Vanessa lives in Eugene, Oregon with her boyfriend and three cats, Freya, Orpheus and Gandalf. Vanessa works as the Licensing & Contracts Officer for the University of Oregon and is an attorney by training. In 2018, she bought her first home and is now facing the prospect of some pricey renovations or the possibility of selling this home and buying a different place. She and her boyfriend are also in the process of discerning whether or not they want to stay together for the long-term, which will understandably impact her finances. We’re off to the Pacific Northwest today to help Vanessa sort through these possible life changes.

What’s a Reader Case Study?

Case Studies address financial and life dilemmas that readers of Frugalwoods send in requesting advice. Then, we (that’d be me and YOU, dear reader) read through their situation and provide advice, encouragement, insight and feedback in the comments section.

For an example, check out the last case study. Case Studies are updated by participants (at the end of the post) several months after the Case is featured. Visit this page for links to all updated Case Studies.

The Goal Of Reader Case Studies

Reader Case Studies intend to highlight a diverse range of financial situations, ages, ethnicities, locations, goals, careers, incomes, family compositions and more!

The Case Study series began in 2016 and, to date, there’ve been 77 Case Studies. I’ve featured folks with annual incomes ranging from $17k to $200k+ and net worths ranging from -$300k to $2.9M+.

I’ve featured single, married, partnered, divorced, child-filled and child-free households. I’ve featured gay, straight, queer, bisexual and polyamorous people. I’ve featured women, non-binary folks and men. I’ve featured transgender and cisgender people. I’ve had cat people and dog people. I’ve featured folks from the US, Australia, Canada, England, South Africa, Spain, Finland, Germany and France. I’ve featured people with PhDs and people with high school diplomas. I’ve featured people in their early 20’s and people in their late 60’s. I’ve featured folks who live on farms and folks who live in New York City.

The goal is diversity and only YOU can help me achieve that by emailing me your story! If you haven’t seen your circumstances reflected in a Case Study, I encourage you to apply to be a Case Study participant by emailing your brief story to me at mrs@frugalwoods.com.

Reader Case Study Guidelines

I probably don’t need to say the following because you folks are the kindest, most polite commenters on the internet, but please note that Frugalwoods is a judgement-free zone where we endeavor to help one another, not condemn.

There’s no room for rudeness here. The goal is to create a supportive environment where we all acknowledge we’re human, we’re flawed, but we choose to be here together, workshopping our money and our lives with positive, proactive suggestions and ideas.

A disclaimer that I am not a trained financial professional and I encourage people not to make serious financial decisions based solely on what one person on the internet advises.

I encourage everyone to do their own research to determine the best course of action for their finances. I am not a financial advisor and I am not your financial advisor.

With that I’ll let Vanessa, today’s Case Study subject, take it from here!

Vanessa’s Story

Hi Frugalwoods, my name is Vanessa! I’m 37 and currently live with my boyfriend, age 36, and three cats–Freya, Orpheus, and Gandalf–in Eugene, OR. I work as the Licensing & Contracts Officer for the University of Oregon. I am an attorney and use a lot of my legal training in my job but am not an attorney on behalf of the university–the university’s technology transfer office handles many of the intellectual property matters for the University in its research administration office.

Vanessa’s Career

In college, I studied science and thought I would be a research scientist, but a quarter-life crisis took me from science to law (thinking I would go into patent law, which requires a science/technical background). I was in private practice for a few years, but a couple of bad firm partners and a third-of-life crisis led me to technology transfer. So I’m still in the legal and scientific fields, but working for an educational institution. That choice brought me to Eugene and my current position where I’ve been for about five years. I also have a side hustle as an IP consultant and I donate plasma for additional income.

Settled in Eugene, Oregon

After spending my 20’s moving and reinventing myself and my career, I’m very happy being settled in Eugene. I bought my house in September 2018 and started developing roots. I don’t intend to move again unless my circumstances drastically change (e.g., it is for the job of my dreams, I become destitute and have to move in with my mom, etc.). I love to garden and one of the reasons I bought my house is that it has a large area to garden. My grandmother taught me to sew block quilts and I am slowly teaching myself how to sew more intricate patterns.

I also inadvertently got involved in cat rescue this past fall when my boyfriend found a feral mama cat and her litter. I helped foster and get those kittens adopted and would like to work more in spay/neuter and Trap-Neuter-Release (TNR) programs to help prevent and reduce the cat population in my area.

Getting involved in cat rescue made me realize that a lot of people who work in TNR are spending their own money out-of-pocket to provide these services. Unfortunately, our local county shelter shut down its TNR program with the start of the pandemic and the rescue I previously worked with focuses more on rescue/adoption. I’ve considered establishing a non-profit to allow these volunteers an opportunity to at least receive a tax deduction for their expenses.

What feels most pressing right now? What brings you to submit a Case Study?

My life is in a transition stage!

#1: The most significant thing is that I believe my boyfriend and I will be breaking up soon.

We’ve been together for about four years and are facing a lot of challenges about whether or not our lives and values are really compatible. We are on a probationary period until May when we will decide, but I don’t think we will be able to work out the issues we have. My boyfriend is a non-traditional student who went back for his degree in 2019. He is neurodivergent and it took him three years to get his Associates, and it will likely take him a similar amount of time for his Bachelor’s.

Financially, he contributes $500 each month towards the mortgage and bills (I bought the house and the mortgage is in my name only); we split some of the house expenses, like food and pet expenses at approximately 50%, but most of the other household expenses (e.g., chimney cleaning, stump removal, etc.) I pay for myself. I am not completely sure how the loss of that $500 will affect my overall budget or if costs will proportionally go down.

#2: About a month ago, I was the victim of a hit-and-run.

The other driver left his bumper and license, so my insurance and the police were able to locate him. My car (a paid-off 2010 Honda Civic) was considered a total loss. My car was an awesome car, and I thought I would drive her until she died from natural causes. Of course, this all happened during what may possibly be the worst time in history to buy a car. I went to the most reputable used car dealer I could find, but the cars I test drove for the amount I could get from my car settlement were questionable (over 150+ miles, over a decade old, some with broken parts).

I next turned to buying a pre-certified used car (like my old car), but those were $20K+ to buy a similar car in terms of years old/milage. I ultimately decided to buy a new 2021 Volkswagen Jetta. For a few thousand more, I have more peace of mind with the warranties and quality of the car. It was a huge splurge for me and a weight on my mind and soul. Please no commentary about the wisdom of this choice–I truly believe that despite the cost, this was the best decision for me in this whackadoodle market. This was all two days after I bought my first matching bedroom set and upgraded to a queen mattress. I bought the floor samples at a discount and I love the set. The payments are at 0% for 12 months and I am using my tax refund but still paying over the 12 months. Between the car and the furniture, this will be the first time in years I’ve had debt.

#3: Finally, my original reason for my applying is for advice about my house. Should I remodel or sell it and buy a different house?

My house has an upstairs room (about 15ft x 25 ft) that looks straight out of the 70’s with faux wood paneling, colonial American-style wallpaper, ceiling panel tiles, and fluorescent lighting. I bought the house knowing I would at least freshen up this room, however, it is now evident that the staircase is not safe. The stairs lead up to a half landing where the only attic access is located. It is very difficult to get in and out of attic on the half landing. It also seems like the steps on the stairs may be uneven. Both my boyfriend and I have fallen (not seriously), but I would like to get the stairs redone and placed on a different side of the room. I started to collect bids for the remodel and was told by contractors that they think the work to put in the upstairs room was un-permitted. I did a permit search with the city, and there is no permit on file (although that’s not an absolute guarantee the work was un-permitted).

When I bought the house, no one–not my realtor, the seller/realtor, or the home inspector–said anything about un-permitted work. Of the contractors I’ve had look at the job: one ghosted me without a bid, one wanted to do “exploratory construction” to see what was happening, and one said his company didn’t want the work but his best guess was that to get the work up to code would be $100k-$150k and suggested a smaller construction company might be willing to do the work for less. I don’t know if that amount includes a premium (I know there is a lot of work for construction companies now), but I know materials have gone up significantly in the pandemic, and there were a lot of wildfires in my area in September 2020, which destroyed many homes, meaning construction companies are in high demand right now.

The alternative to investing so much into this house (really at least half the amount of the mortgage) is to sell the house and get another one.

