Jenny and her husband Will live in the Upper Midwest along the shores of Lake Michigan with their two children, Sam (age 16) and Alex (age 10), and their one old cat. Will is 56 and the couple always planned for him to retire at 60 and to pay for Sam and Alex’s college educations. However, now that the date is nearing, Jenny’s not sure this is actually feasible. She’d like our help checking her calculations and determining how they should allocate their resources as they–hopefully–approach retirement and paying for college. I’m doing a deep dive today into one of the most commonly asked questions:

When can I retire and not run out of money?

I’ll walk you through how to model different retirement scenarios–based on the variables of your assets, your spending, and your desired retirement age–and how to determine whether or not you’ll run out of money before you die. Today I’m employing the ultra-comprehensive, detailed FIRECalc modeling system for “when can I safely retire?” Woohoo!

What’s a Reader Case Study?

For an example, check out the last case study. Case Studies are updated by participants (at the end of the post) several months after the Case is featured. Visit this page for links to all updated Case Studies.

The Goal Of Reader Case Studies

Reader Case Studies intend to highlight a diverse range of financial situations, ages, ethnicities, locations, goals, careers, incomes, family compositions and more!

The Case Study series began in 2016 and, to date, there’ve been 81 Case Studies. I’ve featured folks with annual incomes ranging from $17k to $200k+ and net worths ranging from -$300k to $2.9M+.

The goal is diversity and only YOU can help me achieve that by emailing me your story! If you haven’t seen your circumstances reflected in a Case Study, I encourage you to apply to be a Case Study participant by emailing your brief story to me at mrs@frugalwoods.com.

Reader Case Study Guidelines

I probably don’t need to say the following because you folks are the kindest, most polite commenters on the internet, but please note that Frugalwoods is a judgement-free zone where we endeavor to help one another, not condemn.

There’s no room for rudeness here. The goal is to create a supportive environment where we all acknowledge we’re human, we’re flawed, but we choose to be here together, workshopping our money and our lives with positive, proactive suggestions and ideas.

A disclaimer that I am not a trained financial professional and I encourage people not to make serious financial decisions based solely on what one person on the internet advises.

I encourage everyone to do their own research to determine the best course of action for their finances. I am not a financial advisor and I am not your financial advisor.

With that I’ll let Jenny, today’s Case Study subject, take it from here!

Jenny’s Story

Hello! I’m Jenny (age 50), married to Will (age 56). Will is a software engineer and I’m a stay-at-home mom. We have two kids, Sam (age 16) and Alex (age 10), who are homeschooled. We also have a lazy old cat who refuses to be schooled in any way. We reside in the Upper Midwest along the shores of Lake Michigan. We live pretty simply, enjoying time together going for hikes, collecting beach glass, gardening, playing board games, reading books, etc.

Our biggest expenses by far involve our health, due to both chronic (non-debilitating) as well as immediate medical issues. Food is our biggest line item and, despite cooking 100% at home and making almost everything from scratch, it’s a crazy high amount. Part of that is due to our insistence on buying only organic, grass-fed/finished, pastured, etc. We also spend a lot on supplements (after tracking for the last few months I’m honestly shocked by just how much!). And lately, the medical bills have been sky-high; the deductible on our health insurance is over $6,000 and we’re using our HSA as an investment vehicle so we haven’t been touching it.

What feels most pressing right now? What brings you to submit a Case Study?

As the one handling our finances, I’ve been telling Will for a while that I think he might be able to retire when he turns 60. Now that the date is drawing near, I’m freaking out a bit. I don’t see how he can stop working in just a few years.

My original target for “enough to retire on” was:

- $1,000,000 in Will’s IRA

- $100,000 in Will’s inherited IRA

- $100,000 in Will’s HSA

- $100,000 in our Roth IRAs (combined)

- $100,000 in cash

However, we recently had to stop investing in our Roth IRAs due to ongoing medical expenses, and we don’t have any cash saved at all. I realize this last part is a problem, but somehow I just can’t seem to save an emergency fund.

In addition, our net worth has dropped since the beginning of the year, thanks to the swings in the stock market. While I knew the good stock market times wouldn’t last forever, it’s another thing to see it actually happening. I’m not one to freak out (I mostly just stop checking our investments), but with Will getting closer to retirement age, it’s something that concerns me.

College for Two Kids

Complicating the picture of when Will can retire is the fact that both of our kids will be college-aged in just a few years. We’d like to make sure they get through whatever advanced education they want/need with no debt. We obviously don’t have much saved to that end, so we’ll need to cash-flow it, even if it means Will works a bit longer. I’m also concerned about what we’ll do for health insurance as a family once he retires.

Finally, I should add that I’ve been making calculations based on current investment balances and contributions, using 7% as a base interest rate and adjusting each year with the new balances. I have also looked into what Social Security might offer us, though I’m not counting on it. The Open Social Security website indicates that our best strategy would be for me to file for my retirement benefit when I turn 62 and 1 month, for Will to file when he turns 70, and then for me to file for my spousal benefit at that time. The first full year that Will is 70 would result in us receiving almost $54,000 a year. But again, I’m not counting on Social Security to be available, at least not in full.

What’s the best part of your current lifestyle/routine?

What’s the worst part of your current lifestyle/routine?

The worst part of our current lifestyle is not having Will home all the time. His company allows him to work remotely a few days a week, but the rest of the time he needs to be in the office, which is a 45-minute commute from home. We’d prefer for him to work from home full-time, and even better, not have him beholden to a job at all. Alas, an income is still required to pay for the necessary goods and services.

Where Jenny Wants To Be in Ten Years:

Finances:

- I would like for Will and I to have enough money saved to live off comfortably and to help our kids pay for their higher education if necessary.

Lifestyle:

- Will would be retired and we’d be continuing to live pretty much the way we have been, without Will having to work.

Career:

- No career! 😉

Jenny’s Finances

Income

| Item | Amount | Notes |

| Will’s net income | $6,491 | Will’s net salary, minus health insurance, taxes and the following deductions:

HSA: $8,300 per year (Will contributes $6,350 & his employer contributes $1,950) |

| Required Minimum Distribution from Will’s inherited IRA | $237 | This amount changes yearly (taken as a lump sum each December). |

| Monthly subtotal: | $6,728 | |

| Annual total: | $80,736 |

Debts: $0

Mortgage: None. Our house is paid off and valued at around $350k

Assets

| Item | Amount | Notes | Interest/type of securities held/Stock ticker | Name of bank/brokerage | Expense Ratio |

| Will’s 401K | $658,675 | VINIX | Fidelity | 0.035% | |

| House (paid off) | $350,000 | Estimate based on comp. sales. | |||

| Will’s Inherited IRA | $102,670 | Required RMD every year. | VBTLX & VTSAX equally | Vanguard | 0.05% & 0.04% |

| Health Savings Account | $55,750 | In the bank Will’s company uses. | VINIX | local bank | 0.035% |

| Jenny’s Roth IRA | $17,421 | VTSAX | Vanguard | 0.04% | |

| Will’s Roth IRA | $9,408 | VTSAX | Vanguard | 0.04% | |

| 529 (Sam) | $5,412 | In our state 529 program. | TISPX | 0.05% | |

| 529 (Alex) | $5,412 | In our state 529 program. | TISPX | 0.05% | |

| checking | $1,000 | Wells Fargo | |||

| savings | $500 | Capital One | 1% | ||

| Total: | $1,206,248 |

Vehicles

| Vehicle make, model, year | Valued at | Mileage | Paid off? |

| Toyota Sienna 2006 | $7,500 | 141,000 | yes |

| Honda Civic 2007 | $6,000 | 164,000 | yes |

| Total: | $13,500 |

Expenses

In filling out the financial spreadsheet I realized that I haven’t accounted for many expenses, mainly the maintenance and repair on our vehicles and house. Somehow we always find a way to pay for the things that come up irregularly without going into debt, but obviously living on the edge like this is not good. I think part of me knows that if we absolutely had to we could withdraw funds from the inherited IRA (and pay taxes on it) or the HSA (for medical expenses). Obviously, though, this goes against using those accounts to save for retirement!

