Puck works as a librarian and recently settled into a new job and new apartment in Boston, MA. Ve is also a writer and recently had vis first work of fiction published! Vis family immigrated to New York City from Ukraine in the early 90s and vis parents still live there. Today, Puck would like our help determining how to create a sustainable, mindful spending and savings pattern going forward. Ve is deeply generous and connected to a wide range of artists and creators, whom ve loves to support. However, now that Puck has student loan debt from vis master’s in library science degree, ve feels the need to rein in this generosity a bit in order to get vis finances into shape.

And a note: Puck’s pronouns are ve/ver/vis/verself (example sentences here) which are new to me as a writer, so please bear with me as I get this format under my belt. Please feel free to correct me in the comments section. I love a day when I get to learn something new! Thank you for that opportunity, Puck!

What’s a Reader Case Study?

Case Studies address financial and life dilemmas that readers of Frugalwoods send in requesting advice. Then, we (that’d be me and YOU, dear reader) read through their situation and provide advice, encouragement, insight and feedback in the comment section.

For an example, check out the last case study. Case Studies are updated by participants (at the end of the post) several months after the Case is featured. Visit this page for links to all updated Case Studies.

The Goal Of Reader Case Studies

Reader Case Studies intend to highlight a diverse range of financial situations, ages, ethnicities, locations, goals, careers, incomes, family compositions and more!

The Case Study series began in 2016 and, to date, there’ve been 70 Case Studies. I’ve featured folks with annual incomes ranging from $17k to $200k+ and net worths ranging from -$300k to $2.9M+.

I’ve featured single, married, partnered, divorced, child-filled and child-free households. I’ve featured gay, straight and trans people. I’ve featured men, women and non-binary folks. I’ve had cat people and dog people. I’ve featured folks from the US, Australia, Canada, England, South Africa, Spain, Finland and France.

I’ve featured people with PhDs and people with high school diplomas. I’ve featured people in their early 20’s and people in their late 60’s. I’ve featured folks who live on farms and folks who live in New York City.

The goal is diversity and only YOU can help me achieve that by emailing me your story! If you haven’t seen your circumstances reflected in a Case Study, I encourage you to apply to be a Case Study participant by emailing mrs@frugalwoods.com.

Join the UBER FRUGAL MONTH!!!

I’m hosting an Uber Frugal Month Group Challenge in January: a free and fabulous way to tackle and tame your finances. It’s kind of like doing a Reader Case Study on yourself! Sign up in the box below to join me starting January 1.

Reader Case Study Guidelines

I probably don’t need to say the following because you folks are the kindest, most polite commenters on the internet, but please note that Frugalwoods is a judgement-free zone where we endeavor to help one another, not condemn.

There’s no room for rudeness here. The goal is to create a supportive environment where we all acknowledge we’re human, we’re flawed, but we choose to be here together, workshopping our money and our lives with positive, proactive suggestions and ideas.

A disclaimer that I am not a trained financial professional and I encourage people not to make serious financial decisions based solely on what one person on the internet advises.

I encourage everyone to do their own research to determine the best course of action for their finances. I am not a financial advisor and I am not your financial advisor.

With that I’ll let Puck, today’s Case Study subject, take it from here!

Puck’s Story

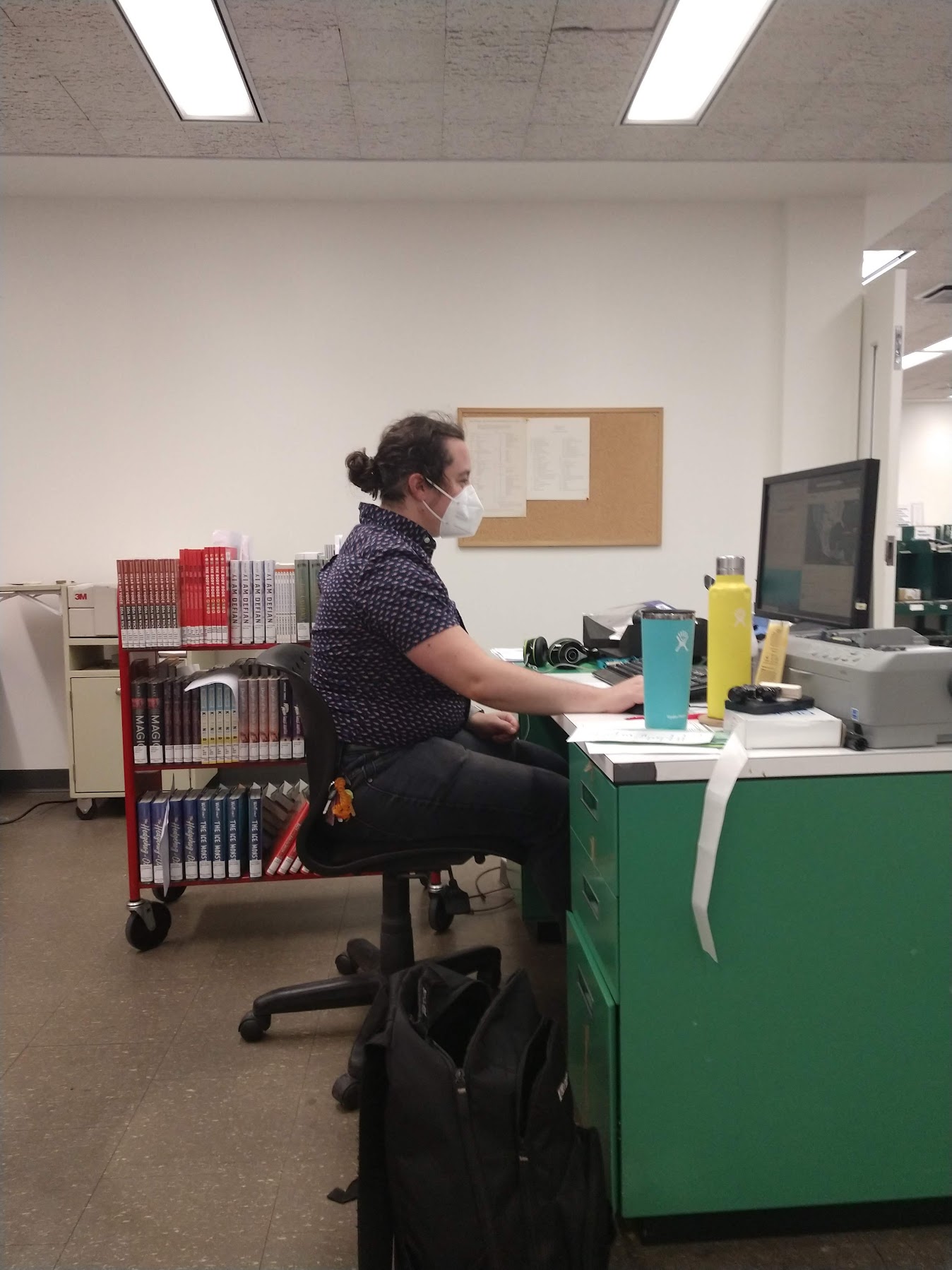

Hi, Frugalwoods! My name is Puck and I work as a librarian in Boston. I’m 31 years old and my pronouns are ve/ver/vis/verself, although “they/them” pronouns are also fine if neopronouns are hard. I am a writer, librarian, and all-around nerd with particular passions for tabletop roleplaying games, languages and linguistics, and all things sci-fi/fantasy.

I’ve also done a bit of voice acting in a fiction podcast, something I enjoyed immensely and hope to do more of. I live with two roommates who are my close friends, as well as being a romantic couple (with each other, not with me). I myself am polyamorous and have a few serious partners but nobody I live entwined with, and all of my romantic relationships are long distance for the moment.

Puck’s Hobbies

My hobbies include doing watch parties of various films and shows with friends and loved ones (I have something nearly every night of the week, most of them virtual), playing tabletop roleplaying games (currently I participate in ongoing games of Monster of the Week, Star Wars: Edge of the Empire, and Ars Magica), learning new languages (currently Mandarin and Korean are at the top of the docket), and creative writing (fanfiction, poetry, and original fiction). I tend to have fairly eclectic interests and love trying new things.

Pre-Pandemic Hobbies

It’s hard to remember what things were like before the pandemic, but other things I used to do: Traveling! I’ve done a very small amount of travel since my grad program, mainly with family, but no international travel in a while, and I miss that. Dance! I really love social dancing, especially Argentine tango, and I was also briefly in a contemporary dance company. I’d like to start going to social dancing events once it feels safer to do so, but I’m definitely not ready to touch strangers or even friendly acquaintances like that just yet.

Puck’s Background

My parents, sisters, grandparents (now deceased), and I immigrated to the United States from Ukraine in the early 90s after the Soviet Union fell apart. I grew up in New York City, where my parents still live, but my two sisters and I all ended up living in New England.

