Welcome! We’re ex-urban, rookie homesteaders finding contentment (and a lot of chores) on 66 acres in rural central Vermont along with our our two young daughters.

I’m Liz, better known as Mrs. Frugalwoods, and I write about a wide range of topics, including my experiences as a parent, my adventures as a novice homesteader, and the financial decisions that made our life possible.

My philosophy is that managing your money wisely enables you to pursue unusual aspirations and opens up a world of options for how to live your life.

Through the application of frugality–coupled with good incomes and judicious financial management–my husband and I have created a life that we love living every single day. It’s not a life beholden to consumerism or the drive for material perfection or the incessant clarion call for more.

I started Frugalwoods in April 2014–before we moved to the country and before we had children–so the arc of my writing has changed over time, as have my thoughts and opinions. I often articulate that there are two sides of the financial independence equation–income and expenses–and that the more you earn, the more you can save.

A primary focus of my writing is on saving money, because that’s what I most enjoy writing about, but investing and income are key elements of financial independence and topics that I touch on periodically.

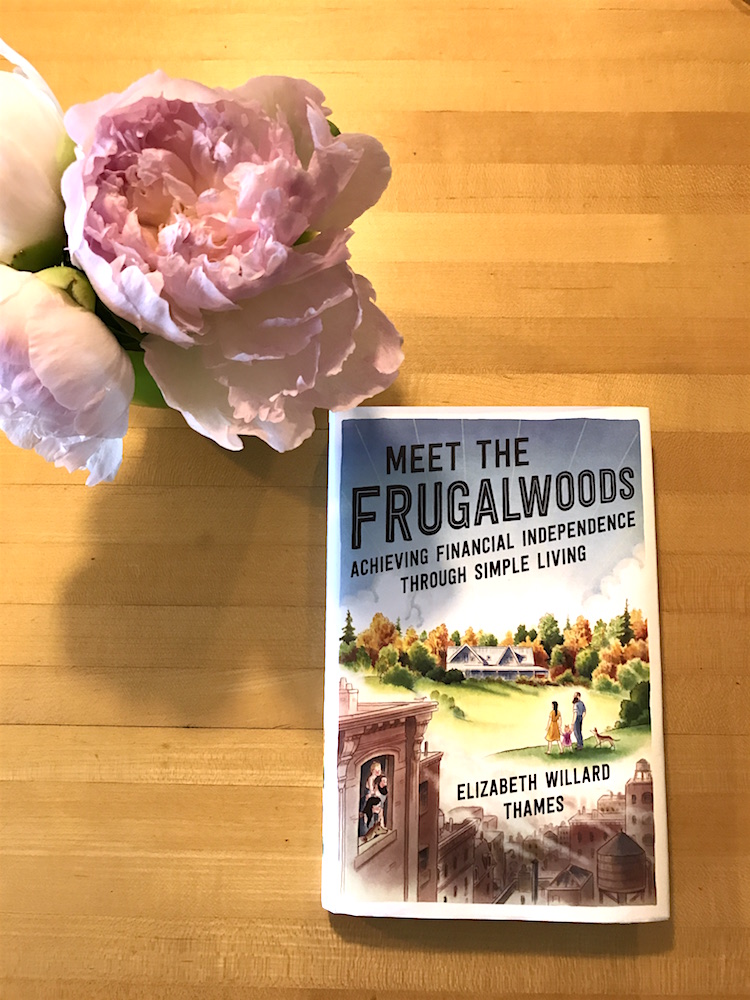

My book, Meet the Frugalwoods: Achieving Financial Independence Through Simple Living, was published by HarperCollins in March 2018. Read more about it here.

How A Diagnosis Of Postpartum Depression Changed My Life

Frugal Minimalism: Do Less, Buy Less, Worry Less, Live More

How Making Luxuries Rare Increases Our Happiness

You Can’t Buy Your Way To Green: How Frugality Is Environmentalism

The Joy That Comes When Less Is Enough

19 Reasons Why Frugality Is The Best Thing That’s Ever Happened To Me

The Privilege Of Pursuing Financial Independence

Why I Broke My Three Year Clothes Buying Ban

If you’re interested in jump starting your own financial management and frugality journey, take my free Uber Frugal Month Challenge, which charts the steps my husband and I took to change the way we think about money and ultimately, to reach financial independence.

You can sign-up for my email list here to make sure you get all of my posts delivered hot and fresh to your inbox:

Who We Are

We’re Mr. and Mrs. Frugalwoods (aka Nate and Liz), 35-year-old frugal weirdos living on a 66-acre homestead in central Vermont with our two young daughters, Kidwoods and Littlewoods.

Frugalwoods began in April 2014 as a living documentation of our journey from conventional, 9-to-5 white collar professionals in ultra-urban Cambridge, MA to modern day digital homesteaders (pretty sure I made that term up… ) in rural Vermont. We moved to our homestead full-time in May 2016, so we’re still getting the hang of life out here on the farm. Our land is primarily forested with several cleared acres around our home and barn, which are populated with mature apple trees, plum trees, and vegetable gardens (which we have a spotty record of keeping alive… ).

Every day out here brings a new opportunity for us to learn, problem-solve, innovate, and make tons of mistakes. The self-reliance and aptitude for constantly trying new things (aka making mistakes) that homestead life mandates is precisely why we wanted to live here. Every day is filled with unknowns and adventure (did I mention mistakes?). I write about life on the homestead every month in the obviously aptly titled This Month On The Homestead series.

For more about homesteading, check out:

- The Best And Worst Moments Of Our First Year On The Homestead

- City vs. Country: Which Is Cheaper? The Ultimate Cost Of Living Showdown

We’re Hybrid Homesteaders!

My husband and I are not full-time farmers; we work on our land as one of the many projects of our lives. While we enjoy working in the dirt, we also choose to engage in decidedly less dirt-focused jobs (which is good for those long Vermont winters… ): Mr. Frugalwoods works full-time from home as a software engineer and IT manager while I’m a writer (one who actually gets paid! hooray!). Another source of income for us is our former home in Cambridge, MA, which we now rent out.

The rhythm of our days is such that one hour we’re harvesting asparagus while the next we’re writing code (or articles), and the next we’re baking bread, or clearing brush in our woods, or on a family hike. Of course a lot of our time is also used in service of raising our two small kiddos. This balance between manual labor and exercise of the mind is what constitutes, for us, the perfect life. Although we’re financially independent, we’re not early retired since we both choose to continue working from home.

