Kayla and her partner Lauren live in Charlotte, NC with their two dogs and one cat. They both work in banking–at the same bank, in fact–and are feeling settled in the home they bought in 2019. Very soon, they plan to have children, which has them reflecting on their financial priorities. While they still have some debt, they’ve done a fantastic job of paying it down over the years. Now, they’re ready to get serious about their financial health and they’ve asked for our help. Kayla and Lauren both grew up in households they describe as financially unstable and they’re committed to breaking that cycle for their own children. Let’s work together as the Frugalwoods community to help this young couple chart the best possible future for their family!

What’s a Reader Case Study?

Case Studies address financial and life dilemmas that readers of Frugalwoods send to me requesting advice. Then, we (that’d be me and YOU, dear reader) read through their situation and provide advice, encouragement, insight, and feedback in the comments section.

For an example, check out the last case study. Case Studies are updated by participants (at the end of the post) several months after the Case is featured. Visit this page for links to all updated Case Studies.

The Goal Of Reader Case Studies

Reader Case Studies are intended to highlight a diverse range of financial situations, ages, ethnicities, geography, goals, careers, incomes, family composition and more!

The Case Study series began in 2016 and, to date, there’ve been 58 Case Studies. I’ve featured folks with annual incomes ranging from $17,160 to $200k+ and net worths ranging from -$317,596 to $2.9M+.

I’ve featured single, married, partnered, divorced, child-filled and child-free households. I’ve featured gay, straight and trans people. I’ve featured men, women and non-binary folks. I’ve had cat people and dog people. I’ve featured folks from the US, Australia, Canada, England, South Africa, and France.

I’ve featured people with PhDs and people with high school diplomas. I’ve featured people in their early 20’s and people in their late 60’s. I’ve featured folks who live on farms and folks who live in New York City.

The goal is diversity and only YOU can help me achieve that by emailing me your story! If you haven’t seen your circumstances reflected in a Case Study, I encourage you to apply to be a Case Study participant by emailing mrs@frugalwoods.com.

Reader Case Study Guidelines

I probably don’t need to say the following because you folks are the kindest, most polite commenters on the internet, but please note that Frugalwoods is a judgement-free zone where we endeavor to help one another, not condemn. There’s no room for rudeness here–the goal is to create a supportive environment where we all acknowledge that we’re human, we’re flawed, but we choose to be here together, workshopping our money and our lives with positive, proactive suggestions and ideas.

A disclaimer that I am not a trained financial professional and I encourage people not to make serious financial decisions based solely on what one person on the internet advises. I encourage everyone to do their own research to determine the best course of action for their finances. I am not a financial advisor and I am not your financial advisor.

With that I’ll let Kayla, today’s Case Study subject, take it from here!

Kayla & Lauren’s Story

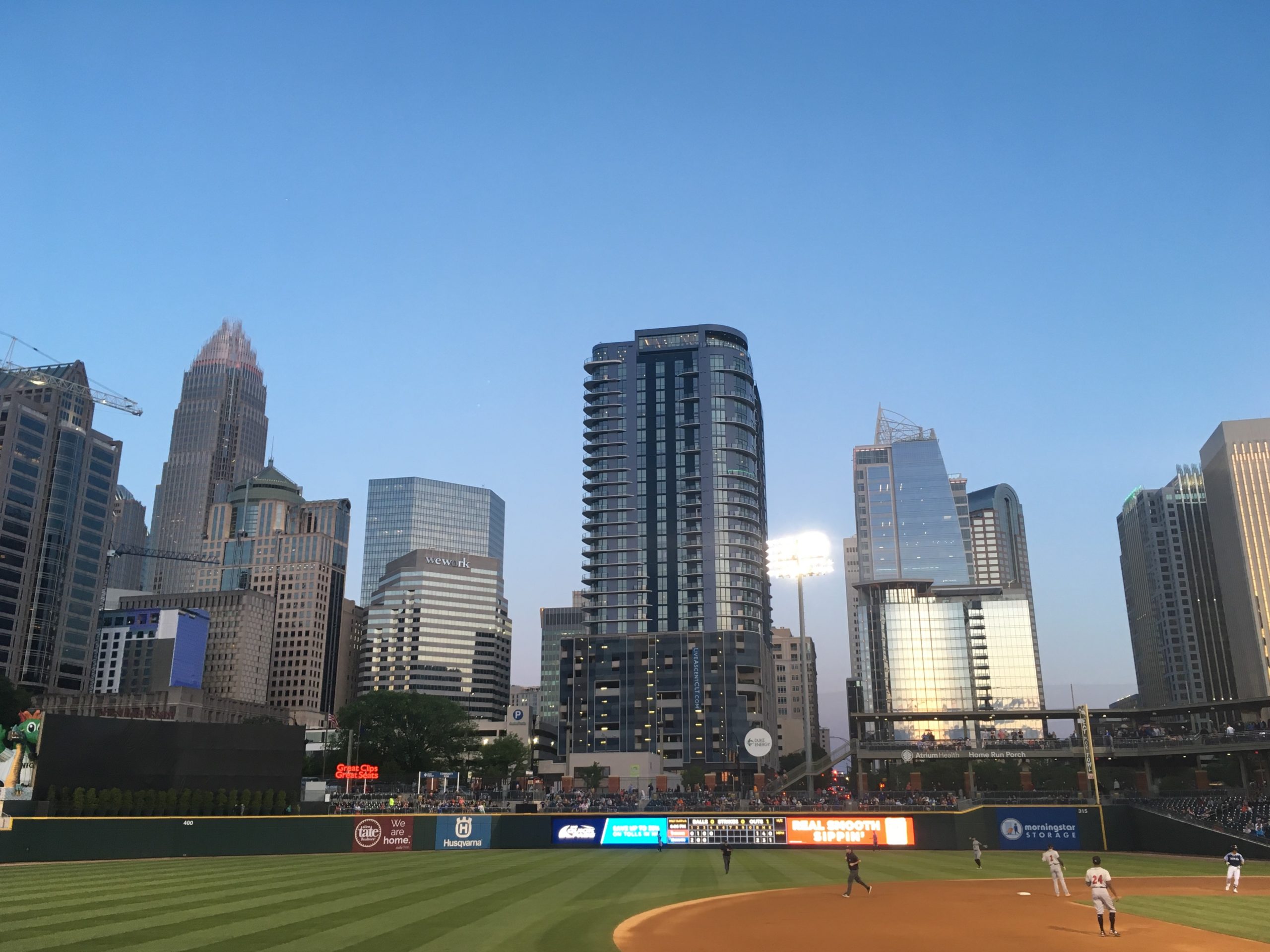

Hi! I’m Kayla, 26, and my partner (we’re married, so she’s technically my wife but I’m not crazy about the word “wife” and prefer “partner”) Lauren is 30. We have two dogs and a cat and live in Charlotte, NC. We work at the same bank – Kayla in Corporate Treasury and Lauren in Supply Chain Risk. We got married while living in DC in 2017 and have been together since meeting in college in 2012.

Pre-COVID, the biggest thing we liked to spend our money on was travel. We both have a huge passion for traveling and have been to 15+ countries together. When traveling and in general, we really like luxurious experiences. We love to go on spa dates, to the ballet, to see concerts of artists we love, go to plays, nice restaurants, museums, etc.

Since COVID, we’ve been less focused on these types of experiences and more focused on individual hobbies. Lauren likes woodworking and home projects, which there’ve been plenty of since working from home and quarantining began. Kayla likes to read, bake, and garden. Some shared passions we have are the outdoors and history. North Carolina is naturally such a beautiful state with a lot of history. We love exploring and are really thankful to live in a location that has an urban feel but also a big beautiful lake for the summer time and a short driving distance to the mountains.

The Transition

I feel like we’re at a transition point in our lives. We both had pretty unstable childhoods that included both financial instability and physical instability (as in, we both moved at least once per year due to the instability of our family units, relationships, etc.). While we can both fully acknowledge the ingrained privilege we’ve had in our lives, we also inherited some of the unstable habits of our parents.

After Kayla graduated from college in 2015, we spent the next 4 years spending beyond our means. We purchased our first home in late 2015, which turned out to be a money pit with a lot of deferred maintenance that was missed during the inspections. We moved from Charlotte, NC to DC and then back again, which was quite expensive. We spent way more money on our wedding and honeymoon than we had to. We took frequent vacations and put them on credit cards without having the money to pay them off right away, traded in cars like the money didn’t actually matter, etc.

The list goes on and we have spent the past two years paying off all of that credit card debt and working through the emotional issues that led us to the same cycle of overspending and physical instability as our parents. We’re very proud of the progress we’ve made in our spending habits. Paying off our credit card debt and finding physical security through the purchase of our current home was a huge accomplishment. Our next financial goals seem daunting and we feel like we need some guidance and perspective.

The Best

The best part of our current lifestyle is the comfort we have. Lauren and I have been together since I was 18 and I literally feel like we have grown up together (because we have). I think we are really lucky that the work-from-home COVID situation has been fairly easy for us.

