Sam loves her outdoorsy life in Salt Lake City, Utah and is an avid rock climber, hiker, trail runner, ultimate frisbee player and skier. On the professional side, she manages content creation for a company that manufactures work-at-height equipment for careers in vertical spaces. She enjoys her job and the stability it provides, but craves a more independent lifestyle. She wants to explore the possibility of becoming a freelance video producer in order to be her own boss and control her hours. She’d like our advice on how to make this dream a reality!

What’s a Reader Case Study?

Case Studies address financial and life dilemmas that readers of Frugalwoods send in requesting advice. Then, we (that’d be me and YOU, dear reader) read through their situation and provide advice, encouragement, insight and feedback in the comments section.

For an example, check out the last case study. Case Studies are updated by participants (at the end of the post) several months after the Case is featured. Visit this page for links to all updated Case Studies.

The Goal Of Reader Case Studies

Reader Case Studies highlight a diverse range of financial situations, ages, ethnicities, locations, goals, careers, incomes, family compositions and more!

The Case Study series began in 2016 and, to date, there’ve been 82 Case Studies. I’ve featured folks with annual incomes ranging from $17k to $200k+ and net worths ranging from -$300k to $2.9M+.

I’ve featured single, married, partnered, divorced, child-filled and child-free households. I’ve featured gay, straight, queer, bisexual and polyamorous people. I’ve featured women, non-binary folks and men. I’ve featured transgender and cisgender people. I’ve had cat people and dog people. I’ve featured folks from the US, Australia, Canada, England, South Africa, Spain, Finland, Germany and France. I’ve featured people with PhDs and people with high school diplomas. I’ve featured people in their early 20’s and people in their late 60’s. I’ve featured folks who live on farms and folks who live in New York City.

The goal is diversity and only YOU can help me achieve that by emailing me your story! If you haven’t seen your circumstances reflected in a Case Study, I encourage you to apply to be a Case Study participant by emailing your brief story to me at mrs@frugalwoods.com.

Reader Case Study Guidelines

I probably don’t need to say the following because you folks are the kindest, most polite commenters on the internet, but please note that Frugalwoods is a judgement-free zone where we endeavor to help one another, not condemn.

There’s no room for rudeness here. The goal is to create a supportive environment where we all acknowledge we’re human, we’re flawed, but we choose to be here together, workshopping our money and our lives with positive, proactive suggestions and ideas.

A disclaimer that I am not a trained financial professional and I encourage people not to make serious financial decisions based solely on what one person on the internet advises.

I encourage everyone to do their own research to determine the best course of action for their finances. I am not a financial advisor and I am not your financial advisor.

With that I’ll let Sam, today’s Case Study subject, take it from here!

Sam’s Story

Hello! I’m Sam and I’m beyond grateful for my life. I’m 30-years-old, single and only have student loan debt. I have an office job that’s flexible and pays enough for me to do the things I love and, living in Salt Lake City, there are plenty of outdoor activities I love! My favorite is rock climbing and I dedicate a majority of my time, thoughts and money toward the silly sport.

During the summer I trail run, play ultimate frisbee, backpack and climb. In the winters I ski or travel south for warmth. I spend most evenings with friends or alone baking, cooking and Netflixing. I work at a company that manufactures work-at-height equipment for careers in vertical spaces (tree care, tower, window washing, rope access) as well as gear for ice and rock climbing. I oversee content creation for the professional side, which means I travel often for photo and video shoots, averaging about one trip per month.

What feels most pressing right now? What brings you to submit a Case Study?

What feels most pressing right now is the immediacy and brevity of life… and the awful reliance on money. My job offers fairly generous paid time off (18 days), but it’s absurd to me that you’re allotted this tiny amount of time to live. With that being said, I’ve been considering the transition to a freelance career as a producer. Producers are the backbone of any photo and video shoot. They’re the individuals who create the schedule, coordinate the logistics, ensure everyone is fed, secure necessary insurance, etc. A single parent on steroids, essentially. What draws me to this work is the freedom of working when I want, meeting new people, traveling and being an entrepreneur.

I have the freedom, time and dedication for this transition. However, I’m nervous about the financial aspect of it. Thankfully I don’t have to worry about dependents, pets or a mortgage. But, I do have school debt and am worried about saving for retirement, paying for insurance and school loans; all the while saving to buy a house. Although I love being single, it does make launching into a freelance life all the more intimidating!

What’s the best part of your current lifestyle/routine?

The best part of my current lifestyle is that I don’t have to worry about income. Since I’m salaried, I get the same amount distributed into my accounts each month no matter how much or how little I work. Plus, I don’t have to worry about paying an obscene amount for insurance. I also love the travel and social aspect of my routine.

What’s the worst part of your current lifestyle/routine?

The worst part of my current lifestyle is not having autonomy over my life and having someone (my employer) telling me where to go and what to do. Also, it often feels like my job is meaningless. I recently didn’t get a promotion I was surprised to not get. I want to be in a leadership position and be my own boss. The world needs more women in leadership! Also, I would enjoy a life with a partner who supports my career ambitions and who wants to raise healthy, happy kiddos.

And! I don’t have enough time to do all the things I want to do – I have big ideas and want to do so many things. Often, my day is scheduled from 6am – 8pm and I feel like there’s still so much to do. Don’t we all though? I’m hoping that a more flexible schedule will open up time to do things like start a decentralized garden program and volunteer at the state prison.

Where Sam Wants to be in Ten Years:

Finances:

- In 10 years I want to have half a million in my 401k and 6 months of expenses saved.

- I would also like to have a diverse portfolio of investments.

Lifestyle:

- I want to have a family ~ partner and kids ~ and a house.

- I’d also like to be able to travel internationally and be grateful for my life.

- I want to spend time with friends and family who reside in Washington State.

Career:

- I would like to have an impact on the world, somehow. Not entirely sure what that looks like, but I know I want to work with people through visual media and storytelling, which is why I’m leaning toward producing.

- I also want to build a reputation as a hard worker who is honest and determined.

Sam’s Finances

Income

| Item | Amount | Notes |

| Sam’s net income | $3,100 | 8% is going into 401k (2% into before tax; 6% into Roth) |

| Dogsitting Average Income | $185 | |

| Monthly subtotal: | $3,285 | |

| Annual total: | $39,420 |

Debts

| Item | Outstanding loan balance | Interest Rate | Loan Period/Payoff Terms/Your monthly required payment |

| School Loan AB | $18,997 | 6.80% | All currently on hold until October 2022 |

| School Loan AE | $7,956 | 3.40% | |

| School Loan AA | $1,623 | 4.50% | |

| Total: | $28,576 |

Assets

| Item | Amount | Notes | Interest/type of securities held/Stock ticker | Name of bank/brokerage | Expense Ratio |

| Investment Account | $27,081 | Dad gave me $20,000 for school loans, but I put it in an investment account and deposit $800/month | Betterment | 0.11% | |

| 401k | $16,073 | 8% of income / work matches 4% | RFTTX | Empower Retirement | 0.28% |

| Liquid Savings | $10,002 | Liquid HYS account | Marcus Goldman Sachs | ||

| Savings | $2,752 | everyday savings | Columbia | ||

| 401k | $2,458 | Random 401k account that I don’t do anything with and need to transfer | Charles Schwab | ||

| 2nd Checking | $2,163 | second checking account for rent, gas, etc | America First Credit Union | ||

| Random savings account | $1,914 | I don’t have a card for this account; initially was for my truck payments, but I put in $800 a month now just for extra savings | Utah Community Credit Union | ||

| HSA | $1,690 | health savings account | America First Credit Union | ||

| Checking | $1,522 | everyday checking & mostly to pay for credit card | Columbia | ||

| Total: | $65,654 |

Vehicles

| Vehicle make, model, year | Valued at | Mileage | Paid off? |

| Toyota Tacoma, 2016 | $30,000 | 80,000 | Yes |

Expenses

| Item | Amount | Notes |

| Rent | $550 | Very grateful! |

| Groceries | $250 | I get CSA’s every summer & eat mostly whole foods & LOTS of meat |