Hobbies? Do We Have Hobbies?

I feel like before we had kids we had those things called “hobbies.” Now I’m wondering if changing diapers counts as a hobby? Reading books (to kids) maybe? When we do carve out “hobby” time, we love to hike, travel (uh, mostly without our kids… ) and read. Mr. FW dabbles in welding, woodworking, astronomy, ham radio, home repair, electronics, bicycling, gardening, forestry management, reading science fiction, and cooking. For my part, I like wine. I mean YOGA. I totally meant to say yoga there.

Our older daughter, Kidwoods, is our mini gardener/hiker who adores being outside in nature with her parents every season of the year (and, ya know, stealing toys from her sister and eating dirt). Our younger daughter, Littlewoods, is a baby who likes to clap her hands, gum toys, and spit up.

A major factor in our decision to quit the city (and our office jobs) was our desire to be work-from-home parents. We are fortunate beyond belief to spend every day together as a family (I mean, some days it’s not so great, but on the whole we love it. Except for that whole potty training thing… ).

If you’re interested in my thoughts on parenting in this hectic modern era, and how we buck conventional wisdom that “children are expensive,” check out my Kids section.

Frugal Hound was the official mascot of Frugalwoods and was our 8-year-old retired racing greyhound. Sadly, Frugal Hound passed away in early 2018 and we miss her dearly. She was an integral part of our family and served as the motivator for my writing on frugal pet care.

Our History

Mr. Frugalwoods and I both went to college at the University of Kansas (where we met our freshman year), did relatively well, graduated in 2006 without any debt, and got good jobs. We avoided incurring debt from undergrad through a combination of attending an inexpensive state school, working while in college, scholarships, and–most crucially–financial help from our parents.

While neither Mr. FW or I inherited any money (or has a trust fund), we both come from families who were able to help us out with our undergrad tuition, which we’re deeply grateful for and which we consider a privilege (more about my thoughts on privilege here and here). I never want to lose sight of how fortunate I am to have a family who could support me through college and launch me into the world without debt.

After college, Mr. FW and I worked hard to advance in our careers. We figured this was what our lives would be for the next 30-40 years. We got married in 2008, I completed my master’s degree in 2011 debt-free (I worked full-time at the university while I attended grad school full-time, which entitled me to free tuition), we bought our first home in 2012 (with money we saved entirely ourselves–no gifts from family or friends), and adopted our sweet Frugal Hound the same year. That’s where our normal, standard timeline stops.

In 2012 we both landed what we considered our dream jobs–professional positions as managers in offices at desks under artificial lights. We thought we’d made it. But a strange thing happened. Here we’d achieved everything we’d set out to and yet, we weren’t fulfilled. We found ourselves working for the weekend and counting down the hours to 5pm every single day. Neither of us felt true passion for what we did on a daily basis. We spend so much of our lives at work and we started questioning why we were doing it. We started to feel like we were working to earn money that we weren’t spending (thanks to a combination of high incomes and frugality) and coming home exhausted and stressed. And so, we made the decision to navigate our way out of the cycle of consumerism and materialism that our society seemed trapped by. We now live a simpler, more creative life closer to nature, where we work together towards our future and our shared goals.

Our Quarter-Life Crisis

Mr. FW and I had a shared quarter-life crisis in March 2014 at age 30. We realized that all of our creative energy and our best ideas were funneled into doing work for our employers—not into endeavors that we find personally rewarding. And we had a sneaking suspicion that, if we didn’t change something, we’d wake up in 40 years still in those same cubicles We felt trapped.

We began discussing what we’d do if we didn’t have to work traditional office jobs for a living and we simultaneously agreed we’d live a simpler life in the woods. We love hiking and spending time together in nature and so, moving ourselves from the city to a more rural setting sounded ideal.

At first we thought, ok, we’ll move to the woods when we retire at 65. But the more we talked, the more apparent it became that we wanted to make this move sooner—much, much sooner. Our desire to live in ways that we find personally meaningful was powerful.

This was made financially possible by the fact that we’d always lived well below our means and that we’d continuously increased our salaries over the years, while saving ever higher percentages. In 2014, we’d been saving our money together for almost 8 years. We took a look at our finances and realized that if we embraced extreme frugality–and maintained our decent salaries–we’d be able to make this dream a reality much sooner.

Why Homesteading?

A major component of our decision to go rural is that we’ve done the city thing. We’ve lived in the three big East Coast haunts: New York City, Washington, DC and Boston, MA. There’s a lot that we love about dense, urban environs, but it was time for a change. Also, city livin’ is expensive and didn’t provide the time or the space we craved to explore our myriad interests.

An additional factor spurring us on is that we don’t know how long we’ll be around–life is short and unexpected. We don’t want to work for the next 30 years and then finally move to the country in an effort to find solace. We decided to take this risk now so that we can build a meaningful life to enjoy.

We want to wake up inspired to try new things and create a life of variety. We crave adventure and part of what we disliked so much about working in offices is the lack of diversity and discovery. We’re victims of wanderlust. We’re committed to creating a life of purpose and intention. We’re striving for a life where we work hard, but on projects that are rewarding.

The Blog

Through Frugalwoods, I share our journey and stories of intentional living. My writing is a narration of our successes, foibles, and lessons learned along this path to a wholly unconventional, whimsical, and purpose-filled life.

One of my goals in writing Frugalwoods is to build an online community of like-minded folks who value living life above spending money. We love the community that has grown here and we thank you all for sharing your personal stories with us and with each other. I’m so glad you’re joining us on this journey. Every month, I feature two series that directly engage readers: Reader Case Studies and Reader Suggestions. Please join us and chime in!

In sharing my story, I hope to prompt each of you to ask yourselves the questions that guided our transformation: what would you do if you didn’t need your paycheck? When are you happiest? And what’s stopping you from making that a reality?

Where You Could Start

If you’re new to the concepts of financial independence, or curious about how Mr. Frugalwoods and I approach it, start with How A Year Of Extreme Frugality Changed Us.

This is a pretty comprehensive overview of why we’re doing what we’re doing. If you’d like to know how we’re doing it, check out Why We Don’t Micromanage Our Money. I also break down our expenses every single month, which you can review in our Monthly Expense Reports.