We like being around each other but at the same time are totally cool if one person needs alone time and then we barely talk to each other for 2 days while we each do our own thing. We are at a point where there are no plans to move. We can pay all our bills without concern, purchase the food we want at the grocery store, buy whatever books we feel like buying, etc. with no thought of oh how are we going to pay this off or where is this money coming from. It’s just nice to be comfortable and stable for what feels like the first time in both of our lives.

The Worst

The worst part of our current lifestyle is our fear of the future. The added layer of uncertainty surrounding COVID has definitely not helped. We both have always wanted a family and are ready to start that process. There are a lot of financial goals tied to this next chapter and they seem overwhelming and uncontrollable when looked at through a lens of fear and uncertainty.

Where Kayla and Lauren Want to be in Ten Years:

Finances:

- No debt aside from our mortgage.

- Able to finance our pregnancy process in cash with no additional debt accrued.

- Adequate savings for our children’s primary and college educations.

- The ability to pay for family vacations and travel in cash.

- Be on track to both retire somewhere between age 50-55.

- Not worry about money at all.

- Not have parental arguments about finances be something our kids ever experience.

Lifestyle:

- We want to be long done with the pregnancy process and have our children as part of our family unit.

- We have a family cabin in the NC mountains and would like our kids to spend a ton of time outdoors, swimming at the lake, exploring around the cabin in the mountains (we are very lucky to have ownership in this property with no expenses currently).

- On the flip side we also love living in an urban space and want to take advantage of the public transport available to us in addition to the art, culture, and food scene of our town.

- We want to be able to travel both domestically and internationally to historic and/or beautiful places.

Career:

- Kayla: I’m very happy with the career path I’m on. I work in a very corporate setting, which I feel is kind of looked down upon from others in my generation, but it works for me. My job fits both my personality and my strengths. I love the mental challenge my job provides and it’s a good outlet for me to push myself. I like the stability and predictability of the type of work that I do and in terms of being able to provide for my family. I also feel like I am on a path that can provide opportunities for career growth and higher income in the future.

- Lauren: Am I in love with my job? No. Am I content? Yes. While I don’t feel that my current career path is my passion, I do appreciate what it provides: a great manager, low pressure, and a hybrid schedule once we go back to the office. I’ve spent many years trying to figure out what I want to be when I grow up and the best I can come up with is that I don’t know. I like the company I work for and they encourage internal movement, so if I ever want to move to another role I know I have internal support. Otherwise, I am content to stay in my current field and progress upwards. My ultimate goal is to be financially independent so I can choose how and what I spend my time working on. I would like to get to a place where I don’t have to work for a living and instead can work without concern for how much income I make i.e. with a non-profit, as an EMT, with my woodworking.

Kayla and Lauren’s Finances

Income

| Item | Amount | Notes |

| Kayla’s Net Monthly Income | $4,659 | Minus Kayla’s 401k contribution (6% pre tax), supplemental life insurance and critical illness coverage, and state and federal taxes |

| Lauren’s Net Monthly Income | $3,501 | Minus health/dental insurance for both of us, Lauren’s 401k contribution (6% pre tax), HSA contribution ($200 per month), and state and federal taxes |

| Kayla’s Bonus | $333 | Paid annually – target is 7% of salary (81,600) but could be more or less depending on performance. Subtracted 30% for taxes. |

| Lauren’s Bonus | $193 | Paid annually – target is 5% of salary (66,300) but could be more or less depending on performance. Subtracted 30% for taxes. |

| Monthly subtotal: | $8,686 | |

| Annual total: | $104,232 |

Mortgage Details

| Item | Outstanding loan balance | Interest Rate | Loan Period and Terms | Equity | Purchase price and year |

| Mortgage on primary residence | $269,157 | 2.88% | 30 year mortgage | $4,843 | $276k; purchased in 2019 |

Debts

| Item | Outstanding loan balance | Interest Rate | Loan Period/Payoff Terms/Your monthly required payment |

| Lauren’s Student Loans | $57,127 | Currently set at 0% and not able to find what the interest rate was pre-Covid | Normally pay $442 per month + $100 employer contribution – currently only paying $100 employer contribution |

| Kayla’s Student Loans | $32,546 | Currently set at 0% and not able to find what the interest rate was pre-Covid | Normally pay $158 per month + $100 employer contribution – currently only paying $100 employer contribution |

| Lauren’s Car Loan | $17,859 | 5.53% | Pay $553 per month (minimum payment) – 2 years and 8 months left on the loan term |

| Kayla’s Car Loan | $14,202 | 4.50% | Pay $446 per month (minimum payment) – 2 years and 6 months left on the loan term |

| Medical Bill | $3,460 | 0% | Pay $65 per month (minimum payment) – program through our hospital to make small monthly payment with no interest for unexpected surgery |

| Total: | $125,194 |

Assets

| Item | Amount | Notes | Interest/type of securities held | Name of bank/brokerage |

| Lauren’s 401k | $28,377 | This is Lauren’s employer sponsored 401k (current employer). We both contribute enough to qualify for our employer’s full match. | Tier 1 Vanguard Target Retirement 2055 | Vanguard |

| Kayla’s 401k | $17,005 | This is Kayla’s employer sponsored 401k (current employer). We both contribute enough to qualify for our employer’s full match. | Tier 1 Vanguard Target Retirement 2060 | Vanguard |

| Lauren’s Company Stock | $10,584 | Some of Lauren’s stock was purchased through the employee stock purchase plan but most was gifted by the company | Stock + accrued dividends | Solium |

| Kayla’s Company Stock | $8,674 | All of Kayla’s stock was gifted by the company | Stock + accrued dividends | Solium |

| Savings Account | $4,937 | This is our savings for unexpected events, things for the house, basically anything/everything right now especially sperm purchase savings | Cash – 0.50% | Ally Bank |

| Kayla’s IRA | $3,437 | This is a 401k from an old job of Kayla’s that rolled into an Traditional IRA | 0.50% | Ally Bank |

| HSA Account | $1,500 | This is our HSA account – Lauren contributes $200 per month and our employer occassionally contributes as an extra perk. We pay for all medical expenses out of this account which have been a lot over the past few years. We also never track what we spend out of this account but there are recurring charges such as therapy for Kayla which changes based on when we hit our deductible. | Currently cash (usually we have it set to automatically move anything over $1,500 to investments managed by the brokerage but we currently only have $1,500 in the account) | Health Equity |

| Total: | $74,515 |

Vehicles

| Vehicle make, model, year | Valued at | Mileage | Paid off? |

| 2017 Buick Enclave | $17,780 | 67,561 | No, the amount I owe is listed under “Debts” |

| 2014 JC Tritoon Pontoon Boat | $14,000 | Less than 50 hours | Yes. We split the cost at the time of purchase with Kayla’s mom who covers the insurance and yearly storage fee as well. So we own half the value of $14k, not the whole amount. |

| 2016 Hyundai Sonata Hybrid | $10,000 | 49,000 | No, the amount I owe is listed under “Debts” |

| Total: | $41,780 |

Expenses

Note about this section: we don’t track our monthly spending at all (aside from making sure our bills are paid). Doing this spreadsheet was pretty eye opening because for the most part, we have like no idea where our money goes each month. Once we paid off all our credit card debt, we went to a system of only budgeting for bills and putting everything else on the credit card and then paying it off at the end of each month. It is very easy to buy a whole bunch of stuff using that method and have way less to transfer into savings at the end of the month.

We’ve now switched to using Dave Ramsey’s Allocated Spending Plan worksheets and are hoping that those help us reign in our discretionary spending and stop just swiping our credit card because we know we have excess cash to pay it off. Long story short: this is why we don’t have breakdowns for clothing, vacations/travel, holidays, entertainment, home goods, etc. because we genuinely just have no idea what we’ve historically spent on these things.

| Item | Amount | Notes |

| Mortgage | $1,562 | Taxes and Insurance are escrowed |

| Lauren’s Car Payment | $553 | Noted in liabilities section |

| Groceries and household supplies | $547 | We don’t track this on a monthly basis, which I think is part of our issue with wondering where our money goes. We purchase household supplies and hygiene items on these trips also but don’t track them. This was the average I was able to calculate by going through our credit card statements. |

| Kayla’s Car Payment | $446 | Noted in liabilities section |

| Lauren’s Student Loans | $442 | (not paying on these currently but employer is contributing $100 per month still) |

| Car Insurance | $174 | Through Geico – pay monthly |

| Takeout/Restaurants | $159 | Again – we don’t track monthly and that is part of our issue. This was our average from 2020. |

| Kayla’s Student Loans | $158 | (not paying on these currently but employer is contributing $100 per month still) |

| Security system monitoring | $80 | CPI Security – very necessary for us as we had some scary incidents in our area last spring |