This question is less pressing right now, especially because of the car situation, and because everything is so much expensive right now; my own equity has gone up over 50% since I bought. I feel that whichever path I choose–remodeling or selling/buying–will be better done in a few years. I am very sentimental about my house because it is my first home and I have already put a lot of sweat equity into this house. There are also some unique features about this house that I like including significant garden space and a hot tub (came with the house), which I don’t know if I could get in a different house. I also don’t want to trade one set of problems for another in a different house.

What’s the best part of your current lifestyle/routine?

What I love most about my current lifestyle is its regularity and consistency. Moving around in my 20’s made me lonely and isolated. Starting from scratch every year or two left me very vulnerable and sad. Being in Eugene has allowed me to grow friendships and community and let me start exploring hobbies like gardening and sewing that I couldn’t do before. I also believe it is very important to donate and volunteer for charity and it’s only with the stability of my current lifestyle that I’ve been able to start doing this.

What’s the worst part of your current lifestyle/routine?

The worst part of my current lifestyle is the anxiety about the future, especially with regard to my boyfriend. Additionally, while my job is super secure, there is absolutely a ceiling to advancement; my group is a small one (six people), so there isn’t room for job growth and development unless someone leaves, which is unlikely. I am getting burned out on this job because it is no longer challenging or interesting. I’m good at it, just bored. Eugene and its sister city Springfield are a medium-ish market, and I don’t know if I’d be able to find another job that pays as well as my current position. If I ever had to find a new job, it would probably have to be remote.

I am also finding it difficult to balance the expenses of homeownership and frugality. I want to be a good steward of the home and keep it in good repair, but find there are constantly things I need/could spend money on. For example, I had a stump that needed to be removed. I bought a mini-chainsaw to help get rid of the branches and will use it in the future for pruning, but it always feels like there is a several hundred dollar purchase that “needs” to be made. Along with my goals of remodeling/selling the house and generally saving, it’s hard to find what a “good” balance is.

Where Vanessa Wants to be in Ten Years:

After the last two years of pandemic, 10 years from now seems like an eternity…

Finances:

-

Travel Picture: Provance I would like my mortgage to be almost completely paid off. I recently stopped paying extra (which hurts, because I hate debt but I heeded Mrs. FW’s previous Case Study advice that there are better uses of money when interest rates are low, but I don’t think I’d otherwise have a choice with the new monthly payments).

- I think I am doing fine with retirement contributions (please let me know if I am not!) and will receive a pension when I retire based on salary at the time and years of service.

- I would like the opportunity to be able live comfortable (absolutely within my means) and have discretionary money to spend on charity, travel, etc. without worrying if it should be spent elsewhere.

Lifestyle:

- I would like enough time to continue to explore my own hobbies and self growth.

-

Travel Picture-Florence I don’t want to go back to a lifestyle like I had in private practice where working 10-12 hours a day and some weekends are the norm.

- I want the flexibility to try and fail and get better with new hobbies and the ability to experiment with new experiences (I’ve always wanted to learn French!).

- I would like to travel more. I’ve done a little international traveling and would love to do more.

- Finally, volunteering/donating to charity is very near to my heart. I intend to keep working with cat rescues, but with it and all charity, there seems to be a constant source of need that makes my heart sad. I know I can’t fix everything myself and can only help as much as I can. Other than setting limits/budget and keeping within them, I am not sure how best to manage the impulse to donate and get the feeling that I’ve helped.

Career:

- The career question is hard because I don’t know what opportunities there might be for me. My answer is that I would like a job that’s challenging and interesting but doesn’t occupy all my time or mental/emotional wherewithal.

- If possible, I would like to stay with my current group for at least the next few years, unless something drastic changes in the leadership or circumstances of my job.

Vanessa’s Finances

Income

| Item | Amount | Notes |

| Vanessa’s Net Income | $4,428 | Vanessa’s net salary after health/vision/dental insurance; life insurance; retirement contribution; taxes; parking. |

| Plasma Donation | $547 | I donate plasma twice a week. The donation center “compensates for my time.” The compensation varies every month and has been higher over the course of the pandemic. It is very difficult to predict how the compensation will change in the future. |

| Boyfriend’s rent payment | $500 | My boyfriend contributes this amount to the mortgage and utilities |

| Side Hustle | $500 | I do some IP consulting on the side. The income is irregular based on my client’s budget. |

| Monthly subtotal: | $5,975 | |

| Annual total: | $71,700 |

Mortgage Details

| Item | Outstanding loan balance | Interest Rate | Loan Period and Terms | Equity | Purchase price and year |

| Mortgage | $182,923 | 1.99% | 15-year fixed-rate mortgage | $62,090.47 | $245,013; purchased September 2018 |

Debts

| Item | Outstanding loan balance | Interest Rate | Loan Period/Terms | Notes |

| Car | $12,000 | 0.90% | Four years; this works out to be about $246/month | |

| Furniture | $2,729 | 0% | I pay 1/12th the initial amount to get the 0% promotional financing; this works out to be about $230/month | I bought my first bedroom set and mattress when I got my tax refund this year. This was naturally three days before my car was murdered. |

| Affirm mattress | $659 | 0% | I pay 1/12th the initial amount to get the 0% promotional financing; this works out to be about $60/month | |

| Total: | $15,388 |

Assets

| Item | Amount | Notes | Interest/type of securities held | Name of bank/brokerage | Expense Ratio |

| Rollover IRA | $103,324 | This account has all my rollover accounts from past jobs | FFFHX; TRRMX | Fidelity | 0.75%; 0.71% |

| 403(b) Account | $50,831 | I contribute 12%/month | FFOPX | Fidelity | 0.81% |

| Individual Account Program (IAP) | $22,285 | My university matches up to 5.25%/month | |||

| Brokerage Account | $21,777 | This is more of a glorified savings account. It has ETF funds based on an aggressive investment strategy. The thought was that given enough time, it would provide a better return than purely a savings account. It has also lost about 10% over the past few months. | ETF | SoFi | N/A; SoFi does not charge fees |

| Savings Account | $15,000 | This is what I consider to be my emergency fund. I typically transfer $500 every month and every few months transfer money into my SoFi brokerage account as bank. | N/A | Chase | N/A |

| Brokerage Account | $10,951 | This is where I invest in individual stocks. I had done well and at least have been able to hold on to any investment long enough to at least break even. It has lost about half its value over the last 6 months because I am invested in biotech stocks and they have taken a severe beating. | Individual stocks | Charles Schwab | N/A |

| Checking Account | $8,363 | This is where most of my transactions occur | N/A | Chase | N/A |

| Second Savings Account | $950 | This is my slush fund. I started it awhile back for mid-range house projects/purchases (up to a few thousand dollars). It has also become my pet emergency fund. I contribute $50 every month. | N/A | N/A | N/A |

| TOTAL: | $233,481 |

Vehicles

| Vehicle make, model, year | Valued at | Mileage | Paid off? |

| VW Jetta | $25,398 | 300 | No; the amount I owe is listed under “Debts” |

Expenses

| Item | Amount | Notes |

| Mortgage, taxes and insurance | $1,574.68 | Principal ($1,018.56), interest ($303.35) and escrow ($252.77) |

| Household | $411 | Includes all household supplies, house decorations, bedding, small appliances, cleaning products, home improvement items |

| Grocery | $322 | Includes all food and beverages (including alcohol) |

| Car payment | $246 | Details under “Debts” section |

| Furniture payment | $230 | Details under “Debts” section |

| Utilities | $182 | Includes electricity and water |

| Charity | $129 | Includes recurring donations and approximate one-off donations from individuals asking for help |

| Pets | $112 | Includes annual vet appointments, food, flea treatment, toys, treats (this is a shared expense with my boyfriend) |

| Medical | $97 | Includes co-pays, contacts, prescriptions, allergy shots |

| Restaurant | $92 | Includes take out from date night (1 date every 1-2 weeks) |

| Hobbies | $85 | Includes gardening and sewing supplies |

| Gifts | $62 | Includes birthdays, Christmas for family and friends |

| Gas | $62 | |

| Affirm mattress payment | $60 | Details under “Debts” section |

| Car Insurance | $59 | |

| Internet | $53 | Includes internet only |

| Firewood | $38 | Includes 2 cords of wood used for heating over the winter |

| Clothing | $18 | Includes clothes and shoes (I buy almost everything off eBay) |

| Garbage | $18 | Includes garbage service |

| Bar Fees | $15 | Includes state bar fees for New York and California |

| Subscriptions | $14 | Includes local newspaper ($8) and Paramount+($6; where I get Star Trek and is extremely valuable to me) |

| Entertainment | $10 | Includes video game, movies, etc. |

| Monthly Subtotal: | $3,890 | |

| Annual Total: | $46,680 |

Credit Card Strategy

| Card Name | Rewards Type? | Bank/card company |

| Alaska Visa | Travel | Bank of America |

Vanessa’s Questions for You

1) Short term: how can I reconfigure my budget to be more balanced?