| Personal Care (Waxing & Massage & Chiro) & random health Items | $234 | I look forward to these massages every month; would be hard to give up. I see a chiropractor for my scoliosis and waxing is well… maybe TMI |

| Eating out | $210 | |

| Gas/Rideshare | $195 | #trucklife |

| Sports/Outdoor Gear | $166 | Didn’t get a ski pass this year, which will (hopefully) lower this amount. But, this includes gear and training programs |

| Clothes & Shoes & Accessories | $138 | Eeek! Didn’t realize it was this high |

| Home goods & Hobbies (candles, film, art hobbies, cleaning supplies, etc) | $128 | I just lumped together, but I since my place is so small, and live alone, I don’t spend much on cleaning supplies |

| Gifts (Holidays & Birthdays) | $100 | Gift giving is my love language! |

| Trips & Vacation | $100 | This will increase this summer with three int’l trips planned… |

| Concerts/Entertainment | $100 | Love going to shows! This also includes books, online courses and movies |

| Car & Rent Insurance | $93 | State Farm |

| Internet | $65 | Comcast |

| Phone Bill | $56 | Unlimited data on Verizon family plan |

| Climbing gym membership | $52 | Might cancel this since I also get a free gym membership through work at a different gym |

| Car tabs & oil changes | $35 | |

| Google/iTunes fees for extra storage | $12 | Maybe not necessary? |

| Vitamins | $10 | |

| Haircuts | $10 | |

| Monthly subtotal: | $2,504 | |

| Annual total: | $30,048 |

Credit Card Strategy

| Card Name | Rewards Type? | Bank/card company |

| Travel Rewards American Express | Earn 3 points per dollar spent on eligible net airfare purchases. Earn 2 points per dollar spent on eligible net hotel and restaurant purchases. Earn 1 point per dollar on all other eligible net purchases.No foreign transaction fee $95 annual fee |

Columbia Bank |

Sam’s Questions for You:

- Any insights into freelance work?

- Financial recommendations for starting a freelance career?

- Is it too late, financially, to make this career change?

- Any insights into health insurance for a single person?

- Advice for someone with a renaissance soul? How do I pick just one career?

Liz Frugalwoods’ Recommendations

I’m thrilled to have Sam as our Case Study today and want to congratulate her for all of her wise financial choices! She’s done a great job on a not-super-high income and I want to commend her for her values-based, prioritized spending. Sam’s at an interesting juncture and I’m excited to explore her options for next steps. So let’s dive in!

Sam’s Question #1: Any insights into freelance work?

At the outset, I want to establish that freelancing isn’t going to be less work. It’s going to be more work–at least at the beginning. However, it might give you more flexibility to choose WHEN you work. I love working for myself and prefer my freelancing lifestyle, but over the years, it’s been A LOT more work than a traditional 9-5. That’s because in addition to doing the actual work (in Sam’s case, video production), you also have to run your own small business:

- You have to pay quarterly taxes

- You have to set up your own liability insurance

- You have to set up (and contribute to) your own retirement plan (I use a Solo 401k)

- You have to research and sign-up for your own health insurance (my family and I are on a plan through the ACA).

- This is my quick answer to Sam’s question #2 on health insurance: you sign-up through your state’s ACA portal. Insurance varies by state, so you’ll just have to see what Utah offers.

- You have to manage all of your own tech: website, social media accounts, email provider, video calls, etc

- You’re your own front and back office: you have to invoice clients, reconcile invoices, keep a database, etc

- You are your own marketing firm: you have to build a name for yourself and solicit clients.

This is not to scare Sam off; rather, it’s a reality check. I’ve been working for myself since 2014 and a lot of this stuff has gotten easier over the years, but I still always feel behind on the “back office” stuff. Yes, I could hire someone, but then I’d have to find them, interview them, hire them, train them, set up payroll, manage them, do performance reviews, etc… It hasn’t been worth that hassle to me (at least, not yet).

Also, I worked WAY harder building up my business than I ever did at a 9-5 office job because my business is my third child and I love what I do and I want it to succeed! I joke that my initial hourly rate was probably $0.05. It has increased over the years, but my point is that it’s taken time to build it to this point.

One Idea: Build Your Freelance Business Alongside Your 9-5

This is what I did and, I have to say, it’s the most financially responsible approach. I used to get up at 6am every day and work for 2 hours on Frugalwoods before going to my office job. In the evenings, I’d go to yoga, come home and eat dinner and then work for another 2-3 hours on Frugalwoods. Every single day. That was the only way I could build it into a real business while working full-time.

This was before I had kids and my husband helped me every step of the way. The advantage to doing this–for me–is that I continued to receive my stable office job income (and benefits) while building up my passion project. Since we didn’t have kids yet, I was able to devote all this extra time to Frugalwoods and I’m so glad I did. I’ll never forget the euphoria I felt on my first “full-time” day working on Frugalwoods after I left my office job. I was euphoric because:

- I was already earning an income from it

- I had clear, precise goals and next steps to execute

- I knew exactly why I was working on it

- I was grateful to have so much time to devote to it

Consequently, because I became so accustomed to cramming Frugalwoods work into the odd hours of the day, I’m able to not work full-time on it to this day. My priorities have shifted to spending more time with my kids and out on the homestead. But, I’m able to get a lot done in my part-time schedule because I’m so used to working fast and furious when I’m “on the clock.”

Sam’s experience will obviously be different from mine and she’s in a totally different industry, but, I strongly encourage her to start building up her freelancing work while working at her stable 9-5. This’ll give her ample financial buffer and will inform her choice of whether or not this is actually what she wants to do.

Since flexibility and control over her schedule seems like her top goal, I could envision Sam doing something like 9 months of hard work per year and then taking 3 months off to go rock climbing! Again, it’s not going to be less work, but you can choose when and where you do the work.

Sam’s Question #2: Is it too late, financially, to make this career change?

The answer is that it really depends. If Sam wants to quit her job tomorrow and live off her savings while building up her freelance business, I’d say she’s going to put herself in a more financially precarious position. On the other hand, if Sam wants to build up her freelance business while continuing to work her regular job, she’ll only be spending her time to do so.

Let’s run through all of Sam’s numbers:

1) Cash: $18,352

This is a phenomenal emergency fund! Sam spends just $2,504 per month, so this amount would cover seven months worth of her spending–fantastic! An emergency fund is easily-accessible cash (held in a checking or savings account) that covers anywhere from three to six months worth of your spending. It’s your safeguard from debt and a #1 financial priority.

My suggestion: consolidate this to one account.

- Sam has this money spread across five different checking/savings accounts, which seems like a lot to keep track of.

- If it were me, I’d consolidate to one high-yield savings account, such as the American Express Personal Savings account, which–as of this writing–earns 1.50% in interest (affiliate link).

- Sam would earn $275 on her money in a year, just by having it in this high-interest account.

The Freelancing Challenge:

If Sam were to quit her job to focus on building up her freelancing career, she could spend down this $18k on living expenses, which as noted, would last her about 7 months. I don’t recommend that approach because it puts Sam in a dangerous position of having no buffer from debt and uncertain income.

2) Retirement: $18,531

I agree with Sam that she should go ahead and roll over her old 401k. It’s great that she’s been contributing to her retirement and fantastic that her employer offers a match! The major red flag I see is the expense ratio on this account: 0.28% is way too high. Sam should contact her employer’s benefits coordinator to explore what other funds might be available at lower expense ratios (I’ll talk more about this below).

The Freelancing Challenge:

Once freelancing, she’ll no longer have an employer match in this same sense, although she can match her own contributions to a Solo 401k. She stated that one of her goals is to have $500k in her 401k in ten years, so let’s see how she can get there.

