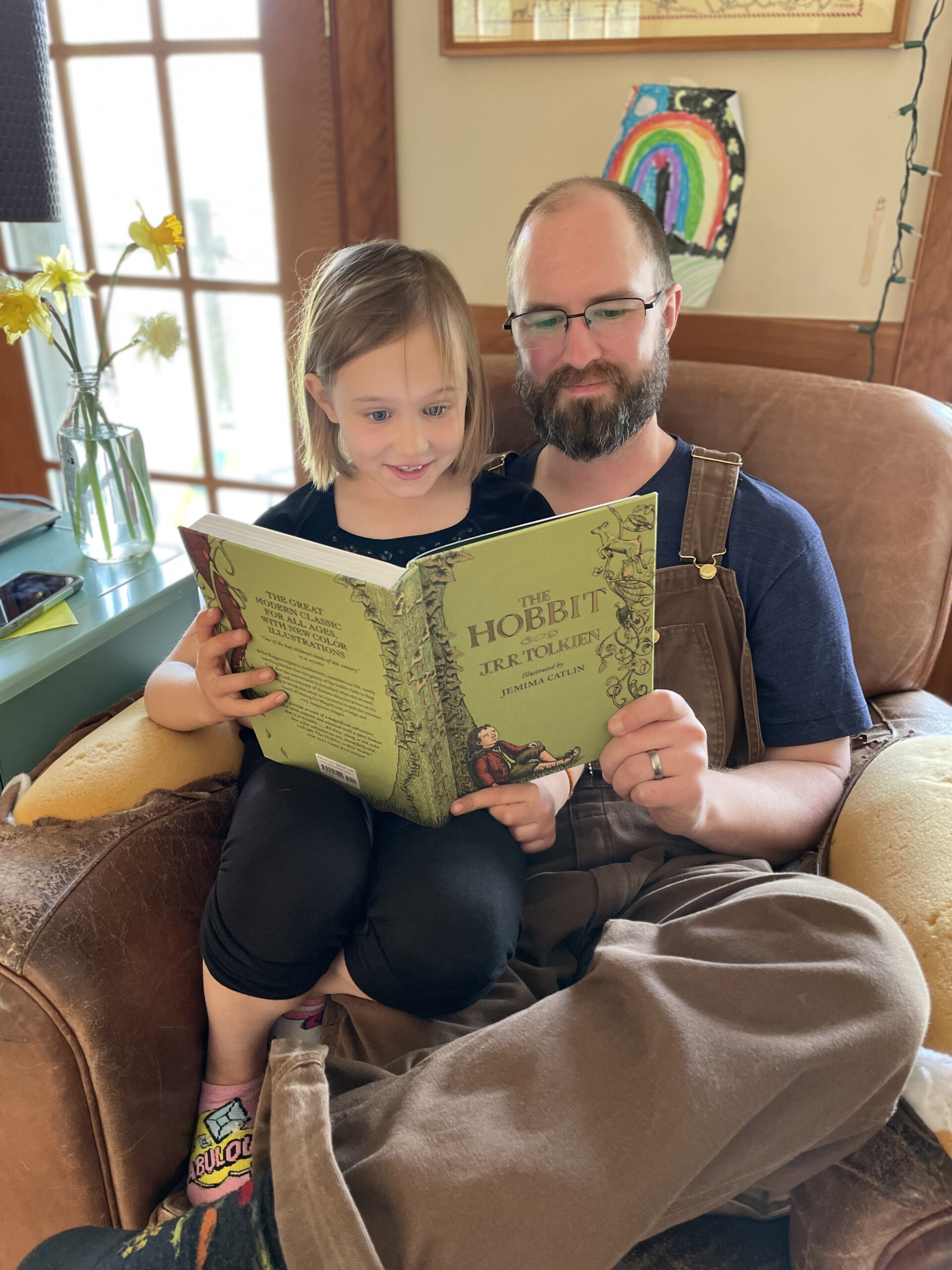

Yes indeed, we’ve welcomed a hobbit into our home. Mr. FW is a well-known lover of The Lord of The Rings books and the main reason he wanted to have children was to one day read the series with them. He’s been working Kidwoods up to The Hobbit by having her first read the Fern Hollow books (by John Patience), next the Redwall series (by Brian Jacques) and finally, last month, she began reading The Hobbit to him.