- In doing the analysis for the Case Study, I saw how much of my budget goes to household goods (generally meaning charges from Target; Bed, Bath, & Beyond; the local hardware store and items like Christmas decorations, mini-chainsaws, chimney cleanings), especially if I want a larger discretionary budget for things like hobbies and traveling?

- Where should I readjust my budget if my boyfriend and I do breakup?

- My income from my side hustle and plasma donations are inconsistent. My side hustle is consulting for a start-up and they don’t necessarily pay on a regular basis (which I am ok with because they do eventually always pay) and the plasma donations are set by the company and can change every month. It is great to have the extra money, but it isn’t something I absolutely count on.

2) Medium term: What should I do about my new car/furniture payment?

-

Quilt Vanessa made #2 I have enough to pay the car/furniture off now. The interest is low enough that the interest would be about the same as one payment.

- I don’t really want to sell any of my investments right now because the markets have been down and I will lose money (even though I know I can take it as a tax deduction).

- My grandmother passed in December, and my aunt (the executor) said I was named in the will, however, I don’t know how much the amount will be or when the estate will be settled. My best guess is it will be something between $10-20K.

- I am also expecting some kind of settlement from the hit-and-run for the injuries, but don’t have an idea of how much that will be yet.

- I hate debt and want to get rid of the debt and new car payment as soon as possible, but I know with such a low interest rate, it seems like like free money not to pay them off.

3) What are the best saving methods for medium (a few thousand dollars) and large (tens of thousands of dollars) purchases?

- Right now I have a couple of investment accounts, but both of those (one stocks and one ETFs) are down right now. Is there a better strategy or in-between strategy between bank accounts that earn no interest and the temperamental stock market?

4) Long term: Should I remodel or sell my house?

- Either way, I think I will have to save for this because I would like to pay cash (or as much cash as possible) for either. Some of my cash reserves went towards my car’s down payment (about $6K so that my payments would be under $250/month).

- My heart says to keep the house and invest in its care and upkeep, but my head says it is probably not the best financial choice. Also, in say 5-10 years what might the conditions or situations be that could change my decision?

Liz Frugalwoods’ Recommendations

Vanessa’s in great shape and I think a lot of what we’ll be looking at today are longer-term plans, which are fun to map out! I commend Vanessa for thinking through her long term financial plans and am excited to think through these items with her!

Vanessa’s Question #1: Short term: how can I reconfigure my budget to be more balanced?

First area: house-related costs

I actually think Vanessa’s budget is already pretty balanced. I think the disconnect here is that Vanessa may be comparing her post-home ownership budget to her pre-home ownership budget and those two will never be in alignment. Home ownership is wonderful, it’s fun, it can be a great investment, it’s a secure place for your money, but it ain’t cheap. Having now owned two homes myself, I can tell you that something is ALWAYS breaking, something ALWAYS needs to be fixed or replaced and…. the expenses never end. This isn’t to scare Vanessa (or anyone else contemplating home ownership), it’s simply wise to assume it’ll be an ongoing, constant, forever monthly expense. It’s not a bad thing to spend money on needed repairs to a home, it’s just a fact of no longer being a renter.

I suggest Vanessa do the ol’ expense deep dive on all those Bed, Bath & Beyond, Target, hardware store, etc purchases and divide them up according to the below rubric:

1) Emergency, required:

-

Quilt Vanessa made #1 For example: your toilet flange-dingle breaks and you have to replace it.

- This is stuff you can’t strictly plan for but can anticipate. If you own a toilet, the flange-dingle is going to break at some point.

2) One-time, including large appliances:

- For example: the mini chainsaw. Sure, you’ll have to replace it someday, but not annually.

3) Decorative:

- For example: throw pillows, Christmas decorations, etc. Most of these are also likely one-time.

4) Annual maintenance:

- For example: chimney sweeping.

I think re-assessing her budget according to these distinct categories might help Vanessa better metabolize the true costs of home ownership. This will also highlight areas that can be reduced/eliminated if desired (such as “decorative”) and things that need to be budgeted for on a regular basis (such as “annual maintenance”). If she’s not already using an expense tracking service, such as the free one from Personal Capital, doing so might help in this process (affiliate link).

Second area: Where should I readjust my budget if my boyfriend and I do breakup?

I think Vanessa will have to wait and see on this front. As it is, she’s shouldering the bulk of their household expenses, so I’m not sure the loss of his $500 contribution per month will be all that seismic since I assume things like household supplies (toilet paper, toothpaste, etc) and groceries will likely decrease.

If they do break up, I also encourage Vanessa to give herself some grace and time before being too worried about her new budget. A break-up (even if mutual and desired) is still a seismic change and Vanessa should ensure she takes time for self-care and rest afterwards. Once she’s a few months out from the breakup, she can do an analysis of her post-breakup expenses and how she might want/need to recalibrate.

In general, Vanessa is super frugal and her expenses are really low! Without her boyfriend’s rent payment and both of her side hustles, she’s still making more than she spends every month:

$4,428 (salary) – $3,890 (expenses) = $538

Given that, there’s no hair-on-fire situation for Vanessa to immediately solve if they do break-up. She can take her time to sort through things and determine how/if she wants to adjust her spending going forward.

Vanessa’s Question #2: Medium term: What should I do about my new car/furniture payment?

Exactly what you’re doing! Particularly with the 0% interest on the furniture, there are zero mathematical reasons to pay them off early. The thing that’s bad about debt are high interest rates. Debt with no interest rate isn’t bad, it’s a reallocation of resources. The caveat is that if either furniture loan incurs an interest rate at some point, then you might want to pay them off.

In terms of the car, I completely agree with Vanessa’s research and decision to buy a new car. It makes no sense to buy a used car for nearly as much (or as much!) as a new car. In the current ridiculous bananas car market, you might as well buy new. No reason to pay more for used! The only reason it USED to make sense to buy USED is because used cars used to be a TON cheaper than new cars. Now that they’re not, the entire car calculus is changed. So Vanessa, rest assured you made a great decision on this front: you chose a reasonably-priced, safe, new, reliable vehicle. Feel good about the research you did and the decision you made!

The car’s interest rate is also incredibly low at 0.90%. Even though the interest rate isn’t zero, I still agree with Vanessa’s assessment that it makes the most mathematical sense to deploy her resources into assets that will earn her more than a 0.9% return.

With debt-payoff on low or zero interest debts, it’s always a question of:

What’s the opportunity cost of paying off this debt?

In other words, if I don’t dump my money into this debt, what else can my money do for me? Hint: the answer is NOT “take on more debt to buy a boat!,” it’s more like “invest in my retirement, savings or brokerage accounts!”

But this is all a question of personal preference. Sure, it’s mathematically best not to pay off low-interest debt, but some people do so because they value the peace of mind of no debt OVER the potential financial returns of investing their money. Just be clear with yourself about whether you’re making a “peace of mind” or a “financially/mathematically best” decision.

Vanessa’s Question #3: What are the best saving methods for medium (a few thousand dollars) and large (tens of thousands of dollars) purchases?

1) If I want to buy a house sometime in the next, oh, two years or so, I’ll want to keep that money liquid (in a checking/savings account) so that I don’t lose any of it in the always unpredictable stock market.

2) If I want to buy a retirement condo in the next, oh, forty years or so, I’ll want to invest that money in the stock market (in a taxable brokerage account) so that it can grow over time.

Q: Why do I do this?

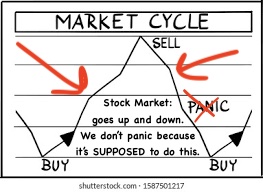

A: Market volatility.

If I were to invest all of the money I intend to use for my down payment on a house in the next few years, there’s a very real chance I’d lose some (or most) of that money.