| Item | Amount | Notes |

| groceries | $2,400 | |

| medical bills | $850 | |

| supplements | $681 | |

| misc. household expenses | $650 | health & hygiene, cleaning supplies, furnace filters, light bulbs, printer ink, etc. |

| property taxes | $544 | |

| kids’ activities/classes | $400 | |

| gas/electric bill | $200 | |

| gifts/holiday expenses | $162 | gifts, Halloween costumes/candy, Xmas tree, Xmas cards, memorial donations, etc. |

| water bill | $117 | |

| gasoline | $85 | |

| auto insurance | $76 | Erie Insurance |

| alcohol | $65 | |

| internet | $60 | |

| life insurance | $58 | Cincinnati Life |

| clothing | $50 | |

| pet supplies | $50 | cat litter/food/vet visits |

| homeowner’s insurance | $37 | Erie Insurance |

| books | $30 | We utilize the library as much as possible but buy a book if the library doesn’t have it or we want to own it. |

| virtual exercise classes | $25 | |

| New York Times subscription | $20 | |

| cell service (Tello) | $14 | |

| Netflix | $9 | |

| landline (Ooma) | $6 | Kids don’t have their own cell phones so we need this for when they’re home alone. |

| umbrella insurance | $6 | Erie Insurance |

| Monthly subtotal: | $6,595 | |

| Annual total: | $79,140 |

Credit Cards: none

Jenny’s Questions for You:

1) Are we on track for Will to retire in four years?

2) What options do we have for helping our kids with the costs of higher education?

3) If Will is able to retire before the kids are old enough to have their own health insurance, how do we make sure they’re covered?

4) How do we save an emergency fund? I used to be so good with money, but lately I feel as though we’re drowning in expenses.

5) Am I focusing too much on retirement savings at the expense of our finances today?

Liz Frugalwoods’ Recommendations

I’m delighted to have Jenny as a Case Study today because I think her family finds themselves in a situation familiar to many: Barreling towards retirement age and college tuition at the same time. I’m thankful to all of our Case Study subjects for their honesty and transparency since these deep dives help not just the subject, but plenty of readers too! Many thanks to Jenny for joining us :).

Most of Jenny’s questions are inter-dependent, so forgive me for addressing things slightly out of order today. Let’s dive in!

Jenny’s Question #1: Are we on track for Will to retire in four years?

It depends. There are a number of factors at play here and the theme I’ll return to over and over today is the need for prioritization and organization. Jenny and Will need to identify their highest priorities and then focus their financial energies towards those ends.

The big prioritization question is:

Do they want to pay for their kids’ college or do they want Will to retire at 60?

If they’re going to pay for their kids’ college, they’ll need to change their spending and allocations.

Priority 1: Paying for College?

Their oldest will be off to college in about two years and they have $5,412 in his 529 (a college investment plan). This is great! Any savings are great! Any investments are great! The downside is that this won’t be nearly enough to cover four years of tuition, room, board, books, etc.

Jenny mentioned cash flowing the kids’ college education, but that’s impossible at their current spending level. Will’s annual take-home pay is $80,736 and they spend almost all of that ($79,140). In light of this, if they want to pay for their oldest’s college in full, they’ll have to:

- Dramatically decrease their spending (and/or dramatically increase their income)

- Select a college with affordable tuition

- Seek out scholarships and other financial aid

- Stop contributing to their retirement accounts

As you all know, I’m not a fan of parents not contributing to their retirement because I think it leaves parents in a precarious position. I almost never advise people to stop investing in their retirement–particularly when you have an employer-matching 401k as Will does–and it makes me uncomfortable to even write it out.

In past Case Studies, I’ve encouraged parents to think about it like this:

Would your kid rather have you pay for their college and then potentially have you rely on them financially in your old age? Or, would your kid rather take out student loans and NOT be financially responsible for you in your old age?

Will and Jenny’s position isn’t quite this diametric, but they really need to be honest about how much money they have to work with, given the fact that their oldest is fast approaching college age and their youngest is close behind.

Remember: It’s not selfish to invest for your retirement–it’s fiscally responsible.

Expenses

A major hurdle to all of Will & Jenny’s financial goals is their spending. Jenny and Will are breaking even every month, which is a perilous position to put yourself in–especially if you don’t have to.

This isn’t a criticism of their spending, but rather an invitation for them to re-assess their longterm goals as a family and as a couple.

Unless they dramatically increase their income, this level of spending is not tenable.

I applaud Jenny for her honestly about their challenges with tracking their expenses. It takes a great deal of courage to face this and to articulate it. Nobody wants to admit fault–especially not on the internet!–so I want Jenny to understand how proud I am of her for taking this step and how difficult that is to do.

Since this seems to be a persistent issue for Jenny and Will, I encourage them to do three things right away:

- Sign-up for Personal Capital, which is a free, online, expense tracking system (affiliate link). I use and recommend Personal Capital, but there are other services out there if you prefer something different. The key is to find something that works for you and stick with it.

- Take my free Uber Frugal Month Challenge together. You can sign-up at any time and start with Day 1 of the challenge. This 31-day program guides you through the steps it takes to understand your goals, your money and the emotions around your finances.

- Review the below spreadsheets together and determine where they can start saving ASAP (Jenny, I’ll email this to you so you can edit as you and Will discuss).

As Jenny noted, it’s their top four expenses that are killing their budget. These “Big Four” total $4,581. Jenny and Will don’t have a mortgage, which should enable them to live on less, but these four are absolutely draining them. Let’s look at them first:

| Item | Amount | Notes | Mrs. FW’s Notes |

| groceries | $2,400 | I understand and share the desire/need to eat healthfully, but am hard-pressed to see how it needs to cost $2,400 per month. I live in a different part of the country and my kids are younger, but we spend around $600-$800 per month for a mostly organic, grass-fed, tons of fresh produce, minimal meat diet for our family of four.

Again, if this is Will & Jenny’s absolute highest priority, they will need to cut in other areas to support this amount. If Jenny’s open to considering reducing this amount, I recommend she start by reading: Our Complete Guide To Frugal, Healthy Eating. |

|

| medical bills | $850 | I’m confused as to why money is going into the HSA, but not being used to foot these bills? Let’s talk more about the HSA in a moment because this isn’t making sense to me (even in light of the tax advantages of investing in an HSA). | |

| supplements | $681 | I’m not a health professional, so I cannot discuss the efficacy/need for supplements, but WOW is this a huge amount. It’s $8,172 per year! Again, not criticizing the choice, just highlighting that this is an outsized amount of money. Is there an opportunity for reduction here? | |

| misc. household expenses | $650 | health & hygiene, cleaning supplies, furnace filters, light bulbs, printer ink, etc. | This amount also blows me away. I’m not clear on how this bill can be so high alongside the astronomical groceries and supplements? This is a category to really dig into to investigate the itemization, since it’s equaling $7,800 per year. |

| TOTAL: | $4,581 |

Everything else in their monthly expenses pales in comparison and totals a mere $2,014. While Will & Jenny can, and should, trim around the edges of these expenses, it’s the Big Four that are making the difference. Here’s my “trim around the edges” advice:

| Item | Amount | Notes | Mrs. FW’s Notes | Suggested New Amount |

| property taxes | $544 | Fixed cost | 544 | |

| kids’ activities/classes | $400 | Reduce/eliminate | 200 | |

| gas/electric bill | $200 | Explore opportunities for using less | 175 | |

| gifts/holiday expenses | $162 | gifts, Halloween costumes/candy, Xmas tree, Xmas cards, memorial donations, etc. | Reduce | 100 |

| water bill | $117 | Explore opportunities for using less | 100 | |

| gasoline | $85 | Fixed cost | 85 | |

| auto insurance | $76 | Erie Insurance | Shop around to see if there’s a better rate. | 76 |

| alcohol | $65 | Reduce/eliminate | 45 | |

| internet | $60 | Fixed cost | 60 | |

| life insurance | $58 | Cincinnati Life | Fixed cost | 58 |

| clothing | $50 | Reduce/eliminate | 25 | |

| pet supplies | $50 | cat litter/food/vet visits | Fixed cost | 50 |

| homeowner’s insurance | $37 | Erie Insurance | Shop around to see if there’s a better rate. | 37 |

| books | $30 | We utilize the library as much as possible but buy a book if the library doesn’t have it or we want to own it. | Eliminate | 0 |

| virtual exercise classes | $25 | Eliminate | 0 | |

| New York Times subscription | $20 | Eliminate | 0 | |

| cell service (Tello) | $14 | Fixed cost. Well done on using an MVNO!!! | 14 | |

| Netflix | $9 | Eliminate | 0 | |

| landline (Ooma) | $6 | Kids don’t have their own cell phones so we need this for when they’re home alone. | Fixed cost | 6 |

| umbrella insurance | $6 | Erie Insurance | Fixed cost | 6 |

| Monthly subtotal: | $2,014 | Monthly subtotal: | $1,581 | |

| Annual total: | $24,168 | Annual total: | $18,972 |

Even if Jenny & Will trim all of their expenses in this category, they’re only going to save $5,196 per year. Which isn’t nothing! I’m not saying they shouldn’t save this–they should–but the eye-opener are the Big Four expenses totaling $54,972 per year.