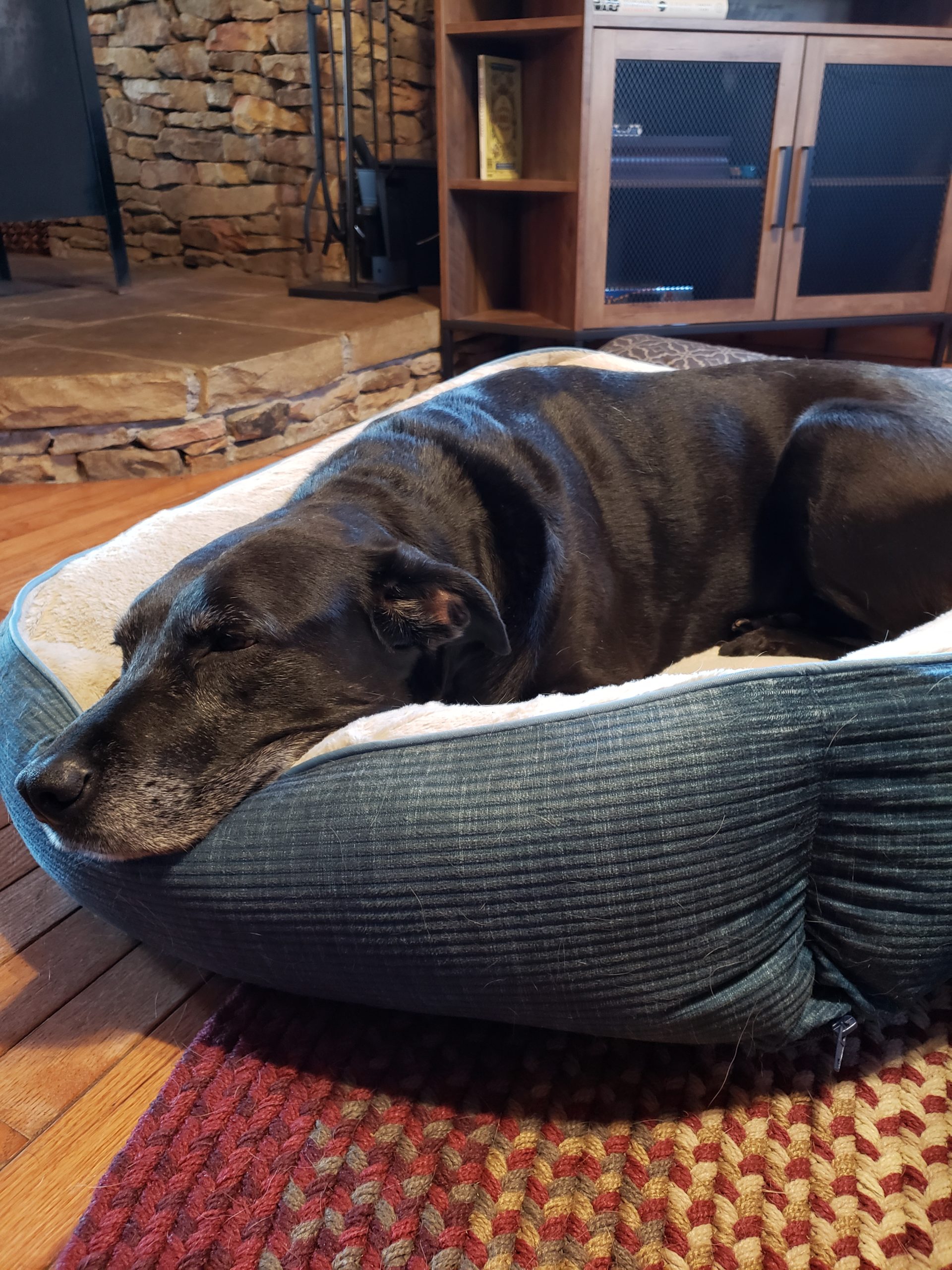

| Dog Medicine | $75 | Purchased monthly (both of our dogs take a daily medication) |

| Dog Boarding | $73 | We spent $879 on this in 2020. We typically board our dogs a few times a year if we go to visit family or on vacation. Calculated monthly by total divided by 12. |

| Vet Bills | $70 | We took our dogs to the vet once in 2020 (typically take them once a year for check ups, vaccines, etc.) It costs a lot when this happens and one of our dogs was sick when we went last time so the bill was $845. We paid it in full at the time but divided by 12 for the monthly amount. |

| Internet | $70 | Through Spectrum – unfortunately our only provider in our area |

| Dog Food | $70 | Purchase 1 bag of food per month |

| Medical Bills Payment | $65 | Noted in liabilities section |

| Gas for cars | $64 | Again, we don’t track this monthly but this was our 2020 average per month. |

| Electricity Bill | $61 | On equal billing payment plan where you pay one price based on historical usage and are billed or refunded at end of year |

| Gas Bill | $51 | Varies between $20-150 per month depending on time of year. Used average from 2020 to calculate |

| Water Bill | $44 | Varies between $40 – $65 per month. Most months it is around $45. Used average from 2020 to calculate |

| Car Registration Fees/Inspections | $41 | Pay annually in full for both cars but divided by 12 to get the monthly amount. |

| Netflix | $20 | Pay for family plan for us + siblings monthly |

| Cat Food | $20 | Purchase 1 bad of food every 2 months (so around $20 monthly) |

| Dog Membership | $18 | We pay a monthly fee to be part of our dog’s boarding and training facility |

| Amazon Prime | $13 | (Membership paid once per year but broke cost down monthly) |

| Disney Plus | $7 | Pay for family plan for us + siblings monthly |

| Costco Membership | $5 | Monthly amount divided by 12 |

| Monthly subtotal: | $4,888 | |

| Annual total: | $58,656 |

Credit Card Strategy

| Card Name | Rewards Type? | Bank/card company |

| Citi AAdvantage | American Airlines Miles | Citi Bank |

| Bank of America Travel Rewards | Points used to make payments towards travel related purchases | BOA |

| Capital One Platinum | None | Capital One (affiliate link) |

Kayla and Lauren’s Questions for You:

-

Our dog Hudson hanging out at the cabin How do we prioritize our financial goals and where our money goes each month?

- Our priorities are: paying off our cars and student loans, saving for the pregnancy process, saving for our children’s education, and investing for retirement.

- We have a big issue with excess discretionary spending. We’re no longer spending above our means, but we have lofty goals each month to transfer X number of $ into savings at the end of the month. But by the time the end of the month rolls around, we’ve spent money on so many random things/experiences/etc. that our savings transfer is a fraction of what we wanted it to be.

- How much should we be saving for retirement (monthly or annually) if we both want to retire somewhere between age 50-55?

- When should we start saving for our children’s education and how much should we save?

- It’s a big priority for us to gift a college education to our children if they choose that path.

- How do we save for other things (vacations, holidays, unexpected expenses, unexpected job losses, etc.)?

- Kayla has the larger salary. For tax purposes should we switch over insurance, HSA, etc. withdrawals from her paycheck to have a smaller take home pay or should they stay with Lauren?

- After looking at our financial situation – are there any other recommendations you have that would help us reach our goals?

Mrs. Frugalwoods’ Recommendations

Congrats to Kayla and Lauren for the hard work they’ve put in to pay off their credit card debt! I am really impressed with their drive to break this cycle of financial instability. I commend them both for recognizing that their childhood money experiences have a profound bearing on how they manage money as adults. A lot of folks don’t realize how deeply your childhood money experiences impact your lifelong relationship to money. Acknowledging this will help Kayla and Lauren create a money culture for their family. It will help them chart a path that’s different from how they were raised and recognizes the triggers and traumas of their unstable financial upbringings.

While I can offer advice about the numerical side of things, we all know that our relationship to money goes much deeper than that. Kayla and Lauren might want to consider speaking with a therapist about the deeper issues surrounding their emotional responses to money and finances. Until they’re able to truly understand what prompts them to churn through cycles of spending and debt, they’ll likely keep falling victim to them. I encourage Kayla and Lauren to consider spending some time with a couples’ therapist to dig into these issues. It will likely be time and money very well spent!

Ok, let’s dig into Kayla’s questions.

Question #1: How do we prioritize our financial goals and where our money goes each month?

To answer this, I’m going to back up a few steps and encourage Kayla and Lauren to start tracking their expenses rigorously. Kayla noted they’re not doing this and that’s obvious from their expense report. If they were truly spending only $4,888 per month, they’d have $3,798 leftover every month, which isn’t the case (that’s their net income of $8,686 – $4,888).

Priority #1 for Kayla and Lauren is to track where every dollar is going. Without that crucial data point, we can’t really move forward because we don’t know how much money is leftover every month.

There are tons of different ways to track your spending, here are a few ideas for them to try:

- Sign-up for the free expense tracking service from Personal Capital. This is what I use and recommend because it does the work for you.

- Commit to writing down every expenditure at the time of purchase. Then, create their own spreadsheet every month of what they’ve spent.

- Comb through their credit card statements to determine what’s being purchased every month. Combine this with a list of everything purchased with cash, direct deposit and check.