To facilitate this love of literature, we purchased a gorgeous, illustrated, hard-cover copy of The Hobbit (affiliate link). Normally, we buy zero new books–they all come from the library or a yard sale, but this was a special one Mr. FW wanted to gift to Kidwoods.

This is now their daily afternoon habit–she sits in his lap and reads him books. It started out as an assignment from her fabulous 1st grade teacher at the beginning of this year and, wouldn’t you know it, her reading has advanced quickly and dramatically. Having her read aloud to him enables us to track her progress and ensure she’s nailing the pronunciations as well as internalizing the context and story line. She now delights in giving me the rundown on what the characters are up to each day!

I initially thought The Hobbit might be too scary for a seven-year-old, but she LOVES it and it provides a lot of opportunities to discuss when characters aren’t nice to each other. She can recognize bad behavior when it crops up in the story and is able to articulate why it’s bad. All in all, an adorable routine is cemented in our home. The only downside is that Littlewoods is FURIOUS she can’t read yet.

Yard Sale & Thrift Store Scores

The other notable line items this month are my yard sale and thrift store scores since it’s yard sale season here in Vermont! My yard sale buddy, RW, and I’ve been hitting it hard early on Saturday mornings and have made some excellent hauls.

As longtime readers are well aware, I utilize yard sales and thrift stores to procure the following:

- Birthday and Christmas gifts for our kids! No reason to buy new when there are so many amazing second-hand toys/games/books/puzzles available.

-

The marble run: a fantastic hand-me-down! Birthday gifts for other kids! Anytime I find a new, unopened, tags-on, in-package toy/book/puzzle/craft kit, I scoop it up for one of the many kid birthday parties we attend.

- Household decor and furniture! I buy all of my seasonal decor, everyday decor, lamps, tables, picture frames and more from yard sales. Very occasionally I need to buy new, but I’m able to find just about everything I need/want from the cheap used market.

- Clothing and shoes for me and the kids! I get nearly all of our clothes second-hand, with the exception of things like: underwear, socks, swimsuits, running shoes and any other specialty items we need, such as ski goggles or ski socks (if I can’t find them used). I very rarely find anything used for Mr. FW–occasionally I’ll find a good insulated work shirt, but most men’s clothes seem to be torn to shreds so we usually have to buy his stuff new.

Why Buy Used?

I mean, honestly, why not? I’ve written tomes on this in the past, and for my longwinded thoughts, check out:

- How I’ve Saved Thousands of Dollars on Clothes for My Kids

- How to Thrift Like a Rockstar: Plan Ahead, Buy Ahead and Focus on Depreciation

- How To Find Anything and Everything Used: A Compendium Of Frugal Treasure Hunting

- The Myth Of The Gross Used Things

More Than Money Saved: Other Benefits Of Buying Used

Beyond the astronomical amounts of money I save by accepting hand-me-downs and thrifting it up, I’ve discovered a slew of non-monetary benefits of the used market:

1. Buying used = fewer decisions, which makes us humans happier.

- More choices actually decrease our happiness and too many choices can push us into a paralysis by analysis spiral of doom:

Infinite choice is paralyzing… and exhausting to the human psyche. It leads us to set unreasonably high expectations, question our choices before we even make them and blame our failures entirely on ourselves… Too much choice undermines happiness (source: NPR).

2. Used stuff is more environmentally friendly.

- Used stuff avoids the embodied environmental costs of new: packaging, shipping, manufacturing, etc.

- Plus, it keeps stuff out of the landfill!

3. Buying used allows for the experience of kismet.

- Oh yes, there’s kismet in finding great used deals. I love my garage sale scores and I delight in the sheer kismet of finding, for example, a $1 baby doll stroller that my girls ADORE.

- They adore it so much, in fact, that I was thrilled to find another ($2) used baby doll stroller so that they can each push a stroller around the house at the same time.