Never saved a penny in your life? Have debt to pay down? Want to flex your frugal muscles? Take my free Uber Frugal Month Challenge. And if you’re seeking general personal finance advice, you might enjoy the Demystifying Personal Finance series as well as the monthly Reader Case Studies.

For more on the ideology that grounds my approach, visit the Frugalwoods Philosophy section. All other content is listed in the categories at the right, which I add to as I address new topics.

Thank you for joining me, I’m glad you’re here! I’d love to meet you and learn where you are on your financial journey. Email me or leave a comment below anytime. You can also follow me on Twitter, Facebook, and Instagram.

Okay, I have a lot of (likely silly) comments.

– I love dresses with pockets (and your arms look killer in that dress – I long for nicely toned arms, LOL)

– Our cats sneeze on us frequently. Seriously, don’t they know to at least turn their heads if they won’t cover their muzzles?

– I think I am starting to feel that general malaise and I’ve only been working for a little over a year. Yikes! I reached my goals as they were and now I hate the 9-5.

– I think when I get a slightly larger raise over the next year or two, I am hoping to save 50% of my income. Not quite there yet, but I just finished grad school so I have some catchup to play. I doubt I’d ever catch up to your 65%, let alone your 82%!

– I love Frugal Hound. She’s a superstar in the making.

Thanks for the overview 🙂

You are so sweet! And not silly at all!

-Agreed, dresses w/pockets rock. This was an awesome bridesmaid selection that I’ve worn several times since that wedding.

-You are far too kind about my arms ;). I do lots of yoga and I lift weights (we have a weight bench at home).

-Frugal Hound is an EPIC sneezer and burper. It’s like she intentionally saves them up–she’ll run over to us and just sneeze right in our faces. All the time. Glad to hear we’re not the only pet parents with this problem.

-Yep the malaise hit us SO BAD when we realized we’d achieved what we’d set out to do and were unhappy. It was a watershed moment and a total shift in our life plans. If you want to do it, you can and you should!

-A 50% savings rate is amazing! You’ll be in great shape with that!

-Frugal Hound thanks you, although she’s deeply embarrassed by all these photos of her snoozing (she does sleep with her eyes open sometimes).

Thank you so much for stopping by! I always love your comments!

One of our Irish wolfhounds burps in our faces. The other waits until we are asleep and then quietly shoves his head under our blanket and licks my feet. Only mine, not my husband’s! I tried wearing socks to bed, even though I hate having my toes compressed all night, so he changed his site of licking to my calves. It both drives me crazy and makes me laugh.

Hi Alicia, I completely concur with your statement about the 9 to 5 job. For a number of years, I worked contract while I co-authored a book. I was so happy because I could literally maintain my own schedule and work at my own rhythms and get out in nature when I wanted to. Now, I have finally secured this full time permanent job that I wanted for so long, and sometimes I feel like I don’t have the flexibility and creativity I used to have. I guess it goes to show, the grass is always greener on the other side. Anyway, wishing you the best of luck with your journey wherever you may be.

Great article, guys! Awesome that you’ve found eachother and share the exact same outlook and views. Should make the Frugalwoods project a walk in the park.

Keep it up!

I enjoy reading about other people’s life and journey towards financial independence way too much… Might as wel call myself an FI voyeur. 🙂

Have a great day,

NMW

PS: although I’m not a big fan of dogs, the pictures are really funny and spice up the text beautifully!.

Thank you so much, NMW! I too love reading about other people’s FI journeys–yours included! Maybe Frugal Hound will win you over with her ridiculous poses 🙂

I have to agree with Alicia, dresses with pockets are awesome! And thank you for sharing your “about us” section now blog post with us. FB Hubby and I have decided that we are ready for the simple life, unfortunately, we have about 10 more years to go until my son is done with school at which point we will be ready for financial freedom. It’s funny, when I turned 30 I began my quest for finding meaning and purpose. I have been on the journey for 6 years now and it has been an amazing one. I think it is a healthy exercise to question what we are doing and why we are doing it. If you don’t like the answer, then that tells you you need change.

Agreed! It’s introspection, and being honest with ourselves, that prompted us to make this change. And, amen to dresses with pockets!

Thank you for reading!

Love it – I always love learning more about the people writing the blogs I’m reading but I rarely click over to the About Me section for some reason.

Wow – way to go on nailing your savings rate. I feel like a slacker at 20-25%, but NYC is freaking expensive and production manager’s do not make a ton.

Homesteading is awesome too. How terrific that you and your husband’s outlook on things changed at the same time and in the same way.

Thanks so much! You’re no slacker at 20-25%–that’s awesome! Yes, very thankful that our viewpoints changed in unison! Thanks for stopping by.

It’s always great to hear about others who have lots of hobbies/interests. I’m interested in a lot of different things as well, and it’s actually a big reason I’m motivated to live a more “sustainable” financial life. I want to free up my time so I can pursue all those interests and not be tied down to a job for the next 40 years.

Absolutely! I guess I didn’t mention that’s one of our reasons as well–we want to have the time and bandwidth to purpose our varied hobbies and interests. Glad to hear you’re doing the same! Thanks for sharing!

Didn’t realize y’all were homesteaders in spirit. That’s the direction I’m heading too.

Obviously there are some excellent blogs out there (NWEdible being my current fav), but a really great book if you haven’t heard of it is The Resilient Gardener. I like it because she focuses on growing/breeding core staple crops (potatoes, dry beans, squash, corn, and then having a laying flock of Ancona ducks). I’m currently reading the author’s much more detailed book about plant breeding.

Would love to chat homesteading if you wanted to start an e-mail thread or PM on the MMM forums. Any parts of the country you’re targeting?

Btw, I love the “read all of the things” in your description. That’s my wife and I too!

Hey! That’s great to know! And thank you for the tips! Agreed on the fabulousness of NWEdible. We’re looking at rural southern Vermont–checks a lot of our boxes. We should definitely connect via email!

Awwww…..nice to meet you guys! The dog pictures are certainly a nice touch!

Thanks Holly! We’re glad to meet you too! Frugal Hound says thanks, although she adds that she’d appreciate less photos and more treats.