- To be clear, I wouldn’t actually “lose” the money, it would just be fluctuating with the market.

- I would actually lose the money if I sold my stocks during a downturn and locked in that loss.

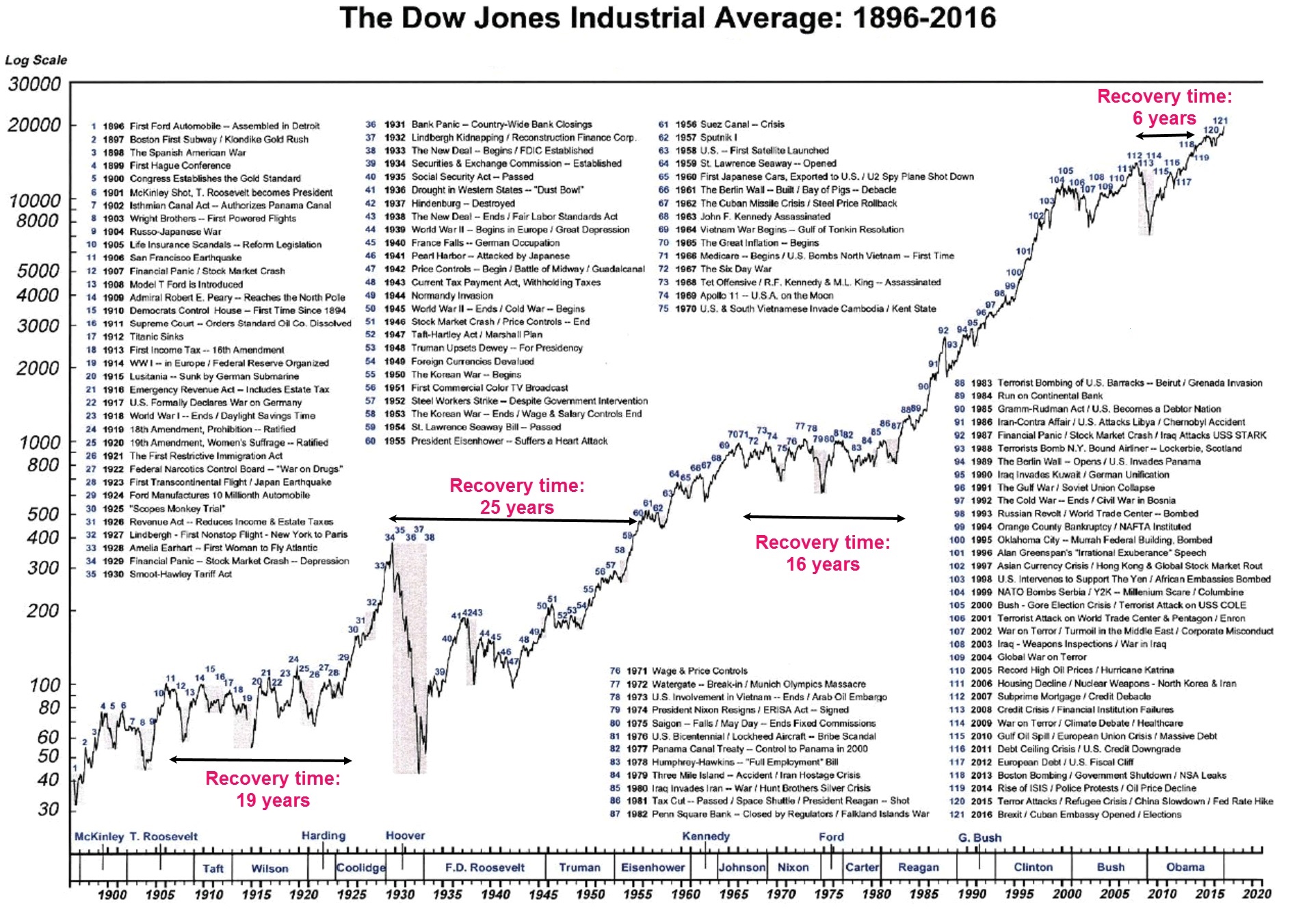

But if I don’t panic and don’t sell, I DON’T lock in the loss. Instead, I ride the market. I keep my money invested for decades because, history demonstrates that over time, the market goes up. Over time, history has shown a 7% average annual return. As long as I don’t panic and sell in a downturn. Now could history not repeat itself and the market fall off a cliff? Absolutely! Also, could we be hit by an asteroid? Absolutely! Investing is risky; living on Earth is also risky. Only YOU know your personal risk tolerance and only YOU can make the investment choices that align with your goals and your risk tolerance.

Here’s a graph of the Dow Jones Industrial Average’s behavior over a 120-year period (1896-2016):

This long-winded, cartoon-riddled answer is to illustrate for Vanessa (and everyone else) that investing is a question of your time horizon, more so than your dollar amount, as well as your risk tolerance.

Short Term Savings

Now that we’ve established the stock market is the place for our LOOOOONNNNNGGG term money, what do we do with our short term money? Several options:

- Checking account

- High-yield savings account

The stock market is not a savings account. It’s a long-term investment account. You only put in money you do not need anytime soon.

Things that are NOT savings accounts:

- ETFs

- Individual stocks

- 401ks

- Pensions

- Total market index funds

- Dogs wagging their tails

Things that ARE savings accounts:

- Savings accounts

Asset Allocation and Investing Strategy

Let’s do a rundown of where Vanessa has her money:

1) Cash:

Vanessa has three different liquid (AKA checking/savings) accounts totaling: $24,313

What is cash for? Everyone say it with me:

- Emergency fund (this should be three to six month worth of your living expenses).

- Living expenses.

- Saving for near-term larger purchases (vacations, new cars, a dress for your sister’s wedding, a new cat condo, etc)

Vanessa spends $3,890 a month, which means she should have an emergency fund of $11,670 (three months worth) to $23,340 (six months worth). Hence, her cash savings are spot on!

Suggested tweaks:

- Perhaps combine these three accounts into one? This is a personal preference and I like to have everything as consolidated as possible, but I know some folks prefer multiple ear-marked accounts. If there’s no pressing reason to have three different accounts, I’d combine for simplicity

- Move everything to a high-yield savings account(s). Interest rates are rising right now and one the only areas where this is advantageous are high-yield savings accounts. Make sure you’re earning something on your savings account–never settle for 0%. Even a small percentage makes a difference over time.

- For example, the American Express Personal Savings account currently earns 0.60% in interest. This is not a ton, but in a year, Vanessa’s $24,313 will have increased to $24,459 (affiliate link). That means she’d earn $146 just by having her money in a high-interest account!

2) Retirement:

Vanessa’s three retirement accounts total $176,440. Let’s reference our favorite retirement rule of thumb:

Aim to save at least 1x your salary by 30, 3x by 40, 6x by 50, 8x by 60, and 10x by 67 (source: Fidelity).

Since Vanessa’s 37, let’s go with age 40. This means she should have:

[$4,428 x 12 =] $53,136 x 3 = $159,408

Vanessa is 100% spot on in this category as well! Woohoo, Vanessa is rocking it!

3) Taxable investments:

The rules around taxable investments are:

- Make sure you understand the basics of investing. I highly recommend the book The Simple Path to Wealth: Your Road Map to Financial Independence And a Rich, Free Life, by: JL Collins (affiliate link). It is a fantastic primer on investing.

-

Orpheus helping Vanessa transplant Only invest money you don’t need in the near term.

- Remember that investing is for the long term.

- Don’t panic and sell when the market goes down.

- If you do this, it defeats the entire purpose of investing. You’d likely be better off not investing at all.

- Make sure you understand the fees/expense ratios of your investments. I did a deep dive on expense ratios in this post. All investment accounts have fees associated with them. If they don’t have a fee, they’re not an investment account. It’s crucial to have low fees because you can lose a TON of money to high fees over the decades of your investing career. Three brokerages known for their low-fee total market index fund options are:

- Fidelity

- Vanguard

- Charles Schwab

- I choose to invest in total market, low-fee index funds. Read The Simple Path to Wealth to understand why this is the choice I (and the vast majority of other FIRE folks) make.

I also want to highlight for Vanessa that investing in individual stocks is a hobby, not an investment strategy. Stock picking is something a lot of people enjoy doing for fun, but it’s not a wise financial move. Only do this if you have money to burn and really enjoy picking stocks. Otherwise, historical market data indicates you’re better off in a total market low-fee index fund.