- Move to the cash envelope system and set a budget at the beginning of the month for each category. Create envelopes of cash (yes, actual envelopes) with the category and monthly budget written on the front. When the money’s gone from each envelope, that’s it for the month–you can’t buy any more. For example: you write “Groceries (food only), May 2021, $400” and you put $400 in that envelope. When you’ve spent the $400, you can’t buy any more groceries until June.

Bottom Line: there are a million different ways to track your spending and there’s no one right way. The “right way” is whatever Kayla and Lauren can commit to for the long haul. They need to find a system that works for both of them.

Once Kayla and Lauren know what they’re spending every month, they can start setting savings goals (more on that in a moment).

Question #2: How much should we be saving for retirement (monthly or annually) if we both want to retire somewhere between age 50-55?

I want to take a moment to give a HUGE congratulations to Kayla and Lauren for contributing enough to their 401ks every month to qualify for their employer’s match. Very, very well done!!

At this point, they’re so many years away from retirement that it’s not possible to give them a precise answer. However, we can apply a few simple rules of thumb to help them track their progress.

- Lauren’s total retirement: $28,377

- Kayla’s total retirement: $20,442

- Combined: $48,819

To give them some context, we’ll use Fidelity (somewhat oversimplified) retirement rule of thumb:

Aim to save at least 1x your salary by 30, 3x by 40, 6x by 50, 8x by 60, and 10x by 67

Since Kayla is 26 and Lauren is 30, we’ll go with 1x their combined salaries, which would be $104,232. While they’re pretty short of this metric, I’m not super worried because they’re doing the right thing by contributing to their 401ks. It would be great if they could increase the percentage they contribute every year. One easy way to do this is to increase their contribution by one percentage point every year. So if they’re contributing 6% this year, bump it up to 7% next year, 8% the following year and so on.

However, I can’t really advise them on how much more to contribute each month because we don’t know how much they’re spending every month. It all goes back to tracking your spending so that you know how much money you have to work with (net income – total monthly expenses = money leftover to put into savings and investments).

Question #3: When should we start saving for our children’s education and how much should we save?

I totally understand their desire to pay for their future children’s higher education, however, this should be their lowest priority at this point. Not forever, but right now, it’s the least important of their financial goals because:

- Kayla and Lauren need to first get out of debt.

Their debt is literally dragging them down. They are losing money to interest every month that they carry this debt.

Let’s take a look at their car loans first:

- Kayla’s car: $14,202 owed at a 4.5% interest rate

- Lauren’s car: $17,869 owed at a 5.53% interest rate

You want to prioritize paying off debt according to interest rate. The higher the interest rate, the worse the debt. So, if it were me, I would throw everything I have at paying off Lauren’s car ASAP since 5.53% is a pretty steep interest rate.

At their income level, if they really, really buckled down and trimmed every single unnecessary expense, they could pay off Lauren’s car in LESS THAN FOUR MONTHS!!!! Here’s how:

| Item | Amount | Kayla & Lauren’s Notes | Mrs. FW’s Notes | New Amount Suggestion |

| Mortgage | $1,562 | Taxes and Insurance are escrowed | Fixed | $1,562 |

| Lauren’s Car Payment | $553 | Noted in liabilities section | Fixed | $553 |

| Groceries and household supplies | $547 | We don’t track this on a monthly basis, which I think is part of our issue with wondering where our money goes. We purchase household supplies and hygiene items on these trips also but don’t track them. This was the average I was able to calculate by going through our credit card statements. | Reduce by $200 | $347 |

| Kayla’s Car Payment | $446 | Noted in liabilities section | Fixed | $446 |

| Lauren’s Student Loans | $442 | (not paying on these currently but employer is contributing $100 per month still) | Deferred at present | $0 |

| Car Insurance | $174 | Through Geico – pay monthly | Fixed | $174 |

| Takeout/Restaurants | $159 | Again – we don’t track monthly and that is part of our issue. This was our average from 2020. | Eliminate | $0 |

| Kayla’s Student Loans | $158 | (not paying on these currently but employer is contributing $100 per month still) | Deferred at present | $0 |

| Security system monitoring | $80 | CPI Security – very necessary for us as we had some scary incidents in our area last spring | Fixed | $80 |

| Dog Medicine | $75 | Purchased monthly (both of our dogs take a daily medication) | Fixed | $75 |

| Dog Boarding | $73 | We spent $879 on this in 2020. We typically board our dogs a few times a year if we go to visit family or on vacation. Calculated monthly by total divided by 12. | Eliminate | $0 |

| Vet Bills | $70 | We took our dogs to the vet once in 2020 (typically take them once a year for check ups, vaccines, etc.) It costs a lot when this happens and one of our dogs was sick when we went last time so the bill was $845. We paid it in full at the time but divided by 12 for the monthly amount. | Fixed | $70 |

| Internet | $70 | Through Spectrum – unfortunately our only provider in our area | Fixed | $70 |

| Dog Food | $70 | Purchase 1 bag of food per month | Fixed | $70 |

| Medical Bills Payment | $65 | Noted in liabilities section | Fixed | $65 |

| Gas for cars | $64 | Again, we don’t track this monthly but this was our 2020 average per month. | Reduce by $25 | $39 |

| Electricity Bill | $61 | On equal billing payment plan where you pay one price based on historical usage and are billed or refunded at end of year | Fixed | $61 |

| Gas Bill | $51 | Varies between $20-150 per month depending on time of year. Used average from 2020 to calculate | Fixed | $51 |

| Water Bill | $44 | Varies between $40 – $65 per month. Most months it is around $45. Used average from 2020 to calculate | Fixed | $44 |

| Car Registration Fees/Inspections | $41 | Pay annually in full for both cars but divided by 12 to get the monthly amount. | Fixed | $41 |

| Netflix | $20 | Pay for family plan for us + siblings monthly | Eliminate | $0 |

| Cat Food | $20 | Purchase 1 bad of food every 2 months (so around $20 monthly) | Fixed | $20 |

| Dog Membership | $18 | We pay a monthly fee to be part of our dog’s boarding and training facility | Eliminate | $0 |

| Amazon Prime | $13 | (Membership paid once per year but broke cost down monthly) | Eliminate | $0 |

| Disney Plus | $7 | Pay for family plan for us + siblings monthly | Eliminate | $0 |

| Costco Membership | $5 | Monthly amount divided by 12 | Eliminate | $0 |

| Current Monthly Subtotal: | $4,888 | Suggested New Monthly Subtotal: | $3,768 | |

| Current Annual Total: | $58,656 | Suggested New Annual Total: | $45,216 |

I took their expenses spreadsheet and eliminated everything not required for their survival and reduced every other category I could.

The challenge is that this isn’t their actual monthly spending. Kayla and Lauren didn’t include any of the following on their expense spreadsheet:

- Travel/vacations

- Gifts

- Clothing/shoes

- Personal care (haircuts, etc)

- Home improvement supplies

- Hobby-related expenses

- Household supplies

- Miscellaneous

The good news is that everything on that list is discretionary. If they eliminate all the stuff I listed–and every expense they didn’t list–they could wipe out their debt really quickly.

With their monthly net income of $8,686, if they stripped their spending down to the bare minimum of $3,768, they’d have a whopping $4,918 leftover every month to funnel into debt repayment.

At that rate, they could pay off Lauren’s car in LESS THAN FOUR MONTHS!!!!!!!

Lauren’s car loan $17,869/$4,918 = 3.63 months

Holy cow that’s fast!!! Then, if they were up for continuing this super duper frugal experiment, they could pay off Kayla’s car in UNDER THREE MONTHS!!!!!!

Here’s How:

Once they eliminate Lauren’s monthly car payment of $553, we can do the math of $3,768 – $553 = $3,215 to get their new monthly spending. Once again, we’ll take their net monthly income of $8,686 – their new proposed monthly spending of $3,215, which leaves them with $5,471 leftover every month.

- Kayla owes $14,202 on her car, so we’ll do $14,202/$5,471 = 2.59 months to paid off!!!!!

Bottom Line: If Kayla and Lauren decide to eliminate all discretionary expenses for the next seven months, they’d have both of their cars completely paid off!!!! That’s a good thing for several reasons:

- They’d no longer be losing money to interest on those car loans every month.

- They’d no longer be paying $999 in two car loans every month (Lauren’s at $553 + Kayla’s at $446). That’s a TON of money freed up every single month! In fact, it’s $11,988 PER YEAR! That’s real money, folks.

Now that the cars are paid off, let’s turn to their…

Student Loans

Federal student loans are currently deferred due to the pandemic. Given that, Kayla and Lauren are wisely not making payments on their loans right now. Here’s what I’d do if it were me:

- Continue to not make payments while the loans are in forbearance and the interest rate is 0% for federal student loans.

- Wait to see if the administration moves forward with waiving student loan debt of up to $10k (higher amounts of forgiveness are being discussed as well, so it’s very much a wait-and-see moment for student loans)

- I very rarely advise people to not pay off debt, but given the forbearance program as well as the looming potential for loan forgiveness I think it’s wise not to pay down federal student loans right now (provided you’re certain you qualify for the federal student loan forbearance program. Read more about pandemic-specific financial programs in my series Uber Frugal Week: How to Manage Your Money in the Time Of Pandemic and Recession).