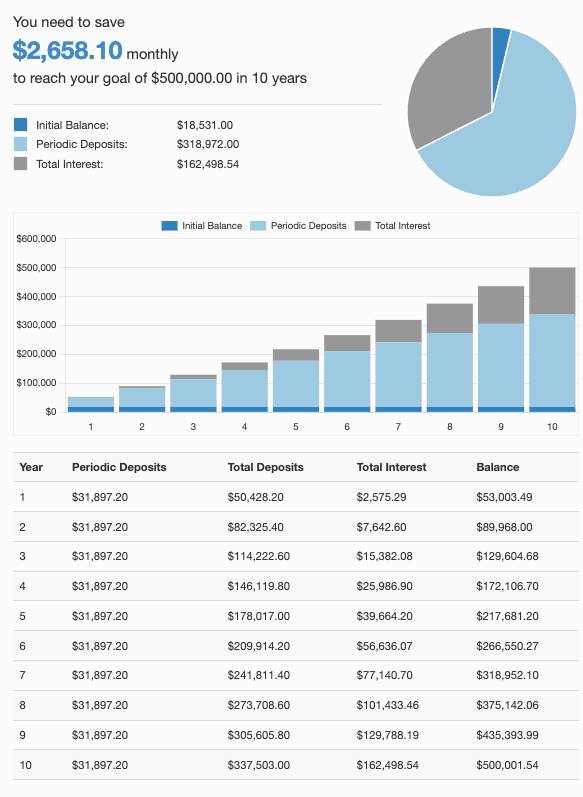

I used this online calculator to determine how much Sam will need to save every month in order to reach her goal of $500k in ten years:

What this shows is that starting with Sam’s current retirement savings of $18,531, and her goal of growing that to $500k in ten years, she’d need to save $2,658.10 per month. The caveat is that this calculator assumes a flat 7% annual return, which is the historical stock market average. But, the stock market doesn’t return that amount every single year and certainly isn’t guaranteed to do so every year for the next ten years. That caveat aside, this does give Sam a general idea of how much she’ll need to save every month in order to hit that goal.

3) Taxable Investments: $27,081

Taxable investments are investments in the stock market that aren’t retirement accounts. Having a taxable investment account is wonderful, but it’s a higher level goal. Before opening an account like this, you generally want to do all of the following first:

- Pay off all debts (excluding a low, fixed-rate mortgage)

- Save an emergency fund (of 3 to 6 months’ worth of your expenses)

- Have fully funded retirement accounts (and the ability to continue contributing to them)

- Not have a major capital expense in your near future (such as buying a house or car)

While I commend Sam for being forward-thinking in opening this account, my concern is that she still has $28,576 in student loan debt. In general, you don’t want to tie your money up in a taxable investment account when you could instead be using it to pay off debt. This is particularly true in Sam’s case because her largest loan has a 6.8% interest rate and–as we noted above–the stock market’s average annual return is only 7%. That means she’s losing money on that interest rate anytime the market doesn’t deliver a return above 6.8%.

What to do?

All that being said, the US is currently in a period of federal student loan limbo. Payments on federal student loans were paused during the pandemic and continue to be in deferment until August 31, 2022. Sam noted that hers are deferred until October 2022, but the US Department of Education site on student aid states that all loan re-payments will re-start on August 31, 2022. Sam should check her paperwork to ensure she has the correct re-start date in mind.

This period of student loan deferment has been a wonderful gift to anyone with a federal loan because it enabled them to stop making payments but not incur penalties. Additionally, there is speculation that President Biden might further extend student loan deferment or potentially even cancel some portion of student loans. In light of that, I think it makes total sense for anyone with federal student loans to not make payments while in deferment and to wait and see what the administration decides.

Scenario #1: If student loan deferment (or cancelation) continues:

- Sam should continue not making payments.

Scenario #2: If student loan payments re-start:

- Sam needs to be on top of when these payments resume to avoid incurring penalties.

- In this scenario, the big question is whether or not Sam should liquidate her taxable investment account in order to pay off her student loans.

Liquidating A Taxable Investment Account (AKA pulling money out of the stock market)

I typically do not advise doing this because:

- The whole point of having a taxable investment account is to keep it open for many decades in order to benefit from the stock market’s longterm growth.

- You have to pay capital gains taxes on the profits (not the total amount)–in other words, any money your stocks have earned over the years.

- If you liquidate during a market downturn, you’re locking in your losses and ensuring that you lose money. See this Case Study for a detailed explanation of this unfortunate scenario.

Sam, however, presents an interesting case because:

- Her investment account almost equals her student loan debt and the interest rate on her debt is fairly high.

- She’s young and can open another taxable investment account once her loans are paid off.

- Perhaps most importantly, her salary is low. See below for why this matters:

Since Sam files her taxes singly and makes under $41,675, her long-term capital gains tax rate should be 0%, assuming she’s owned the stocks in question for more than a year (that’s the threshold for “long-term capital gains”). Short-term capital gains taxes are higher than long-term, which is yet another reason to keep taxable investment accounts open for the long-term.

Capital gains are determined by any profits you’ve made from your stocks as well as your taxable income. However, you only pay higher tax rates on amounts above each tax bracket threshold. Given Sam’s income and the size of her taxable investment account and, assuming she’s held the stocks for more than one year, it looks like her tax rate will be nominal or non-existent. This fact makes liquidation-to-pay-off-student-loans more attractive. Check out this Motley Fool article, which outlines the process and from which I drew much of this information. Since Sam’s account is with Betterment, here’s their overview on how to withdraw funds from an investment account.

Opening A Future Taxable Investment Account

If Sam decides to liquidate her Betterment account in order to pay off her student loans, I suggest she consider a different brokerage in the future. Betterment is nice because it offers assistance with investing, but it’s not so nice because it charges pretty high fees for their services. The expense ratio on Sam’s Betterment account is 0.11%. For comparison, I have an expense ratio of 0.015% on my FSKAX account (Fidelity’s total market index fund). These numbers might sound similar, and that’s what companies like Betterment are hoping you’ll think.

To calculate what Sam is losing in fees, I used this calculator from BankRate.com:

If Sam were to remain invested in this fund for the next 20 years, and the stock market delivered its annual average 7% return, her investments would stand at $102,513 and she will have lost a total of $2,282 to Betterment, broken down as follows:

$992 in opportunity costs (in other words, what the money she paid in fees could’ve earned her if instead invested in the market)

+ $1,290 in fees (in other words, payments to Betterment)

$2,282 lost

Now, this is not a ridiculously large amount of money, but it’s money Sam doesn’t have to pay. Let’s run the calculation again, but this time with Fidelity’s 0.015% expense ratio. In this scenario, we find that Sam would lose only $237 in fees and $181 in opportunity costs, for a total of $418 lost.

In other words, if Sam were to switch to a low-fee brokerage, she’d stand to save $1,864 in fees.

For reference, the following three brokerages offer DIY low-fee investment options:

- Fidelity’s Total Market Index Fund (FSKAX) has an expense ratio of 0.015%

- Charles Schwab’s Total Market Index Fund (SWTSX) has an expense ratio of 0.03%

- Vanguard’s Total Market Index Fund (VTSAX) has an expense ratio of 0.04%

Wondering how to find a fund’s expense ratio? Check out the tutorial in this Case Study.

Sam’s Expenses

Sam’s expenses are totally reasonable for her current salary level. She makes $3,285 a month (after 401k contributions) and spends $2,504. The challenge will be if she wants to reach her 401k goal of $500k in ten years and if her freelance salary is lower than her current income. But no worries, all of this is solvable!

As always, we have two levers to pull here:

- Income

- Expenses

If Sam were to start building her freelance business while working her full-time job, she’d potentially increase her income and be able to maintain her current spending level, pay off her debt, and increase her retirement contributions. On the other hand, if Sam quits her job to build up her freelance business full-time, she might reach profitability faster, but would need to use her emergency fund for her expenses and should consider reducing her expenses during this time period.

