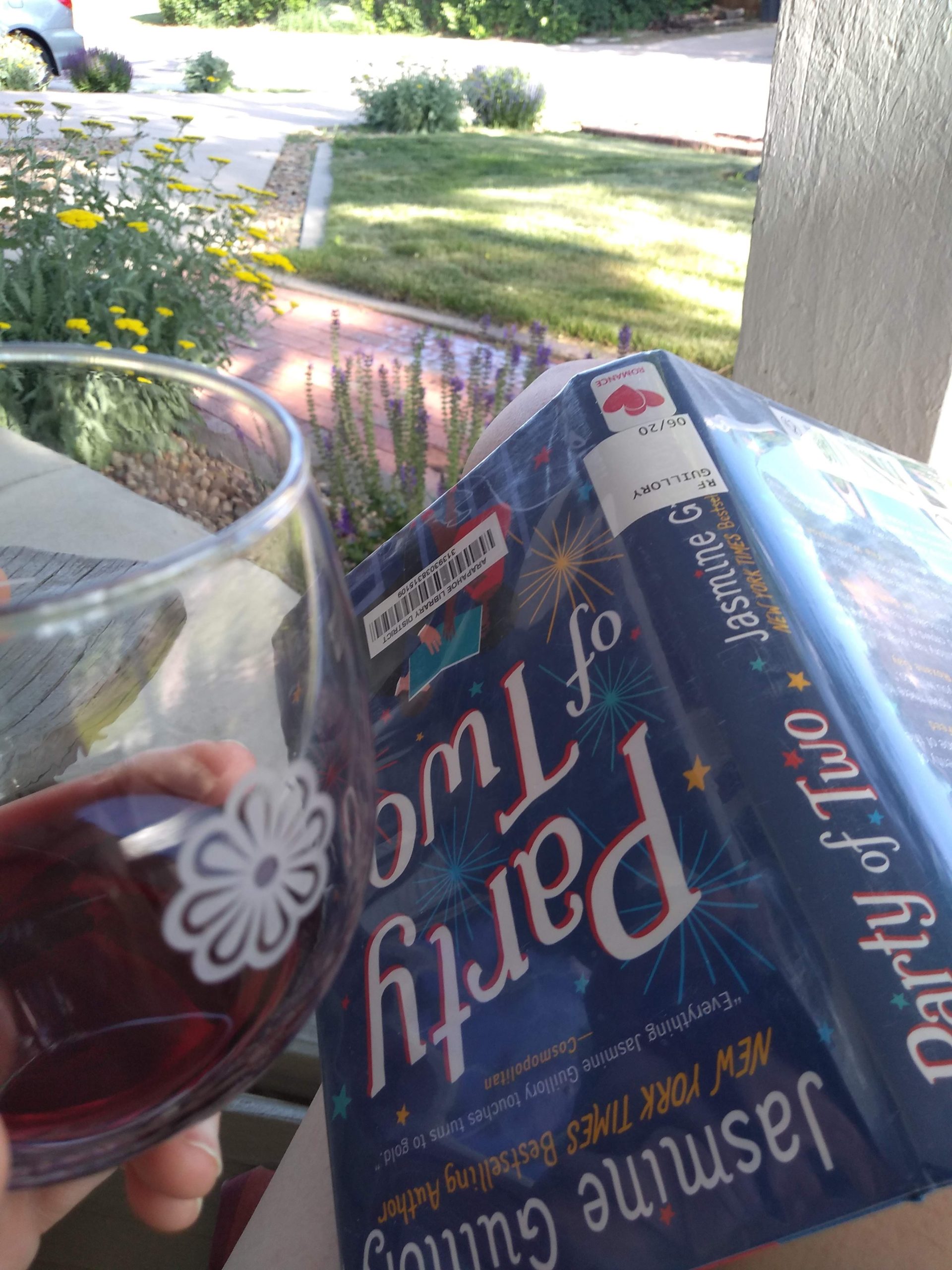

Leigh’s happy place at home with books, cheese, fresh flower and candles (and wine). I’m often tired at the end of the day, and by the fourth day of the week, I’m very tired

- I hate to cook and am often too tired to cook in the evenings

- I don’t often feel that I have “enough” time to pursue friendships, hobbies, exercise and reading due to longer hours at work and more home maintenance

- I’m sad that my kids are close to moving out

- COVID was a very lonely time to become a divorced empty-nester and I’m still figuring out the rhythms of life post-kids and post-divorce

- I’ve been frugal for years and find that, now that I work full-time, I’m not as excited about or don’t have as much time for frugality. I end up spending money because I’m trading it for convenience. I don’t have a big problem with this, per se, but sometimes I wonder about the frequency of this trade off and what striking the right balance looks like for me at this stage of life.

Where Leigh Wants to be in Ten Years:

1) Finances:

- Saving enough for retirement

- Not stressed about day to day expenses

- Living in a smaller home that is near my current neighborhood

2) Lifestyle:

- Working at my current job

- Traveling more often to the DR

- Hiking and catching up with friends both locally and in other locations

- Enjoying my grown kids, sisters and extended family

3) Career:

- Continuing to excel in my career and to engage with my patients and colleagues

Leigh’s Finances

Income

| Item | Amount | Notes |

| Job | $4,458 | Net take home after deductions for 401K, healthcare, life insurance and disability insurance |

| Child support | $200 | Monthly until youngest graduates from college, was $400 per month until 2021 when our oldest got their bachelor’s degree, which was our agreement, our kids live with me in our family home when they are not at college (on breaks, during summers) |

| Monthly subtotal: | $4,658 | |

| Annual total: | $55,896 |

Mortgage: none, paid off

Debts: none

Assets

| Item | Amount | Notes | Interest/type of securities held/Stock ticker | Name of bank/brokerage | Expense Ratio |

| Home | $630,000 | Paid off my mortgage in 202. I acknowledge my privilege in that family gifts helped me pay off the balance of my loan, as well as my extreme good fortune of being a homeowner during the crazy market gains in the past 20 years, particularly the past 15 years in metro Denver.

My home is estimated to be worth $630k-650k. Denver home prices are bananas right now! I bought this home in 2007 for $290k. |

|||

| TIAA-CREF work 401K | $165,000 | Invested in a targeted retirement fund that grows more conservative the closer I get to a predicted retirement age of 65 | TIAA-CREF | ||

| Thrivent retirement account Traditional IRA | $140,442 | Moderately aggressive allocation | Thrivent | ||

| Thrivent retirement account Roth IRA | $68,622 | Moderately aggressive allocation | Thrivent | ||

| Thrivent annuity | $94,000 | Thrivent deferred variable annuity | |||

| Thrivent brokerage account | $52,000 | ||||

| Cash: emergency fund | $25,800 | I transfer $625 per month into this account. | Regular savings Wells Fargo | ||

| Cash: checking | $4,400 | ||||

| Cash: escrow account for insurance and taxes | $3,750 | I keep this small savings account to pay my annual expenses of property taxes and insurance since I don’t’ have a mortgage | |||

| Total: | $1,184,014 |

Vehicles

| Vehicle make, model, year | Valued at | Mileage | Paid off? |

| Subaru Outback 2018 | $20,800 | 44,000 | Yes! I like to joke that this is the requisite car for living in CO, especially if you like to hike or do outdoors things! |