4. Buying used reduces the endowment effect.

-

My nearly 100% second-hand home (there’s that high chair!!) Since so much of our stuff was purchased used at a deep discount, I’m not super attached to any of it. This allows me the freedom to let it go so that it doesn’t clutter up my life. This is also why I’m in favor of the Plan Ahead, Buy Ahead approach.

- Since I paid nothing, or very little, for our stuff, I don’t feel compelled to hoard it or sell it in an effort to squeeze out a return on my investment (which is unlikely to happen, based on depreciation).

- It relieves me from being held hostage by the endowment effect, which occurs when, “…an individual places a higher value on an object that they already own than the value they would place on that same object if they did not own it” (source).

5. Buying used is fun! So fun.

- Similar to kismet, I find second-hand shopping fun. It’s not stressful because if a yard sale doesn’t have anything I need? I just move on. Conversely, if I do happen to find a great deal, it’s cause for frugal celebration!

- Another reason I find garage sale shopping so delightful is that I have a BGSGP (best garage sale gal pal). With our forces combined, we are garage sale mavens. We plan which Saturdays we want to garage sale, we get up early those mornings, leave our husbands and kids at home, and quest forth for finds. Garage saleing–like most things–is better with friends.

- Plus we now have some hilarious stories, like the time a guy tried to convince us VERY EARNESTLY that his old, small cooler was worth $40…

6. Buying used and handing stuff down creates community.

- When I shop at a garage sale, I’m giving money to my neighbors, which I love. Their stuff gets a new life, I get a great deal, they make a few bucks, and everyone is happy.

- My cycle of receiving and giving hand-me-downs further enhances a community mentality of sharing, lending, borrowing and just generally taking care of each other.

- I was over at a friend’s house last week and saw our old high-chair (which was handed down to us) in her kitchen. I hadn’t passed it along to her, so I asked her to relay the chain of events:

- A few years ago, I gave the high chair to friend A, who handed it down to friend B, who handed it down to friend C (who is currently using it). That made me SO SO SO HAPPY!!! It’s a fantastic high chair that’s now been through ~7 kids and is still going strong!!!!!!

7. Buying used takes less time than buying new.

- It takes drastically less time than shopping new. There’s a misconception that it’s more time consuming, but that’s a fallacy if you do it the right way.

- My BGSGP and I don’t go to garage sales every weekend–that would be far too time consuming! Garage sale season in Vermont is confined to the summer months, so she and I scout out the most likely goldmine sales in advance and do strategic strikes. We go early for the best selection and are usually home by late morning.

- Note: we are not always successful, but then we have great stories including, but not limited to, the $40 nasty old (and small) cooler. P.S. I just looked it up and that cooler is currently $22 new… LOL

I Still Spend Plenty Of Money

…on other things (such as restaurants and coffee shops!). From my perspective, if I can get perfectly good stuff used for cheap, why buy it new? I can’t get perfectly good used lunches out with my husband, but I sure as heck can get fantastic used bikes for my kids. It’s all about saving where it’s easy to save so that you can spend in other areas.

Want Help With Your Money? Book a Financial Consult With Me!

Money is terrifying for a lot of people and many of us don’t know where to start.

That’s where I come in.

I demystify personal finance and break it down into manageable steps. I explain where to start, where to go and how to confidently manage your money on your own.

My consultation sessions–and resulting written financial plans–are comprehensive, holistic, and all-encompassing of each person’s finances. I look at income, debts, assets, mortgages, expenses, investments, retirement accounts, anticipated social security, credit card strategy and more. I run through every aspect of a person’s financial life alongside their longterm goals and aspirations.

I help people figure out how to make their money enable them to live the life they want.

Need help with your money?

- Hire me for a private financial consultation here.

- Schedule an hourlong call with me here.

- Schedule a 30 minute call with me here.

→Not sure which option is right for you? Schedule a free 15-minute chat with me to learn more. Refer a friend to me here.

I Love the Free Money Tracking Tools from Personal Capital… now called Empower!

I use and recommend a free online service called Empower to organize our money. It tracks our spending, net worth, investments, retirement, everything. While the name is different, the free net worth tracking and money organization tools are the same!