Sam can look at reducing discretionary spending, as outlined below:

| Item | Amount | Notes |

| Personal Care (Waxing & Massage & Chiro) & random health Items |

$234 | I look forward to these massages every month; would be hard to give up. I see a chiropractor for my scoliosis and waxing is well…maybe TMI |

| Eating out | $210 | |

| Sports/Outdoor Gear | $166 | Didn’t get a ski pass this year, which will (hopefully) lower this amount. But, this includes gear and training programs |

| Clothes & Shoes & Accessories | $138 | Eeek! Didn’t realize it was this high |

| Home goods & Hobbies (candles, film, art hobbies, cleaning supplies, etc) | $128 | I just lumped together, but I since my place is so small, and Iive alone, I don’t spend much on cleaning supplies |

| Gifts (Holidays & Birthdays) | $100 | Gift giving is my love language! |

| Trips & Vacation | $100 | This will increase this summer with three int’l trips planned… |

| Concerts/Entertainment | $100 | Love going to shows! This also includes books, online courses and movies |

| Climbing gym membership | $52 | Might cancel this since I also get a free gym membership through work at a different gym |

| Haircuts | $10 | |

| TOTAL discretionary spending per month: | $1,238 |

There’s no pressing need for Sam to eliminate all of these expenses. But, if she wants to pursue freelancing full-time, she may need to cut these out while she builds up her business so as not to deplete her entire emergency fund. If she were to temporarily pause all of these expenses–and switch to an MVNO for her cell phone service–she’d rocket her monthly spending down to a very low $1,225:

| Item | Amount | Notes |

| Rent | $550 | Very grateful! |

| Groceries | $250 | I get CSA’s every summer & eat mostly whole foods & LOTS of meat |

| Gas/Rideshare | $195 | #trucklife |

| Car & Rent Insurance | $93 | State Farm |

| Internet | $65 | Comcast |

| Phone Bill | $15 | Unlimited data on Verizon family plan |

| Car tabs & oil changes | $35 | |

| Google/iTunes fees for extra storage | $12 | Maybe not necessary? |

| Vitamins | $10 | |

| TOTAL required monthly spending: | $1,225 |

At this super-low rate, her fabulous emergency fund of $18,352 would last her 14 months, which should be plenty of time to make her freelancing business profitable! Of course the trade-off is that she wouldn’t be contributing to her retirement during this time period. Sam has two options here on how to proceed and she can determine which she prefers–or perhaps she’ll choose a blend of both.

Low Rent Is Great While It Lasts!

I also want to highlight that her rent appears to be way under market value. $550 per month is fantastic, but I can’t imagine it’s market rate. Sam should plan for the eventuality of this increasing–possibly by quite a lot. To get a sense of what market rate is in her area, she can scan Craigslist, etc for similarly sized and located apartments. This’ll give her a sense of what she can expect to pay in the future.

Another super easy way to save money is to switch her cell phone provider to a low-cost MVNO.

Here are a two MVNOs to consider:

- Mint has plans starting at $15 per month!

- Twigby starts at just $10 a month!

For more, I have a full chart of providers and their prices here: How to Save Money on Your Cell Phone Bill with an MVNO: I Pay $12 a Month

Sam’s Question #3: Advice for someone with a renaissance soul? How do I pick just one career?

I have no idea. If anyone knows the answer to this, please let me know :)! I’m on my second (third?) career, but that doesn’t bother me. I’m happy to change my mind as I age and as my family circumstances evolve. My priorities change with each year and I’m comfortable with this level of fluidity in my life.

A few things that have worked for me:

-

Sam hiking Scratch the itch for a different career through volunteer work.

- Sam mentioned she has an interest in building out this aspect of her life and I encourage her to do so! I derive a lot of fulfillment from my service on nonprofit boards and it lets me flex my nonprofit fundraising muscles (that was my pre-Fruglwoods career and I enjoy keeping a toe in it).

- Keep your mind and body engaged through hobbies and friends.

- Sam is already doing this perfectly with her climbing and other outdoor pursuits.

- I don’t feel the need to turn every hobby into a revenue-generating thing, which is why I’m so delighted with my pursuits of skiing, paddle boarding, hiking, yoga and terrible farming. I’m clear in my mind that these are hobbies and that I can just enjoy learning for the sake of learning.

- Be very clear about where your income comes from.

- I do some work that I don’t 100% love because it earns me money. I try not to do a TON of this work, but I do have revenue goals in mind and I’m very clear-eyed about how I make money versus what I do because I love it, not because it’ll ever make me any money.

- This also encourages freelancers to set clear goals and rates. Too many freelancers give away too much for free because they’re passionate about their work. I’ve made this mistake 100,000 times over the years and am trying to be better about accurately valuing my time and my worth.

Essentially it’s about building a well-rounded life, which Sam is already doing! I think giving yourself permission to designate which things will earn you money and which things won’t is a great way to allocate your energy and understand how you want to use your two most precious resources: time and money.

Summary:

1. If student loans are not cancelled or deferred:

- Check on the date for student loan re-payment re-start and ensure you’re ready to start making payments at that time.

- Consider liquidating the Betterment account in order to pay off the student loans in one fell swoop:

- If you go this route, pay the loans off in full.

- In the future, consider opening another taxable investment account with a lower expense ratio.

2. Contact your HR department to explore what other funds are available for your employer-sponsored 401k since 0.28% is a very high expense ratio.

3. Decide if you want to start building your freelancing work while maintaining the security and income of your current job. Create a schedule and business plan for making it profitable and identify a “quit date” for leaving your job.

4. If you want to quit your job now in order to build a freelancing business, be prepared for leaner times:

- Eliminate all discretionary spending and create a a schedule and business plan for reaching profitability.

- Have a plan for re-entering the traditional workforce if the freelancing business isn’t profitable by that point.

5. Be aware that you’re paying under market rate for rent and that it’s likely to increase at some point. Do some research to determine what market rate is so you have a sense of what you might need to pay in the future.

Ok Frugalwoods nation, what advice do you have for Sam? We’ll both reply to comments, so please feel free to ask questions!

Would you like your own case study to appear here on Frugalwoods? Email me (mrs@frugalwoods.com) your brief story and we’ll talk.

The main thing that pops out at me is that in 10 years Sam hopes to have 500k in her retirement fund AND a house. But she only earns 40k per annum. I know investments grow, but I still don’t think that’s realistic. I think you need to work out how much you could earn as a freelance video producer. Even though you can set your own rates etc i don’t believe that that is the type of job where you keep getting paid after you finish the work. Ie you get paid once to make the video and then you’re done, you don’t get paid per click afterwards or anything like that. So while you might earn a good bit more than 40k (depending) I doubt the increase will be so much that you’ll be earning the guts of a million dollars over ten years. Maybe I’m wrong.

On the other hand creating your own content or working in some way where you continue to get paid afterwards at least has the potential to earn more. Not sure how realistic that is though. Maybe there are some video based industries where the producer typically gets a percentage of the profits? Or just higher paid industries where you could get paid more for the same type of work?

So I think either reduce your expectations or look for work that pays MUCH better than you are currently on.

Another thing that pops out is that you say you want a partner and kids, so presumably your plan is also to have them contribute to the house. Buying a house has transaction costs so you could plan to save up your deposit and money for transaction costs for a house and put it in low risk investment or high yield savings. But continue to rent in the mean time. When you find your partner then buy a house together. Or save up a deposit and buy whatever you can afford but work on the assumption that you will eventually be renting it out when you move to your forever family home.

I don’t think any of this contradicts anything Liz said but just it wasn’t really mentioned above.

Please remove the name of the company that she works for. Disaster waiting to happen.

My thought exactly. I’m reading this 2 days later and it is still up. Really needs to be removed!

Hello! Yes, the salary bit was confusing, I think. I make $65k, but my net is about 40k after taxes! But, the outdoor industry is notorious for lower wages – no matter the company!

And, it’s my hope I can earn more freelancing…

She absolutely could own a house and save $500K (taxable and retirement) on her income. How I know? Because I did it. We differ in that when I was her age, I paid off my student loans.

I work in tv on the post production side and want to correct one thing. Most production companies pay freelance producers through payroll services – things like cast and crew or entertainment partners. While some people set up LLCs and like to be paid 1099 that is not always an option as the conditions of our work generally dictate that we be paid as employees not contractors. This comes in handy if you need to file for unemployment during a production slowdown and also if you work for the same employer often enough you qualify for health insurance. And no quarterlies!