Expenses

| Item | Amount | Notes |

| Taxes and property insurance | $750 | I am my own escrow account! |

| Groceries | $394 | Varies: as high as $700 when both kids home, as low as $250 when just me on vacation for half the month! |

| Home utilities: water, sewer, electric, solar, compost, trash and recycle | $302 | water-73, electric -93 (might go down this year, solar was new as of 8/2021, I’m leasing the system), solar-60, trash and recycle 17,(paid yearly, with a discount) curbside compost -28 (awesome program that lets you compost everything including meat, bones, oil, and it’s weekly curbside drop-off and pickup of a bucket! ) , sewer -31 |

| Car: gas, oil changes, maintenance, registration | $252 | Gas- 95, oil change- 16, registration- 25, repairs 116 (four new tires and some brake and differential repairs) |

| Restaurants | $230 | Lower when it’s just me, higher when my kids are home and I want to celebrate and treat them. This also includes coffee with friends and dates. |

| Home maintenance | $228 | Fridge replacement, furnace annual service, garage door repair, sprinkler system repair, lawn care, dryer vent clean out, biannual lawn cleanup (paying someone to help with that) and home supplies like fans, lightbulbs, vacuum bags, cleaning supplies, etc. |

| Costco | $200 | Monthly stock-up on coffee, cat litter, toilet paper and a few other basics |

| Insurance: auto | $175 | paid every six months through USAA with a prepayment discount |

| Charitable Giving | $160 | To support friends in the DR, to an immigrant legal fund through my church |

| Vacation | $120 | Several trips to NM to see my college kid, a staycation with my sisters and cousin, a trip to the DR (long overdue) to see friends. I booked flights with points. |

| Gifts | $103 | Christmas, birthdays, a couple of graduations, so blessed to be able to celebrate with so many loved ones this year! |

| Miscellaneous | $87 | Skincare products (I buy nice stuff, I’m really addicted to skincare), postage, care packages for my college kids, cat sitter, uber and airport parking, graduation announcements for my college kid! |

| Healthcare (doctor and dentist copays) | $87 | Copays for myself and my two college-aged kids who are insured under my plan, we are relatively healthy and I’m so grateful, we had a couple of urgent care and one ED copay this year, includes PT and therapy copays |

| Pet care | $70 | Food, litter, and vet visits for George and Lucy |

| Healthcare: my contacts and glasses | $66 | Yearly contact supply, bought new glasses this year, plus exam (not cheap for middle-aged people) |

| Massage | $60 | monthly |

| Clothing | $52 | I bought a new leather purse from a sustainable company, replaced my 13-year-old Danskos, bought a new (on clearance) pair of hiking boots, and mostly thrift or get hand me downs for everything else (have been buying used for years, the thrifting scene is amazing here in CO). |

| Wine | $45 | Fancy boxed wine for my nightly glass of red |

| Phone- two phones through Republic wireless | $43 | Mine and my kid’s phones |

| Internet | $40 | Through Century Link |

| Pedicure | $40 | monthly |

| Coffee | $40 | Coffee out. I drink a lot of coffee. I bring it from home to work a fair amount but really enjoy almond milk lattes in the pm at work. |

| Tax prep | $18 | paid a pro to do this for me |

| Home décor | $15 | Mostly candles, I have a tiny problem |

| Haircut | $15 | my haircut, $60 three times per year |

| Subscriptions | $9 | NYT digital (must do the spelling bee every day) and Sojourner, I share Hulu with my sister |

| Monthly subtotal: | $3,601 | |

| Annual total: | $43,212 |

Credit Card Strategy

| Card Name | Rewards Type? | Bank/card company |

| Chase Sapphire Preferred® Card | Travel | Chase Bank (affiliate link) |

| Jet Blue | Travel | Barclays |

Leigh’s Questions For You:

1) Is my timeline of planning to downsize to a smaller home in two years reasonable? Or should I do it sooner?

- My current home is estimated to be worth $630k-650k. I bought this house in 2007 for $290k. My mortgage is paid off.

- The townhomes I’m interested in are in the $550k-$600k range.

2) Can I afford my Dominican Republic dream home?

3) Can I afford to cut back to 30 hours per week?

- If I decreased to 30 hours per week, my take-home pay would be $3,300/month.

Liz Frugalwoods’ Recommendations

I love that Leigh came to me for a Case Study at this juncture in her life. She’s done a great job with her finances up to this point and I’m confident we can help her chart a sustainable path forward. I think the overarching theme for Leigh is that she can do some of the things she wants to do, but not all of them, and not all at the same time. Let’s explore!

Leigh’s Question #1: Is my timeline of planning to downsize to a smaller home in two years reasonable? Or should I do it sooner?

This is a tough one. Normally, downsizing saves you money, but in this case:

- Leigh’s house is paid off and represents a significant percentage of her net worth.

- Smaller homes in her area cost almost exactly the same amount as her current home.

Given that, there’s really no benefit to downsizing.

Typically, the reason to downsize is to free up more of your assets as you age: you don’t need as much house, so you sell your big house and buy a cheaper, smaller home. But in Leigh’s desired area of Denver, she’d essentially get a smaller house for the same price, with all the hassles and expenses of selling, buying and moving. I understand the desire to live in a smaller place, but it doesn’t seem like there’s any financial upside to doing so. If anything, it’d be a financial detriment.

However, if Leigh is able to find a smaller place that costs WAY less than her current home, that would likely be a great financial decision. If, for example, she wanted to sell and move to a lower cost of living area, that could work in her favor. It’s a seller’s market and it’s hard to say what will happen with housing prices in the future.

Another idea: if Leigh really wants to unload her house during this hot market, she could sell it and then rent a smaller place until she finds an affordable smaller home to buy. However, that involves a fair amount of disruption without a guaranteed pay-off.

Leigh’s Question #2: Can I afford my Dominican Republic dream home?

I don’t know. We don’t have enough information to adequately answer this one. This is a great area for Leigh to dig into research!

-

Summer front porch reading at Leigh’s house How much are homes in the region she’s interested in?

- Would she qualify for a mortgage in the DR or would she need to buy a home in all cash?

- How much are taxes and insurance on a home in the DR?

- What are the other legal ramifications of owning a property there?

- How much would it cost to hire a caretaker to look in on the home while she’s out of the country?

- What are the laws governing AirBnB rentals (referral link).

- How much could she rent the property out for?

- How much is a cleaning service for cleaning the property in between guests?

Lots to explore! If Leigh runs the numbers and is able to purchase a property that would be a cash-flowing investment, that could be a great option. However, she can’t–at present–afford the carrying costs of two homes that don’t generate revenue.

The other consideration is whether or not she’d be able to rent out her Denver home while in the DR? It’s a tough financial proposition to own two homes and have one standing empty while you’re at the other. At the very least, she’d need to rent out one–if not both–to stay solvent.

Also, if Leigh is still working full-time, I’m wondering how much time she’d be able to spend in the DR? If it’s just a week here or there, I wonder if it wouldn’t be cheaper (and far less hassle) to rent an AirBnb/hotel room for those visits? Home ownership is a massive expense and hassle, and I wouldn’t enter into it unless there’s a compelling reason–financial or otherwise–to do so. If, on the other hand, she intends to spend a good portion of the year in the DR, might it make the most sense to sell her expensive Denver home and rent while she’s in the states? I think identifying how much time she’ll spend in each region will help inform her choice.