I really like Boston and I am hoping very hard not to have to move anymore, because I’ve moved apartments at the rate of about once a year or so and it’s extremely draining, both to the spirit and to the finances. There’s a Russian saying that two moves is equivalent to one house fire in terms of disruption to one’s life, and I really feel that.

Puck’s Career

To give a little background on my current professional and financial situation: I moved states in 2017 to move in with some (different) close friends and in the summer of that year, decided to enroll in a Master’s program in Library and Information Science, changing careers from linguistics annotation. It’s hard to explain just what linguistics annotation is, but long story short, I was freelancing and there wasn’t really a way to survive long term doing it, so the only reasonable next steps were to either go into academia for linguistics or learn to code and go into industry, neither of which appealed to me.

However, I’d been kicking around the idea of becoming a librarian for a few years at that point, and with my finances getting sticky, my health going down the drain due to untreated Lyme disease misdiagnosed as fibromyalgia, and no desire to do the other kind of grad school, I took the leap and started studying for my MLIS.

When I’ve done info sessions for my grad program, I’ve always told people not to do what I did — go into the program without any prior experience working in libraries and then study full time while living on student loans. It’s a really risky way to go about it, and there’s no guarantee you’ll find a job that’ll help you recoup that kind of debt. That said, it worked out very well for me. In addition to this just being the way my brain works, I was also being treated for chronic Lyme disease at the time, so living on student loans full time was the only way I could really function. If I had to both study and work to support myself, I wouldn’t have managed it.

Puck’s Current Job as an Assistant Librarian

In 2020, I began working for the city library and moved in with strangers in a relatively cheap apartment to fulfill the residency requirement. This is the job I currently have. The benefits are good and it’s a union position.

I started working here in April 2020 when the library was actually closed, and I was paid my full salary to do no work for several months before I was given things that were possible to do from home. This was helpful to begin to build my funds back up after spending a lot on the move.

In addition, that same month, I got really into a new show with a bunch of friends and started writing extremely prolific amounts of fanfiction, which led to me having an original story accepted into an anthology! This is my first time getting paid for creative writing and it is a huge milestone. I’ve hung the check up on my cork-board to remind myself what I’m capable of. I fully intend to continue working to get my original writing published, both poetry and prose, although I haven’t had the bandwidth recently to work on submissions.

This past September, I moved once more, this time to live with close friends in a more intentional household. We share a lot of expenses and have dinners together most nights. We watch shows and movies together and cuddle on the couch, something I would never want to give up after being so completely touch-starved for a year during the pandemic. I was friendly enough with my former roommates, but we were never super close, and a co-op-y style household is very important to me, so even though this apartment is significantly more expensive (I was paying $550/month when I moved out and that was AFTER a rent increase!), I think it’s worth it. So that’s my life now!

What feels most pressing right now? What brings you to submit a Case Study?

As I mentioned above, I moved recently and it’s my second move in about a year and a half, and both moves ate up my savings. I was lucky enough to graduate my undergrad with no debt–thanks to a good amount of scholarships and my parents being able to pay the rest–so my current student loans (all of which are federal) are a very new thing for me.

I’d like to find a way not to wipe myself out with my moves, to be more intentional with my spending and saving, and to create a plan to handle my student loans.

For awhile I was attempting to at least knock a hole in my interest so the loans don’t increase. When all my loans went into forbearance and the interest dropped to zero due to the pandemic, I was excited to start paying down the principal, but I looked into Public Service Loan Forgiveness (PSLF) once I started at my current job and it appeared that payments paid during forbearance didn’t count toward the 120 required payments, so I stopped paying the $400 a month that I’d initially been throwing at them. Since then, this appears to have changed.

I’ve sent in the paperwork to be certified towards PSLF, but it’s going to take some time. In the meantime, I’m not quite sure what to do. Eventually forbearance will end, and I’ll definitely want to start making payments, but until then, do I continue to hold off on making payments?

When it comes to my spending, I have a tendency to, er, patronize the arts, so to speak. I get excited about people creating things on Kickstarter and Youtube, and artists on Tumblr and twitter, and I’ll fund Kickstarters, subscribe to Patreons, commission works of art from friends and strangers both. And then because I get glorious art or books or games or video essays as a result, the joy of having art outweighs the pain of spending money, so I don’t really learn my lesson until I start looking at my funds and going “oooh, oh no, that is extremely low.” You know?

For now I’ve unsubscribed from all my Patreons and a bunch of my software subscriptions (many are annual so I won’t renew when the time comes), and have put a moratorium on kickstarters and art commissions, but I don’t want that to be a permanent thing, because, well, I really like being able to support creators in creating! And I have a few extremely specific art desires and I know exactly whom I’d like to commission to make them, once I have money again…

My other biggest pain points are food expenditures, both groceries and eating out. This is kind of in flux because I have new roommates and we share a lot (though not all) of our food expenses, so what this will look like in the future, I’m not 100% sure. Right now I have maybe a month and a half of data? I don’t want to count September because that was the month I moved and everything was so messy then. But I do know I can do better in that whole, “Oops I forgot to make lunch again, time to go buy a sandwich at B. Good” vein, and that has nothing to do with my roommates and everything to do with me.

When it comes to assets, I have a Roth IRA I’ve had since undergrad, but which I’ve never funded to the maximum (which is $6,000 a year, I think). My current job also has this pension plan, but I don’t fully understand what that entails. From my research, it looks like in addition to the pension, I can apply for a 457 SMART Plan, but there doesn’t seem to be any kind of matching, so it doesn’t seem worth it?

The CD is from when I very briefly had an investment account with a company that closed and rather than trying to roll that money over into other investments, I threw it in a CD. That may not have been the wisest move ever, but it’s done now.

I’m looking for full librarian positions at the moment, both because they require an MLIS (and I’d like not to have gotten my degree in vain) and because most librarian positions pay more than my current library assistant position. But it’s relatively slow-going, in part because I’m not willing to move so I’m only looking at jobs in the area, and in part because libraries are only just now beginning to hire again after most of them having hiring freezes during the pandemic.

What’s the best part of your current lifestyle/routine?

Two things:

1) Living with my roommates! I love sharing chores and cooking with them, eating together, cuddles and hugs, showing each other movies and shows we like! They’re really good friends, and although they are a couple with each other, I never feel left out or third-wheeling or anything like that.

2) My online fandom communities. I have several Discord and Slack servers that I’m in and I really love yelling about shows/books/fics/art we like with friends, sharing works in progress, cheering each other on in our creative endeavors, and recommending new works. I do not exaggerate when I say that my online communities got me through the pandemic and, although this is less important than the social/emotional aspect, did I mention that I got original fiction published because of my fanfic?! I never in a million years would have put that on my 2020-21 bingo card.

What’s the worst part of your current lifestyle/routine?

I’m not super great at doing things that have long term benefits but involve short term discomfort or boredom (keeping up with my physical therapy exercises, saving up for emergencies rather than spending money on shiny new things). I’ve repeatedly failed to rearrange my schedule such that it includes daily PT, making sure I have a preprepared lunch ready to go on workdays, and a reasonable bedtime routine.

Also, naturally, the pandemic is a constant source of stress and it’s very much not over. I find navigating conflicting information about what is safe and what isn’t extremely stressful. And I’ve got some major dental stuff that’s come up recently, so getting those procedures done is going to be both stressful and expensive (although my insurance is pretty good so it should cover a fair chunk of it, and the rest can be paid with the FSA).

Where Puck Wants to be in Ten Years:

1) Finances:

- Student loans either forgiven or on their way to being paid off;

- Emergency fund built up to withstand shocks;

- A good sense of where I’m going in terms of retirement.

2) Lifestyle:

- Still living in a co-op-style intentional house with people I care about, although possibly not the exact people I’m currently living with;

- Visiting family and long-distance partners somewhat regularly;

- Some international travel, particularly to places whose languages I’ve learned or am going to learn;

- Still participating in some form of fandom, doing tabletop roleplaying, and dancing regularly;

- I’d also like to learn stage combat at some point in the intervening years.

3) Career:

- I’d like to have a librarian position that includes both back-of-house cataloging/classification work and public-facing duties. This would probably require getting a job in a smaller library system than the one I’m currently in, since larger systems tend to silo different duties across departments.

- I’d also like to have more voice acting credits under my belt and be publishing poetry and short fiction for pay, although I’m not interested in either of those as a primary career.

Puck’s Finances

Income

| Item | Amount | Notes |

| Library salary | $2,743 | My net salary from the library minus the following deductions: health & life insurance, pension contribution, union dues, and taxes. |

| Short story sale | $33 | This was a single payment for a short story divided by 12; I’m very proud of this |

| Monthly subtotal: | $2,775.59 | |

| Annual total: | $33,307.08 |

Debts

| Item | Outstanding loan balance | Interest Rate | Loan Period/Payoff Terms |

| Student Loan 4: Direct Grad PLUS | $26,072 | 0% interest | Currently in forbearance. |

| Student Loan 2: Direct Grad PLUS | $25,526 | 0% interest | Currently in forbearance. |

| Student Loan 1: Direct Loan – Unsubsidized | $22,933 | 0% interest | Currently in forbearance. |

| Student Loan 3: Direct Loan – Unsubsidized | $16,021 | 0% interest | Currently in forbearance. |

| Total: | $90,552 |

Note: all of my student loans are federal and so should qualify for PSLF.