That said the idea that you’re setting your own schedule is only partially true. Generally you get a call about your availability for certain dates and say yes or now. You can wind up with chunks of time where you’re not working but planning any kind of trip very far in advance is tough – even around the holidays. And especially starting out you just say yes to everything. Some of my best opportunities came because I was willing to start immediately to replace someone who dropped out unexpectedly.

Thanks Grace!! I’m totally prepared to mitigate the balance of work and spending friends/family while pursuing this new career. I know it won’t be easy, but I’m hoping it’ll set me up for more overall life enjoyment 🙂

Two things struck me as I was reading Sam’s story:

1) Has she considered finding a fully remote producer gig in the tech space?

2) Has she run experiments (like spending a Saturday at the prison volunteering) on what she wants life to be post-freelance transition?

I work in marketing at a tech company with creative producers and we’re all fully remote. So, you get the flexibility with a 6-figure salary (I’m estimating, I don’t know exact salary numbers). Tech is going through layoffs at the moment, but this could be a long term play.

Re: experiments, I ask because I recently completed the Design a Life you Love course with Jess at the Fioneers and thought for certain I wanted to run a dog rescue in my post-FIRE life. We decided to foster a dog as step one and it wasn’t a good fit. I much preferred just spending time with dogs at the shelter and not bringing fosters into our home. I learned from that experience that I can’t know what I really want my life to be without experimenting and trying it.

Good luck, Sam!

Maybe become a climbing YouTuber? For a greater upside of income? Or partner with YouTubers? Idk. You’re doing great and best of luck!

Aww thank you Jon! I’ve thought about the ol’ YouTube!! Couldn’t hurt to try it!

This is a great letter and she has so many options available to her! I’m a few years older but feel like financially I was in a similar position when I was 30. I didn’t feel in control of my finances until I started making a better salary — there’s only so much to squeeze from 40k. Another thing she could consider is taking more control of her 9 to 5 situation — are there new and different skills she could learn on the job? Can she check in about what can set her up for that promotion? That should be part of an ongoing conversation with her supervisor so she knows how to get on a leadership track. Maybe going freelance is a five year plan, which would give her more time to explore improving her current financial situation (debt and savings).

Also, as already suggested, she can explore freelancing on the side and making local connections that could set her up for projects down the road.

Thanks for a great case study. I agree to look at fully remote jobs. WA state caught my eye. Many state jobs (such as at state dept of health) are fully remote now. Check out the state website. Many things like communication that pay ok, are remote and have good leave and insurance

Thanks Lynn and Peggy! You would think at 31 I would have things “figured out,” right? But, life doesn’t follow a plan. I’ve definitely thought about remote salaried positions as a back-up option. And, I could definitely be ‘squeezing’ more out of my current position. I’ve been trying to get my titled changed for the past 5 months to ‘content producer’ to help with job searches in the future…

I am glad to see Liz mention paying off the student loan debt. I think this is a good idea, not just because of the math, but also because the $20k that was gifted by her Dad was given for paying off students loans, not to set up investment accounts.

As as former freelance worker, I will also say- it was not for me. I was working three times more than I worked salaried, it felt like a constant hustle and I was always anxious work would dry up, so I was scared to not take on things that were offered to me. And the tax rate was so high, that you really had to be careful about what pay you would take, or you’d end up working for way less than you thought.

I was thinking the same thing about the gifted money going to paying off student loans. Also, it seems prudent no matter what your plans are to start from a place being debt free.

I immediately had the same thought. Her Dad gave it to her to pay off her student loans. I can see waiting till the payments are required again though.

Thanks for the comments! My Dad knows I put the money in an investment account. He’s supportive either way! And, with Biden’s recent decision, I’m glad I didn’t pay the loans off right away!

How fun! Sam, thanks for writing in. I live in neighboring Colorado and spent my late 20s and early 30s going “um, what do I want to do with my life there’s just so many options!” I swear just in the last couple of months have I really started to solidify what I’d like my future to look like. All this to say it’s okay that you have a renaissance soul and you’re in a great stage of life to try things out and figure out what you’d like to do moving forward.

Aww thanks Liz! I appreciate the empathy! It’s tough being an adult sometimes, especially in early 30s when society says ‘this is what you should be doing.’ I hope you’re happy!!

Pay off the student loan debt! Your Dad gave you that money to pay it off (although maybe he’s ok with you investing it) and although you have more money than you started with, that is often not the case with fluctuating investment accounts. I’ve never regretted paying off a debt, I’ve definitely regretted putting money into the market that I ended up needing within 2yrs (like right now, when I invested in early 2021 and am still negative and could really use the cash to pay some bills….).

I agree with Liz that she should wait until the Biden administration decides whether or not they’ll forgive $10,000 in student loans. She should immediately pay off her remaining student loans once the administration takes student loans out of forbearance. Or if she wanted to make payments now, it would make sense to pay off the loans in >$10,000 now, especially the higher interest rate loans.

Thanks Kat & Amy! So stoked about the recent school loan decision! This means I can pay off my school loans by the end of the year.

I so relate to what you said about how we’re only on this planet for a tiny amount of time and it sucks to spend that time working in a job you don’t enjoy. This is not a criticism of YOU at all, but I’m surprised that your company isn’t paying you a higher salary, especially since you’re required to travel. Given that, and given the fact that you have savings and no dependents, I say heck yeah, try freelancing. Maybe line up a couple of gigs first (or work a couple in addition to your FT job) and go for it. Worst case scenario, you’ll end up back in the 9-5 (but also hopefully at a company that pays you more).

For years, my partner has bounced back and forth between freelancing and a traditional desk job. One thing he’s learned is that it’s easy to fall into a grass-is-always-greener mindset. When he’s in a 9-5, he misses the flexibility and creativity of freelancing. When he’s freelancing, he always starts to panic about where the next paycheck is coming from. I guess what I’d say is that if you do decide to freelance, give yourself a set period of time (like a year) to see how it’s going and don’t allow yourself to fall into a scarcity mindset. You’ve got this! And if it turns out freelancing isn’t for you, well, you’ll have more experience and a better idea of what you want.

Thanks!! Yes, that’s definitely my plan – see how I like it and if I can manage the anxiety haha. But, yeah pre-tax I make $65, but darn taxes and retirement take alot out!

I have to agree with Jessi. I tried freelancing and consulting, and it just was not my jam. I felt like I spent 40 hours a week chasing work, and another 40 hours chasing my money! After a lot of soul-searching (and some pretty lean years), I realized I needed & wanted the stability of a 9-to-5, probably because of the poverty I experienced in my childhood! Moreover, my working full-time allowed DH and I to send our kids to state schools with no debt, and it also allowed us to save a ton of money for our retirement (we’re in our late 60s.).

Sam, if I were you, I would absolutely pay off those #$% student loans. A debt-free life is beautiful! Explore your passions through volunteer work, keep saving your brains out, and take some online courses or read books that will help you discover where your heart lies.

I wish you peace.

Hey Kate, I appreciate the kind words! I’m thinking I’ll give it a good college try for a year and see how my anxiety does before making a decision! But, if I don’t try it then I’ll never know.

I’m very excited to be debt free!