I’m a fan of long-term research and dreaming, so I think Leigh is very smart to start considering her options now.

Leigh’s Question #3: Can I afford to cut back to 30 hours per week?

This depends on what she decides to do regarding her Denver home and her DR dream home. Again, it’s a question of being able to do some, but not all, of her dreams.

Let’s break down the numbers:

- Leigh’s current monthly take-home: $4,458 (I’m omitting the monthly child support payment since she noted that will end when her youngest graduates from college)

- Leigh’s current monthly spending: $3,601

- Leigh’s monthly take-home if she reduced to 30 hours/week: $3,300

At her current spending level, a reduced salary would put her at a $300 deficit every month, which isn’t tenable. However, if Leigh is interested in reducing her monthly spending in the following discretionary categories, for example, she’d be able to break even at the very least:

- Restaurants: $230

- Vacation: $120

- Gifts: $103

- Miscellaneous: $87

- Massage: $60

- Clothing: $52

- Wine: $45

- Pedicures: $40

- Coffee: $40

- Haircuts: $15

- Home Decor: $15

It’s a question of trade-offs and of what Leigh most wants to do. I’m confident Leigh could make her monthly expenses work if she chooses to go down to 30 hours per week, in part because of her detailed, rigorous expense tracking.

The level of detail she provided shows that she is indeed tracking her spending every single month, which is the only way to create an accurate picture of your annual spending and how it fluctuates throughout the year. Very well done, Leigh! If you’re not tracking your spending in granular details, I use and recommend the free service from Personal Capital (affiliate link). Here’s my full write-up on why.

Another key question is whether or not Leigh’s employer offers a match on her 401k contributions and if she would still qualify for that if she reduced to 30 hours?

Let’s spend some time taking a look at her assets.

Leigh’s Assets

As I mentioned, Leigh’s primary asset is her paid-off home, which is valued at $630k-$650k. Setting that aside–since she’s living in it–Leigh’s assets total $554,014 and are broken down as follows:

1) Retirement: $374,064

Leigh is on track for a traditional retirement! Awesome work, Leigh! Let’s check in with our retirement rule of thumb:

Aim to save at least 1x your salary by 30, 3x by 40, 6x by 50, 8x by 60, and 10x by 67 (Fidelity).

Since Leigh is 49, we’ll go with 6x by age 50, which would be [($4,458 x 12) = $53,496] x 6 = $320,976. Perfecto!

Leigh should also go ahead and calculate her expected monthly Social Security payments by following these instructions on how to retrieve her earnings tables from ssa.gov (the government’s Social Security website). Knowing the dollar amount she can expect to receive from Social Security every month is a helpful factor in her retirement budget. General note: Social Security benefits increase the later you start taking them.

2) Cash: $33,950

Leigh has a robust emergency fund here, which is commendable! An emergency fund is cash–held in a checking or savings account–that equals three to six months’ worth of your expenses. Leigh spends $3,601 per month, which means she should target an emergency fund in the range of $10,803 (three months’ worth) to $21,606 (six months’ worth).

My question: why is this spread across three different accounts? If it were me, I’d consolidate to one high-interest account. Leigh noted she’s not earning any interest on this money, which is a lost opportunity. Even though you’re not going to earn millions of dollars through a high-interest savings account, you might as well earn something. Something is better than nothing! Always question if your money isn’t earning anything! Here’s the math on that:

If Leigh moved this $33,950 into, for example, American Express’ High Yield Savings account, which earns 0.65% interest as of this writing, in one year, her $33,950 would grow to $34,171 (affiliate link). She’d earn $221 per year just for having her money in this high interest account!

3) Taxable Investments: $52,000

I’m not familiar with the brokerage Thrivent–where Leigh’s investment accounts are–so I checked out their website and I have to say, I did not like what I saw:

- They force you to call an advisor in order to open/view their investment products.

- They do not clearly state their fees or expense ratios.

Both of these things indicate one thing to me: they’re over-charging for their service. Probably WAY over-charging. Now I might be wrong, but I’m willing to bet two corndogs I’m not. Why force a customer to work through an advisor and not share your fees publicly if the fees are low?

Given my endless curiosity, I googled around and found this PDF, which breaks down Thrivent’s fees. I am owed two corndogs:

For the “moderately aggressive allocation” (TMAAX) Leigh’s invested in, Thrivent is charging her an eye-watering 1.33% annually. What does that mean for Leigh?

- Leigh has a Roth IRA, a Traditional IRA and a taxable investment account through Thrivent, which total: $261,064.

- Thrivent charges her 1.33% annually on that total amount AND they charged her 5.50% on her initial investment (this is called a “sales charge” or “front end charge”). Yes indeed, some unscrupulous funds skim off a percentage of your initial investment when you put your money into their fund.

- To calculate what Leigh is losing in fees, I used this calculator from BankRate.com and input the following variables:

If Leigh were to remain invested in these funds for the next 20 years, and the stock market delivered its annual average 6% return, her investments will stand at $605,339 and she will have lost a total of $231,929 to Thrivent, broken down as follows:

$121,781 in opportunity costs (in other words, what the money she paid to fees could’ve earned her if invested in the market)

+ $110,148 in fees (in other words, payments to Thrivent)

$231,929 lost to Thrivent’s fees

That’s a lot of money! Like, A LOT OF MONEY! This is why it is so crucial to know the expense ratios and fees on your investment accounts. It’s not a small thing, people! And while 1.33% might sound small, it’s demonstrably not!!!!

I want to point out that it’s not like Thrivent has some special sauce they’re sprinkling onto her investments. There is only one stock market, people. Thrivent is investing in the same stock market that I invest in, but I do it myself and pay only 0.015% in fees annually.

PANIC at the financial disco!!!!

I want to be crystal clear about something: I am NOT blaming or shaming Leigh. This is not her fault. This is something MOST people do not understand and MOST people overpay and lose money to high fees every single year. This isn’t something she “should’ve known” or “is doing wrong.” Rather, it’s a great wake-up call to do something about it ASAP. Like, today.

I also feel compelled to share how abhorrent I find this because Thrivent is a Lutheran company. They purport they’ve, “…been helping others live more generous lives while guiding them on their financial path” and that they, “…help all Christian denominations achieve financial clarity.” In reality, what they’re doing is charging people like Leigh out the nose!

To be clear, I have no problem with businesses making money. Businesses are supposed to make money! What I have a real problem with is a business that purports to adhere to Christian values while taking gross advantage of people like Leigh. It really boils my blood. If you want to charge high fees? Be upfront about it. Explain to people–in plain English–what you’re charging them and why.

Explain what you’re doing with Leigh’s $231,929. Explain why you should take that money away from her.

I rarely rant, but the moral overtones of Thrivent’s marketing feels harmful and disingenuous when you dig into what they’re charging people. Whew, ok, I’ll try and cool off here.

Wondering how to find a fund’s expense ratio? Check out the tutorial in this Case Study.