Let me reiterate: I do not care what Will & Jenny spend their money on. I’m not judging WHAT people spend on, I’m looking at the bottom line of HOW MUCH they spend versus their income. Jenny asked for my advice and, in this case, some radical expense reduction is what needs to happen.

Let’s circle back to the retirement question:

Jenny and Will have $788,174 in all of their retirement accounts combined. Let’s see how this stacks up against the retirement rule of thumb:

Aim to save at least 1x your salary by 30, 3x by 40, 6x by 50, 8x by 60, and 10x by 67 (Fidelity).

Since Will’s 56, let’s go with 7x: $80,736 x 7 = $565,152, which indicates they are ahead of schedule. However, the issue is that if Will stops contributing to retirement in order to pay for their children’s college AND/OR to retire at 60, this amount won’t be enough to see them through old age. Time for some serious math!

How To Model When You Can Safely Retire (hint: use an online calculator!)

I ran several different mathematical models for Jenny and Will using the online FIRECalc retirement calculator (don’t worry, I didn’t try to do my own math 🤣). What I like about FIRECalc is that it allows you to input a ton of variables and model scenarios based on different future choices you could make. Bear with me, I’m going to walk you through how I navigated the calculator and what I input for each tab. My hope is that this (long-winded) explanation will enfranchise anyone reading this to perform their own “When Can I Safely Retire?” calculations. To follow along with your own numbers, go to firecalc.com.

1) I start at the “Start Here” tab and input:

- Spending: $79,140

- Portfolio: $788,174

- Full Years: 30

Their portfolio is only their retirement investments ($788,174) because we can’t include any of their other assets:

- They have to live in their house:

- A paid-off house is a wonderful thing, but it’s not a liquid asset. If you sell your house (and don’t buy another), then you’ll have that money in cash. But until then, it’s a place to live, not a liquid asset.

- The 529s are earmarked for their kids’ college

- The HSA is earmarked for medical expenses

- Their cash totals just $1,500

The variable here that Jenny and Will can most easily influence is their spending.

2) Next, I go to the “Other Income/Spending” tab and input:

- Social Security: $54,000 (this is the amount Jenny indicated they’ll receive)

- Starting in: 2036 (when Will turns 70, which is when Jenny indicated he’d elect to receive SS)

3) Next, I went to the “Not Retired” tab and input:

- What year will you retire?: 2026 (when Will is 60)

- How much will you add to your portfolio until then, per year? $37,350

- $37,350 = Will’s annual contribution to his 401k ($27,000) + his employer’s contribution ($4,000) + the amount they currently contribute to their HSA ($6,350).

- Note: they’d have to stop contributing to their HSA in order to include the $6,350

- If they decided to contribute more to their IRAs, they would add that amount here

4) Next, I go to the “Spending Models” tab and leave it alone, per the instructions:

If you leave this section alone, FIRECalc assumes you will continue to spend the same amount (after adjustments for inflation) every year for 30 years.

5) Next, I go to the “Your Portfolio” tab and input:

- How much are you paying in investing fees (expense ratio)? 0.04%

- For more on what expense ratios are and why they’re so important, check out this Case Study

- I selected “Total Market” since Will & Jenny are invested in low-fee, total market index funds

- Percentage of your portfolio that is in equities: 100%

- Note: Will & Jenny are currently invested 100% in stocks (aka equities). They should research whether or not they want to diversify their their portfolio to include some lower-risk, lower-reward bonds.

6) Next, I go to the “Portfolio Changes” tab:

This is the place to input major lump sum changes (either additions or subtractions) to your portfolio. The most relevant for Jenny and Will is college tuition. Other examples: an inheritance (addition), the sale of a home (addition), the purchase of a home (subtraction).

I had to make estimations since I don’t know how much college tuition will cost for Jenny & Will’s kids. I made the wild guess that it’ll be $125,000 for each of their boys to attend four years of traditional college (a grand total of $250k for both kids). They can adjust this number when they have real data from their sons’ prospective universities.

To model paying for college:

- I selected “Subtract a lump sum” of $125,000 in 2026 for their first child:

- I picked 2026 because it should be roughly the mid-point of their 16-year-old’s college education

- Then for the second child, I selected: “Subtract a lump sum” of $125,000 in 2032:

- I picked 2032 because it should be roughly the mid-point of their 10-year-old’s college education

7) And finally…. we get RESULTS! I go to the “Investigate” tab:

Retirement Scenario #1: Retiring at 60

I want to model Will & Jenny’s likelihood of success for several different possible retirement scenarios. Here’s the link Jenny and Will should use for modeling each of these scenarios.

We’ll start with the assumptions Jenny set forth (and the variables I input as noted above):

- Will retires at age 60

- They pay for both of their children’s college educations

- Their annual spending and savings rates do not change

To model this, I click on the first box, which says “The success rate of your portfolio and withdrawal plans…” Then I click “Submit.”

Unfortunately, it is not good news.

The FIRECalc results state:

- Because you indicated a future retirement date (2026), the withdrawals won’t start until that year.

- Your contributions will continue until then.

- The tested period is 4 years of preretirement plus 26 years of retirement, or 30 years.

- FIRECalc looked at the 122 possible 30 year periods in the available data, starting with a portfolio of $788,174 and spending your specified amounts each year thereafter.

Here is how your portfolio would have fared in each of the 122 cycles:

- The lowest and highest portfolio balance at the end of your retirement was $-2,339,890 to $7,662,214, with an average at the end of $2,002,135. (Note: this is looking at all the possible periods; values are in terms of the dollars as of the beginning of the retirement period for each cycle.)

- For our purposes, failure means the portfolio was depleted before the end of the 30 years. FIRECalc found that 22 cycles failed, for a success rate of 82.0%.

In plain English, FIRECalc is telling us that if Will retires at age 60 and they pay for both of their kids’ educations and the stock market performs according to an amalgamation of 122 different historical stock market scenarios (per the market’s performance since 1871), their likelihood of NOT running out of money in retirement is only 82%. That means they have an 18% chance of going broke before they die.

This is too risky for me personally. If it were me, I would not feel comfortable pursuing a path that only has an 82% chance of success. Everyone has to determine their own risk tolerance, but I cannot advise taking this path.

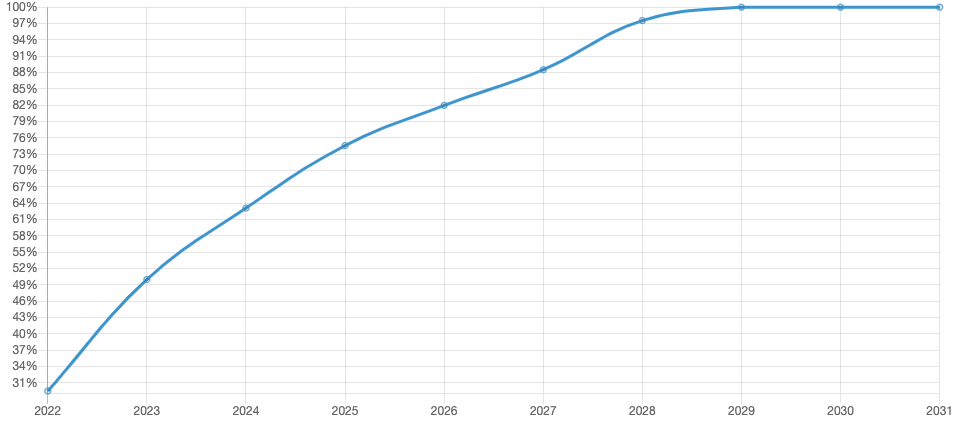

Retirement Scenario #2: Delaying Retirement Age

Ok, since scenario #1 fails 18% of the time, I’m going to change some of the variables I noted above to increase Will & Jenny’s likelihood of success.