I’m not a freelancer but I am self employed and in the beginning my boyfriend and I each had multiple jobs at the time, I had three for about 1.5 years. No days off, no vacations, no going out with friends on Fridays, nothing…. Our main goal with work was not necessarily to have more free time, but to have more control over where we lived, money, and when we worked etc….Let me tell you, after 10 years of running our own business, and now having 5 full time employees, our own warehouse etc….it was a TON of work, like a completely unreasonable amount of time a dedication & learning. It was incredible, and difficult, and amazingly rewarding. We don’t have kids and only got a dog once we were financially stable. With that said, Sam is 30 years old, which is a great age to tackle a career change IMO (I was 34 when we started our business and had over $100,000 in student loan debt from graduate school that is now paid off) but I agree that she should start to work on this while she still has stable employment. Maybe she could find a better paying job, that was at least partly remote, or less hours, maybe doing more of what she wants to do as a freelancer, this could be a potential way to initiate a transition into freelancing full time(??). I think she is very vulnerable with her current situation if her rent goes up. This financial scenario sounds like my life when I graduated from college in 2001 and got my first job in Boston, MA making $28,000 and paying $500 in rent living in a suburb (the commute was what broke me, I lasted 3 whole months). That was 21 years ago, so I am a little surprised that her salary is where it is. I think that dipping a toe in the water of self employment while still having a job is a smart move, and most folks out there who have successfully made the transition from working for others to working for yourself tend to follow this approach out of necessity, and it is a good proving ground for testing your dedication, work ethic, and ability to sacrifice time in the short term. Also, finding different employment in a more precisely desired area of work may allow Sam to make some more professional connections that would be more difficult to realize as a freelancer. My biggest piece of “advice” though is really to be open to possibilities. Maybe Sam will have an experience that really shows her some new direction to go in. Being flexible and adaptable and will ing to change your own mind about what you’re capable of what you might enjoy doing is still important. Who knows, maybe an opportunity will come her way she has never even considered and it could be the start of something completely unexpected and wonderful! Trust me, what I do every single day in my work is nothing that I expected to be doing. I went to school to become an acupuncturist (and practiced for 10 years) and now I make soap, LOL.

Hey Fran,

Congrats on your business and entrepreneurship! That’s NOT easy! And, thank you for sharing your story. I’ve been doing a little bit of producing hustle on the side and have made alot of connections in SLC. But, yes, I could be doing more and also look for a part-time remote job during the interim. It’s just hard to do any other work during shoot days; it’s often 12 hours a day, so I’m a little worried about managing a part-time job with another job. But, yeah I technically make $65k, but after taxes and 401k, it’s down to about 40k hah. But, yeah I’m hoping my rent doesn’t go up!! And, that’s the beautiful thing about life; is that you never know what could happen….

I found this bit concerning:

“I recently didn’t get a promotion I was surprised to not get. I want to be in a leadership position and be my own boss. The world needs more women in leadership!”

I challenge you to dig into three aspects of this — not here, publicly, but privately and for your own benefit.

First, why didn’t you get the promotion? Was your expectation realistic? What is your plan for getting a promotion in the next cycle? Have you had a series of incisive discussions with your bosses about your career path and salary expectations and what you need to be doing to get that promotion next time?

Second, I challenge you to look at this from your company’s point of view. I’m not trying to be negative but I spent a good chunk of my life in middle management in a large corporation and have some insight. Yes, the world needs more women in leadership who will succeed and thrive. It does no one a service if a woman is promoted who doesn’t have or can’t quickly cultivate the skills, knowledge and ability to succeed and thrive.

Third, becoming a manger in a corporation isn’t a path to being your own boss. You say you feel like your job is meaningless and you chafe against the 9-to-5; a promotion within your company is likely to exacerbate your frustrations, not resolve them.

Along these same lines, I challenge you to be sure your realistic about freelancing. Have you talked to numerous freelancers? Do you have a realistic idea of how they work how much time they pour into their work and how much money they earn? (See Grace’s and Hannah’s notes above.)

Again, I’m not trying to discourage you. Rather I’m encouraging you to set yourself up for success.

One last comment: it’s concerning your father gave you money to pay off your student loans but you used the money to invest. While I don’t favor giving gifts with strings attached, that’s what your dad did. Is he OK with you investing the money? Will this cause friction between you two?

My guess is she invested the loan repayment $ while the student loans are at 0% interest because of COVID (they have been paused). I could be wrong, but that would be a smart move, and then when they are no longer paused, use the principal from dad plus the interest it earned in the meantime to pay off the loan.

I also noted that statement and wondered if the desire to completely switch careers was related to the recent disappointment of not getting that promotion. Maybe with time, that disappointment will ebb, and some other promotion will come along at the company she’s with now.

Thanks for the comments!

1) I had an interview review with the managing director and he mentioned that it ‘was a hard decision,’ but it came down to the fact that Kyle had a better grasp on the overall strategy. Which, studies have shown that women are often better leaders in every aspect besides strategy. (How many women do you know *enjoy* playing the game Risk???) Also, the ET positions are all white men, and I live in Utah, which isn’t as progressive as other states.

2) To your argument, I took on a major portion of the MM responsibilities during the 4 months of not having a manger. I met with HQ in France once a week, managed the million dollar budget and set part of our marketing plan in motion. Additionally, every co-worked I spoke with was expecting me to get the position and was shocked when I wasn’t promoted.

3) Ultimately, I’m glad I wasn’t promoted because the MM now looks like his soul has been sucked out of him hah. The company is small – about 72 people – so the room for growth is pretty small!

4) Thanks for the concern about the friction with my Dad haha. It didn’t’ and he knows I invested!

Sam, you seem awesome and are doing great! Rooting for you to achieve all your goals. A couple things:

1) as a fellow hair removal enthusiast, just wanted to recommend a couple alternatives to waxing. Laser could be a great option for you with your coloring. I am so glad I did it on my legs, underarms, bikini line. It is way more expensive upfront but saves you money and time in long run since it’s not a recurring cost. I don’t recommend it as much for facial hair though — I think bc it’s thinner it doesn’t work as well, plus it doesn’t have the control you’d want for eyebrows . A way more budget option Id recommend for facial hair removal is a small facial razor. They are super cheap and easy. Schick makes a popular one but there are many other brands too https://www.schick.com/products/hydro-silk-touch-up-razor?gclid=EAIaIQobChMImoaC5crL-QIVkYjICh0I6gShEAAYASAAEgIt8vD_BwE

2) if you go freelance, make sure you factor into your rate ALL the costs you’ll be shouldering yourself into your rate (vacation time, sick leave, future parental leave, taxes, insurance, retirement contribution, cost of setting up and maintaining an LLC with your state if you go that route, etc). Cost out everything for the year and the divide by the number of hours you want to work in a year, giving yourself cushion for the hours Mrs FW mentions for back office stuff that’s not visible to the client, and for lean times where it might be hard to get business.

Keep us posted!

I second the recommendation for laser hair removal. The price has come down a lot in the last several years thanks to groupons and what not.

Sweet! Thanks for the tip! And yes, I should sit down and calculate that all out. Super helpful!

Hey Sam! A few years ago (when I was also coincidentally 30) I was in a similar spot. I too thought about going freelance or starting my own company, and I craved the flexibility to set my own schedule. Well 2020 hit…and I lost my job due to the pandemic…so I decided to use the opportunity to explore starting my own business. Long story short, I found out that it wasn’t something that I enjoyed. I also found out that remote work doesn’t work for me. I really craved the structure and social aspects of working in an office environment. So, I switched to looking for a job, and now I’m happily working in an office. I say all of this because having the opportunity to experiment gave me clarity and revealed to me what I needed and what I valued. I know this can be challenging with a full time job, but maybe you could start exploring on your own time to see what you find. Dip your toe in – outline a business plan, get one freelance job, etc. – and see how it goes. If you love it and know this is for you, then you have some momentum to move forward. And if it doesn’t work out, there’s no shame in that. Figuring out what you value and want out of life is an amazing journey! Wishing you all the best.

Thank you Melissa!! I’ve taken on one producing job as a side hustle and, let me tell you, it fills the bucket for socializing!

I’m self-employed and HIGHLY recommend that you start doing production on smaller projects and side gigs to learn the ropes of running your own business, seeing what business is out there, and making sure you like doing it. Another option is seeing what a larger production business pays so you get paid to learn the ins and outs. Even though you’re overseeing it now, there will still be a lot of things to learn. I’m a serial entrepreneur, and I’ve made much more money more quickly when starting companies where I worked in the industry first, then doing the exact same thing vs. starting from scratch. Case in point: I am starting an online business whose target audience is people in my same demo, age, etc., and I have worked in the position of organizations that my company will help. Despite this background, it’s taken me 2 years because I didn’t have experience with the backbone of the business – creating the website, app, etc. – even though I’ve hired people to do this before. Six months of side-freelancing will be invaluable for you. Good luck!

Thanks Alys!! Thankfully I have a website up and running, but yes, there’s definitely much more to explore.