- Once the COVID forbearance program ends on September 30, 2021, resume paying the monthly minimum required payment. However, keep an eye on this date as it continues to be pushed back.

If it appears that student loan forgiveness isn’t going to happen anytime soon, Kayla and Lauren might want to consider accelerating their pay-off of these loans. Unfortunately, without knowing the interest rate on these loans, it’s tough for me to give concrete advice. With debt, it’s the interest rate that matters.

- Lauren has $57,127 in loans and Kayla has $32,546, for a total of $89,673

I would prioritize paying these off according to interest rate–in other words, pay off the loan with the highest interest rate first. If they continue with the uber frugal spending I outlined above, they could pay off both loans in 15.15 months.

Here’s how:

- Once again, we’ll take their monthly net income of $8,686 – their new proposed monthly spending of $2,769, which leaves them with $5,917 leftover every month.

To recap, here’s how we got them to a monthly spend rate of $2,769:

- We took their current spending of $4,888 – the eliminations I suggested in the spreadsheet above = $3,768. Then, with both cars paid off, we subtracted their $999 monthly car payments to reach $2,769.

Then we take their total student loan debt of $89,673 / $5,917 per month = 15.15 months

That means they could have BOTH of their student loans obliterated in ONE YEAR AND THREE MONTHS!!!!!

Debt Freedom in LESS THAN TWO YEARS

Based on the calculations I’ve done, Kayla and Lauren could be completely debt-free (other than their mortgage) in 22 months, which is UNDER two years! That’s an incredibly fast timeline!!!! To recap, it would take approximately 4 months to pay off Lauren’s car, 3 months to pay off Kayla’s car and 15.15 months to pay off BOTH of their student loans.

I realize that they still have a medical bill of $3,460, but assuming their hospital keeps this loan at a 0% interest rate, there’s no reason to pay it off ahead of time. Just keep paying on it every month until it’s gone. Kayla and Lauren should confirm that the 0% interest rate is fixed and not subject to adjustment.

The Trade Off

The trade off with this super sonic speed to debt freedom is their discretionary spending. What I’ve outlined is a pretty bare bones frugal lifestyle. However, Kayla and Lauren should feel free to tweak this spending as it suits them. Maybe they want to spend even less in one category in order to add a treat or luxury. Maybe they’d like to extend the debt-freedom timeline another few months in order to spend more every month. The bottom line is that Kayla and Lauren have a lot of options here and, given their salaries, they have the ability to be free from their debt in short order.

Question #4: How do we save for other things (vacations, holidays, unexpected expenses, unexpected job losses, etc.)?

Now that we’ve addressed their retirement investments and debt repayment strategy, let’s talk more about their savings.

What Kayla and Lauren really need is an emergency fund. An emergency fund is easily accessible cash held in a savings or checking account that prevents you from slipping into debt in the event of an emergency.

If you lose your job or your car breaks down or a tree falls on your roof, you have the ability to dip into your emergency fund as opposed to racking up credit card debt. An emergency fund is calibrated on your monthly spending, which is why its so crucial to track what you spend every month. The general rule of thumb is that an emergency fund equals three to six month’s worth of your expenses.

At Kayla and Lauren’s current spending rate of $4,888, they’d want to target an emergency fund of $14,664 (three month’s worth) to $29,328 (six month’s worth). Of course, if they choose to spend less every month, they can target a smaller emergency fund.

If they choose to stick with the super frugal spending rate of $2,769 per month, they could save $8,307 (three months worth) to $16,614 (six months worth). Since they already have $4,937 in savings, it would take them just TWO months of saving $5,917 per month to reach a fully funded emergency fund of $16,771. Nice!!!!

Question #5: Kayla has the larger salary. For tax purposes should we switch over insurance, HSA, etc. withdrawals from her paycheck to have a smaller take home pay or should they stay with Lauren?

Assuming they are “married filing jointly,” it doesn’t matter because the IRS considers your income to be combined total household income.

Question #6: After looking at our financial situation – are there any other recommendations you have that would help us reach our goals?

Let’s do a summary of what I recommend for Kayla and Lauren:

- Start rigorously tracking their monthly spending. Sign-up for Personal Capital, use your own spreadsheet, write it in a notebook–whatever system will work best for them, Kayla and Lauren need to get a handle on what they’re spending every month (affiliate link).

- Continue contributing enough to their 401ks in order to qualify for their employer’s match. Consider increasing their contribution amount by 1% (or more) per year in order to catch up to where they need to be at their age.

- Consider stripping their monthly spending down to $3,768 as I outlined in the spreadsheet above. To guide them on this process, I strongly encourage them to take my free Uber Frugal Month Challenge together.

- Take their newfound monthly savings (per #3) and throw it at their debt in order of interest rate:

- Pay off their highest interest rate debt first, which is Lauren’s car loan of $17,869 at a 5.53% interest rate. This’ll be paid off in UNDER FOUR MONTHS!

- Pay off Kayla’s car loan next, which is $14,202 at a 4.5% interest rate. They’ll pay this off in LESS THAN THREE MONTHS!

- Monitor the federal student loan forbearance/forgiveness program, which is set to expire on 9/30/21. If student loan forgiveness isn’t happening by that point, consider wiping out their student loans, starting with the highest interest rate loan:

- Based on my calculations above, they could have BOTH of their student loans completely paid off in just over 15 months!

- If they decide to follow steps 3 – 5, Kayla and Lauren could be debt-free (other than their mortgage) in under two years, which is remarkably quick!!!!!

- The next major priority is building up a fully funded emergency fund. Emergency funds are calculated based on your monthly spending, so Kayla and Lauren will need to track their spending and decide what level of frugality they’re comfortable with. The glorious thing is that, without their car payments, they’ll have a cool $999 extra every single month!!!

- Determine their monthly spending and save an emergency fund of three to six months worth of expenses.

- As outlined above, if they stick with the uber frugal scheme, they could have this baby fully funded in TWO quick months.

- Now it’s time to save for their other priorities!! Based on the above, Kayla and Lauren could spend exactly two years paying off all of their debt and building their emergency fund. There’s a hierarchy of financial wellness that Kayla and Lauren should strive for BEFORE turning their attention to other priorities. They’ll be ready to focus on their other priorities AFTER they’ve:

- Paid off their debt

- Built up an emergency fund

- Continued to contribute to their 401ks, increasing their contribution levels annually

Kayla and Lauren’s Other Priorities: Pregnancy and Their Children’s Education

I’m addressing these two priorities last because financial management is very much a “put your own oxygen mask on first” situation. You need to get your own financial house in order BEFORE you start planning and saving for your children’s future.

Kids can take out loans for higher education, parents cannot take out loans for retirement. Kids will be vastly happier if their parents are financially stable and don’t need to move in with them later in life because they can’t pay their own bills. To be clear: living together by choice is a totally different conversation, I’m talking about NEEDING to move in with your adult children because you can’t pay your bills.

After Kayla and Lauren take care of their car loans, student loans, emergency fund, and 401ks, they can–and should–turn their attention to their future children.

Kayla shared:

We have a big issue with excess discretionary spending. We’re no longer spending above our means, but we have lofty goals each month to transfer X number of $ into savings at the end of the month. But by the time the end of the month rolls around, we’ve spent money on so many random things/experiences/etc. that our savings transfer is a fraction of what we wanted it to be.

My suggestion: instead of waiting until the end of the month to save money, set up direct deposits from their paychecks into savings accounts. This way, the money will never actually be theirs to spend. Much like how their 401k contributions automatically come out of their paychecks, this would eliminate the issue of Kayla and Lauren having a big pot of money to spend. They’d have to commit to not touching these savings accounts, but it would be a way to automate their savings and put their long-term goals first.

They might want to open different savings accounts for different goals and name the accounts accordingly. For example, they could open an account for each of their stated goals:

- Pregnancy Process

- Children’s Education

Then, they could specify that $x of every paycheck go into theses accounts. Thus, instead of being paid the big lump sum of $8,686 every month, they’d be paid, let’s say, $4,000 with the difference going directly into these savings accounts. They’d obviously have access to these accounts, but it would be a way to “trick” themselves into saving. Then, if they wanted to spend this money on a meal out at a restaurant, they’d have to face the fact that they were taking $100 away from their goal of “Pregnancy Process” in order to go to a restaurant.

It’s still their money, but by segregating it, Kayla and Lauren would be confronted with their long-term goals every time they wanted to spend money on short-term treats.

This would force them to do the mental exercise of “Do I want to buy these shoes or do I want to save for our kids’ education?” This is the technique I used when we were saving for our financial independence/homestead goal. I would actually ask myself, “Do I want to buy these boots or do I want to get to my homestead faster?” Sometimes I bought the boots, but more often, I’d be reminded of my overarching goal and I’d put the boots back on the shelf.