“…building a few cabins to rent out on Airbnb”

Hmmm, I’ve been to 39 states, but your neck of the woods (Northeast) has always eluded me. At the same time, I love building. Look us up if you need some help when the time comes? I’ll throw my framing nailer in the car and we’ll hit the road.

The thing I’m struggling with now is that I don’t have a good plan together for after I bail from my 9-5. I write code for a living and enjoy mobile development, so writing apps is probably what I’ll focus on, at least initially. I’d really like to get a rental soon too. We’ll probably flip some houses as well.

You and the fam are welcome to come stay with us anytime! Especially if you bring a framing nailer :). We’re researching different building options for the cabins–yurts, tiny houses, etc. It’ll depend on the land we purchase and any existing structures. But, the goal is to have plenty of space for family, friends & Airbnb folks on the property.

Mr. FW (also one who writes code) has considered doing freelance programming post-FIRE, but, I think he wants to explore totally different avenues of his brain and abilities (like building cabins!).

I’d say you’ve got a good struggle to contend with there ;). Plus, hopefully you’ll have plenty of time to come build cabins/yurts/huts with us!

“But, the goal is to have plenty of space for family, friends & Airbnb folks on the property.”

Wow, I love this idea and can’t wait to hear more about it. The framing nailer will be busy in short time putting up a fort for the children, but it looks forward to bigger projects in retirement.

“Mr. FW (also one who writes code) has considered doing freelance programming post-FIRE, but, I think he wants to explore totally different avenues of his brain and abilities (like building cabins!).”

I think it all comes down to “building.” When writing code, you’re building. Lego, building. Building a yurt or cabin is just another extension of this brain model.

Oh yeah! Complete agree. Yesterday I was tearing out the wall of our built in shed (long story involving asbestos shingles, lead paint, and particle board that was never intended to be installed in moist environment) and it was _just like_ peeling back the layers of method abstraction to find a deeply hidden bug.

The difference, of course, is that I got to smash things with a hammer while troubleshooting 🙂 Much more fun that finding a misplaced ‘

Love getting to know you both better! I admire your ideals and I think it is awesome! I have a question for you about Frugal Hound. When you take her for hikes do you have to keep her leashed? From meeting with other greyhound rescue (retired greyhounds) parents, they say that they are so focused on ‘the bunny’ that if they saw one or a squirrel, they would take off. Will she come on recall if you are in the woods, okay?

Thanks for reading! Good question on Frugal Hound–she is leashed 100% of the time unless we’re in a very contained, fenced area (like a friend’s backyard). As you mentioned, greyhounds are bred to bolt after small prey and with a max speed of 40 mph, they can go really far really fast. So, to be on the safe side, she’s always leashed :). When we do let her run in a fenced area, it’s almost frightening how fast she’s capable of running!

It’s so nice to “meet” you. Great story! Also, Frugal Hound is adorable and so sweet. It’s so cool to read somebody’s story when they have a dream and goals SO SIMILAR to ours. Now I’m all enthusiastically excited, haha.

It’s nice to meet you too–I really enjoy your blog as well! Thank you so much for stopping by! And, Frugal Hound thanks you for the compliments 🙂

Our dog Brooklyn always sneezes on us, usually right in my face when I’m giving him kisses, gross! Eric and I both lived in Boston separately before we moved to NYC and met each other when I was in grad school. I love the Cambridge area, but can totally understand and appreciate wanting to get to a more rural area where you can do homesteading. I’m definitely a country girl at heart and the closest we get to agriculture here in the city is our CSA share 🙁

Love your dog’s name–so cute! Why do they sneeze in our faces!? The world may never know. Before we got engaged, I lived in NYC while Mr. FW was here in Cambridge (I developed more than a passing familiarity with the Fung Wah bus route). A CSA is better than nothing! Thanks so much for stopping by!

ahh…kindred spirits. We are on the final sprint to retirement too and plan to find/build ourselves a homestead. Unfortunately the price for land in the region we are looking is hideously expensive. I sometimes wonder if it would be worth moving back to the US for cheaper cost of living, but I don’t think DH would be up for it.

Yay fellow future homesteader! Land prices vary in the area we’re exploring, but it’s relatively reasonable for what we want. Thanks so much for sharing!

I am not a pet person but that dog is very cute!

Thank you so much! We do love our Frugal Hound. Thank you for stopping by and saying hi :)!

Love getting to know you guys! I’m not a big greyhound fan (big dog fan though) but he’s hilarious! Plus that’s really cool that you adopted him. Was it from a rescue, or did you just have the opportunity to adopt him privately?

Thank you! Frugal Hound is actually a girl 🙂 and we got her from Greyhound Options, which is a rescue organization here in MA. Thanks so much for stopping by!

Great story and I’m curious if homesteading is a really viable option for the rest of your lives. It might work for a few years, but change might occur. How far is a homestead from your current location? I know there’s farms 1 hour west from where I currently live in NJ.

Good question! We’re certainly open to the possibility that things might change in the future and we’ll want to do something different. We plan to keep other options open should we change our minds. We’re considering rural properties that are a 2hr drive from our current house, but haven’t purchased a place just yet 🙂

Hi! I have just discovered your web and I really love it, so inspirational!!.

We have been living frugal and minimal since 2012 and it is the best thing that we have done. Less expending, more experiences, more money for an early as possible retirement.

Thank you for sharing your experiences with all of us.

Please let Frugal Hound know that I am a big fun of her.

Oh thanks! A focus on experiences over stuff really does make life more enjoyable!

I told Frugal Hound of your nice comment, and she sneezed. We’ll take that as an “awww shucks, thanks!” 🙂

Hey you guys. I’ve been reading your posts for a while, and just read “How We Live Frugally in the City.” Have you ever thought about putting together a book? Like, a sort of reference book for frugal living in the city? Man, I sure could go for that. You guys have so many great tips. I’d love to have something like that to refer to while making my life here in Chicago more frugal.

Hi Carla! Thank you so much for your kind words–I really appreciate it :)! A book is definitely something we’d consider doing in the future, thank you for your vote of confidence!

I’ve been following your blog for awhile now, and just finished reading your interview with ES…

…all of which finally prompted me to do what I had been planning to do for awhile now…

…and which I profess in my Manifesto on my own blog…

…which says to keep a mental list of people you’d like to have a coffee with…

…and invited them.

Consider yourselves invited. 🙂

On the off chance this appeals to you, and I hope it does, perhaps the next time you pass thru NH on your way to VT?