Under the “Investigate” tab, I’m going to now click the box under “Investigate delaying retirement” and input 10 years:

What happens if you retire in any of several years between now and 10 years from now?

This is exactly what it sounds like: if Will were to delay his retirement date, how likely is it that they’d run out of money?

Here are our new variables:

- Will delays retirement

- They pay for both of their children’s college educations

- Their annual spending and savings rates do not change

What we’re seeing here: if Will were to work until the year 2029, they’d have a 100% chance of success! This is great news as it would enable them to pay for both of their kids to go to college and ensure they wouldn’t run out of money in retirement. The downside is that Will would have to work until age 63. But that doesn’t seem like too bad of a trade-off to me!

The assumptions here are:

- They do not change their spending

- College does indeed cost $125k per child

- They stop contributing to their HSA and instead invest that money in retirement

- The stock market continues to perform as it has in the past

- They continue with Will’s current 401k contributions (and his employer continues to contribute as well)

- Their Social Security estimate of $54k annually is correct

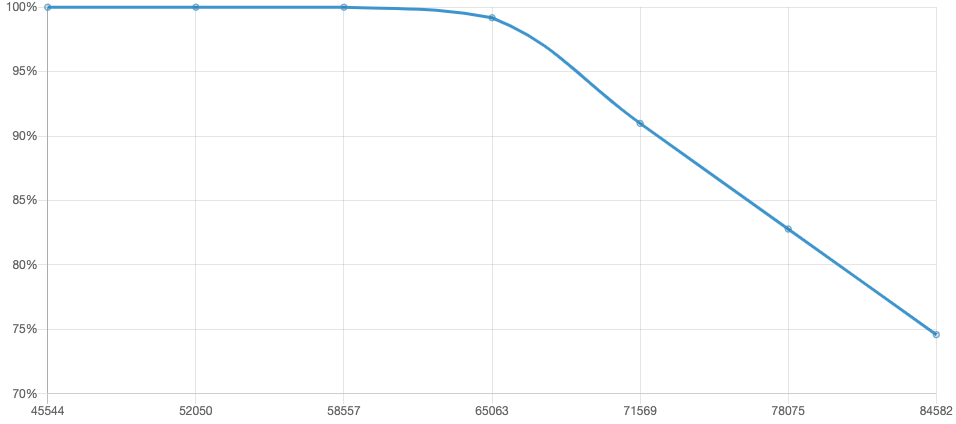

Retirement Scenario #3: Retiring at 60, Decreasing Annual Spending

Let’s run another scenario. If the #1 priority is for Will to retire at age 60, they’ll need to change other variables in order to achieve success.

The most obvious variable they can change:

- Their annual spending

Back to the “Investigate” tab and this time, I go to the “Given a success rate, determine spending level for a set portfolio, or portfolio for a set spending level” section and select “Spending Level”:

Search for settings that will get a success rate of as close to 99% as possible (usually within 1%) by changing…

Spending Level or Starting portfolio value

Results:

A spending level of $65,063 provided a success rate of 99.2% (122 total cycles, of which 1 failed). This spending level is 8.25% of your starting portfolio. (Your spending is assumed to come from any Social Security and pensions you entered, as well as from the portfolio.)

Here’s the graph:

Scenario #3 is also good news! If Jenny and Will are able to reduce their annual spending to $65,063, they’d have a 99.2% chance of not running out of money in retirement. At $58,557 per year, they’d have a 100% success rate.

Reducing their spending would enable them to reach their goals of:

- Will retiring at age 60

- Paying for their children’s college educations

- Not running out of money in retirement

Jenny’s Question #4: How do we save an emergency fund? I used to be so good with money, but lately I feel as though we’re drowning in expenses.

The standard emergency fund advice is to have three to six months worth of your expenses saved in an easily-accessible checking or savings account. At their current rate of spending, that’d be $19,785 ($6,595 x 3) to $39,570 ($6,595 x 6). However, I really encourage Jenny and Will to try and reduce their monthly spending. Then, they’ll be able to target saving a smaller emergency fund.

Other Notes

1) I question the HSA decision.

I know that some folks espouse the idea of hacking an HSA because of the tax advantages, which I get. But, it’s a complicated, potentially risky thing because it has to be used for qualified medical expenses:

- you have to be certain you’re going to spend this much in qualified medical expenses

- you have to save all of your medical expenses receipts for decades

- you have to hope that the laws governing HSAs don’t change

It’s not so much that this is a “bad” financial decision, it’s just kind of a quirky, secondary one that should take a back-seat to standard priorities, such as:

- Saving up an emergency fund

- Saving for retirement

- Saving for college

If a person has maxed out ALL other possible tax-advantaged accounts, has no debt, has an emergency fund, has a robust taxable investment account, a fully-funded retirement, etc, then the HSA hack is probably a fine thing to do. What concerns me in Jenny and Will’s case is how much money is sitting in this HSA while their other financial priorities suffer.

2) Look into getting a high-yield savings account.

For the awesome emergency fund Will and Jenny are going to save up, they should leverage their savings by choosing a high-yield account such as the American Express Personal Savings account, which–as of this writing–earns 1.15% in interest (affiliate link).

Summary:

Have a conversation about the family’s long-term financial priorities:

- Is spending on the Big Four the #1 priority?

- Is paying for the kids’ college the #1 priority?

- Is Will retiring at 60 the #1 priority?

- Based on the outcome of that conversation, adjust your spending and savings to align with these priorities, in their order of importance.

- Utilize the FIRECalc to model different scenarios.

- Re-assess the use of the HSA as an investment vehicle. Consider instead spending it on your existing medical expenses and funnel the money you would put in the HSA into an emergency fund.

- Encourage oldest kid to begin researching college options, scholarships and financial aid possibilities.

- Sign-up for Personal Capital or some other free expense tracking service (affiliate link).

- Take the free Uber Frugal Month Challenge to help identify your financial goals and areas for improvement.

- Save up an emergency fund calibrated on your monthly spending. Look into putting this into a high-yield account, such as the American Express Personal Savings account (affiliate link).

- Take a deep breath and be thankful to yourself for embarking on this difficult process. I know these are hard choices to make, but you should feel confident in your ability to forge a solid financial future. Very well done!

Ok Frugalwoods nation, what advice do you have for Jenny? We’ll both reply to comments, so please feel free to ask questions!

Would you like your own case study to appear here on Frugalwoods? Email me (mrs@frugalwoods.com) your brief story and we’ll talk.

I love reading these so thanks for providing them!

I just wanted to chime in on the college situation, we have 3 kids getting to that age and we have 25k for each kid. That’s all they are getting from us. However, as long as they are reasonable that should cover it for them.

They all have quite high ACT scores, they have taken it multiple times and have purchased some supplemental study books, so they should all get pretty good academic scholarships. The middle one has quite high and is looking at a full ride pretty much to any state school.

They are all taking or took concurrent high school credits. So they are earning college credits while in high school ( for free!). My oldest has almost 2 years of college credits just from high school.

The older two work. The youngest one isn’t old enough to get a real job. They have money saved, which I assume will be kind of their spending money at college, or whatever they may need.

We have community college options around here, where they could easily get their first two years if needed and we could pay out of pocket ( if no scholarships) and then save their $25k for their last two years of state school.

Again, that combination should get all 3 of our kids through school debt free.