Vanessa’s Question #4: Long term: Should I remodel or sell my house?

Vanessa hit the nail on the head when she said that either way, she’l likely have to wait. Yep, yep, yep. If anything is more hot cocoa bananas than the car market right now, it’s the housing market. Now is not the time to buy a home unless you absolutely have to. Ditto for renovations you’ll be hiring someone else to perform. Contractors are fully booked and materials are either unavailable or expensive. Or more likely, both.

I think Vanessa is wise to think about this potential future decision and to start looking at homes for sale in her area. Never hurts to go to a few open houses to get a sense of what’s on the market. If nothing else, it could provide some renovation ideas and thoughts on how to deal with her unusual upstairs room.

Vanessa has an absolutely fantastic interest rate (1.99%!!!!!!!) on her mortgage, so she is sitting pretty right now. Don’t do anything to jeopardize this enviable situation!

Summary:

For the most part, Vanessa should just keep doing what she’s already doing! She’s made excellent financial decisions over the years. The few tweaks I suggest:

-

Travel Picture: Ecola State Park in Oregon Do a deep dive into house-related expenses and create sub-categories for:

- Emergency, required

- One-time, including large appliances

- Decorative

- Annual maintenance

- Feel confident about not paying off the car, house and furniture at an accelerated pace because the interest rates are fabulously low.

- Read The Simple Path to Wealth: Your Road Map to Financial Independence And a Rich, Free Life, by: JL Collins, to broaden her knowledge and understanding of investing (affiliate link).

- Identify the time horizons for her larger purchases and determine if investing or cash will be wisest.

- Do an analysis of all accounts and consider:

- Consolidating cash accounts into one. Ensure this account is high-yield and earning interest.

- Consider eliminating the individual stocks account and instead focusing on low-fee, total market index funds.

- Wait on making the renovate or move decision. Spend this time gathering data: interview contractors, visit open houses, get renovation ideas, and save up!

- Know that you are doing a great job!!

Ok Frugalwoods nation, what advice do you have for Vanessa? We’ll both reply to comments, so please feel free to ask questions!

Would you like your own case study to appear here on Frugalwoods? Email me (mrs@frugalwoods.com) your brief story and we’ll talk.

If your extension is ‘ not permitted’ and you were mislead or mis sold by lawyers/ realtors – there may be recourse to some compensation?

With regard to your boyfriend – sadly, I think you know the answer to that already. 😔

And my instinct is not to move house until you are clear on your employment future, moving home is costly and you don’t want to do that twice in quick succession.

All the best!

Typically realtors/lawyers/inspectors do not comment on permits unless you ask. Shady but if they don’t know, they don’t have to tell you. And if they didn’t want to or didn’t do the research themselves, there was no benefit for them to find out it was unpermitted and impact the sale to Vanessa. You can check your title insurance or with your closing lawyer to see if that would be covered.

There is no compensation for being mislead!! However it’s time for her to live on her own and grow emotionally. Maybe later on bro g in a friend who needs to rent short term.

Hello Vanessa & congratulations on the admirable financial stability! I am 38 & not nearly as on track financially as you but also in a strange relationship, love to garden & am rescue feline parent, lol.

I purchased a cheap, tiny house several years ago that was entirely wood paneled, the ugly early 80s paneling that appeared orange in the sun, just awful. We’ve almost completely painted the entire house according to our shared love of pretty colors. Cheerful walls make you happy, so definitely paint over the paneling & even the wallpaper. Just use oil based primer on the wallpaper so it doesn’t peel. Put the felines in another room for a couple days & that entire room would be transformed over the weekend.

Wouldn’t worry about unique landing, just don’t go up there while tipsy (lol) & only use it to store items that aren’t needed very often. You are creative so just paint a cute sign to hang on your newly painted walls that says “Delightfully Quirky”!

Thank you so much for seeing the need for rescuing & TNRing felines. I occasionally sell on eBay to supplement our TNR fund. You could possibly do the same with beautiful quilt creations. You could even earmark the proceeds for charity. Additionally, any surplus from the garden could be donated to a food bank.

Also congratulations on having a great job that you do well. Even if it’s boring, you’ll have the free time to focus positive energy on fun projects in your free time.

Have fun, thanks for cute kitty pics & blessings to you : )

Loved everything about your comment

A session of therapy (or a couple) can go a very long way toward figuring out what you want out of life. Things with your boyfriend sound tense. Nothing you said about him made it seem like you’re in love with him and genuinely want him to be in your life for the rest of your life. So I feel like that’s your answer.

Also, not that you can’t afford the payments, and yes, it’s low interest, but I’d personally pay things off and just aim the money back at the emergency fund. One less item on the balance sheet, one less item you have to cover should you lose your job, one less thing to worry about. I’ve found I’m happier when I’m not trying to optimize such small debts. My happiness is more important than extreme financial optimization of what amount to such small dollar amounts over the scheme of life.

I would really think about the words you use when you describe your job – burnout is not the same as boredom!

And a job doesn’thave to be anything more than a way to pay bills if the rest of your life is full and fulfilling. My grandmother always said, “Intelligent people need never be bored,” and while finding satisfaction isn’t always as easy as choosing our words and thoughts carefully, sometimes it is.

You’re doing great – my advice is to break up with the guy and then focus on all the ways your life is awesome exactly as it is – you’ve got a new car, a cozy new bed, a quirky house you love, friends and hobbies, a job that allows energy and room and resources in your life for all of the above, and probably way more amazingness than you listed for us!

This is great advice Seppie. You are right she is doing pretty well and is very self suffiecient. I agree with Mrs Frugalwoods in that she shouldn’t pay off her low interest debt for now. Also the home mortgage is tax deductible. Someone posted earlier that there should be some recourse for being sold a house with an illegal space. Wondering if she used a home inspector? Lastly, sounds like Vanessa’s had a lot going on lately- boredom, a car accident, a potential break up, maybe she could use a small break. There are animal sancturaries that you can volunteer at while vacationing like this one: https://bestfriends.org/sanctuary/visit-sanctuary

I think you are exactly right! A lot of the weight seems to be around the ambivalent relationship and I think the break up and subsequent relief will change how she feels about everything including her job! Also in addition to conditions not being right to move/renovate the ability to garden and foster with no limits put on you are rare. Rescue life IS overwhelming, rest assured that what you are doing by fostering is an invaluable piece of it!

Hi Vanessa, you are doing a great job at balancing a lot! Here are some of my thoughts:

1) do not start a nonprofit rescue without serious homework into what it entails and being willing to make a long term commitment. I used to work with small nonprofits started by people with a heart for the mission but the bureaucracy and fundraising required is often not what founders are interested in. Or there ends up being duplication of effort. The saddest thing is when it folds after a few years.

Alternatives I would suggest: serving on a board of an existing rescue (to get an inside look), plus nonprofit boards always need lawyers. Exploring collaboration with other existing rescue groups. Is there a TNR nearby (in another city) that would travel monthly or quarterly if you can help fundraise?

2) your boredom at your job. Right now it sounds like you’ve got enough going on in your personal life and aren’t looking to switch careers, just feeling some low key dissatisfaction. It sounds like your one side hustle may have some additional intellectual challenges, perhaps expanding that could help offset some of the boredom you feel. 0n the other hand, exploring hobbies like learning a new language, planning travel, etc could also scratch that itch. Alternatively are there certifications or professional development you could do that could expand your skills should the perfect remote opportunity come up?

It sounds like you’re in a time of transition which is always uncomfortable. But it can also be 3xciting to be able to reinvent your life and make the changes that will make it best for you.

As someone who works for a nonprofit organization and served on the board of a small nonprofit that ultimately folded, I second this advice on doing your homework before starting a nonprofit. Getting a 501c3 organization off the ground and running is an undertaking and will require an investment of both your time and money (unless you can fundraise to cover expenses). It’s like taking on another job, and if the main reason you are doing this is for tax deduction purposes, then I’m not sure that’s enough of a reason to devote yourself to this task. I know you care about your rescue work, and perhaps there’s other more compelling reasons for you. Either way, I think you should do some digging on what it’d entail and what your goals are before you jump into things.