Assets

| Item | Amount | Notes | Interest/type of securities held/Stock ticker | Name of bank/brokerage |

| Roth IRA | $18,620 | Roth IRA I’ve had since just before I finished undergrad. | Large mix of ETFs | Wealthfront |

| High Yield 5-Year CD | $1,352 | Matures Aug 9, 2024. | Earns 2.65% interest | Ally Bank |

| Savings Account | $1,092 | This is where my money lives unless I need it immediately, since it’s got the higher percentage. It used to be over 1% interest when I first opened it, but alas. | Earns 0.5% interest | Ally Bank |

| Checking Account | $756 | This is the money that’s going to be used imminently | Earns 0.1% interest | Ally Bank |

| Total: | $21,820 |

Vehicles: none

Expenses

| Item | Amount | Notes |

| Rent | $850 | |

| Moving Costs | $484 | Average for 2021 according to YNAB. I am hoping this number stays at 0 for the foreseeable future. |

| Groceries | $378 | This is the average for 2021 so far according to YNAB. |

| Kickstarters | $206 | Average for 2021 according to YNAB. I have committed myself to not contributing to any more Kickstarters for the foreseeable future. |

| Daily Dining Out | $204 | Average for 2021 according to YNAB. I separate out daily dining out from social dining out because going out/ordering in with friends happens way less frequently and this—buying lunch out for myself—is definitely an area I can improve. |

| Monthly IRA contribution | $100 | |

| Home supplies/expenses | $93 | Average for 2021 according to YNAB. |

| Fitness | $86 | Average for 2021 according to YNAB. This includes ballet classes I took over Zoom while at my old place, and a personal training package that I expect to get reimbursed by my FSA once I’ve completed all the sessions. |

| Patreons | $80 | Average for 2021 according to YNAB. I have unsubscribed from all of these for now, but I would like to go back to supporting some of my favorite Patreons when I’m more stable, but probably not all of them because it does add up. |

| Art purchases/commissions | $73 | Average of individual purchases in 2021. I’m not going to do any more of these for a while, although I do have a few specific art pieces I’d like to commission at some point when I’m more stable. |

| Clothing/shoes/accessories | $70 | Most years this is a lot less, but I needed to buy a lot of clothes that I hadn’t bought replacements for in years in the last three months. |

| Books | $67 | Average for 2021 according to YNAB. |

| Gifts | $64 | Average for 2021 according to YNAB. |

| Gaming | $61 | Average for 2021 according to YNAB. I bought a Nintendo Switch over the summer and a bunch of games for it. I also recently bought several reference books for a tabletop RPG I am participating in. This is another place where I intend the number to go down to $0 going forward. |

| Donations | $59 | Average for 2021 according to YNAB. Includes monthly contributions to the organizations that matter to me, as well as spur of the moment donations to beggars and people experiencing emergencies. |

| Utilities | $56 | Includes gas, electric, internet, and compost pickup |

| Medical | $52 | Average for 2021 according to YNAB. Not reimbursed by FSA. |

| Social Dining Out | $52 | Average for 2021 according to YNAB. This one varies a lot, there’s some months where it’s $0 and some months where it’s nearly $200. |

| Other entertainment | $50 | Average for 2021 according to YNAB. This includes purchases of music albums and movie rentals, paying buskers, virtually attending events, & the one and only movie theatre experience I’ve done this year. |

| Travel | $41 | Average for 2021 according to YNAB. |

| Tea stuff | $41 | Average for 2021 according to YNAB. I’ve pledged myself to buy no more tea or tea accessories until I have at least put a dent in my current supplies. |

| Renter’s Insurance | $21 | $247 paid annually |

| Software Subscription | $19 | This used to be a lot more but I’ve cancelled a lot of my software subscriptions since I moved, so this is going forward: LastPass (my password manager), YNAB (my preferred budgeting software), and two supportive things for software I use for free and appreciate: Signal and XKit |

| Streaming Services | $9 | My share of a Netflix subscription I’m sharing with my former roommates & an annual subscription to Viki divided by 12 |

| Monthly subtotal: | $3,213 | |

| Annual total: | $38,556 | |

| Totals minus the things I’ve recently cut out: | ||

| Monthly subtotal: | $2,309 | |

| Annual total: | $27,708 |

Credit Card Strategy

| Card Name | Rewards Type? | Bank/card company |

| Citi Double Cash | 1% back on purchase, 1% back on payment | Citi |

| Amazon Store Card | Some % back depending on whether I have Amazon Prime or not at any given time | Synchrony Bank |

Puck’s Questions for You:

1) How do I balance my desire to support cool creative endeavors and my need to remain financially solvent?

2) I find the experience of having nearly $100k in debt new and frightening, and I don’t have a concrete plan apart from ‘hope PSLF works out.’ I’d love to hear advice from people who are more familiar with the PSLF process and advice about managing student loans in general, especially in a time of pandemic.

3) How can I plan for future moves without wiping my savings out?

4) How can I become more intentional with my spending and saving?

Thanks, Frugalwoods and the commentariat! I’m a huge fan of the blog in general and the Reader Case Studies in particular. I’m both excited and trepidatious about being a case study myself.

Liz Frugalwoods’ Recommendations

I am thrilled Puck came to us for Case Study because I think ve’s at an important juncture: finished with grad school, gainfully employed in ver’s long-term profession and settled in a new city. Puck’s made a lot of excellent decisions to get to this point and I very much see the financial piece as the “what’s next” on ver life plan. With that, let’s dive in!

Puck’s Question #1: How do I balance my desire to support cool creative endeavors and my need to remain financially solvent?

Puck, before you can help/support others, you’ve got to first take care of yourself. Puck is already aware that spending more than ver income isn’t sustainable and I’m delighted at the changes ve’s already made to get ver spending down below ver net income.

But, even at the new spending level of $27,708 per year–with an annual income of $33,307.08–that only leaves $5,599.08 for savings every year. This is not bad, but it’s also not sustainable for the longterm.

The biggest challenge we’re going to continually bump up against today is Puck’s income. Yes, we will devise a budget and plan at ver current income level; however, I don’t want to gloss over the fact of the dollar amount: $33k in a high cost of living city like Boston is tough.

I heard two notes in Puck’s write-up that indicated a higher salary might be on the horizon:

- Ve mentioned ve’s looking for a full librarian position, which I assume would pay more than ver current assistant librarian role.

- Ve articulated the enjoyment and pride at publishing ver first piece of writing and so I wonder if that could be a viable and continuous side hustle?

At the end of the day, we can frugalize everything in Puck’s life, but the biggest change will come from an increased income. I think tackling this from both ends–income and expenses–will be a good way for Puck to think about ver finances going forward. Since expenses are the thing we can address today, let’s go for it!!!

Puck’s Uber Frugal Budget

I’ve done one of the first exercises in the Uber Frugal Month: I’ve identified Puck’s fixed expenses. Fixed costs are things you can’t (easily) change and are required for survival: rent/mortgage, utilities, medical care, food. Discretionary costs are…. everything else! When you boil it down to what you NEED to survive, the list is pretty short.

I’m not saying this is how most of us want or choose to live, but I find it instructive to identify one’s bare bones budget. That’s one of the primary goals of the Uber Frugal Month: to help you discern your base cost of survival. From there, you’re enfranchised to add back in the luxuries (aka Discretionary costs) that mean the most to you.

Here are Puck’s Fixed/Mandatory Expenses for Survival:

| Item | Amount | Puck’s Notes | Liz’s Notes |

| Rent | $850 | This is super low for Boston. Nicely done! | |

| Groceries | $378 | This is the average for 2021 so far according to YNAB. | Very reasonable and impressively low. Strictly speaking, groceries fall under ‘discretionary,’ since you have control over how much you spend.

But, since Puck’s groceries are so low already, we’ll assume there’s not room for additional frugalization in this category. |

| Utilities | $56 | Includes gas, electric, internet, and compost pickup | This is so low! Nice! |

| Medical | $52 | Average for 2021 according to YNAB. Not reimbursed by FSA. | |

| Renter’s Insurance | $21 | $247 paid annually | |

| Monthly subtotal: | $1,357 | ||

| Annual total: | $16,284 |

Puck’s baseline for survival is very inexpensive! Again, I’m not saying this is an ideal lifestyle, but I am illuminating what’s possible with an uber frugal mindset. An annual expenditure of $16,284 would enable Puck to save $17,023 annually.

Much of this boils down to embracing a mindset of values-based spending.

Put resources–money and time–towards the things that matter most to you and siphon resources from less important, lower ROI activities/people/experiences. Puck stated that the two best things in ver life are:

1) Living with my roommates!

2) My online fandom communities.