In STARK contrast to Thrivent, the following three brokerages offer DIY investment options and are extremely forthright about their fees:

- Fidelity’s Total Market Index Fund (FSKAX) has an expense ratio of 0.015%

- Charles Schwab’s Total Market Index Fund (SWTSX) has an expense ratio of 0.03%

- Vanguard’s Total Market Index Fund (VTSAX) has an expense ratio of 0.04%

What you’ll note with all of these brokerages is that they clearly identify this information on their websites. Anyone can read it, understand it and invest in it on their own. They’re proud of the services they’re providing, so they don’t try to cloak it behind clever marketing or force you to call an advisor.

Let’s take a look at where Leigh’s money would be if she were instead invested with a brokerage with an expense ratio of 0.015%:

- If Leigh were to remain invested for the next 20 years, and the stock market delivered its annual average 6% return, her investments would stand at $833,925 and she would’ve lost a total of $2,031 in fees with a $1,311 opportunity cost. That is an astronomical difference from Thrivent.

If Leigh stays with Thrivent, she stands to pay them $231,929

If she switches to a brokerage with a 0.015% expense ratio, she’ll pay them a mere $3,342

I think you know my advice with regard to Thrivent…

Unfortunately, Leigh’s employer-sponsored 401k is with TIAA-CREF, which is also not known for low fees. I can’t find the fees on Leigh’s 401k without knowing what it’s invested in at TIAA-CREF, but I urge her to do some digging to find that information. If Leigh’s employer offers another brokerage option for her 401k, she should investigate those fees and compare them to TIAA-CREF’s.

4) Variable Annuity: $94,000

In general, I am not a fan of annuities because of the fees they charge. Annuities are essentially a type of insurance, which means you’re transferring some amount of risk to the insurer. I think the easiest way to describe a variable annuity is that it’s invested in the stock market and you will receive a specified percentage of money as a pay-out once you are out of the accumulation phase and in the annuitization (pay-out) phase.

You are basically betting that this percentage will be higher than what the market can deliver you on its own. For this risk mitigation, you are paying decently high fees to your broker. I encourage anyone looking into annuities to read this page from the US Securities and Exchange Commission (investor.gov). Anytime a financial professional tries to sell you a product, feel enfranchised to google it and read up on it on your own.

With most annuities, it’s not possible to cash them out without incurring serious penalties. However, Leigh should go ahead and read the prospectus for her specific variable annuity just to confirm there’s no option for cashing this out without incurring astronomical fees.

Summary Suggestions for Leigh:

- Start researching the process for purchasing a home in the Dominican Republic:

- Housing prices.

- The process/laws for getting a mortgage, taxes, insurance, etc.

- The process/laws for renting out a property on AirBnb or as a long-term rental (referral link).

- The availability of a property manager/AirBnb manager and cleaners.

- Consider how long she’d be spending in each country and whether it would make sense to own properties in both locations OR if it would be more tenable to rent in one location and own in the other.

- Consider the trade-offs for reducing her work to 30 hours/week:

- There’s no right or wrong: it’s a question of trade-offs.

- What is she willing to eliminate from her monthly budget in order to live on a smaller salary?

- Is buying a home in the DR her #1 priority? If so, she’ll need to continue working 40 hours per week in order to afford it.

- Look into moving her investments over to a brokerage that offers low-fee investment options. Do this ASAP as she’s losing money every day to Thrivent’s excessive fees.

- Read the prospectus on her variable annuity from Thrivent just in case there’s a way for her to cash this out without incurring fees.

- Ask her HR department if there’s an option other than TIAA-CREF for her 401k. Read up and compare the fees (aka expense ratios).

- Explore consolidating her cash accounts and moving them to a high-yield savings account so that she’s earning interest.

- Calculate her expected Social Security payments, so that she has a sense of what to expect in retirement.

- Continue contributing to her employer-sponsored 401k so that she stays on track for retirement.

Ok Frugalwoods nation, what advice do you have for Leigh? We’ll both reply to comments, so please feel free to ask questions!

Would you like your own case study to appear here on Frugalwoods? Email me (mrs@frugalwoods.com) your brief story and we’ll talk.

Thanks for this! I appreciate your rant against brokerages like Thrivent, and like you I find it particularly galling when those types of overcharges are cloaked in moralistic language.

Re: TIAA — I have a 403b through TIAA and they aren’t terrible. They aren’t amazing, but the fees I pay on TIAA products (which are the best options in one of my accounts range from .17-.23). And the other account w/ TIAA offers Vanguard Institutional funds ranging from .04-.08. So not the best in the world, but not the worst I’ve seen either. Other plans might vary, though.

We recently moved to Canada, and my employer plan up here is much closer to the Thrivent model, unfortunately. There’s no front load, but the fees are in the 1.1 – 1.2% range. Because of that, I contribute enough to get the match, and then I do the rest in an individual plan where I can use Vanguard ETFs. Before we moved, I’d read that Canada’s personal finance was like the US ~10 years ago, and I’ve found that to be fairly accurate.

I agree about TIAA. The fees on their branded products can be higher, but if you go a DIY route and select your own investments, you can control the expense ratios better. I have a 403b and 457 from a previous employer through TIAA, and the only fees I pay are the Vanguard expense ratios. I’m fine leaving those investments in place for the time being, but my current 401k through Empower will get moved the day I leave my company because the fees are all so high, even with DIYing the investments.

I recommend Leigh look at what options are available to her in her TIAA plan, review the expense ratios, and consider building a total stock market package from her plan’s offerings. Bogleheads has a great article for that: https://www.bogleheads.org/wiki/Approximating_total_stock_market

She can adjust accordingly with whatever percentage of bonds she prefers to carry in that portfolio.

Hi Lisa, this is interesting! While TIAA is my only option at work, I hadn’t realized I could DIY a better mix for myself. I’m currently in a targeted retirement fund.

Leigh, check out your employer’s other offerings! Each company gets to choose what’s available to their employees. You should be able to get a full list of stock symbols, fund name, investment type (small, mid, large cap), and the expense ratio. Once I had this list, I used the Bogleheads article to approximate VTSAX, which you’ll learn about as you read Collins’s The Simple Path to Wealth! Best of luck!

Lisa, thank you! I have to admit that right now your advice doesn’t make much sense, I clearly need to read up on this! Appreciate your advice.

Good case study, thank you Mrs FW and Leigh. I agree that dreaming and researching are a great combo! And Mrs FW, why don’t you tell us what you REALLY think of Thrivent and similar? ;p

Re: downsizing — I have also been tempted to exchange a big house for something easier to maintain. But it doesn’t make sense for a number of reasons, one being the aforementioned bananas housing market. As an alternative, it occurred to me that I could take steps to “simplify in place.” Get rid of things AS IF we were moving to a smaller place. Stop using — and therefore no longer have to clean — spaces that we only use because they’re there. Part of my frustration with the big house is the time it takes to keep it tidy and clean. Cleaning goes a lot faster when there aren’t hundreds of items requiring complicated dusting… And rarely-used rooms can be rarely-cleaned rooms.

I realize this doesn’t address the issues of fixing broken stuff, maintaining heating and cooling systems, and caring for the outside of the property. But the mindset has helped me feel like I’m moving in the right direction without literally moving. Now to get my spouse on board, ahem.