One other thing related to college that a lot of people don’t know about are there are scholarships specifically for upperclassmen. I had multiple friends get scholarships only available to juniors and seniors that didn’t have much competition simply because most people don’t think about it. The university scholarship office can help you find and apply for those. I had one friend who was able to piece together enough to pay all his tuition his last two years.

In our experience (3 kids through college, all entered college with college credits) students are still considered freshman and are eligible for freshman scholarships, even though they are entering with college credit-IF the college credits were earned while in high school.

Yes, we definitely plan on having the kids utilize community college as much as possible to reduce costs!

I am on multiple Facebook groups for parents trying to pay for college and I just want to say you have to be very discerning about which schools to apply for because many schools no longer offer merit based scholarships and the competition is quite steep.

I see a lot of parents complaining that they’re high achieving did not recieve scholarshipe

That must be frustrating. Here you can go online and look up the merit-based scholarships based on ACT score, and they will give you the exact amount that your child will get. These are all public state schools.

Rachel, what state are you in? Gathering as much information about scholarships and public state schools as I can! thanks =)

We live in Kentucky, and all our regional state universities publicly release this chart of guaranteed academic scholarships based on ACT. Yes, the chart has gotten tougher (higher scores required) over the years.

Also, both Univ of Alabama in Tuscaloosa (Roll Tide) and Huntsville have guaranteed out-of-state tuition scholarships for high ACT scores.

Two of our kids went to Univ of AL, the other 3 went to KY state schools.

Yes, it was the kids’ part-time job to study for the ACT, and take it multiple times.

Yes, it would be great to set aside $125K for each kid’s college experience.

That wasn’t realistic for us.

Our kids got full tuition scholarships, and we gifted them about half of their room/board expenses.

Three kids lived at home for some of the time, which worked well, too.

My dh is 61yo and we’re looking forward to his retirement in the next year.

However, we waited until our youngest child was half-way thru his college path, so we knew he could graduate with our current financial arrangement.

I think Jenny does need to cut expenses, but they will know more as their kids get closer to college.

It’s definitely not “choose whatever college you want”!

Average state uni costs in our region (living on campus, in state tuition and fees) is $150k for the four years. 25 k wouldn’t cover a full year. The one school closest to home, if they live at home, is $60k for four years in todays dollars. We haven’t assessed Community college, but depending on region, $25 k is a very low estimate for college. Your area may be different but we are planning $180k per kid “all in” without scholarships (if they get them fantastic, but we plan for worst case)

Interesting case study!

If it were me, I’d drastically reduce the whole ”supplements” spend and really take solid medical advice on what is actually needed and what is in fact, um, not so much a requirement as clever marketing. I’d also look to reduce my food spend by about 20%, i.e. still have great quality food and enjoyment of same, but get a lot more frugal around what is and isn’t a luxury.

And then I’d get that retirement date pushed to 63. I know time is priceless of course, but 63 is still plenty young enough to reasonably expect a good long retirement while still in decent health / ability to enjoy that time. I also wouldn’t be so intent on actually underwriting my kids entire college education. After any scholarships and bursaries were sought, I’d look to pay maybe 50% of the rest., or however much would be enough to mean they’d be okay with a part-time gig to supplement their studies, but not have to work full time as well as study or drown in debt. Your own retirement and financial goals should absolutely be the priority here. It’s amazing to pay for a good education and I’m all in favour, but a decent contribution towards that and a healthy retirement for yourselves is nothing to be sneezed at either.

Thank you! All the supplements are actually recommended by/vetted by our doctor, but I’m seeing her soon and will go over the list again.

We may have to push off retirement. This deep-dive has given me a lot to think about and discuss with Will!

As a medic, there are very few supplements I recommend. You can check your calcium intake using an online calcium calculator. Vitamin D is sensible in Northern climates. That’s about it unless other specific medical conditions. Might be worth getting an independent medical professionals to review you list.

As a registered dietician and nutrition scientist (phD, involved in updating the national nutrition recommendations in one of the major EU countries), I absolutely second this. As in ABSOLUTELY!!!

One thing I think not addressed was how they would pay for health insurance in early retirement. I’m not sure which Lake Michigan state they’re in but if it’s mine, marketplace insurance can be quite expensive and not great coverage. She mentioned they have chronic conditions and high medical expenses so to me, keeping employer insurance seems worth working a few more years.

Thank you, that’s definitely something to consider.

If your (early) retirement income (AGI) is low, you qualify for ACA subsidies. Subsidies were temporarily expanded during the COVID relief bill . . . and I’m optimistic they will extend those subsidies.

Adding this = The “Inflation Reduction Act” (which was passed over the weekend by Congress) officially extends these ACA subsidies.

Awesome post, and a huge thank you to Jenny for sharing your story — stay strong, dig in, you got this!

Thank you!

Could you share some of the vitamins/supplements and purposes? There may be lower cost options for the same supplements, and readers may have either data to support their use or to disprove their use. There is vast medical research of vitamins and supplements and using this could help ensure you are confident in where your money goes for this category.

For miscellaneous household, could you share the items? Are there trends where biting a multi pack or bulk in advance would save money, like with batteries or lightbulbs?

You mentioned what seemed like an extremely high amount for cleaning supplies, etc. Healthy, non-toxic cleaning supplies can be made a home for pennies with white vinegar and dish detergent. Recipes abound on the internet. I use them as I like the cost savings and health benefits. I am also curious why your supplement usage is so high when you seem to be eating a very healthy diet and should be getting your dietary needs covered with that. This is not criticism by any means! I am in my 70’s and spend a large amount of my income on supplements as I have health conditions that require dietary restrictions that keep me from getting the vitamins and minerals I need through my diet. Your family appears to be eating a healthy diet and you did not mention any health needs so that is why I am mentioning it.

Miscellaneous household includes things like a replacement printer and dehumidifier, both of which we needed in the few months that I kept track of spending. Maybe that’s why the total was so high? Basically it includes anything needed to keep the household running, except for major repairs.

Shouldn’t the recommended retirement amounts by age (annual salary x age) be based on gross salary – not net? It looks like Will an Jenny are putting a substantial amount into 401K, HSA, Medical and or course taxes prior to receiving their net income. If the recommended 401K savings is based on gross, not net, they would need substantially more to retire.

Correct–check out the calculations I did in the FIRECalc for how these amounts are accounted for. Specifically this section: 3) Next, I went to the “Not Retired” tab and input:…

Good Morning! I’m a university instructor and the parent of a 20-year-old college student. Can I just add that often parents are overly optimistic about what ACT credits can actually do. How these credits count varies from school to school. Universities will allow them as course equivalents for some classes, but not for others. Often students bring in those ACT credits, but they only count toward general education requirements and not toward anything required for their major or degree program. While they can be useful, I honestly think ACT “oversells” their value. And for us, the cost of housing our student on campus is almost as high as tuition, especially with private landlords, or with universities selling students on their fancy meal plans, climbing walls, and other amenities.

We’ve done a balancing act of 529 savings and cash flowing housing, but honestly, those months when we’re paying for housing are pretty lean, even with contributions from our daughter’s part-time and summer jobs And I’ve seen first-hand the burden of student debt on both students and their parents. It’s not pretty.

If grandparents or other family members can buy I Bonds or something like that for birthday gifts, I heartily recommend that.

Yes, we definitely plan on having the kids live at home while taking college classes!

Keep in mind that living at home for college may not work for them. One or both may have better academic opportunities at a university further away. They may also end up feeling like they need to do the very normal and reasonable step of living elsewhere for awhile to help them forge and solidify their identity as individuals. This is often especially important to keep as an option in families that are very close.

I lived at home for 3 years of my 6 years that it took for me to get my engineering degree. I don’t recommend it to anyone if they are going to a university that most of the kids live on campus or near campus, not an issue in the first year or 2 at a community college. I failed out of school, had constant fights with my parents (which never happened in high school), nothing but issues. When I went away to college I became a 4.0 student and loved life again.