The good news is that this Uber Frugal budget allows Puck to keep both of those things. Roommates and internet included above!

Since ve doesn’t own a car or pay to commute, transportation isn’t factored in here. Obviously for people who do need a car/metro pass, that item would be included.

I encourage Puck to join the Uber Frugal Month in January and complete all the exercises on how to craft this lifestyle. Again, this isn’t intended to be a forever option–although some people choose to make it so. It’s intended to be a detox from spending, a realignment of priorities, and an illustration of the options you have with your money.

Why Save All This Money?

Two reasons: student loan repayments and an emergency fund.

Student Loan Repayments

Once Puck’s student loans are no longer in forbearance (more on that in a moment), ve will be on the hook for making monthly minimum payments. I don’t know what that dollar amount will be but, based on the overall size of Puck’s loans, it could be substantial. By living at the uber frugal rate above, Puck will have $1,418 per month available to funnel into loan payments and ve might need that entire amount.

Emergency Fund

Puck’s cash-on-hand stands at $1,848, which wouldn’t cover even one month of expenses at ver current spending rate. Yikes bikes! An emergency fund is the bulwark between you and debt. When I see Puck’s assets and expenses, what I fear for ver is a future of credit card debt. Because one cannot spend more than one makes and, if you don’t have any savings, you will eventually have some sort of emergency that plummets you into debt.

The emergency could be a lay-off from a seemingly stable job, a health crisis, a sudden increase in your rent/utilities, etc. An emergency fund is what ensures you don’t plunge into debt when one of those terrible (but kinda inevitable) things happen. See my epic car repair expenses last month for a great example…. And unfortunately, in a unionized profession, lay-offs are often first-in, first-out. Meaning, the most recently hired people (such as Puck) are the first to be laid off in the environment of lay-offs.

In an ideal world, you want an emergency fund totaling three to six months worth of your expenses. The less you spend, the less you need to save. The more you spend, the bigger your emergency fund needs to be. This is another area where knowing your uber frugal baseline is tremendously helpful!

At Puck’s current rate of spending $2,309 per month, ve would need an emergency fund in the range of $6,927 (three months worth) to $13,854 (six months worth). At the above uber frugal spending rate of $1,357, ve’d need $4,071 to $8,142.

Short-Term Goal: Do It for Six Months

If Puck is game to try out this uber frugal budget for, let’s say six months, ve would save $8,511.54. IN ONLY SIX MONTHS!!! AT VER CURRENT SALARY! If ve did if for a year? $17,023 saved. IN ONE YEAR. That would be a really substantial change to Puck’s overall financial picture in a very short period of time! I’m not saying Puck HAS to do this, but I think it merits serious consideration. It also might be absolutely necessary depending on what ver student loan repayment totals are each month.

Ok now we’ve got to talk about the other two elephants here:

- Student loan debt

- Retirement

Puck’s Student Loan Debt

The pandemic pause on student loan repayments ends January 31, 2022 (aka the end of next month). After that, Puck will need to resume paying off ver loans, which will add another line item to their uber frugal month mandatory expenses.

Now is the time to follow the steps outlined under “Preparing for Repayment to Resume” on the Federal Student Aid website. Puck needs to figure out what vis minimum required payments are and then make them starting in February.

Public Service Loan Forgiveness (PSLF)

Since Puck’s loans are federal and since ve works for a city government, ver loans should be eligible for the PSLF program. Under this program, the balance of the loans are forgiven following 120 months (ten years) of qualifying payments. Puck should do the research and application now to ensure vis enrolled in PSLF and ready to go starting February 1, 2022.

Additionally, once ve knows the monthly minimum required payment AND the interest rates on all of ver loans, ve should do the math to see how quickly ve could pay the loans off verself as opposed to waiting the ten years for PSLF. I doubt it’ll make sense for Puck to do this and it’ll probably be wiser to take advantage of PSLF, but a calculation is merited.

At the above uber frugal budget, Puck could put $17,023 towards the loans each year. At that rate (and not accounting for interest since I don’t know what the interest rates are), Puck could pay off ver $90,552 in loans in 5.4 years. That’s pretty fast!!!! It would necessitate that gruelingly low spending rate, but it would get Puck out from under those loans in half the time as PSLF. Plus, it would save ver five years worth of interest. Again, worth doing the calculations once Puck knows the interest rate on ver loans as well as the required monthly payments.

Once Puck does these calculations, ve needs to make a determination and stick with it. Once you are in PSLF, you’re making a longterm commitment to work only for PSLF-qualified organizations until your loans are forgiven. The bad choice here would be to enroll in PSLF, make minimum payments and then at say, eight years in, transfer to a non-PSLF-qualified organization. Once you’re in it, stick with it until the loans are forgiven.

Retirement

Pension

Puck’s government job comes with a pension, which is great! However, according to the city of Boston retirement plan website:

You’ll become vested after you’ve worked in your public service job for 10 years. That entitles you to your benefits when you retire.

This means Puck needs to work for the city for at least 10 years. If ve feels this is reasonable and within ver life plan, then great! If not, then the pension is essentially meaningless for Puck, although the city will refund as follows:” “You will receive your total amount of retirement deductions paid into the retirement system plus interest.” I encourage Puck to poke around on this website and discern which group ve falls into under the “Retirement Formula Chart.”

Social Security

Puck might qualify for social security, but also might not due to the pension offered by the city of Boston. Ve should research this to determine the answer. If ve is disqualified from social security, the most financially viable option will be to continue working for the city government to ensure full pension benefits.

457 SMART Plan for Public Employees

Puck noted ve is eligible for the Massachusetts 457 SMART plan, which is a tax-advantaged retirement investment account that employees can contribute to via deferred compensation (aka money coming out of every paycheck). You put money into a 457 pre-tax, which means you pay taxes on the money when you take it out in retirement. The advantage of this is that it’s assumed your income will be lower in retirement and thus, your tax rate will be lower as well.

Roth IRA

Puck also has a Roth IRA, which is an Individual Retirement Account. Here’s what that means:

- A Roth IRA is a retirement account that’s post taxes.

- This means you pay taxes on the money you put into a Roth IRA, but you don’t pay taxes when you withdraw the money in retirement. In that respect, a Roth is the opposite of a 457, which makes it a nice way to diversify your retirement investments.

- A Roth IRA grows tax free.

- You must be age 59.5 before you can withdraw money penalty-free (although there are exceptions).

- Your eligibility to contribute to a Roth IRA depends on your income and your particular tax situation.

- I like this Nerd Wallet article on Roth IRAs if you want to read more.

The wonderful and beautiful thing is that Puck started ver Roth IRA about a decade ago, which means it’s been growing and compounding since then!!! One of the very best (and very easiest) ways to ensure you have enough for retirement is to START EARLY. I have this entire post on the math behind why starting early with a small amount will yield better results than starting later with a larger amount. Kudos, Puck!!!!! Let this Roth IRA keep on keeping on!

Since Puck’s income is so low, the tax deduction from a 457 isn’t all that useful. I’d say that at ver current income level, it’ll make the most sense to continue investing into the Roth IRA and not open a 457 at this time.

Note:

Puck should investigate what ver Roth IRA is invested in and what the fees are. I’m not familiar with Wealthfront and don’t know their investment options or fees, so I encourage Puck to do ver research. I did a deep dive in the last Reader Case Study on how I invest and on how to check the fees and expense ratios on your investments. Puck should follow those steps.

Once Puck has an emergency fund saved up and a tenable monthly budget that enables ver to save, ve can explore investing more money for retirement. Puck’s priorities going forward are three-fold:

- Saving up an emergency fund.

- Paying off the student loans.

- Investing for retirement.

These can’t really be tackled in isolation, so Puck will need to balance addressing all three simultaneously. The good news is that most of this can be automated every month.

Summary:

- Sign up to take the January Uber Frugal Month Group Challenge. I think this’ll help Puck with the overall task of creating a values-based, sustainable and mindful spending and savings regimen.

-

Grand canyon lit by the setting sun Consider living on the above outlined uber frugal budget for at least six months in order to save up an emergency fund.

- Research and follow the steps needed to ensure ve is ready to make PSLF-qualifying student loan payments once forbearance ends on January 31st.

- Enroll in the PSLF program (if not already done).

- Do the math on paying off the loans verself versus waiting for PSLF to forgive the balance. Ten years worth of interest isn’t nothing.

- Investigate the investments and the expense ratios (fees) of the Roth IRA. Refer to this post for help. Read this book for further investment how-to info: The Simple Path To Wealth by JL Collins, a version of which is in his blog’s “Stock Series” (affiliate link).

- Continue investing into the Roth IRA.

- I’ll be honest, there is very little room for error in the next few years–Puck needs to reduce expenses, increase income, pay off the student loans, invest for retirement, and build up an emergency fund. But the wonderful news is that, long-term, I think Puck will be in fantastic shape!

- Ve has a wonderful career, great friends, engaging hobbies and is living in a city FILLED to the BRIM with free/cheap entertainment as well as ample barter and trade opportunities.