Good luck with your transition into this next phase of life, Leigh! You have cultivated many wonderful people and pursuits in your life, which is inspiring.

That is a great idea. Small houses aren’t always the best for aging in place because washrooms tend to be too small for walkers. Laundry rooms tend to be in the basement. A bigger house can still be minimalistic.

My brother is in a similar situation. An empty-nester who wants to downsize but smaller homes are the same cost as his current home. He closed off the second story and moved his bedroom to the first floor. He has also gotten rid of a lot of stuff so that when the opportunity arises it’s easier for him to move to a smaller home.

Stephanie, thank you!! I appreciate this “reframe” of how to think about a big house. There are ways we can live smaller in a big house, that’s clear from your story.

On a side note, it’s kind of you to imagine that I’m industriously cleaning and dusting my house. Haha! Not a very good cleaner over here.

Thank you for your comment! It means a lot.

OH my goodness regarding your downsizing paragraph I am doing exactly the same thing.

If part of Leigh’s desire to downsize is maintenance and ease of travel, have you considered finding a roommate who could share the space? Maybe you could charge below market rent and have an agreement on certain tasks you’d like off your plate (yardwork, minor repairs, etc) and caretaking while you’re in the DR. I bet there are lots of people who would love this type of arrangement and it could give some of the benefits of downsizing without losing your community.

Second, I would suggest not trying to buy a second property overseas without lots of research and ideally talking to others who’ve done the same. Airbnb is essentially a full-time job with high expectations of customer service and the chance of rude guests. You’d also likely need to carry extra liability. You can hire it out but again, extra work.

I think a trying a long term vacation rental would be a better first step vs. Investing so much capital in a project that would have a lower ROI and the possibility of a lot of stress. If you end up having an emergency that requires you to change your plans, your only opportunity cost is the duration of your lease. (I say this as someone who had this happen…we had just bought a fixer upper in the country and then found out my daughter would need heart surgery at the hospital 10 minutes from our current home. 2 years out we are still not done with the reno and are trying to finish so we can sell. We’ve been paying a mortgage on a place we’ve never gotten to live in- fortunately bc of frugality it’s been within our means…but it’s still incredibly frustrating).

I was thinking along exactly the same lines as you, Rachel! I thought “roommate” immediately, especially as she mentions her recent divorce and kids not being around a few times. Sure, a roomie isn’t the same as having your adult children around, but it’s extra income which come help her get back to fewer work hours and, as you mentioned, the potential for some work trade depending on the person. I’m in the Denver area as well in a highly-desirable community… it’s insanity with these home prices and especially when the inventory in your area isn’t high. Some realtors sure are making a massive profit right now. 😀

I also agree on the long-term vacation rental. That way, Leigh has a home base, one property to maintain, and doesn’t have to deal w/renting out a foreign property and paying someone to manage it in the event something needs to be fixed. If Leigh wants to spend the majority of time in the DR, then she could consider flipping that around and owning there, but it sounds like she loves where she’s at in Denver and I’ll tell ya… having a community of caring, loving, friendly individuals is irreplaceable.

It sounds like Leigh has a variety of options available to her and that’s super exciting! She’s had a lot of transitions and I’m excited that she’s planning her next chapter thoughtfully, starting from a wonderful place already!

I had this thought as well, and also thought Leigh could dabble in Airbnb with her Denver house as part of researching a house in the DR. It would be a low-commitment way to see if she likes Airbnb, and she could black out dates when her kids will be staying with her so she has the whole house when she wants it.

You guys, roommate!! Why hadn’t I thought of this yet?! That seems like something worth exploring. Especially if I could find someone who is handy.

Thank you for your thoughts as well about the DR. Definitely a lot for me to consider. I don’t want to get in over my head.

KP , cheers to Denver housing craziness! What a ride.

I do love my neighborhood community. And you are right, that’s pretty priceless.

Could you build a form of granny suite at your house in Denver and rent out the main house? A house can be very cheap in the Dominican Republic and maintenance and cleaning are not very expensive ( materials are more dear then in the US) . Security would be a big factor, a empty house will get robbed and airco and such stollen. I would rent untill you want to be at least 8 months of the year on the island.

On cooking and eating healthier for less money, don’t wait for evening to think about it, do a meal planning and prep cook one day and get about 5/6 days of dinner and lunch out of it.

Greetings from a island dweller.

While the housing market in Denver is insane, there may be a deal to be found if you put your wishes out there and you’re not in a rush. If you let all your neighbors know, perhaps somebody will someday want to sell to you directly which can really reduce costs (I sold my last house without a realtor to keep price lower). It may be worth a significant penny to them to not have to go through all the hassle of marketing the house, fixing it up for strangers, etc. Plus knowing you and that you are part of the community may inspire them to keep cost a bit lower as well. There may also be a diamond in the rough to be found. Good luck!

I would really advise against building a home in a place where you aren’t directly there to see the process through. It’s so easy to romanticise the building of our own houses, but it’s not for the feint of heart. I would only do this if you want to live there permanently on retirement, and did this in your early retirement years. If you only want to say a few weeks or months a year, financially its unlikely to make sense, especially with hurricane risk and damage that can occur. Staying in a rental or hotel for shorter periods of time will free you up to actually enjoy your time there (unless fun for you is haggling with contractors about building a septic tank or whatever 😂

Gaby, of course this would be complicated! The only reason I’m considering building is because several of my dear Dominican friends are contractors and tradesmen. So I think I’d have people I could trust doing the work.

Laughed at the Thrivent rant. My husband’s employer’s 401k plan also has a shocking 1.5% expense ratio. When he met with HR to set it up, the lady said, “We partner with a company with really low fees.” Husband asked what it was and then his jaw dropped. “That’s NOT low! Not even close! That’s literally 37 times higher than the fees I’m paying Vanguard.” Poor HR lady was not expecting a rant on expense ratios….

And I find it not very christian like to state they are helping all christians.

I Bonds are a good place to park extra cash now. They are paying 9%plus for the next 6 months. Readjusted for inflation every 6 months. You can only get them thru Treasury Direct and only $10,000/year. Have to hold at least one year. Research and see if it is right for you. You lose only 3 months early if cashed out between 1 and 5 years. Still better than .065.

Mentions of cats, but no fotos of cats. Pay the cat tax!

Love this comment! 😀

Me too!! Peep fat George hiding at my side as I read The Guide in the picture above. Sneaky boy!! 😂 Lucy declined to be photographed for public consumption. She’s reclusive.

We rent out a downstairs bedroom/bath in our empty nest home regularly. It could be a great source of extra income for you to be able to return to 3 day work week, save for your DM place, or easily pay for home upgrades and repairs. A local college is a good source of renters: especially grad students, college athletes and incoming assistant coaches. All have very busy lives and only come home to sleep! If you are only spending a few weeks a year in DM, it seems like renting an air bnb is the way to go.