I always recommend folks live at home during undergrad if it’s a workable situation for both student and family, so I think it’s smart for your family to consider it. I lived at home for all four years of college, and while it meant not having as easy access to certain on-campus activities (I walked/rode bus as I couldn’t afford a car and insurance), I was certainly still able to make a tight knit group of friends, many of whom I am still close with ten years later. Living at home meant my family covered my room and board, so I only needed grants, scholarships, and a part time job to cover tuition and fees.

While I understand what people are saying regarding the need to leave home and forge their own identities, I don’t think nurturing that independence and identity can’t happen while also living at home, particularly if you’re all intentional about what that looks like. Communication was so important for us as we navigated what adulthood looked like and meant for me in the context of our relationships and responsibilities. Graduating debt free meant I had the freedom to accept the jobs I wanted post-undergrad without the weight of student debt. I’ve worked in four different countries since completing my undergrad and don’t think a few extra years living at home were in any way a detriment to my maturity, independence, or relationship with my family.

This is the same for AP courses. I had 2 classes waived (10+ years ago) but that did not reduce my time at university/I was able to take other classes for a minor (so same cost).

Nancy do you mean AP credits? ACT is a test for college admission, AP classes potentially give credits. (Like you said, the AP credits are not always as helpful as you think.)

Agreed. AP credits are often better for practicing taking college level courses but they’re not a guarantee that you’re going to get all the college credit. Dual enrollment in community college during high School is often a better investment but even still you may not transfer all the credits

Community college professor here.Your community college should be able to tell you which4-year schools accept their credits. Our college has transfer agreements worked out with all state public schools and many local private colleges as well. The credits don’t always transfer to out-of-state or highly competitive private schools.

Seconding this. The AP exam system is overrated and is a great money maker for the company that runs it but is not great for students. In my opinion, and in our experience, community college classes have a much higher chance of counting for college credit, and the college classes often require less work (AP courses can be an insane and unnecessary amount of work-it all depends on the whims of the teacher, which is never a good position to put oneself in). It’s best to check which community college classes are likely to transfer (often the general ed ones do).

Can you clarify “ACT credits”? I teach high school and I’ve never heard of getting college credits from the ACT exam. Do you mean AP (Advanced Placement) credits? Or something else?

[Sorry if this double-posts.]

My older daughter used CLEP and AP and college-specific tests to get credit for courses, mostly core courses. She left her frosh orientation as a rising sophomore! Three years and done! With scholarships and work-study in the mix as well, she didn’t use all we’d set aside. So the extra boosts her launch funds.

Does your 16 year old have a job? If so, is he saving for college as well? Will you be giving your kids spending money in college or are they expected to pay for that from their savings? Be upfront with your kids about what you can afford to pay for college, and what part they need to pay for. Do you give your kids an allowance? Since you homeschool your kids I would think it would be hard to cut back on their activities, they need that interaction. I had always made it clear with my kids that my goal was to pay for college, except they had to pay for 10,000 of it, which they took out in financial loans. They were also responsible for their spending money. I would also analyze the food bill as well, seems really high.

I think you may want to look into the advantages of an HSA a bit more rather than saying they should stop contributing entirely. For now while they are under 65, yes they can only use the account for medical expenses. However, they can pull money out at any time to reimburse (if they’ve saved their medical receipts) and need to have cash. Also, once they turn 65 they can withdraw from the account for non-medical expenses without penalty. So I wouldn’t say stop contributing entirely, because they are likely treating it as an investment vehicle for the time being and will use it after age 65 for whatever they want.

Sorry, I misspoke at the end. They can withdraw for whatever medical expenses they may have in retirement without penalty. I think this is smart for them since they have chronic health needs.

True! My concern with the HSA is that it’s a more limited account than, say, a regular retirement vehicle or a taxable investment account. There’s nothing “wrong” with using an HSA, I just personally think it’s a more nuanced use case and shouldn’t take precedence above saving an emergency fund (in Will and Jenny’s case).

Once you hit age 65 (I think) you can take money out of your HSA for any reason and only pay the taxes, not the penalty.

Meg and Leeann are correct. At 65 it’s functionally an IRA. It makes sense to consider this their emergency fund. Its easy enough to scan invoices and save them, and then use these to draw upon the money as needed. Our HSA has an investment side and a savings account side if there’s concern over the need to withdraw from an invested .

Would it make sense to just reimburse yourself for a years worth of medical expenses from the HSA now, to have some cash? At 850×12 that’s a good cushion. I understand wanting to leave it for the future but I’d be anxious to not have *some* cash around.

Second this! I think that’s a great idea.

Yes, we are absolutely using the HSA as an investment vehicle. I was always under the impression that HSAs are amazing tools to use for retirement.

If we had to we could pull a lot of money from it right now (since we’ve saved up years of receipts for medical expenses), but I was letting the fund grow instead.

Their primary use is for medical bills. You have lots of other accounts for investing, you should seriously consider being reimbursed for the $850 in medical expenses every month through there.

While I agree with Mrs. FW’s judgement on their HSA – that given their other expenses, they should probably be using this account for medical costs rather than as a retirement vehicle – I’m surprised by the argument that “you have to be certain you’re going to spend this much in qualified medical expenses” during your retirement. According to the Fidelity Retiree Health Care Cost Estimate, an average retired couple age 65 in 2022 may need approximately $315,000 saved (after tax) to cover health care expenses in retirement. Given the way things are going, that will probably only go up over time! HSA funds can be used to cover assisted living, physical therapy, and a whole bunch of other medical expenses that older adults are likely to face. It seems pretty likely that they’ll spend at least as much as they have saved in that account.

True! My concern with the HSA is that it’s a more limited account than, say, a regular retirement vehicle or a taxable investment account. There’s nothing “wrong” with using an HSA, I just personally think it’s a more nuanced use case and shouldn’t take precedence above saving an emergency fund (in Will and Jenny’s case).

I’m not sure about using HSA funds to cover assisted living expenses. My impression/understanding is that you cannot do that, and those expenses are extremely high.

This analysis probably covers probably 3/4’s of working Americans. This is the perfect storm of the modern age: Kids college/Retirement cash flow/Medical expenses. Medicare kicks in at 65YO… 60 is to early… try 62 or even safer 65YO. Are the supplements for longevity program , or existing medical conditions ?

Maybe you could BOTH work PT 20 hours at a “fun” easier job. Its hard to beat remote work tho….great analysis! I don’t see how your kids at that young age and your advanced age you guys will be able to retire while they go to college. College has other expenses, also out of state schools, study abroad, food, clothes, train tickets..etc.. Our twin girls attend out of state ( at the same time!) and are sophomores. The decision was based on their majors. Its about ~36 k a year. But we and both sets of grandparents were able to bank 100k each from 1-18yo… so with a little luck they will get their BA and have no debt.. or a little overage. We told them your fam has teh BA- but any future degrees will be on you guys while working!

Given the high demand for labor, I would recommend that Jenny find a job, at least part-time. A job with benefits may also enable her to contribute to her own retirement account as well as social security.

RE college, good grades and SAT or ACT scores help, but they are not a magic bullet that will garner a full ride, for the most part. My kids both had perfect 1600 SAT scores and very high GPAs and yes, they got scholarships, but we still paid over $35K per year each for their undergraduate degrees. (It was a priority for us to get them through debt-free.)

Rosalie, we have similar experiences. Our girls were in a top 5 school public strath haven hs, all honors all great SAT’s , they to got scholarships and a boost for twins in school at same time.. and its still 36k for out of state! If you don’t save at 1YO and have the entire fam pitching in… well kids today will all graduate with crushing debt.

Well, it says that she homeschools her two kids, which I did for my two boys up until last year and that is a job. A very time consuming one. I doubt she has the time for a part-time job outside of that.

Regarding the heavy allocation of funds into the HSA – both COBRA and Medicare coverage are currently qualified expenses under current HSA law. While I wouldn’t add more money to that pot right now, you’ll definitely be able to use it up when you turn 65.

For the supplements, I would have your doc or a functional medicine specialist look over the list and see if there are better options that might offer broader coverage. I also have a chronic condition and need lots of supplements and my nurse was able to recommend a random multivitamin (for hair of all things!) that covered a lot of the supplements I had been taking. I spend almost a hundred a month on supplements and I thought I was the spendiest supplement person ever 🙂 I bet you can whittle yours down a bit.