- Once Puck gets these financial action items under wraps, ve can look forward to a long and fulfilling career with a stable retirement.

- Crucially, once Puck stabilizes ver finances, ve can once again support the artists and creators who make ver life so rich and beautiful.

Ok Frugalwoods nation, what advice would you give to Puck? We’ll both reply to comments, so please feel free to ask questions!

Would you like your own case study to appear here on Frugalwoods? Email me (mrs@frugalwoods.com) your brief story and we’ll talk.

Fellow librarian here! I know the pain of grad school debt and a modest librarian salary all too well. You’re doing great at keeping basic living expenses low with roommates and not having a car (I lived for years without a car and enjoyed walking/biking/taking public transit to work – so much exercise).

I agree with Liz that looking into PSLF ASAP is an important first step. I decided to pay my loans off without PSLF (I had about 67k from undergrad and grad school plus interest; now down to 38k), but honestly with your salary and higher COL city, I think PSLF will make the most sense for you. The good news is, once you’re set up with PSLF your loans will be consolidated and you’ll be on an Income-Based Repayment plan which should keep your payments manageable. I also think, if I understand what I’ve read, that you’ll receive credit for PSLF for the months that the loans were in forbearance even if you haven’t been making payments. I could have misunderstood that, but you may already have a year+ of PSLF under your belt.

And yes, an emergency fund will help immensely! I didn’t have one until my late 20s, and put way too many things on a credit card that could have easily been covered had I just set aside some money. What worked for me to finally get one established is to split my paycheck across accounts (X to checking, Y to savings) so that I didn’t even see that money in my checking account. My brain tends to look at the checking account balance once bills are paid as “extra money” but having it in a savings account at a separate bank labeled “Emergency Fund” helped me make that transition from spending money to “Don’t Touch!” money.

As for cutting back on lunches out; one thing that’s helped me is to pack pretty much the same thing each day. It’s a little monotonous but it’s something I like and it streamlines my morning routine which is a blessing when I have to be out the door around 7:30.

I highly recommend the Budget Bytes blog for some great lunch meal prep ideas! You could prep on your day off for 4+ days in advance.

Welcome to librarianship and congratulations on your MLIS! It’s a wonderful career, and I hope you can find a full librarian position that compensates you appropriately for the time and money you’ve invested into grad school.

May I ask what you take to lunch?

@marie, I know you didn’t ask me specifically, but I also have the same thing 4 days a week. I have access to a toaster and a hot water dispenser in work. For breakfast I bring a sliced bagel (which I toast) and a pack of cream cheese, and a few cherry tomatoes. I make a fresh toasted bagel with cream cheese and tomatoes each morning with my coffee and it’s one of my favorite things. For lunch I have a wholemeal sandwich with cheese or ham or sometimes I mix it up with cooked chicken. And I have a cup a soup with it. By mixing up the cup a soups I get a different meal multiple times a week with no change to my prep. I also being a packet of crisps (chips) and a chocolate bar (candy) which are both very cheap if you buy in bulk.

Thanks! I think working from home kind of ruined me for office lunches and I’m struggling. I’m also a bit fussy – like bagels wreak havoc with my blood sugar. I’m close enough that I can drive home for lunch but I’d rather not do it every day. Unfortunately the only break room is super far from my office, so everyone in my section has their own fridge and microwave, which I don’t want to spend money on.

I make batches of soups/stews/chili and bring those to work each week. I agree with the budget bytes rec. following Beth’s blog has taught me how to cook !

Marie, I usually pack the following:

Veggies with peanut butter or hummus

Cottage cheese or yogurt with berries

A cheese stick

A piece of fruit

Something salty like chips/pretzels/cheese curls

I don’t always eat everything, but it gives me enough variety that I don’t feel bored with it and I occasionally pack something different if I do feel like I’m tired of the same old same old. I have access to a fridge and microwave at work but I usually just put an ice pack in my lunch bag which is enough to keep it cool until lunchtime.

Another vote for Budget Bytes here! Now that I mostly WFH I find I don’t need to meal prep as much, but when I was going to the office I would make some sort of bath recipe and set aside 3 portions for lunches that week and freeze whatever was left. That would prevent me from getting lunch for a few meals, but also prevent some boredom because I wasn’t eating the same lunch every single day.

*batch recipe, not bath!

I totally agree with the “make the same lunch every day” thing. Pick something simple that you enjoy, buy in bulk, and eat it 4 days a week. The other day can be “treat day” where you have something different. Having that different thing once a week seems to make a difference. And some weeks I even buy lunch once a week.

I also think it’s a good idea to make lunch the night before.

Kirsten – this is what I used to do when I worked in an office. Friday was treat day and I went out to lunch. I *DID NOT* go out any other days. It wasn’t the treat day. I used to work in Boston and there was a delightful cafe that did a pasta meal with a roll, salad and soda for under $10. I could usually bring half the pasta home for dinner or lunch the next day. It was so delightful!

I love the idea of a “treat day” as an intentional luxury!

Thank you, Megan!

I do think PSLF is the way to go for me because, if I can get the job I have my eye on, I’ll be quite pleased to do it for the next ten years. And then I’ll be vested for the pension, as well!

Re: lunches – The batch prepping ahead of time works so well when I do it that I wonder why I don’t do it more often, but I haven’t made it a weekly habit. I’ll definitely check the budget bites blog out, thank you!

I have made about eight different vegan soups from the Budget Bytes blog and every single one was superb. You can also freeze soups in zip lock bags laying flat then use as wanted if you don’t want too many meals the same. When working in an office, I kept treat meals to one every other month or so. $10/week can add up if you’re trying to cut back. It kept it a real treat.

Puck’s doing great in a lot of ways!

I’m very near finishing my loans through PSLF (about 8 more months, unless their audit shaves some more time off). PSLF has always been an obvious option for me because I’m public service driven and will continue that after loans are gone. But it has been a roller coaster – like fighting with them to count my time in Micronesia (which specifically says in the law but nobody understood) or when they took away 3.5 years of credit because they changed their mind about what qualifies (which was restored thanks to a lawsuit). We don’t know what the future holds but I held in there and believed it would work out and now I’m so close. The real issue I have with PSLF is that they require you to consolidate loans at an obscenely high rate – mine is I think 7.75% with no room to figure out something better – so the $150,000 in law school debt is now $270,000 even though I made monthly payments until the pandemic forbearance. There is simply no way i could pay that latter amount back on a public servant salary.

That said, sometimes I’ve made pretty good money and so I’ve been all in on 401k/457/403b type offerings as well as HSA as a way to minimize my taxable salary (and reduce student loan payments). I’ve also been lucky in real estate (my house now would have the mortgage fully paid if I took a roommate, thanks to a studio apartment in the back).

I’m also curious about why moving is so expensive. I move a lot (this year 4,500 miles) and haven’t had the same experience. But I do have a pickup that i load all my possessions into which helps. I also leave things behind. Where I am now, I had wanted to get some nice furniture once repairs were finished but I’ve decided not to. I bought a rug cleaner and am getting used floor coverings for free/very cheap and I’m repurposing cheap bookshelves for the storage I need. This definitely looks like I’m still the poor college student of the 1980s and I’m ok with that as i anticipate moving long-distance again within a couple of years. Usually with a move I reuse the same totes I’ve had for years (which I use for furniture and for luggage) fill them up, throw them in the back of the pickup, and just move.

I do agree with Ms. Frugalwoods about the no-spend months being a great reset and I recommend it.

Best of luck and I think your intentional community is a wonderful way to live – and frugal!

As a fellow Bostonian, moving = first month’s rent, last month’s rent, and one month security deposit. Sometimes you get stuck paying a month’s as a broker’s fee but I’ve always drawn the line there – I will pay 3 but not 4!!

With Boston rents being as ridiculous as they are, this is easily 3-6k upfront for a move.

Moving can require having cash upfront, which is the case in most places. It means having liquid assets on hand to make deposits, but if getting back all deposits then it comes out about even and that isn’t lost money.

Boston moves are also usually all on the same day (Sept 1 due to college students) and you have to compete with other movers and potential storage if your apartment requires you to be OUT at midnight and you can’t get into the new place. 🙁 Ugh don’t miss it!

One suggestion for Puck, if ve know they may move in a few years, set up a sinking fund. If it costs $4000 to move, save up $1000 a year in a HYSA at Ally. It can also double as an extra emergency fund.

That’s a really good idea re: moving costs. Saving up money for a move in advance will definitely help, even though I’m hoping to stay in my current apartment for at least another two years, and hopefully more.

To add to the explanation of how expensive my moves were: The last two moves were also the first time I’ve hired movers rather than moving myself or with friends. I don’t drive myself so I couldn’t hire a truck without a driver, and this is also the first times I own furniture too heavy to carry for non-professionals. The movers made my moves so much smoother and were actually fairly reasonably priced, so I consider it a totally worthwhile expense. It’s just that I had definitely not saved up enough ahead of time so I’m building my finances back up from scratch.