I also recommend that Kayla and Lauren take my free, 31-day Uber Frugal Month Challenge. The Challenge is designed to help you prioritize your spending, understand your triggers to overspend and come to a place of peace with frugality. If they’re up for it, I think doing the Challenge together would lend a lot of insight into the issues Kayla and Lauren face every month with their spending.

A final note: since the kids needs to be born before they go to school, if it were me, I would focus solely on the Pregnancy Process goal at this time. Once the kiddos are born, and assuming Kayla and Lauren are still on track with being debt-free and have fully funded emergency and retirement accounts, they can consider opening 529 college savings accounts for their kids.

The point of all of this isn’t deprivation, it’s about having control over your money. The goal isn’t to save every last penny and make yourself miserable, the goal is to spend your money mindfully and on your highest and best priorities.

Ok Frugalwoods nation, what advice would you give to Kayla and Lauren? Kayla and I will both reply to comments, so please feel free to ask any clarifying questions!

Would you like your own case study to appear here on Frugalwoods? Email me (mrs@frugalwoods.com) your brief story and we’ll talk.

I had to stop reading and google Prinsesstarta and, after wiping the drool off my tablet, add it to my recipe database. Thank you, Kayla, for bringing that to my attention!

There is a good British Baking Show episode about making these!

You can also see it being made on the Great British Bake Off (2014 season).

Likewise. That cake is a true work of art. I’m jealous of your skills.

One of our friends introduced us to this amazing cake. It is SO delicious, but also a pain in the rear to make– so many steps. Definitely worth it if someone else makes it for you(!)

Oh thank you!

Funny to see that cake here. It is a very typical one in at least here Finland and Sweden. We always had one for my teenage birthdays.

As someone who just rented an Airbnb cabin in the Asheville area….have you thought about offering your cabin as a short term rental in order to add a revenue stream? Perhaps you could segregate that income as being your travel fund / discretionary fund and use your bank income as described above.

Thank you! Yes we definitely plan on doing this. Unfortunately it’s joint owned with several of my siblings so the goal for now is to just put all income back into the property until the mortgage is paid off.

Frugalwoods comments are very sound. I would only add – don’t ever underpay your pensions. You’ll need more than you think to maintain a half decent lifestyle. And – kids cost way more than you might imagine – get rid of those debts first. ( P.S. kids are worth it! 😊). Finally – all the best as you move forward.

As always Liz has made perfect sense. Could the home baking and woodwork be another source of income along with the cabin? The prinsesstarta looks amazing by the way. I always struggled with savings until I started to think of them as another bill to be paid. Now the savings almost look after themselves and we can only spend whatever’s left. We still have treats and have more than we need but we also have a healthy financial future

I really love how you do this for people!!!! thanks so much for inspiring me too to be way more mindful of my spending.

That is so true

Here, here. And such careful and caring feedback and recommendations.

You’re doing incredible Kayla and Lauren! Really great to hear the positive financial choices you’ve made for your family to this point and wonderful to hear you thinking about your future.

A few thoughts on your question:

1. Another option for budgeting is an app called You Need A Budget (YNAB). It’s essentially a cash envelope system in a digital form. On that note though, Frugalwoods made some excellent suggestions. Mostly, find what works for you. And keep in mind that it’s a process so don’t get frustrated with yourself if you aren’t able to track your spending effectively with one method immediately. I’m 10 years into the process and have tried many systems (spreadsheets, envelopes, YNAB, etc.) along the way. Tweak and optimize to fit your life at the stage your in (and life changes so you may find what works now may not serve you well 3 years from now). Keep it up and enjoy the evolving process (as much as one can with budgeting).

2. A way to calculate your retirement goal amount is the FIRE method (Financial Independence Retire Early). It’s not the only way by any means so research what would be best for your family. The FIRE rule is 25x your true expenses for retirement (based on a 4% withdraw rate at retirement). There’s a ton out there on it so I won’t go into detail (ChooseFI or Mr. Money Mustache are just two easy resources). Again, it’s just one way to think about it, but it could give you a solid number to work with for the time being and you can adjust as you need with more information down the road.

Congrats on where you’re at today and cheers to experiences that enrich your lives!

I second YNAB!!

So do I. YNAB does just what Mrs frugalwoods describes in that it makes trade offs very clear; the “do I want the boots or the homestead”. But in every purchase, not only between the things you have a special savings account for. Also, it aknowledges that no 2 months are the same and it is allright to change your plan, while keeping the overarching plan clear.

Especially as Lauren and Kayla haven’t tracked their spending before and getiting into that habit may take some effort: YNAB makes it easy and fun (ok, for me 😊) while not making it feel as a failure if you don’t predict right.

I agree whith mrs fugalwoods and Ashley that you should find a system that works for you. YNAB was just eye opening for me and I whish you the same experience 😊.

Once you do track your expenses and see the trade offs more clearly, in whatever system, it becomes easier to make them; for some it might fit to go extreme for a while, but maybe you discover you want to pay off your debt a bit more slowly and save for a pregnancy first and quick as you can. Though being debt free is wonderfull! And I second mrs frugalwoods order of tackling the loans!

Good luck.

Thanks for your advice!

The only advice I’d add is to consider saving for the pregnancy in your HSA, since you end up getting a triple tax break on it. (It goes in tax-free, grows tax-free if invested, and is spent tax-free.) Plus, it comes out of your paycheck directly, which helps with the “pay yourself at the start of each month” suggestion. You can save $7,100 a year in it ($591.66 per month), including employer contributions. If I were Lauren, that might be one of the first steps I took.

This is exactly what I was thinking. I’m not sure exactly what the process would be, but I would check whether it would be HSA-eligible. If so, you can maximize your contributions to your HSA, which come out tax-free, and you can invest some of that money. Additionally, you get that “triple tax benefit,” where your money grows interest-free and your overall gross income is considered to be less for tax purposes. If the money ends up not being used for pregnancy and other health costs, it can eventually be used for retirement.

Hi Kayla & Lauren! My wife and I are currently doing exactly this. You can pay for both IUI and IVF costs from either an HSA and FSA (with the possible exception of donor sperm, rules on that are kind of unclear) and those costs can be incurred by either you or your spouse. We maxed out the HSA this year for that purpose. Another note is that our journey has been way longer than we thought it would be. We are both young and don’t have medical fertility issues, but we’ve done many IUIs, had an ectopic pregnancy, and now IVF over the course of almost 3 years. We have probably spent $20k all together on this so far (and it’s only that low because IVF is now covered by my insurance). The good news is, we started getting our financial house in order 4 years ago before we got started (just like you’re doing now), and have not incurred any debt as a result of trying to get pregnant. We have also been able to meet our other savings goals during this time. We budget using Mint, and we have dealt with the cost by adding $500/mo to the monthly ‘Health’ budget that rolls over each month. For reference, our income is a bit less than yours, so it is possible. Good luck fam!

I absolutely agree with the HSA max out. Its a complete life saver (if you have a high deductible plan) not to be confused with the other health accounts that are not nearly as good. Max your HSA out, just do it. Invest what you dont need this year in index funds. I keep one full deductible out just in case. I buy coverage from the market place (very high deductibles) and having a very well stocked HSA from my youth is a huge reason my husband and I decided I could stay home with my daughter. Good luck in your fertility journey!

Definitely agree that maxing out an HSA is a great idea! And even better because it can roll over from year-to-year. Less flexibility with the FSA, but we maxed out our FSA the past two years and spent it all on fertility/pregnancy stuff easily. Once we moved from home inseminations with a known donor to using the donor in a clinic setting, the $ added up quickly. We were able to pay donor expenses with our FSA, but you’ll want to check on your individual plan’s limitations. Also check out your company’s fertility benefits – corporate benefits can be pretty good. BUT look into what restrictions they may put on it – some have limitations like requiring so many IUIs out of pocket to “prove” infertility before they’ll begin covering them, or other non-queer-friendly stuff.

That is such a great idea and one we did not realize was possible. Makes so much sense – thank you!

Does North Carolina have a 529 deduction? If so, you can put money into a 529 to max the deduction each year, and then take it out immediately to use for student loan payoff. You can do this each year until you reach the lifetime maximum of $10,000–and then, if you have a kid by then, just change the beneficiary to the child.

But I agree with Ms. Frugalwoods that having the kid comes logically before saving for its college. This is also a good time to link to MMM: you’re allowed to have only one kid!

https://www.mrmoneymustache.com/2014/09/10/great-news-youre-allowed-to-have-only-one-kid/

https://www.investopedia.com/articles/personal-finance/020217/can-i-pay-student-loans-my-529-plan.asp

529 offers flexibility in that it can be used for one of you to pursue further training or education as well if the need arises.