Knowing where your money’s at is one of the easiest ways to get a handle on your finances. You cannot make informed decisions about your money if you don’t know how you’re spending it or how much you have. If you’d like to know more about how Empower works, check out my full write-up.

Without a holistic picture of your finances, there’s no way to set savings, debt repayment or investment goals. It’s a must, folks. Empower (which is free) is a great way for me to systematize our financial overviews since it links all of our accounts together and provides a comprehensive picture of our net worth.

If you don’t have a solid idea of where your money’s at–or how you’re spending it–consider trying Empower (note: the Empower links are affiliate links).

Credits Cards: How We Buy Everything

We buy everything we can with credit cards because:

-

It’s easier to track expenses. No guesswork over where a random $20 bill went; it all shows up in our monthly expense report from Empower. I also spend less money because I KNOW I’m going to see every expense listed at the end of the month.

- We get rewards. Credit card rewards are a simple way to get something for nothing. Through the cards we use, we get cash back as well as hotel and airline points for buying stuff we were going to buy anyway.

- We build our credit. Since we don’t have any debt, having several credit cards open for many years helps our credit scores. It’s a dirty myth that carrying a balance on your credit card helps your credit score–IT DOES NOT. Paying your cards off IN FULL every month and keeping them open for many years does help your score.

For more on my credit card strategy, and a list of the best rewards credit cards on the market now, check out:

The Best Credit Cards (and Credit Card Rewards)!

(note: the credit card links are affiliate links

Cash Back Earned This Month: $81.64

The silver lining to our spending is our cash back credit card. We earn 2% cash back on every purchase made with our Fidelity Rewards Visa and, this month, we spent $4,081.76 on that card, which netted us $81.64.

Not a lot of money, but it’s money we earned for buying stuff we were going to buy anyway! This is why I love cash back credit card rewards–they’re the simplest way to earn something for nothing.

To see how this adds up over the course of a year, check out How I Made $712.59 With My Cash Back Credit Card.

Where’s Your Money?

Another easy way to optimize your money is by putting it in a high-yield savings account. With these accounts, interest works in your favor as opposed to the interest rates on debt, which work against you.

Having money in a no or low interest savings account is a waste of resources–your money is sitting there doing nothing. Don’t let your money be lazy! Make it work for you! And now, enjoy some explanatory math:

Let’s say you have $5,000 in a savings account that earns 0% interest. In a year’s time, your $5,000 will still be… $5,000.

Let’s say you instead put that $5,000 into an American Express Personal Savings account, which–as of this writing–earns 4% in interest (affiliate link). In one year, your $5,000 will have increased to $5,200. That means you earned $200 just by having your money in a high-yield account.

And you didn’t have to do anything! I’m a big fan of earning money while doing nothing. Is anybody not a fan of that? Apparently so, because anyone who uses a low or no interest savings account is NOT making money while doing nothing. Don’t be that person. Be the person who earns money while sleeping.

Yes, We Only Paid $28.24 for Cell Phone Service (for two phones)

Our cell phone service line item is not a typ0 (although that certainly is). We really and truly only paid $28.24 for both of our phones (that’s $14.12 per person for those of you into division). How is such trickery possible?!? We use an MVNO!

What’s an MVNO?

Glad you asked because I was going to tell you anyway: It’s a cell phone service re-seller.

MVNOs are the TJ Maxx of the cell phone service world–the same service, A LOT cheaper. If you’re not using an MVNO, switching to one is an easy, slam-dunk, do-it-right-away way to save money every single month of every single year forever and ever amen.

Here are a few MVNOs to consider:

- Mint has plans starting at $15 per month!

- Twigby starts at just $10 a month!

- Gabb specializes in kid-safe phones (with no internet access or games) and has plans starting at $24.99 per month

- GenMobile starts at $10 per month AND has unlimited international calling plans at $18/month

- Tello has plans starting at $10 a month

For more, I have a full chart of providers and their prices here: How to Save Money on Your Cell Phone Bill with an MVNO: I Pay $12 a Month*

*the amount we pay fluctuates every month because it’s calibrated on what we use. Imagine that! We only pay for what we use! Will wonders ever cease. These MVNO links are affiliate links.