Mrs. F is spot on. The only thing I didn’t see mentioned is that a townhouse will actually be more expensive (once you add in monthly HOA fees and there also can be assessments), and with new construction it can be hard to determine quality until you are in it. I wonder if you can do things to help lower your house expenses that would also boost resale when you sell it (insulation, solar, low flush/flow plumbing, etc.). IME, having a second home is a huge time and $$ sink, especially one that could get hit by a hurricane, plus I think you are too close to your current income/expenses. IME, having a rental also takes time and you need to plan that things (aka, $$) will always go wrong. Maybe you can try AirBnB with your current home from time to time? Definitely keep an eye on the DR market and follow through on all the things Mrs. F recommends, but take your time before you leap. You are pretty young to have grown kids, so you have a lot of options and time to do things. Good luck!

Thank you Liz for the Thrivent rant! You inspired me to go through my accounts and I discovered some funds that had .6-.9% expensive ratios!! Personal capital looks it up for you in the “investment checkup” tab. Now they are 95% sold (except for a tiny bit that was short term) and will be reallocated to my usual index funds.

Leigh, have you spoken to other expats (esp Americans) who have retired to the Dominican Republic? Retiring overseas has some real complications, like changing rules around special visas for retirees. Thailand and Malaysia have both changed theirs in the past few years, which have left retirees scrambling. You also won’t be able to use Medicare overseas, so will need to make sure you have private insurance that will cover your time abroad (routine care may be cheap, but major emergencies are still expensive). If you were looking at a US territory like Puerto Rico, both these issues would be simpler, but your heart is clearly set on retiring to the DR for good reasons. I would though caution you to wait on the very substantial financial and time commitment of building or buying a house there until you are ready to live there. Then you will reduce the risk of not knowing how visas, your health, and any country specific major changes in things like crime and climate will develop over the next 15 years. You also then have more financial flexibility in the meantime and won’t have to worry about maintenance or damage.

Regarding your work, have you considered making wednesdays your day off? It would break up the week and might make 4 days feel more manageable. On the other hand, you may feel that if you can only work 3 days a week your stress level will be Low enough that you are happy to trade off coffees, massages, pedicures, and eating out. It is all about trade offs and figuring out what makes you the most fulfilled.

A very neat case and Leigh is my kind of the person ;-). She’s frugal, but doesn’t deprive herself of simple life pleasures. It’s too bad her marriage hasn’t worked out, but at least the partners were very amicable with the divorce. I wish her good luck finding a new good man if that’s what she would like to in the future.

I saw two students in the story but I didn’t notice any mention of their college expenses (tuition and board/food, miscellaneous exp. while they are not home). Is this part of expenses accounted for anywhere or are Leigh “off the hook” for this major expense? I didn’t read very thoroughly so I might have missed.

I don’t have much to add except that I’m probably even more conservative than Mrs. FW.

I deem it too tight to cut hours to 30 for $3,300/mo. and cover $3k/mo expenses (in case Leigh even agrees to cut $600 of her monthly expenses). I think I’m spooked by the current inflation and we ain’t seen the full inflation of 2022 this year yet. Let’s wait for the grocery prices in Oct through Jan first. The crazy Kremlin mob are trying to inflict as much pain on the world as possible since it didn’t get what it wanted the easy way. Fidelity analysts agree that the next 2-3 years will not be easy for agriculture worldwide.

One more thing. Mrs. FW advised to go with HY savings account at AmEx, but I got an email from AllyBank and my savings get 0.75% now. Woohoo!! LOL

Unless the taxes are killing you …I would stay put! Kids still come & go post college- you like & love them so welcome them through new jobs , lay offs romances , roommate hassles etc. Plenty of space and extra bedrooms. Time to turn a bedroom into a hobby room! STAY PUT.

Living mortgage free is GOLDEN… and the last of the American dreams left.

OMG Thrivenet….. enough has been said on this = switch yesterday!

James, that’s true!! I do like my kids.

I would really explore the possibilities of utilizing your paid off house differently and not sell. You can rent it out for income and use that to rent a smaller place, get a roommate, build an ADU and live in that…there may be other ideas I am missing. Paid off mortgage is a great problem to have!

Thank you, Mrs Frugalwoods, for the expense ratio rant. It was clear and non -shaming and vital for Leigh and all of your readers. On that same vein I would urge Leigh to consider moving her accounts out of Wells Fargo. She seems like a person who cares deeply about social responsibility. Google Wells Fargo to read about their deceptive selling practices and homophobia. Please find a local bank or credit union or an on-line option that cares about its customers, its employees and the planet. I wish you all the best, Leigh!

Faith, you are the second person in the past month who has educated me about some of Wells Fargo’s less than stellar track record on social issues. Thanks for mentioning it!

I loved this story, especially because I’m planning a move to Mexico and am currently learning Spanish. The neighborhood/community Leigh describes is what I’m hoping to find/build, not to mention all the time outside! As a fellow educator who’s also single and the same age, this was really cool for me to read! She feels like a kindred spirit. 🙂

I’m glad you got the great advice on your investments, Leigh, but I’m in awe of all you have in savings! WTG!

JH, hola, que tál? What a cool deal that you and I share the desire to live abroad and speak and immerse in Spanish!!

Thanks for taking the time to comment. I’m really grateful.

Question re: the 401k savings advice: I noticed you used Leigh’s net income to calculate whether she’s on track. I looked at the Fidelity link but it wasn’t clear if it should be calculated with net income or gross income? Thank you! Great case study.

Liz above is questioning if the target X salary is gross or net. I believe the recommendation is gross and depending on the source varies between 10x – 12x your salary. She could still be on track if part of her plan will be downsize and move to a lower cost of living area. We also don’t know what your SS benefits will be.

I am so grateful for each reply so far! I’m looking through them ( as I eat my packed lunch at work today) and have a giant smile on my face. I plan to comment individually but just wanted to say thank you for the kind and generous advice.

AirBnb on the surface looks like a good deal, but it is a time killer and a lot of additional work, probably equal to the time she wants to cut from her day job. Many people think about runing a short term rental oeration because of intangib things, such as great weather and a cheaper economy. Living and working in a third world country, younhave to understand that it IS a third world country because of the lack of a lot of American amenities. Airbnb’s around the world are now beimg much more tightly regulsted and tsxed by their muicipalities, so its not the cash cow it oncewas. I haveAirBnb’d for noine years and have been taxed and bylawed out of the business in Toronto. I got out in time.

Thank you, Mrs. F. This was such a great and thorough presentation by both Leigh and you. Your dissection of the investment account is so illustrative; and I would imagine so very helpful. As always, a gift to read and analyze along with you. Great luck Leigh. You have done such good work so far.

Paul, thank you. Your kind words made me smile.

Another thing that Leigh might want to consider is renting out a room to a college or overseas exchange student, during term time. It’s very popular in my home town for empty nesters to host a young student and give them a homely environment. It tends to attract the quieter type of student who is not attracted to college living and overseas students who want to experience the local culture and to practice speaking English.

Hello! before cutting back on hours, live on the amount that she would have if she did cut back for a number of months. In 6 months she would have a realistic picture of what the choice really looks like.

Hate to squash a dream the DR home has far more draw backs than positives. As several have mentioned being a long distance “landlord” would leave Leigh open to theft, etc. Long term rental makes long term financial sense without the risks.