I agree, freelancing may sound like freedom, but it is the opposite. Not only is there more work, but probably greater financial pressure and stress to generate income and you are 100% on your own. Time off = no income, plus no employer contribution toward anything.

Think it through and perhaps as suggested ease into it part time.

Thanks Richard!!!

My husband and I are free lancers and although we make a very good living, we always feel compelled to take jobs offered because we are afraid the work will dry up. As a result, we work many more hours than we would if we were employees. It suits us because our jobs can be done remotely for the most part, so we can travel or work for six months from a different location (most recently the Scottish highlands). But there are trade-offs, like always taking every job offered, that you might want to consider.

thanks lindsey!! the scottish highlands sounds awesome! But, yes, agreed on the stress of taking every job; even if it’s one that might not line up with your morals….

Hi Sam! Fellow SLC resident here. I’m impressed at how well you live on your income- especially with your rent! I am sure you recognize what a lucky position you are in to live alone at that price. I really can’t wrap my head around it as I’ve seen rent prices go crazy here the last few years and I thought you would need to spend at least 3x that. For your sake I hope it doesn’t change!

We are still in a hot job economy . My husband’s company is trying to hire recent college grads starting at $50k/ year and can’t find anyone to take the positions. Until you can get freelance work going, I’d ask for a raise or look at other jobs along the Wasatch front. I can imagine you could earn a lot more! I’ve found that job satisfaction is often tied (more than we consciously admit) to how well I am compensated, and that might be the case for you. Good luck!

Hey Bailey! I’m very grateful for my rent situation! I think the landlord felt bad for me after a bad breakup and offered this place at a lower cost haha. Yeah, I make $65k, but after taxes and retirement, the net drops down alot!! But, the outdoor industry is notorious for low wages.

Hi Sam! I’m surprised no one has mentioned the very expensive truck – and all of the increased costs associated with keeping it on the road. Have you considered selling it and using the $30k to buy a more reasonable, older, smaller car (around $7-10k should be more than sufficient) and use the leftover to pay off student loans? This way, you will save more money going forward on gas, insurance, etc AND you won’t have to touch the money in your investment account.

And if you’re worried about space for transporting your outdoor gear, I’d encourage you to think outside the box. Mr Money Mustache is a great resource for telling you exactly how much cars cost the average Jane. It’s a lot and probably the single biggest barrier to financial independence for most people. Here’s an article that might be a good place to start if transporting sporting gear is a concern: https://www.mrmoneymustache.com/2011/12/08/turning-a-little-car-into-a-big-one/

Best of luck!

Hey Jenny! Thanks so much! I’ve thought about it the last few months especially with the lack of cars available for purchase I could probably make most of what I spent back. I’ll take a look at the article! Thank you!

Hi, Sam — I recognize that “itch” one starts to get after several years in a job (even a challenging, creative one that you love). Another idea to throw into the mix — can you switch companies and get a pay raise to do similar work at another organization, for a better salary? A few years ago, I was really eager to go freelance (or maybe even ditch my industry entirely and go for a full-on career change). I’d been working in one industry, at the same job, for almost 10 years, and I was over it.

I ended up changing jobs (but staying in the industry), got a healthy salary increase, and was able to pay off my debts and start really contributing to my 401(k) and investing. And I guess I got a fresh perspective on things, too — I realize now I was just eager for a change, and it didn’t have to be as radical of a change as I’d originally thought I needed. It might be worth looking for a new salaried job — if you hate it after a year or two, you’ll know that (and you’ll have more money in the bank to do whatever you want).

I really respect the beautiful life you have built for yourself and the clear vision you have for your future — partner, kids, fulfilling hobbies. You can make it happen!

This is the advice I was going to give too. I’d first look for a better job, a better 9-5 job, especially in the current job market (go read Ask A Manager!!) and then if that wasn’t fulfilling or enough of a pay bump or change, I’d start freelancing — on the side. I imagine in a place like SLC that there are plenty of openings, or maybe even full-remote options that can give you a salary increase (40 seems low for your industry and SLC, but maybe I’m wrong). Maybe an industry change, even! I work remote and ~30 hours from home and just that change gives you a lot more hours in the day to do things (and I can work weekends if I want to, flexing my schedule around).

Thanks Shelby and Hannah! Yeah, the salary bit was confusing. I make $65k on paper, but my net is $40k after taxes and retirement! But, the outdoor industry is notorious for low wages. And yes, three years is the longest I’ve had a job and I’m definitely feeling the itch!!

I’ve thought about an industry change, but I know I will have a hard time doing work I don’t care about. Like tech or medical devices or health insurance lol.

When I was thirty, I had a very similar lifestyle, (single, not a high salary but everything I wanted or needed) and life events- I was also “passed over” for a promotion (I sucked it up, stayed another 9 months until I was fully vested, then quit, at which point they offered me the promotion they had passed me over for- way too late!) I freelanced for awhile, took some time off to try a bunch of different career options (going on a Forest Service Archaeology dig made me realize I did *not* want to go back to school to become an archaeologist!), traveled a bit, then set up my own firm with a friend. I realized quickly that a paycheck coming in that doesn’t require you to get the money from someone else first is a very nice thing, and also started working part time for a small firm that would hire me part time while I simultaneously started up my own firm. For me, being self employed with a friend was a great time, and we did some really fun projects and I’m glad I did all that because I learned a lot about how to structure my time and how to live on very little… I then started concentrating on the improvement of other pieces of my life and bought a fixer-upper condo in Boston, fixed it up, traveled a lot to dream locations, and started internet dating and eventually met my husband in my late 30’s, which led to a bunch of different adventures- a farm in Tennessee, grad school in North Carolina, having kids in West Virginia in my 40’s. My point is, you have time- you need to just figure out what you want to try, and try it. Your risk adverseness level determines if you try things with a paycheck, or without! Renaissance minds need a lot of stimulation and the best solution I’ve found is to try things- either through serial careers, or serial vacation/ volunteer opportunities, or whatever works for you. While I discovered that I loved “being my own boss” instead of working in an office, I absolutely *hated* the minutiae of running the business end of it and the stress of having to take every job was just too much for me. When I went back to an office after taking time off to have babies, I negotiated a part-time (30 hours), flex time job so I could be home for the kids.

Luckily, with the help of the pandemic, I have been able to stay at the same firm with totally remote work and total flex time, but at our dream homestead in Vermont… which I always tell people is the absolute best of all worlds- that regular paycheck which is auto-deposited, and if I want to go play on a mountain with the kids instead of be at my desk, it’s fine, as long as I don’t have meetings, etc. and get my work done before the next morning. I would encourage you to try freelancing while you have the regular paycheck if you can, because you may discover that while you can do it, it’s not worth your effort….. But trying and deciding you don’t like it (to me) is better than never trying it at all….

Hey Katharine! What sweet words! It’s consoling to read stories with a similar trajectory as mine. It can feel overwhelming when you see friends on a different path and finding ‘success.’ But, yes, I agree with your last sentence! I think I would regret not trying. And, maybe I’ll lose some money, but I’ll also learn and grow as well, which also makes me richer!

I’m sorry Mrs. FW for being such a broken record as a Case Study commenter! But two things continually stand out to me as relevant recommendations: IRAs and FSAs.

*Sam should open a Roth IRA. This can be a backup emergency fund because she can withdraw on the principal penalty-free. If I were Sam, I would take $6,000 of the $18,000 emergency fund and open an IRA savings account.

*Since her income is low enough, Sam could also consider contributing to a traditional IRA (instead of the Roth IRA). Her income is low enough that she could deduct the contributions for the tax advantage.

*While the HSA is a good investment vehicle, Sam should run the numbers on getting a PPO plan and FSA to go with it. With a letter of medical necessity, she could pay for her chiropractor, massages, vitamins, and more with pre-tax dollars, which may outweigh any premium increase.

*I echo Mrs. FW’s advice to consolidate the old 401k into the new, the 3 savings accounts into Marcus Goldman Sachs, and the 2 checking accounts into Columbia since it’s connected to your credit card.