Expense Report FAQs

- Want to know how we manage the rest of our money? Check out How We Manage Our Money: Behind The Scenes of The Frugalwoods Family Accounts

- Don’t you have a rental property? Yes! We own a rental property (also known as our first home) in Cambridge, MA, which I discuss here and more recently, here too

- Why do I share our expenses? To give you a sense of how we spend our money in a values-based manner. Your spending will differ from ours and there’s no “one right way” to spend and no “perfect” budget.

- Are we the most frugal frugal people on earth? Absolutely not! My hope is that by being transparent about our spending, you might gain insights into your own spending and be inspired to take proactive control of your money.

- Wondering where to start with managing your money? Take my free, 31-day Uber Frugal Month Challenge.

- Want help with your money? Hire me for a financial consultation or call. Not sure what that means? Start with a free 15-minute call.

- If you’re interested in other things I love, check out Frugalwoods Recommends.

- Why don’t you buy everything locally? We do our best to support our local community and buy as much of our food as possible directly from our farmer neighbors. Our town doesn’t have any stores, so we rely on online ordering and big box stores for necessities. The closest stores are 45 minutes away and we go a few times a month to stock up on what we can’t get from our neighbors or online.

But Mrs. Frugalwoods, Don’t You Pay For X, Y, Or Even Z???

Wondering about common expenses you don’t see listed below?

-

Cherry blossoms in May! We don’t have a mortgage because we paid it off (details here)

- We pay bills in full the month we receive them. That’s why you won’t see monthly payments for things like car insurance or property tax. These expenses show up as the full annual (or bi-annual, etc) amount in the month we pay them.

- Here’s what we do for health insurance.

- We don’t have any debts and we paid cash for our cars.

- Here’s how we make charitable contributions: How We Donate To Charities Like Billionaires and also How We Make Meaningful And Tax Efficient Charitable Donations.

- Here’s an overview of how we save for our kids’ higher education: How We Use 529 Plans To Save For College

- We live on 66 acres in rural Vermont, so our utilities and household expenses are different from traditional urban and suburban homes:

- We don’t pay for water, sewer, trash, or heating/cooling because we have a well, a septic system, our town doesn’t provide trash pick-up (we take it to a transfer station once a week in bags we purchase from our town), we heat our home with wood we harvest ourselves from our land, and we don’t have central air conditioning (we use window units during the hottest parts of the summer).

- There are, of course, costs associated with maintaining these systems (such as having our septic system pumped and inspected) and those expenses show up in the months we pay them.

- We have solar panels, which account for our low electricity bill.

- For more on our rural lifestyle, check out my series This Month On The Homestead as well as City vs. Country: Which Is Cheaper? The Ultimate Cost Of Living Showdown

If you’re wondering about anything else, feel free to ask in the comments section!

Alright you frugal money voyeurs, feast your eyes on every dollar we spent in May:

| Item | Amount | Notes |

| Groceries | $879.72 | |

| Restaurants | $493.81 | |

| Household supplies & home improvement materials & some clothing | $469.98 | Thrilling items such as: toothpaste, shampoo, laundry soap, dishwasher detergent, socks for both kids, socks for me, craft supplies, and home improvement supplies. |

| Preschool | $420.00 | One of the final preschool payments of our lifetime! |

| String trimmer | $293.15 | This Battery String Trimmer for cutting down all the small trees and large bushes trying to eat our house (affiliate link). |

| New summer/fall wardrobe for Mr. FW | $223.91 | Shirts, shorts, pants, swim trunks and more! |

| Beer & wine | $204.54 | |

| Gas for the cars | $181.69 | |

| Annual family pass to our local beach | $150.00 | |

| Vermont DMV | $140.00 | Annual Registration for the Subaru Outback |

| Pole Saw Attachment | $126.94 | This pole saw attachment for pruning our fruit trees (affiliate link). |

| Coffee shops & several lunches out with friends | $118.54 | Coffee shops & several lunches out with friends |