Since I’m from NC (same city as well), unfortunately, the state eliminated the deduction years away. As soon as it was cut, I pretty much stopped contributing to my kids’ 529 plan (but increased investing in the taxable accounts instead). To this day, it irks me to remember the stupid justification then the Republican governor gave for this elimination… A correspondent asked him why to eliminate the deduction for the 529 plan which encourages parents to save (I don’t recall if it was $5k or $10k max) but leave the deductions for the yachts and their maintenance… The answer was “Parents will not stop saving in 529 if we eliminate it, but the rich might decide to stop buying yachts and keeping in the state.” That’s the dumbest move and explanation I’ve ever heard. Unfortunately, the Dems didn’t reinstall the 529 deduction either, but I do believe having the deduction against taxes would be appreciated by parents. OTOH, not having the deduction you have choose any state’s 529 plan to contribute to because at the time I was only able to sign up for NC529 plan or would have lost the tax benefit.

Does North Carolina have a 529 deduction? If so, you can put money into a 529 to max the deduction each year, and then take it out immediately to use for student loan payoff. You can do this each year until you reach the lifetime maximum of $10,000–and then, if you have a kid by then, just change the beneficiary to the child.

But I agree with Ms. Frugalwoods that having the kid comes logically before saving for its college. This is also a good time to link to MMM: you’re allowed to have only one kid!

Can you say more on “You’ll need more than you think”

Well done, love the details and wonderful to see real numbers from real people… helps so much to put things into perspective.

A good topic for the FW community to discuss is whether college is even worth it if you have to take out student loans. Fat cats on Wall St are getting rich off Federally guaranteed loans and young people are falling into the trap financial indentured servitude.

Yes, please! My husband and I are both college educated and managed to make it out debt free but we are highly skeptical that the value is worth the expense for our kids (unless they want to be in medicine or maybe law.) My brother recently got a very good (well paying) tech job. The job qualifications didn’t even list educational experience, just skill experience. He doesn’t even have a bachelor’s degree. He basically taught himself and gained experience through work. The company didn’t care.

I agree this would be an interesting topic, but remember the issue is very localised. I’m in Ireland, where university education is tuition-free, and fees are capped at 3000 euros a year. With other European countries being similar. Yes, I pay somewhat higher taxes (and I came here many years ago as an American taxpayer) but considering those taxes have also covered healthcare for my family of six, it’a not a bad deal, and what’s more it promotes better social equality. It does not entirely mitigate the problem of some students spending time and money on qualifications with little return or prospect of employment. But declaring all but a few majors to be a waste in the US suggests the real discussion that need to be take place tbere is how to make education affordable. To everyone.

This all seems like great advice. As a fellow travel-lover, I want to suggest that while Lauren and Kayla are working hard in the next few years to pay off debt, if they do not want to forego travel completely, they might want to consider traveling to places where the USD goes a lot further (Southeast Asia, Eastern Europe, for example). This is potentially less luxurious (but not necessarily-my partner and I once lounged around a world class hotel/pool/spa in the Philippines for very little money) and there are plenty of “off the beaten path” cities/countries with history, art, culture, good food for a fraction of the price compared to Western Europe (just noticing that is where most of their lovely travel photos were taken). Not to mention, these more “adventurous” places might be nice to visit pre-children (when staying in the hostel/budget lodging, taking public transportation, etc. is easier). Of course, this is all advice in a reality apart from Covid… All the best!

And South America! I loved traveling down there because the USD went so far and you didn’t even change time zones and lose a day to jet lag! There’s plenty of luxury down there too! (though obviously right now, Covid concerns might be an issue)

Thanks for your advice! Yes we definitely want to find a balance between still traveling some and also reaching our financial goals.

So many of the couple’s eggs are in the single basket of their mutual employer. They both work for the same company, they both own company stock, and I imagine any company match in their 401(k)s is in company stock. We tend to forget how much we depend on our employer and how, should that employer have catastrophic financial difficulties, our finances could suffer.

I’d like to see the couple get rid of the company stock if they are vested; if these shares are the result of stock options, consider exercising options in future by selling rather than holding them. And as they vest in their company 401(k) contributions, they should consider selling that stock to diversify. Finally, if the opportunity arises for one of the couple to change jobs, that would be prudent. Charlotte is a major banking center so finding work with another bank is something to keep in mind.

Are there companies that make 401(k) contributions of their own stock? I assumed employer contributions were always allocated the same way your own contributions are. (I’ve never worked at a public company so that may not have been a reasonable assumption.)

Correct, my company contributes to my 401k but you can choose (from their offerings) how to invest. Different than an ESPP or gifted stock or whatnot.

Agreed with this– don’t get yourselves into an Enron situation. Sell off the company stock as it matures (is vested, like Dorothy says) on a regular basis and replace it with something else.

Yes, we have definitely thought of this as well. Once our stock is vested we are planning on selling Lauren’s. Long term, Lauren is also planning on probably switching jobs since I have a better trajectory currently. Thanks for your advice!

I also came here to say something about the reliance on a single employer. Every time a big employer closes down locations or does big layoffs, you see someone on the news who both partners worked there and both their inckems are gone simultaneously. Add to that pensions and investments with the same employer, and that’s a lot of your eggs in one basket. If this bank goes bust, or even just has a big round of involuntary redundancy, you could lose a huge amount all in one go.

Also, i think you need to take into account the age of the partner who plans to become pregnant. If the 26yo partner plans to be the only one to carry kids, then the order laid out in the answer makes sense – get debt free, build up emergency fund, save for pregnancy costs. But if the 30yo partner plans to have any pregnancies, you may want to consider moving the baby plans earlier.

*incomes – no idea where “inckems” came from!

A thought for consideration: Lauren and Kayla are extremely dependent on their common employer. That single company provides their entire household income (both salaries and both bonuses), health/dental/supplemental life/critical illness insurance access, some of their ongoing savings (the 401(k) matches), and a chunk of their existing investments (company stock). If the company is on very solid financial ground for the foreseeable future, this may not be an issue, but if there’s any chance the company might have problems, they might want to explore one of them moving to a different company and diversifying out of the company stock, so all their eggs aren’t in one basket.

Thank you so much for mentioning this, Wendy! I meant to include it in my recommendations, but forgot!

It looks like Dorothy and I had a mind meld, writing virtually the same comment at the same moment.

Kayla and Lauren seem to have other higher priorities right now with debt repayment and pregnancy process, but I wanted to point out for other readers and in case they end up with extra savings they want to move in a tax advantaged way. You can actually set up 529s that you will use for your kids before your kids are actually born. Many states will give you a state tax break on contributions to a 529 in anyone’s name, and you can switch the beneficiary to another person in the beneficiary’s family. So you’re can contribute to a 529 in your name and then transfer it to your child once they are born or closer to college age. You may also be able use this feature to increase your state tax benefits, ie contributing to 529s in both your and your child’s name to get tax benefits on both, and then later transferring your 529 balance to your child’s name.

What struck me is how jealous I am about all of their trips and a cabin! I wish I had gone to more countries when I was young and didn’t have kids. So I wonder if they will have trouble cutting out travel, etc. while paying down debt (I would!)

I did also notice the line about freely ‘buying books,’ etc. I think their lifestyle is going to change a lot if they are more frugal (use libraries, etc.). Still, they have the income to pay off some of these debts. Good luck!

This case study sucked me in because I agree that this is about the emotional side of spending. I too grew up with financial instability (we didn’t move much but the last week of every month was the hungry week waiting for the social security payment at the beginning of the next month). I wholeheartedly second doing some personal work, with a therapist and on your own too, to further uncover how spending attempts to fill the emotional hole of scarcity and instability. For 2 of my siblings, this manifested as living as good a life as debt could provide in order to prove to themselves that they’d “made it”. For me, I bounced in the same cycle of debting and paying it off but over the years have managed to redirect the spiral upward and thanks to the pandemic curtailing my spending I am paying off my last credit card this month. My personal advice is:

(1) Do the hard emotional heavylifting of dredging up how spending and fun stuff compensates for the childhood financial instability and what message you’re telling yourself by buying All the Things.

(2) Use hacks to find the cheapest ways to still do the things you love (e.g., work as an usher at shows you really want to see, use the library instead of buying books or offer to haul books away from other people as a junk hauler [our friends now know to call us when they cull their book collections], be willing to travel on a major holiday when airline tickets are cheaper, etc.).

(3) Remember that you can afford anything you want but not everything you want. Prioritizing is key. Write down everything you want to do and pick the top 3, focus on those and let the rest go for now; eventually you’ll be able to circle back to them or you’ll discover they weren’t that important in the first place.

(4) For any non-essential purchase, put it aside for 24-48 hours. If you’re still thinking of it a day or two later, it’s probably worth getting. If you’ve forgotten about it, leave it forgotten.

(5) Avoid temptation such as websurfing stores, you will always find the pretty shiny’s to buy so don’t put yourself there.

(6) Keep a gift wish list so when loved ones ask you what you want for birthday/anniversary/Xmas, you can pull items from there that you wanted to buy and have someone else buy it for you.

(7) Get and read “Your Money or Your LIfe” – this will help redirect your thinking per above.

(8) Attitude is everything. If you think of cutting back as deprivation just like when you were a kid, it will be nearly impossible to sustain. Reframe it as the choices you’re making now so that 40-year-old you will be in the happy place for real instead of just pretending.