Why thank you! I’m deeply flattered that you read Frugalwoods and incredibly honored to be invited to coffee! We’d love to and will certainly get in touch the next time we’re trekking up to VT. And likewise, if you ever find yourself in the Boston area, we’d be delighted to have you over.

I have read many of your posts, but this is the first time I’ve read your background story. Wonderful! I wish you very well in reaching your homesteading goal at just the right time. So interesting that you were “living the dream” and then realized it was the wrong dream. Good for you for not settling – I mean for the wrong life. You’ll settle on your homestead some day instead. Looking forward to hearing all about it!

Thank you so much, Prudence! We’re really looking forward to the adventure and change in lifestyle that the homestead will bring about for us. Thank you for reading 🙂

As someone who reached this conclusion a bit late in life, I wish I had realized it at you age ! I am keeping at it though. Great to see people with different perspectives than the oft beaten path! Wish you all the best!

Thank you so much! I think reaching the realization at any age is a good thing—congrats to you. Thank you for reading and commenting 🙂

We have the homestead but we both still work in the big cities and plan to reduce our hours within a few years. My partner Dave is new to our more self-sufficient lifestyle and, even though he knew it already, he didn’t quite fully prepare himself for how long things take when being self sufficient. For example, it took me 1.5 hours to cart the logs over to the wood store and stack them at the weekend. Then lighting the fire and tending to it takes time, just to keep warm and get hot water. It’s a lot of work. A lot different to switching on the central heating in normal homes. On top of that, my step dad cut the logs which again takes a lot of time despite having a timber forwarder and a Hakki Pilke log splitter. Then, on top of that, these logs will last us 4 days. Yep, just 4 days. So many hours go into just heating the house. My advice (please don’t take this as patronizing because that certainly isn’t my intention) is to consider the cost/benefit of doing everything yourself, because sometimes it saves time to pay someone else to do it which frees your time to spend on working to bring in much needed income. It’s hard to make such decisions and sometimes we feel like we are cheating, but cheating who? Sometime it just makes sense. There just isnt enough time to do everything

Miss Tulip x

PS. We will always cut our own logs and use them to heat our home 🙂

Great to hear from someone who is already on the homestead :)! For us, we take great pleasure in doing things for ourselves and it’s largely why we want to leave our 9-5’s. We enjoy insourcing everything that we can and we fully expect the management of the homestead to take up most of our time, but, that’s really what we’re aiming for by quitting our jobs and moving on out there.

That being said, it’ll be a total change for us and I’m sure we’ll experience quite a few growing pains :). We’ll probably look back on our past selves and laugh at all the plans we made before we knew what we were actually doing on a homestead :).

So glad I came across your blog. Looks like there are a lot of great articles waiting for me to read!

Thanks so much for reading! We’re so glad you found us 🙂

Greetings from a fellow Cambridgian!

I came across Frugalwoods while searching for ways to be more frugal (have been on Mr. Money Mustache for awhile) so I could pay down my medical school debt quicker. I’ve been very impressed with how candid and open you guys are about your personal and financial lives on this blog.

I’m a resident at a local hospital, and my fiancee and I feel like living in the Boston area makes trying to save money particularly difficult. Even after cutting expenses on dining out and entertainment, we notice that certain categories (esp. rent and groceries) take up a large proportion of our monthly expenses. As residents in Cambridge, how have you approached these? I’d be willing to discuss more through e-mail or private messaging if you wish.

Brian

Hi Brian! I’m so glad you found us :)! It’s wonderful to have a fellow Cantabrigian here!

I think rent is pretty much high everywhere in Cambridge. Our mortgage is certainly expensive, though we plan to rent out our home once we move to our homestead, so the high rents will work in our favor then.

But groceries can definitely be done on the cheap! My friend, let me introduce you to Market Basket :). Have you been before? The closest store is in Somerville and their prices are dirt cheap. We buy mostly organic fruits & veggies and their selection is really quite good! We also have a Costco (it’s in Everett) membership, which has been a fabulous way for us to save.

I have a few posts that specifically address some of our city hacks:

Why We Don’t Meal Plan

How We Live Frugally In The City

Why Did We Buy Our House?

If you’re interested in the details on what we spend every month, there are our Monthly Expenses Reports.

And, please feel free to shoot me an email if you’d like–I’d be happy to chat more! Thanks again for saying hi 🙂

Hey I have been lurking through your blog and is very interesting!!! I have never heard of frugality before and I came across you through reddit.

How was your life in the time you got married and by your house?, I am that 2008-2012 gap, have you talked about it, were you renting and saving for your 20% Down Payment???

Congrats for such a great life!

Glad you found us! Before we bought our house, we were renting and saving as much money as possible for our down payment. We found that through frugality, we were able to save enough for our down payment and then some. We also rented below our means–we could’ve lived in nicer apartments, but we chose lower rents in order to help us save more. I wish you all the very best in your journey!

It seems to me your website could just have a single three word post on it: “don’t have children”. (Not that there’s anything wrong with that – I don’t have any children myself). The effect of that single decision far outweighs any other piece of advice outlined on this blog.

Well, we’re actually delighted to be pregnant with our first child right now (after a struggle with infertility) :). For us, building a frugal life is all about optimizing what matters to us–which for us includes kids and our dog, neither of which are particularly frugal. It’s all about eliminating the unnecessary expenses so that we can retire early and do what we love.

And, as a sidenote, we plan to parent as frugally as possible a la the frugal parents who’ve gone before us in the FI space (MMM, 1500 Days to Freedom, Root Of Good, etc). If you’re interested in our philosophy on this front, you can check out my post: Fighting Back Against The Baby Industrial Complex.

Congratulations on your lifestyle. My husband and I are retiring next year at the age of 50. We already own our retirement home, bought last year for cash money. From day one of our go to work adult days we have put 50% of our gross salaries to retirement. We have also raised 4 children the last 2 graduate from college next year. We always have lived our 25 years of marriage within our financial means. No loans, no credit ( well one credit card paid always on time) and have managed to live comfortably. We didn’t sacrifice at all. My children have learned priorities which will be passed on to my grandchildren. If you plan as you live it is possible. Beautiful greyhound by the way.