Thirding the advice on the nonprofit! I’ve been basically running a small one on the side for the past two years, and even though it was well-established before I got there and aligns with my interests/passions it is a huge ton of work. And, a lot of that work is what I call “administration” stuff: answering emails, writing agendas, bills, paperwork, etc. All of that is important, valuable to the organization, and necessary—but if it’s not what you want to spend your time doing, you’re better off volunteering with an existing group.

I watch the Eugene housing market pretty closely (I’ll probably move back there soon), and I’d agree with your strategy to start saving with the idea of either buying a new house or renovating a few years down the line but not making the decision now. That interest rate is fantastic so instead of shifting back to making extra principal payments I’d sock that money away for when you’re ready to decide.

I’ve always had houses with non-permitted work and don’t think it’s that unusual; it’s regrettable that your realtor didn’t point out the potential issues and use that for negotiating leverage, but for all the good of the house and the crazy expensive housing market you probably still got a really good deal. Perhaps an ideal solution will become visible with time or something else about your house will make you want to leave or stay. Where I currently am, what was a small annoyance 6 years ago now is an important problem, but other annoyances have become fine.

Hi Vanessa, agree that you are doing an excellent job! I think a mindset shift on the house would help your anxiety tremendously. You 100% don’t need to make any decisions about your house right now. Simply decide to be ok with your current situation. (In terms of the house – sounds like you could continue to explore other aspects of your life). You have lived there for four years without renovating, does it really need to be done now? Same with moving. I just read an article that said the interest rate rise on a 30 year fixed mortgage over the last five months only have raised the monthly payment on a $400k house $500 PER MONTH. Now is definitely not the time to get a new mortgage. Not to scare you, but you have an excellent interest rate so I’d say just stay put. The reason I mention the mindset shift is because I’ve learned to do something similar in my house. I have a 10×8 floral florescent 70s light in my kitchen since I’ve lived her (over 5 years). I’ll get rid of it eventually but there are other important things to deal with first, so no rush on renovations like that! If you can mentally decide to be on with deferring that decision for a few years, I think that would remove some stress/anxiety from your life.

First of all, as Liz says, the house ownership thing is so, so different from renting. The ”realisation” of worth and the investment of all those hours and random financial outlays, along with the more considered ones will present itself in about a decade. I know. Ugh. However. Your mortgage deal is a good one! Also, if it’s really and truly a burden for you emotionally or for reasons other than financial, you can always sell it. It’s always an option. I wouldn’t, but then, I’m not you, so.

Now. The boyfriend sitch. As my darling mum always said – sometimes in response to actual real-life questions of that nature from the various people who she mothered – ”if you have to ask, the answer is clear” and since there are no dependents involved, it’s even more obvious. Once it’s gone, it’s gone. I’m sorry. Clearly you care about each other and clearly it hurts, but my advice is, it’s over. End it kindly and with decency. The financial side is pretty minor in the overall scheme of things. Your costs will actually go down a bit anyway.

I would pay the car off for sure. Also, I think you did 100% the right thing re getting a new one in those circumstances. The increased cost sounds really small and why not have all the advantages and protections of a new car and warranties etcetera? I’d have done what you did. Peace of mind and solid value are big things.

As to the inheritance. I know it feels icky, but can you straight up ask your aunt? I don’t know the relationship, but when I was involved in will-divvying, I made a point of telling each beneficiary what precisely they were getting, because it’s helpful to know. All concerned were extremely sad about the death, me most of all, but money is neutral. When you’ll receive it is of course a different matter, but knowing what it will amount to will help clarify things a bit for you. Ask. Ask nicely, but ask. It’s a totally reasonable thing to do.

Otherwise, you’re doing amazingly well and I hope that very soon you look back on what must be quite a time of flux as the starting point of so many great things!

Hello,

A couple things really stand out to me in your situation.

1- I think you already know that breaking up with your boyfriend is best for you. Life is too short to spend time with someone you truly aren’t fully committed to and in love with.

2- you love your garden and your home. I’d stay there.

3- your quilting is beautiful and you have a good job and a side hustle. That’s wonderful!

Maybe quilting can be a second side income.

3-can you rent out a room to provide extra income or rent out your garage for storage for someone? It might help you make up the loss of your boyfriend’s income.

4- I’ve redone many homes with sweat equity and contractors. The Reno bids seem high to me. Also painting the room and paneling and removing the wallpaper may make you feel much better about the room while you keep collecting bids and saving for repairs.

Good luck!

I agree on the sweat equity thing. I’ve painted more paneling in my life than I can count, and it always cheered me up immensely while I was saving to make the renovations I *really* wanted to make!

“..painting the room and paneling and removing the wallpaper …” That’s what I was going to say! Paint is a LOT cheaper than renovations, and may be enough until it’s time for the move-or-stay decision.

Hi! I also agree. Most of the things you’ve said that bother you sound cosmetic. Save your money for now, look through some magazines to get ideas about what you like, and make some small changes. If you’re bored, you might also learn some of the renovation skills that you will eventually need. We have a 100-year-old+ farmhouse, which we’ve renovated over the past 28 years. For the first ten years, we took a room at a time, and I learned how to refinish wood floors, paint, patch plaster, glaze windows, etc. When we had professionals in, I asked questions and learned from them too. So be patient and enjoy the ride.

And thank you for your fostering work! One of the sad side effects of the pandemic has been the abandonment of many cats in my neighborhood, which have all made their way to our backdoor. We now have twelve that we care for, with seven neutered/spayed in this past year alone. It’s a big expense, but it has brought us a lot of joy and satisfaction that we’ve made a difference for these poor cats. I look forward to fostering cats when I retire soon!

Love how you’ve travelled so much, but also how you’ve settled down in Eugene for a better sense of community. Your job sounds great, but always keep your eyes open for different opportunities…

I’d consolidate your savings to just one online high yield bank account, where you can organize savings with subcategories. I’d also step back from a big renovation like the steps/attic room, and focus on the rest of the house first. Organizing/focusing on the other living spaces will ultimately help you figure out exactly what you want that extra room to become(maybe a craft room? Guest room? Maybe a room to rent out?). That will give you time to stash away more money into the savings account. We put off finishing our basement for years until the pandemic brought on the urgent need for extra work/living space for my husband and kids. The years we put it off allowed us to save the money required to pay for a finished basement, and gave us perfect insight as to what we needed that space to be. That said, stay in your home:).

Ok-lastly, I’d probably pay off the mattress first, the bedroom set, and then the car for my own peace of mind. Eliminating payments feels SOOO good, and will free up money every month to stash away for future goals. I’d also look into your dream of founding a charity to do the work you want to do for the cat population. It’s never enough, I know the feeling well!! Give yourself some grace and focus on what you are doing that will make an impact. Each “fixed” cat means so much!

Good luck with everything, you are definitely on a great path!!

The thing that struck me most about your situation is that you mention hurting. Granted, it was in relation to your charitable work, but I suspect you have a lot more pain underneath. Your relationship is very likely going to end, and with regard to your job, you’re having a certain amount of “is this all there is?”. I suggest that you make no drastic changes of any kind until you’ve spent some time chatting with yourself about what you really want for your life, once your boyfriend has moved out and you can reassess without needing to take someone else into account. I hear that you love your community, your friends, your house, your garden…is there actually a job you would love, or will your job simply need to be the thing that pays the bills? You may wish to consider if your longer-term financial goals should include early retirement, and if you should keep your boring job and find fulfillment elsewhere.

Hi Vanessa,

It looks like you have things very well on track! Regarding the room, since you are a single person living in the house, can you store your stuff somewhere in the house other than the attic? Then you can just close the door to the weird room and ignore it for several years, since you don’t have any current need for the space. Concentrate on the parts of the house and yard that bring you joy, you don’t need everything to be “finished” anytime soon, and certainly not unused space that is going to be a huge project.

Regarding your expenses, you may find that they reduce more than you expect after your breakup when you are only buying food, alcohol, household goods that you actually consume. In that circumstance your dates budget could also be either eliminated or reallocated to getting together with friends (how fun!)

If you’re wanting the company and/or extra funds to stockpile for future reno work, have you considered taking in a roommate when/if the breakup occurs? I’d guess your rental market could be decent since you’re near a college.