Any chance you’d be willing to work part time to help cash flow when your kids are going to college? That is our plan, if it turns out that our savings aren’t quite enough. Work 16-24 hours a week is absolutely better than the 50 we each work now. And plenty of people enjoy getting out of the house for a few hours a week and interacting with other people. Good luck! You really have lots of options.

Thanks! I’m seeing my doctor soon and will go over our list of supplements. 🙂

I’ve considered a part-time job, but I honestly don’t think I could handle it physically. We’ll see how things are once the kids are a bit older, though.

Sara, what is the multi you are taking for hair?

I have a question–when you calculated how much money they should have saved for retirement, I noticed you just used Will’s age and income to calculate it. When it is a couple is it better to calculate for both of them? I know this is a little different because only Will is working but I was curious about this. Obviously only he is working but they are BOTH going to have to live off of the retirement so just wondering about how to account for that?

Good question! Since Will is the only person in the household with an income, I used his salary. Since they are living off of his salary alone, that will also be their retirement model, which is why it is calibrated based on his age.

thanks for the response and clarification!

I use the “Dirty Dozen” and “Clean 15” lists to determine which vegetables I feel comfortable buying that are raised conventionally (Clean 15) and which to buy organic (Dirty Dozen). This list changes annually. For example: onions were on the dirty frozen list several years ago but now are on the Clean 15 list. This helps with my grocery budget.

Another comment–Jenny, thanks for sharing your story. You all are doing a GREAT job! Here are a few of my ideas:

-Maybe you could get a part time job at a university and get tuition discounts for your kids that way

-Encourage your kids to go into trades–electrician, plumber, nurse. Those are usually more affordable and faster programs and pay well. Take it from me, going back to school to be a nurse after having my first undergraduate degree paid for by my parents. I feel like I wasn’t as invested in what I studied because it was paid for. If it had been me paying, I think I would have been a lot more conscientious about what I chose to study.

-Encourage your older kid to get a part time job. That could help them contribute and also learn the value of their education

-Work part time at a supplement store 😉 get some discounts!

Just some ideas. You seem to have a lovely happy life and your family obviously adds tons of value, which ultimately is worth solid gold. Happy for you!

Thank you! I appreciate your input and kind thoughts!

Great idea about working for a university, Quincy. I’m sure it varies from school to school, but I work full-time at a state university and my son gets four free classes a year. My stepkids graduated from the same university, and at that time my husband was also working full-time at the same school so those free classes helped tremendously! Cheers for “debt-free degrees!”

Our state (Ky.) also has the KEES scholarship, which is funded by the Ky. Lottery. It’s based on a student’s grades in high school, ACT score, etc. Not sure if there is a similar “thing” in other states, but I would have your kids apply for every possible scholarship. You never know- they could be the only one who applies! Even the little ones add up…

Kudos for the savings you have so far! Something else that wasn’t brought up – could your husband go down to part time work? Possibly best of both worlds, allowing you to cash flow college and getting more time back.

Yes, we’ve considered that. I think it’s possible that he could be part-time before completely retiring.

Establishing an emergency fund is critical I think for a single income.I would look at decreasing the amount spent on supplements unless it is something that research has shown is actually helpful for one of your specific health problems and is recommended by a doctor or registered dietician. Consider buying a side of beef from a local farmer who pastures their cattle. Same with eggs and chickens. Grow produce next year. Unless you want to only buy organic (and cut elsewhere) consider only buying the dirty dozen. Speak to your oldest about their ideas for post secondary. It might be unobtainable to pay for 4 years at a private university and a discussion about how much you can give a year might be in order if you have told them you are paying for it all.

Agree that the EF is critical!

We’re not thinking four years at a private university! We’re thinking community college, living at home, possibly going part-time at least at first. But a close look at numbers and a discussion with our oldest is a good idea. Thanks!

One thing that is missing from the analysis is are there more comprehensive healthcare plans available if you forego access to the HSA? With such high healthcare deductibles and copays, it is definitely worth looking into.

Are the supplements from a functional or holistic doctor? Unless there are a huge number for each member of the family, it is hard to see how it can be quite so high. Can you reassess if all of the supplements are necessary and if there are more economical ways of getting them without sacrificing quality? Iherb has options to order high quality, reasonably priced supplements, for example. In some cases there may also be easy food substitutes (such as Brazil nuts for selenium or dried seaweed for iodine).

The supplements are all recommended by or vetted by our health care practitioner, and each member of the family takes at least some of them. I’m seeing our doctor soon and will go over everything again, though!

I scour the internet to find the lowest prices and mostly buy from FullScript, which has the cheapest prices on the highest quality supplements.

And yes to Brazil nuts! We do try to optimize food nutrients but due to various health and genetic issues food doesn’t always cover it.

I teach and advise community college students in another state. I concur with Nancy that students should be strategic with college credits earned while in high school.

Many college degree programs prescribe almost all of the classes, including general education classes, that students are required to take. Students can maximize college credits taken in high school if they know what they will study in college. Otherwise, as Nancy wrote above, it is a guessing game as to whether or not the credits will “count” in a meaningful way.

For example, I advised a student who entered my community college with 54 college credits earned while in high school. This student is studying engineering. Engineering pathways are prescribed and require sequential classes. This student completed college algebra and trigonometry while in high school and obtained college credit. And for many majors these courses will meet general education requirements. In engineering, these classed are “pre-requisite” courses to the required entry level mathematics calculus course.

Some very strategic students dedicate their time and energy to researching and applying for scholarships. The most successful put together multiple small, locally-offered, scholarships. Typically there are not as many competing applicants.

But in your example, the student still “saved” money because they didn’t have to pay for those pre requisite courses in college because they already had them.

In many states they have a prescribed undergraduate “core” and the list of general education ed type courses are the same across the board for all state public institutions. So no matter what you are going to major in, everyone has to have a Comp 1, Comp 2, Oral Communications, Art Appreciation, Health and Wellness (etc.etc.etc.). That way you know they will count.

I’m a dinosaur (between Jenny and her husband’s age), but I took one AP test in HS. English. I became an engineer. It actually worked in my favor, because I got two classes worth of college credit for the English AP.

What I’ve seen is that taking AP classes in your eventual major is good at preparing you for college – but in many cases, you should probably still take the college course. Taking AP classes in your NON-major is where you can get credit that you might not have to repeat. YMMV.

My 16 yo is taking AP classes and dual enrollment at our CC, and I doubt it will have any effect on college. We’ll still probably end up paying for everything. I don’t have a clue where he’ll go or what he’ll major in. I know that even though I got college credit for that AP test, my private university still required the same number of graduating credits, so instead of English I ended up taking extra history, plus swimming and a PE class.

Since they homeschool, have they looked into non traditional options fit high school? CLEP is one option as is dual enrollment at a community College which could allow their kids to transfer to a four year university as a sophomore or junior. As someone else pointed out, not all colleges take those credits but there are a lot that do

Yes, I’ve been looking into having our older child take a few CC classes now, but I’m not sure he’s interested in doing that just yet.

We homeschooled one and had great experience with CC classes. I then “required” my other kids, who were in public school, to take at least one CC class while in high school. I thought the experience was invaluable. Even my REALLY reluctant one was glad in the end. And yes, I gave all the support needed to the reluctant one, no good would have come from it if it was a bad experience. This kid is just reluctant to try new things. The confidence this one gained from having completed a college class BEFORE they went to college was priceless.

Same here. Dual Enrollment (some online) worked great for us.

Our kids started the summer of their Junior Year . . . so we homeschooled with that goal of being ready for specific gen ed classes at that time.

Our dd did all the pre-requisites for her 2 year RN program in high school, so she was ready to start nursing school in the Fall after graduation.

A motivated teen can really accomplish a lot.

CLEPs were not readily accepted at our CC, sadly.

What are ACT credits?

I think she meant AP credits

Just our own experience with a child 18 and child 16: If you want to help your kids with college, cut everything right now that you possibly can and throw it ALL into college savings after you boost your emergency fund so you aren’t living paycheck to paycheck.