“If you plan as you live it is possible” Couldn’t agree more! It’s wonderful to hear from folks who have successfully done what we’re trying to do. Thank you for sharing your story!

Congratulations on living in a totally different way; the frugal way. Althougt I dont plan to retire from 9 to 5 jobs, my wife and I opt to live as conservative (frugal) as possible. This allow us to already paid our mortgage in full many years ago, no credit cards balance, good retirement funds (via savings – not as high saving rates as yours – but good). Our 2 kids are starting College (state, which is less expensive). Frugal living can also work even if you decide to stay in 9 to 5 jobs.

Thanks so much! And, I completely agree with you on the benefits of frugality beyond early retirement. Frugality yields dividends no matter what your ultimate goal is. The peace and serenity extreme frugality brings to our lives is worth it alone! Huge congrats to you and your wife for enjoying a life of financial freedom!

Hi! I’m so happy to have discovered your blog. Trying to live frugally is kind of a new thing for me, so I can use all the tips I can get. I will be back for sure.

Sarah 🙂

PS: By the way, we are probably sort-of-neighbors: I live in Cambridge as well (although not in the woods, so maybe not that close!).

PPS: The ICA rocks.

Ah, after reading a few more posts I have now grasped the situation: you’re not in the woods yet, just really excited about it! That is awesome. Vermont is awesome.

By the way, you may have convinced me to finally start shopping at Market Basket. It’s kind of out of my way, but it sounds like it really might be worth it to make the extra trip.

Yes! You got it :)! We’re still living in Cambridge, but are planning to retire to the woods in about 2 years when we’re 33. And, Market Basket is a frugally awesome place! Thanks for reading 🙂

Hey Mrs FW!

Based on your guys’ monthly expense numbers, you are fortunate to make more than me–quite a bit more, actually. I don’t make nearly what you spent in September in take-home pay. I take home about $2300 a month, plus I max out my 401K (which work matches up to 6% at 50%), and signed up for the high-deductible health insurance. I’m debt free and have been living very frugally for about 8 years now (don’t eat out, don’t have cable or internet, pay less than $50 for phone, don’t have any pets, own a grand total of 4 pair of “out in public pants”, live 1 mile from work, etc.). However, with my take-home pay, and the fact that I give about 15% of my net income for charitable purposes, I’ve run out of ways to trim expenses so that I could save even 50%, let alone rock-star amounts like you do. Any tips for those of us trying to save on smaller budgets?

I just started perusing your blog a few weeks ago — your writing/content is amazing! I got to you by searching for coffee cost-savings and was looking for information on Costco coffee options. After reading enough of you blog entries that I adored, I got around to reading this ‘about us’ page and realized that you are likely our neighbors 😀 We live really close to MIT in Cambridge, I knew I liked you guys! Both my husband and I work and now have a toddler – doing the working long hours and having a toddler turns out to be quite stressful and expensive. We love the urban childhood our son is getting, but want to slow down and enjoy life a little more with him. Although we’ve already been fairly frugal/money conscious we fell off the bandwagon when our son was born to try to buy back some time/energy to spend with him. It hasn’t been easy, so we decided to take a plunge into stay at home motherhood and are transitioning to living off one meager post-doc salary. So we aren’t trying to retire early at this point, but I can already tell that your blog is going to be an excellent resource for our new life in frugality – I look forward to seeing your journey to your homestead.

Howdy neighbor! I’m so glad you found us too! Sounds like you’re on an awesome journey to creating a better/happier life for you and your family–congrats to you for taking the plunge. Please say “hi” if you see us in the neighborhood 🙂

I really enjoy reading your blog. I am 53 and planning to retire in the next 2-3 years. I can only wish I had known more about how to live frugally when I was your age, I could have retired a long time ago. What I find most interesting about frugality is how many different ways there are to do it. There’s homesteading, but also living in an intentional community, tiny house living, and living in a boat, van or RV. There are surprising relationships among these. For example, people who mostly live in a van sometimes use a particular intentional community as their home base. This allows them to have an official residence, as well as a place where they can spend a few months of the year and plant a garden, without costing much money. It’s also common for people who live in a van to settle on a homestead after a few years. The basic skills of frugal living are similar across modes. The most important is a willingness to question assumptions about what society says we should buy or do.

I don’t recall seeing much about religion on your blog. Are the Frugalwoods perhaps atheists or agnostics, or did I miss something? You seem like the sort of people to consider all sides of such questions very carefully.

Mrs. FW, I’m very impressed with your writing! You are talented and funny. My wife and I have such a similar timeline to you and your husband for meeting, graduating, and purchasing a home. I am inspired by your frugal lifestyle, yet I am feeling like I’m out of the loop with my career. Based on some rough calculations, I think we make about 30% of your gross salaries. I’m working on a master’s, and I hope to get a little closer:)

Frugalwoods,

Any concerns about internet security with Personal Capital? We have always been reluctant to connect to any online source that “links” our bank accounts. Can you comment on this subject?

This is so great. I am twenty five and I have just started my first baby steps towards frugal living. I reside in Mumbai, India’s most expensive city. To keep up with the expense, I had to move 30km away from office and the train journey takes me an hour and a half to reach office after a long struggle. I do not see all this struggle worthwhile to fill some large corporate’s coffers unless it offers me great value interns of learning or social status. Just last month, I cut down on my visit to pubs and clubs in order to save more money in hand. I am also opting to reduce my intake of meat cooked at restaurants and go more for food cooked at home by a maid in this new city to cut down on expenses. The last six months of my first job have left me with very little savings to speak of despite my considerably higher than average salary owing to my high education loan to pay for my MBA. I will share more as my journey progress, though frugality as a word might be frowned upon by others, I’d like to call it Lean Living and total cost management..

My name is Darlene and I have greatly enjoyed and am inspired by your blog! It took me 50 years to learn what you have in your wise 30 years! I also began a total money makeover in April 2014 and am in the process of paying off debt ($30,000 down, more to go) including my mortgage. I went bk to school at 33 and became a special education teacher after spending 18 years with the state of nj as a secretary. Unfortunately I found teaching to be incredibly stressful and not my dream job, so I left it in 2011. I took an early retirement and have been doing all kinds of odd jobs (my choice) in order to get out of debt and pay off my mortgage. By 55 I plan to be “payment free” and on the road to traveling and investing! Minimalism/Frugality is the next step in my journey now which is helping to propel me forward! Thanks so much for your example and inspiration Frugalwoods! You ROCK!!!