In a somewhat stream of conscious order:

1. Mini-chainsaws are awesome and invaluable!

2. I agree that you seem to be financially in a great place. Sometimes its nice to hear that from other people.

3. Love the cats’ names

4. I think sometimes people can mistake a primary home as a purely investment (ie your head) when its perfectly fine for it to be an emotional purchase (ie your heart). As long as you love it and can reasonably afford it, I would keep it. I once lived in a more financially advantageous situation and was miserable.

5. I am in no position to offer relationship advice. As others have suggested, a counselor could be great to help sort feelings and the appropriate path forward.

6. If your relationship allows, I would go ahead and ask your aunt about the inheritance. It should help with future planning.

I just wanted to mention you could give the room a cosmetic update for very little money. Removing wallpaper, painting and new flooring are pretty simple things you can do yourself or with the help of friends. None of those changes would require a permit and it will allow you enjoy the space more while you decide what you want to do.

My sister bought a house in Los Angeles before she was married. After a couple of smaller reno projects, when they approached a larger one, they took a step back and looked around, eventually buying a house about 3 blocks away that already had what they wanted. You may find that this is the best option, even if you have to wait a while to execute it.

Just popping in to mention I think it would be worth looking into other attorney jobs. My husband is an attorney. He started at a big firm straight out of law school. He HATED it. He made good money, but the stress and “always be available work” life were unbearable. He took a pay cut to work for the government. He recently took a new job as a county attorney. The hours are typical 9-5, low stress, and it’s unionized.

If my husband was working a job where he didn’t need his law degree, (and still donating plasma), I think I’d have some opinions. Just a thought!

I was thinking a similar thing. I’m sad that you might feel you need to donate plasma to make ends meet. You are an attorney! Yes, it’s a good thing to do because people need plasma, but hope you don’t have to rely on that forever.

I hear a restlessness in your story. I’ve been there and if the cause is impatience or boredom a step back to realize this is actually a good thing might reframe your situation. You have the luxury of margin to take the time and make some small changes that might make a big impact. If I was you I would: learn French, leave the relationship, divide the reno into stages and then use the inheritance to tackle phase 1.

Thank you for doing cat rescue. Animals are so wonderful! Whenever I need work done on our house, I find that if I ask around enough I find some great people to do the job.

As I read your story I see you have lots of balls in the air. My educated guess is that, if you can settle a few things, that will help get thing more orderly and give you the psychic space you need to relax and make additional decisions. Each additional resolution will propel you toward the next.

Here are the items I’d get settled asap:

* the boyfriend: if it’s over, it’s over. Make the decision so you can both move on. Mourn the “might have been” and settle it.

* pay off the debt you can. This isn’t a purely financial decision. If getting rid of this debt makes you feel better that’s a sufficient reason to pay it off.

* find out from your aunt how much you can expect from your grandmother’s estate and when she expects to settle it. As an heir (as you know as a lawyer) she’s obliged to handle the estate as it’s fiduciary and you have a right to this information. And an early partial distribution is often possible.

* deal with the house/permit issue. Can you find a contractor with whom you can barter legal services in exchange for consulting and work? What would be involved in getting the existing work permitted? (If you can find permits, and several contractors have told you the work want permitted assume it wasn’t permitted. (Non-permitted work is very common and an expert can tell. My partner is an appraiser and he can tell at a glance. I’ve never seen a permit search turn up a permit when he thought work was un permitted.)

Good luck!

.

I am currently getting bids for attic work. It is very costly, many contractors won’t do it as it involves more liability than kitchen/bathroom reno. I dont think she’s gonna barder her way into $150k worth of work lol

That attic entrance and half-landing do look pretty hazardous! Unless you use that room and attic entrance a lot I’d wait and save money for a renovation. If the only reason you want to move is because of that situation I’d stay where you are. You can save up the money to renovate the space and turn it into exactly what you want. In the meantime, you could do a little visual refresh on your own pretty cheap – remove the wall paper and paint the wood paneling. For a couple hundred bucks and some elbow grease it could help feel like you are making progressing in that room and make it more bearable to look at while you wait to save enough money for the big stuff.

Another issue to consider – if that space isn’t permitted and the stairs are dangerous – how will that affect your ability to sell it and the price at which it sells? Do you have to disclose that it’s not permitted?

I do not think it’s worth it to move in this market unless you absolutely have to. You’ll pay at or near the top of the market price to buy something new and have a much higher interest rate. If the housing market does go down right after you purchase, how will you feel if you end up underwater?

It’s also tough to buy right now. There’s so much competition, and you are often competing against cash offers. Things are routinely going for 125% of the list price in my MCOL area. Then if the appraisal doesn’t match the sales price, you have to come up with the difference in cash. Buyers are waiving all contingencies and buying things without inspections. Here, you also can’t buy a house if it’s contingent on selling yours. You’d have to sell your house first, find somewhere to live temporarily, and then hope something goes on the market you like and that you are lucky enough to have the winning bid on it. Bottom line: don’t move if you don’t have to!

I for one applaud the purchase of the new car. Buying a good used car is hard in the best of times.

As to your was it/wasn’t it “legal” construction issue, see if your title insurance covers this. You may hit the same issue trying to sell the house.

It will be hard to find a house too (IMHO). Do you need access to that area on a regular basis – in other words, do you have the luxury of time to get all the facts, figures, and permits if required? If you can look at other work done by a contractor (or have a reliable friend/relative who can vouch – easier said than done also).

The only thing I can offer any suggestions on is the book “Too Good to Leave, Too Bad to Stay” by Mira Kirshenbaum for helping thinking through the relationship conundrum. Other than that, thank you so much for sharing your story and thank you to Mrs. Frugalwoods for breaking it all down helpfully!

Thanks for sharing with us, Vanessa! It seems you are doing great. I just have two comments. First, regarding your relationship, I echo everyone else’s comments…you seem to already know the answer. As hard as it can be to move on, I think you will eventually find peace with that decision. Second, definitely hold off on selling and renovations for the moment. Focus on your lovely garden and your quilting. If you do try to sell the house, I’m wondering if you’d have to put in renovations anyway to bring things up to code? You can save for the renovations and in the meanwhile, spend time figuring out how you’d like to renovate the space in a way that will serve you best and make you happy. Best of luck to you!

I’m also an OR PERS member. I suggest really learning about your PERS benefits so when you are thinking about changing positions, you can make a fully informed decision. PERS holds a retirement expo every October. It’s been online the last few year. I’ve found the sessions really helpful. Also, you may want to look at positions with the Oregon Judicial Department. Many of our positions have gone remote or remote/hybrid since the pandemic.

Personally, for the time being, I’d keep the house and simply shut the door on the room that needs renovating. Sometimes ignoring the problem is the way to go. LOL. It sounds like the rest of the house might not need work (or as much work); if that’s the case, keeping this house might still be well worth it, especially because you are attached to it. Or as someone else suggested, make some cosmetic changes to the room so that it’s more comfortable, and then use it as a crafting/hobby space? I also get the sense that some of these house- and money-related questions will be much easier to answer once you know how you plan to proceed in your relationship. I wish you all the best! You’re doing a great job.

Agree with this. It seems like an extra room not a burning immediate issue. It might be good to save for long term.

Since you asked about short-term savings methods and Mrs. F mentioned HY savings accounts, here is another option: government I bonds. These work like CDs and right now the interest rate is an amazing 9+%, guaranteed interest for 6 months if purchased before November. The interest rate re-sets every 6 months based on inflation. The down side is that you cannot access the money for one year. If you cash out between 1 and 5 years after purchase, you lose 3 months of interest. If you cash out after 5 years, there is no penalty. Another down side is you have to purchase them through a clunky government website: treasurydirect.com . However, there is no better place to put your money right now that guarantees that kind of interest rate, if you can leave it there for at least a year. FYI, you can purchase only $10k per year (with some exceptions). An excellent source of info on these is Harry Sit’s blog, The Finance Buff.

Oops, just realized I listed the wrong website address – it should be treasurydirect.gov (not x.com)

Also, here’s a link to a helpful blog post: https://thefinancebuff.com/how-to-buy-i-bonds.html

Yes! Came here to also mention I-bonds as I was wondering why the wonderful Mrs FW didn’t mention them. Seems like a great middle ground between low return savings account and higher risk stock options — best of both worlds, especially with CD rates still being abysmal right now

I was going to say the same thing. Safest, and best returns to be found!