Leigh, I loved reading your story, in part because we have some things in common; like you, I’ve spent a lot of time in the Dominican Republic, and while my son is quite a bit younger than your children, I also dream about some day spending more consistent time in the Caribbean. Like Gaby and Rachel (above), however, I would caution against building something yourself unless you were going to 1) be there full-time to supervise the build, and 2) were planning on living there a good part of the year. As you know, buildings in hot, tropical climates require quite a lot of upkeep, and it seems to me that it’s only really worth it to invest money in a property and its maintenance if you get to enjoy it. Although I don’t have firsthand experience of it, from friends’ accounts, building (or restoring a building) in the DR can also be particularly challenging, so you would want to be in a position to weather those ups and downs in terms of both time and money. You don’t mention what part of the country you’re attracted to (looked like one photo was from Santiago?), but I know that in places like Cabarete or Samaná there are plenty of condos and even small houses that can be rented at reasonable rates longer-term (anywhere from a few weeks to several months) through property-management companies. That might be a way to afford longer stays without all of the potential hassles and headaches related to home ownership abroad. Whatever you decide to do, you’re in a great position to be able to explore so many options!

Hi Emily, it’s fun to read about someone else who loves the DR!! My good friends live in Puerto Plata, so I should look at Cabarete and Sosua. Thanks for the feedback on building. It’s going to be fun to do research!!

This is coming in large part from my status as a renter, but I strongly recommend that you keep your house. A paid-off place in Denver is like gold! Personally, I’d wait until the housing market has calmed down a bit before making any firm decisions. (It has to calm down eventually… right? Maybe?)

I think it’s awesome that you have a job you love. As a parent of a kid recently diagnosed with T1D, I can tell you that our diabetes educator in the hospital was just AMAZING. The knowledge and reassurance you and your colleagues provide are invaluable. You make such an important difference!

That said, I always think people should cut their hours if they can afford to do so (and I think you can).

$76 K, big love to you on your T1d journey!!

$76K, big love to you and your family on your T1d journey!!

“Leigh noted she’s not earning any interest on this money, which is a lost opportunity.”

Also – with inflation so crazy high, she’s losing money every day by keeping more than she needs in cash. Cash = money not growing at the rate of inflation.

Wow! Such an impressive case study. I liked the suggestions of getting a roommate and to AirBnb the house when she’s not in it. I will add that it could be a good idea to rent a private room in the house, especially if she’s close with her community. There could be friends, in-laws and family members of neighbors who want to visit them and welcome a private space under someone else’s roof. This way she can choose when she has a roommate but also generate income. Nice job overall.

Yes those fees are crazy stupid and 100% the average person is none the wiser as these firms quote that they have your best interests are heart. Wonderful to own your own home and I agree about staying in your own home mortgage free if a smaller house is going to be worth the same and also you love the area, neighbours and have a existing network. As far as working 4 days a week is getting to you I can offer you some great advice on this one. My sister was ill and had to take a couple of years off work and went back 2 days a week for a period of time before transitioning to 4 days a week. She worked 2 days had a day off and 2 days. So working Monday & Tuesday – YEH a DAY OFF then work Thursday & Friday so in reality you are only working 2 days and then you get a day off then another 2 days and 2 days of the weekend off. It was brilliant because she wasn’t tied and having the day off in the middle was great – working 4 days straight or 2 days straight? I know which one would appeal to me. I think this is a great option because you wouldn’t feel so tired and working 2 days and looking forward to a day off to meet up for coffee, go to the library, a bush walk or hike on your day off then you can still look forward to the weekend. My other advice is since you have a big house is to look at short term international students. You can look up companies in your town and often they need a place for 4 weeks [or longer] when they arrive to get their bearings and then they go off and rent with other students. You get paid really well and provide food [I have done this and I had to provide breakfast and the evening meal]. They do their own washing once a week and have access to internet [which is extra]. In Australia this money is Tax Free as you are “hosting a student” through a company who brings students over to learn English. With Covid I stopped doing this a couple of years ago however I see they are starting to bring back International Students again. You can still work your 4 days a week [2+2] and host a student every second month maybe in your spare room. It would be better to host 2 students at a time [since it sounds like you have the room] because they then have a friend and feel more comfortable if another person from their country is living in the same house. You could do this while you are working your 4 day week to built up a financial nest egg for retirement. Make your mortgage free house work for you and buying and selling is so stressful and due to closing costs and stamp duty you do loose thousands even if you find something suitable and packing up and moving is not for the fainthearted particularly if you have lived in your home since your kids were toddlers. Look into reputable company in your city. Go to a couple fill out forms you have to show pictures of your houses, room etc. and then decide who you would like to use. When you get paid, weekly, fortnightly etc. food costs comes out of the total amount they pay you. All the best.

Liked the comment about the granny suite, or an ADU, then rent out the house.

I just want to throw it out there that you could pull out your 401k every other year or something. Roll it into your existing rollover IRA account (not Thrivent). Most people only do it when they change jobs, but you do not have to wait until that time. I did this a few times just because my 401k was quite limited. To be clear, I continued to contribute to my 401k every paycheck, but then rolled it over to an outside company every couple of years and kept my same job.

The expense ratios are atrocious. You should not pay more than 0.15% in expense ratios, no 12b-1 fees, no sales loads (commissions) and no back end loads.

Read J.L. Collins “The simple path to wealth” . It will give you the best direction on managing your investments, And of course like mentioned earlier use an investment company like Vanguard.

Mo, yes, that book is now on hold at the library! Thank you. Looking forward to educating myself further.

I would continue to work 5 days and would save up with cash and build a granny flat. Once that is paid, I would drop to 30 hours. I would rent it and then would use the money coming in to fund regular trips to/rent in the Dominican Republic. But I wouldn’t own a holiday home there.

Chiming in to say to things – have not read through all comments so may be repetitive:

1. I don’t thin you should build in DR. Too complicated to maintain and deal with when you are not there. Better to rent when you want to go.

2. Agree with comments I saw about renting space in your current house and suggests looking into renting to travel nurses. They often have short contracts (3 months or maybe even less) so you do not have to worry about having someone long term who you might not want to deal with. They also usually receive a stipend for rent so are not as worried about costs as many others. I have not done this myself but a good freind has been doing this for years with great success.

Monica, I have seriously been thinking about renting to travel nurses. They seem like the perfect tenants, and I’m pretty near a few hospitals. Thanks for the suggestion!

I agree, travel nurses sound like a great idea! Plus, I imagine once you’re plugged into the nursing network, you’d have a steady pipeline of tenants!

One budget item to look at is car insurance. $175/month seems really high unless you’re covering the kids too, and if you are, shouldn’t that be an expense that you and your ex-partner share? I would shop around for quotes and see if you can get that lowered.

ABAA, you’re right! I probably am paying too much for car insurance. I was covering kids but now just myself. Thanks for having an eagle-eye on my expenses!

Hello Leigh! I applaud your careful planning. I agree with considering how much time you will spend in DR. A monthly AirBnB may be sufficient. Also, as an aside. I am the Executive Director of the Diabetes Association of Atl and we are always contracting with Diabetes Educators to provide virtual education. We are currently working with an Educator in Denver! Feel free to contact me and Best Wishes!

Hi Karla, thank you for your kind words! I wasn’t sure of the best way to reach out, so I went ahead and sent you a LinkedIn request. You’re doing important work!!

Question for Mrs FW – my husband and I both have Roth IRAs with Thrivent. Can we just call up and switch to Vanguard? Capital gains fees? Thanks!