I don’t know i got here,but by reading your story ,i noticed that many of us feels like you felt, studying,then work all time,then stress out to get more and more stuffs we don’t even need or make us happpier ,we just survive with our diplomas in hand…

just wanted to congratulates and tell that I’ve been thinking about doing the same than you ,for the last 4 years, but i feel that ,since we became parents seems to be more and more difficult to jump out off the matrix!.I must say that your blog is pretty encouraging,I might consider to “make the change” again …we need it!

Many Regards

Giselle from Buenos Aires,Argentina

All I can say is YES!!! I am so pumped up about finding your blog (a friend of mine told me about it after a conversation where I expressed some ideas about gaining a bit more financial freedom, many of which included frugality). This blog is going to be a great resource for me so THANK YOU! (And I live not far from where you moved from – just a few miles west in Natick, Mass.). Thanks again for the effort you put in to sharing your journey with all of us!

looove your story. Where we are – We worked 4 yeras, took a year off for college travel, then 5ish more years then took 2 years off to stay at home parent (both of us). Now back to full time work with aim of FIRE in 10-12 years, then go travel the world and live from wherever we feel like next (around this time both our kids will be in college (if they choose to go). We do really well on the savings part now but the expenses are killing us – so you are an absolute inspiration. Just convinced husband to start cutting my hair lol and do a one month hard core savings challenge. He said yes! One step at time!

Hi Frugalwoods! I love your blog. My best friend suggested it and we both love that you are new parents too. Your baby is such a sweetheart.

Yours is the first financial/frugal blog I started reading. I decided I would like to read more frugal living blogs. I found that you are listed as one of the top blogs of 2016 (http://www.plushbeds.com/blog/green/best-frugal-living-blogs/). Congrats!

Are there any blogs that you read that you would suggest? Keep up the great writing and tips!

Just found you via Ask A Manager. And I just finished making a batch of orange-rhubarb marmalade. That and rhubarb bars are what you do with rhubarb. 🙂

You’ve got a really fantastic blog here, you’re both clearly very intelligent people with good insights into life. Your articles are great to read. Thank you very much for sharing your thoughts with us. I wish all the best, and send you greetings from Switzerland.

Our Girls are in their late 30’s – we life shifted to living on a boat about 11 years ago, once they had totally transitioned out of the house and into their own lives. Thank you for such organized and humorfull sharing of your thought processes, actions, and experiences. I just recently ran into “Frugalwoods”, and am now backtracking to read all. Very entertaining, informative, thought provoking blog!

Oh how I love your story! So inspirational. We are currently paying off our debt, and our goal is to save and buy a farm. We live very frugally, so the Jonses definitely do not intimidate this house! We are also blogging about our journey! Congrats to you and enjoy!

Mrs. Frugalwoods. I wanted to stop by and say thank you for all of your posts. I too am a frugal weirdo. It is nice to be among those that are like minded. You inspired me to push toward financial independence and I started to blog my journey to share with others. Looking forward to many years of your posts. All the best.

Wish you would consider writing a book some day! Eagerly look for any new post from you.

Wow! Discovering your blog is already the highlight of my day. I have some reading to do this weekend! 🙂

ps: I am Dutch. We are frugal by nature, as they say 🙂 But unfortunately, these champagne times make even the Dutch people greedy and I see a lot of people spending so much money on useless things

I’ve just recently discovered your blog, searching for more inspiration on my decision to frugalize our life (not to the excess, but wherever we can and want to). I love your approach as well as your witty posts (same sense of humor!), and well, although Babywoods is cute, Frugal Hound is THE star! Keep on the great work 🙂

First, your daughter is maybe the most adorable porcelain skinned lovebug alive. I particularly enjoy the placement of her large bows just so on her forehead. That’s not really finance related, but I presume it cuts down on entertainment costs just playing dolly with her. Second, I love your writing style. It keeps me on my toes with needing to look up a few word definitions, too. Impressive. And, lastly, scarily, I read so many of your blogs on a wild Friday night, that I swore you were the grocery checker’s twin on Saturday morning. Do you have relatives in Oregon?? I look forward to applying some of your advice to my life, and seeing more photos of your precious little one. Thanks.

It’s so refreshing to see life this way! My husband follows money mustache guy and I found your blog as inspiration from woman’s standpoint. I also do try to live frugally, although I really love beautiful clothes and purses, but learned to tame myself. My husband is amazing with frugality! I always compliment him on his decision making what comes to money. Anyhow, thank you for writing this blog.

I loved the book ….encore please …The best finance book I ever read …thanks , John

Hi Mr and Mrs Frugalwoods!

I can’t find a contact page, so I hope you get this comment. I’m Lisa Lynn from The Self Sufficient HomeAcre. I love your blog…great job!

I wanted to get in touch and ask if you would be interested in joining me in a blogging ‘challenge’. Starting on May 1st, I am planning to start a Be More Self Reliant challenge for 1 month. I am hoping to find a few other bloggers interested in challenging themselves to be more self reliant during May and blog about their experiences. Each blogger who participates would share a link to the other bloggers involved, which is a great way to get to know other bloggers and maybe gain some new followers.

I know that setting up a challenge for a month sounds a bit daunting, but it would only involve 4 posts, one each week during May (unless you want to do more).

Each week we will share the things that we are doing to be a bit more self reliant. This could include links to posts about emergency food and water preps, gardening, keeping livestock, wild crafting, home cooking, anything that you feel makes you more self reliant.

I look forward to hearing back from you! Keep up the great work on your blog!

I hope you will join the challenge…I think it will be fun and encouraging to get to know some other like minded bloggers.

Thanks…Lisa Lynn

Inspiring story. Wonder if one day I’ll be able to do the same.

Quote “An additional factor spurring us on is that we don’t know how long we’ll be around–life is short and unexpected. We don’t want to work for the next 30 years and then finally move to the country in an effort to find solace. We decided to take this risk now so that we can build a meaningful life to enjoy. We want to wake up inspired to try new things and create a life of variety. ”

It’s the woe of modern people to be trapped by their own desires and fears. You guys made one brave step and I’m encouraged. Maybe one day I’ll do the same

I’m looking forward to learning more about your frugal adventures :). I just signed up for your email alerts.