(9) Remember this all takes time – Rome really wasn’t built in a day. But at some point a foundation has to get dug and a structure raised, and done repeatedly, so that the city gets built.

Good luck! You have great assets of high-paying jobs and lower COL, you can leverage those now for real improvement. Warren Buffett said, “When the tide goes out, you find out who is swimming naked.” Use your high tide to find and pull on a bathing suit. 🙂 I hope to hear an update from you in a year or two and I wish you both the best.

Agree with the “Your Money or your Life” recommendation. For a lighter read, the “Ultimate Cheapskate’s Road to True Riches” also covers re-thinking how you think about money and is pretty funny along the way. Good luck!!

Thanks for your advice!

I can personally attest to the envelope method. I put so much money in every week for food, versus once a month. That works for us. I also used to have a few different savings accounts, vacation, Christmas spending, taxes, it really helped to simplify my life by having those different accounts. Do you make any charitable contributons? What about gifts for family members and office friends? Once you start tracking all your different expenses you’ll have different budget categories. I noticed you have company stock given to you. That could also make a difference in your retirement. I worked for a bank for 30 years and was given stock every day. When I retired after 30 years the stock was worth over a million dollars.

Kayla – don’t feel bad about working a corporate job! If you like it and it pays the bills, that’s great, and so much more than what many people have in their jobs. Companies need corporate treasury functions to operate and provide goods/services to others in the wider economy. That’s very useful! If you are worried about your job not having as much of a social mission, then you can always donate time/money to causes you believe in as well. Plus you have a valuable skill that you could always transfer to another organization if/when you feel like it.

Thank you Elizabeth! This is definitely one of my biggest insecurities. I appreciate your perspective!

I don’t have any advice but as “naturalized” Swede, I just have to say awesome job on the prinsesstårta! It looks legit!

We lived on one salary and saved the other one for retirement. We saved up for a new car by pretending to have a car payment. We are too frugal to pay interest. We rode our tandem bicycle. We shopped at thrift stores for clothes. We are retired now. Because we have been frugal our whole married lives, it is pretty easy to live on one pension check and one social security check with money left over. I watched my grandmother live on $486 a month. It wasn’t pretty. I made no money at 27 but I saved for retirement first.

Did you hear me? Live on one salary. You never know when you will lose a job. Get a side hustle just in case.

I lost my job at 24 and my husband proposed a few days later. We have lived our entire married lives basically saving one salary and living on one. It has given us so much choice. We live in a small home we could afford on the lowest salary. Maxed out and HSA long before medical bills were an issue, retirement, savings. I cant say enough how much this is a great system if you can possibly do it. We were able to take big international trips, buy used cars outright and quit my job (making more money and carrying our insurance) when I wanted to stay home with our daughter. Our savings/HSA/retirement is still growing in the stock market and our fabulous frugal lifestyle fits so well with our new family life. Now we are 33/35 with a 2.5yr and one on the way. And I am thankful every day that I was a recession college graduate and saved before I spent and my husband lived at home and worked full time for several years and saved a ton. Thank you Frugalwoods for your insight over the years, that helped too!!

I would suggest maybe selling the boat to cover most of the vehicle loans. Shout out to the 2016 Sonata Hybrid, that’s my car. Also, I would suggest maxing out your HSA, I think the limit is 7,100 per year for married couples, that should get you to the cash price of a birth in 2 years I think (never had kids so I could be way off with this one.) With the HSA, you save on FICA and SS taxes, so it’s the most efficient way to save for a planned medical expense.

Simply safe home security system is much more affordable at $15 per month, for sure this is a reoccurring expense that could be drastically reduced.

Consider also fully funding your HSA for triple tax benefits and not touching it. We keep track of all our medical expenses we pay out of pocket and don’t pull the money out of HSA so it can grow tax free like a retirement account. If we ever need money we can withdraw it since we keep the records

Use online tax filing software like TurboTax or tax act to better understand the implications of taxes. It’s very affordable way to file your taxes each year and it will be obvious that if you are married filing jointly it doesn’t matter which income your health insurance comes out of.

I enjoyed reading your story and Mrs. FW’s advice. I wanted to offer some perspective as a parent because I admire you both for wanting to take charge of your finances prior to adding children into the mix. The new proposed budget is as Mrs. FW said a little “barebones”…however, the feeling of starting a family without the mental weight of carrying a lot of debt is an awesome feeling. Besides not having to think about chipping away at it while raising your family, it also simplifies and streamlines your finances. Good luck with everything!

Great post. $70 a month for 1 bag of dog food could be cut a lot lower. Grain Free diets at fad and expensive. Go with a $30-40 dollar large bag of Purina Pro Plan and save some dough – from a veterinarian.

Since they areCostco members, Costco (Kirkland ) dog and cat food is highly rated!

I agree. Our 5 have been on this food for years and love it! Unless their animals are on special dietary restrictions, they could give it a try.

Kudos to Kayla and Lauren for submitting this case study, and for proactively dealing with their shared past of financial insecurity and general instability. That is not a small thing! I, too, experienced financial instability growing up, and I’ve worked hard to right the ship. I also identified with this case study because I live in the NC Triangle area, and my husband and I make just a hair under what Kayla and Lauren do combined.

All that being said, what I’m going to say might sound harsh, but I am saying it from a caring place. To me, Kayla and Lauren’s situation is what MMM calls a “five alarm fire.” Lots of debt and few assets, but with their salaries it can be turned around rather quickly.

I would recommend the following, some of which is more drastic than what Mrs. FW recommended:

–Trade in the Buick and get a used compact SUV—something boring like Honda or Toyota. You may need to take out a very small loan to pay for it, but imagine paying off a ~$4k loan instead of an $18k loan. That is a huge difference.

–As others have said, now’s the time to get really clear on your priorities. You want to keep traveling, have kids and pay for their education, AND retire early. Frankly—and this is important to understand—you don’t have enough assets right now to accomplish all of those things. I love the phrase “You can have it all, just not all at once!” I would continue the honest conversations you’re having with one another about what is most important to you. Perhaps you travel only to domestic destinations for the next 10 years (although I am super jealous of your honeymoon photo), have one kid, and retire at 60 or 65. There are so many options!

–I’ve seen lots of comments above about 529 plans. Please do not even think about 529’s right now. In North Carolina, 529 contributions are not tax deductible. Furthermore, you have a ton of tax-advantaged retirement space (the rest of your 401ks + Roth IRAs) that you could be taking advantage of, but you’re not. Please, please, please do not open a 529 or even think about contributing until you are saving significantly more for your own retirement and have a robust emergency fund.

I have a slightly different recommendation from Mrs. FW in terms of how to prioritize your emergency fund and debt payoff:

–Get rid of the $18k loan and assume a smaller loan, or none at all.

–Then, simultaneously pay off the $14k loan and increase your emergency fund. Split the money between the two goals. You do not have enough of an e-fund and need to bolster that sooner rather than later given that you own a house and work for the same employer.

–Investigate your student loan interest rates and see if refinancing them makes sense. Don’t pay on them currently, and, if the interest rate is under 4%, you don’t need to pay them off super quickly, either. Concentrate on beefing up your emergency fund *before* paying off your student loans.

Our situations are similar, except for one thing: I have children, and they’re in full-time daycare. We’ve always paid around $1,300/month per child, and in the Triangle that’s standard. I say this not to discourage you from having kids, but so that you know what to expect once you have them. Say goodbye to that extra $999 from not having car loans! While I know that talking about buying used kid clothes is fun, the day-to-day expenses pale in comparison to the cost of your time. It is so important to have your ducks in a row financially before you have kids. I commend you for taking the time now to re-prioritize and scale back your discretionary spending so that you’re on solid footing by the time you have a child.

Finally, I love Laura’s comments above that deal with the emotional side of spending and saving. Such good stuff in this case study. Thanks to Mrs. FW for posting, and I wish Kayla and Lauren the best of luck!

I love this story, my partner and I found ourselves in a similar scenario in our mid 20s. If all of your spending is on credit cards, personal capital/YNAB/mint can be really helpful. We trade off cooking responsibilities month by month- mint helped illustrate that one of us spent 2x the grocery budget with cold hard facts 🙂

By having our loan payments/savings direct deposited we were able to create limits which enabled us to pay off$180k in student loan debt, save for a 6 mo emergency fund and bet to the 401k max point in 5 years. Not seeing the money hit your checkbook is powerful!

1) Car Insurance seems pretty high for two cars. See if you can shop around for better rates. Also i increased deductibles and reduced coverages on one car which we are not using much during Covid. You can try that

2) Try Ring or Simply safe which cost less than $20 and gives all kinds of services. $80 is wayyy too high

3) If you are really into watching lot of shows, try IPTV which cost around $10-$12 and pretty much has every show from all the streaming services

Excellent case study and lots of good advice in the comments and from Mrs Frugalwoods. I just want to suggest this: Since you’re both working from home and both work at the same location, maybe sell one of the two cars, and share a car instead.