Yes, I want to know the answer to this as well!

Kelly and Leigh: great question! Yes, you can do it on your own. Here’s a Nerd Wallet article on the process. If you have an online account with Thrivent, you can likely execute the switch online. If not, I imagine you’ll need to call them. For whichever brokerage you choose, start online with creating an account and call them if you run into snags. In general, I’ve found brokerages to be pretty helpful over the phone–they’re accustomed to doing this kind of thing. GOOD LUCK! And relish all the money you’ll be saving!

If you’re having trouble prioritizing, I’d recommend living with your new salary exclusively for at least a month (better two or three) before you cut the hours. You can easily afford it! But give yourself a moment to make sure it’s actually what you want. Don’t exceed, put all that cash difference in your emergency fund since you’ll have less buffer income later to rebuild it if needed, and see how you feel. I personally love my monthly pedicures and massages, going out, vacation spending, and all the other things on the chopping block.

You’re doing a great job 🙂

Kristine, yes, you’re exactly right! Thank you. I can try it out and see how it feels. My work is pretty emotionally taxing and I do enjoy the self-care of all those wonderful “chopping block” items.

Great case study. I invest with St James Place in the UK. This study has made me think about their fees.

Leigh sounds like she lives in a great neighbourhood. Instead of moving could Leigh consider renting one of her rooms out, to make extra money. This would be helpful if looking to go part time.

Really good case study. One thought: given the ten-year time horizon, perhaps a partner could be part of the plan? I know we all like to think that money isn’t important when it comes to love, but it still comes in handy. And I wonder sometimes if a wish to “protect our assets” gets in the way of finding a partner, particularly later in life.

And if Leigh were to be with someone in a similar position to her, they could downsize together (and Leigh would be able to access half her home equity). Also, there would be someone to share cooking and chores with – as well as life. I am conscious that this isn’t the type of advice that you expect on financial websites, but I think that Frugalwoods is about good lifestyles more generally, hence raising this.

Good luck and best wishes with whatever path you follow 😁

i will not beat the dead DR horse on how much work it to simply buy a turn key rental and manage let alone build something from afar with limited resources, skills, experience and time. it will suck from your delightful life10+ hours/week during build process and even 5+/week managing a completed one. that is not even counting stress. i own a business that buys and remodels houses then rents them on airbnb for 10+ years now and it is not a process to be taken lightly. we have teams of professionals we employ to do each step and it is still takes mountains of times. On a brighter note, we housing has never been more fluid and easy to explore maximizing your incredible asset in denver. we host traveling nurses all the time and they are great. rotating doctors are great as well. all they do is work and sleep. airbnb is so easy to find people to host. the KEY is being very picky because it is your home. cherry pick precisely what you want and who you want to live with. converting to ADU is such a heroic effort compared to making spare bedroom cute for guest. you could bring in $1,000-$2,000/month with only slight effort and compromise. it would allow the 30 hours/week with ease. i have a friend who only rented monday-friday for working folks to live without commute. the options are limitless and COMPLETELY in your control with little expense or effort beyond $1,000 or $2,000 to tidy up and upgrade (which you may love anyway). you have created an amazing life and most importantly have an even better attitude. enjoy it and take on small enjoyable projects at your pace. everyone talks about airbnb from ROI perspective and few talk about the fact that it can be really fun. best of luck

I have TIAA at work and I love it, but I always avoid target funds because of the higher fees. And regarding dinner, we stopped eating it. I don’t cook and we just have a snack if necessary. No more dinner stress!

One point to also consider down the line if you do look to move to a townhome or condo are the assessments. We were chatting with a couple who got a great deal on a condo but the occupancy rate wasn’t superb for the building and their assessments for new roof one year, balcony railings the next, pavement repairs in the parking lot, etc. were much much higher due to the condos that weren’t sold. They were stuck financially as they’d anticipated the HOA but not ever increasing assessments. (This was in Florida… But still it got my attention 😃)

Good luck, Leigh! I originally went to hop on regarding looking for a roommate, but it looks like that’s been brought up multiple times 🙂 Best of luck if you go that route, too!

I did this…last year I bought my retirement home in the DR, Bavaro-Punta Cana area, which I now rent on Airbnb and other platforms. I am not quite ready to retire yet, but it was a good investment. It is a beautiful 3/2, two-floor house with a nice yard and private pool, located in a gated residential community, 24/7 security. I bought it brand new and it cost me $125k. Sometimes people will advise against what they don’t know or would not risk doing themselves. There are lots of expats living in the DR.

Leigh, if you would like to check out my house, please search for Villa Nadia on airbnb, and feel free to reach out, as I would love to tell you about my experience buying the house and how I am managing the rental. For me, it is easy to travel to the DR because I live in FL and flights are usually cheap and fast; however, I leave the house empty and available to produce income.

Best of luck!

@Liz can you do a blog/review of the robo-investments out there, like Betterment. I see their fees are way below Thrivent, but I’m lacking the confidence to go full DIY like the ones you’ve listed.

The neighbourhood sounds like it has an amazing sense of community which is really hard to find! Considering you will not save much changing houses to a smaller one, I would really reconsider moving. This really sounds like the kind of community one would want to grow old in!

Downsizing from the current house will be disappointing as she would end up owning something of lesser value for resale and net cash out from the house will be sucked up by closing costs/realtors fees/etc. Would make sense only if she was leaving the area for good. Selling/buying/moving is exhausting and she likes her current setup and is a “homebody” so why not stay in the home that gives you warm fuzzies like she described. Better to keep the house and rent it out while finding an apartment to rent worse comes to worse.

Regarding the DR, she only spends several weeks a year there so I like Mrs. F’s suggestion of AirBNB or similar. Perhaps she could ask her local friends to help find an appropriate situation for her- 1 month rental? Housesitting for a local traveler? Etc.Locals will have access to better deals without the AirBNB markup. Also, would her job work if she telecommuted from there? Take it from someone who has done it- it is really a pain having to manage real estate that’s not nearby, particularly in another country. You can rely on friends but only to a point where that starts looking like a part time job.

Homes are much cheaper in the DR and I think you could use your non-retirement brokerage money to start funding your home there. If you can airbnb it part of the time, you may likely off-set your expenses and that could be a win-win for you. I’m hoping there is a way for you to get a low interest loan and then fund the monthly payment (after the down payment) out of your brokerage. I think you may have to pick either working less or owning the 2nd home. Maybe knowing that you can vacay in your DR home will make working tiring hours more tolerable only for a few years, until you can retire. Do you have a lot of sick time? Call in sick once a month at the end of the week to recuperate. Or schedule a Dr’s appt that day and say you need the whole day off for it. I have every other Friday off because I work 9 hours/day and it makes the week I only work 4 days seem so much better. Like others, I don’t see much point in downsizing, unless your expenses, i.e. utilities will decrease a lot. The townhouse costs after you pay to sell and all the expenses with moving, don’t seem worth it. Best wishes and I love all of your ideas.

my wife and I who live in denver …recently built a home in the Dominican Republic,…I would be more that happy to talk with you…but be aware its very challenging and you need a good lawyer https://www.youtube.com/watch?v=hHt3AjlplCY