As a parent of a neurodivergent, they can be wonderful and suck the energy from you. I feel the struggle in you and applaud how you are handling it. You have given him the time he needs to transition. Know that you can walk away and leave him in a good place. He will be ok. Also he may act like now that you are out of his life , you don’t matter to him. But you do.

Awesome case study! I agree with others that you should keep your house. While waiting to decide about a major reno, you could remove the faux paneling and wallpaper and then paint it yourself. I’m interested in what you want that room to be. It’s probably not worth it to pay for a major reno if the room is just bonus space.

Also, while you may be bored with your job, at least you have good work-life balance and can enjoy more challenging pursuits in your non-work life. The gardening and taking care of cats sound like healthy, busy hobbies.

Wallpaper can be painted! A couple cans of paint for about $25 each would make a world of difference if it is bothering you too much! Also, rather than redoing the stairs, can you scootch that wall at the top of the stairs back 2 feet? That would give you a safe landing. Or, what about turning the staircase at the top, where the steps are shaped like pie pieces, kind of like a spiral staircase?

I live in a house where the previous owners painted the wallpaper, and I have to say: DON’T DO IT! You will be able to see lines where there are seams and if there is a border. It will be a hideous mess and the only solution we have found is to cover it with something else, like paneling. Rent a steamer or use a scoring tool and a solution of vinegar/fabric softener/water/409 to strip the wallpaper. THEN prime, sand and paint the walls.

Please check and see if your title insurance (which you likely bought when purchasing your home) covers the unpermitted work. I did a cursory search and found that it can sometimes cover unpermitted work discovered in your home so it would be worth it to check. Also, whatever it is you have to do to find out if the work was or was not permitted would be worth doing. That way you can get more accurate estimates from any contractors.

You are doing great! You should be really proud of how well you are setting yourself up financially.

Looks like Eugene has a tool library: https://www.eugenetoolboxproject.org/. Become a member, and you can borrow the tools for those one-time or occasional projects! Tool libraries are the best.

Exactly! Came here to say the same thing… Even put the word out with your friends or co-workers if you need to borrow a tool one time on a weekend. Definitely don’t invest in many that you MAY use in future. I used to joke that close neighborhoods should also have spice libraries or very easy ways to share the unique ones!

You’re doing great, Vanessa! As many readers have commented, there is no huge rush in taking the next step with your house. I’ve been in mine for 20 years, and still have my eye on a few reno projects I thought of soon after I moved in. Nothing earth shattering, but the timing has never been right.

In regarding your car, it sounds like you had little options and made the best choice in those circumstances, which is all we can ever hope to do.

It also sounds like you have good insight, and good instincts… Those will help you go a long way!

On the note of the potentially unpermitted room, what is the long term implications of this to you if you stay in the house? It is most likely not up to code but it is possible that the town lost permits along the way or didn’t require them for that type of work at that time. We bought a completely unpermitted cabin due to our own negligence (we didn’t research and we knew it was unfinished/in bad repair) and the town gave us the option to bring in a structural engineer to prove it was safe, etc. You often do not have to bring things entirely up to code to sell them. If you know there is a potential issue, you need to disclose it but would need to talk to realtor about what you would need to legally disclose.

We also sold a house with the worst staircase in the world – completely not up to modern code but it was when it was built in the 1920s so it was ok. It was clearly visible to the potential buyers and when they asked about permits, we could honestly say we didn’t know as we didn’t build the stairs.

Vanessa, I feel like I was exactly where you were in my late 30’s, just a general vague dissatisfaction with everything, even though on paper I had nothing to complain about. (Except my old, perfectly road-worthy, perfect city-car Honda was stolen and they gave me next to nothing for insurance – same situation as your hit-and-run almost!) This may sound totally hokey, but I took a class at my local adult education extension that was titled “100 Things to Do Before You Die” and it reframed my entire life for me. Some of the exercises were things like writing down 100 things you wanted to do, and writing down 15 things you used to do and were good at, but don’t need to do anymore. 10 jobs you wish you had had. 10 jobs you never wanted to do. Writing a letter to yourself from 5 years in the future, 10 years in the future, and 20 years in the future. At one point we put the 100 things on index cards and threw them in the air and picked out 15 or 20 and made strategies (no matter how wild and crazy) about how to make them happen. Stuff like that. Anyway, as a result of that class, I changed my life in random ways. I went on a Forest Service volunteer archaeological dig (always thought I wanted to be an archaeologist). I traveled with a sketchbook by myself for a month in a foreign country (took a leave/ long vacation through work) and tried to learn a language. I joined the board of a Farmer’s Market. I joined a local caving club and went in caves. The point was you found things you thought you were interested in and figured out ways to do them. What I discovered is that I love to volunteer for almost anything- it makes me feel like I’m giving back and making a difference- and it sounds like your TNR volunteer work does that for you. I definitely recommend volunteering for a local board for an animal rescue before you start your own. You will meet people who are passionate about the same things you are and your life will open up. I think the pandemic has made things particularly hard because it’s hard to make plans for the future when you don’t know what the future holds. So, by exerting control over things you *can* control, you gradually lift yourself out of your dissatisfaction. As far as your specific questions, I’d do some cosmetic sweat equity projects on your house- you’ll be amazed at how much painting paneling and wallpaper can do for your perspective of a space. Moving right now in this housing market when you have the rates you already have is silly, especially if you like your neighborhood and garden and don’t know where you’ll be in 5 years- stay where you are for now and spruce it up some, while you save for the “do it right” renovations (spoiler- for me I ended up moving before I finished my “do it right” renovations, but I had that money set aside which helped me with my next adventure). You did the right thing on the car in today’s situation too- we did the same thing recently for a tractor- we could either buy a used for one price, or a new for just a little more… duh! You’re rocking this- you just need to journal or find a life counselor you click with, or hang out with a friend and brainstorm about what you need. I recently found my letter I wrote to myself “from the future” and it made me cry, because I’m so lucky. My life is basically what I had written I wanted it to be! Yeah, life’s not perfect, because it never is, but you have no reason not to make it what you want. I wish you the best in your adventures!

Just want to say I love this response. So much food for thought here.

I need to find out more about this! Is this class something available online? I need this!!

Anne, I wish it was! Maybe look up online and see if something like it is? That teacher totally changed my life perspective. It was through the Cambridge Adult Education (in Cambridge, MA) way back when. The teacher was a former Peace Corps volunteer who had lived a life full of joy and adventures and service. I really ought to try to find him and tell him thanks…..

I also love this comment!

Hi, Vanessa, you are doing great, but I can understand the many changes going on around you may have you questioning yourself.

Like most others, I say stay in your house, and like some others, I say just do some cosmetic work in that room that you hate until you know for sure what you want to do. The wallpaper is definitely… interesting.

And someone mentioned the non-profit and that comment struck a chord with me. I see non-profits started up that are doing almost the exact same thing as other non-profits, or else they overlap significantly. I know of a woman who survived cancer who started a non-profit to help people get support as they go through cancer and in the next town, another cancer survivor started one for the same thing, even with almost the exact same name, because she hadn’t looked to see if one existed already. Check first to see what is out there to help with fostering animals, assisting shelters, neutering ferals, etc. You may find there is already a good organization you can assist, without taking on the huge burden of starting one.

You have a lot going on, but you have put yourself in a good financial position. Be deliberate and intentional in what you do, listen to good advice and examine your reasons for what you want to do, and I think you’ll come out of this doing well. And remember – life is not static and it won’t be stuck this way forever.

Hey Vanessa, I very much enjoyed your case study. It hits me as I read that you are in a process of grieving and need the time, space, and energy to actively heal before you are ready to move on and make the right big decisions. You sound like you are in a really good place that will help make it easy to start healing with the big questions like housing, relationship, and job pretty settled. I encourage you to give yourself the gift of time and pursuing healing through therapy or other avenues so that you will be ready for your next relationship with less baggage brought into it. Best of luck to you.

I also live in a house that I love that has a weird upstairs bedroom that can only be accessed by suspect stairs. My solution is: just ignore it, since I don’t need that living space at the moment and I don’t have a clear idea of what to do with it. I’ve been here since 2014 and so far ignoring it is going just fine 🙂 I definitely don’t think it’s worth selling the house and moving over. Lots of people in my neighborhood (in St. Louis) have similar 1930s houses where former owners McGyvered more living space without asking anyone. Everyone seems to live with it or eventually hire a contractor if they decide they really want the space. I’d say it’s no big deal!