Hmm, weird. I tried to comment on this but it doesn’t seem to have taken. I will preemptively apologize for a double post, just in case.

Thank you, Marie, Jessica, & Nora in this thread!

I’ll definitely start saving up for moving ahead of time, even though I’m hoping this current place will be my home for at LEAST two more years (and hopefully more).

To add to the explanation of my moves being expensive – the last two moves were also the first time I hired movers. Prior to that I’d been able to move with other folks, but I don’t drive so I couldn’t rent a truck sans driver. I also now own more heavy furniture that professionals would move more safely than I could. The movers I hired helped make both my last two moves extremely smooth and easy and I would definitely hire them again. But I hadn’t saved up enough ahead of time and it ate up what meager savings I had.

One thing I would like to add re: PSLF is that it is a chain. I *thought* I would be a position that offered it my whole career, and never really looked elsewhere due to having the promise ( who knows if you’ll actually get it anyways??) of loan forgiveness. It was so freeing to basically say forget that and actually look for a job I enjoyed and paid much better. Which is what I did. So my advice is to get it paid off as quickly as possible and then get on with your life. Since you seem to be so creative and intelligent there are no limits as to what type of work you may want to do. You don’t want to be tied down to a job “just” to get loan forgiveness.

Rachel, that’s a very good point and certainly a consideration! Right now, I’m pretty committed to public library work, which would all qualify for PSLF, but if I start feeling trapped rather than fulfilled by my career choices, it definitely makes sense to have alternative plans set up for what to do with my loans.

Another fellow librarian here! Welcome to the profession, and way to go getting finances together!

I work in technical services in an academic library, so I might not have the perspective to say much about career paths that include behind-the-scenes *and* public services, but I think you’re right that a smaller institution would likely be a good way to combine those interests. My institution is much more open to hiring remotely for positions that don’t actually require onsite work since the pandemic, so if that’s of interest you might have good luck casting a wider job search net, outside of your immediate geographic area. We’ve had SO many retirements and people reshuffling their lives to move closer to family in the last 18 months, and it seems like there’s been a lot of turnover everywhere that you might be able to take advantage of when job hunting!

The other career advice that may or may not be interesting is that you are also very hire-able in publishing with a library science degree. It wasn’t my first choice, but I worked in publishing for about 7 years right after graduating because it was easier to find a job. I worked with a lot of lovely people and had good salary/benefits. Just something to consider if you’re out there looking, although that would probably interfere with PSLF plans.

Congratulations again, and nice to chat with fellow frugal librarians. 🙂

Oooo this is fascinating! Can you say more about the remote work options in your institution?

About halfway through last year, my work went on a one week in person two weeks WFH schedule, which then turned into every other week. I kinda loved those, but we’re back to in person full time, which does make a lot of things harder (including having the energy to prep food ahead of time). I’m hoping if I can get a cataloger position I could negotiate for at least partial WFH.

I haven’t considered working in publishing, but that’s definitely a thought! I’ll look into it, altho public service is more my inclination.

A suggestion on the relatively small issue of the lunches out: if you tend to forget to prep and pack lunches, don’t judge yourself, plan for it! Buy a bunch of ready made stuff at the grocery store that you can keep at the office for the week like granola bars, individual yogurts, bagels etc. it will be slightly more expensive than meal prepping but much more likely to be successful. Sometimes you just need to lean in to the stage you are at. Maybe someday you will be a meal prepping machine, but it’s ok that you aren’t today. You can still take small steps to get in a better position.

I love this idea. I think it’s just as valuable if you’re excellent at packing a lunch every day because there will inevitably be a time you forget to bring it or sleep through your alarm and don’t have time to make something. When I worked in an office, I would lean into shelf-stable items I could keep at my desk forever (microwave popcorn, granola bars, trail mix, beef jerky) so I didn’t have to worry about expiration dates.

As additional advice on lunches: I was never great at making lunch-specific meals. If it works well for Puck and vis roommates’ cooking style, I’d consider doubling or tripling whatever they make for dinner and packing individual serving sizes to take for lunch the next day. Work smarter, not harder!

“don’t judge yourself, plan for it”. Huh. I’d never thought of it like that. I just used to beat myself up for being a failure when I forgot/ran out of time and then punish/reward myself with unhealthy food.

That’s a really interesting approach and something I’ll try to think on

Great point. I used to always have a box of crunchy nut cornflakes in my office. If I forgot lunch I just needed to buy a pint of milk!

YES! I had an entire desk drawer at work that was devoted to cans of soup or little ramens, oatmeal, etc. With some water and the microwave, I had my free lunch. This trick completely cured me of eating out every single day, so I was able to save a ton once I got in that habit. Then, knowing you’re not going out for lunch, you’re more likely to pack something more interesting than your can of soup or ramen! I find leftovers are my go-to packed lunch. I would cook extra dinner and just package it up for lunches.

This is so wise! Thank you, Anne and everyone else in this thread.

I do have granola bars in my backpack and my roommates and I do often have dinner leftovers that can be lunch, but I love the idea to have things I can keep in my office fridge/at my office desk for the days when I forget/don’t have time in the morning.

Special thanks to Lisa for reminding me of the existence of jerky. I love jerky and it’s such a good filling snack!

Honestly, my attention span is INCREDIBLY short. It takes me about an hour every weekend to prep for the week – this includes part of breakfast for 5 days and 5 days of fruit / cottage cheese. It takes so long because I try to multitask – while prep part of breakfast is in the microwave, I’m sweeping / mopping, taking out trash, etc. If I was JUST prepping for the week, closer to 30 minutes to prep. I can get up every morning and if needed, have breakfast completed and lunch packed in about 10 minutes (this includes coffee). Breakdown and coffee prep every afternoon is another 5 – 10 minutes. Buying precut fruit is more expensive, but allows my attention span to focus on prepping for the week in one shot.

I don’t have much general advice since it seems Puck has figured out how to have a fulfilling life on a reasonable budget which is fantastic! On the lunch side of things, to avoid having to go out to eat, I keep mostly shelf stable food in my desk or locker so that if I forgot lunch I would have something. I am also very prone to getting “hangry” :-). So in college I would keep peanut butter and crackers. Now that I have a fridge in the office, I will keep a large tub of hummus or block of cheese and crackers and maybe grab an apple. I also sometimes keep packs of tuna at my desk Boring? Yes, but good enough if I forget to pack something.

Puck, your passion and zeal for life come through so clearly. And it sounds like you’re really hitting your stride in terms of finding what makes you happy in your career, living situation, lifestyle, writing, etc. As someone who changed jobs and homes a lot earlier in my career/life, I know finding this stride makes it much easier to be more settled and intentional with finances. So kudos for being on a great path!

Just one suggestion– your renter’s insurance looked high to me. I live in NYC, not Boston, so not sure what the going rate is there, but yours is about twice mine. You might want to look into comparison quotes to see if you can save an easy $100 there.

Agreed! My renter’s insurance in Boston is about $120 paid yearly.

Agreed. I live in greater Boston and my renter’s insurance (through GEICO, which they then farm out to a company called Assurant) is $75/year.

Oh this is good to know! I’ll look into it. I’m using Lemonade right now, mainly because it was easy to set up, and as baby’s first renter’s insurance, easy to set up was good. But cheaper is better! I’ll go look into what my options are.

I also live in Boston, have GEICO, and pay around $100ish per year for good coverage. Something else to consider is if you could bump up the coverage slightly so it would cover the value of your stuff and your roommates, then split it with them. When I lived with 2 roommates (granted, this was 5-6 years ago), we split a $140/year insurance bill 3 ways and got a decent amount of coverage for it.

Oh that’s extremely wise! I just proposed sharing/splitting renter’s insurance to my roomies. Extremely good call.

Another fellow librarian here! You mentioned looking for jobs. Like many other careers, it does help to make connections- I know you are trying to save but it might help to join an organization such as ALA (American Library Association) for non-librarian people who read this comment. I’m pretty sure they have a hardship option for membership which would allow you to join at a lower cost. Join a specialized list serve for public service and cataloging! I’m constantly seeing librarian jobs posted there. With the Great Resignation, librarians have been just as affected and I think that there are more positions available than normal. Good luck job hunting!

I was an ALA member prior to this year, but I’ve let my membership lapse because the cost began to outweigh the benefits. Right now my main source of job listings is the MBLC (Massachusetts Board of Library Commissioners) website, which aggregates library jobs in MA. Since I’m not at present looking further afield, it makes sense to look at local positions.

If the time comes, I might rejoin ALA. One day when we’re less pandemic-y I’d love to go to conferences again!

I don’t have much to add Re: how well Puck is doing building a great life on a tiny budget — truly impressive! And congrats on being a published author — life goals!

On the lunch front: yes, this can really add up! I started to go line by line through my credit card bills in my twenties and was appalled by how much I spent on expensive sandwiches/salads I didn’t even enjoy because I was eating them at my desk. One way to ease into meal prep is to make dinners that leave you plenty of leftovers to package up for work. Of course this depends on your work kitchen situation, but it’s how I started tackling that expense and eventually I eased into Sunday prep of lunches for the work week. Also, bringing stuff for mid-afternoon work snacks (like nuts you can grab a handful of) are key!