I just finished reading your fabulous book in one sitting and enjoyed every bit of it. I picked it off the shelf at the local library (we never actually BUY books unless its something we want for a long term reference) and was pleasantly surprised at both the content and the style.

If there was one lesson EVERYONE should take away from your book is a single paragraph where you caution people that few things are absolute necessities and that if you can’t pay cash than you should wait until you can.

That is the best advice you could give anyone, especially “youngsters” (we are over 65 years old) just starting out. Running up huge debt is a sure fire way to wipe out any chance of financial independence and so many of life’s necessities” are not really necessary, just desired. If you can control your desires you can control your destiny.

We have one car and while we bought it new we will drive it for 10-15 years until we buy a another (or perhaps a walker). We watch free broadcast TV, seldom eat out (and enjoy it when we can), use TracFone for our cell service and generally spend less and save more. Our two sons are smart and went to prestigious colleges (Drexel and West Point) on full scholarships so neither they not us incurred college debt. The younger one is busy building a Tiny Hose on Wheels when he is not exploring the world with a small backpack and his bicycle.

Less is more and the simple lifestyle you have chosen should serve as an example to most Americans. having less does not mean enjoying life less and you are living proof.

I am glad I pulled that book of the shelf on a whim and met the Frugalwoods family.

Hi! I remember a post of yours recently about finding like-minded mom friends on playgrounds and introducing yourself but I can’t find the post despite search terms (playdate, meet, friends, etc.). Can you reply with the link to this post or email it to me? I want to share it with a friend who would be encouraged by the post. Thank you!

Oooo it might’ve been the most recent Reader Case Study: Reader Case Study: More Frugal Than The Frugalwoods or it might be in this one: How I Saved Tons Of Money During My Baby’s First Year.

I can’t tell if this posted yet or not. If I’m repeat-posting, my apologies.

Hi, Mrs. FW! I just found your blog yesterday. I like your style of writing about FI. I’ve actually done debt-free a couple of times before. I’ll spare you the details – and spare myself the embarrassment and mental taxation that would be necessary to explain. 🙂

I’ll just say that I’m about to be 64 next month, already retired for 4 years now, and playing catch-up because of some unexpected challenges. I am sure I’m not alone in that regard.

So anyway, I’m working a plan. Although I know HOW to achieve DF and FI, it’s helpful – as you have mentioned – to have a group of like-minded folks to share ideas and encouragements with. I think you’re doing a great job providing such a group with your blog. I’ve read a lot of information, from a lot of blogs. Yours is among the very best.

So I’ll be around. 🙂

Good job! And thanks. 🙂

SB

Hey Mrs. Frugalwoods,

I just wanted to thank you for all you’ve done for the community. You’re honestly one of the inspirations behind my getting started blogging. I’m a year in and have been incorporating many of your suggestions into my personal life and posts. I admire your dedication and think you’re lucky to have a husband who’s so supportive. Please keep it up! I’ll continue being an avid reader!

Best,

Bob

I just read your book (borrowed it from the library — frugal bonus points!), and discovered your blog, and I have to say how refreshing I find your approach to frugality and personal finance. I was blown away that you open with a discussion of privilege — I feel like that’s a conversation that’s seriously lacking in frugality spaces.

(Also I live in the Boston area, and so often when you talked about Cambridge, I was like, oh hey, I know where that is!)

Overall I’m just impressed with how open, honest, and vulnerable you are about your financial journey, and I think I find that the most inspiring thing of all 🙂

i need to ask an opinion about a friend she is working on FI , she has 27k credit card debt , 24k auto loan where as husband has 45 k credit card debt , both are high income earners she makes 157k and husband makes 230 k per year , husband contributes 50 % of his salary to common account for household expenses. wife wants to be debt free , husband does not care and would not want to cut down his monthly 1000 + uber trips ( he has a car still use uber for convienence ) what can they do about it , get a better model for household budget , get a financial advisor from DaveRamsay or see legal counsel for get some boundaries . marriage / finances/debt/different goals … so complicated

thank you very much for your attention

Hi Liz,

I first came across your blog thanks to my husband. We have over the years talked about different changes like moving out of California. Within the last year we started looking into the pacific northwest, but I’ve never been there. My mom and her new husband spend the summer in new hampshire and she says we’d love it. Neither of us are originally from California. Any way, I started listening to you on martini’s and your money and heard that you are taking an absence from it. I hope all is well with you and your family. This may sound weird, but with some of what you’ve shared like issues getting pregnant, one of your daughters’ name, the age of your youngest, I feel like I have a connection with you. I have almost 2 year old twins.

Any way, I know the pandemic has been hard on many and I really hope that all is well or that you are at least getting the support that you need.

If possible, I’d really appreciate an email so that we can communicate further. I’ve been looking for one for you, but I imagine you’ve made it hard for a reason.

In my thoughts, thank you

I said pacific northwest and that was totally wrong…

I mean the New England states, primarily Vermont and Maine.

I really can’t say where that mess up came other than trying to hurry up and get my message posted and go start dinner. *sigh.

what is your advice when you KNOW there is more to life than working 8to5 corporate jobs and you want to drastically change your lifestyle but your husband is 0% on board. like against downsizing, moving, being super frugal, seems very complacent. me on the other hand am ready to sell all our belongings and travel the world. ha!! help!! (we also have 3 kids so that’s a thing too)

secondly, what is your advice who someone who always wanted to start a blog to share my story. is it worth it!? is it doable while working a FT job?

I’ve read your book & follow your blog. Please update your main picture to include your second child – I couldn’t imagine not including my second son in my family bio. 🙂

I had never heard of you before this past week or so. I was referenced to your site by two other things I was reading! It seems that discovering your site was meant to be. My husband and I just moved with our 6 kids to a remote mountain and mountain community, from a smaller rural community (this one is even smaller than our previous one, think a post office, a gas station, and no traffic lights). We loved our old community, but a bit like you, my husband and I needed a change. Moving and changing lifestyles a good bit has been a challenge with teens. It’s always encouraging to see others who have made big changes that are a bit more radical like our own. We are still navigating our way and trying to figure out how to get out of the money grind. We were in a great financial position that the house we built hurt a good bit. Don’t build a house, but if you do, don’t do it during a worldwide pandemic. I’m looking forward to exploring your site and learning from your journey.