| Dentist appointment for me | $114.00 | We don’t have dental insurance so we just pay out of pocket.This was for my regular 6-month cleaning and check-up. |

| Cash | $100.00 | For garage sales, baby! |

| Utilities: Internet | $72.00 | |

| Gym Rings and mount | $71.99 | To improve our upper body strength, Gym Rings and a Mount (affiliate link).Currently installed in our basement and used daily by Mr. FW. I need to start as well… |

| Haircut | $69.00 | For me! |

| Thrift Store scores | $62.89 | Clothing for me and the girls, shoes for the girls, bikes for them and some household decor/supplies. |

| Tools | $57.88 | A new sillcock to replace our broken one as well as some tools for job: this tool and also this tool (affiliate link). |

| Liz dinner out with ski ladies | $52.84 | |

| CO2 canister | $44.62 | 20 lbs of C02 for our hacked Sodastream, seltzer-on-tap device. |

| Health insurance premium | $41.74 | Through the Affordable Care Act |

| Oil filter for mower | $39.27 | This oil filter for our mower (affiliate link). |

| Utilities: Electric | $36.59 | We have solar; this is our monthly base price for remaining grid tied. |

| Cell phone service for two phones! | $28.24 | Thank you, cheap MVNO! |

| More guitar strings! | $27.55 | Mr. FW is sounding seriously good! More guitar strings (affiliate link). |

| A hobbit | $22.78 | A gorgeous copy of The Hobbit (affiliate link). |

| Replacement cabinet hinges | $17.71 | Something no one told us about having kids: you will have to replace the hinges on all of your low cabinets (affiliate link). Often. |

| Propane | $14.59 | |

| Spotify | $13.77 | |

| Replacement toilet paper roll holder | $12.71 | Something no one told us about having kids: you will have to replace your TP holder after the kids knock the old one off the wall so many times that it simply can’t be screwed back in (affiliate link). |

| Writing tablet | $12.55 | This thing is worth its weight in gold. My in-laws gave one of these writing tablets to Littlewoods for her birthday a few years ago and the girls had been sharing it (mostly successfully), but it was time to give one to Kidwoods to preserve familial unity (affiliate link). |

| Rechargeable batteries | $10.99 | AAA rechargeable batteries (affiliate link). |

| Replacement doorknob | $10.50 | Something no one told us about having kids: you will have to replace doorknobs periodically after your kids twist them so hard they no longer function (affiliate link). |

| Parking | $5.00 | In the big city! |

| TOTAL: | $4,641.49 |

Oh, I love The Hobbit and The Lord of the Rings. I have purchased beautiful keepsake copies of each with watercolor illustrations by Alan Lee (love his interpretation of Middle Earth). If my husband and I are ever able to have kiddos, I’d love to share these with them some day.

It is a really special Joy you when you have something you have loved for many years and share it with your child. I have a whole collection of books that I loved growing up and couldn’t bear to part with and now I’m getting to read them to my daughter. Her father got dibs on Hobbit and Lord of the rings but I got to read Matilda, A little princess and The Secret garden to her.

My mom gifted us a book called “100 books you should read before you grow up” and it’s fun to use that as a guide to deciding what we should read next.

The look of sheer excitement and wonder on Kidwood’s face while she is reading to Mr FW – priceless!!

The Hobbit! And just love this – the reading, and the thrifting and the sense of community. Thankful for you and all that you share.

The photo reading together is so freaking precious. 🙂 Good idea from the teacher!

How I love The Hobbit and Lord of the Rings! I read The Hobbit when I was nine, I think, followed by the trilogy. She’s not too young-enjoy!!

We believe in second hand shopping too. A friend of mine got most of her kids clothes from ebay or kindergarten sales (they organize it, you get a fixed number of sale tags and they collect the items, offer everything sorted by size and you get the money at the end minus a small fee which the Kindergarten use for unfunded projects). She gave the clothes away at her suburb, got several again when she had her second child and now another friend has a girl and got some items. “Baby 1” is 18 years now, but some clothes are still in use in the neighborhood. Especially baby items are never worn out.