Eating pistachios at my desk while I’m reading these on my afternoon break. haha

One think Puck could possibly look into is a position at a university. Depending on the institution, and academic library might allow for more flexibility for front/back of the house work and could potentially have a higher wage. I’m not a librarian but the university I work for in Boston even has a pension 🙂

oh also, I had a coworker who lived in JP CoHousing! https://www.facebook.com/jpcohousing/ maybe someday this would be a good fit for you?

I’m definitely keeping an eye out for university positions as well! There’s certainly no shortage of institutions of higher education in Boston XD

Thanks for sharing a glimpse of your interesting life and finances, Puck. I second keeping it simple for lunch and automating it as much as possible. I make a huge batch of soup every two weeks that I freeze in two-cup portions. I eat this with a variety and of chopped veggies and hummus and left-over protein from dinner. I never tire of eating this lunch five days a week. I also make a big batch of homemade granola and muffins that I freeze, so we have breakfast and snacks pre-made as well. Good luck with your loan forgiveness process and your creative endeavors.

Hi everyone! Thanks so much for the kind words! I’m at work right now transferring books out to the branches, so I could only skim, but I’ll read and comment more thoroughly this evening, and in the meantime, I just wanna say again how grateful I am for the FW community.

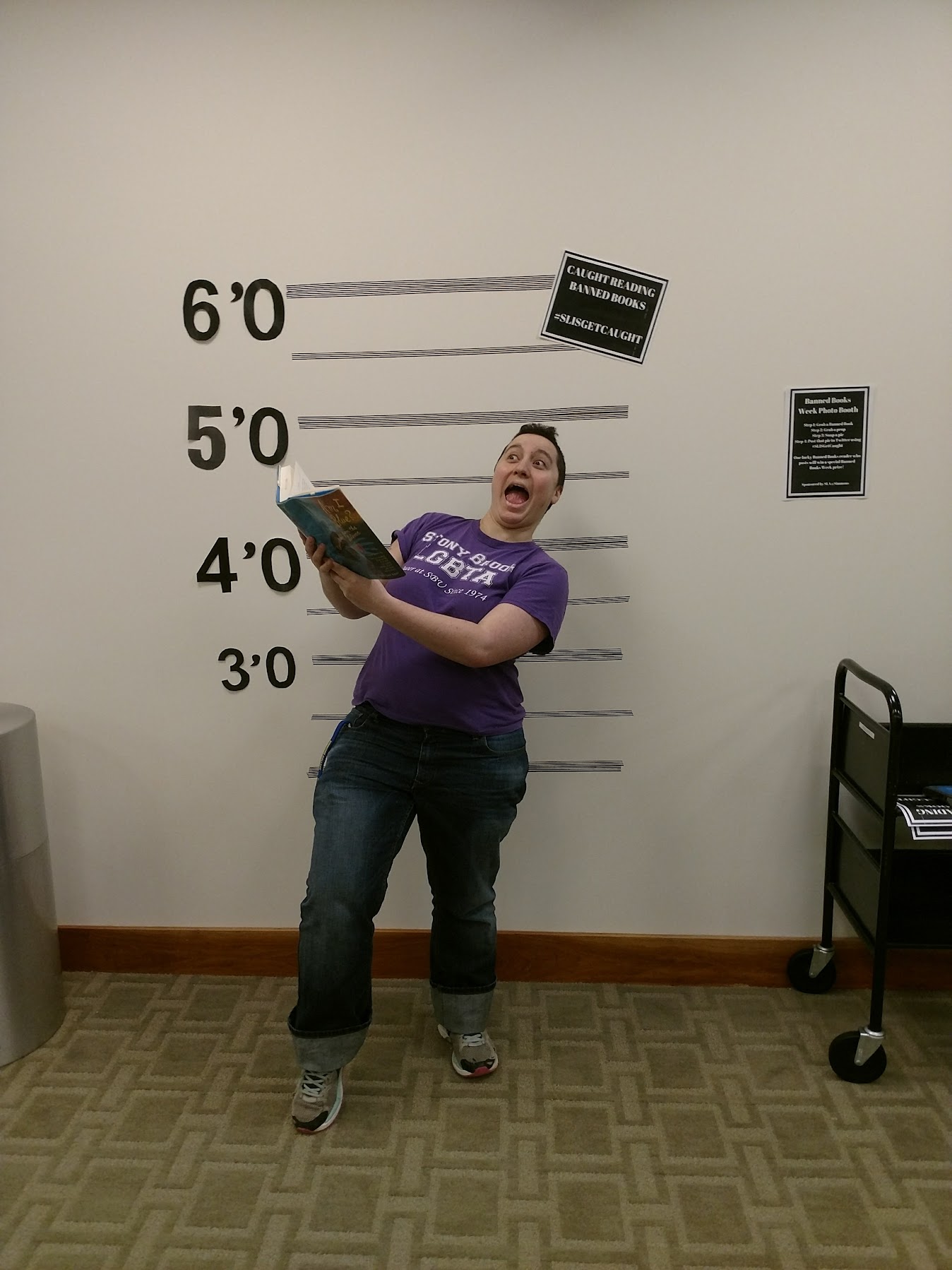

Puck, I’ve got no advice to offer… But I loved reading your reader case study. Thanks for submitting, thanks for being so generous with your cool pics (and, you know, your overall joie de vivre!). I couldn’t stop thinking ‘I wish Puck would share vis journey on a blog’. So I guess what I’m trying to say is this: please share your story on a blog. Or in a book. Or on Instagram. You’ve already got one fan. Love & all the best from Germany

Puck, I don’t have any advice that you haven’t already heard but I wanted to compliment your Ninth House cosplay and ask what TTRPG you’re playing!

Thank you, Zip! I was very proud of that cosplay!

Right now I’ve got a The Untamed-themed Monster of the Week game going, although we’re on hiatus for the holiday season. I’m playing a game of Ars Magica set primarily in Pomerania in 1221 AD (although we move time pretty quickly, so we’ll probably get through the 1220s fairly fast). And, although we haven’t scheduled one of these in a while, I play a big ol’ tanky Barabel fighter in a Star Wars: Edge of the Empire game.

I’m not a big D&D fan – have bounced off it several times in the past – but a close friend of mine is gonna start GMing a game this coming spring and I’ll be joining that, so fingers crossed I’ll finally understand what all the fuss is about.

studentloanplanner.com is a very helpful resource for navigating the PSLF decision.

The most important thing for PLSF now is making sure you’re on the right payment plan (must be one of their income-based ones). You can certify employment at any time, it just is a mechanism to keep track of your qualifying payment counts.

To get a rough estimate of your annual student loan payment, it would be 10% of your discretionary income (take your AGI from last tax return and minus 150% of the federal poverty line [which would be $19,320 for 1 person in 2021]). Then divide by 12 for monthly payment.

One general rule of thumb used is PSLF is likely a good decision if your income is less than 2x your student loan balance. But that’s just a rule of thumb. If you commit to PSLF it makes sense to pay the minimum possible on your student loans and have the rest forgiven. So it would be good to have a back-up plan if you are unsure about PSLF, because it is a completely opposite strategy (when optimized) to paying off your student loan balance.

A quick note: Since tax-advantaged retirement accounts decrease your AGI/taxable income, if you are going for PSLF there are some additional advantages in contributing to tax-deferred accounts since they would lower your income-based student loan repayments.

Thank you for your comment, Kelsey, this is really informative! That makes sense re: tax-deferred accounts, so I will look into that.

Just want to wish Puck good luck with vis financial journey. I find it inspiring that ve is such a creative person and can understand that the burden of student loans can feel overwhelming and daunting. I do not have any good advice – the Danish financial system is so different from the American – high taxes but many welfare state benefits, such as free education also at graduate level and education stipends every month for everyone. Therefore, my level of loans was much lower when I finished university, but it was still a mountain to climb. Cool with the living arrangements. It seems to work well for you and will keep your costs for rent down.

Thank you so much, Bitten! Your kind thoughts are definitely much appreciated.

You mentioned that you were paying $400/month towards your loans for a few months during the pandemic forbearance. You should be able to get that reimbursed with no effect on your 120 PSLF payments. The months of forbearance all count towards the 120, so if you are all in on PSLF, there is absolutely no reason to pay for those months. I got my March 2020 payment reimbursed back at the beginning of the pandemic. Definitely worth looking into it!

This is definitely something I’m interested in! I attended a PSLF webinar hosted by my work and they mentioned that reimbursement was possible without endangering the future forgiveness, so I’m going to try to get that going. Thank you for reminding me!

I’m a professor and I always suggest that my graduate students go onto the website that Mrs. Frugalwoods sited a year before they graduate. It shows them how low a monthly loan repayment amount they will have based on a modest income (non-PSLF programs.)