We personally are not contributing anymore to the 529 for the oldest as he needs the $ in next two years and we’ve seen half a year’s tuition evaporate this year due to stock market pain. For that child we’re putting it into a plain old bank account.)

Here’s what we found: State schools have a ton of smart, high-scoring applicants. They don’t need our kids. Our child took the ACT multiple times and got fantastic scores and had above a 4.0 average. He did community college dual enrollment and knocked out credits that way. He had a few classes and knocked out more credits that way. At the state schools he applied to the end result would still have been $30,000-$30,000 a year. Student loans won’t cover that. He wound up applying to a small private school that offer a lot more merit aid. (Consider smaller schools, because sometimes that’s a great option. There’s such a thing as “buyer” and “seller” schools… Google it… Schools basically that need your kids and are willing to pay for good grades and schools that don’t need your kids and aren’t.)

I’m not trying to scare you but we saw a financial advisor who said: your retirement is in decent shape. The big red flags are you want to help pay for your kids college and you don’t have near enough set aside for that.

We never intended to pay for all of it. We hoped to help with about half and we are doing everything, including side jobs, in order to make that possible. I would really encourage you to cut expenses now and shovel that money into college accounts IF helping with that is a priority for you. One of us was a stay at home parent for many years and took a job specifically for this reason.

Sorry for typos: he did AP classes to knock out credits. College costs we saw ran $20K to $30K for public schools.

Thank you!

I don’t know them, but I like Jenny and Will! I have a decent amount in common with then, including age and chronic health condition. However, we got our kids through college by our early 50’s, so we had a little more breathing room for retirement planning.

I’m sure Jenny and Will are looking at any and every way to save on college expenses. I strongly encourage their kids to take a gap year and work, both to save money and to see if it helps them determine a career path. Changing majors is a huge added expense. I also encourage the kids to work part time through school. Our kids each had a prepaid tuition program helping them, but they also got scholarships, took AP courses in high school, went to community college first then transferred to university, and worked the entire time they were in school – both graduated with no debt, and while we helped them with a used vehicle and a portion of their rent, that was all we had to do. We kept contributing to our retirement the entire time.

I have to go along with Mrs. FW on their spending. I also eat almost strictly organic, and buy my grass-fed meat and dairy from local organic farmers, but even multiplying my individual grocery bill by four to match the number of people in their family (and figuring in additional food for growing kids) I don’t pay near that much for groceries. There has to be a way to reduce that bill without sacrificing clean food. Because of my health issue, I can’t eat the usual lower-cost foods such as beans, eggs, rice and other grains and pasta, but I still pay much less per person for my groceries than their family does. Food is one of my splurges and it’s important to me, as it is to Jenny and Will, but I’d have to say I think there is a lot of room to reduce this bill along with their miscellaneous spending and supplements bills.

I take a couple of doctor-ordered supplements myself, so I understand that. Still, I know supplements have a habit of “expanding.” You takes this for heart health, so then it seems to make sense to take this for digestive health, then bone health, then eye health, and… before you know it, you’re taking 50 capsules a day. You can guess how I know about this. I finally had to pull myself up short and take a hard look at what I needed vs. what I was taking.

I know retirement looks so good right now, but I think Will needs to hang on another year or four. Once they get their spending settled and catch up some on the savings, then I would say retire and enjoy it!

I appreciate the honesty of Jenny and Will and their openness and willingness to put it out there for us to see. I think they have good goals, they just need prioritization. I think seeing where their money is actually going is probably going to be super helpful for them, and I feel confident they have what it takes to make this work.

Thank you for your kind comment! I’m actually making a list of all the supplements we take right now and figuring out exactly what they cost us per day/month. I think it’s a lot lower than I put in the case study; I had been going on spending for a few months but I believe I was stocking up on many supplements and that skewed the numbers a bit.

My two kids eat a LOT, and we also eat mostly grain-free, but you’re right in that I may be able to buckle down and get the grocery spending under control!

This is a case that many can relate to. I wonder what her doctor is relying on to advise this level of supplements. I would ask that question and do your own research. There is very little evidence that supplements improve health status. And the manufacture of health supplements is not well regulated. Being careful with our food intake should include being sure any supplements are required based on a deficit or specific medical condition. Then the goal is finding a low cost, safe source. I also would be sure that my doctor was not the source of the supplements or related to the distribution chain. Supplement sales of $30 billion a year are a market promoted to physicians despite little evidence of efficacy and actual evidence of harm.

Other questions I wondered were do they garden, can the kids get jobs. If cooking from scratch I am hard pressed to understand their food budget. It is a good place to drill down into unit costs.

Good luck

Also, medical doctors tend not to be experts in nuitrition, it’s a separate field of expertise.

We are a homeschooling family of 6 with one heading to college next month and one heading to college next year. Our kids have dual enrolled at the local community college for years. This helps lower the cost and time they will be at university. Also in our state they have been awarded full tuition scholarships for high grades. Please look into your state’s options. There are so many options out there and homeschoolers have many advantages since they have flexibility. You can also CLEP test for credits as well. All this planning saves thousands plus helps them try out some majors without any pressure!

As a person with chronic illness who is currently functional only to the degree that I take the right supplements, let me say that boy are they expensive, and yet the consequences of not taking them are even more so. And, formulations matter hugely. The more expensive version can mean the difference between keeping it down, and not.

It’s complex, and tweaking the regimen can be both miserable and time-consuming. However, cycling off and back on particular supplements is really essential for me, to get data on efficacy and side effects. When I go off things and symptoms deteriorate, then I have the peace of mind that I’m getting my money’s worth.

I also understand how important the kids’ activity fund is when you homeschool. People who public school think of it as unnecessary, but it is not.

Thank you! Yes, I definitely notice a difference when I’m off some of my supplements. I also am very picky about the quality and reputation of the products I use. That said, I’m looking at each one with fresh eyes to make sure I think they’re really necessary.

And I realize that Mrs. FW was just doing her job when she suggested cutting some of the kids’ activities, but we’re not willing to do that. My kids thrive on those lessons and classes!

While I can appreciate not wanting our kids to incure debts for school, I believe in having them participate in paying the costs. It teaches them not to take for granted that everything in life will be easy and handed out to them. They could work part time once in University, apply for grants, ask family members for cash for school instead of gifts on Christmas, etc. Handling every monetary need for our kids makes them dependent and – sometimes – entitled and ungrateful later in life. Just my two cents! 🙂

I completely agree! I want them to get through with no debt, but that doesn’t mean we’ll hand over cash without discussion and involvement on their part.

Supplements are also near and dear to my heart. I know that beneficial supplements aren’t cheap and that they can improve the quality of life. I get some of mine through Vitamin Shoppe and I am able to save 10% on each order by using the subscription service. When I looked to see how much my discount was, I realized that my favorite (expensive) vitamins are on sale BOGO 50% off. They also regularly post coupon codes and they have an active one now, you just have to check the website. So this next subscription cycle I will be opting out of my auto delivery of that particular supplement for the multi vitamin and purchasing 2 jars with the coupons which will save me roughly $50 for the next 4 months as opposed to buying each jar separate at regular price. I also regularly get valerian extract, which helps me with sleep, anxiety, and pain management from a wonderful online company called Mountain Rose Herbs and they offer deep discounts for buying in bulk. I hope this helps with the supplement category.

If you have found something better, PLEASE let me know as I realized from using the FIREcalc (Thanks Mrs. FW), that I need to reallocate $68 per month to investments to make my scenario 100% secure, which is all that me and my anxious self find acceptable…lol.

Thanks for commenting! I love Mountain Rose Herbs! I’ll check out Vitamin Shoppe, but I do shop around and the cheapest I’ve found our supplements is through Fullscript. I think you need to go through a health care practitioner’s “portal,” but I believe several health bloggers offer links to theirs for free. You might find that $68 savings there!

I totally support eating grass fed beef and wondering if buying direct from a farmer in bulk would help. Purchasing half a cow has been a cost effective method for my family…but a deep freezer is required. Good luck!

Look into CLEP tests for the kids- some colleges offer a lot of credits for completing them.

I’ve heard about CLEP over the years but it seems like now is the time to really look into it! Thanks!