*I’d also consider opening an AmEx Blue Cash Everyday card. It’s $0 fee, and you’d get 3% back on groceries & gas. You could combine those points with the points from your Travel Rewards AmEx to make your return go a bit further.

Hope those help!

Not my case study, but your first comment has really resonated with me. I have a quite large backup emergency fund which I watch with despair during inflation, but I don’t want to wholly tie it up in case my car dies (it’s 20 years old and going strong) or i have massive home repairs (after another hurricane, still fixing from last time, or old AC or water heater go out, etc.). I have these funds tied up out of an abundance of caution, but I could Roth IRA that instead! Not sure why this didn’t occur to me before. Thanks!

Thanks Sarah! I have a Roth and I put 6% into Roth currently, and I’ve bene meaning to consolidate retirement accounts for awhile!

I think before I tried free lancing,( not ruling it out), I might look for a higher paying job right now. With that low rent, and more income, Sam could knock out her debt, and really save up a safety net fund if she decides she still really wants to free lance.

Thanks Carol!! Agreed!

Great post, Sam has a bright future mainly because she is conscious of all this stuff at such a young age. I was in my 40s when I got serious about finances, so there were a lot of opportunity costs at play with my situation. I think if Sam kept working diligently on the side, it may lead to full time work as a freelancer or heck, you may meet someone who hires you for a full-time dream job!

Aww thanks so much Jim!

Sam, have you considered combining a couple of your goals and doing some pro bono work for nonprofits? That would help to build a portfolio (and maybe future client list), while also doing something a little more “meaningful” with your time. As someone who does a lot of nonprofit work, I promise there are plenty of groups out there who would appreciate free video production.

You might set a secret date and dollar amount of money you want before you leap into self-employment— and as everyone else said, do some gigs on the side meanwhile to build that up. Sometimes having a secret “exit date/amount” in your head can cheer you on during frustrating times at a job.

I liked the flexibility of freelancing. I HATED having to constantly market myself and to know that any time I took time off I was not making money. You may be different but for me, I could rarely unplug because I couldn’t predict future work and felt I could rarely turn anything down. I couldn’t get away from work.

If it were me, I would focus my energies on finding a different job. One that paid considerably more and gave me more days off. This is a good market in which to try that.

Thanks for the advice, Tam!

Do you have a mentor in the production field? Can you find one? Network? Intern? Job shadow? Informational interview? Join professional organizations? Set up a structure for researching what you would need to know and keep track of what you learn and from whom.

Also, do make sure you know why you were not promoted. Lots of stories online about how to ask for a raise or other job benefits; rework those to find out what you need to do to get the promotions. You might even ask to work fewer hours while you explore options. Best wishes to you!

Hey Heidi,

I do have a few mentors right now and several contacts. Thanks so much!

I’d recommend paying off the college debt for a couple reasons: (1) to honor your Dad’s request that the $20K go against your college debt and (2) to lower your debt to income ratio. Getting it gone will feel great. Put that debt in the rear view mirror!

It stood out to me that you say your days are scheduled from 6am-8pm yet you are only netting 39k salary. Are you really working 14 hour days or is ther non-work stuff in there?

Other than that, I will echo what others said about freelancing. Tried it, wasn’t for me. It was definitely a grass is greener situation that sounded better than it was. I’m older, 46, with two school age kids. My full time office job with long commute was not working out when I had kids, so I became a SAHM. I learned to code and build websites and I thought this would be a lucrative freelance gig. In my mind I would get a client or two and then it would take off through referrals and such. In the end, I felt like I was constantly trying to network and sell myself, which I did not enjoy, and I spent barely any time actually building websites, which I *did* enjoy. When I did get a freelance job, the client generally wanted the work done asap so it was unpredictable when I would be busy and therefore hard to plan. I also was not very profitable when I considered the cost of my coding classes, cost to build and maintain my own website (hosting, etc), cost to join networking groups, etc.

Now I have a fully remote job that I love. My hours are very flexible, but I generally work 7am-3:30pm, which allows me to be available for my kids after school. I feel like I have more control over my time now with a flexible remote job than I did when I was attempting to freelance. My hours are set, my pay is consistent. I actually have unlimited PTO, which in my case means about 4 weeks, plus I don’t sweat a half day here and there if I am caught up on work. Just food for thought. I think the idea of freelancing on the side is a good one because it will give you an idea if it’s easy to get business, what you will get paid, etc. If you love it you can make the leap but if you don’t you haven’t lost anything.

Also, I think it’s a good idea to consider future children when thinking of career paths. In my remote job I can pop out to pick up a kid from school. My 8 year old was sick today and there was no issue, he could just hang out at home while I work. When my husband and I both worked in person, a sick kid would be a huge stress.

That’s great advice, AW. thanks so much!!

Liz, there are companies that handle the back office work for small businesses on an hourly or fixed rate. You may want to look at that it you want to get some back office stuff like invoicing off your plate, but of course don’t have enough of it to hire someone full time. Social media and other front office stuff is a completely different skill set, so wouldn’t be easily combinable with the back office stuff you want to outsource. Just a suggestion to make life (and work) easier!

Thanks Anne! Yes, I would probably hire someone to help with finance stuff.

What struck me in this case study is that she is looking to change her type of work to video production at the same time as she goes from full time direct hire to freelance. There are two variables here, the video production and the freelance. She could easily discover that one of these two aspects she either doesn’t like or isn’t good enough at yet to take it on as her primary income. I would REALLY recommend at least doing a few freelance video production gigs first to make sure you like the work and build up enough of a portfolio or reputation to be able to get work before you even think about quitting your day job. Once (if) you know you really want to do video production and are good enough at it to be competitive, then look at doing it freelance. If you find you enjoy freelance and the money works out, then great! If you find you love video production but don’t like the instability or backend work of freelance, then you will be in a good position to look for a video production direct hire job. You may even find a company that will hire you for part time or have more flexible hours.

I am also someone with a lot of interests, and what has helped me is remembering that a job is 40 hours a week but you also have 72 non-working waking hours a week to do what you want with. Meaningfully incorporating other things I love in the mornings, evenings, weekends, and holidays makes a big difference in how satisfied I feel with life. For me, I have tried freelancing and found that I don’t like the instability. I also don’t like the pressure of feeling that I have to monetize other activities I enjoy that don’t easily lend themselves to monetization. I prefer to have a 40-hour job that fulfills one of the things I love and serves as a time and financial anchor in my life from which I can fly free with the other things I love to do in the rest of my time.

Thanks so much for the comment! I’ve done a few side gigs over the past few years. And, yes I’ll also look into a company for some part-time work as well.

Re: your student loans.

1.) Ignore whether the government is going to forgive them or not. That is a highly volatile political situation and I would not waste time or energy waiting to see what will happen. You have the money to pay off the debt, and enough of it is gathering a high enough interest rate that the math on the return is worth it. Depending on what you choose to do with your career, you can make up $20,000 of progress faster than you might think. If student loan forgiveness comes through, then you can be happy for the people who have been mired in debt and now have another tool to start digging with, even if it’s not necessary for you.

2.) Others have brought up that you have not used your dad’s gift as intended. Obviously, this is between you and your father, but when money and family mix, that’s a potentially toxic combination and I know that if I had given a significant sum to a family member for a specific, stated purpose and they had chosen not to use it for such, I would be annoyed at the VERY least. I understand your logic in choosing to invest the money (especially with student loans paused to help with pandemic relief), but I would hope your relationship with your father is worth more than about $28k.

In short, pay it off. Immediately. You will be in a much better financial position to try freelancing if you choose to do that and you’ll be able to give your father the comfort of seeing you much more secure as you navigate these next steps.

Thanks so much for your input!

Sam, first off, thank you for sharing your case with us.

I would probably also pay off the student loans with the money your dad gave you. Not just because that is what he gave you the money for, but also because I find any kind of debt really stressful and I can imagine it is the same for you.

I would also try some freelance gigs while you are employed before quitting your job. That way you can test the waters and see if it was for you. From many replies and in general, freelance seems to be a lot more stressful and does not really offer more freedom (unless you don’t actually need the money) than being employed.