I just went to the website and plugged in $90K in loans (not sure of the interest rate on your loans) and $33K in annual income and it said the monthly amount would be $55/month till 2041 which looks very doable for Puck’s budget. After that time $108K will be forgiven and you’ll need to pay taxes on that amount as if it was “income.” Each year you need to send in your tax return and if you make a higher annual income the monthly repayment amount will increase as well. But if you make less the next year it will decrease accordingly.

I have seen how this has been a lifeline for my graduate students who don’t make much money in the first 5 years of their post-graduate lives before their careers start to gain momentum. It means you have to be comfortable will a monthly payment for 20 years but after that the rest is forgiven. This option also allows Puck more flexibility in choosing/changing jobs over the next decades. Who knows what a “library” will be in the future and what Puck will want to explore that may not be eligible for PSLF. Just my two cents.

Join the Public Service Loan Forgiveness Program Support on Facebook. It’s a very well run group and will keep you informed on all things PSLF. I work in state government and I’m 8 years towards getting my graduate school loans forgiven. I would also encourage you to look more into the 457. I have one and only wish I had started contributing as soon as I had access. The 457 can be both pre-tax and Roth. My 457 has a Roth option. Contributing money pre-tax can help keep your income low for Income Based Repayment plans for PSLF. Also, a beneficial feature of the 457 is that there is no early withdrawal penalty to take out money before 59 1/2, so can be a nice tool if you plan to retire on the early side.

I just joined this group on your suggestion, thank you! I’m almost never on Facebook at all anymore, but I’ll try to keep my eye on it.

re: the 457, ooo this is good information. I shall definitely look into it some more.

I’m fascinated by habit psychology (that’s normal, right?) and I just wanted to chime in on the challenge of sticking with things that are good long-term but uncomfortable short-term. Here is what works for me- Don’t worry too much about the long-term goal you’re trying to achieve (for me, it has been stuff like regular exercise, being tidier, etc.). Instead, set a clearly defined, super short-term, super tiny “challenge” in the direction of the long-term goal. Bonus points if you give the challenge a cheesy name. Then come up with some way to track progress (like a sheet of paper with check boxes). Then pep talk yourself, make a big deal out of it when you’re doing the challenge and checking off the check box (feel free to compliment yourself out loud, give “I’d like to thank the fans” speeches, etc… Maybe only do this at home or around people you know really well, haha).Optional- give yourself some small reward to celebrate. Then when the challenge is done, you can repeat it or set a new challenge that is incrementally harder. Within a couple of weeks or months, you will likely have formed a new habit and won’t need all the shenanigans.

Some examples I’ve done- “For one week, I will put my laundry away instead of piling it on the floor” (Success! After 3 weeks of repeating this, it was a set habit and now I haven’t had clothes piled everywhere for several years!) “Three times this week, I will do 5 repetitions of run for one minute/walk for one minute.” (I kept making incremental, tiny tweaks to this until no joke I ran a half marathon, which I NEVER thought I’d be able to do, I am not naturally a runner at all).

If I’m feeling discouraged or dragging about doing something, I start breaking it down even smaller to get myself through (for example: I just have to put on my running stuff then walk out the front door. Then once I’m out- I just have to run to that light post. And so on). Also- I’ve had better luck when I only work on changing one habit at a time.

You seem really cool and I’m happy you found a career and living situation that are working well for you! Best of luck!

The Habitica app (or website at habitica.com) is one way to track these things. There’s even a suggestion about making the task names more ‘exotic’, which is in line with complimenting yourself out loud or being cheesy 🙂 https://habitica.fandom.com/wiki/Gamifying_Your_Lists

Yesss habit psychology is a whole thing. A couple of fandom friends of mine actually started a 365 day habit tracker using the journey of the main characters of Grandmaster of Demonic Cultivation/The Untamed. I’ve printed out two copies – one to use to keep up my physical therapy exercises and one for my writing/editing/submitting process. I have given myself really small versions as a goal for the day – 2 PT exercises rather than a time span and a minimum of 100 words written OR some editing done OR beta-reading someone else’s work OR submitting something to be published. I’m only 3 days in, but it’s pretty satisfying to be like “Heck yeah I’ve left Mo Village and I’m getting closer to the Cloud Recesses!”, silly as that might sound. And I’ve exceeded both goals already for the first two days, but anything in excess is a cherry on top, so I can be proud of myself.

We shall see if I can keep it up, but I’m optimistic!

Puck, awesome job at thinking these things through! I have a suggestion about your desire to support artists/creators. It might be worth giving yourself a small budget of $10-15/month to put towards patreon or kickstarter. Having some discretionary spending can make it much easier to stay on track with the larger budget and saving goals, rather than quitting cold turkey, and giving yourself a hard stopping point keeps that spending in check!

I also support the idea of stocking up on non-perishable foods at work—it makes a big difference in the long run! I’d just make sure it’s something you will actually eat, not something aspirational….if you don’t like granola bars, don’t get granola bars (ask me how I know…).

Puck, I’ve got no advice to offer… But I loved reading your reader case study. Thanks for submitting, thanks for being so generous with your cool pics (and, you know, your overall joie de vivre!). I couldn’t stop thinking ‘I wish Puck would share vis journey on a blog’. So I guess what I’m trying to say is this: please share your story on a blog. Or in a book. Or on Instagram. You’ve already got one Fan. Love & all the best from Germany

Hee, thank you! Unfortunately I have never gotten the hang of bloggin with any regularity. You can find my silly posts and reblogs on theleakypen at tumblr, but there won’t be much of my real life there.

I do appreciate your enthusiasm for my life tho 😀

Lots of great ideas here for managing lunches! When I was a grad student and new worker in the NE, I always had a few cans of soup and a box of crackers in my office (not great for sodium but excellent for emergency meals and nothing better than hot soup on a cold day) to fill in for the days I didn’t/couldn’t/wouldn’t pack a lunch. That plus other random nonperishables helped me to cut my horrible lunch habit WAY down, especially once I enlisted friends/coworkers to join me. You’re doing so great thinking about the big picture of your life and finding your way. Congrats on the degree and best of luck!

I wanted to mention something on the pension front. I noticed that it said “10 years of service” and not “10 years “. 10 years of service may mean the equivalent of working full-time for 10 years, which in Puck’s current position of working part- time could be 20 years. It might be worth going over the language on that or asking a union rep.

To be clear, I do work full time, according to the metrics by which PSLF judges full time (more than 30 hours + it counts as full time per the institution at which I work)

Not a librarian like a lot of people, but a fellow nerd! I totally understand about supporting Patreons, local artists and spending funds on RPG books. I cut back on my Patrons by reviewing the rewards and seeing what I actually wanted versus what I was paying for. I ended up saving about $10 a month while still supporting three artists.

I’m not sure if you have to have the physical book for RPG, but it could be cost saving to find some of them online or share with a fellow gamer.

Fellow nerd! *high five*

re: cutting back/reassessing Patreons – I think I’m going to do the same once I’ve finished the Uber Frugal Month. Taking An’s (above) advice of budgeting 10-15/month for supporting creators, and using that as the pool of money from which to commission new works, as well. A good commission can run anywhere from 100-400 depending on the amount of work involved, so it’d take time to save up to that, but worth it!

re: RPGs – unfortunately being able to physically flip through is really useful for reference books. When I’m playing Ars Magica, in particular, I’ll often have a PDF copy of the core rulebook open on my laptop as well as having the physical book next to me, so I can have them open to different pages, not to mention the specific books for the region we’re playing in and the House of Hermes my maga belongs to. That said, there’s definitely plenty of RPG books that I share PDFs with friends so I haven’t had the need to purchase them. It just depends on the system, more than anything else. And a lot of RPGs nowadays have cheat sheets available for free for easy reference, especially Powered by the Apocalypse games!

I am a librarian at a public library in Massachusetts! Congrats on landing a job in the field! Massachusetts is a state where you can not collect a city or state pension and social security. I assume you are not paying into SS but are paying into medicare? Do more research on the fees of the 457 Smart Plan. I worked on a contract for a community college and was required to pay into it . It was several years ago but it awful and I paid more fees than I earned in interest. You may be better off putting that money into an IRA and/or brokerage account.

To get into a MLS required higher paying job is tough. Talk to your boss about carer plans/path, take advantage of every professional development opportunity you can that they will pay for. Network, network, network! To earn more money and build the resume, look at work subbing at one of the branch libraries or other towns or colleges. Do you plan to stick with public libraries or think you want to work college in future? It is harder to go public to academic than academic to public so see if you can get your feet into the academic world as a substitute or contract/grant work if that is something you think might be in your future. There is a big market in public libraries for programs for all ages with escape rooms, role playing games, film clubs, book groups, etc. so look within your own system or at the Mass Library System program planners group to see what people are seeking and if your hobbies and interests could align for paid gigs at other libraries.

Your budget doesn’t include transportation and you don’t own a car. Is there a bus pass, t pass, uber, etc. in your budget?