I found a lovely hard back “Hobbit” at a yard sale, in perfect condition – the print inside cover said it was a special edition. It probably isn’t worth any more money than any other hardback, but I only paid $1 for it, so I’m happy.

So much of my household items are used. I was thinking of that the other day as I cooked in my $1.00 yard sale 12″ cast iron skillet and using my $1 thrift store toaster: how much money have a saved buying used? I should some day look up prices of what I’ve bought used, and allowing for inflation, make an estimate of how much I’ve saved.

Yes! That is such a fun exercise :)! I, for example, adore my $5 Zojirushi bread machine!!!

I’m in VT as well and love yard sale season…a good strategy means you get the best deal! I some times go with my girlfriends and their kids but we have a game with the kids on who can get the best value for $5 (the kids learn about money and you would be surprised how many people want to make a deal when they hear about the game…though parents get some veto rights depending what the kids are trying to purchase)

We have that same illustrated version of The Hobbit, and it has become an annual tradition to read it to the kids over the Christmas holiday. We recently introduced them to The Lord of the Rings. The six year old is still a little young for it, but our eight year old loves it!

Absolutely, pre-owned when and where possible! That was my mantra when my two kids where growing up, and still is! The ton of money saved makes it all worthwhile.

My favorite yard sale score was the complete set of Harry Potter books in hardback for $5! My 4 kids and I have gotten a lot of value out of those books over the years, and we still do.

I’m just here to say how much I love your thrift store dress. It’s beautiful.

Seen the films and visited Hobbiton in New Zealand last year – but never read the books as yet!! Well done Kidwoods on her reading success.

Ooh. When she’s a little older she might like the Wings of Fire series. Keep an eye out for them at yard sales. The author lives in Belmont, MA and occasionally does events around New England.

How do you all package or wrap second hand gifts if they don’t come with a box or packaging? I love the idea, but that seems to be my brains stumbling block re : secondhand gifts.

Once again, nothing spent on the dog.

My 8-year-old son just finished reading The Hobbit with my husband, and loved it. It was so nice to see them bond over a book every evening.

I just purchased a second hand bike for my son for AUD $50 (about $34 USD). The same bike retails new for AUD $469 (about $318 USD), so I was pretty happy with that. I love garage sales and FB Marketplace!

Hi Liz! Do you still have your dog?

I never see dogfood or vet bills? Or photos?

We read with our girls aloud until they were both in HIGH school. It was just a habbit everyone seemed to enjoy and the stories always instigated good conversation. Enjoy that time with your girls 🙂

Kia ora, I am from N.Z and during covid when our island was shut off to the rest of the world we took a trip and visited Hobbiton (https://www.hobbitontours.com/). It was such a lot of fun and has since then been the inspiration for my garden! Because there were hardly any visitors we really had the place to ourselves and it felt a little like we lived there! The absolute highlight was going to the green dragon tavern- dressing up and having a beer (and something that wasn’t beer but equally fun for the kids!).

Enjoy the Hobbit!

How are y’all doing with all the rain?

The joy on her face in the photo is a gift! What a great catch! Have to say, you may want to consider eliminating Mint Mobile from your MVNO list. I had an experience too awful and long to really go into here although if you ask for a private telling, I’ll be glad to oblige. Suffice it to say that I am still trying to retrieve $859.28 I paid them for a phone I couldn’t activate because they apparently coded the order incorrectly and they have no one with sufficient training and language skills that can be reached by phone to sort things out. Complaint to BBB joined many similar–if only I’d checked before I leaped. Got a response saying someone from Mint would reach out nearly 2 weeks ago. I’m not holding my breath. Working with my bank to dispute all that $$$. Buyer beware, big time!

What happened to the dog?

One word of caution about MVNOs. I was using Verizon and then saw your post on MVNOs so I switched to Visible Wireless. They are an MVNO that uses Verizon’s network but were 1/4 of the monthly cost. After I switched I noticed my data was slower and my calls more frequently did go through – which I thought was odd since I never had that problem with Verizon and Visible uses their network. After some research, I discovered that Verizon deprioritizes MVNO traffic on its network and that the other big networks such as AT&T do the same. I switched back to Verizon and I no longer have any cell issues.